Navigating Taxes on Life Insurance

- dustinjohnson5

- Jun 30, 2025

- 16 min read

Let's cut right to the chase: when your loved ones receive a life insurance payout, that money is almost always income-tax-free. This is the single most important tax benefit of life insurance and the bedrock reason it's such a powerful tool for families.

The Core Principles of Life Insurance Taxes

It's easy to get bogged down in the details of policies and provisions, but the tax rules for life insurance really come down to a few simple ideas. I like to think of a life insurance policy as a unique financial vehicle, one that the government gives special treatment to because it helps people secure their family's future.

The biggest tax perk, by far, is that death benefit. When you pass away, the lump sum paid to your beneficiaries doesn't count as taxable income for federal purposes. This isn't a new loophole; it's been a part of the U.S. tax code for over a century. The goal has always been to make sure grieving families get the full amount of support they need without a surprise tax bill.

Key Takeaway: The tax-free death benefit ensures your family gets the full financial support you planned for, right when they need it most, without the government taking a slice.

This simple rule makes life insurance an incredibly efficient way to pass on wealth. That money can be used to pay for a funeral, clear a mortgage, or replace your income, and every single dollar goes directly to its intended purpose.

Understanding the Basics

While the death benefit gets all the attention, other parts of a policy have their own tax rules. You have to understand the full picture.

Here are the three foundational concepts you need to know:

Death Benefit: As we've covered, this is generally paid out to your beneficiaries free from federal income tax.

Cash Value Growth: If you have a permanent life insurance policy, the cash value inside it grows on a tax-deferred basis. Think of it like a 401(k) or IRA—you don't owe taxes on the gains each year as they build up.

Policy Premiums: This is the one that trips people up. The money you pay for your policy is not tax-deductible. It's treated as a personal expense, just like car insurance.

This special tax framework has been in place since the Revenue Act of 1913, which shows just how fundamental it is to long-term financial security in the U.S.

To really get a handle on this, it's helpful to be clear on the terminology. If you ever come across a term you're unsure about, a good financial glossary can be a lifesaver. Getting the basics down now will make the more advanced concepts much easier to grasp.

A Quick Guide to Life Insurance Tax Events

To make things even clearer, here’s a simple table summarizing how the IRS generally treats common life insurance events.

Event | General Federal Income Tax Treatment |

|---|---|

Premiums Paid | Not tax-deductible. |

Death Benefit Paid | Received income-tax-free by beneficiaries. |

Cash Value Growth | Grows tax-deferred within the policy. |

Policy Loan Taken | Generally not taxable. |

Policy Surrendered for Cash | Gains are taxable as ordinary income. |

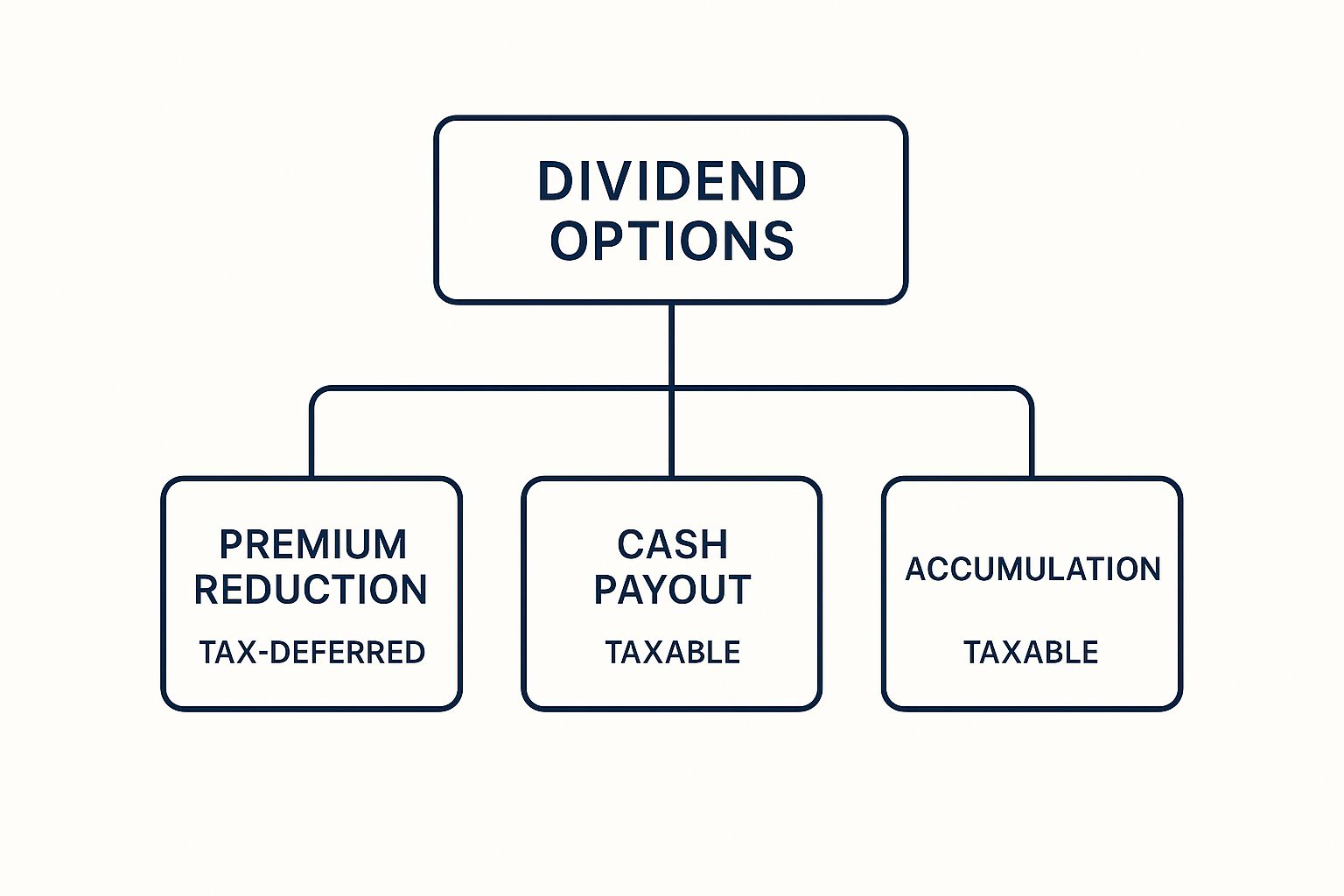

Dividends Received | Typically considered a tax-free return of premium. |

This table is a great starting point, but remember, individual situations can vary. It’s always smart to use this as a guide and consult with a professional for advice specific to your circumstances.

How Cash Value Grows Inside Your Policy

When you have a permanent life insurance policy, like whole or universal life, you get more than just a death benefit. You also get a powerful feature known as cash value.

Think of it as a savings component that's built right into your policy. Each time you pay your premium, a portion covers the actual cost of the insurance, and the rest gets funneled into this cash value account, where it starts to grow.

The Power of Tax-Deferred Growth

Here’s where it gets interesting. This isn't just a standard savings account. The money in your cash value grows on a tax-deferred basis. This is a massive advantage. In a normal investment or savings account, you'd likely get a tax bill every year on your interest or gains. Not here.

Tax deferral essentially puts your money on a turbocharged growth track. Because you aren’t chipping away at your earnings to pay taxes annually, the full amount stays in the policy to compound. It’s a classic snowball effect—the money that would have gone to the IRS is instead earning more money for you.

This principle is probably familiar if you have a traditional 401(k) or IRA. The funds grow year after year, untouched by taxes, as long as they stay inside the account. This tax-sheltered growth is exactly why so many people see permanent life insurance as a long-term financial tool, not just a safety net. For a deeper look, check out these details on life insurance policies that accumulate savings.

Key Insight: Tax deferral lets your cash value grow on its full, pre-tax amount, which dramatically boosts the power of compounding over the long haul. This is what makes permanent life insurance such an effective vehicle for building wealth.

When Cash Value Growth Becomes Taxable

While the growth is tax-deferred, that doesn't automatically mean it's tax-free forever. There are specific actions that can trigger a tax bill, and it’s crucial to know what they are.

The most common trigger is surrendering the policy for a gain.

Let's say you decide you no longer want the coverage and you "surrender" (or cancel) the policy. The insurance company will send you a check for its cash surrender value. At that moment, the IRS will want its piece of any profit you made.

Your taxable gain is calculated by taking the total cash you receive and subtracting your cost basis. In simple terms, your cost basis is just the sum of all the premiums you've paid over the years.

An Example of a Taxable Gain

Let's walk through a quick example to see how this works in the real world.

Imagine you've had a policy for 20 years. Here are the numbers:

Total Premiums Paid (Your Cost Basis): $40,000

Current Cash Surrender Value: $55,000

To figure out the taxable portion, the math is straightforward:

Calculation Component | Amount |

|---|---|

Cash Surrender Value Received | $55,000 |

Less: Total Premiums Paid (Cost Basis) | -$40,000 |

Taxable Gain | $15,000 |

In this case, that $15,000 difference is considered a gain. You would owe ordinary income tax on it—not capital gains tax. This is a critical distinction. If your cash value was less than what you paid in premiums, there would be no gain, and therefore, no taxes owed.

Understanding this rule is key to managing your policy wisely. The tax advantages are fantastic while the policy is active, but cashing it out can change the entire equation.

Tapping Into Your Cash Value Without Triggering a Tax Bill

One of the best things about a permanent life insurance policy is that it’s more than just a death benefit. It's a living asset, building a pool of cash value you can tap into while you're still around. But how you get that money out makes all the difference when it comes to taxes.

You’ve got two main doors to access your cash: taking out a policy loan or making a direct withdrawal. Knowing which door to open is crucial for keeping your money out of the IRS's hands. Your choice really boils down to your specific financial needs and where your policy stands.

The Smart Way to Borrow: A Policy Loan

Hands down, one of the most powerful perks of permanent life insurance is the ability to take out a policy loan. Why? Because the money you receive is generally not considered taxable income. That’s a huge win.

It helps to think of it less like a withdrawal and more like a secured loan. You aren't actually taking money out of your policy; you're simply using your cash value as collateral for a loan directly from the insurance company. It’s a lot like a home equity line of credit (HELOC), where you borrow against the value of your house. Since it's a loan, the IRS doesn't see it as income.

You can usually borrow a significant chunk of your cash value and use the money for anything you want—a down payment on a house, college tuition, or an unexpected medical bill. The loan does accrue interest, but you’re in the driver's seat. You can pay it back on your own schedule or choose not to pay it back at all. If you don't, the insurance company will just subtract the outstanding loan and any interest from the death benefit paid to your beneficiaries.

Taking Your Own Money Back: Direct Withdrawals

The other path is a direct withdrawal, also known as a partial surrender. The tax rules here are different but can still be very friendly, all thanks to what's called the cost basis first rule.

This rule is simple: you get to take out your own money first, tax-free. You can withdraw every dollar you've ever paid in premiums—your cost basis—before you have to worry about paying a dime in taxes.

Let's say you've paid a total of $30,000 in premiums over the years, and your cash value has grown to $45,000. You can pull out up to $30,000 without any tax consequences. Only once you take out more than that $30,000 would the extra $15,000 (the growth) be considered a taxable gain.

This makes withdrawals a great strategy if you just need a bit of cash and know you won't be taking out more than you've put in.

The Critical Tax Trap You Must Avoid

While loans are an incredible tool, they come with one major "gotcha" you need to be aware of: lapsing a policy that has an outstanding loan. If you surrender your policy or just stop paying the premiums and let it lapse while you have a loan, the rules flip entirely.

Suddenly, that loan balance is no longer treated as a loan. The IRS reclassifies it as a distribution. If that loan amount is greater than what you've paid in premiums (your cost basis), the difference becomes taxable income right away.

How a Loan Can Create a Surprise Tax Bill

Imagine this scenario:

Total Premiums Paid (Your Cost Basis): $50,000

Current Cash Value: $80,000

Outstanding Policy Loan: $70,000

You decide to walk away from the policy and it lapses. That $70,000 loan is now viewed as a payout. The IRS looks at that number and subtracts what you put in.

Loan Amount (Treated as a Payout): $70,000

Less Your Cost Basis: -$50,000

Taxable "Phantom" Income: $20,000

Just like that, you’re on the hook for taxes on $20,000 of income, even though you didn't see a penny of new cash when the policy lapsed. This is what experts call "phantom income," and it's a nasty surprise if you're not ready for it. This is exactly why managing your policy and any loans against it carefully is key to enjoying the tax benefits of life insurance.

Tax Rules for Surrendering or Selling a Policy

Life insurance is usually a long-term play, but life happens. Your financial picture can change, and a policy that made perfect sense years ago might not fit your needs today. When it’s time to move on, you generally have two ways to get cash out of your policy while you're still living: surrendering it back to the insurer or selling it to an investor.

Each option has its own tax implications, so it pays to know the rules before you act.

When you surrender a policy, you're essentially ending your contract with the insurance company. They, in turn, pay you the policy's cash surrender value. From the IRS's point of view, the main question is simple: did you make any money on the deal?

The math is pretty direct. If the cash you get back is more than the total premiums you paid in (your "cost basis"), that profit is considered a gain. And it's important to know this gain is taxable as ordinary income—not at the lower capital gains rates.

The Life Settlement Option

What if your policy is worth more than its surrender value? Sometimes, a third-party investor is willing to pay more for your policy than the insurance company will. This opens up an alternative route called a life settlement.

In a life settlement, you sell your policy to an investor for a single cash payment. This payout is almost always higher than the cash surrender value but less than the policy's final death benefit.

While you might walk away with more cash, the tax rules for a life settlement are more complex. The IRS splits the money you receive into three different tiers, and each one gets taxed differently.

Key Insight: A life settlement can put more money in your pocket than a surrender, but the tax calculation isn't as simple. Getting a handle on the three-tiered tax structure is the only way to know what you'll actually keep.

Let’s break down exactly how this three-part system works so you can see your true financial outcome.

Understanding the Three Tiers of a Life Settlement

Think of the money you get from a life settlement as a three-layer cake. Each layer is treated differently by the IRS.

Return of Premium (Tax-Free): The first part of the payment, up to the amount of your cost basis (total premiums paid), is simply your own money coming back to you. This portion is completely tax-free.

Ordinary Income (Taxable): The next layer is the amount that takes you from your cost basis up to the policy's official cash surrender value. This slice is taxed as ordinary income, the same as it would have been if you had just surrendered the policy.

Capital Gains (Taxable): Anything you receive above and beyond the cash surrender value is the final layer. This amount is taxed as a long-term capital gain, which usually means a lower tax rate than ordinary income.

A Life Settlement Example

Let's walk through an example to make this crystal clear. Say you decide to sell your policy and the numbers look like this:

Total Premiums You Paid (Cost Basis): $60,000

Current Cash Surrender Value: $75,000

Life Settlement Payout: $100,000

Here’s how the IRS would break down that $100,000 payout:

Tier | Calculation | Amount | Tax Treatment |

|---|---|---|---|

1. Return of Premium | Equal to your cost basis. | $60,000 | Tax-Free |

2. Ordinary Income | CSV less your cost basis ($75k - $60k). | $15,000 | Ordinary Income Tax |

3. Capital Gains | Payout less the CSV ($100k - $75k). | $25,000 | Capital Gains Tax |

As you can see, selling your policy can be a smart move, but you have to factor in the different taxes on life insurance to understand the bottom line. Knowing this ahead of time helps you make an informed choice and prevents any nasty surprises when you file your taxes.

How Life Insurance Impacts Your Estate Tax

While a life insurance death benefit masterfully sidesteps income tax, it can walk straight into another potential trap: the federal estate tax. For anyone with a sizable estate, understanding this distinction isn't just a technicality—it's the key to preserving your wealth and making sure your legacy reaches your heirs intact.

The heart of the matter boils down to a simple but critical concept: incidents of ownership. If you, the person insured, own your life insurance policy directly, the IRS sees that entire death benefit as part of your taxable estate when you die.

Think of it this way: if you have the power to change the beneficiary, borrow against the policy, or even just cancel it, you have control. And to the IRS, that control makes the policy your asset.

If your total estate's value—including your home, investments, and that life insurance payout—climbs over the federal estate tax exemption, the death benefit can suddenly get hit with a massive tax bill. This can shrink the amount your loved ones actually receive by a surprising margin.

The Problem with Direct Ownership

Let's look at a real-world example. Imagine you have an estate worth $13 million and you also personally own a $2 million life insurance policy. For 2024, the federal estate tax exemption is a generous $13.61 million.

Here’s how the math shakes out:

Your Taxable Estate: $13 million (other assets) + $2 million (life insurance) = $15 million

Amount Over Exemption: $15 million - $13.61 million = $1.39 million

That $1.39 million is now exposed to federal estate taxes, which can climb as high as 40%. This is a classic case where simply owning the policy yourself creates a huge, and often completely avoidable, tax liability for your heirs.

Using an ILIT to Protect Your Legacy

So, how do you keep life insurance proceeds safely outside of your estate? The most powerful tool for this job is an Irrevocable Life Insurance Trust, or ILIT.

An ILIT is a special type of trust designed for one primary purpose: to own your life insurance policy. It's a clever, legal way to sidestep the ownership issue.

Here’s the basic flow:

You set up the ILIT and name someone you trust as the trustee.

The trust, not you, applies for and purchases a life insurance policy on your life.

You make cash gifts to the trust, and the trustee uses that money to pay the premiums.

When you pass away, the insurance company pays the death benefit directly to the trust—not to your estate.

Key Takeaway: By having the ILIT own the policy, you give up all incidents of ownership. The death benefit is therefore not counted as part of your taxable estate, allowing the full, untaxed amount to flow to your beneficiaries as laid out in the trust's instructions.

This strategy effectively shields the entire death benefit from estate taxes, no matter how large your estate grows.

Policy Ownership and Estate Tax Inclusion

Choosing the right ownership structure is everything. This table breaks down the most common options and their direct impact on your taxable estate.

Ownership Structure | Death Benefit Included in Taxable Estate? | Best For |

|---|---|---|

Individual (You Own It) | Yes | Individuals whose total estate is well below the federal exemption. |

Another Person (e.g., Spouse) | No (in your estate) | Simple situations, but the policy value becomes part of the owner's estate. |

ILIT (The Trust Owns It) | No | Individuals with large estates who want to maximize wealth transfer. |

As you can see, an ILIT is the gold standard for high-net-worth individuals focused on estate preservation. It provides unmatched protection against estate taxes.

Of course, a strategy like this requires careful planning. Properly drafted wills and other legal documents are crucial to ensure your life insurance proceeds are handled exactly as you intend and to minimize any tax burdens. You can learn more about professional wills and estate document preparation services to make sure every piece of your financial puzzle fits together perfectly. Taking this step is essential for protecting your family’s future and the assets you’ve worked so hard to build.

Life Insurance Isn't What It Used To Be—It's Much More

Knowing the tax rules for life insurance is more important today than it has ever been. Why? Because life insurance has quietly transformed from a straightforward safety net into a powerful and flexible financial planning tool. It's no longer just about leaving money behind; it's about navigating the complex economic and social shifts we're all facing.

Think about what's happening around us. Interest rates are unpredictable, and the populations in many developed countries are aging. These aren't just headlines; they're real-world pressures that are changing how we plan for the future. As a result, people are looking for reliable financial solutions, and life insurance is increasingly in the spotlight—not just for its death benefit, but as a strategic asset for retirement and passing wealth to the next generation.

The numbers back this up in a big way. The global life insurance market is set for some serious growth. Total premiums are expected to jump from USD 3.1 trillion in 2024 to an estimated USD 4.8 trillion by 2035. That’s a massive 55% increase, fueled directly by these economic and demographic trends. For a closer look at the data, you can check out the full economic and insurance market outlook from Swiss Re.

Why You Need to Understand the Tax Rules Now

This surge in popularity really drives home a critical point: with more and more people relying on life insurance, getting a handle on its tax implications is no longer optional. It’s fundamental to your financial health. The tax advantages we’ve covered—like the tax-free death benefit and tax-deferred cash value growth—are precisely what make these policies so valuable for today's financial challenges.

Mastering the tax rules allows you to unlock the full potential of your policy. It transforms it from a passive product into an active strategy for building and protecting your family's wealth across generations.

For anyone serious about securing their financial future, this knowledge is power. It lets you use your policy to its full potential, whether you're looking to:

Supplement retirement income using tax-advantaged loans or withdrawals.

Create a tax-free inheritance for your kids and grandkids.

Keep a business afloat by funding a buy-sell agreement.

Protect a large estate from getting carved up by federal estate taxes.

Securing Your Financial Future

At the end of the day, the favorable tax treatment is what elevates life insurance from a simple product to a cornerstone of a smart financial strategy. In a world full of economic uncertainty, understanding these principles gives you a sense of stability and control.

When you master how taxes on life insurance work, you put yourself in the driver's seat. You can make more informed decisions, ensuring the financial security you're building today will be there for your family tomorrow—intact and ready to support them just as you planned. It’s one of the most important steps you can take to protect your legacy and gain true peace of mind.

Common Questions About Life Insurance Taxes

It's natural to have questions as you dig into the details of life insurance, especially around taxes. Even after you grasp the basics, some specific "what if" scenarios can pop up. This section is designed to give you direct answers to the most common questions we hear.

Think of it as a quick-reference guide for those nagging points of confusion. We'll clear things up so you can feel more confident about your policy and your financial plan.

Are My Life Insurance Premiums Tax-Deductible?

This is easily one of the most common questions, and the answer is usually pretty simple: No, your life insurance premiums are generally not tax-deductible.

The IRS sees these payments as a personal expense, just like your home or auto insurance. You're using your after-tax money to pay for personal protection, so you can't write off those premiums on your individual tax return. While some business owners might be able to deduct premiums for policies provided as an employee benefit, that's a narrow exception that doesn't apply to personal policies.

Is the Death Benefit Ever Considered Taxable Income?

For the most part, the death benefit payout lands in your beneficiaries' hands completely free from federal income tax. That’s one of the biggest advantages of life insurance. However, a few specific situations can trigger taxes.

Installment Payments: Let's say a beneficiary decides to take the payout in smaller chunks over several years instead of all at once. The insurance company will likely pay interest on the money it holds back. That interest is taxable as ordinary income, though the original death benefit amount remains tax-free.

Transfer for Value: Things get complicated if a policy is sold or transferred for something of value. This "transfer for value" rule can cause the death benefit to lose its tax-free status. If you're in this boat, it’s crucial to get professional tax advice.

Important Note: Remember the difference between income tax and estate tax. A death benefit is almost always free from income tax. But, as we covered earlier, it might be included in your estate and subject to estate tax if your estate is large enough and you retained ownership of the policy.

What Is a Modified Endowment Contract (MEC)?

A Modified Endowment Contract, or MEC, is a label the IRS gives to a life insurance policy that has been overfunded—meaning more cash has been paid into it than federal tax laws permit for it to retain all its tax advantages.

The government put these rules in place to stop people from using life insurance purely as a tax shelter, straying from its main purpose of providing a death benefit.

A policy trips into MEC status if it fails the 7-Pay Test. In simple terms, this test checks if you've paid more in premiums during the policy's first seven years than the total amount needed to have the policy fully paid-up in seven years.

If your policy becomes a MEC, the tax treatment of its cash value gets a lot less friendly:

Loans and Withdrawals: Any money you take out is taxed on a last-in, first-out (LIFO) basis. This is the opposite of how most non-MEC policies work. It means your taxable gains are considered to come out first.

Penalties: On top of regular income tax, you'll likely get hit with a 10% penalty on the taxable portion of any distribution you take before age 59½.

The good news? A MEC's death benefit is still paid out tax-free. But the "living benefits"—the ability to access your cash value tax-efficiently—are significantly hampered. It’s a critical distinction to watch out for, especially when you plan on putting a lot of cash into a permanent life policy.

At America First Financial, we believe in providing clear, straightforward protection that safeguards your family’s future and aligns with your values. If you're looking for insurance solutions that prioritize your security without the noise, we can help. Get a free, no-hassle quote from America First Financial today.

_edited.png)

Comments