Navigating the Early Retirement Withdrawal Penalty

- dustinjohnson5

- Aug 23, 2025

- 13 min read

When you hear the term early withdrawal penalty, think of it as a 10% speed bump the IRS places on your retirement funds. It's an extra tax they charge if you take money out of most retirement accounts before you hit age 59½. This isn't just a small fee; it's a hefty penalty stacked right on top of your regular income taxes.

Understanding the "Why" Behind This Financial Guardrail

So, why does this rule exist? The government provides some fantastic tax breaks for accounts like 401(k)s and Traditional IRAs to encourage us to save for the long haul. The 10% penalty is the stick that goes with that carrot—it's there to protect your future self by making you think twice before raiding your nest egg for something that isn't a true emergency.

This penalty is a massive deal in financial planning. If you ignore it, you could see a significant chunk of your hard-earned savings disappear. It applies to the taxable portion of your withdrawal, which means you get hit with a one-two punch: first your normal income tax, and then this extra 10% on top.

Which Accounts Does This Penalty Affect?

This rule doesn't apply to every single investment, but it does cover the most popular tax-advantaged retirement plans. Knowing which of your accounts are on this list is the first step to avoiding a nasty surprise from the IRS.

The usual suspects include:

Traditional IRAs: Any pre-tax money you put in and the earnings it generates are fair game for the penalty if you withdraw them early.

401(k) and 403(b) Plans: Just like Traditional IRAs, early distributions from these common workplace plans will trigger the 10% tax.

SIMPLE and SEP IRAs: These retirement plans, often used by small businesses and self-employed individuals, are also subject to the same early withdrawal rules.

Annuities: The earnings portion of a deferred annuity can get hit with the penalty, too.

Early Withdrawal Penalty at a Glance

To simplify things, here's a quick breakdown of what you need to know about the early withdrawal penalty.

Component | Details |

|---|---|

Penalty Rate | A flat 10% of the taxable amount you withdraw. |

Age Threshold | This kicks in for withdrawals made before you reach age 59½. |

Additional Taxes | It's important to remember this is in addition to your regular federal and state income taxes. |

Primary Goal | To promote long-term saving and prevent you from tapping into retirement funds too soon. |

One last thing to keep in mind: this IRS penalty is completely separate from any fees your plan administrator or brokerage might charge. Some plans have their own "surrender charges" or administrative fees for early access, so you could potentially face both.

Calculating the True Cost of an Early Withdrawal

That 10% early withdrawal penalty you always hear about? It’s really just the tip of the iceberg. The real financial damage comes when you combine that penalty with your ordinary income taxes. This one-two punch can take a surprisingly big bite out of the money you thought you had.

Let's walk through a real-world example to see exactly how this works.

A Real-World Withdrawal Scenario

Imagine you need to pull $20,000 out of your Traditional IRA for something that doesn't qualify for an exception. You're under age 59½, so the early withdrawal rules are in full effect.

Here’s a play-by-play of the costs:

The Immediate 10% Penalty: Right off the bat, the IRS hits you with a 10% penalty on the full amount. For a $20,000 withdrawal, that’s an instant $2,000 loss ($20,000 x 10%). Think of it as an extra tax you owe for breaking the rules.

The Income Tax Hit: This is where it really stings. The entire $20,000 you took out is added to your taxable income for the year. If your income puts you in the 22% federal tax bracket, you’re looking at another $4,400 in taxes ($20,000 x 22%).

Add it all up, and your $20,000 withdrawal just cost you $6,400 in combined penalties and taxes. You only walk away with $13,600 of your own money. And that's before we even consider state income taxes, which could shrink that amount even more.

Key Takeaway: An early withdrawal doesn't just cost you 10%. The true cost is the 10% penalty *plus* your marginal income tax rate. It's not uncommon for this to eat up 30% or more of the money you pull out.

To see how a withdrawal might affect your own financial situation, using an asset calculator can give you a clearer picture of the long-term impact on your goals.

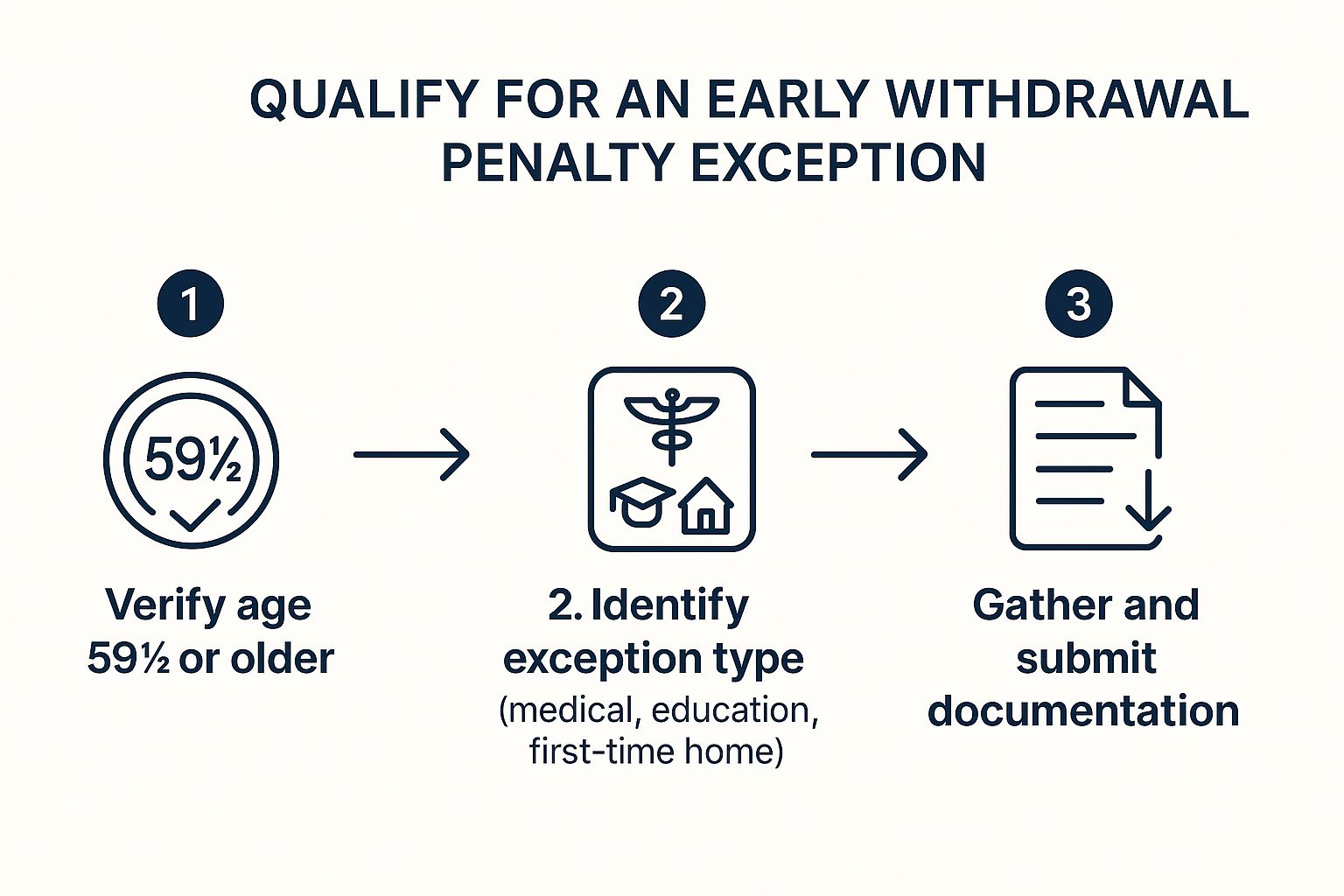

Qualifying for a Penalty Exception

Thankfully, the situation isn't always so dire. The IRS has a list of specific circumstances that let you avoid the 10% penalty. It's important to remember, though, that even with an exception, you'll almost always still owe income tax on the withdrawal.

The infographic below gives a high-level overview of how you might qualify.

As the visual shows, getting an exception isn't automatic. It requires you to confirm your situation matches an IRS-approved reason and then file the right paperwork with your tax return. Getting each step right is the key to successfully avoiding that painful 10% hit.

Why This Penalty Exists and How It Shapes Behavior

It’s easy to see the early withdrawal penalty as just a punishment, but that’s not really its purpose. Think of it more like a protective barrier for your future self. The government provides some really nice tax benefits for accounts like 401(k)s and IRAs to get us to save for retirement.

Those tax breaks—like letting your money grow without being taxed every year or giving you a tax deduction on your contributions—are a big deal. The 10% penalty is simply the government's way of making sure we use these accounts for their intended purpose: funding retirement, not paying for a new car or a vacation. It's a powerful nudge to keep that nest egg intact.

This system is designed to prevent what financial planners call "leakage." That's when money slowly trickles out of retirement plans for things that aren't true emergencies. By making it costly to dip in early, the rules help keep that money locked up and growing for the long haul.

The Behavioral Impact of the Age 59½ Rule

That age 59½ rule might seem random, but it draws a clear line in the sand that really changes how we think about our savings. The penalty forces you to stop and think. It makes you ask, "Is this immediate need really worth the long-term hit I'm about to take?"

That psychological hurdle is surprisingly effective. Without it, the temptation to raid a large savings account for a major purchase or a temporary cash crunch would be immense, potentially leaving millions of people in a tough spot later in life.

The rule's impact isn't just a theory; the numbers back it up. One study found that getting rid of the 10% penalty led to a roughly 93% jump in annual withdrawals. That's about $1,576 more being pulled out by each person, every year. You can dig into the specifics of that research on retirement distribution behavior in this study.

This data proves just how strong a deterrent the early retirement withdrawal penalty really is. It successfully shapes our saving habits by making the immediate financial sting align with the long-term goal of a secure retirement. It’s a foundational piece of the puzzle that helps your savings actually last a lifetime.

Legitimate Exceptions to the 10 Percent Penalty

While that 10% early withdrawal penalty is designed to keep you from raiding your retirement savings, it’s not set in stone. The IRS gets it—life happens. Sometimes you genuinely need that money before age 59½, and for those very specific situations, they’ve created some important exceptions.

Think of these as penalty-free passes. You’ll still owe regular income tax on the money you take out, of course, but you get to sidestep that extra 10% hit. Knowing what these exceptions are can save you a bundle if you find yourself in a tough spot.

Just remember, the burden of proof is on you. You'll need to file the right paperwork (usually IRS Form 5329) with your tax return to officially claim the exception.

Disability and Medical Hardships

Some of the most critical exceptions are tied to your health. If you become totally and permanently disabled, the IRS allows you to access your retirement funds without penalty. They have a very specific definition of "disabled," so you'll need a doctor's certification stating you can't perform any substantial work due to your condition.

You can also tap your accounts to handle major medical bills.

Unreimbursed Medical Expenses: You can take a penalty-free withdrawal to cover medical costs that exceed 7.5% of your adjusted gross income (AGI). So, if your AGI is $100,000, you can withdraw funds penalty-free to pay for any medical bills over $7,500.

Health Insurance Premiums: If you lose your job and have collected unemployment benefits for at least 12 weeks in a row, you can use money from an IRA to pay for health insurance premiums without the penalty.

These rules provide a crucial financial cushion, ensuring a health crisis isn't made worse by a punishing tax bill.

Education and Homeownership Goals

The government also carves out exceptions for a couple of major life goals: sending someone to college and buying a first home. It’s a recognition that sometimes you have to invest in your present to build a better future.

For education, you can pull money from an IRA penalty-free to cover qualified higher education expenses. This isn't just for you; it can be for your spouse, kids, or even grandkids. It covers things like tuition, fees, books, and other required supplies.

Another very common exception is for first-time homebuyers. You're allowed to withdraw up to a $10,000 lifetime maximum from your IRA to help buy, build, or rebuild a first home for yourself or a close family member. That can be a huge help when you're scraping together a down payment.

A Quick Rundown of Key Exceptions

Navigating the rules for each plan type can get confusing. Here’s a table that breaks down some of the most common exceptions and which accounts they typically apply to.

Exception | Applicable Account(s) | Key Limitation or Requirement |

|---|---|---|

Total & Permanent Disability | IRAs, 401(k)s, 403(b)s | Must meet the IRS's strict definition of disability with a physician's certification. |

Unreimbursed Medical Expenses | IRAs, 401(k)s, 403(b)s | Only for expenses that exceed 7.5% of your Adjusted Gross Income (AGI). |

Health Insurance Premiums | IRAs only | Must have received unemployment compensation for 12 consecutive weeks. |

Higher Education Expenses | IRAs only | For qualified expenses for yourself, spouse, children, or grandchildren. |

First-Time Home Purchase | IRAs only | Lifetime limit of $10,000. |

Substantially Equal Periodic Payments (SEPP) | IRAs, 401(k)s, 403(b)s | Must take a series of payments calculated by an IRS-approved method. |

IRS Levy | IRAs, 401(k)s, 403(b)s | The withdrawal is made to satisfy an IRS levy on the account. |

Qualified Reservist Distribution | IRAs, 401(k)s, 403(b)s | Must be called to active duty for at least 180 days. |

This isn't an exhaustive list, but it covers the situations most people encounter. Always double-check the specific rules for your plan.

Other Important Exceptions

Beyond those more common scenarios, a few others are worth knowing about. They are a bit more niche but can be a lifesaver if they apply to your situation.

Substantially Equal Periodic Payments (SEPP): This is a more complex strategy, often called a 72(t) distribution, where you commit to taking a series of calculated annual withdrawals over a long period.

IRS Levy: If the IRS comes after your retirement account to collect on back taxes, the money they take isn't subject to the extra 10% penalty.

Qualified Reservist Distributions: Members of the military reserves called to active duty for more than 179 days can often take penalty-free distributions during their service.

Every one of these exceptions comes with its own set of rules and required paperwork. Before you make any move, it’s always a smart idea to chat with a financial advisor or tax pro to make sure you qualify and are reporting everything correctly. A little bit of expert guidance can go a long way in protecting your savings from an avoidable early retirement withdrawal penalty.

Smart Ways to Tap Your Retirement Funds Early

Life doesn't always wait for you to turn 59½. Beyond the official hardship exceptions, there are several established, proactive ways to access your retirement funds without getting hit with that dreaded 10% penalty. These aren't sneaky loopholes; they're IRS-approved provisions designed for specific financial situations.

Knowing how to use these tools can give you incredible flexibility, whether you're planning an early retirement or just need a financial safety net. And people use them—a lot. One study found that in a single year, households under 55 pulled out an amount equal to 20% of that year's contributions and paid the penalty. On top of that, they withdrew another 21% using penalty-free methods. You can dive deeper into the data on early withdrawal trends in this study.

The Rule of 55 for 401(k) Plans

One of the most powerful but often misunderstood strategies is the Rule of 55. This is a special provision that applies to 401(k) and 403(b) plans, but—and this is a big "but"—it does not apply to IRAs.

Here’s how it works: If you leave your job (whether you quit, get laid off, or retire) during or after the calendar year you turn 55, you can start taking penalty-free withdrawals from that specific company's 401(k). So, if you part ways with your employer at age 56, you can immediately access that 401(k) money without the 10% penalty.

The key is that the money has to stay in that 401(k). If you roll those funds over to an IRA, you lose this special privilege, and the standard 59½ rule kicks back in.

Substantially Equal Periodic Payments (SEPPs)

What if you're nowhere near 55 but need to create an income stream from your savings? This is where Substantially Equal Periodic Payments (SEPPs) come in. Governed by IRS Rule 72(t), this strategy lets you take a series of calculated withdrawals from your IRA or 401(k) at any age, penalty-free.

Think of it as turning your retirement account into your own private pension. But it comes with a strict set of rules you have to follow to the letter.

How it's Calculated: You don't just pick a number. The IRS requires you to use one of three approved methods (amortization, annuitization, or life expectancy) to figure out your annual withdrawal amount.

The Commitment: Once you begin, you’re locked in. You have to keep taking these exact payments for at least five years or until you turn 59½, whichever comes later.

The Consequences: If you mess up—by changing the amount or stopping the payments early—the 10% penalty comes roaring back and gets applied retroactively to every single withdrawal you've already taken, plus interest.

SEPPs offer amazing flexibility for early retirees, but they require iron-clad discipline. It's a great option if you need predictable income and are absolutely certain your financial needs won't change.

Your Best-Kept Secrets: Roth Contributions and 401(k) Loans

Two other strategies are much more straightforward and can be incredibly useful for more common financial needs.

First up, your Roth IRA contributions are a game-changer. Since you already paid taxes on the money you put in, the IRS lets you withdraw your direct contributions—not the earnings, just what you put in—at any time, for any reason. It's completely tax-free and penalty-free. This makes a Roth IRA a fantastic hybrid account for both retirement and emergency savings.

Second, a 401(k) loan is often a much better move than a withdrawal. Instead of permanently taking money out and triggering taxes and penalties, you're just borrowing from yourself. You pay the loan back to your own account, with interest. As long as you follow the repayment plan and stay with your employer, there's no tax or penalty involved. It’s a powerful way to handle a short-term cash crunch without derailing your retirement goals.

Alright, let's tackle the tax paperwork. It might seem like a maze of forms and codes, but getting it right is the key to making sure a necessary withdrawal doesn't create a bigger mess with the IRS.

When you pull money out of a retirement account, the financial institution that holds your funds is required to report it. You'll receive a copy of Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. in the mail. This document is the official record of your withdrawal, detailing exactly how much you took out and what, if anything, was already withheld for taxes.

Your Two Must-Know Tax Forms

Now, that Form 1099-R is just the first piece of the puzzle. The second, and arguably more important, form is Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts.

Think of them working together like this:

Form 1099-R tells the IRS, "Hey, a withdrawal happened." It's the what.

Form 5329 is your chance to explain yourself. It's the why. This is where you either calculate the 10% early retirement withdrawal penalty or formally claim an exception to avoid it.

If you took an early distribution, you have to file Form 5329 along with your annual tax return. This is non-negotiable. Even if you qualify for an exception and owe zero penalty, you still need to file this form to officially tell the IRS why you're exempt.

The Steep Price of Ignoring the Paperwork

What happens if you don't file? The consequences can be severe, and it's a more common mistake than you might think. In 2021, tax data showed that while 6.2 million people reported taking early distributions, a shocking 5.2 million of them didn't file Form 5329 to go with it. You can read more about these taxpayer compliance findings on Plansponsor.com.

The IRS doesn't take this lightly. If you fail to file, they can hit you with a 5% failure-to-file penalty each month on the unpaid taxes from your withdrawal. This is on top of the original 10% penalty and the income tax you already owe. It’s a financial snowball that can quickly get out of hand.

Ultimately, taking a few minutes to understand and correctly file these two forms is your best line of defense. It ensures that a short-term solution doesn't become a long-term, and entirely preventable, financial headache.

A Few Common Questions, Answered

Once you start digging into early withdrawal penalties, a lot of specific "what if" scenarios pop up. Let's walk through a few of the most common questions people ask when trying to navigate these rules.

Does the Penalty Apply to Roth IRA Withdrawals?

When it comes to a Roth IRA, the answer is a classic "it depends." This is actually where one of the biggest perks of a Roth really shines. You are always free to withdraw your direct contributions—the actual money you put into the account—at any time, for any reason, without paying a dime in taxes or penalties. Why? Because you already paid taxes on that money before it went in.

The earnings on your investments, however, are a different story. To get those gains out tax-free and penalty-free, you typically need to meet two key tests: you have to be at least 59½ years old, and your Roth IRA must have been open for a minimum of five years.

Do I Still Owe Income Tax If I Qualify for an Exception?

Yes, you almost always do. This is a crucial point that trips a lot of people up. Getting an exception means you get to sidestep the 10% early withdrawal penalty, but it doesn't magically wipe out your regular income tax bill.

Any money you pull from a pre-tax retirement account, like a Traditional IRA or a 401(k), is treated as income for that year. It gets added to your other earnings and taxed at your normal rate. The exception just saves you from that extra 10% hit.

Key Insight: Think of an exception as a penalty waiver, not a tax-free pass. You should always plan for the income tax you'll owe, even when you qualify to avoid the penalty.

What Is the Rule of 55?

The Rule of 55 is a handy provision, but it’s specific to workplace retirement plans like 401(k)s and 403(b)s—it doesn't work for IRAs. Here’s the deal: if you leave your job for any reason (quit, laid off, fired) during or after the calendar year you turn 55, you can start taking withdrawals from that specific company's plan without the 10% penalty.

The key is that you have to separate from service. It’s a great option for people who are aiming for an early retirement between the ages of 55 and 59½. Federal employees have their own complex rules, and resources like these FAQs about FERS Retirement can provide more specific guidance.

At America First Financial, we believe in securing your family's future with clear, dependable financial solutions that honor traditional American values. Explore our insurance and annuity options designed for long-term stability and peace of mind. Get a no-hassle quote today at https://www.americafirstfinancial.org.

_edited.png)

Comments