No Medical Exams Life Insurance: Fast, Affordable Coverage

- dustinjohnson5

- Jul 24, 2025

- 16 min read

No-medical-exam life insurance does exactly what the name suggests: it lets you secure coverage by skipping the traditional physical exam. Instead of dealing with needles and scheduling doctor visits, insurers use data and technology to figure out your eligibility. The result is often a decision in minutes or days, not the weeks or even months it can take with a standard policy.

How No Medical Exam Life Insurance Really Works

So, how do they do it? It’s not magic; it’s just a smarter, faster way for insurance companies to get the information they need. Think of it less like a full physical and more like a comprehensive background check for your health.

Instead of a doctor sending your bloodwork to a lab, insurers use secure, third-party data to get a snapshot of your risk profile. This whole process is designed for our busy, modern lives, letting you lock in crucial financial protection for your family right from your living room.

The Digital Health Snapshot

When you fill out an application, you give the insurance company permission to pull information from a few specific databases. They aren't snooping through your entire private life. They’re just looking at key pieces of information that, when put together, create a clear picture of your overall health and lifestyle.

This digital-first approach helps them accurately price your policy without you ever having to see a doctor. It’s a trade-off that works for both sides: you get convenience and speed, and the insurer gets the data it needs to make an informed underwriting decision.

The primary sources they check include:

MIB Group (Medical Information Bureau): Think of this as the insurance industry's fraud-prevention database. It shows if you’ve applied for life or health insurance in the past, but it doesn’t contain your detailed medical records.

Prescription History: This is a big one. A quick look at your prescription records gives underwriters a clear view of any health conditions you’ve been treated for.

Motor Vehicle Records (MVR): Your driving history says a lot about your lifestyle. A record with DUIs or multiple reckless driving incidents signals a higher risk to the insurer.

By piecing together this data, insurers can build a surprisingly accurate health profile in a fraction of the time. This is the secret sauce that makes near-instant approvals possible.

For a quick overview, let's compare the two approaches side-by-side.

Traditional vs No Medical Exam Life Insurance At a Glance

This table breaks down the main differences you can expect when choosing between a traditional policy and one that skips the exam.

Feature | Traditional Life Insurance | No Medical Exam Life Insurance |

|---|---|---|

Medical Exam | Required (physical, blood, urine) | Not Required |

Application Process | Lengthy, involves in-person visit | Quick, usually 100% online |

Approval Time | 4-8 weeks, sometimes longer | Minutes, hours, or a few days |

Data Sources | Exam results, medical records, MIB | Digital data (MIB, Rx, MVR) |

Coverage Amounts | Very high limits available | Often capped (e.g., $1M - $3M) |

Ideal For | Healthy individuals seeking maximum coverage | People wanting speed and convenience |

As you can see, the choice often comes down to what you value most: the lowest possible premium or the fastest, most convenient process.

The Underwriting Process Demystified

The popularity of these policies has exploded because they remove the biggest hassles for applicants. In fact, research shows that about 50% of people are more likely to buy life insurance if they can skip the medical exam. It’s a game-changer for people with packed schedules or a bit of "white coat syndrome." To see which companies are leading the pack, you can check out reviews of 2025's best no-exam term life insurance from lifeinsure.com.

At the end of the day, the process works by swapping a physical exam for a digital one. If your data checks all the right boxes for the insurer, you can get approved for a great policy almost instantly. It’s a secure, efficient, and increasingly popular way to protect what matters most.

Finding Your Fit in No-Exam Policies

Not all no-medical-exam life insurance policies are the same. The term is really just an umbrella for a few different ways to get coverage, each built for a specific kind of person. Figuring out these options is the first step to landing a policy that actually fits your health, budget, and timeline.

Think of it like picking a lane on the highway. There’s an express lane for people in great health who want to get there fast, a steady middle lane for most drivers, and a more accessible lane for those who need it. Your health and financial picture will point you to the right lane.

Accelerated Underwriting: The Express Lane

Accelerated Underwriting (AU) is the quickest and often cheapest route for no-exam life insurance. It’s designed for healthy people who simply want to skip the hassle of a physical exam.

This isn't a "no questions asked" situation. Instead, the insurer uses that digital health snapshot we talked about—your prescription history, MIB file, and MVR—to quickly confirm you're in good or great health. If your data checks out, you can lock in coverage that's often priced just as competitively as a fully underwritten policy. The best part? It can happen in minutes.

So, who's this for?

The Healthy and Busy Professional: Imagine a 35-year-old software engineer with no major health problems. They need solid coverage fast but can't afford to disrupt their packed schedule.

The Young Family Starter: Think of a 30-year-old couple just buying their first home. They need to get protection in place immediately to cover their new mortgage.

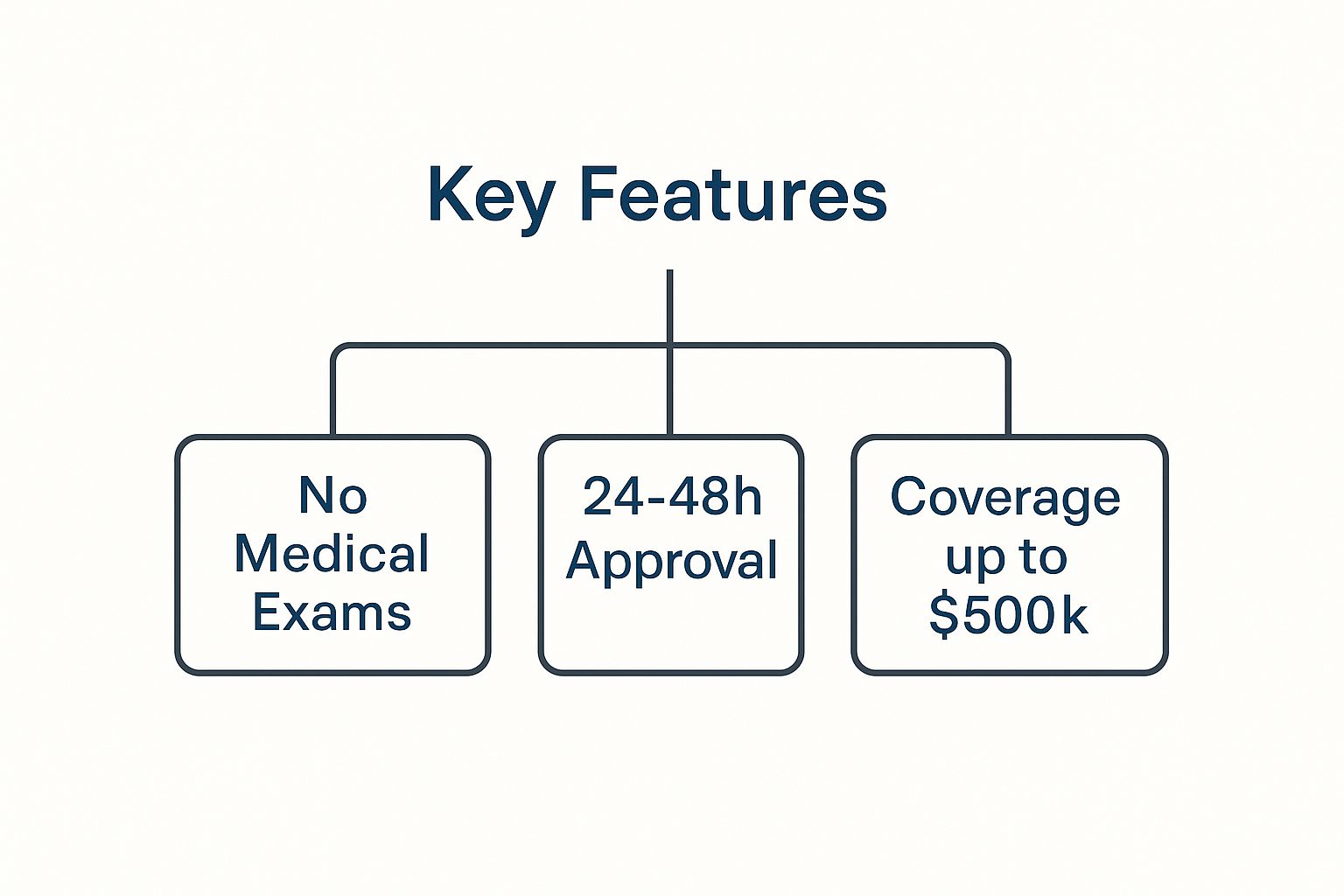

This image breaks down the key features that make these policies so appealing.

As you can see, the value is clear: no physical exam, lightning-fast approval, and genuinely meaningful coverage amounts.

Simplified Issue: The Middle Ground

But what if you have a few minor or well-managed health issues? Simplified Issue life insurance could be the perfect solution. It sits right in the middle, between the strict data-driven approach of accelerated underwriting and the completely open-door policy of guaranteed issue.

Instead of a deep dive into your data, this process hinges on a short health questionnaire. You won’t have to take a medical exam, but you will have to answer "no" to a handful of "knock-out" questions about major health problems like recent cancer treatments, AIDS, or a terminal diagnosis.

Simplified Issue policies are built for the average person who is in decent health but might not qualify for the absolute rock-bottom rates. It offers a straightforward path to getting the coverage you need.

Take, for example, a 60-year-old who has their high blood pressure and cholesterol under control with medication. They see their doctor regularly and are otherwise healthy. While an accelerated policy might be out of reach, they can easily get approved for a simplified issue plan and secure peace of mind for their family.

Guaranteed Issue: The Safety Net

Finally, we have Guaranteed Issue life insurance. It is exactly what it sounds like: your acceptance is guaranteed, no matter what your health looks like. There is no medical exam and, most importantly, no health questions are asked.

Of course, that accessibility comes with a few trade-offs. These policies offer much lower coverage amounts, often capping out around $25,000, and the premiums are higher. They also almost always include a two-year waiting period. If the insured person passes away from natural causes during that time, the beneficiaries don't get the full death benefit; instead, they receive a refund of all the premiums paid, plus some interest.

This structure makes it a very specific tool, not an all-purpose life insurance solution.

Who needs this?

Seniors with Significant Health Issues: Someone with a chronic illness who has been turned down for other types of coverage can use this to handle final expenses, like funeral costs or leftover medical bills.

Anyone Needing Final Expense Coverage: A person who simply wants to make sure their burial costs don't become a financial burden for their loved ones.

Choosing the right type of no-medical-exam life insurance all comes down to an honest look at your health and your priorities. Whether you need the speed of the express lane, the balance of the middle ground, or the absolute certainty of a safety net, there’s a policy designed to fit where you are right now.

Is a No-Exam Policy Worth It? Let's Weigh the Pros and Cons

Choosing a no medical exams life insurance policy comes down to a fundamental trade-off. You're essentially swapping the time-consuming, sometimes invasive, traditional application process for one that puts speed and convenience first. This modern approach has some serious perks, but it's not without its downsides. To make the right call for your family's future, you need to see both sides of the coin.

The appeal is obvious. For a lot of us, the thought of skipping the needles, doctor's office visits, and personal health questions is a huge plus. It’s the main reason these policies have caught on. Instead of playing the waiting game for weeks, you can often get covered in a day, or sometimes even just a few minutes, all from your own couch.

This isn't just about saving time; it's about making financial protection accessible to more people. The numbers back this up. A staggering half of potential buyers say they'd be more likely to get life insurance if they could skip the medical exam. This shows just how much of a roadblock the old way can be, especially when you consider that 42% of adults already feel they don't have enough coverage. You can dig deeper into these trends and discover the details behind life insurance statistics on Bankrate.com.

The Upside: Why People Love Skipping the Exam

The benefits of no medical exam life insurance are about more than just dodging a needle. Let's break down the real advantages to see who stands to gain the most.

Unbelievable Speed: The approval process is lightning-fast. Accelerated underwriting can give you an answer in minutes, while simplified issue policies usually only take a day or two. This is perfect when you need coverage in a hurry, like for a small business loan or to protect a new mortgage right away.

Total Convenience: You can handle the entire application online or over the phone. No scheduling appointments, no taking time off work, and no discomfort from a physical exam. It fits into your life, not the other way around.

Easier Access: If you have a packed schedule or a genuine fear of needles, these policies remove major hurdles. They also open the door for people with some moderate health issues who might be a great fit for a simplified issue plan.

The Downside: What You Give Up for Convenience

While the benefits are compelling, you have to be realistic. All that convenience comes with trade-offs you need to consider carefully.

Because the insurer is working with less health information, they're taking on a bigger risk. That increased risk usually shows up in the policy's price and how much coverage you can get.

Here are the main drawbacks to keep in mind:

Potentially Higher Costs: Although accelerated underwriting can be very affordable for healthy applicants, simplified and guaranteed issue policies are almost always more expensive than a comparable plan with a full medical exam. You're paying a premium for the convenience.

Lower Coverage Amounts: To manage their risk, insurers put a cap on the death benefit for no-exam policies. You can still find significant coverage—sometimes over $1 million with accelerated underwriting—but you won't get the huge multi-million dollar policies available the traditional way.

You Can Still Be Denied: "No medical exam" isn't the same as "guaranteed approval"—unless you're buying a guaranteed issue policy. Insurers still look at your digital footprint. If something in your MIB file, prescription history, or driving record raises a red flag, they can still say no to an accelerated or simplified issue application.

Who Should Consider No Exam Life Insurance?

So, is a no-exam policy right for you? It really depends on your situation and what you value most. This table can help you figure out if your needs align with what these policies offer.

You Should Consider This If... | Best Policy Type | Key Consideration |

|---|---|---|

You are young, healthy, and want coverage fast. | Accelerated Underwriting | Your digital health data must be clean to get the best rates. |

You have a moderate, well-managed health condition. | Simplified Issue | Premiums will be higher, but approval is more likely than with a traditional policy. |

You need coverage to secure a loan (e.g., SBA). | Accelerated or Simplified Issue | Speed is the biggest advantage here; you can get proof of coverage quickly. |

You have a fear of needles or are extremely busy. | Any No-Exam Policy | You're paying for convenience and avoiding the hassle of a medical appointment. |

You have serious health issues and have been denied before. | Guaranteed Issue | Coverage is a sure thing, but it comes with low benefit amounts and a waiting period. |

In the end, it's a personal decision. Are you willing to pay a bit more for a quick and painless experience? Or is your top priority getting the absolute lowest rate, even if it means a more involved process? By weighing these pros and cons, you can decide with confidence whether no medical exams life insurance is the best way to protect your loved ones.

Getting Approved for No-Exam Life Insurance

So, who actually gets approved for no-medical-exam life insurance? Figuring this out from the start saves a lot of time and hassle. It helps you set the right expectations and apply for the policy you're most likely to get.

Think of it like different security lines at the airport. You have the super-fast TSA PreCheck for low-risk travelers, the standard line for most people, and other lanes for different needs. Life insurance companies have a similar system for their no-exam policies. Each type—Accelerated Underwriting, Simplified Issue, and Guaranteed Issue—is built for a different kind of person.

Let's walk through what it takes to get into each lane.

The Best Fit for Accelerated Underwriting

Accelerated underwriting is the express lane, and insurers reserve it for people who look like a safe bet. To get the green light, you need to be in pretty good shape, not just on the surface but in your official records, too. The company runs a deep data check, and they're looking for a clean bill of health.

You’re likely a great candidate for this fast-track option if you are:

Younger: Insurers are often more comfortable with applicants under 50 or 60.

In Good Health: You don’t have any major or chronic health issues, and your prescription history is minimal.

At a Healthy Weight: Your height and weight fall within the company's standard guidelines.

Living a Low-Risk Lifestyle: No red flags like a recent DUI or a criminal record pop up in your background check.

If your digital records paint this picture, you can often get coverage just as affordable as a traditional policy that requires a full medical exam.

Passing the Test for Simplified Issue

Simplified Issue policies are a bit more flexible. They're a great fit if you have a few health concerns that are well-managed but are otherwise doing okay. Approval here isn't about a deep dive into your data; it's all about how you answer a short health questionnaire.

The whole process hinges on your ability to answer "no" to a handful of critical "knock-out" questions. The exact questions can vary, but they all aim to screen out people with severe, high-risk conditions.

Answering "yes" to just one knock-out question usually means you won't be approved for that specific plan. It's vital to be honest—if you aren't truthful, the company could deny your family's claim down the road.

These questions almost always ask if you’ve ever been diagnosed with or treated for conditions like:

HIV or AIDS

Alzheimer's or dementia

A terminal illness

Congestive heart failure

Cancer within the past two years (though some policies have exceptions)

The need for an organ transplant

If you can confidently say "no" to these types of questions, you stand a very strong chance of being approved for a simplified issue policy.

Who Gets Guaranteed Issue Coverage

Guaranteed Issue is the most straightforward option of all because there's no real underwriting involved. Your health doesn't matter for approval. No health questions, no background checks, no fuss.

So, who qualifies? Pretty much anyone who fits the age criteria. These policies are built for a specific demographic, usually people between 50 and 85 years old. If you're in that age range, you're in.

This makes it a critical option for people with serious health problems who've been turned down everywhere else. Of course, that guaranteed acceptance comes with some trade-offs: premiums are higher, coverage amounts are much smaller (usually topping out at $25,000), and there's a mandatory two-year waiting period before the full death benefit is paid for anything other than an accident.

Your Step-by-Step Application Guide

Getting life insurance without a medical exam might sound complicated, but it's really a simple, fast-moving process. Let's walk through it, step by step, so you can feel confident from start to finish.

Think of this as your roadmap. The journey doesn't start with filling out a form—it starts with figuring out what you actually need. Before you even think about getting quotes, you need to land on a coverage amount that makes sense for your family.

Step 1: Figure Out How Much Coverage You Need

This isn't a number you just pull out of thin air. It’s about calculating the financial hole your passing would leave. The whole point is to create a safety net big enough to cover these costs so your family isn't hit with a sudden, devastating financial shock.

A great way to start is by adding up a few key things:

Income Replacement: How many years of your salary would it take for your family to get back on their feet and maintain their standard of living?

Major Debts: This is the big stuff—your mortgage, car payments, credit card debt, and any other loans you have.

Future Education Costs: If you have kids, what will it cost to send them to college? It's a huge expense that's easy to overlook.

Final Expenses: Don't forget about funeral and burial costs. These can easily run over $10,000, so it’s important to account for them.

Once you have a solid idea of your target coverage amount, you're ready for the next step.

Step 2: Get Your Information Together

To make the actual application a breeze, do yourself a favor and gather all the necessary info ahead of time. The insurance company is going to use data to confirm who you are and check on your health, so having everything ready and accurate is key.

Here’s what you’ll likely need:

Your driver's license number.

Your Social Security number.

Basic info for your beneficiaries (their full name and date of birth is usually enough).

Your medical history details, including any prescriptions you’re taking and your doctor’s contact info.

With this little bit of prep work done, you'll fly through the application instead of stopping every few minutes to dig through your files.

Step 3: Compare Quotes and Fill Out the Application

Now for the fun part: shopping around. Never take the first quote you get. The prices for the exact same coverage can be wildly different from one company to the next. This is where working with an independent broker can be a huge help—they can instantly compare rates from multiple insurers to find the best deal for your specific situation.

After you've picked a company, the online application is usually pretty quick. You’ll answer the health questions and give the insurer permission to look up your digital records from places like the MIB and prescription databases.

Crucial Tip: Be 100% honest. It's not worth the risk to fudge the details on your health questionnaire. If you die within the first two years of the policy (the "contestability period"), the insurer has every right to investigate. If they discover you weren't truthful, they can flat-out deny the claim, leaving your family with nothing more than a refund of your premium payments.

By following these simple steps, you can take control of the process. You'll be able to compare your options intelligently, apply with confidence, and secure real financial protection for your family—all without the long wait.

Where Is Instant Life Insurance Headed?

The surge in popularity of no-medical-exam life insurance isn't just a passing phase; it’s a genuine preview of where the entire insurance world is going. We're in the middle of a major overhaul, driven by powerful data analytics and the simple fact that people want things to be fast and easy. Insurers aren't just tweaking the old system—they're building a new one from scratch.

This shift is part of a much bigger picture. All over the world, financial tools are becoming more accessible. By swapping out needles and medical appointments for secure data, companies are knocking down the biggest hurdles—time and hassle—that used to stop people from getting the protection they needed.

A New Chapter in Accessibility

The insurance industry has gotten the message loud and clear: customers want coverage without the runaround. This demand for a simpler process is shaking things up globally, and the life insurance market is growing because of it.

In fact, projections show worldwide life insurance premiums climbing from USD 3.1 trillion in 2024 to an expected USD 4.8 trillion by 2035. A huge chunk of that growth is coming from no-exam policies as insurers get smarter about using data to assess risk. For a deeper dive, you can check out the full global economic and insurance market outlook from Swiss Re.

This isn't just about speed. It’s about making financial security a real possibility for more families. The future of insurance is one where getting vital protection is as simple as any other online purchase.

As technology gets even better, the difference between traditional and no-exam policies will start to fade. Underwriting algorithms will become so precise that insurers can offer instant, well-priced coverage to almost everyone. What started as a niche option is quickly becoming the new way of doing business.

Opting for a no-exam policy today is more than just a shortcut; it's a savvy financial move that fits a modern lifestyle. It’s about efficiency, access, and taking control of your financial planning. You’re not just buying a policy—you’re adopting a smarter, more streamlined way to protect your family’s future, guided by the same principles of freedom and personal responsibility that organizations like America First Financial stand for.

Answering Your Top Questions

Alright, so you’ve got the basics down, but a few questions are probably still nagging at you. That's completely normal. Let's tackle some of the most common things people wonder about no medical exam life insurance so you can feel 100% confident in your next steps.

Can You Really Be Denied for a No-Exam Policy?

In a word, yes. The only real exception is a Guaranteed Issue policy, which, as the name implies, guarantees approval for anyone in a certain age bracket, usually 50 to 85. For every other type, "no exam" definitely doesn't mean "no questions asked."

Insurers have gotten very good at digging into digital records to get a picture of your health. For both Accelerated Underwriting and Simplified Issue policies, they’ll pull your:

Prescription history

Driving record (MVR)

If these digital breadcrumbs point to serious health risks or a history of dangerous behavior, they absolutely can and will turn down your application.

Is Skipping the Exam Always More Expensive?

Not always, but often, yes. It really depends on the person and the policy. If you're young and healthy, an Accelerated Underwriting policy can be just as affordable as a traditional plan that requires an exam. The insurance company is confident in its data and is willing to offer its best rates to low-risk applicants.

Where you'll really see the price difference is with Simplified Issue and, especially, Guaranteed Issue policies. In these cases, the insurer is taking a bigger gamble because they have less information (or none at all). You're essentially paying a bit more for the convenience, speed, and the easier approval process.

What Is the Contestability Period?

This is a big one, so pay close attention. For the first two years of nearly any life insurance policy, there's something called the contestability period. During this window, the insurance company reserves the right to investigate a death claim to make sure there wasn't any fraud or major misrepresentation on the application.

Let's be blunt: If you weren't honest when you applied—say, you hid a serious diagnosis—and you pass away within those first two years, the insurer can deny the claim. They won't pay the death benefit. Instead, they'll simply return the premiums you paid to your beneficiaries.

This is exactly why honesty is your best policy during the application. Once those two years are up, the policy becomes "incontestable," meaning the death benefit has to be paid out as long as the premiums are paid, no matter the cause of death.

What if I Have a Chronic Illness?

Having a chronic illness is not an automatic "no." Plenty of people with common, well-managed conditions like diabetes, high blood pressure, or high cholesterol get approved for coverage, particularly with Simplified Issue policies. The key word here is managed.

What really gives insurers pause are severe, uncontrolled, or terminal diseases. If you're dealing with a more significant chronic condition, your best bet is to work with an independent broker. They know which companies are more lenient for specific health profiles and can steer you toward the one that gives you the best shot at approval for a policy with immediate coverage.

At America First Financial, we believe in providing clear, straightforward protection for your family. Get a no-obligation quote in under three minutes and discover an affordable life insurance plan that aligns with your values. Secure your family's future today.

_edited.png)

Comments