Pension or Annuity Choosing Your Retirement Income

- dustinjohnson5

- Jul 23, 2025

- 14 min read

The real difference between a pension and an annuity boils down to a simple concept: a pension is a retirement benefit your employer gives you for your years of service, whereas an annuity is an insurance product you buy for yourself.

Think of a pension as a reward for loyalty to a company. An annuity, on the other hand, is a financial tool you actively choose and control. Whether you should rely on one, the other, or a combination of both really depends on your career path and what you want your retirement to look like.

Understanding the Fundamental Difference

When people talk about "pension or annuity," they're often comparing apples and oranges. These aren't just two different products; they are two entirely different ways to create a reliable income stream in retirement. One is handed to you as part of your job, and the other is a safety net you build yourself.

Pensions, often called defined benefit plans, are a bit of a throwback these days in the private sector. You'll still find them commonly offered to government employees, military personnel, and union members. With a pension, your employer contributes to the plan, takes on all the investment risk, and promises to pay you a set monthly amount for the rest of your life. That amount is usually calculated with a formula based on your final salary and how long you worked there.

An annuity is a completely different animal. It's a personal retirement contract you purchase from an insurance company. You fund it with your own money, either from savings or by rolling over funds from a retirement account like a 401(k) or an IRA. Essentially, you're using your own capital to create a private pension for yourself, giving you total say over the contract's terms.

Key Differences Pension vs Annuity at a Glance

To quickly see how these two stack up, it helps to put them side-by-side. This table offers a high-level look at their core distinctions.

Characteristic | Pension (Employer Benefit) | Annuity (Personal Product) |

|---|---|---|

Funding Source | Funded entirely by your employer. | Funded by you, the individual. |

How You Get It | Earned as a benefit of your job. | Purchased directly from an insurance company. |

Control Level | Low; the employer sets all the rules. | High; you choose the contract and its features. |

Availability | Becoming rare; mostly for public sector jobs. | Widely available to almost anyone who can afford it. |

Risk | The employer takes on the investment risk. | You assume the risk (or pay to transfer it). |

Ultimately, the source and control are what truly separate them.

The simplest way to frame it is this: A pension is something you receive for your labor. An annuity is something you create with your capital. Both can provide a guaranteed income, but how they come to be—and the control you have over them—couldn't be more different.

How an Employer Pension Plan Is Supposed to Work

Think of a traditional defined benefit (DB) pension plan as a formal promise from your employer. In exchange for your years of loyal service, the company commits to providing you with a reliable income stream throughout your retirement.

The company is on the hook for everything. They set up a massive investment fund, manage it, and ensure it grows enough to cover all its promises to retirees. This means all the investment risk lands squarely on the employer’s shoulders, not yours. Your job is simply to put in the time.

Your eventual payout isn’t a mystery tied to stock market whims. Instead, it’s determined by a set formula. This calculation usually involves your final average salary, how many years you worked, and a specific multiplier. A common example looks like this: 1.5% x Years of Service x Final Average Salary = Annual Pension.

Earning Your Benefits and Keeping Them Safe

Of course, you can't just start a job and expect a pension. You first have to become vested, which is the fancy term for working long enough to earn a non-forfeitable right to your benefits. A five-year vesting schedule is pretty standard. If you leave before hitting that five-year mark, you could walk away with nothing from the pension plan.

But what if your company runs into financial trouble or even goes bankrupt? That’s a scary thought, but there's a safety net. The federal government established the Pension Benefit Guaranty Corporation (PBGC) to act as an insurance backstop for most private-sector pension plans. If your former employer can’t pay, the PBGC steps in to guarantee a portion of your promised benefits.

The Bottom Line: A pension is a benefit you earn through service, not an account you personally manage. Your employer handles the complex financial lifting to deliver a predictable income, and the PBGC is there to protect you if the company falters.

The Great Shift: Where Have All the Pensions Gone?

If you talk to your parents or grandparents, you'll hear how common pensions once were in the private sector. They were a cornerstone of corporate America. Today, that world has changed dramatically. Most companies have ditched pensions in favor of 401(k) plans, largely to shed the immense financial risk and administrative headaches that come with managing a DB plan.

As a result, defined benefit plans are now mostly found in the public sector. Government employees—from teachers and firefighters to administrative staff—are the primary group still covered by these traditional pensions. While this offers incredible retirement security for millions, these systems face their own set of challenges.

Many state and local government plans are struggling with significant funding gaps. Recent data reveals that the average funded ratio for these plans is around 81.4%, which leaves a staggering collective unfunded liability of about $1.35 trillion. These numbers really underscore the financial pressures on the very systems so many Americans depend on for their future. If you're curious, you can explore more about the state of public pensions and their financial health to see just how deep these issues run.

How Annuities Create Your Own Personal Pension

Think of a traditional pension as a benefit your employer gives you. An annuity, on the other hand, is something you build for yourself. It’s a way to create your own private pension by entering into a contract with an insurance company. You’re essentially using your own savings—often funds you’ve built up in a 401(k) or IRA—to generate a guaranteed stream of income. This puts you firmly in the driver's seat.

The process generally unfolds in two key stages. First comes the accumulation phase. This is when you fund the annuity, either by making a single, lump-sum payment or by contributing a series of payments over time. Then, you move into the annuitization phase, which is when you flip the switch and the insurance company starts sending you those regular, predictable checks.

This structure directly tackles one of the biggest anxieties in retirement planning: how to convert a lump-sum nest egg into a reliable paycheck that you can count on for the rest of your life.

Designing Your Income Stream

Unlike a one-size-fits-all pension plan, annuities offer a surprising amount of flexibility. This is where you can really tailor the income to match your specific needs and risk tolerance. The choices you make at the outset will dictate exactly how and when you get paid.

For instance, a fixed annuity is the straightforward option. It provides a set, guaranteed interest rate, leading to payments you can count on, completely shielded from market swings. On the other end of the spectrum, a variable annuity invests your money in subaccounts that function like mutual funds. This gives you the potential for higher returns, but it also means you’re taking on market risk.

Another critical decision is about timing:

Immediate Annuities: These are for people who need income now. You fund it with a lump sum and start receiving payments almost immediately, usually within one year.

Deferred Annuities: You fund this type of annuity now, but the payments don't start for years. This lets your investment grow tax-deferred during the accumulation period, making it a powerful tool for future planning.

The core idea behind an annuity is control. You are not just a passive recipient of benefits; you are the architect of your own financial security, designing the terms of your future income.

Customizing Payouts and Features

The real power of an annuity is revealed in its customization options. You might choose a life-only payout, which gives you the highest possible monthly payment but ends when you pass away. Or, you could opt for a joint-and-survivor payout to ensure that if something happens to you, your spouse will continue receiving income for the rest of their life.

You can also add optional features known as riders to bolt on extra protections. An inflation protection rider, for example, can adjust your payments upward over time to help your income keep pace with the rising cost of living. For a closer look at the different strategies for securing guaranteed income in retirement, it's worth exploring all the available solutions. Understanding just how much you can customize an annuity is a key part of the pension vs. annuity decision.

A Head-to-Head Comparison of Your Options

It’s one thing to know the dictionary definitions of pensions and annuities, but seeing them side-by-side is where the rubber really meets the road. To truly understand which might be right for you, we need to compare them based on the things that actually matter for your retirement: your money, your security, and your lifestyle. Let's dig in.

The main difference really comes down to where they come from. A pension is an earned benefit—it’s part of your compensation package, a reward for your years of service with a company. An annuity, on the other hand, is a purchased contract. It’s a financial product you go out and buy yourself to create a private income stream.

Think of it this way: a pension is something your employer gives you for the work you've already done. An annuity is a tool you buy to build your own financial safety net for the future. This single difference in origin shapes everything else about them.

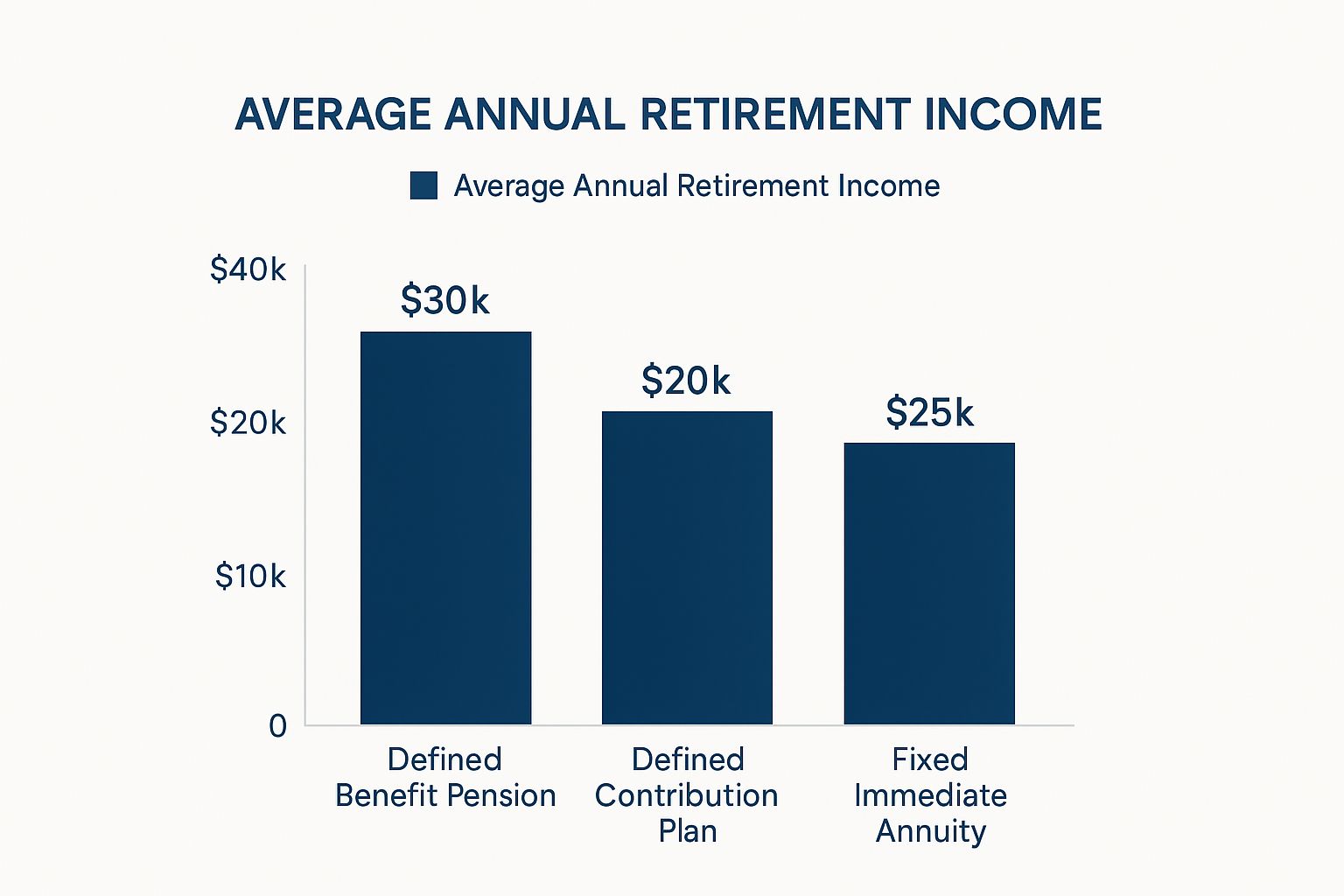

This chart offers a great visual for how different retirement income sources, like a traditional Defined Benefit Pension and a Fixed Immediate Annuity, can stack up in terms of the annual income they produce.

As you can see, while pensions often form a solid income foundation, a well-structured annuity can provide a very competitive and dependable payout. In many cases, it can offer more guaranteed income than you might get from drawing down a typical 401(k).

Funding Source and Your Role

With a pension, your employer does all the heavy lifting. The company contributes money to a massive fund and takes on the full responsibility of investing it wisely to make sure there's enough cash to pay you and all its other retirees down the line. Your contribution? The time you put in on the job.

An annuity flips that script entirely. You are the one funding it. You buy the annuity contract with your own money—maybe from savings, an inheritance, or, very commonly, by rolling over a lump sum from a retirement account like a 401(k) or an IRA.

Payout Structure and Customization

Pensions are usually quite rigid. Your payout is calculated with a set formula, typically based on your final salary and how many years you worked there. You get little to no say in how or when those payments start.

Annuities are the opposite; they're built for flexibility. You work directly with an insurance company to design a payout plan that fits your specific needs. You can control things like:

When payments start: You can begin receiving income right away or let it grow and start payments years from now.

Who gets paid: You can set it up to pay out for just your lifetime or choose a joint-and-survivor option that continues payments to your spouse after you’re gone.

Extra features: You can add riders for things like inflation protection to help your income keep up with rising costs, or a death benefit to leave something for your heirs.

This level of control allows you to solve for very specific financial problems in retirement, something a one-size-fits-all pension just can't do.

Risk Exposure: Who Carries the Burden?

This is probably the most important distinction of all. In a traditional pension plan, the investment risk falls almost completely on your employer. If the plan's investments do poorly, the company is on the hook to make up the difference and ensure you get your promised check.

When you buy an annuity, the risk depends on the type you choose. With a fixed annuity, you hand the risk over to the insurance company. They guarantee your principal and a specific interest rate. But with a variable annuity, you hold onto the market risk, hoping for higher returns but also accepting the possibility of losses.

The scale of pension funds globally is staggering, highlighting their economic importance. Global pension assets have reached an incredible US$58.5 trillion across 22 major markets. This immense pool of capital, now heavily influenced by the shift to defined contribution plans like 401(k)s, shows just how much responsibility employers and governments bear. To get a sense of the sheer size of these commitments, you can read more on the global pension asset study.

Which Option Fits Your Retirement Scenario?

Choosing between a pension and an annuity isn’t just a financial calculation; it's a deeply personal decision that hinges on your unique life story. Your career path, how you feel about investment risk, and the legacy you hope to leave behind are all critical pieces of the puzzle.

To make it real, let's walk through a couple of common scenarios. This isn't usually an "either/or" choice. More often, the real question is how these two powerful tools can work together to build the retirement you've envisioned.

The Public Servant With A Solid Pension

Let's start with Sarah, a 58-year-old teacher who has dedicated 30 years to the public school system. She’s earned a solid defined-benefit pension that she knows will comfortably cover her essential living costs—the mortgage, utilities, and property taxes.

Sarah isn't worried about making ends meet. Her concern is about funding her lifestyle goals, like traveling the world and having a dedicated buffer for any surprise medical bills, without having to sell off her other investments.

Her Need: A reliable, supplemental income stream for discretionary spending that isn't tied to the stock market's ups and downs.

The Best Approach: For someone like Sarah, taking a piece of her personal savings to buy a fixed immediate annuity is a smart move. This creates a second, smaller "paycheck" that she can earmark specifically for her travel fund. It’s the perfect complement to her pension, layering a guaranteed "fun fund" right on top of her secure foundation.

By structuring her finances this way, Sarah creates a clear separation between her needs and wants. The pension handles the essentials, while the annuity guarantees her lifestyle goals are met, giving her incredible peace of mind.

A pension can be the bedrock of your retirement plan. But layering an annuity on top allows you to customize your income to meet specific goals that a one-size-fits-all pension can’t address.

The Self-Employed Professional Building From Scratch

Now, let's look at Mark. He's a 50-year-old freelance graphic designer who has been his own boss his entire career. He's been diligent about contributing to his SEP-IRA, but the entire balance is tied up in the market. As retirement gets closer, the idea of his income depending entirely on market performance is starting to make him nervous.

Mark doesn't have a pension to lean on. He needs to create his own income floor from scratch, one that ensures his basic expenses are covered, come what may.

His Need: A foundational, pension-like income stream to cover his non-negotiable living expenses for life.

The Best Approach: Mark is a prime candidate for rolling over a portion of his SEP-IRA into a deferred annuity with an income rider. He can fund it now, while he's still working, and schedule the payments to start when he plans to retire at age 65. In essence, he’s building his own private pension.

This strategy carves out a portion of his retirement savings and shields it from risk. The rest of his portfolio can stay invested for long-term growth, but he can sleep at night knowing his core financial needs are locked in. For the self-employed, an annuity often isn't just a supplement—it's the essential tool for creating that secure base.

Making a Confident Retirement Income Decision

In today's retirement landscape, the decision isn't always a simple choice between a pension or an annuity. For most people, the real question is a bit more nuanced: How can an annuity fit into my overall financial picture to create a reliable and stress-free income stream? It's time to move past the "either/or" mindset and start thinking about how these powerful tools can work together.

The road to a secure retirement is really paved with self-awareness. It all begins with a frank assessment of your needs, your personal comfort with risk, and the absolute minimum income you need to cover your essentials. Answering a few critical questions can bring a surprising amount of clarity, giving you the power to build a plan that’s genuinely right for your life. Think of it less like finding one perfect answer and more like building a custom solution piece by piece.

A Framework for Your Financial Future

To move forward with real confidence, use these questions as your guide. They’re designed to help you zero in on what you truly need and figure out if an annuity could be a smart addition to your strategy, especially if you don't have a traditional pension to lean on.

What is my guaranteed income floor? First things first, add up your non-negotiable monthly expenses—think mortgage or rent, utilities, groceries, and healthcare. What's the magic number you need in guaranteed income to know those bills are paid, no matter what the stock market does? If your Social Security and any pension you have don't cover this, an annuity is a fantastic tool for bridging that gap.

How much market risk can I honestly handle? Be real with yourself. Does the thought of a major market downturn keep you up at night? Would it tempt you to panic and sell at the worst possible time? If you know market volatility makes you anxious, then dedicating a slice of your savings to a fixed annuity can bring an incredible sense of stability and peace.

What are my goals for my spouse and heirs? Do you want to make sure your spouse is financially secure for life? Or perhaps leave a specific inheritance for your children or grandchildren? Annuities are flexible and can be structured with features like joint-and-survivor payouts or death benefits to achieve these exact legacy goals.

The goal is to transform a lump sum of savings into a reliable, lifelong paycheck that you control. By methodically answering these questions, you create a blueprint for your own personal pension, designed by you, for you.

Working through these questions gives you a solid foundation for a productive conversation with a financial advisor. To make sure you haven't missed anything, it's also a great idea to review a comprehensive retirement planning checklist. When you walk into that meeting armed with this self-knowledge and a clear vision, you can confidently build an income plan that delivers security for all the years ahead.

Common Questions About Pensions and Annuities

When you're trying to figure out your retirement income, it's natural for a lot of questions to pop up. Let's tackle some of the most common ones I hear about pensions and annuities.

Can I Have Both a Pension and an Annuity?

Yes, and honestly, this can be a fantastic strategy. It’s not an either/or situation at all.

Think of it this way: your pension can be the bedrock of your retirement, providing that steady, reliable check to cover your essential bills. Then, you can use funds from your 401(k) or IRA to purchase an annuity, which creates a second stream of guaranteed income for everything else—travel, hobbies, or just a bigger financial cushion.

What Happens to My Pension or Annuity When I Die?

This is a critical question, and the answer comes down to the choices you make upfront.

With a pension, you’ll typically be offered survivor benefits for your spouse, which means they'll continue receiving payments, though usually at a reduced rate.

Annuities, on the other hand, offer a lot more flexibility. You can structure them in several ways:

Joint and Survivor: This option ensures payments continue for your spouse’s lifetime after you’re gone.

Period Certain: This guarantees payments will be made for a specific number of years. If you pass away before that period is up, your named beneficiary will receive the remaining payments.

Is My Pension or Annuity Income Taxable?

In most cases, yes, but how it’s taxed is different.

Payments from a traditional pension, which was funded with your employer's pre-tax dollars, are taxed as ordinary income. For non-qualified annuities—the ones you buy with your own after-tax money—only the earnings portion of each payment is taxable. The part that's a return of your original investment is not.

Tax rules can get complicated fast, so this is one area where talking to a financial professional is always a smart move.

_edited.png)

Comments