Secure Retirement Planning: Achieve Financial Freedom

- dustinjohnson5

- May 30

- 11 min read

Navigating Today's Retirement Reality Check

The retirement landscape has changed significantly. Unlike previous generations who often depended on guaranteed pensions, today's workers primarily manage their own retirement savings through self-directed accounts. This places the responsibility of secure retirement planning directly on their shoulders and requires a proactive approach with a solid understanding of market dynamics.

Understanding market trends is no longer exclusive to financial advisors. It's essential for everyone saving for retirement. Economic uncertainty and global market fluctuations can significantly affect retirement portfolios, requiring adaptable strategies. This isn't about becoming an expert overnight, but about understanding how these shifts influence your savings and adjusting accordingly.

The sheer size of global retirement savings further emphasizes the importance of individual planning. Global pension assets have reached record levels. The 22 largest pension markets (the P22) are now collectively valued at US$58.5 trillion as of 2025. This represents 68% of the GDP of these economies, with the seven largest markets (Australia, Canada, Japan, the Netherlands, Switzerland, the UK, and the US) holding 91% of these assets. This highlights the global imbalance in retirement security and underscores the need for personalized planning. Learn more about this in the Global Pension Assets Study 2025.

Adapting to the New Retirement Landscape

This new reality demands a shift in mindset. We need to move away from passively relying on employer-sponsored pensions and towards actively managing our retirement futures. This involves:

Understanding your risk tolerance: How comfortable are you with market volatility?

Diversifying your investments: Spreading your investments across different asset classes can help mitigate risk.

Regularly reviewing your plan: Life circumstances change, and your retirement strategy should adapt accordingly.

This proactive approach empowers you to navigate today's complex financial world and build a secure retirement. It's about taking control of your financial future and ensuring you're prepared for the future. This understanding is the first step toward a robust and adaptable retirement plan.

Conquering Your Biggest Retirement Fears

Losing sleep over your retirement savings? You're not alone. Pre-retirees commonly experience anxiety about financial security in their later years. These concerns often center around key aspects of secure retirement planning, such as the future of Social Security and escalating healthcare costs. But instead of letting these worries consume you, it's crucial to confront them directly and turn them into a plan of action.

A 2025 nationwide survey revealed the prevalence of these concerns among US investors between the ages of 55 and 75. A substantial 76% expressed worry about receiving full Social Security benefits, while 67% were concerned about their income lasting throughout retirement. Another 46% were focused on balancing asset protection with growth. For more detailed information, see the 2025 Retirement Outlook Survey. This data underscores the need for a proactive and adaptable approach to retirement planning.

To help illustrate the most pressing concerns, we’ve compiled the following table:

Top Retirement Financial Concerns by Priority

Concern Category | Percentage of Respondents | Impact Level | Planning Response |

|---|---|---|---|

Social Security Benefits | 76% | High | Diversify income sources |

Longevity of Income | 67% | High | Conservative spending plan |

Balancing Asset Protection and Growth | 46% | Medium | Diversified investment portfolio |

This table highlights the importance of addressing these key areas when developing a comprehensive retirement plan. Diversification, conservative spending, and a balanced investment portfolio are just some of the strategies that can help mitigate these concerns.

Transforming Worry Into Action

One of the best ways to overcome retirement fears is to learn from those who have successfully transitioned into this phase of life. Many happy retirees faced similar anxieties during their working years. They conquered these worries not by dismissing them, but by actively engaging in comprehensive financial planning.

This proactive strategy involves several core components:

Stress-Testing Your Plan: Think of your retirement plan as a ship navigating unpredictable waters. Stress-testing involves simulating various economic situations, like market downturns or unforeseen expenses, to assess the resilience of your plan.

Building Financial Cushions: A financial cushion serves as a reserve to handle unexpected costs without jeopardizing your overall plan. This could involve establishing a dedicated emergency fund or exploring insurance options to protect against major healthcare expenses.

Regularly Reviewing Your Plan: Sound retirement planning isn't a one-time activity. It's an ongoing process that requires periodic adjustments. Regular reviews enable you to adapt to changing circumstances and ensure your plan remains aligned with your objectives.

Building Confidence in Your Future

By acknowledging your fears and taking concrete steps to address them, you can shift your perspective from anxiety to empowerment. Effective retirement planning goes beyond just numbers; it's about building confidence in your ability to manage the future. This involves crafting a plan that’s not just financially sound, but also tailored to your specific needs and aspirations. This proactive approach turns worry into preparedness, laying a solid foundation for a secure and fulfilling retirement.

Building Your Bulletproof Retirement Foundation

A secure retirement starts with a solid plan. This means understanding key principles and realistically evaluating your needs to create a retirement strategy that can withstand market fluctuations. This section outlines the essential steps to build that foundation.

Calculating Your Retirement Number

One of the first steps in retirement planning is determining your "retirement number." This figure represents the estimated amount of money you'll need to maintain your lifestyle after retirement. While financial advisors often use specialized software to help clients determine this number, you can start with a simpler assessment. Consider your current annual expenses, estimated future costs (such as healthcare), and your desired income in retirement. For example, if your current annual expenses are $50,000 and you anticipate an additional $10,000 per year for healthcare, your target retirement income would be around $60,000.

Understanding Your Risk Tolerance

Risk tolerance, or your comfort level with potential investment losses, is another critical factor. Understanding your risk tolerance is essential for making sound investment choices. An individual with a high risk tolerance may be comfortable investing in stocks, which offer higher growth potential but also higher risk. Someone with a lower risk tolerance might prefer the stability of bonds, even if the potential returns are lower. Much like choosing between a slow-growing oak and a faster-growing but more delicate willow, understanding your risk tolerance ensures your investment strategy aligns with your comfort level and goals.

Identifying Gaps in Your Current Strategy

After defining your retirement number and risk tolerance, the next step is to evaluate your current savings and investment strategy. This involves identifying any discrepancies between where you are now and where you need to be. For instance, if your retirement number is $1 million and your current savings trajectory puts you at $500,000, you have a substantial gap to address. This might mean increasing contributions to your retirement accounts, diversifying your investments, or adjusting your retirement timeline.

Exploring Retirement Account Types

A fundamental aspect of retirement planning involves understanding the various types of retirement accounts. Each option, such as 401(k) and Individual Retirement Accounts (IRAs), has distinct benefits and limitations. 401(k) accounts are commonly employer-sponsored and offer tax advantages, while IRAs offer greater investment flexibility. Understanding these differences helps you choose the right accounts to maximize tax benefits and meet your individual needs. Knowing the contribution limits and withdrawal rules for each account type is also crucial for optimizing your savings strategy. By strategically utilizing these accounts and understanding their advantages, you'll create a more secure and efficient retirement plan, paving the way for long-term financial well-being.

Breaking Through Retirement Savings Roadblocks

Saving for retirement can often feel daunting. Many people find themselves behind on their savings goals. Recognizing this is the first step towards achieving secure retirement planning. This section explores common obstacles and provides practical strategies to get your retirement savings back on track.

Psychological Barriers to Saving

One of the biggest hurdles to saving for retirement isn't financial—it's psychological. People tend to prioritize immediate gratification over long-term security. This can manifest in several ways, such as overspending, neglecting to budget, or even avoiding the topic of retirement altogether. The appeal of a new purchase can often outweigh the less tangible benefit of contributing to a retirement account.

The distant nature of retirement can also make it seem less important, which leads to procrastination. However, these psychological barriers can be overcome with the right mindset and tools.

The 2025 U.S. Retirement Market Outlook found that 33% of respondents weren't saving enough, and 21% were unsure if their savings were adequate. This means over half of American workers might face financial insecurity in retirement. You can find more information in the 2025 Retirement Market Outlook Research. This data underscores the importance of addressing these savings gaps.

Overcoming Inertia and Automating Savings

Automation can be an effective tool against procrastination. Setting up automatic transfers from your checking account to your retirement account removes the element of willpower. This "set it and forget it" approach ensures consistent contributions, even during busy periods.

Scheduling a recurring monthly transfer, even a small amount like $100, can accumulate significantly over time due to compounding interest. This allows you to save consistently without actively thinking about it, making retirement savings a seamless part of your financial routine.

Optimizing Investment Choices

Choosing the right investments can also be challenging. While extensive market knowledge isn't required, understanding basic investment principles is key for secure retirement planning. This includes diversifying your portfolio across different asset classes, like stocks and bonds, to manage risk.

Target-date funds and managed accounts are also worth considering. These offer professionally managed portfolios aligned with your estimated retirement date. These options simplify investment decisions and offer a balanced approach for long-term growth. However, assess whether these options align with your individual goals or if a more personalized strategy is necessary. For those starting later, exploring catch-up contributions offered by some retirement plans can help boost savings growth and close the gap.

Advanced Strategies That Actually Work

Building a solid retirement foundation is essential, but thriving requires more. This section explores practical, advanced strategies adapted from institutional investors to enhance your secure retirement planning.

Asset Allocation and Diversification

Just like a stable stool needs multiple legs, a resilient retirement portfolio requires diversification. Asset allocation distributes your investments across different asset classes, like stocks, bonds, and real estate. This strategy, common among successful pension funds, mitigates risk. For instance, if the stock market dips, bond holdings can provide stability. This balance becomes increasingly crucial as retirement nears.

Dynamic Strategies for Changing Circumstances

Retirement planning is not a one-time event; it’s an ongoing process. Your investment approach should evolve as you approach retirement. Gradually shifting from growth-focused investments (like stocks) to more conservative options (like bonds) protects accumulated wealth. This doesn't mean eliminating risk entirely, but strategically managing it to match your evolving needs. Even seemingly unrelated income streams, like music royalties calculated with a Spotify Royalties Calculator, highlight the principle of diversification applicable to retirement planning.

Rebalancing and Tax Efficiency

Rebalancing your portfolio periodically keeps your asset allocation on track. It's like tending a garden: regular pruning and nurturing maintains balance. This doesn't necessitate constant attention, but a systematic review and adjustment, perhaps twice a year.

Tax-efficient investing is also vital. Minimizing taxes on investment gains maximizes your returns. This might involve using tax-advantaged accounts like 401(k)s and IRAs, or exploring tax-loss harvesting strategies.

Maintaining Flexibility

Life is unpredictable, so your retirement plan should be adaptable. Liquidity, or access to cash, is important for unexpected expenses. Your plan should also accommodate potential retirement timeline or lifestyle changes. This flexibility ensures your plan remains relevant, regardless of what life throws your way. By embracing these advanced strategies, you move beyond the basics to cultivate a truly secure financial future built on diversification, dynamic adjustment, and tax efficiency. These institutional-grade methods empower you to manage risk and optimize growth for a comfortable and confident retirement.

Your Personalized Retirement Action Plan

Creating a secure retirement takes more than just grasping the core concepts; it requires action. This section transforms the principles of secure retirement planning into a personalized, actionable plan, complete with timelines, milestones, and regular reviews.

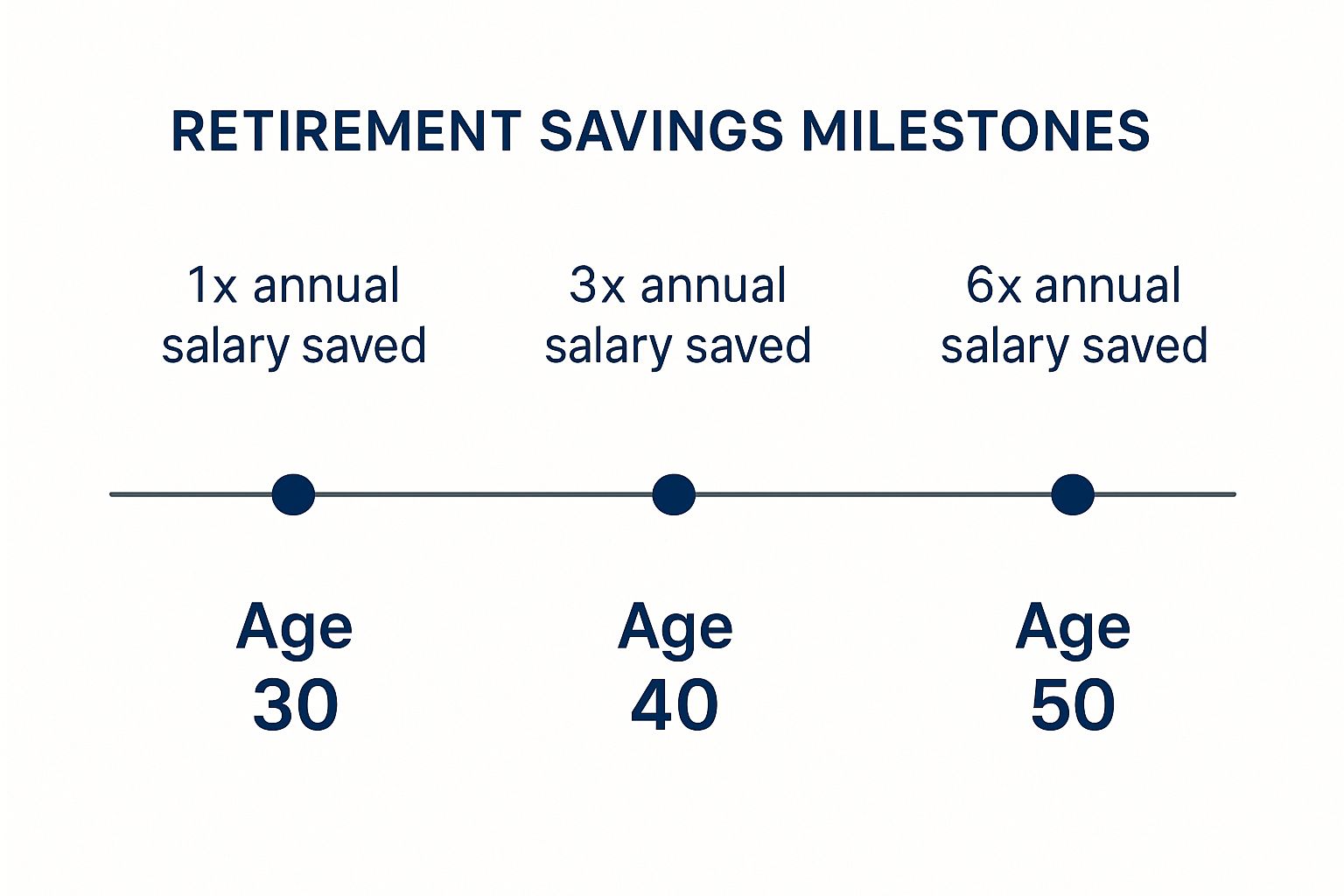

This infographic highlights suggested savings milestones: 1x your annual salary saved by age 30, 3x by 40, and 6x by 50. These targets serve as a useful benchmark to gauge your savings progress and adjust your plan as needed. Notice how the recommended savings multiples increase as you get older, demonstrating the impact of consistent contributions and the power of compounding interest.

Prioritizing Based on Your Circumstances

Everyone's retirement journey is different. Factors like your age, current income, and future goals all shape your planning priorities. A younger worker might prioritize maximizing contributions to tax-advantaged accounts like a 401(k) or Roth IRA. Someone nearing retirement, on the other hand, might focus on reducing investment risk and creating a stable income stream.

For instance, a 25-year-old may feel comfortable with an aggressive investment strategy focused on stocks, while a 60-year-old might opt for a more conservative portfolio with a larger allocation to bonds. Flexibility is paramount. Life is unpredictable, and your plan should be adaptable to changes in income, health, or family situations.

To help visualize the different priorities across various life stages, let's examine a sample retirement planning timeline:

Retirement Planning Timeline by Age Group

Age Range | Primary Focus | Key Actions | Target Milestones |

|---|---|---|---|

20s-30s | Building a Foundation | Maximize contributions to tax-advantaged accounts; Consider a Roth IRA; Begin investing in a diversified portfolio | 1x annual salary saved |

40s-50s | Accelerating Growth | Increase savings rate; Evaluate and rebalance portfolio; Consider catch-up contributions | 3-6x annual salary saved |

60s-70s | Preserving Capital & Generating Income | Reduce investment risk; Develop a withdrawal strategy; Explore annuity options | Secure retirement income stream |

This table presents a generalized view. It's essential to personalize your approach based on your specific circumstances.

The Importance of Regular Reviews

Your retirement plan isn't a fixed set of rules; it's a dynamic roadmap. Regular reviews are essential for keeping it on track and aligned with your goals. These reviews give you the opportunity to track progress toward your milestones, adjust your asset allocation based on market performance, and make any necessary course corrections.

To gain further insights into effective strategies, consider the principles of retail marketing success. Just as businesses adapt to changing market conditions, your retirement strategy must evolve to account for life's unexpected twists and turns.

Seeking Professional Guidance

While you can manage a significant portion of your retirement planning yourself, seeking professional advice can be invaluable. A financial advisor can offer personalized guidance, helping you navigate complex decisions related to investments, tax planning, and estate planning. This is especially helpful for individuals nearing retirement or facing major financial changes.

Their expertise provides a clear, objective perspective and informed guidance to navigate your financial future. This professional input complements your own efforts, providing added confidence in your retirement journey. This combined approach blends your individual understanding with expert advice, fortifying your retirement plan.

Key Takeaways For Retirement Success

Building a secure retirement requires careful planning and consistent action. This section highlights key elements of retirement planning and provides actionable insights you can implement today.

Start Now, Plan Ahead

The most important takeaway is to start early. Time is your greatest asset in retirement planning. The power of compounding allows even small, regular contributions to grow significantly over the long term. Don't underestimate this. Even if you are in your 50s or 60s, starting now is always better than delaying further. Each contribution, no matter how small, moves you closer to financial security.

Understand Your Needs and Goals

Effective retirement planning requires a clear understanding of your individual needs. Calculate your estimated retirement expenses and define your desired lifestyle. This creates a tangible financial target. Understanding your risk tolerance is also essential. This knowledge will guide your investment choices, ensuring your portfolio aligns with your comfort level and objectives.

Build a Solid Foundation

Creating a solid financial foundation involves diversifying your investments. This mitigates risk. A diversified portfolio, much like a house built on solid ground, can better withstand market fluctuations. Regularly review and rebalance your investments to maintain your desired asset allocation. Think of this as routine maintenance, keeping your financial house strong and stable.

Overcome Roadblocks

Many people encounter obstacles in their retirement savings journey. Acknowledge these challenges, whether they are psychological barriers, financial limitations, or simply procrastination. Develop strategies to overcome these hurdles. Automating your savings is one very effective approach. This ensures consistent contributions without relying on willpower alone.

Seek Professional Guidance

Consider consulting with a financial advisor for personalized advice. A professional can offer valuable insights specific to your situation and goals. While this section offers key takeaways, personalized guidance can address the complexities of your financial picture. A financial advisor can assist with investment decisions, tax planning, and estate planning.

Stay Informed and Adapt

The financial world is dynamic. Stay informed about market trends and be prepared to adapt your retirement plan as needed. Flexibility is crucial for navigating unforeseen circumstances. Regularly review and update your plan to ensure it remains aligned with your changing needs and the evolving financial environment.

Secure your financial future today with America First Financial. We provide affordable insurance options to protect your family and secure your retirement. Get a free quote in under three minutes.

_edited.png)

Comments