Secure Your Future with a Lifetime Income Annuity

- dustinjohnson5

- May 11, 2025

- 14 min read

Understanding the Power of Lifetime Income Annuities

A lifetime income annuity provides a unique approach to retirement planning. It converts a lump sum into a guaranteed income stream that lasts for the rest of your life. This creates a predictable and reliable income source, regardless of lifespan, eliminating the worry of outliving your savings. You can enjoy retirement without constantly monitoring market fluctuations or worrying about dwindling funds.

Immediate Vs. Deferred Annuities

There are two primary types of lifetime income annuities: immediate annuities and deferred annuities. Immediate annuities start payments soon after the initial investment. This offers an immediate income stream, especially beneficial for those already in or nearing retirement.

Deferred annuities, on the other hand, allow investments to grow tax-deferred for a set period before payments begin. This option is suitable for individuals still accumulating wealth for their future income needs.

Creating Pension-Like Security

Traditional pensions are becoming less common. Lifetime income annuities provide a way to create a similar sense of security and predictability. They offer a guaranteed "paycheck" for life, mirroring the benefits of a traditional pension plan.

For example, retirees can use a lifetime income annuity to cover essential expenses, such as housing and healthcare. This "income floor" creates financial stability and reduces stress, improving overall well-being in retirement.

Historically, lifetime income annuities have been important retirement planning tools because of their guaranteed income streams. This is crucial for maintaining financial security later in life. In the United States, for example, the annuity market has experienced significant growth, especially recently. By 2024, annuity sales exceeded $430 billion, a substantial increase from prior years. Lifetime income annuities, including immediate annuities, contribute significantly to this growth. They offer predictable income, an increasingly attractive feature given market volatility and inflation concerns. You can find more detailed statistics here: LIMRA Annuity Sales

Psychological Benefits of Guaranteed Income

Beyond financial benefits, lifetime income annuities offer significant psychological advantages. Knowing that a portion of your income is guaranteed provides security and reduces anxiety about financial uncertainties.

This peace of mind allows retirees to enjoy their retirement more fully, focusing on personal interests and time with loved ones. This sense of financial freedom enables individuals to pursue activities and experiences they might otherwise avoid due to cost concerns. This makes lifetime income annuities valuable not only for financial planning but also for enhancing overall quality of life in retirement.

Key Benefits That Make Lifetime Income Annuities Essential

Lifetime income annuities offer more than just a guaranteed income stream. They contribute to a sense of financial and psychological well-being that many retirees find invaluable. For instance, they directly address the fear of outliving one's savings, a concern for 68% of pre-retirees. This fear can significantly affect retirement planning and the overall enjoyment of this stage of life. Lifetime income annuities offer security and stability, allowing individuals to focus on their priorities.

Guaranteed Income and Peace of Mind

The most significant benefit is the guaranteed income for life. This "income floor" provides coverage for essential expenses without the need to constantly monitor investment performance. It removes the anxiety associated with market downturns, offering stability and allowing retirees to truly enjoy their retirement. This predictability empowers retirees to pursue hobbies, travel, and spend time with loved ones without the constant worry of financial instability. It also simplifies financial management, especially as we age.

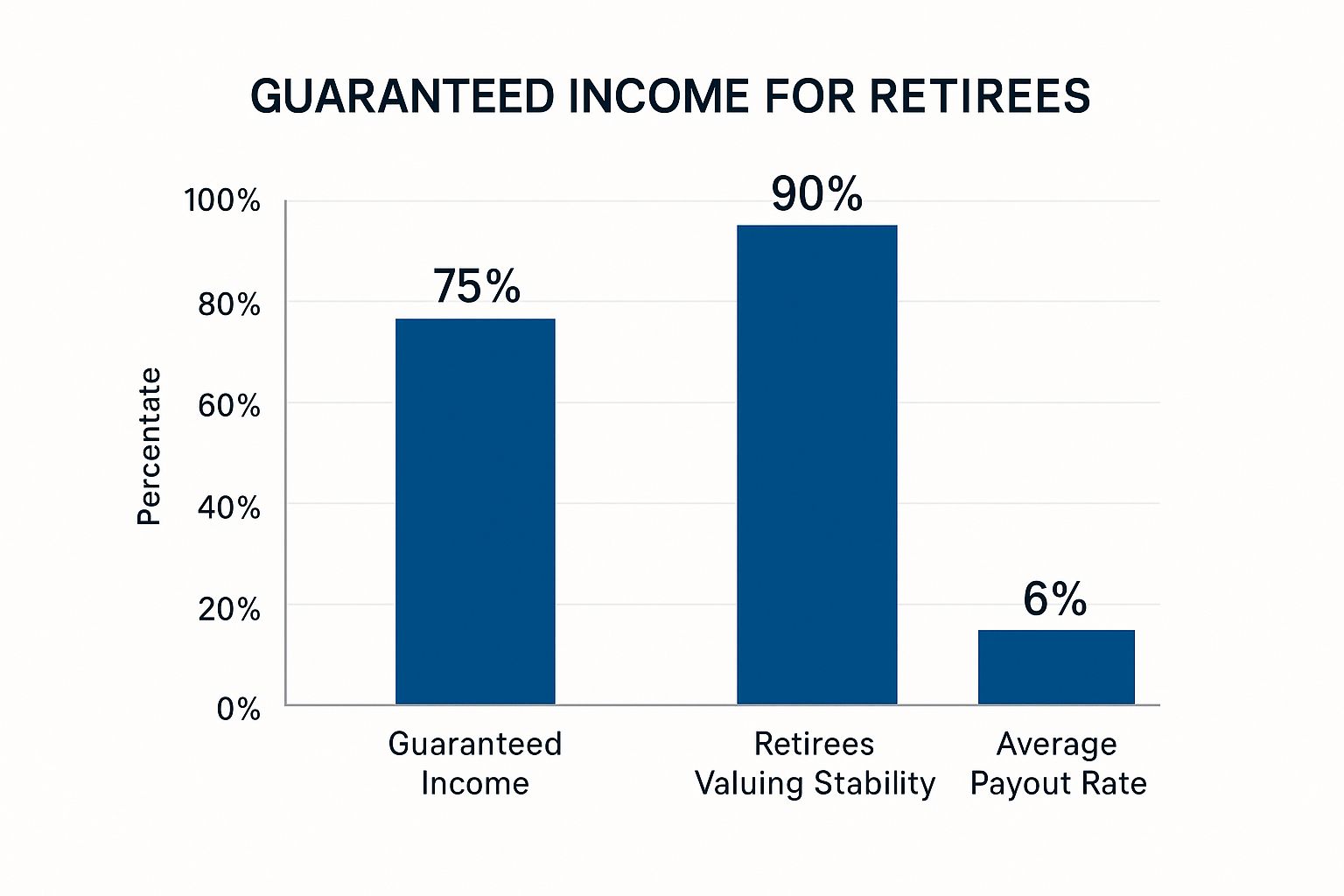

The infographic below visualizes key data points related to lifetime income annuities, including the percentage of guaranteed income, retirees valuing stability, and average payout rates.

As the infographic illustrates, the guaranteed income aspect is highly valued, with a significant majority of retirees prioritizing stability. This highlights the appeal of predictable income during retirement. Strategically incorporating a lifetime income annuity can often improve overall portfolio returns. With a secure income base, retirees may feel more comfortable taking calculated risks with other investments, potentially leading to higher long-term growth. The demand for predictable income streams is fueling growth in the U.S. annuity market. By 2029, the market is projected to reach $388.42 billion, with a 5.98% compound annual growth rate (CAGR). Learn more about annuity market growth.

Tax Advantages and Simplified Financial Management

Certain types of lifetime income annuities offer tax advantages that can boost your spendable income. These tax benefits depend on the specific annuity product and individual circumstances. However, they can significantly impact the annuity's overall value. Annuities provide a simplified approach to financial management, which is particularly beneficial as we age. This simplified approach reduces stress and provides greater peace of mind for both the retiree and their family. Managing finances becomes less burdensome, allowing individuals to focus on enjoying their retirement. These features, combined with the psychological and financial benefits, make lifetime income annuities an important consideration for retirement planning.

To better understand how lifetime income annuities stack up against other retirement income strategies, let's take a look at the following comparison:

Lifetime Income Annuity Benefits Comparison

This table compares the key benefits of lifetime income annuities against other retirement income strategies.

Benefit | Lifetime Income Annuity | Traditional Investments | Pension Plans |

|---|---|---|---|

Guaranteed Income | Yes, for life | No | Yes, for life (defined benefit) or based on contributions (defined contribution) |

Market Risk | No | Yes | Depends on the plan type (defined benefit or defined contribution) |

Control over Investments | Limited | Full | Limited or none depending on plan type |

Tax Advantages | Potential tax deferral | Varies based on investment type | Tax-deferred growth |

Simplicity | High | Low to Moderate | High |

As you can see, lifetime income annuities provide a unique combination of guaranteed income and simplicity, distinguishing them from other retirement income strategies. While traditional investments offer more control, they come with market risk. Pension plans also offer guaranteed income (in some cases), but the type and amount of benefits can vary significantly. The key takeaway is that each strategy has its own set of advantages and disadvantages.

Finding Your Perfect Lifetime Income Annuity Match

Not all lifetime income annuities are the same. Selecting the right one is essential for making the most of your retirement income. This involves understanding the various available options and how they fit your specific needs. Let's explore the main types of lifetime income annuities to help you find the perfect fit.

Immediate Vs. Deferred Annuities

One of the first choices you'll encounter is deciding between an immediate annuity and a deferred annuity. Immediate annuities start payments shortly after your initial investment, creating an immediate income stream. This is often the best option for people already retired or close to retirement who need income now. For instance, someone retiring at 65 might choose an immediate annuity to supplement their Social Security benefits.

Deferred annuities, on the other hand, let your investment grow tax-deferred for a set period before payments begin. This makes them well-suited for those still building wealth and planning for future income. Someone younger, perhaps in their 50s, might opt for a deferred annuity to establish a future income stream while taking advantage of tax-deferred growth. Financing an annuity purchase can be difficult. Consider using resources like an SBA Loan.

Fixed, Variable, and Indexed Annuities

Within immediate and deferred annuities are further classifications: fixed, variable, and indexed annuities. Fixed annuities provide a guaranteed, fixed interest rate, resulting in predictable income payments. This stability attracts those seeking certainty and wanting to avoid risk.

Variable annuities, conversely, tie your payments to the performance of underlying investments. This presents the possibility of higher returns, but also introduces market risk. Variable annuities might suit individuals comfortable with more risk who are looking for greater growth potential.

Finally, indexed annuities try to combine the advantages of both. They provide a minimum guaranteed return while also allowing you to participate in market gains, up to a certain point. This offers some protection against losses while still enabling growth. However, understanding the details of these products is important, as factors like participation rates and caps can impact performance. This complexity means thorough research is crucial.

Riders and Features: Customizing Your Annuity

Another important factor in finding the right annuity is understanding the available riders and features. These options enable you to tailor your annuity contract to meet your particular requirements. For example, an inflation protection rider helps ensure your income keeps up with rising prices, protecting your purchasing power over time. This is vital for maintaining your standard of living during retirement.

A joint-survivor option ensures payments to both you and your spouse as long as either of you is alive, offering ongoing income security for your partner. There are also several other features, such as death benefits and withdrawal options, which can further personalize the annuity to your individual needs. Understanding these features and how they affect the annuity's costs and benefits is crucial for informed decision-making. Ultimately, careful consideration of these features is essential for selecting the best annuity for your long-term financial well-being. A wise choice can significantly impact your retirement income and provide peace of mind.

Timing Your Purchase: Market Factors That Impact Your Income

Deciding when to purchase a lifetime income annuity is a crucial step in retirement planning. Choosing the right product is important, but the timing of your purchase, in relation to prevailing economic conditions, can significantly impact your future income stream. Factors such as interest rates and market volatility play a key role in determining how much income your annuity will generate.

Interest Rate Environments and Your Annuity Income

Interest rates are fundamental to how annuity payouts are calculated. Even a seemingly small difference of 1% in interest rates can significantly alter your lifetime income, potentially adding thousands of dollars to your overall returns. Securing a favorable interest rate at the time of purchase is therefore paramount for maximizing your retirement income. Higher prevailing interest rates generally translate to higher initial payouts for fixed annuities, establishing a more robust and reliable income stream.

A higher rate locks in a larger initial payout, which remains fixed for the lifetime of the annuity. This makes it essential to carefully consider the current interest rate environment before committing to an annuity purchase.

Annuity Laddering and Future Rate Opportunities

Balancing the need for current income with the possibility of higher interest rates in the future can be challenging. One strategy financial advisors often recommend is annuity laddering. This involves purchasing multiple annuities over time, staggering the purchase dates. This allows you to take advantage of potential future interest rate increases while securing a guaranteed income stream in the present.

Each annuity purchase, representing a "rung" on the ladder, has the potential to benefit from varying interest rate conditions. This diversified approach can help mitigate the risk of locking in all your funds at a potentially lower rate.

Inflation Expectations and Protection Features

Inflation can erode the purchasing power of your annuity payments over time. Understanding how inflation may affect your future income is vital when considering an annuity purchase. Some annuities offer valuable inflation protection features, which adjust your payouts to keep pace with rising prices.

While these features can sometimes increase the initial cost of the annuity, they provide essential protection against the diminishing value of your income over time. A careful evaluation of these features is crucial for ensuring your retirement income maintains its purchasing power.

To better understand how economic conditions can influence annuity decisions, let's examine the following table:

Economic Factors Affecting Lifetime Income Annuities

This table shows how different economic conditions impact annuity payouts and purchasing decisions.

Economic Factor | Impact on Annuity Rates | Consumer Consideration | Strategic Response |

|---|---|---|---|

Rising Interest Rates | Increased annuity rates | Opportunity to lock in higher payouts | Consider purchasing an annuity or adding to an annuity ladder |

Falling Interest Rates | Decreased annuity rates | Potential for lower payouts | Delay annuity purchase or consider alternative investment options |

High Inflation | Pressure on annuity rates to rise, but may lag behind actual inflation | Decreased purchasing power of fixed payouts | Seek annuities with inflation protection features |

Low Inflation | Less pressure on annuity rates | Stable purchasing power of fixed payouts | Consider fixed annuities for predictable income |

Market Volatility | Can create buying opportunities due to increased competition among providers | Potential for higher rates but increased uncertainty | Consult with a financial advisor to assess risk tolerance and potential benefits |

This table highlights the complex interplay of economic forces and their impact on annuity rates. It underscores the importance of strategic planning and careful consideration of individual circumstances.

Market Volatility and Annuity Buying Opportunities

Market downturns, while unsettling for investors, can sometimes create favorable conditions for annuity purchases. During periods of volatility, annuity rates may become more competitive as providers seek to attract investors seeking stability and guaranteed returns.

This can present a unique opportunity to secure a portion of your retirement funds, locking in a predictable income stream despite market fluctuations.

However, attempting to time the market perfectly can be risky. Prioritizing your individual needs and financial situation is paramount. Consulting a financial advisor specializing in retirement income planning can provide personalized guidance tailored to your specific goals. A financial advisor can help you navigate the complexities of annuity purchasing, enabling you to make informed decisions aligned with your long-term retirement objectives. For more information on annuity trends, you can find detailed statistics here. The increasing interest in products like buffer annuities, which provide a measure of protection against market downturns, further emphasizes the importance of understanding market dynamics.

Building Your Retirement Income Layer Cake With Annuities

Smart retirees diversify their income sources. Instead of relying on a single source, they build a "layer cake" of retirement income streams. This approach ensures greater financial security and flexibility. Lifetime income annuities can play a crucial role in this layered strategy. They act like a personal pension, providing a solid foundation for your financial future.

The "Income Floor" Approach

Many financial planners recommend the "income floor" approach. This strategy uses guaranteed income sources, like Social Security and lifetime income annuities, to cover essential living expenses. This creates a secure financial base, ensuring your basic needs are always met.

For example, a retiree could use Social Security and a fixed immediate annuity to cover housing, utilities, and groceries. This then frees up other investments for discretionary spending, such as travel or hobbies, which in turn reduces financial stress.

Annuity Laddering: Balancing Needs and Growth

Annuity laddering is another valuable tool. This involves purchasing multiple annuities at different times, creating staggered income streams. This approach balances immediate income needs with the potential for higher returns later.

You might, for instance, purchase a series of deferred annuities, each beginning payments at a different point in your retirement. This provides increasing income as you age, adapting to your evolving needs. Understanding broader economic trends is important when timing your annuity purchase; you can read more about the impact of inflation on Americans' financial health. This knowledge can significantly enhance the effectiveness of your annuity laddering strategy.

Allocation Guidelines and Your Retirement Timeline

The ideal allocation of retirement funds to annuities depends on your individual circumstances. Factors like your retirement timeline, income needs, and other assets all contribute to the decision.

A younger retiree with substantial savings might allocate a smaller percentage to annuities, favoring more growth-focused investments. Someone nearing retirement with fewer savings might allocate a larger portion to guarantee income stability. There is no one-size-fits-all solution. Careful planning and professional guidance are essential.

Evaluating Insurance Company Strength: The Backbone of Your Guarantee

The guarantees of a lifetime income annuity are only as reliable as the insurance company providing them. Thoroughly research the financial strength of any insurer you are considering.

Look for companies with high ratings from independent agencies. These ratings reflect an insurer's ability to meet its long-term obligations. This due diligence is key to ensuring your guaranteed income remains secure, offering peace of mind throughout retirement.

Working with Advisors Who Understand Retirement Income

Seek advice from financial professionals specializing in retirement income planning, not just general investment management. Not all advisors possess the expertise to effectively incorporate annuities into a comprehensive retirement strategy.

Ask potential advisors about their experience with lifetime income annuities, their understanding of different annuity types, and their approach to integrating these products with other retirement income sources. This helps you find an advisor who can truly help you reach your retirement goals. The right advisor can offer valuable insights and guidance, helping you navigate the intricacies of retirement income planning and make informed decisions tailored to your unique needs.

When Lifetime Income Annuities Aren't The Right Answer

Lifetime income annuities offer compelling benefits, but they're not a one-size-fits-all solution. Before committing to a lifetime income annuity, carefully weigh the potential drawbacks. A balanced approach requires understanding these limitations to make a truly informed decision.

The Liquidity Challenge

One key drawback is the liquidity challenge. Committing a significant portion of your savings to an annuity can restrict your access to those funds. While you receive guaranteed income, accessing the principal may be difficult or come with penalties.

Imagine facing an unexpected medical expense. If most of your savings is locked in an annuity, accessing the necessary funds quickly can be problematic. This lack of flexibility can cause financial strain in unforeseen circumstances. Maintaining sufficient liquid assets outside your annuity to cover emergencies is crucial.

The Erosion of Purchasing Power

Another consideration is the potential erosion of purchasing power due to inflation. A fixed income stream provides stability, but its value can diminish over a long retirement if not protected. This is especially important for younger retirees facing decades of retirement.

Consider a retiree receiving fixed annuity payments for 20 years. Without inflation protection, these payments could buy significantly less by the end of that period, particularly if inflation rises substantially. Considering inflation-adjusted annuities or other mechanisms to safeguard purchasing power is essential.

Opportunity Costs in Bull Markets

During robust market growth, or bull markets, a lifetime income annuity’s fixed payments can represent opportunity costs. While other investments may generate considerable gains, your annuity income stays the same.

This can be frustrating when markets perform well. This potential for missed growth requires careful evaluation, especially if you have a longer time horizon and higher risk tolerance. Balancing growth potential with guaranteed income is key to optimizing your retirement portfolio.

Financial Strength of the Provider

The financial health of the annuity provider is crucial. If the insurance company experiences financial difficulties, your guaranteed income could be jeopardized. Carefully assess the financial stability of any provider before committing to a contract. Research reputable companies with strong ratings from independent agencies like A.M. Best.

Exploring Alternatives

Exploring alternative retirement income strategies is vital. Systematic withdrawal strategies from diversified investment portfolios, dividend-focused portfolios, and bond ladders offer different levels of income, growth, and control. Each has its own set of pros and cons.

Strategy | Guaranteed Income | Growth Potential | Control | Expenses |

|---|---|---|---|---|

Lifetime Income Annuity | High | Low | Low | Moderate |

Systematic Withdrawal | None | High | High | High |

Dividend Portfolio | Moderate | Moderate | Moderate | Moderate |

Bond Ladder | Moderate | Low | Moderate | Low |

This comparison highlights the trade-offs inherent in each approach. Lifetime income annuities prioritize guaranteed income and simplicity. Other strategies offer greater growth potential or control, but with increased risk and complexity.

Ultimately, a lifetime income annuity's suitability depends on individual needs and circumstances. Careful planning, evaluating potential drawbacks, and exploring alternatives are crucial for sound decision-making and building a secure retirement.

Taking Action: Your Lifetime Income Annuity Roadmap

Knowing about lifetime income annuities is the first step. Successfully integrating one into your retirement plan requires a clear roadmap. This section provides a practical, step-by-step guide to evaluating and purchasing a lifetime income annuity.

Planning Your Annuity Purchase Timeline

A well-structured timeline is crucial. Start with thorough research. Explore different annuity types, understand their features, and compare providers. This initial phase helps define your needs and identify potential products.

Consider these three phases: initial research, product comparison, and finalization. Take 1-3 months for initial research, allowing ample time to explore different annuity types and providers. Dedicate 2-4 weeks to compare specific annuity products, analyzing payout rates, fees, and features. Finally, allocate 1-2 weeks for finalization, ensuring all documentation is in order. This provides a practical framework, but remember to adjust it based on individual circumstances.

Key Questions for Potential Providers

Asking the right questions is essential for identifying red flags and understanding the annuity's true value. Here are some key questions to ask:

What are the guaranteed minimum and potential maximum payout rates?

What fees are associated with this annuity (e.g., surrender charges, administrative fees)?

How does the annuity handle inflation?

What riders are available, and what are their costs and benefits?

What is the financial strength rating of the insurance company?

These questions offer valuable insights into the annuity's structure and the provider's stability. Requesting and reviewing all relevant documentation, including the contract and supporting materials, is crucial before making a final decision. This protects your interests and ensures complete understanding.

Comparing Seemingly Similar Products

Annuities can appear similar but have significant differences. One might offer a slightly higher payout rate but have higher fees. Another might include valuable riders that offset a marginally lower rate.

For example, compare two fixed indexed annuities. Annuity A offers a 5% guaranteed minimum return with a 7% cap. Annuity B offers a 4.5% guaranteed minimum with an 8% cap and an inflation rider. The best choice depends on your individual circumstances and risk tolerance. A higher cap offers more growth potential, but the inflation rider in Annuity B protects against purchasing power erosion.

Finding the Right Financial Advisor

Many investment advisors lack specialized annuity knowledge. Seek out advisors with proven annuity expertise. Ask potential advisors these questions:

What percentage of your clients hold annuities?

What types of annuities do you typically recommend, and why?

Can you explain the different riders available and their implications?

These questions quickly reveal an advisor's knowledge level. An annuity allocation worksheet, considering your income needs, retirement timeline, and other assets, can be very useful. Finding the right advisor and using tools like this worksheet is critical to effectively integrating an annuity into your retirement plan.

Ready to secure your financial future? Visit America First Financial for annuity options designed to provide lifetime income and peace of mind. Protect your family's future with affordable, reliable insurance solutions.

_edited.png)

Comments