Secure Your Future with Guaranteed Lifetime Income

- dustinjohnson5

- Jun 9

- 13 min read

What Guaranteed Lifetime Income Really Means for Your Future

Think of guaranteed lifetime income as a financial bedrock. Imagine knowing, with absolute certainty, that a check will arrive every month, regardless of how the stock market performs or how long you live. That’s the power of guaranteed lifetime income: predictable and consistent. It's like having a financial safety net, easing the worry of outliving your savings.

This consistent income stream isn’t just about the dollars and cents; it's about peace of mind. Knowing your basic expenses are covered, regardless of market ups and downs, can significantly enhance your retirement. Imagine the freedom to truly enjoy your retirement, without the nagging fear of running out of money. That peace of mind is invaluable.

But the reality is, many retirees are facing increasing anxiety about their financial future. Social Security is a cornerstone for many, but concerns about its long-term stability are widespread. A 2025 survey by Global Atlantic found that while 35% of respondents expect to rely heavily on Social Security, a whopping 76% expressed concerns about its ability to pay full benefits throughout their lifetime. This underscores the need for additional sources of guaranteed income.

This is why savvy retirees are building their retirement plans on a foundation of guaranteed income. It's the difference between hoping your money lasts and knowing it will. Guaranteed lifetime income products provide that bedrock of predictable income, freeing you to invest other assets with more flexibility and potentially higher growth.

For example, imagine a retiree whose guaranteed income covers their essential living expenses. This allows them to comfortably allocate a portion of their remaining savings to investments with greater growth potential, knowing their basic needs are met. By the time you finish reading this, you’ll understand not just what guaranteed lifetime income is, but why it could be the key to a truly confident and enjoyable retirement.

Why Your Grandparents' Retirement Plan Won't Work for You

Remember the classic retirement image? A gold watch, a heartfelt goodbye party, and a pension check showing up without fail each month. For many of our grandparents, this wasn't a dream, it was their reality. Their employers essentially handled their retirement, providing a consistent income stream for life.

But this familiar picture of retirement is fading fast.

Today, the retirement landscape looks very different. Pensions are becoming scarce, placing the responsibility of retirement planning firmly in our own hands. Instead of depending on an employer, individuals are expected to manage their nest eggs, often through 401(k)s and similar investment options. It's a fundamental shift in how we need to think about retirement.

Think of it this way: you're now your own pension manager. You're not only responsible for saving money, but also for making sure that money generates enough income to last throughout your retirement. This can feel overwhelming, especially when you factor in fluctuating markets and longer lifespans. Many people realize too late that their 401(k), while a useful tool, doesn't automatically guarantee the secure, reliable income they had imagined.

This decline in traditional pensions has brought guaranteed lifetime income solutions into sharper focus. A 2025 Global Atlantic survey found that only 56% of respondents had access to any form of pension benefits. And even among those with pensions, 36% worried about inflation eating away at their pension's value. This underlines a growing need for more dependable income sources during retirement. Discover more insights on this shift.

The New Retirement Reality

The old retirement playbook just doesn't cut it anymore. The "contribute to a 401(k) and hope for the best" strategy is insufficient. The most forward-thinking retirees are proactively building their own guaranteed income streams, essentially recreating what pensions used to provide.

They're looking at various options, from annuities to dividend-paying investments, to secure a steady and reliable income throughout their retirement. This proactive, hands-on approach is the new normal for retirement planning, providing financial security in a world without the traditional pension safety net. It highlights the critical importance of understanding guaranteed lifetime income strategies and weaving them into your own retirement plan.

How Your Age Shapes Your Guaranteed Income Strategy

Believe it or not, the generation you belong to significantly influences how you think about retirement. Millennials, Gen X, and Baby Boomers have all walked different economic paths, shaping their feelings about financial security and, importantly, guaranteed income. Understanding these generational differences is like having a secret decoder ring for retirement planning.

For example, younger workers, especially millennials, are increasingly interested in guaranteed income, even though retirement is still far off. This may sound odd, but it reflects a change in how they see risk. Having witnessed market downturns and economic uncertainty, the idea of predictable income offers comfort. They also have a different outlook on Social Security.

Generational Perspectives on Risk and Retirement

Fewer millennials expect to rely on Social Security compared to older generations. An Allianz Life report revealed only 44% of millennials anticipate relying on Social Security, compared to 69% of Gen X and 84% of Baby Boomers. This gap shows a larger pattern of younger generations considering other guaranteed income products, like annuities. Explore generational trends in retirement planning.

Gen X, caught between Boomers and millennials, often takes a more balanced approach. They've witnessed both the stability their parents enjoyed and the economic rollercoasters of younger generations. This gives them a respect for guaranteed income while recognizing the need for growth in investments.

They often focus on a mix of guaranteed income and market-tied investments, balancing security with the potential for higher returns. Think of them as building a bridge between two different retirement worlds.

Baby Boomers, however, often bring a different viewpoint. Many entered the workforce expecting pensions and steady jobs. This can make them less enthusiastic about newer guaranteed income products like annuities. They may see them as complicated or less adaptable than traditional pensions.

Some Boomers may have lived through high inflation periods, making them cautious about fixed income that could lose value over time. Understanding these historical and personal influences is vital for tailoring guaranteed income strategies for each generation.

While your age group is a good starting point, it's essential to personalize your strategy. Consider your unique situation, how much risk you're comfortable with, and what you want to achieve financially. Generational trends offer valuable insights, but your own circumstances should ultimately drive your decisions in building a secure and enjoyable retirement.

Annuities Decoded: Your Primary Guaranteed Income Tool

Imagine you're planning for retirement. You want a reliable income stream, something you can count on like a steady paycheck. That's where annuities come in. Think of them as a personal pension you create with an insurance company. You give them a lump sum of money now, and they promise to pay you a guaranteed income for the rest of your life.

Understanding Annuity Variations

Annuities come in different flavors, each designed for specific needs. Think of immediate annuities like buying a pension today. You start receiving payments right away, providing a predictable income stream from the get-go. Deferred annuities, on the other hand, are more like investing in a long-term CD. Your money grows over time, and you receive payments later, typically in retirement.

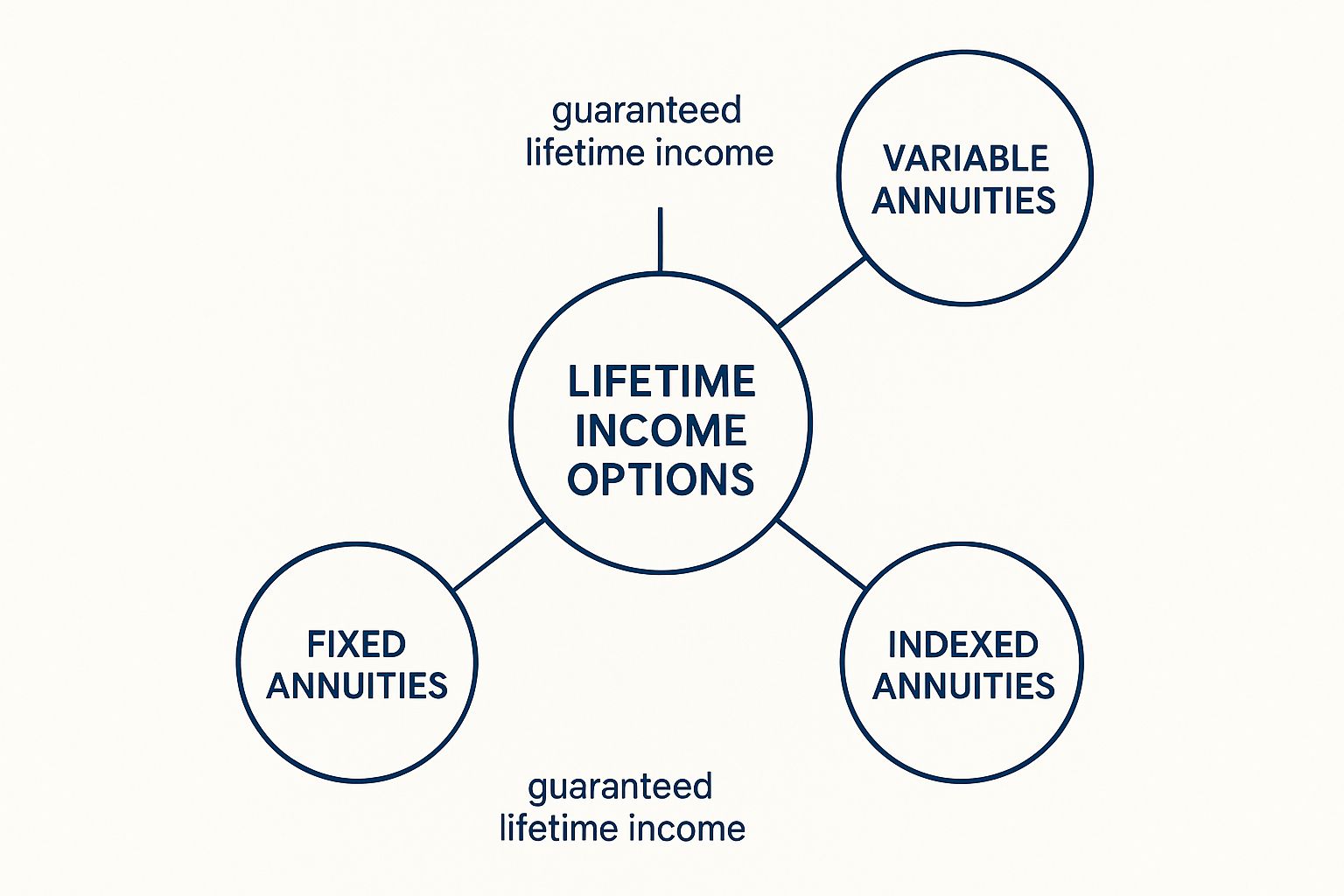

Now, let's talk about how these annuities grow. Fixed annuities offer predictable payments, like clockwork. You know exactly how much you'll receive each month. Variable annuities link your payments to market performance. This means potential for higher returns, but also the risk of lower payments if the market dips. Indexed annuities offer a middle ground. They offer some growth potential tied to a market index, while also protecting you from significant losses.

The infographic above provides a visual snapshot of how these annuity types fit into the broader picture of lifetime income. It’s like choosing different routes on a map to reach your retirement destination. Each path – fixed, variable, or indexed – offers a unique approach to generating guaranteed income.

To help you further understand the differences, take a look at the following table:

Annuity Types Comparison: Features and Benefits

A comprehensive comparison of different annuity types, their key features, risk levels, and ideal use cases.

Annuity Type | Payment Start | Growth Potential | Risk Level | Best For |

|---|---|---|---|---|

Immediate Annuity | Immediate | Low | Low | Retirees needing immediate income |

Deferred Annuity | Future Date | Moderate to High | Low to High | Individuals saving for retirement |

Fixed Annuity | Immediate or Deferred | Low | Low | Risk-averse individuals seeking predictable income |

Variable Annuity | Deferred | High | High | Individuals comfortable with market risk seeking higher potential returns |

Indexed Annuity | Deferred | Moderate | Moderate | Individuals seeking a balance between growth and protection |

As you can see, each type of annuity has its own set of characteristics that cater to different needs and risk tolerances. Understanding these differences is key to selecting the right annuity for your circumstances.

Weighing the Pros and Cons

Just like any financial product, annuities have their upsides and downsides. Fixed annuities offer stability and peace of mind. You know exactly what you're getting, which can be incredibly valuable in retirement. However, the trade-off is lower growth potential. Variable annuities offer the chance for higher returns, but your income can fluctuate. This adds an element of risk that some retirees may want to avoid. Indexed annuities offer a balance, providing some growth potential while mitigating the downside risk.

It’s also important to factor in costs. Annuities often come with fees, such as administrative charges. Some may also have surrender penalties if you withdraw your money early. Understanding these costs is crucial when comparing different annuity options.

Choosing the Right Annuity For You

The best annuity for you depends on your personal situation. Your risk tolerance, financial goals, and when you need the income are all important factors. If predictability and peace of mind are your top priorities, a fixed annuity might be a good fit. If you're comfortable with market fluctuations and aiming for higher returns, a variable annuity might be more appealing. Indexed annuities cater to those seeking a middle ground.

America First Financial offers a range of annuities designed for guaranteed lifetime income. Their online quote system makes it easy to explore your options. Remember, making an informed decision is essential for a secure retirement. Consider your needs carefully, and consult with a financial advisor to determine the best path for you.

Beyond Annuities: Creative Ways to Guarantee Your Income

When planning for a secure retirement income, annuities often take center stage. But they're not the only game in town. Think of your retirement income strategy like building a diversified investment portfolio. You wouldn't put all your eggs in one basket with stocks, and the same principle applies to income. Let's explore some alternative tools and strategies to build reliable income streams, supplementing, or even replacing, traditional annuities.

Dividends: Becoming Your Own Paymaster

Imagine owning a slice of a thriving business that regularly shares its profits with you. That’s the essence of dividend-focused investing. By investing in companies with a solid track record of consistent and growing dividends, you create a personal income stream resembling a business owner's regular paycheck.

This approach lets you participate in potential stock market growth while receiving steady income – the best of both worlds. This is particularly attractive for retirees wanting their income to keep up with inflation, since dividends often increase over time.

Bond Ladders: Systematic Income Over Time

Picture a bond ladder as a series of timed releases, each providing a predictable payout at set intervals. You invest in bonds with staggered maturity dates. As each bond matures, you receive the principal back. This generates a regular income stream you can reinvest or use for expenses.

Let's say you need income starting in five years. You could buy bonds maturing in five, six, seven, eight, and nine years. As each matures, you use the proceeds to buy a new bond maturing further down the line, creating an ongoing income cycle.

TIPS: Shielding Your Income From Inflation

Inflation can silently erode your savings. Treasury Inflation-Protected Securities (TIPS) act as a shield against rising prices. The principal of TIPS adjusts with inflation, ensuring your income retains its buying power even when the cost of living climbs.

Social Security and Pension Optimization

Social Security and pensions often form the bedrock of retirement income. Optimizing these benefits can significantly boost your annual income. Delaying Social Security benefits until age 70, for example, can dramatically increase your monthly payments. If you have a workplace pension, exploring different payout options can help maximize your lifetime benefits. It’s like fine-tuning an engine for peak performance.

QLACs and Other Retirement Account Strategies

Innovative options like Qualified Longevity Annuity Contracts (QLACs) allow you to defer a portion of your retirement savings within a qualified account, such as a 401(k) or IRA, to receive guaranteed income later in life. This is particularly useful for those concerned about outliving their savings. It's like building a delayed income bridge within your existing retirement accounts.

By strategically combining these approaches, you can construct a more robust and adaptable retirement income plan tailored to your individual circumstances and risk tolerance. Diversifying your income sources provides a stronger financial foundation for your future than relying on any single product or approach. This allows you to personalize your strategy for a truly customized retirement plan.

The Honest Truth About Guaranteed Lifetime Income Trade-Offs

Every financial decision involves weighing different factors. Guaranteed lifetime income is no different. Think of it like choosing between the steady paycheck of a regular job and the potential (and risks) of running your own business. Both offer advantages, but understanding the trade-offs is key to making the right choice for you.

The Upsides: Predictability and Protection

One of the biggest draws of guaranteed lifetime income is the peace of mind it offers. Imagine knowing your basic living expenses are covered regardless of how the stock market performs. This security can make a huge difference in how you enjoy retirement, allowing you to relax without the constant worry of outliving your savings.

Guaranteed income also protects you from longevity risk—the risk of outliving your money. It's like having a financial safety net, ensuring you'll have income even if you live to be 100. This is especially important now, as people are living longer than ever before.

Having guaranteed income can also give you the freedom to be bolder with your other investments. Knowing your essential needs are met, you might be more comfortable taking calculated risks with part of your portfolio, potentially earning higher returns.

The Downsides: Liquidity and Lost Opportunities

While guaranteed lifetime income offers significant benefits, it’s important to be aware of the potential downsides. One key consideration is liquidity. When you buy a guaranteed income product like an annuity, you typically commit a lump sum for a certain period. This can make it harder to access that money if unexpected expenses come up.

Another factor is opportunity cost. If the market does exceptionally well, you could miss out on potential gains by having some of your money tied up in a guaranteed income product. It's the age-old trade-off between security and growth potential.

Finally, inflation is a long-term concern. While some guaranteed income products offer inflation protection, others don’t. Over decades, even moderate inflation can significantly reduce your purchasing power. This means the income you receive may not buy as much in the future as it does today.

Weighing Your Options: Making Informed Choices

The key to making the most of guaranteed lifetime income is to carefully consider the trade-offs and make informed decisions based on your individual needs and situation. To help illustrate this, let's look at a comparison table.

Guaranteed Income Pros and Cons Analysis:

A detailed breakdown of advantages and disadvantages of guaranteed lifetime income strategies

Aspect | Benefits | Drawbacks | Mitigation Strategies |

|---|---|---|---|

Security | Peace of mind, protection against longevity risk | Potential opportunity cost | Diversify investments, allocate a portion to growth-oriented assets |

Predictability | Consistent income stream, easier budgeting | Limited liquidity | Maintain an emergency fund, consider annuities with withdrawal options |

Inflation | Some products offer inflation protection | Purchasing power erosion with some products | Choose inflation-adjusted annuities, consider TIPS |

The table above summarizes the key trade-offs. By understanding the potential advantages and disadvantages, you can make informed choices about how much of your retirement portfolio to allocate to guaranteed income. You'll want to balance your need for security with your desire for growth.

Consider working with a financial advisor who can help you evaluate your options and create a personalized plan. They can help you weigh the various factors involved in guaranteed lifetime income and develop a strategy that aligns with your long-term goals. Remember, building a successful retirement plan is a journey, not a race, and requires careful thought about your individual circumstances.

Your Step-by-Step Plan for Guaranteed Income Success

Building a comfortable retirement is much like constructing a house. You start with a foundation and build upon it, ensuring stability and security. Let's map out a practical plan for creating guaranteed lifetime income, piece by piece.

Assessing Your Current Foundation

First, we need to inspect your existing "foundation"—the guaranteed income you already have. This typically includes Social Security and any pensions. Think of these as your initial income pillars. To get a clear picture of your future Social Security benefits, head over to the Social Security Administration's online estimator.

The Social Security Retirement Estimator is a personalized tool that projects your benefits based on your earnings record. This projection is a crucial piece of the puzzle, showing you what to expect from Social Security and helping you assess your overall income needs. It allows you to see the potential gap between your desired income and what Social Security will provide, guiding you toward other income solutions.

Determining Your Guaranteed Income Needs

With a grasp of your existing guaranteed income, let's turn to your essential expenses. Think of these as the non-negotiables: housing, food, healthcare, and other must-haves. What portion of these expenses do you ideally want covered by guaranteed income? Some retirees aim for 100% coverage, creating maximum peace of mind, while others are comfortable with a lower percentage, perhaps 70% or 80%, supplementing with other investments. Your individual comfort level, risk tolerance, and overall financial picture will guide this decision.

Imagine guaranteed income as your financial safety net in retirement. The more essential expenses it covers, the larger and more robust that safety net becomes.

Evaluating Guaranteed Income Products

Now, let's explore ways to bridge the gap between your current guaranteed income and your target income. Annuities often play a role here. It's important to remember that annuities come in various forms – immediate, deferred, fixed, variable, and indexed, each with unique features and fees.

When comparing annuities, ask yourself:

When do I want the income stream to begin?

What level of risk am I willing to accept?

What are the associated fees and any surrender charges?

Does this product align with my long-term financial objectives?

A word of caution: If a product sounds too good to be true, proceed with skepticism. Be wary of high-pressure sales tactics and promises of unrealistic returns.

Timing and Coordination With Other Accounts

The timing of your guaranteed income strategy significantly impacts your overall retirement income. For instance, delaying Social Security benefits can result in a larger monthly payment. It's essential to coordinate these decisions with your other retirement accounts, such as 401(k)s and IRAs. Think of it like conducting an orchestra: each instrument (income source) needs to play in harmony for the best overall performance (retirement security).

Putting It All Together: Building Your Plan

Let’s transform these steps into a personalized action plan. Utilizing worksheets and planning tools can help you calculate precisely how much guaranteed income you need for a comfortable retirement. Explore various scenarios, adjusting contributions and investment strategies as needed. This tailored plan is like a roadmap, showing you how different choices impact your long-term income and security. It's your guide to building a solid financial foundation for a confident retirement.

Secure your financial future with America First Financial. Their range of annuities and other financial products can help you build the guaranteed lifetime income you deserve. Get a personalized quote in minutes and start building your secure retirement today.

_edited.png)

Comments