Short Term Disability Insurance Self Employed: Protect Your Income

- dustinjohnson5

- Jun 15, 2025

- 13 min read

Why Your Income Hangs By A Thread (And How To Fix It)

Imagine this: you've poured your heart and soul into building a thriving business. Then, suddenly, an unexpected illness or injury sidelines you. Your income stream dries up. This is a chilling scenario, but a very real possibility for many self-employed individuals.

Unlike employees with employer-sponsored benefits, freelancers, contractors, and small business owners often lack a built-in safety net. If you’re a solopreneur, you’re probably familiar with the challenges. For some inspiring ideas, check out these solopreneur business ideas.

This is where short-term disability insurance comes in. Think of it as your financial backup plan – a crucial piece of the puzzle for any self-employed person. It’s like having a parachute; you hope you never need to use it, but it's there to protect you in a freefall.

This type of insurance replaces a portion of your income if you're temporarily unable to work due to a covered illness or injury. It helps cover essential expenses – your mortgage, groceries, medical bills – allowing you to focus on recovery, not finances.

Real-World Example: The Freelance Writer

Let's say a freelance writer breaks their arm. Suddenly, typing – their primary source of income – becomes impossible. Without short-term disability insurance, they’re in a tough spot. But with it, they receive regular payments to help them stay afloat financially. This allows them to focus on healing without the added worry of mounting bills.

Let's pause for a moment and consider the bigger picture. Access to disability insurance isn't always equal. To illustrate this point, let’s look at the following comparison:

To better illustrate this point, let's look at a comparison of how traditional employment and self-employment affect access to disability insurance:

Employment Type | Access Rate | Coverage Source | Financial Protection Level |

|---|---|---|---|

Traditional Employee | Often higher | Typically employer-sponsored | Moderate to high, depending on employer plan |

Self-Employed | Often lower | Individually purchased policy | Variable, dependent on chosen policy |

This table highlights the significant difference in how each employment type accesses disability insurance. Traditional employees often benefit from employer-sponsored plans, providing a readily available safety net. Self-employed individuals, however, must proactively secure their own coverage. This makes understanding and obtaining short-term disability insurance even more critical for their financial well-being.

This difference underscores the importance of self-employed individuals taking proactive steps to protect themselves. In the U.S., for example, only 40% of civilian workers had access to short-term disability insurance in March 2020. This statistic, and more insights can be found here, reinforces how vital it is for the self-employed to secure their own private disability insurance. Recognizing this need is the first step toward building a solid financial foundation for yourself and your business.

Decoding How Your Financial Safety Net Actually Works

Think of short-term disability insurance for the self-employed as a backup generator for your income. It kicks in when your primary source of power – your ability to work – goes out. But like any generator, it has specific conditions for when and how it operates. Let's explore the journey from injury to that first check.

Understanding the Elimination Period

First, there's the elimination period, a waiting period before your benefits start. It's like the deductible on your car insurance – you have to cover some expenses before the insurance kicks in. Imagine a freelance writer who develops tendonitis. If they have a 7-day elimination period, benefits won't start until a week after they're unable to work. This highlights why having some emergency savings is essential.

Calculating Benefits With Irregular Income

Next is the benefit calculation, which can be tricky for self-employed folks with varying income streams. Think of a musician who plays gigs, teaches lessons, and sells merchandise. Their income might look quite different from month to month. The insurance company will typically average earnings over a set period, often the past 12 months, to determine the benefit amount. This averaging can significantly affect the final payout.

Navigating Partial Disability

What happens if you can still work part-time? This is where partial disability benefits come in. Picture a web developer who sprains their wrist. They can’t code for long stretches but can still manage project planning and client communication. They might receive a reduced benefit based on the difference between their pre-disability income and what they’re currently earning. Understanding your tax obligations in this situation is crucial. A small business tax guide can be helpful.

The Paperwork Reality

Finally, there's the paperwork. You'll need medical records from approved healthcare professionals confirming your disability and how it impacts your ability to work. The screenshot below shows examples of qualifying conditions.

This screenshot illustrates the range of conditions covered, highlighting the need for accurate documentation specific to your situation. Required paperwork often includes doctor's statements, test results, and sometimes therapy notes, depending on your disability. Approval times vary, but plan for several weeks, especially if the insurance company requires additional medical reviews. This emphasizes the importance of applying for benefits soon after becoming disabled.

The Financial Earthquake You Never Saw Coming

Let's talk about Marcus, a marketing consultant. He felt pretty secure with his six-month emergency fund. Then, at 38, a sudden heart attack turned his world upside down. Within three months, his savings had vanished, his business relationships were strained, and his consultancy was teetering on the edge of collapse.

This isn't just Marcus's story; it's a stark reality for many self-employed individuals. When unexpected health issues strike, the financial impact can be devastating.

Beyond the Obvious: The Hidden Costs of Disability

When we think about disability, lost income is often the first thing that comes to mind. But the financial burden extends far beyond just missed paychecks. Think of it like an earthquake: the initial tremor is the income loss, but the aftershocks – medical expenses, ongoing business costs, and the weakening of client relationships – create a ripple effect of financial stress.

Medical bills start piling up while your ability to earn anything is at zero. Meanwhile, your business expenses—rent, software subscriptions, etc.—don’t stop just because you can’t work.

Your professional network, built carefully over years, can also suffer. Clients facing deadlines might be forced to seek services elsewhere. This gradual erosion of your client base can have a significant long-term impact, even after you've recovered.

Imagine a photographer who injures their hand. They not only lose income from scheduled shoots, but also face medical bills, equipment maintenance costs, and the potential loss of important clients.

Financial stress can even hinder physical recovery. Worrying about bills can slow down the healing process and tempt you to return to work too soon. This can lead to further health complications and prolong the overall recovery period. Many self-employed individuals, under immense financial pressure, push themselves too hard, risking long-term health problems.

The mental and emotional strain of financial instability can be just as debilitating as the physical ailment itself. This is especially concerning considering the existing gap in disability coverage. An estimated 65% of the private sector lacks long-term disability insurance, leaving at least 51 million working adults with only basic Social Security coverage. Learn more about disability insurance statistics. This vulnerability highlights the critical need for self-employed individuals to secure short-term disability insurance.

The Domino Effect: From Temporary Setback to Financial Crisis

A temporary health issue can quickly escalate into a long-term financial crisis. The longer you're unable to work, the greater the strain on your business and personal finances. Understanding the true cost of this vulnerability is paramount for making smart decisions about your protection.

This isn’t about dwelling on worst-case scenarios. It’s about recognizing potential consequences and taking proactive steps to mitigate them. This allows you to build a strong financial safety net, ensuring your business and livelihood can weather any unforeseen storms.

Finding Coverage That Actually Fits Your Reality

Finding the right short-term disability insurance as a freelancer, contractor, or solopreneur can feel like searching for a needle in a haystack. Policies designed for traditional 9-to-5 employees often don't fit the unique realities of self-employment. Your income might ebb and flow like the tide, your "office" could be anywhere from a coffee shop to your kitchen table, and the risks you face can be entirely different.

Navigating the Maze of Self-Employed Coverage

Fortunately, you don't have to go it alone. Think of insurance professionals specializing in self-employed coverage as expert navigators. They can help you chart a course through the complexities of income documentation (especially if your earnings fluctuate seasonally) to ensure you can access the maximum possible benefits. They can also demystify those often-confusing occupational classifications and explain how they impact your coverage. Choosing the right classification is like choosing the right key to unlock the protection you need.

For example, imagine a massage therapist and a software developer. Their daily work lives, and therefore their risks, are worlds apart. A massage therapist might need coverage that focuses on repetitive strain injuries, while the developer might prioritize coverage for carpal tunnel syndrome.

Tailoring Coverage to Your Unique Needs

The nature of your work also plays a significant role in shaping your insurance needs. If you're a seasonal worker, like a landscaper, you might need a policy that adapts to periods of lower income during the off-season. If you're a contractor juggling multiple projects, flexibility in your coverage could be paramount.

Consider a freelance photographer who also leads photography workshops. Their income streams are like two separate rivers flowing into the same lake. A comprehensive policy should consider the combined flow from both sources when calculating potential benefits.

It's crucial to remember that insurance isn't a one-size-fits-all commodity. Don’t just shop based on price. Instead, prioritize quality coverage features. Talking to other self-employed individuals who’ve already secured disability coverage is like tapping into a valuable resource. Learning from their experiences can help you avoid common pitfalls and ensure you have adequate protection when you need it most. This will empower you to make informed decisions and avoid being caught short if illness or injury strikes.

To help illustrate how different policy features can benefit various self-employed workers, take a look at the following comparison guide:

Policy Features Comparison Guide

Key policy features and their importance for different types of self-employed workers

Policy Feature | Importance Level | Best For | Typical Cost Impact |

|---|---|---|---|

Own-occupation definition of disability | High | Professionals whose work requires specialized skills (e.g., surgeons, lawyers, designers) | Higher |

Guaranteed renewable | High | All self-employed individuals | Moderate |

Elimination period (waiting period) | Medium | Those with some financial cushion | Lower (longer elimination periods typically mean lower premiums) |

Benefit period | Medium | Those whose recovery time may be uncertain | Higher (longer benefit periods mean higher premiums) |

Cost-of-living adjustment (COLA) | Medium | Those concerned about inflation eroding their benefits | Higher |

Partial disability benefits | Medium | Those who may be able to work part-time while recovering | Moderate |

Future increase option | Low to Medium | Younger workers anticipating income growth | Varies |

This table highlights how specific policy features can be more or less critical depending on your individual circumstances. For instance, an "own-occupation" definition of disability is crucial for professionals with highly specialized skills, while a guaranteed renewable policy provides peace of mind for all self-employed individuals. Considering factors like elimination periods and benefit periods can help you balance affordability with adequate coverage.

Choosing the right short-term disability insurance is a vital investment in your future as a self-employed individual. By understanding the nuances of these policies and seeking expert advice, you can find coverage that truly fits your reality and protects your livelihood.

The Real Investment In Your Financial Future

Let's be frank: paying premiums for short-term disability insurance as a self-employed individual can feel like a considerable expense. It's understandable, especially when you're balancing various financial responsibilities. But try thinking of it this way: those premiums might feel like the best money you ever spent if you're suddenly unable to work due to an unexpected illness or injury. This section helps you understand what truly goes into making sure you're meaningfully protected.

Understanding the Factors That Drive Your Premiums

Several factors influence how much you'll pay for a short-term disability policy. Your age is one key factor. Younger individuals generally pay lower premiums because they are statistically less likely to need to use the insurance. Your health status is another important consideration. Pre-existing conditions can sometimes affect the cost of premiums.

Your occupation also plays a significant role. Think about the difference between a construction worker and a graphic designer. The construction worker's job has more inherent physical risks, which means their premiums would likely be higher. Finally, the specific coverage choices you select, such as the benefit amount and elimination period (the time you have to wait before receiving benefits), directly impact your premium. A higher benefit amount or a shorter elimination period will result in a higher premium.

Strategies for Managing Costs

While it's never wise to cut corners on necessary coverage, you can be smart about managing the costs. For example, consider exploring group coverage options available through professional organizations or associations. These group plans can often offer better rates than individual policies.

Don't forget about the tax implications. Premiums for individually purchased policies are not usually tax-deductible, but any benefits you receive are often tax-free. Understanding these tax aspects can help you make sound financial decisions. You can also strategically structure your coverage to manage costs. Opting for a longer elimination period can lower your premium without sacrificing a substantial amount of protection. The global disability insurance market is expanding, fueled by growing awareness and tax benefits. In 2021, the market was valued at $3.3 billion and is projected to reach $9.2 billion by 2031. You can learn more about this growth in the disability insurance market. This upward trend reflects the increasing understanding of the importance of having this kind of insurance.

Calculating the True Value Proposition

Shift your perspective and view your premium not as an expense, but as a crucial investment in your future financial security. Imagine the potential income loss you'd face if you couldn't work and didn't have coverage. Now, compare that to the cost of your premiums and the peace of mind you gain knowing you're protected. This comparison helps you understand the real value of what you're paying for. Think about how you'd handle your finances if your main source of income suddenly disappeared. Would your emergency savings be sufficient?

Many insurers offer flexible payment plans—such as monthly or quarterly installments—to help you manage your cash flow, which is especially helpful during periods of lower income. Finally, think about how disability insurance fits within your larger financial plan. It works together with your emergency fund and other safeguards to create a comprehensive safety net for you and your family.

Critical Mistakes That Destroy Your Protection

Even the most prepared self-employed individuals can stumble when choosing short-term disability insurance. These missteps can make their coverage worthless when they need it most. Let’s look at some real-world examples of claims denied and coverage failures.

The Cheapest Policy Trap

Think of insurance like building a house. The cheapest materials might seem appealing upfront, but they won't hold up in a storm. Similarly, choosing the cheapest short-term disability insurance is often a costly decision in the long run.

Imagine a freelance graphic designer who picked a bare-bones policy. When a repetitive stress injury sidelined them, the small benefit barely covered their basic expenses. They had to raid savings, borrow money, and even shrink their business. Inadequate coverage created a financial domino effect.

The Perils of Inaccurate Income Reporting

Accurate income reporting is the foundation of a solid policy. Imagine a consultant who downplayed their income to lower premiums. When they became disabled, their benefits were based on the lower reported amount, leaving them far short of what they needed. Honesty is the best policy, especially when applying for coverage. Proper financial planning is crucial for the self-employed, and tools like the Investment Calculator can help.

The Devil in the Definition of "Disability"

The definition of "disability" in your policy is critical. Some policies define it as the inability to perform any job, while others focus on your own occupation. This seemingly small difference is huge.

For example, a surgeon with hand tremors might be able to teach but can no longer operate. A policy covering the inability to do any job might reject their claim. An "own-occupation" policy, however, would protect them.

Timing Disasters and Policy Exclusions

Timing is crucial with short-term disability insurance. Waiting too long to apply, trying to boost coverage after a health change, or missing enrollment deadlines can be disastrous.

Policy exclusions also require careful review. Some policies exclude pre-existing conditions or specific injuries. A policy might exclude back injuries, a common issue for those working from home. If you don't understand these limitations, you could be left vulnerable.

Finally, documentation errors can sink your claim. Insufficient medical records or incomplete forms can cause delays or denials. Meticulous record-keeping and attention to detail are essential when applying for benefits. Understanding these crucial decisions can make all the difference when disability strikes.

Your Action Plan For Real Financial Security

Knowledge is power, especially when it comes to your financial well-being. This section acts as your personal roadmap to securing short-term disability insurance as a self-employed individual. We'll walk you through each step, from initial research to obtaining coverage, so you can build a solid safety net for yourself and your business.

Preparing for the Application Process

Before you even begin filling out an application, take some time to gather your essential financial documents. This might include tax returns, profit and loss statements, and any 1099 forms you have. Think of these documents as the foundation of a well-built house: the stronger they are, the better the structure. A clear picture of your income, even if it varies, significantly strengthens your application.

Next, prepare for the medical underwriting process. This is similar to a financial health check-up and requires honestly and thoroughly disclosing your medical history. While it might be tempting to skip over minor details, full disclosure is essential for ensuring your coverage is valid when you need it most. Omitting information can lead to complications or even denied claims down the line.

Finally, consider how best to present your self-employment income. If your income fluctuates seasonally, for example, emphasizing your average earnings over a longer period (perhaps a year or two) offers a more accurate and compelling representation of your financial stability.

Navigating the Application and Beyond

It's helpful to have a realistic understanding of the typical timeline for securing coverage. The process generally takes a few weeks, including time for medical reviews and potential requests for additional information. It’s not a sprint; it's more like a carefully planned hike.

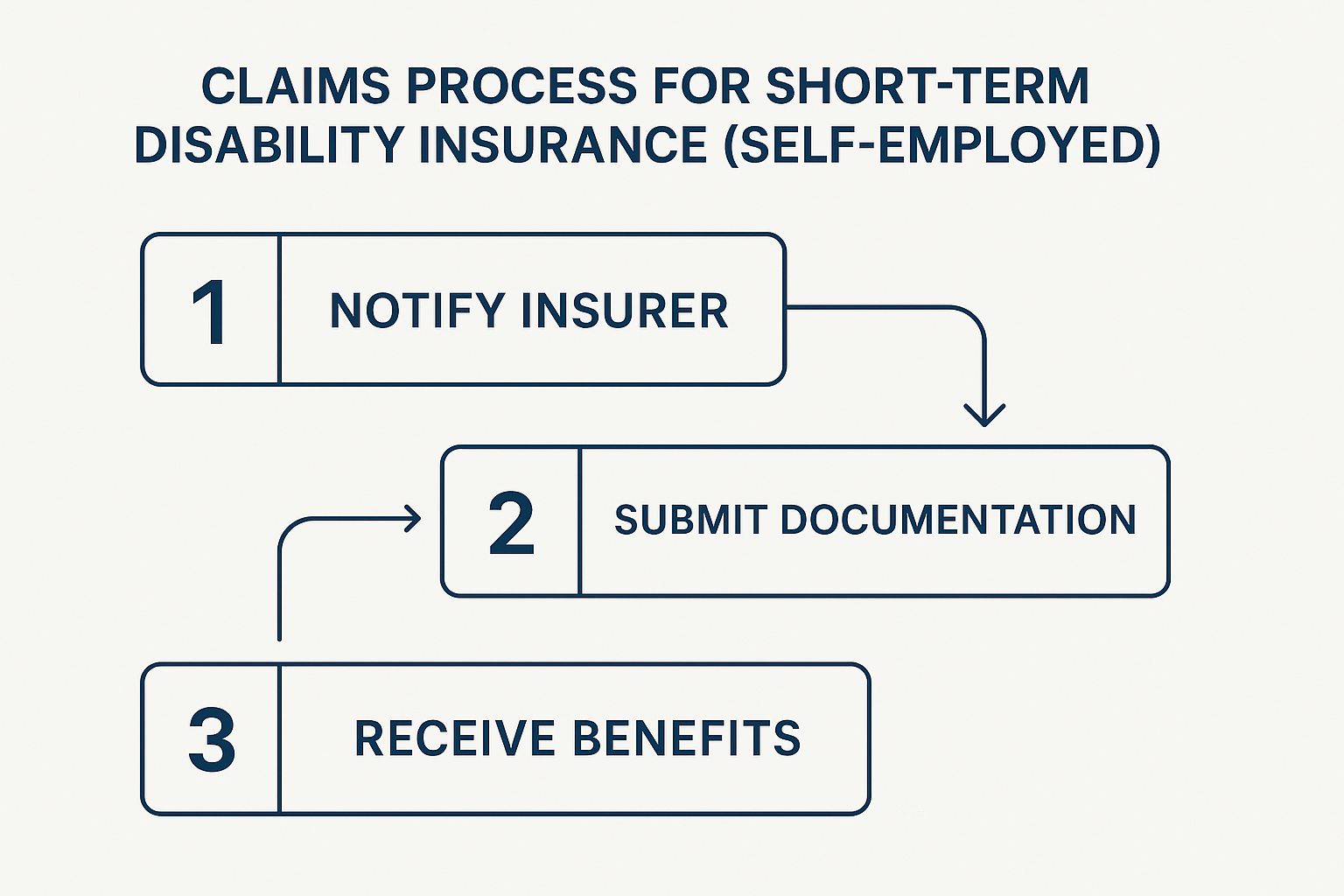

To illustrate the claims process, take a look at the infographic below. It outlines the key steps involved in filing a claim, from initial notification to documentation and finally, receiving your benefits.

This infographic simplifies the process, highlighting the importance of clear communication and thorough documentation when filing a claim.

Be prepared for potential hurdles along the way. Self-employed applicants often face unique challenges when applying for disability insurance. Be ready to explain your work situation thoroughly and provide supporting documentation if necessary. Connecting with other self-employed individuals who have navigated the application process can provide valuable insights and tips.

To help you stay organized, we've compiled a handy checklist to guide you through the application process:

Before the table: Applying for short-term disability insurance can seem daunting, but with a bit of organization, the process can be much smoother. The table below provides a clear roadmap of what to expect and how to prepare.

Step | Required Documents | Typical Timeline | Pro Tips |

|---|---|---|---|

1. Initial Application | Basic personal and business information | 1-2 weeks | Have your social security number and business details ready. |

2. Medical Underwriting | Medical history and possibly a medical exam | 2-4 weeks | Be honest and upfront about your health history. |

3. Income Verification | Tax returns, profit/loss statements, 1099s | 1-2 weeks | Organize your financial documents beforehand. |

4. Policy Review and Acceptance | Review policy details and sign agreement | 1 week | Carefully read the policy terms and conditions. |

After the table: By following this checklist, you can streamline your application process and get your coverage in place efficiently.

Integrating Disability Insurance into Your Financial Plan

Short-term disability insurance shouldn't be viewed as a stand-alone product but as a vital piece of your overall financial puzzle. It works hand-in-hand with your emergency fund and business insurance to create a comprehensive safety net.

Think of your emergency savings as the immediate shock absorber for small, unexpected financial bumps. Your business insurance protects your business assets, like equipment or inventory. Short-term disability insurance, on the other hand, steps in to replace a portion of your income when you're unable to work due to illness or injury. Together, these elements create a fortress of financial security, protecting you and your business from multiple angles.

This proactive approach isn't just about buying insurance; it's about cultivating financial resilience. It's about building a solid foundation that can support you and your business through life’s inevitable challenges.

Ready to secure your financial future? Visit America First Financial today to explore your options and build the protection you deserve.

_edited.png)

Comments