Simplified Issue Life Insurance: Your Fast Track to Coverage

- dustinjohnson5

- May 26

- 13 min read

Understanding Simplified Issue Life Insurance (And Why It Matters)

Finding the right life insurance can sometimes feel like a complicated puzzle, filled with confusing terms and long waits. However, simplified issue life insurance presents a more straightforward way to help secure your family's financial well-being. Unlike traditional policies that often require medical exams, blood work, and lengthy approval periods, this type of insurance is built for speed and simplicity.

So, what does this mean for you practically?

There's no medical exam needed; your application is based on a health questionnaire.

You can expect faster approval times, often getting a decision in days instead of weeks.

The process involves less hassle, making it a convenient choice for people with busy schedules.

You gain access to reliable protection without frustrating delays.

This quicker application process is a big plus, especially for working professionals, parents managing many tasks, or anyone who prefers an efficient system. The main goal is to offer dependable financial protection for your loved ones, avoiding the usual bureaucratic hurdles that can make traditional insurance seem like a burden.

How Does It Work So Quickly?

The term "simplified" directly points to the underwriting process. Instead of undergoing a full medical exam, insurance companies use your responses to a set of health-related questions. While you don't need to visit a clinic, insurers still conduct their checks, often looking at databases such as the MIB (Medical Information Bureau) or reviewing prescription histories to confirm the details you provide. This method enables a faster evaluation of potential risk.

This approach has opened up life insurance to a wider range of individuals. Coverage amounts typically fall between $25,000 and $250,000, though some insurers offer policies up to $500,000. These sums make it a sensible option for covering things like final expenses, unpaid debts, or to provide a temporary income buffer. These policies aim for ease of access while still providing significant financial peace of mind.

Indeed, simplified issue life insurance represents a significant area of expansion in the overall life insurance sector. This growth is largely driven by changing consumer preferences and an increased focus on financial planning. The U.S. life insurance premium market is anticipated to hit a notable $15.9 billion in 2024, a figure influenced by greater consumer interest, particularly following recent global events. You can discover more insights about U.S. life insurance market trends on LIMRA's website. This trend clearly shows a movement towards insurance options that are both effective and more straightforward to acquire.

Why Simplified Issue Wins Over Traditional Life Insurance

Increasingly, people are opting for simplified issue life insurance instead of traditional plans. The attraction is straightforward: it provides necessary protection swiftly and maintains high quality. This type of insurance directly tackles the usual headaches found with older ways of getting life insurance.

The Speed and Convenience Advantage

One of the biggest pluses of simplified issue life insurance is how much less time and effort the application process takes. Traditional life insurance often includes a drawn-out underwriting period, which can put many people off.

No Medical Exams: A key feature of simplified issue policies is that they don't require medical exams or blood tests. This removes a major barrier for many applicants.

Faster Approval: Forget waiting weeks or months for lab results and decisions. Approval for simplified issue can come through in days, sometimes even within 24 hours.

Reduced Paperwork: The application usually consists of a simple health questionnaire, which is much less demanding than the extensive forms often needed for fully underwritten policies.

This efficiency allows you to gain peace of mind more quickly. The simplified underwriting process uses your answers to health questions and information from external sources, such as prescription records, to evaluate risk without needing invasive medical tests.

Why This Matters to You

This quicker way to get coverage is especially helpful for specific groups of people. If you're a busy professional, a parent with a full schedule, or someone who prefers to keep health details private, simplified issue life insurance could be a great match. For example, if you have minor health issues that might make a traditional application difficult, this type of policy can provide an easier path.

The desire for a less complex process is common. Research shows that 50% of people are more inclined to purchase life insurance if the application were easier or available online. This finding supports the increasing popularity of simplified issue products that focus on speed and ease. You can find more details on life insurance consumer preferences here. Also, even though simplified issue policies usually skip medical exams, health-aware individuals might still want to monitor their well-being with devices like health tracking wearables.

Numerous customer stories show how removing medical appointments and lengthy forms has made life insurance reachable for individuals who might have otherwise skipped it. This improved access allows more families to secure their financial future without facing old obstacles, making simplified issue life insurance a sensible option for dependable coverage.

Perfect Candidates For Simplified Issue Coverage

While the quick process and convenience of simplified issue life insurance are certainly appealing, it's important to recognize that it's not a one-size-fits-all answer. Understanding who stands to gain the most can help you determine if this type of policy fits your particular needs. For specific individuals, it presents an excellent route to obtaining financial reassurance.

Pinpointing the Ideal Applicants

Several groups discover that simplified issue life insurance is especially well-matched to their circumstances. A primary benefit of simplified issue coverage is its straightforward application process when compared to traditional insurance options, which often involve extensive security measures and a prolonged vetting period. This ease of access is a significant attraction.

Consider these situations:

Busy Professionals and Parents: If your days are filled with managing a career and family, finding spare time for medical examinations can be quite difficult. Simplified issue provides a method to secure coverage promptly, making sure your loved ones are protected without unnecessary hold-ups.

Individuals with Some Health Issues: Those who have certain pre-existing health conditions, which might otherwise complicate or extend a standard underwriting process, can frequently still qualify. Many applicants with manageable health concerns find the approval process to be quite direct.

Those Needing Coverage Fast: If you require life insurance to be in place quickly, perhaps due to a new mortgage, a business loan, or a divorce agreement, the speedy approval times are a considerable advantage.

Age, Health, and Financial Fit

Age is indeed a consideration, with policies generally accessible for individuals up to age 75. However, the most favorable coverage amounts and premium rates are often available for those aged 16 to 55. The increasing global population of those aged 65 and older is actively shaping insurance market trends. As a result, simplified issue life insurance is becoming increasingly attractive to older customers or those with health concerns that might make approval for traditional life insurance challenging. You can explore this topic further on Deloitte's insights page.

From a financial perspective, these policies are very effective for addressing specific needs such as:

Covering final expenses and burial costs.

Paying off outstanding debts, like credit cards or small loans.

Providing a temporary income buffer for surviving family members.

Coverage amounts are generally lower than those offered by traditional policies, often falling within the range of $25,000 to $250,000, although some insurers may provide up to $500,000. If you need coverage that exceeds this amount, or if you are in excellent health and looking for the lowest possible premium on a large policy, a fully underwritten plan might present better overall value.

Real Costs And Coverage: What You'll Actually Pay

Grasping the financial side of simplified issue life insurance is essential when you're considering if its quick convenience aligns with your budget. While this type of policy provides fast coverage, it's important to carefully compare the actual costs with the benefits you receive. Several key details will directly influence the monthly premiums you'll encounter.

Factors Influencing Your Premiums

The premiums for simplified issue life insurance are not one-size-fits-all; they shift based on a few personal elements:

Your Age: Generally, younger applicants find more favorable rates.

Health Questionnaire Answers: How you respond to these questions plays a significant role in the insurer's assessment.

Coverage Amount: Opting for a larger death benefit will naturally lead to higher premiums.

Policy Type: Your choice between term or whole life insurance will also affect the cost.

Because these policies bypass the need for medical exams, insurers work with less detailed health information about applicants. This often means premiums can be somewhat higher compared to fully underwritten policies, where medical exams provide a thorough health picture. In essence, you're often paying a bit more for considerable speed and simplicity in the application process.

Typical Coverage Amounts and Policy Options

Simplified issue life insurance policies generally offer coverage amounts ranging from $25,000 to $100,000. These amounts are often well-suited for covering final expenses or managing smaller outstanding debts. Some insurers, however, may provide coverage up to $500,000. It's worth noting that individuals over the age of 55 might find their coverage options capped closer to $100,000. Also, consider looking into available policy riders, which can add layers of protection to your base coverage.

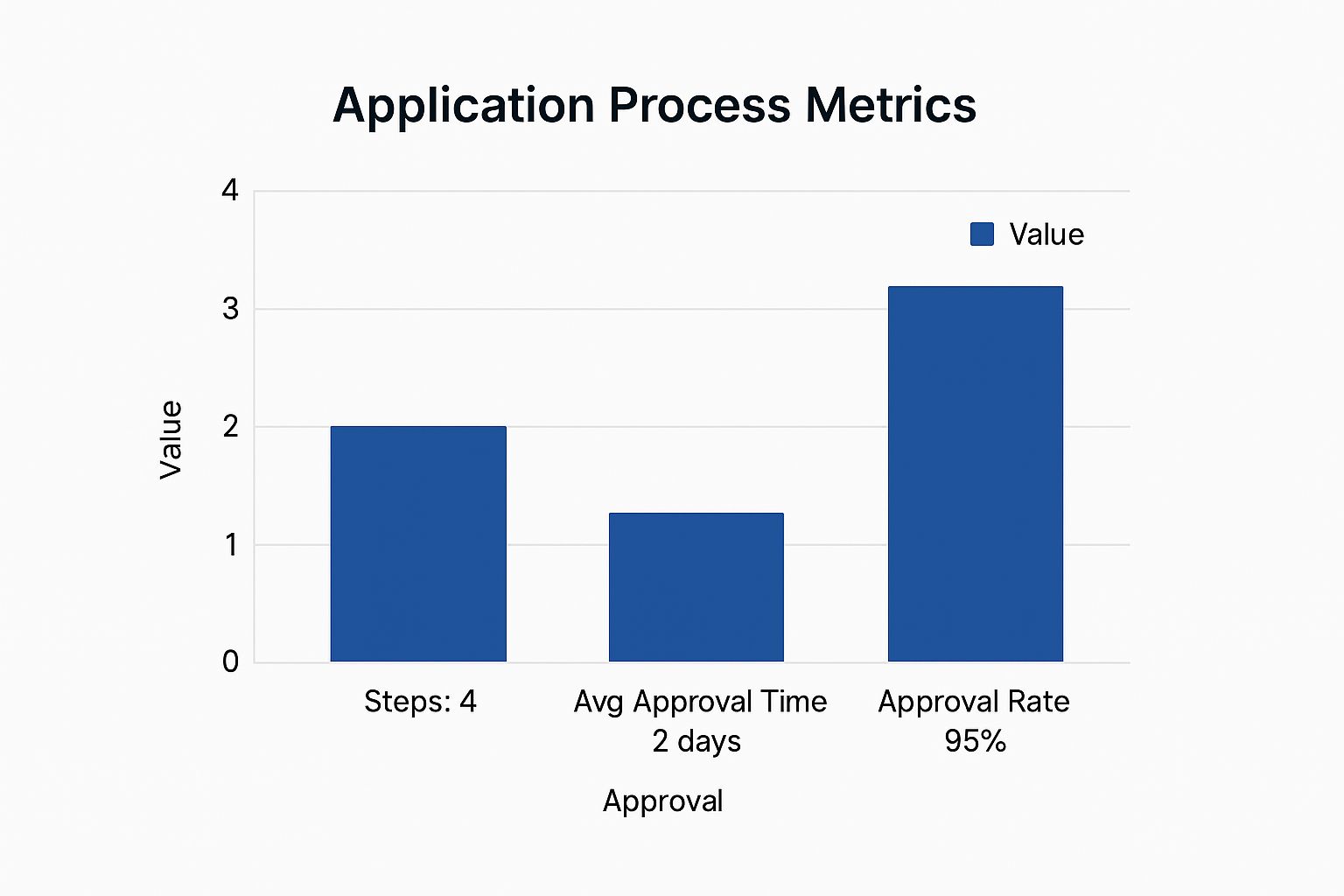

The infographic below breaks down some key metrics about the application process for simplified issue life insurance, such as its minimal application steps and prompt approval times.

As the visual data indicates, the application process frequently involves just 4 steps. On average, applicants can expect an approval time of around 2 days, and these policies boast a 95% approval rate, highlighting how readily accessible this form of coverage can be.

Comparing Costs: Simplified Issue vs. Traditional Policies

The premiums for simplified issue life insurance are tailored to your individual profile. For example, a 50-year-old male looking for $20,000 in coverage might expect to pay approximately $57 per month. In a similar scenario, a female applicant could see a premium of about $45 monthly. Keep in mind that your specific quote will depend on your circumstances.

To help illustrate the differences, the following table compares key aspects of simplified issue and traditional life insurance policies.

Simplified Issue vs Traditional Life Insurance Cost Comparison

Compare premiums, coverage limits, and features between simplified issue and traditional life insurance policies across different age groups.

Policy Type | Monthly Premium (35-year-old for $20k) | Monthly Premium (50-year-old for $20k) | Maximum Coverage | Application Time |

|---|---|---|---|---|

Simplified Issue | ~$30-$38 | ~$45 (female) - $57 (male) | Up to $500,000 | ~2 days |

Traditional Life | ~$12-$18 | ~$20-$28 | $1,000,000+ | 4-8 weeks |

This comparison shows that simplified issue policies prioritize speed and ease of application, often with higher premiums for lower coverage amounts compared to traditional policies. Traditional policies, while more cost-effective for similar coverage, involve a longer application process and medical underwriting.

If you are in good health and don't mind undergoing a medical exam, traditional policies could offer a more economical path to securing similar coverage amounts. However, many individuals place a high value on the speed and simplicity afforded by simplified issue policies, willingly accepting potentially higher costs. This is particularly true if coverage is needed urgently or if medical exams are undesirable. Deciding whether this "convenience premium" fits your financial plan is a personal choice. For those seeking reliable coverage without lengthy waiting periods, companies such as America First Financial present practical solutions.

Your Application Journey: Step-by-Step Success Guide

If you're looking for a fast and uncomplicated way to get life insurance, the application for simplified issue life insurance is built for convenience. Knowing what's involved at each stage can help you move through the process with ease and get your coverage in place quickly, often much faster than traditional insurance methods.

Kicking Off Your Application

Starting your application for a simplified issue life insurance policy is typically a straightforward affair. Many insurance providers, such as America First Financial, provide easy-to-use online application forms or an option to apply via phone with a licensed agent. To begin, you will usually need to share some basic personal information.

This generally includes details like:

Your full legal name and date of birth

Your current residential address and contact details

Your occupation and, in some instances, your income

Basic physical details such as your height and weight

The central part of your application is the health questionnaire. This set of questions takes the place of a medical examination, which is a key feature of the simplified issue life insurance approach. Keeping your information handy will help you complete this part swiftly.

The Health Questionnaire: Honesty Is Key

The health questionnaire for simplified issue life insurance will ask about your medical background, your current health condition, and certain lifestyle choices, like whether you use tobacco. Although these questions are less detailed than those in a full medical underwriting process, giving accurate and truthful answers is essential for your application to be approved.

Why is complete honesty so important?

Insurance companies check the information you submit. They often compare your answers against data from third-party sources, which can include reports from the **MIB Group** (an organization that maintains records of previous insurance applications), prescription medication histories, and driving records.

If there are major differences between your answers and these records, it could cause delays in your application, lead to requests for more information, or even result in your application being denied.

Additionally, most life insurance policies have a contestability period, usually the first two years the policy is active. If a claim is made during this period and the insurer finds that significant false information was provided on the application, they can investigate and possibly refuse to pay the claim.

Providing honest information from the outset helps ensure the application goes smoothly and that you secure the dependable coverage you're seeking for your family.

From Submission to Approval: What Happens Next

After you submit your application for simplified issue life insurance, the review and decision-making stage is remarkably quick. Insurance companies use your answers from the questionnaire and information from third-party verifications to decide on your application. Many applicants receive approval within minutes or by the next business day. This quick processing time is a major benefit of simplified issue life insurance.

Occasionally, if an answer on your questionnaire causes a specific concern, or if there's a mismatch with verified information, your application might be set aside for a more thorough, yet still quick, review. With a general approval rate for simplified issue applications around 70% across the industry, your prospects for obtaining coverage are usually favorable, as long as you meet the insurer's specific requirements. This effective system often allows your simplified issue life insurance policy to be officially active on the same day you apply, offering prompt reassurance.

Important Limitations You Need To Know About

While the easy application process for simplified issue life insurance brings quickness and convenience, it's equally important to grasp the particular limitations that accompany this insurance type. Knowing these boundaries from the start helps ensure your selected coverage genuinely meets your financial protection needs and prevents any future misunderstandings. These policies, created for simplicity, naturally involve certain compromises.

Coverage Amount Ceilings

A key point to consider with simplified issue life insurance is the cap on the available coverage amount. These policies typically provide smaller death benefits when compared to traditional, fully underwritten insurance plans. Although some insurers might go up to $500,000, many simplified issue term policies usually offer coverage amounts falling between $100,000 and $250,000.

For permanent policies, such as those intended for final expense planning, the coverage could be limited to around $25,000 to $50,000. Furthermore, individuals applying over the age of 55 may discover that their maximum coverage options are even more constrained.

The Graded Death Benefit Explained

Another crucial element to understand is the graded death benefit, a feature that can be part of some simplified issue life insurance policies. This provision means that if the insured person passes away from natural causes within the initial two years of the policy (often referred to as the waiting period), the beneficiaries might not get the full death benefit.

Instead, they would usually receive a refund of the premiums paid, occasionally with a small amount of interest, for example, 10%. However, if death occurs due to an accident, it is generally covered in full from the very first day the policy becomes active. This type of arrangement helps insurers manage risk when they have limited medical information about the applicant.

Potential Approval Hurdles

Even though applying for simplified issue life insurance is less complicated, approval is not always a certainty. Specific factors can still result in an application being turned down or sent for more thorough underwriting. These factors can include:

Serious pre-existing health conditions: While many common health problems are acceptable, severe or unmanaged conditions might lead to disqualification.

High-risk lifestyle factors: Involvement in hazardous occupations or hobbies can affect your eligibility for coverage.

Age restrictions: These policies frequently have maximum ages for issuance, typically around 75 years old, with the best coverage options generally more accessible to younger applicants.

Grasping these potential restrictions is vital for forming realistic expectations about what simplified issue life insurance can offer. For individuals with considerable health issues or those requiring very large coverage amounts, a traditional policy, despite its more extended application process, could be a more fitting choice.

Making Your Decision: Is Simplified Issue Right For You?

It's time to figure out if simplified issue life insurance is the right match for your specific protection needs, your budget, and how quickly you need coverage. Making this choice means carefully looking at what's most important to you in a life insurance policy.

Weighing Your Options

The primary draw of simplified issue life insurance is its fast application process and the fact that there's no medical exam required. This makes it an attractive option for individuals who need coverage quickly or prefer to avoid medical examinations. However, it's important to understand that this convenience usually means paying relatively higher premiums for the amount of coverage, and the maximum coverage amounts are often lower than what you might find with fully underwritten policies.

To help you decide, it's useful to see how different types of policies stack up against your personal priorities. The table below, titled "Decision Matrix: Choosing Your Life Insurance Type," is designed to help you evaluate different life insurance options based on your priorities for speed, cost, coverage amount, and health requirements.

Priority Factor | Simplified Issue | Traditional Term | Traditional Whole Life | Best For |

|---|---|---|---|---|

Speed of Approval | Very Fast (Days, sometimes hours) | Slow (4-8 Weeks) | Slow (4-8 Weeks) | Those needing coverage urgently. |

Medical Exam | No | Yes | Yes | Individuals preferring to skip exams or with minor health concerns. |

Cost (Premium) | Higher for amount | Lower for amount | Highest | Those prioritizing convenience over the lowest possible premium. |

Coverage Amount | Moderate (e.g., up to $500,000) | High (Often $1,000,000+) | Varies, can be high | Needs like final expenses, smaller debts, or moderate income replacement. |

Health Requirements | Lenient, some conditions accepted | Stricter, good health preferred | Stricter, good health preferred | People with some pre-existing conditions who may not qualify for traditional. |

This matrix should provide a clearer picture of where simplified issue life insurance fits in the broader landscape of life insurance options. With these comparisons, you can better focus on the right questions to ask and plan your subsequent actions.

Key Questions and Next Steps

Before you move forward, it's wise to ask potential insurers about important policy details. Specifically, inquire about any graded death benefit periods and how they verify health information for simplified issue life insurance. Having complete clarity on these aspects is crucial.

Your next steps could involve a few paths:

Applying for simplified issue coverage if your main priorities are getting coverage quickly and avoiding a medical exam.

Exploring traditional policies if you are in good health, are looking for the maximum coverage for your money, and are comfortable with waiting for the underwriting process.

Combining coverage types as a strategy to effectively address a variety of financial protection needs.

If you are leaning towards simplified issue life insurance, it's best to apply when the need for coverage arises. Ensure all application details are accurate to facilitate a smooth process.

Securing your family's financial future is a significant step. If the advantages of simplified issue life insurance match your priorities, think about choosing a provider that specializes in straightforward protection. You can visit America First Financial to get a quick quote and learn more about their insurance solutions.

_edited.png)

Comments