Tax Deferred vs Tax Free Retirement Guide

- dustinjohnson5

- Aug 18, 2025

- 15 min read

When it comes to your retirement savings, one of the biggest decisions you'll make boils down to a simple question: Do you want to pay taxes now or later? This is the fundamental difference between tax-deferred vs. tax-free accounts. The choice you make is all about timing. Tax-deferred accounts give you an immediate tax break, lowering what you owe the IRS today. On the other hand, tax-free accounts let you pay taxes on your contributions upfront, unlocking completely tax-free income in retirement.

Understanding The Core Retirement Tax Strategies

Saving for retirement isn't just about stashing money away; it's about being smart with your taxes. You want to keep as much of your hard-earned money as possible. This means you have to make a strategic call on when you pay the taxman. The two main paths, tax-deferred and tax-free, each offer unique perks depending on your current finances and what you expect your future to look like.

Think of it as a trade-off. With a tax-deferred plan, like a Traditional 401(k), you get a nice benefit right now. Your contributions are made before taxes are taken out of your paycheck, which can mean a smaller tax bill this year. The catch? You'll pay ordinary income tax on every single dollar you pull out in retirement—that includes both your contributions and all the growth.

A tax-free plan, like a Roth IRA, works the opposite way. You pay your taxes first. Contributions are made with after-tax dollars, so you don't get that immediate tax deduction. But here's the powerful payoff: every qualified withdrawal you make in retirement, including decades of investment growth, is 100% tax-free.

This isn't about avoiding taxes altogether. It’s about strategically timing them to your advantage. The best choice really hinges on whether you think you'll be in a higher or lower tax bracket in retirement compared to where you are right now.

For savvy investors looking to diversify, it's also worth knowing that you can use these tax structures for more than just stocks and bonds. For instance, a Self-Directed IRA for Real Estate Investing allows you to hold alternative assets under the same tax-advantaged umbrella.

Let's break down the core mechanics of each strategy to make the comparison crystal clear.

Quick Look Tax-Deferred vs Tax-Free At A Glance

This table gives you a simple, side-by-side view of how each approach handles your money from start to finish.

Feature | Tax-Deferred Accounts (e.g., Traditional IRA/401(k)) | Tax-Free Accounts (e.g., Roth IRA/401(k)) |

|---|---|---|

Contributions | Made with pre-tax dollars; may lower your current taxable income. | Made with after-tax dollars; no immediate tax deduction. |

Investment Growth | Grows tax-deferred; no annual taxes on dividends or capital gains. | Grows completely tax-free within the account. |

Withdrawals | Taxed as ordinary income in retirement. | Qualified withdrawals are 100% tax-free in retirement. |

Ultimately, understanding these three stages—contributions, growth, and withdrawals—is key to picking the right tool for your long-term financial goals.

How Tax-Deferred Retirement Accounts Work

Tax-deferred accounts, like the familiar Traditional IRA or your company's 401(k), all run on a simple, powerful idea: pay taxes later. The big draw here is the immediate break you get on your taxes today.

When you contribute to one of these accounts, you're typically using pre-tax dollars. That means every dollar you put in is subtracted from your gross income before the IRS and state figure out what you owe. The result? A smaller taxable income for the year, which can mean a lower tax bill or a bigger refund. For a lot of people, that upfront savings is a welcome relief.

Inside the account, your money gets to grow in a protected environment. Unlike a standard brokerage account where you're dinged with taxes on dividends and capital gains each year, a tax-deferred account lets your investments compound without that annual tax drag. This uninterrupted growth is the real secret sauce, allowing your money to build momentum over decades. The Investment Company Institute offers more detail on how this powerful mechanism works.

The Power of Uninterrupted Compounding

Let's make this real with an example. Picture two investors, Sarah and Tom, who each put $6,000 away every year and earn a 7% average annual return.

Sarah (Tax-Deferred IRA): Her entire $6,000 and all the investment gains work for her year after year, with no tax interference. Compounding gets to do its thing on the full balance, maximizing her growth potential.

Tom (Taxable Account): He has to pay taxes on dividends and any realized capital gains annually. This "tax drag," even if it seems small, shaves a piece off his principal each year, leaving less money to reinvest and grow. Over 30 years, that small drag can lead to a nest egg that's significantly smaller than Sarah's.

This is the core advantage of tax-deferred growth in a nutshell. You’re letting your money build on itself more efficiently by pushing the tax bill far down the road.

The whole point of a tax-deferred account is to shield your investment growth from taxes year after year, letting your portfolio hit its full potential before you ever touch it.

Understanding Withdrawals and Distributions

Of course, you can't avoid taxes forever. The bill eventually comes due when you start taking money out in retirement, which is usually after age 59½. At that point, every dollar you withdraw is taxed as ordinary income.

This is a crucial point. It’s not just the earnings that get taxed—it’s your original contributions, too. The money you pull out is taxed at whatever your income tax rate is that year, just like a paycheck. You're essentially swapping a tax break today for a tax liability in the future.

Required Minimum Distributions (RMDs)

There’s one more rule you absolutely have to know about: Required Minimum Distributions (RMDs). Once you hit your 70s (the specific age has been changing, so it depends on when you were born), the government requires you to start taking a certain amount of money out each year.

The IRS put these rules in place to make sure they eventually get their tax revenue. The RMD amount is calculated using your account balance and a life expectancy factor. If you fail to take the full RMD, the penalty is steep, so it’s a critical piece of the puzzle for anyone planning their retirement income. These mandatory withdrawals can easily bump you into a higher tax bracket if you aren't careful.

The Long-Game Power of Tax-Free Retirement Accounts

While getting a tax break today with a tax-deferred account is tempting, tax-free accounts are all about the long game. They deliver their biggest punch right when you need it most: in retirement. This strategy, which is the engine behind Roth IRAs and Roth 401(k)s, completely flips the script—you pay your taxes now so you can have total financial freedom later.

The concept is pretty simple. You fund these accounts with after-tax dollars, which is just a formal way of saying you’ve already paid income tax on that money. Because of this, you won't see an immediate tax deduction when you contribute.

It might feel like a bit of a sacrifice in the short term, but the payoff down the road is enormous. Once inside the account, your money grows completely sheltered from taxes. When you finally take qualified withdrawals in retirement, every single penny—your original contributions and all the growth—is 100% tax-free.

Why Tax-Free Withdrawals Are a Game-Changer

Picture two people retiring, each with a $1 million nest egg. One saved in a Traditional 401(k), the other in a Roth 401(k). The person with the traditional account has to treat every withdrawal as taxable income, which shrinks their available cash. But the Roth retiree? They can access their money without owing a dime to the IRS.

This core difference between tax deferred vs tax free becomes especially important when you think about where tax rates might go in the future. If rates creep up over the next 20 or 30 years, the Roth account holder is sitting pretty, having already settled their tax bill when rates were potentially lower.

A tax-free account gives you one of the most valuable assets in retirement planning: certainty. You know exactly how much money you have to spend, making it far easier to budget for the future without having to guess at what the IRS might take.

That kind of predictability is pure gold for anyone aiming for a conservative and secure retirement. The nest egg you spent a lifetime building is truly yours.

Strategic Perks Beyond Just Taxes

The advantages of tax-free accounts don't stop at the withdrawals. Roth IRAs, in particular, come with some unique features that give you incredible flexibility.

No Required Minimum Distributions (RMDs): Unlike tax-deferred accounts that make you start taking money out in your 70s, the original owner of a Roth IRA never has to. This gives you complete control over your assets for your entire life.

A Powerful Estate Planning Tool: That lack of RMDs makes Roth IRAs a fantastic way to pass on wealth. You can let the account grow tax-free indefinitely and leave it to your heirs, who can then enjoy tax-free distributions themselves.

Access to Your Contributions: In a true emergency, you can withdraw your direct contributions (not the earnings) from a Roth IRA at any time, for any reason, without facing taxes or penalties. It's a financial safety net that most other retirement accounts just don't have.

A Look at Real-World Spendable Income

Let's break down how this plays out with actual numbers. Imagine someone saves $6,000 a year for 30 years, earns an average 7% return, and expects to be in the 22% federal tax bracket when they retire.

Account Type | Ending Balance | Tax Due on Withdrawals | Spendable Retirement Funds |

|---|---|---|---|

Tax-Deferred IRA | $566,765 | $124,688 | $442,077 |

Tax-Free Roth IRA | $566,765 | $0 | $566,765 |

As you can see, the final account balance is identical. But the amount of money you can actually spend is drastically different. The Roth IRA provides over $124,000 more in usable cash. By handling the taxes upfront, you lock in a much larger pool of money that's truly yours when it matters most.

Key Factors for Your Retirement Decision

Choosing between tax-deferred and tax-free retirement accounts is much more than a simple guess about where tax rates are headed. It's really about looking at your entire financial picture—how all your different income streams will play together once you retire. To make a smart choice, you have to get a handle on several moving parts that can seriously affect how much money you actually get to keep.

A good way to frame this is to apply the core ideas of a solid investment decision-making process. This disciplined approach helps you really dig into the subtle differences between paying taxes now or kicking that can down the road, making sure your strategy truly lines up with what you want to achieve.

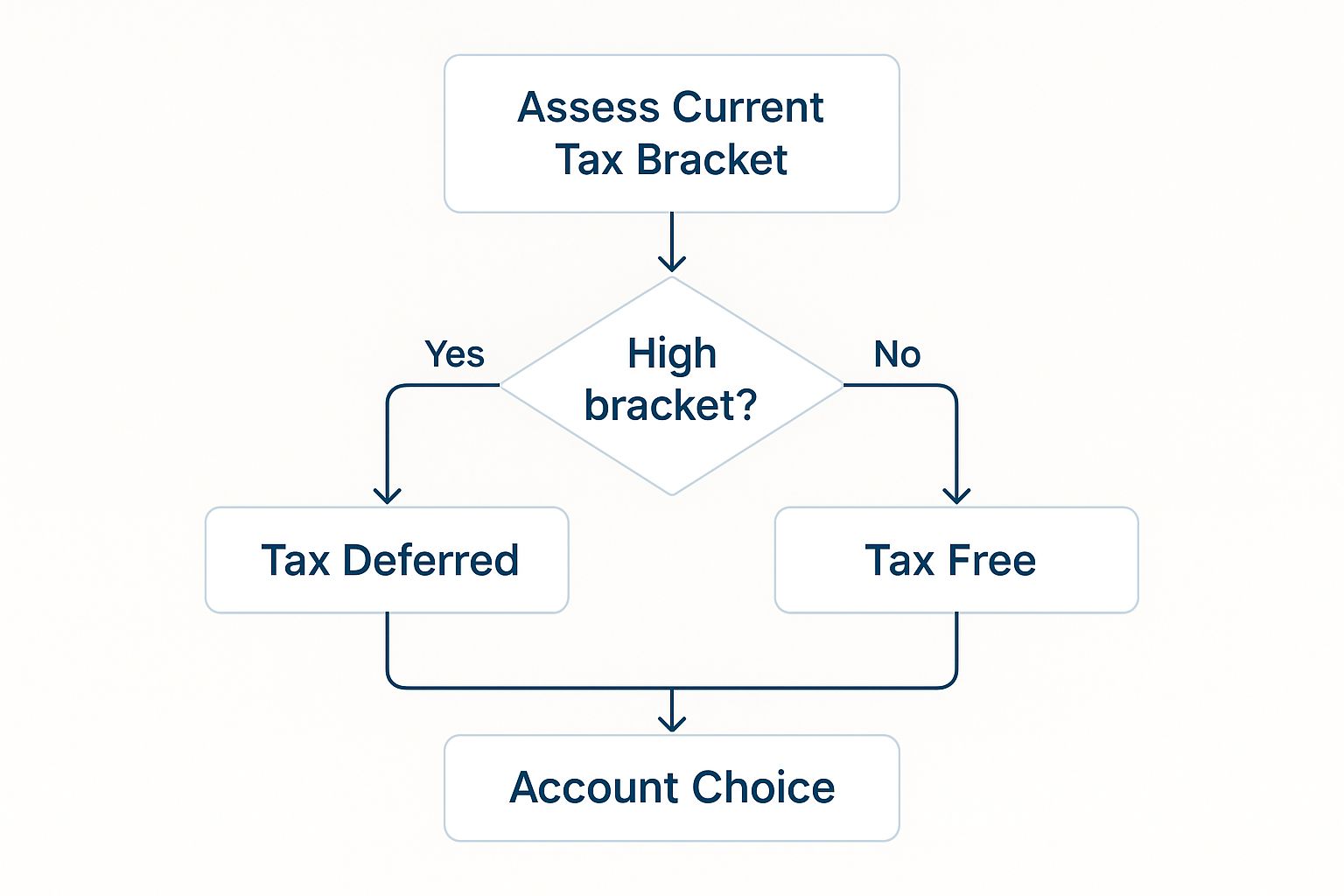

This simple decision tree can be a great starting point to see which path might make more sense based on your current tax situation.

As the chart suggests, there's a common rule of thumb: high earners often get more mileage from the immediate tax break of a tax-deferred plan. On the other hand, if you're in a lower bracket now, paying those taxes upfront with a tax-free plan can be a brilliant move.

Your Current vs. Expected Future Tax Rate

At its core, the tax-deferred vs. tax-free debate comes down to one question: will your tax rate be higher or lower in retirement? Nobody has a crystal ball, but you can make a pretty educated guess by looking at your career path and savings habits.

Higher Now, Lower Later: If you're at the peak of your earning years and figure your income—and your tax bracket—will drop when you retire, a tax-deferred account like a Traditional 401(k) is often the way to go. You get a tax deduction when it helps you the most, pushing the tax bill off to a time when you’ll likely be in a lower bracket.

Lower Now, Higher Later: For young professionals just starting out or anyone expecting their income to jump significantly, a tax-free Roth account is incredibly appealing. You pay the taxes now while your rate is relatively low, which buys you completely tax-free withdrawals later on when you're in a much higher bracket. The long-term savings can be massive.

Remember, this isn't just about your salary. You need to factor in all potential retirement income sources—pensions, Social Security, rental properties, you name it—because they all add up to determine your future taxable income.

The Impact on Social Security Taxation

Here’s a factor that too many people miss: how withdrawals from your retirement accounts can impact the taxes you pay on Social Security benefits. This interaction can take a huge bite out of your spendable income, so it's a critical piece of the puzzle.

Believe it or not, up to 85% of your Social Security benefits can become taxable if your "combined income" crosses certain thresholds. This isn't just your regular income; it's a specific formula that includes your adjusted gross income, non-taxable interest, and half of your Social Security benefits.

This is where your choice of account really matters. Withdrawals from tax-deferred accounts (like a Traditional IRA) are counted fully in your adjusted gross income. That can easily push your "combined income" over the limit, suddenly making your Social Security benefits taxable. In sharp contrast, qualified withdrawals from tax-free Roth accounts are not part of this calculation at all, which can be a powerful tool for keeping more of your Social Security benefits completely tax-free.

A large Required Minimum Distribution (RMD) from a tax-deferred account can, all by itself, trigger higher taxes on your Social Security benefits. This "tax-on-a-tax" effect can create an unexpected and significant drain on your retirement income.

Estate Planning and Legacy Goals

Your choice also has big implications for the legacy you leave behind for your heirs. The tax rules for inherited retirement accounts are very different, and this should absolutely influence how you structure your estate plan.

Tax-Deferred Accounts: When your loved ones inherit a Traditional IRA or 401(k), they're typically forced to withdraw all the money within 10 years and pay ordinary income tax on every dollar. This can create a massive, concentrated tax headache for them.

Tax-Free Accounts: Inherited Roth IRAs are a much better gift. While the 10-year withdrawal rule often still applies for non-spouse beneficiaries, every single distribution they take is tax-free. This lets you pass on wealth that isn't burdened by a future tax bill.

When Does a Tax-Deferred Strategy Make Sense?

Choosing a tax-deferred strategy really boils down to a single, critical forecast: do you believe you'll be in a lower tax bracket in retirement than you are right now? If the answer is yes, this approach can be incredibly powerful, offering an immediate boost by lowering your current taxable income and freeing up cash.

This strategy is a classic move for people in their peak earning years. Think about a mid-career professional pulling in a high salary. For them, every dollar contributed to a Traditional 401(k) or IRA is a dollar they aren't paying taxes on today. That simple act can turn a painful tax bill into a refund or even help you qualify for other valuable tax credits by lowering your adjusted gross income (AGI).

Putting More Money in Your Pocket Today

The biggest draw of tax deferral is the upfront tax break. When you make pre-tax contributions, you're shrinking the portion of your paycheck that the government gets to tax. That reduction in your current tax burden gives you an instant financial edge you can use right away.

So, when does this become a real strategic advantage?

Supercharging Your Savings: The money you save on taxes can be put right back to work, either by maxing out another retirement account or finally building that emergency fund.

Tackling Major Expenses: If you're juggling a mortgage, student loans, or kids' college costs, that immediate tax relief can provide some much-needed breathing room in your budget.

Unlocking Other Tax Breaks: Lowering your AGI might suddenly make you eligible for tax deductions and credits that were previously out of reach due to income limits, creating a domino effect of savings.

Think of a tax-deferred plan as a financial lever. You're essentially using the government's money—the taxes you would have otherwise paid—to fuel your investment growth for decades. You only settle the bill later, hopefully when your tax rate is much friendlier.

A Real-World Example: The High-Earner

Let's make this tangible. Meet Jessica, a 45-year-old marketing director earning $150,000 a year, which puts her in a high federal tax bracket. She plans to retire in 20 years and expects her income to drop to around $80,000 annually, placing her squarely in a lower tax bracket.

By contributing $20,000 to her company's Traditional 401(k), she instantly slashes her taxable income to $130,000. This single move saves her thousands on this year's tax bill. That money then grows for two decades, completely shielded from the drag of annual taxes on dividends or capital gains.

When she finally retires, she'll pay income tax on her withdrawals, but at her new, lower rate. For Jessica, the crucial difference in the tax deferred vs tax free debate is simple: the upfront savings during her highest-earning years deliver the biggest bang for her buck.

When a Tax-Free Strategy Makes Sense

While the immediate tax break from deferred accounts is tempting, a tax-free strategy is often the smarter play for those with a long-term vision. This approach really comes into its own when you expect to be in a higher tax bracket in retirement than you are today. The logic is simple: pay taxes now while your rate is lower, and you could save a fortune later on.

This is a classic "pay me now or pay me later" scenario, and it’s especially powerful for young professionals. When you're just starting out, contributing to a Roth IRA or a Roth 401(k) lets you lock in today’s lower tax rates on that money forever. Every penny of growth and every qualified withdrawal down the road is completely shielded from Uncle Sam, no matter how much your income—or federal tax rates—climb over the years.

Speaking of which, a tax-free strategy is also a fantastic hedge against future tax hikes. Nobody knows what tax policy will look like in 20 or 30 years. Securing a source of tax-free income gives you a degree of certainty and control that's hard to put a price on.

Gaining Control Over Future Tax Liabilities

For high-net-worth individuals, the whole tax-deferred vs tax-free debate becomes even more critical. A massive tax-deferred account can feel less like an asset and more like a ticking tax time bomb. Think about it: once you retire, income from your portfolio, plus Social Security and hefty required minimum distributions (RMDs) from a large traditional IRA, can easily push you into the highest federal tax brackets. As J.P. Morgan points out, sometimes tax deferral can be a costly mistake.

This is precisely why so many savvy savers prioritize tax-free accounts. They offer a level of control that tax-deferred vehicles simply can't match.

No More RMDs: Unlike traditional IRAs, Roth IRAs have no Required Minimum Distributions for the original owner. This gives you complete flexibility to decide when—or even if—you touch the money.

Keep Taxable Income in Check: Since withdrawals are tax-free, they don't count toward your taxable income. This can help you stay in a lower bracket and even keep your Social Security benefits from becoming taxable.

Smarter Estate Planning: Leaving a Roth IRA to your kids or grandkids gives them a stream of tax-free income. That’s a far more powerful legacy than a traditional IRA that passes on a significant, built-in tax bill.

A tax-free account is more than just a place to stash cash. It’s a strategic tool for managing your future tax burden, offering the kind of predictability that's essential for a sound, conservative retirement plan.

Practical Example: The High-Earning Retiree

Let's look at a real-world scenario. Meet David, a 60-year-old business owner sitting on a multi-million dollar traditional IRA. He's rightly concerned that once RMDs kick in, they’ll not only push him into the top tax bracket but also cause his Medicare premiums to skyrocket.

To get ahead of this, David starts a series of Roth conversions. Each year, he moves a strategic amount from his traditional IRA into a Roth IRA, paying the income taxes on the converted amount now.

Yes, he takes a tax hit in the short term. But the payoff is huge. He eliminates future RMDs on all the converted funds, creating a substantial pool of tax-free money he can tap whenever he wants. This gives him total control over his taxable income for the rest of his life.

Frequently Asked Questions

When you start digging into the tax deferred vs tax free world, a few key questions always seem to pop up. Getting straight answers is the only way to feel confident about where you're putting your retirement money. Let's walk through some of the most common ones.

Can I Have Both Tax Deferred and Tax Free Accounts?

Absolutely. In fact, for a lot of people, it's the smartest way to go. Owning both a Traditional 401(k) or IRA and a Roth account is what we call tax diversification, and it gives you some incredible flexibility down the road.

Having both types of accounts means you can strategically manage your income—and your tax bracket—each year in retirement. If you have a year with big expenses, you can pull from your Roth account without adding a dime to your taxable income. In leaner years, you can draw from your tax-deferred account and pay taxes at what will hopefully be a much lower rate.

What Happens If I Need My Money Before Retirement?

This is a big one. If you touch the money in either account before you hit age 59½, you're generally looking at a 10% early withdrawal penalty from the IRS. For tax-deferred accounts, that's on top of the regular income tax you'll owe. It’s a painful double-whammy designed to keep you from raiding your future.

But Roth IRAs have a unique escape hatch.

You can pull out your original contributions from a Roth IRA at any time, for any reason, completely tax-free and penalty-free. Since you already paid tax on that money going in, the IRS lets you take it back out.

This rule makes a Roth IRA a more flexible tool if you're facing a real emergency. That said, taking any money out of your retirement accounts early should be a last resort. You're not just losing the money you withdraw; you're losing all the compound growth it would have generated for decades.

How Do Roth Conversions Fit Into This?

A Roth conversion is when you move money from a tax-deferred account (like a Traditional IRA) into a tax-free Roth IRA. It sounds simple, but it’s a taxable event. You have to pay ordinary income tax on the entire amount you convert, all in the year you make the move.

So why would anyone do this? People use this strategy when they're convinced their tax rate will be much higher in the future than it is today. By choosing to "pay the tax now," they lock in tax-free growth and, crucially, tax-free withdrawals for the rest of their lives. It's also a powerful move for anyone who wants to sidestep future Required Minimum Distributions (RMDs) or leave a completely tax-free inheritance to their kids.

Make no mistake, a Roth conversion is a major financial decision with serious tax consequences. It’s something you should carefully weigh, ideally with a financial advisor who can run the numbers for your specific situation and help you figure out if the long-term gain is worth the short-term tax hit.

At America First Financial, we believe in providing clear, dependable insurance and retirement solutions that protect your family and your future. Our straightforward approach helps you secure your financial stability without the noise of today's political agendas. Get a free, no-hassle quote online in under three minutes and see how we can help safeguard what matters most to you.

_edited.png)

Comments