Term Life Insurance Cost Comparison Guide

- dustinjohnson5

- Sep 16, 2025

- 13 min read

When you start comparing term life insurance costs, you'll quickly see that your premium is all about risk. Insurers are essentially making a calculated bet, and they set your price based on four main things: your age, health, term length, and coverage amount. Getting a handle on how these pieces fit together is the secret to finding affordable, solid protection for your family.

Decoding Your Term Life Insurance Quote

A term life insurance quote isn't just a generic price tag; it's a personalized risk assessment. Insurance companies go through a process called underwriting, where they figure out the odds of having to pay out a claim while your policy is active. This deep dive is exactly why you can get wildly different quotes from various providers for the same amount of coverage.

The whole calculation starts with you. It’s no surprise that a younger, healthier person will almost always get a better rate than an older individual with some health issues. From the insurer's perspective, it's a simple matter of statistics—they see you as a lower risk.

Core Components of a Quote

Your final premium comes down to a few key variables. Some you can control, and others are just part of your story. Each one plays a big role in what you'll pay each month.

Policy Term Length: This is how long you want the coverage to last—think 10, 20, or 30 years. The longer the term, the higher the premium, because the insurance company is on the hook for a longer period.

Coverage Amount: This is the death benefit, or the money your family would get. A $1,000,000 policy is obviously going to cost more than a $250,000 one.

Personal Health: Your medical records, current health, and lifestyle choices (especially smoking) are huge factors.

Age and Gender: These are basic demographic details that have a strong statistical link to life expectancy.

Comparing term life insurance costs isn’t just about hunting for the lowest number. It’s about finding the best overall value—getting the right amount of coverage from a company you can trust, at a price you can comfortably afford for years to come.

The market has seen some shifts lately. The COVID-19 pandemic certainly made more people think about their mortality, which spurred record growth in life insurance sales. This spike in demand has helped keep premiums up, with total U.S. individual life insurance premiums projected to reach $15.9 billion. For a deeper look at these market trends, you can check out LIMRA's 2025 forecast.

The Key Factors That Determine Your Premium

When an insurance carrier looks at your application, they're really just trying to answer one question: How much risk do you represent? Every personal detail they ask for helps them calculate the odds and, in turn, your final premium. The lower they perceive your risk, the less you'll pay each month.

While every company has its own secret sauce for weighing these details, the core ingredients are pretty much the same across the board. This is precisely why getting quotes from multiple carriers is so critical. Let's dig into what they're looking at.

Your Age and Gender

Age is, without a doubt, the biggest piece of the puzzle. It’s simple statistics—a younger person is expected to live longer, making them less of a risk to insure for a set term. This is exactly why locking in a policy in your 30s will save you a staggering amount of money compared to waiting until your 50s.

Your gender matters, too. On average, women live longer than men. Because of this statistical reality, women almost always pay less for life insurance than men of the same age and health profile.

Health and Medical History

This is where the underwriting process gets personal. Insurers will want a complete picture of your health, looking at everything from your height and weight to your cholesterol levels and blood pressure. If you have any chronic conditions, they'll want to know how well they're managed. Having a clean bill of health is your most direct path to a low rate.

They don't just stop with you, either. Your family's medical history plays a part. If a parent or sibling passed away early from something hereditary, like cancer or heart disease, it could signal a higher risk and nudge your premium up.

At its core, an insurer's job is to predict longevity. Every data point, from your blood work to your family tree, helps them build a statistical profile of your health to set a price that's fair for the risk they're taking on.

This deep dive into your health allows the carrier to place you into a specific risk category, which is what ultimately sets the price for your policy.

Understanding Health Classifications

Think of these as tiers. The better your tier, the better your rate. Getting into the top classification can save you a bundle.

Here’s a typical breakdown of how carriers categorize applicants:

Preferred Plus/Elite: This is the gold standard. You're in excellent health, have an ideal height-to-weight ratio, a clean family history, and no risky hobbies or habits.

Preferred: You’re still in great shape but might have a minor, well-controlled issue, like slightly high cholesterol.

Standard Plus: For people in good overall health who might have a couple of controlled health factors or a less-than-perfect family history.

Standard: This is for the average person who might be a bit overweight or have more common health issues like managed high blood pressure.

Substandard/Rated: These categories are for higher-risk individuals. This could be due to a serious health condition, a hazardous occupation, or a history of tobacco use.

The difference in cost between these tiers is dramatic. For instance, a 40-year-old man who qualifies for Preferred Plus might pay around $35 per month for a $500,000, 20-year policy. Another man of the exact same age who lands in the Standard class could be looking at $60 or more for the very same coverage.

Your health classification is one of the most powerful levers affecting your premium. The choices you make every day—like staying away from tobacco and maintaining a healthy weight—are your best leverage for getting the lowest price possible.

How Term Length and Coverage Amount Affect Cost

When you start comparing term life insurance costs, two factors stand out as the biggest drivers of your final price: the term length and the coverage amount. Think of them as the main dials you can turn to tune a policy to your family's needs and, just as importantly, your budget. It’s a simple trade-off: a longer term or a bigger death benefit will cost you more, so finding that sweet spot is the goal.

Choosing a term length—usually 10, 20, or 30 years—is all about matching the policy to your biggest financial responsibilities. For new parents, a 30-year term makes a lot of sense, as it can see them through until the kids are on their own. On the other hand, if you're just looking to cover the last decade of a mortgage, a 10-year term might be all you need.

Likewise, your coverage amount should be enough to fill the financial hole your absence would leave. This isn't just about replacing your income; it’s also about covering debts like a mortgage, paying for future college tuition, and handling final expenses. While a $1 million policy provides a huge safety net, a $250,000 policy might be the more sensible and affordable option for your situation.

The Direct Impact of Term Length on Premiums

The length of your policy term has a direct, and pretty significant, impact on what you pay each month. From the insurer's perspective, a longer term means they are on the hook for more time, which naturally increases the odds they'll have to pay out a claim. That extended risk gets passed on to you in the form of a higher premium.

The price jump between term lengths can be eye-opening. For example, a healthy 40-year-old man looking for a $500,000, 10-year term life policy might pay around $33 per month. If that same man decides he needs a 20-year term instead, his premium jumps to about $53 per month. That's a nearly 60% increase for an extra 10 years of coverage, a clear example of how insurance rates are calculated.

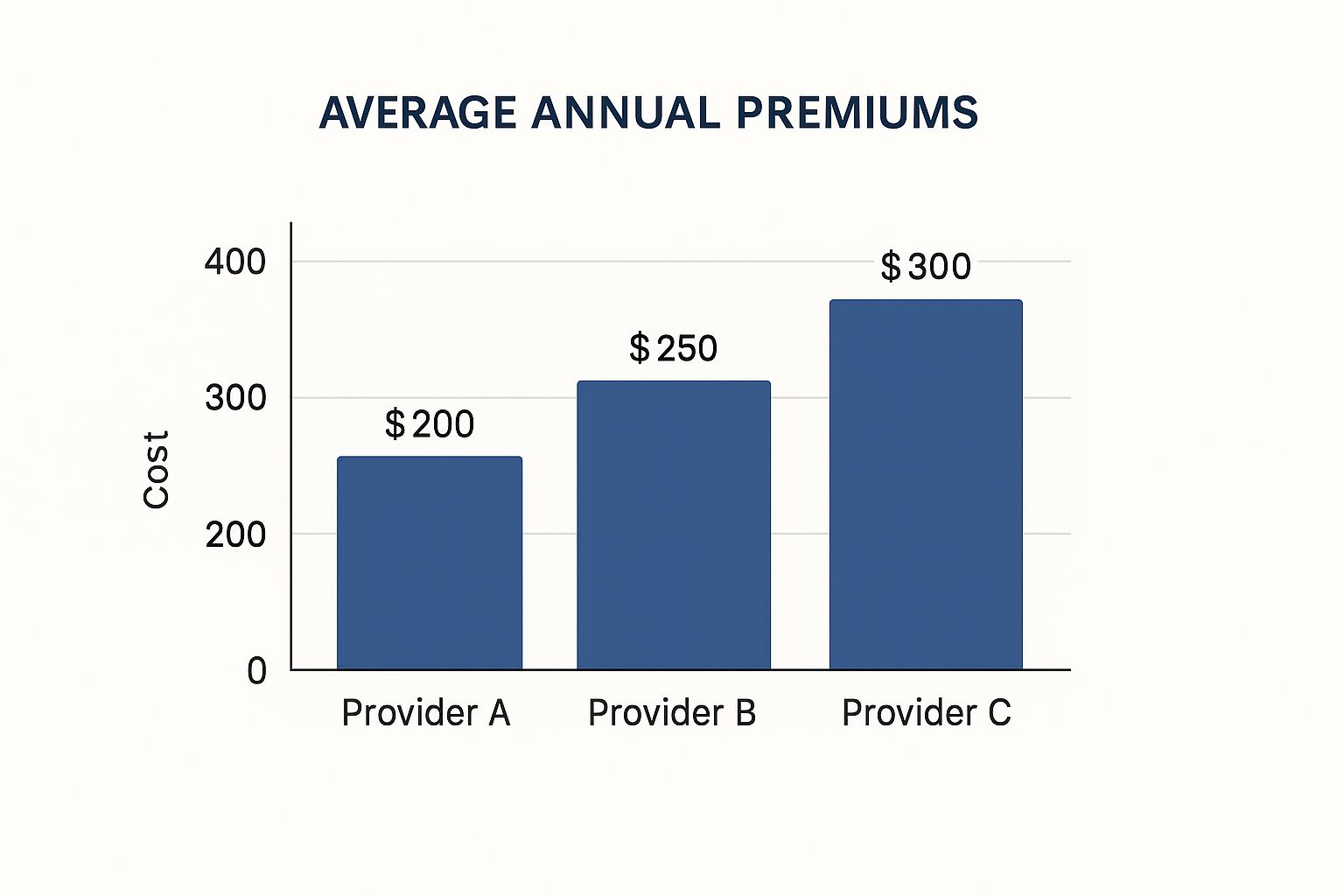

This is why shopping around is so important. As this image shows, quotes for the same person can be all over the map depending on the company.

You can see that even for identical coverage, what one carrier charges can be vastly different from another. Taking the time to compare is one of the easiest ways to save money.

Long-Term Value Versus Short-Term Savings

It can be tempting to go with a shorter, cheaper term to keep your monthly bills down. Be careful with that strategy, though, because it can come back to bite you. If you buy a 10-year policy in your 30s and realize you still need protection when it expires, you'll be applying for a new one in your 40s. By then, you're older and may have developed health issues, meaning your new rates will be much, much higher.

For anyone with long-term financial obligations, the smartest financial move is almost always to lock in the longest term you can get while you're young and healthy. A single 30-year policy bought at age 30 will be far cheaper over the long run than buying three separate 10-year policies.

To see this in action, take a look at the sample monthly premiums below. This table shows how dramatically rates can climb as you age, even for the same $500,000 policy.

Sample Monthly Term Life Insurance Premiums By Age And Term Length

Here are some estimated monthly premiums for a healthy, non-smoking individual seeking a $500,000 policy. It clearly illustrates how both age and term length push costs higher.

Applicant Age | 10-Year Term | 20-Year Term | 30-Year Term |

|---|---|---|---|

30 | ~$20 | ~$28 | ~$45 |

40 | ~$33 | ~$53 | ~$90 |

50 | ~$75 | ~$150 | ~$300 |

These estimates are for illustrative purposes. Your actual rates will vary based on your individual profile.

The numbers don't lie—acting sooner rather than later locks in a significantly lower rate for decades. By carefully weighing your financial timeline against your current budget, you can find a policy that delivers real peace of mind without breaking the bank.

Comparing Top Insurance Providers Head-to-Head

Once you get a handle on how your personal profile affects your premium, the next logical step is to start looking at the insurance carriers themselves. On the surface, a lot of them seem to offer the same thing, but that couldn't be further from the truth.

The real differences are in their underwriting philosophies, the policy add-ons they offer, and the quality of their customer service. Finding the right fit is all about matching your unique situation to the company that's most likely to give you a fair shake.

Some insurers are laser-focused on younger, super-healthy applicants, offering rock-bottom rates to those who can nail their top health rating. Others are known for being more understanding about specific health conditions, like well-managed diabetes. For someone who might get a high quote—or even a denial—elsewhere, that kind of leniency is everything. This is where using a reputable insurance broker can make a world of difference in sorting through the options.

At the end of the day, the goal isn't just to find the cheapest policy. It's to find the best value from a company you can actually count on when it matters most.

Key Differentiators Among Top Carriers

Beyond that monthly premium, several factors really separate one provider from another. These details might seem small, but they can dramatically change the long-term value and flexibility of your coverage.

The Application Process: Some companies have really leaned into technology, offering slick online applications and even no-medical-exam policies for people who qualify. This can shrink a process that used to take weeks down to just a few days.

Available Riders: Think of riders as optional upgrades for your policy. Common ones include an accelerated death benefit (which lets you access funds early if you're terminally ill) or a waiver of premium rider (which covers your payments if you become disabled).

Financial Strength: You're buying a promise that needs to hold up for decades. Always look for carriers with high marks from independent rating agencies like A.M. Best. A strong rating is a good sign they’ll be around to pay claims down the road.

A low initial quote is tempting, but it’s the fine print that really defines a policy's worth. The best provider for your neighbor might be a terrible fit for you, especially if you have a different health history or need specific features.

For instance, a young family might want to find a company with a great conversion option, which lets them swap their term policy for a permanent one later without a new medical exam. On the other hand, someone with a risky job should look for carriers known for being fair about occupational hazards.

Finding the Right Insurer for Your Situation

To make this a bit more practical, let’s look at which types of providers tend to be the best fit for different people. This isn't just about price; it's about matching a company's strengths to your needs.

Who You Are | Best Type of Insurer | Why It’s a Smart Match |

|---|---|---|

Young & Healthy (Under 40) | Direct-to-Consumer & Online Insurers | They often have the best rates for "Preferred Plus" applicants and offer incredibly fast, no-exam underwriting for policies under $1 million. |

Have a Managed Health Condition | Established, Traditional Carriers | These bigger, older companies have decades of data to work with and tend to have more flexible guidelines for common issues like high cholesterol or blood pressure. |

Budget-Conscious & Need Long-Term Coverage | Providers Specializing in 30-Year Terms | Some carriers get very competitive on their longest-term products. This is a great way to lock in affordable protection for the long haul while your family is growing. |

Want a More Customized Policy | Full-Service Insurers | These carriers typically have a much wider menu of policy riders, like disability income or critical illness add-ons, letting you build a more complete safety net. |

This side-by-side look drives home a critical point: your life circumstances are the single most important factor. When you align your needs with an insurer's strengths, you move beyond a simple price-shopping exercise and make a decision that provides real, lasting financial security.

Practical Scenarios and Cost-Saving Strategies

It’s one thing to talk about the factors that drive life insurance costs, but it’s another to see how it all plays out in the real world. Let's walk through a few common situations to show how different needs logically lead to very different policy decisions. This is where you can start to see why a "one-size-fits-all" policy just doesn't exist.

Take a newly married couple in their late 20s who just bought their first home. Their biggest financial anchor is that 30-year mortgage. For them, a 30-year term policy with at least $500,000 in coverage is a smart, straightforward choice. It lines up perfectly with their debt, ensuring that if one partner were to pass away, the other wouldn't lose the house.

By getting that policy now, they're making a fantastic financial move. Their age and good health will help them lock in an incredibly low premium for the next three decades, giving them real peace of mind without breaking the bank.

Growing Families and Planning for the Future

Now, let's picture a family in their mid-30s with a couple of young kids. Their financial picture has gotten more complex. It's not just about the mortgage anymore; they have to think about day-to-day living costs, saving for college, and replacing an entire income for at least 15-20 years.

In this case, a 20-year term policy with a much larger death benefit—somewhere in the $750,000 to $1 million range—makes a lot more sense. The 20-year term is designed to see them through until the kids are grown and out on their own. The bigger payout provides a serious financial cushion to cover everything from groceries to tuition without upending the family's life.

The smartest way to approach term life insurance is to match the policy's length and coverage amount directly to your biggest financial responsibilities. When your policy aligns with debts like a mortgage or the years until your kids are self-sufficient, you know you're not paying for too much or, worse, leaving your family with too little.

Finally, consider someone in their late 50s. The house is paid off, the kids are independent, and their financial needs have shifted again. They might only need a smaller, 10-year term policy for $100,000. This amount would be enough to handle final expenses, clear out any small remaining debts, and perhaps leave a small gift for the grandkids.

Actionable Tips to Lower Your Premium

No matter where you are in life, there are always ways to find a better rate. A proper term life insurance cost comparison should always factor in these simple strategies:

Pay Annually. Most companies will give you a small but welcome discount for paying your premium in one lump sum each year instead of monthly.

Improve Your Health. If you can get your cholesterol or blood pressure down before you apply, you could land in a better health category, which translates directly to lower rates.

Act Now. This is the big one. The single most effective way to save money is to buy coverage the moment you realize you need it. Every single year you wait, your premiums will be permanently higher.

The global life insurance market is a $3.1 trillion industry, and the United States accounts for nearly 27% of that. That scale means insurers are working with mountains of data to price their policies, making your age and personal health the most critical factors you have any control over. You can dig deeper into these global insurance market dynamics if you're interested in the numbers.

A Few Final Questions on Term Life Insurance Costs

As you get closer to making a decision, a few questions almost always pop up. Let's tackle them head-on so you can feel confident you’re making the right choice for your family.

Should I Buy a Longer Term Than I Think I Need?

It’s a common thought: "My mortgage is for 15 years, but should I get a 30-year policy just in case?" Locking in a great rate while you're young and healthy is certainly appealing. If your circumstances change down the road, you'll be glad you have that low premium, especially if new health issues arise.

But you'll also be paying a higher premium today for coverage you might not end up needing. A 30-year policy will always cost more each month than a 15-year or 20-year one. The most practical approach is to match your policy’s term length to your biggest financial commitment, whether that’s your mortgage or the years until your kids are financially independent.

The smartest financial move is to align your term length with your longest-running financial responsibility. This way, you're not overpaying for coverage you don't need, but your family is protected when it matters most.

What If My Health Gets Better After I Buy a Policy?

This is a great question, and the answer is yes, you might be able to lower your rate. If you make a significant health improvement—say, you lose a lot of weight and keep it off, or you quit smoking for at least a year—you can request a "rate reconsideration" from your insurer.

Many insurance companies will re-evaluate your health class and potentially lower your premium. It's not a guarantee, but it's definitely worth a shot. Just be prepared to provide medical records from your doctor that document the improvement. It's a fantastic way to get a better rate without starting over with a brand-new application.

Can I Get Covered Without a Medical Exam?

Absolutely. Many carriers now offer "no-medical-exam" life insurance. Instead of a physical exam with blood and urine samples, they use data from public records and prescription histories to figure out your risk level.

The Upside: The main benefit is speed. You can often get approved in days, not the weeks it can take for a traditional policy. It's incredibly convenient.

The Downside: That convenience can sometimes cost more. While rates are often competitive for very healthy people, you might find a better price with a fully underwritten policy if your health is just average.

For healthy people who value a quick, simple process, a no-exam policy is a fantastic option.

At **America First Financial**, we’re here to give you clear, honest answers so you can protect your family’s future with confidence. Our process is simple—get a straightforward quote in under three minutes, without any pressure or sales calls.

Secure your loved ones with coverage that aligns with your values. Get your free, no-obligation quote today.

_edited.png)

Comments