Term Life Insurance Cost: Tips to Save More

- dustinjohnson5

- May 14

- 12 min read

Decoding Your Term Life Insurance Cost

Understanding how term life insurance premiums are calculated can feel overwhelming. This section breaks down the key factors influencing your costs, empowering you to make informed decisions. These factors work together to determine your final premium.

Key Factors Affecting Term Life Insurance Cost

Several key elements play a crucial role in determining your term life insurance premiums.

Age: Your age is the most significant factor. As you age, the risk of mortality increases, leading to higher premiums.

Health Status: Your overall health and medical history significantly impact your risk classification. Pre-existing conditions, family history, and lifestyle choices all contribute to this assessment.

Coverage Amount: The death benefit, the amount your beneficiaries receive, directly correlates with the premium. Higher coverage amounts result in higher premiums.

Term Length: The length of your policy's term (10, 20, or 30 years) also influences the cost. Longer terms typically have higher premiums because they cover a more extended period.

Gender: Statistically, women tend to live longer than men, resulting in slightly lower premiums.

Lifestyle Habits: Smoking, excessive alcohol consumption, and risky activities like skydiving can increase premiums due to the higher associated risks.

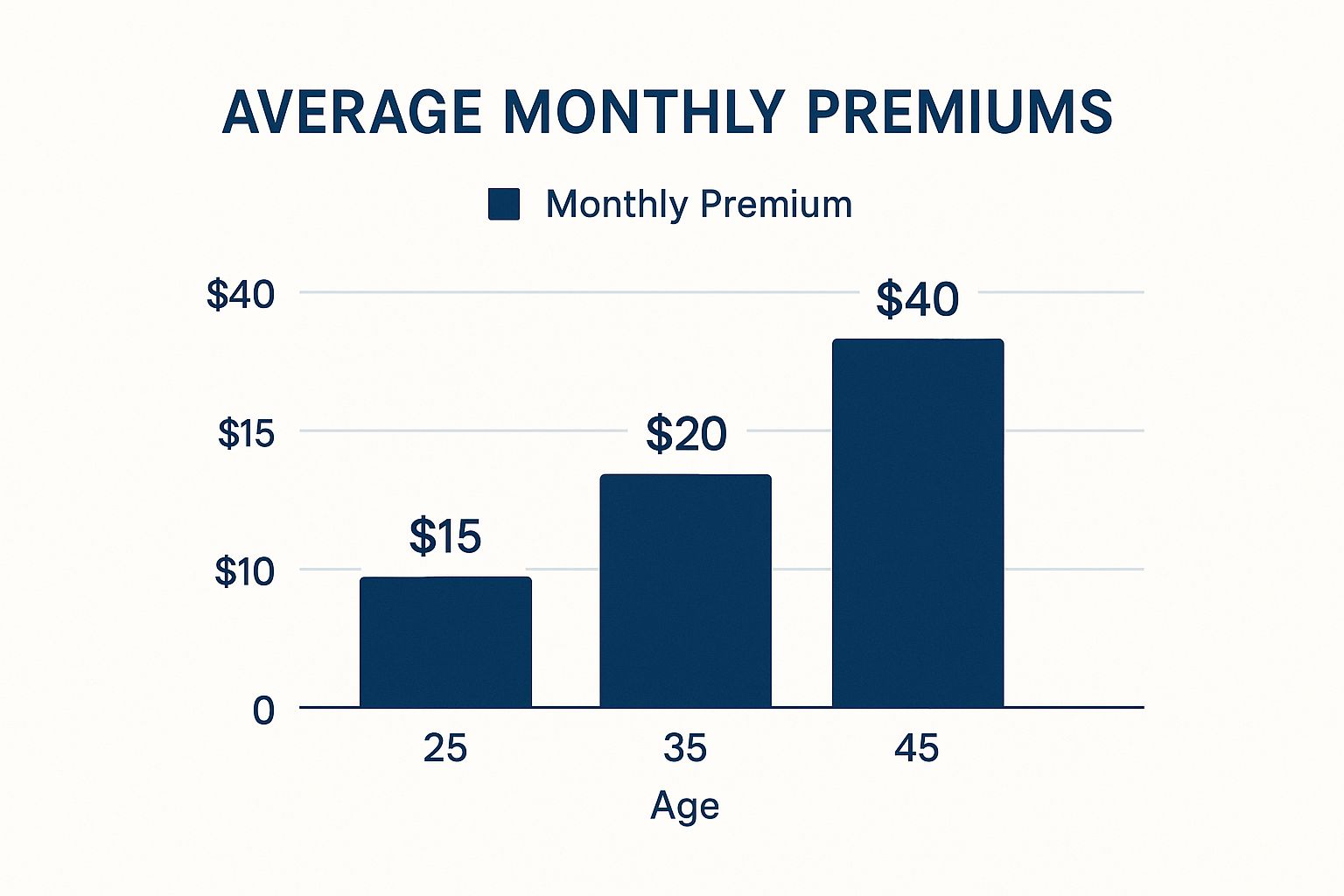

The infographic below illustrates how age impacts average monthly premiums:

As the infographic shows, the cost of term life insurance increases significantly with age. A 25-year-old might pay just $15 a month, while a 45-year-old could pay $40, demonstrating the importance of securing coverage earlier in life.

Understanding Risk Classification

Insurers categorize applicants into different risk classes based on their perceived risk level. These classifications range from Preferred Plus (lowest risk and lowest premiums) to Standard (average risk and average premiums) and potentially higher risk categories. Your risk class directly impacts your premium. Someone classified as Preferred Plus might pay significantly less than someone classified as Standard. This system allows insurers to accurately price policies.

When exploring term life insurance costs, consider investment strategies. Understanding the difference between listed and unlisted shares can be helpful, as market dynamics can influence insurance-related investment choices.

The Impact of Age and Health

To further illustrate how age and health impact term life insurance costs, let's look at some example premiums. The table below compares annual premiums for a $500,000, 20-year term life insurance policy.

Term Life Insurance Premium Comparison by Age, Gender and Health Class This table compares annual premiums for a $500,000, 20-year term life insurance policy across different age groups, genders, and health classifications.

Age | Gender | Super Preferred | Preferred | Standard |

|---|---|---|---|---|

30 | Female | $187 | $221 | $337 |

30 | Male | $210 | $250 | $375 |

70 | Female | $7,994 | $9,500 | $10,574 |

70 | Male | $9,200 | $10,900 | $12,200 |

As you can see, premiums increase dramatically with age. The difference in cost between a 30-year-old and a 70-year-old is substantial, highlighting the impact of mortality risk. Men consistently pay higher premiums than women for the same coverage. You can find more detailed statistics here.

Understanding these contributing factors provides valuable insight into how your personalized term life insurance cost is determined. By recognizing the interplay of age, health, coverage amount, term length, and lifestyle choices, you can take proactive steps to secure the most affordable coverage.

The Age Factor: Why Tomorrow Costs More Than Today

Age plays a crucial role in determining the cost of term life insurance. It's the single most important factor insurers consider. As we get older, statistically, the risk of mortality increases. This higher risk leads directly to higher premiums. Understanding this connection is essential for making well-informed decisions about your coverage.

How Age Impacts Premiums

A 30-year-old will likely pay a much lower premium for a 20-year term policy compared to a 40-year-old seeking the same coverage. This difference isn't arbitrary. Insurers use actuarial tables and complex formulas to calculate age-based premium increases. These formulas consider mortality rates and other statistical data for accurate risk assessment. Understanding your overall financial health is important when considering insurance costs. For more information, see our article about analyzing financial statements.

The Cost of Waiting: Real-World Examples

Putting off a term life insurance purchase can significantly impact your lifetime costs. Even a delay of a few years can result in paying tens of thousands of dollars more in premiums over the policy's term. Waiting just five years, from age 30 to 35, could increase your total premiums by 20% or more. This is because each age bracket carries a higher associated risk, driving premiums upward.

Let's look at two examples. Both individuals want a $500,000 20-year term policy. Individual A buys the policy at 30, with an average annual premium of $250. Individual B waits until 40, resulting in an average annual premium of $350. Over 20 years, Individual A pays a total of $5,000 in premiums, while Individual B pays $7,000 – a difference of $2,000. This illustrates the potential long-term savings from securing coverage earlier.

To further illustrate this point, let's examine the following table:

Term Life Insurance Cost Progression by Age

This table shows how premiums increase with age for the same coverage amount and term length, highlighting the financial impact of purchasing at different life stages.

Age Group | Average Annual Premium | 10-Year Cost | Percentage Increase from Previous Age Group |

|---|---|---|---|

30-34 | $250 | $2,500 | - |

35-39 | $300 | $3,000 | 20% |

40-44 | $400 | $4,000 | 33% |

45-49 | $550 | $5,500 | 38% |

As you can see, the cost of a 10-year term policy increases significantly with each age bracket. Securing coverage early can lead to substantial savings over time.

Strategic Timing and Milestones

Knowing how age affects term life insurance costs allows for strategic planning. Consider locking in a lower rate before major birthday milestones. These milestones often mark the start of a new age bracket, usually meaning higher premiums. Buying a policy just before turning 40, for instance, can secure a lower rate than waiting until after your birthday.

Age Bands and Premium Jumps

Insurers typically group ages into bands, with premiums jumping as you enter a higher band. These increases can be substantial, especially as you get older. Being aware of these age bands helps you anticipate and plan for potential premium hikes. This proactive approach empowers you to optimize your purchase timing for the best possible price. For example, the price difference between a policy purchased at 49 and 50 can be significant, despite the small age difference. By understanding these age bands and planning, you can minimize the financial impact of these jumps and secure the most competitive rates.

Cracking the Health Classification Code

Understanding health classifications is crucial for navigating the world of term life insurance. These classifications, which range from Preferred Plus to Standard, reflect how insurers evaluate your risk. This section clarifies the process, exploring the factors that determine your classification and how you can potentially improve it.

Decoding the Classifications

What distinguishes a Preferred Plus applicant from a Standard one? Insurers consider a range of factors, including your medical history, family history, and lifestyle choices. Conditions such as high blood pressure or high cholesterol can influence your classification.

Lifestyle factors, like smoking or participating in high-risk hobbies, also play a significant role. Even seemingly minor differences in health or lifestyle can result in different classifications and, consequently, different premium rates.

Health Thresholds and Lifestyle Factors

Each classification has specific health thresholds. A Preferred Plus classification, for example, might require optimal blood pressure, cholesterol levels, and a healthy Body Mass Index (BMI).

Interestingly, insurers are becoming more flexible regarding certain conditions, especially well-managed chronic illnesses. This shift is partly due to advancements in medical treatments and a deeper understanding of long-term health outcomes.

Strategies for Improving Your Classification

You can take proactive steps to potentially improve your classification before applying for insurance. One effective strategy is optimizing the timing of your application after a recent health improvement.

For instance, if you've recently lost weight or quit smoking, allowing enough time for these changes to appear in your medical records can significantly impact your classification. This demonstrates a commitment to a healthier lifestyle.

Here are a few practical tips:

Maintain a Healthy Weight: Strive for a BMI within the healthy range.

Manage Chronic Conditions: Effective management of conditions like diabetes or high blood pressure shows lower risk.

Quit Smoking: This is one of the most impactful positive changes you can make.

Limit Alcohol Consumption: Moderate alcohol intake is generally viewed more favorably by insurers.

Underwriting Criteria and Premium Expectations

Understanding the criteria underwriters use helps you develop realistic expectations about your potential premium range. These criteria often include:

Medical Records: Insurers review your medical history for pre-existing conditions or risk factors.

Family History: A family history of certain illnesses, such as heart disease or cancer, can affect your risk assessment.

Lifestyle Questionnaire: Be prepared to answer questions about your lifestyle, including smoking habits, alcohol consumption, and hobbies.

By understanding these factors and taking proactive steps towards better health, you can work towards a more favorable health classification and, ultimately, a lower term life insurance cost. This knowledge empowers you to navigate the application process confidently and secure the best possible rates.

Market Forces Shaping Your Premium Costs

Beyond your personal health and age, larger market forces significantly influence the cost of term life insurance. Understanding these dynamics can help you make informed decisions about your coverage. This means recognizing how factors like interest rates and reinsurance markets affect insurance companies and, ultimately, your premium payments.

Interest Rate Impacts on Term Life Insurance

Interest rates play a key role in how insurance companies invest the premiums they collect. When interest rates are high, insurers earn more on their investments, potentially leading to more competitive pricing and lower premiums. Conversely, low interest rates can pressure insurers to raise premiums to maintain profitability. This dynamic relationship between interest rates and insurance premiums is a vital factor to consider when evaluating your term life insurance cost.

The Role of Reinsurance

Reinsurance is essentially insurance for insurance companies. It helps insurers mitigate risk by transferring some of their liabilities to other companies. This system helps stabilize the insurance market. However, fluctuations in reinsurance costs can influence the premiums you pay. For example, if reinsurance becomes more expensive, those costs can be passed on to consumers through higher premiums. The availability of reinsurance can also affect the types of coverage offered or the demographics insurers are willing to cover.

Inflation and Global Market Dynamics

Inflation is another crucial factor affecting premiums. As the cost of living rises, so do the costs associated with paying out claims. Insurers adjust their pricing to keep pace with inflation to meet their financial obligations to policyholders. The global life insurance market is a dynamic and interconnected system. Valued at $3.1 trillion in 2024, this market shows significant variations in ownership and cost. Hong Kong, with a 79% adult ownership rate, demonstrates higher penetration compared to other regions. This influences overall pricing dynamics. Rising claims costs and inflation have driven premium increases, particularly in developed markets like the US and UK. Globally, non-life insurance premiums grew by 3.9% in 2023, partly due to these pressures. This trend impacts term life insurance as insurers adjust to maintain profitability amidst rising claims and evolving economic conditions. Find more detailed statistics here.

Regulatory Changes and Industry Consolidation

Government regulations and changes within the insurance industry can also impact premium costs. New regulations may impose additional costs on insurers, potentially leading to higher premiums. Mergers and acquisitions within the industry also affect competition and pricing strategies. For example, if smaller insurance companies merge into a larger one, it can decrease competition and potentially raise premiums.

Technological Disruption

Technology is transforming the insurance landscape. Advances in data analytics and risk assessment are enabling insurers to more accurately evaluate risk and personalize premiums. This can lead to more competitive rates for healthier individuals, while those with higher risk profiles might experience premium increases. This trend toward personalized pricing, including the use of wearable technology and telehealth services, is shaping the term life insurance market.

Understanding these market forces provides valuable context for evaluating your term life insurance costs. By staying informed about these trends, you can make more strategic decisions about purchasing coverage, ensuring you get the best possible value.

Strategic Term Selection: Maximizing Value Over Time

The length of your term life insurance policy significantly impacts your overall cost. Choosing the right term involves balancing your current needs with your long-term financial goals. This section explores how different term lengths (10, 15, 20, and 30 years) affect your premiums and offers strategies for maximizing value.

Understanding the Term Length and Premium Relationship

Longer terms typically mean higher premiums. This is because the insurance company assumes more risk by covering you for a longer period. A 30-year term policy will have higher premiums than a 10-year term policy for the same coverage. However, a longer term offers extended protection for major life events like paying off a mortgage or funding a child's education. Shorter terms have lower initial premiums, making them appealing for those with specific short-term financial obligations.

Analyzing Term Life Insurance Cost Across Different Term Lengths

Let's compare estimated annual premiums for a $500,000 policy across different term lengths for a healthy 35-year-old non-smoker:

Term Length | Estimated Annual Premium |

|---|---|

10 Years | $200 |

15 Years | $250 |

20 Years | $300 |

30 Years | $400 |

These are estimates, and actual premiums depend on individual circumstances. This comparison shows the general trend of increasing premiums with longer terms.

Financial Planning and Optimal Term Selection

Financial planners often advise aligning your term length with your specific financial needs. For example, a term matching your mortgage length might be suitable if you're primarily concerned with covering it. If you're focused on providing for your children until they graduate college, a term extending until they reach adulthood might be more appropriate. This strategic approach ensures adequate coverage when needed most.

Laddering: A Strategy for Balancing Cost and Coverage

Laddering combines multiple term policies with varying lengths. This allows customized coverage across different life stages while potentially lowering overall costs. For instance, you could combine a 20-year term policy for $500,000 with a 10-year term policy for $250,000. The shorter-term policy covers immediate needs, while the longer-term policy offers continued protection for long-term obligations.

Identifying Value Inflection Points and Long-Term Cost Implications

A value inflection point occurs when maintaining coverage costs more than its potential benefit. This varies based on individual circumstances, like changes in health or finances. Inflation and policy terms impact term life insurance's real value and perceived cost over time. For example, with a $250,000, 20-year term life insurance policy and a 4% annual inflation rate, the coverage's real value decreases by roughly 56% by the policy's end. This erosion means the death benefit has less purchasing power after two decades. Also, despite the cost, 99% of term life insurance policies don't pay out, meaning policyholders outlive their policies or cancel them early. This shows how term life insurance primarily serves as income replacement protection, not an investment. These factors influence decisions about term length and coverage amount versus premium affordability, affecting how individuals balance immediate insurance costs against long-term financial security. Explore more here. Carefully evaluating these factors helps determine the optimal term length and avoid overpaying for unnecessary coverage. Regularly reviewing your insurance needs and adjusting coverage as circumstances change is essential for cost-effective and suitable protection.

Insider Techniques to Slash Your Premium Costs

Now that you understand the factors influencing term life insurance costs, let's explore proven strategies to minimize your premiums. These techniques go beyond the basics, offering actionable insights from industry experts.

Pre-Application Preparation: Timing Is Key

The time before your application is critical for securing the best rates. This involves more than just compiling your documents. Strategically timing health improvements plays a vital role.

For example, if you recently quit smoking or began a weight loss program, allow enough time—often several months to a year—for these positive changes to appear in your medical records. This can substantially impact your risk classification and, consequently, your premium.

Also, address any unresolved medical issues. Getting a checkup and addressing any known health concerns demonstrates proactive health management to insurers.

Health Improvements with the Highest ROI

Not all health improvements equally affect premiums. Focusing on areas with the highest return on investment is essential.

Quitting smoking is arguably the most impactful change. Insurers consider smoking a major risk factor, and quitting can significantly reduce your premium. Maintaining a healthy weight and controlling blood pressure and cholesterol are also highly influential.

Small changes in these areas can result in substantial premium savings.

Leveraging Competition for Better Pricing

Don't accept the first quote you receive. The term life insurance market is competitive, and comparison shopping is vital. Obtain quotes from multiple insurers to compare rates and coverage.

This helps you find the most affordable policy for your individual needs. Don’t hesitate to use competing offers as leverage. Presenting a lower quote from another insurer might motivate your preferred company to offer a better price.

This can often generate significant savings.

Advanced Rate Reconsideration Strategies

Even with a policy in place, premium reduction opportunities may still exist. Rate reconsideration involves asking your insurer to re-evaluate your classification based on health or lifestyle improvements.

If you’ve notably lowered your cholesterol or blood pressure, providing updated medical records could justify a lower rate class and reduced premiums. This is an often overlooked yet effective strategy.

Policy Riders: Value vs. Inflation

Policy riders are optional add-ons that customize coverage. While some provide valuable benefits, others can unnecessarily increase costs. Carefully assess each rider’s value before adding it.

For example, a waiver of premium rider, which waives premiums if you become disabled, can be beneficial, particularly for younger individuals. However, riders with limited benefits may not justify the added premium.

Payment Frequency and Total Expenditure

Your payment frequency affects your total cost. Paying annually often results in the lowest overall expense. Insurers typically add administrative fees for more frequent payments (monthly or quarterly).

A lump-sum annual payment, while initially larger, can significantly reduce long-term costs by avoiding extra fees. Consider the long-term savings when selecting a payment plan.

By implementing these techniques, you can considerably reduce your term life insurance costs and secure the best possible coverage for your needs. These strategies offer a proactive way to navigate insurance pricing and control your financial future.

Protect your family’s future with affordable and reliable term life insurance. Get a free quote from America First Financial today and discover how we can help you secure the financial protection you deserve.

_edited.png)

Comments