Term Life vs Whole Life: 6 Key Differences

- dustinjohnson5

- May 9

- 16 min read

Term or Whole: Which Life Insurance Suits You?

Choosing between term life vs whole life insurance is crucial for your family's financial security. This listicle clarifies the key differences between these policies, empowering you to make informed decisions. We'll cover premium costs, coverage duration, cash value, policy flexibility, tax implications, and qualification requirements. Understanding these six points will help you select the best coverage for your budget and goals, providing the stability and peace of mind valued by families across America.

1. Premium Structure and Cost

Understanding the premium structure is crucial when comparing term life vs. whole life insurance. This boils down to how much and how often you pay, and what that money buys you. Term life insurance offers significantly lower initial premiums than whole life insurance. This is because term life provides coverage for a specific period (the "term"), such as 10, 20, or 30 years, and doesn't accumulate cash value. Whole life, on the other hand, provides lifelong coverage and builds cash value over time, resulting in higher premiums. A portion of your whole life premium goes toward the death benefit, while the remainder contributes to the cash value component, which grows tax-deferred.

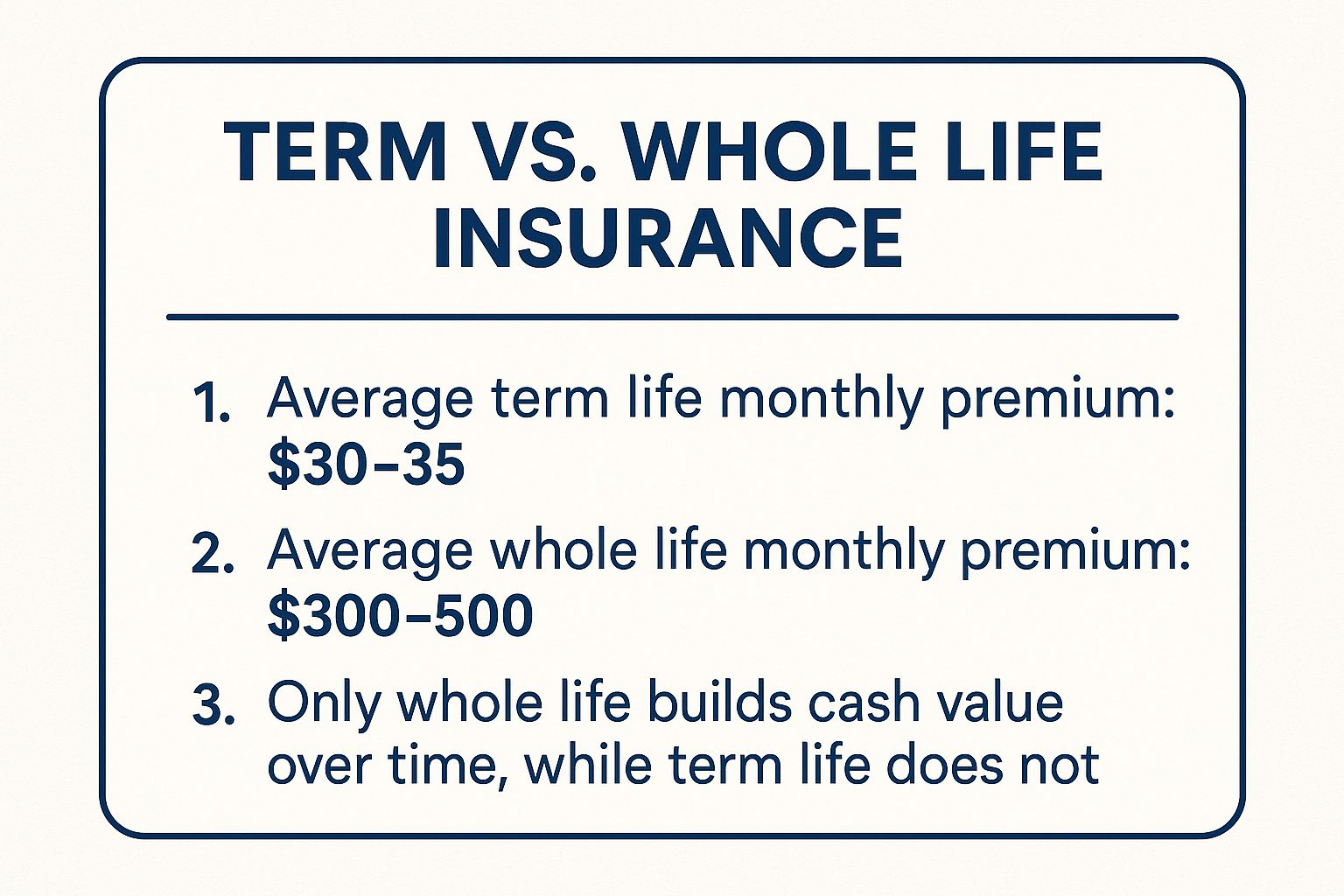

As the infographic visually summarizes, term life offers lower initial premiums ideal for budget-conscious families, while whole life has higher, fixed premiums that contribute to a cash value component. This cash value can be a valuable asset down the line. However, the initial cost difference is substantial.

With term life, premiums remain level throughout the initial term period. For example, a healthy 30-year-old male non-smoker could secure a $500,000 20-year term policy for approximately $25-$35 per month. A comparable whole life policy for the same death benefit could cost between $300 and $500 per month – roughly 5 to 15 times more expensive. This difference in cost is a primary factor for many budget-minded insurance shoppers, especially young families. Whole life premiums are typically fixed for the life of the policy, providing predictable costs and peace of mind. Companies like Northwestern Mutual, known for their whole life policies, often feature level premiums with potential dividends that can offset costs over time.

Here's a quick reference summarizing the key premium differences:

Term Life: Lower initial premiums, level during the term, increase significantly upon renewal.

Whole Life: Higher fixed premiums for life, contribute to cash value.

This cost disparity has significant implications for how you plan your finances. To understand this further, let's examine the pros and cons of each premium structure.

Pros:

Term Life: More affordable coverage for young families and those with limited budgets, allowing the purchase of higher coverage amounts.

Whole Life: Premium payments eventually stop at policy maturity (typically age 100 or 121), and premium amounts never increase.

Cons:

Term Life: Premiums increase dramatically upon renewing after the initial term expires and may become unaffordable in later years, particularly if health declines.

Whole Life: Initial premium costs can be prohibitive for many, and there's an opportunity cost associated with higher premiums compared to investing the difference elsewhere.

Tips for Choosing:

Consider purchasing term life during high-need years (e.g., while paying off a mortgage or raising young children) and investing the premium difference to potentially build wealth. This strategy can be particularly appealing to conservative American families and individuals approaching retirement who are looking for financial stability.

If considering whole life, request illustrations showing guaranteed vs. projected cash values. Understanding the potential growth of your cash value is vital, especially for health-conscious consumers who value long-term security.

Look for term policies with conversion options to whole life without medical underwriting. This provides flexibility for the future, particularly if your health status changes.

This aspect of term life vs. whole life insurance deserves its place at the top of the list because it directly impacts your financial planning. By carefully considering your budget, current needs, and long-term goals, you can choose the policy that best aligns with your individual circumstances and provides the protection you and your family deserve.

2. Duration of Coverage: A Key Difference in Term Life vs Whole Life

Duration of coverage is a critical factor when comparing term life and whole life insurance, representing a fundamental distinction between the two. This feature dictates how long your policy will remain in force, and therefore, how long your beneficiaries will be financially protected. Understanding this difference is crucial for making an informed decision that aligns with your family’s long-term financial goals.

Term Life Insurance: Term life offers coverage for a specific period, or "term." Common term lengths include 10, 15, 20, and 30 years. Think of it like renting an apartment – you're covered for the duration of the lease (the term), but once it expires, the coverage ends unless you renew it (at a likely higher premium) or convert it to a permanent policy. This type of insurance aligns well with time-bound financial obligations such as paying off a mortgage or covering your children’s college expenses.

Whole Life Insurance: Whole life insurance, on the other hand, provides permanent coverage for your entire lifetime, as long as premiums are paid. It's like owning a home – your coverage remains in place indefinitely. The policy matures at an advanced age, typically 100 or 121. This offers the peace of mind of knowing your loved ones will receive a death benefit regardless of when you pass away.

Pros and Cons:

Feature | Term Life | Whole Life |

|---|---|---|

Pros | Aligns with specific financial obligations (mortgage, college) | Guaranteed lifelong coverage |

Can be tailored to time-bound needs | Never needs renewal or expiration | |

Generally more affordable premiums initially | Cash value accumulation potential | |

Cons | Coverage disappears when you may still need it | May pay for coverage beyond what's needed |

Renewal may require new medical underwriting | Premiums generally higher | |

Cannot adjust duration to match changing needs | Less flexibility in coverage amount |

Examples:

Young families concerned primarily with providing for their children until they become financially independent often opt for 20 or 30-year term policies. This covers the period when the financial impact of their loss would be greatest.

MetLife and other companies offer Guaranteed Acceptance Whole Life Insurance, appealing to individuals nearing retirement or those with health concerns, providing lifetime coverage without a medical exam, securing a legacy for their loved ones.

Tips for Conservative American Families and Others:

Laddering: Consider purchasing multiple term policies with staggered expiration dates (“laddering”) to match decreasing financial obligations. As your mortgage balance decreases and your children become independent, your insurance needs may lessen. This approach can offer both cost-effectiveness and targeted coverage.

Guaranteed Renewability: Look for term policies with guaranteed renewable options, allowing you to extend coverage at the end of the term without undergoing a new medical exam. This provides flexibility and protects against future health issues.

Conversion Options: If you anticipate future health challenges, explore term policies with the option to convert to whole life before the term expires. This locks in lifelong protection without the need for future medical underwriting.

Long-Term Needs: Carefully evaluate whether your family's financial security needs extend beyond a specific term. Factors like estate planning and legacy considerations might warrant the permanent coverage of whole life insurance.

This aspect of term life vs. whole life is crucial for families, especially conservative American families focused on financial security and legacy planning. Understanding the duration of coverage empowers you to choose the policy that best aligns with your family's values and financial goals, whether that be the targeted protection of term life or the enduring legacy provided by whole life.

3. Cash Value Accumulation

A key differentiator in the term life vs. whole life insurance debate is cash value accumulation. This feature is fundamental to understanding the long-term financial implications of each policy type. Term life insurance offers pure death benefit protection without any savings component. Conversely, whole life insurance builds cash value over time, creating a living benefit alongside the death benefit. This cash value grows tax-deferred, meaning you won't pay taxes on the growth until it's withdrawn. It can be accessed during your lifetime through policy loans, withdrawals, or by surrendering the policy.

The mechanics of cash value accumulation are relatively straightforward. A portion of your premium payments funds the death benefit, while the remainder contributes to the cash value component. This cash value grows at a guaranteed minimum rate, providing a predictable, albeit often modest, return. It's important to note that it typically takes 10-15 years for the cash value to build significantly. Policy loans are available against the accumulated cash value, offering access to funds without triggering a taxable event.

Features:

Term Life: No cash value component

Whole Life: Guaranteed minimum cash value growth

Whole Life: Tax-deferred growth

Whole Life: Cash value typically takes 10-15 years to build significantly

Whole Life: Policy loans available against cash value

Pros:

Whole Life: Provides living benefits through accumulated cash value, offering financial flexibility for various needs.

Whole Life: Cash value can supplement retirement income, providing an additional source of funds during retirement.

Whole Life: Policy loans are not taxable events, making them a tax-advantaged way to access cash.

Whole Life: Cash value is protected from creditors in many states, providing an extra layer of financial security.

Cons:

Term Life: No return of premiums unless a specific rider is purchased.

Whole Life: Lower returns compared to other investment vehicles, typically ranging from 2-4% after fees.

Whole Life: Relatively illiquid asset with surrender charges in the early years, making it less accessible than other investments.

Whole Life: Unpaid policy loans reduce the death benefit, impacting the financial protection provided to beneficiaries.

Examples:

Historically, companies like MassMutual have demonstrated consistent dividend payouts on their whole life policies, providing a tangible example of long-term cash value growth.

New York Life’s Custom Whole Life policy allows for accelerated premium payments, enabling faster cash value accumulation for those seeking to build their living benefits more rapidly.

Tips:

Request illustrations from insurers showing both guaranteed and non-guaranteed cash value projections to understand the potential range of returns.

Consider adding paid-up additions riders to your policy to enhance cash value growth.

Monitor your policy's performance against projections annually to ensure it's meeting your expectations.

Thoroughly understand policy loan interest rates before borrowing against your cash value to avoid unexpected costs.

Popularized By: The "Bank On Yourself" concept by Pamela Yellen and the "Infinite Banking Concept" by Nelson Nash highlight strategies for leveraging whole life insurance's cash value component as a personal banking system.

This aspect of whole life insurance makes it particularly appealing to conservative American families seeking long-term financial security and individuals approaching retirement who desire supplemental income options. For budget-minded insurance shoppers, it's crucial to weigh the higher premiums of whole life against the potential long-term benefits of cash value accumulation. By carefully considering your financial goals and risk tolerance, you can determine whether the cash value component of whole life insurance aligns with your overall financial strategy.

4. Flexibility and Convertibility

Life insurance needs change as you journey through different life stages. What suits you as a young professional may not be the best fit as you approach retirement or experience major life events. Flexibility and convertibility features allow you to adapt your life insurance coverage to these evolving needs, offering peace of mind knowing your policy can adjust along with you. This is a crucial factor to consider when comparing term life vs whole life insurance, as both offer different approaches to flexibility.

Term life insurance often provides a conversion option, allowing you to switch to a whole life policy without undergoing a new medical exam. This is invaluable if your health declines before your term expires, preserving your insurability. For example, Prudential's Term Essential offers a conversion option until the earlier of the end of the term or age 65. Furthermore, some term policies are renewable at the end of their term, although premiums will be higher. While you can adjust coverage through rider additions with term life, the customization options are generally more limited compared to permanent policies.

Whole life insurance, on the other hand, offers flexibility through its dividend options. You can use dividends to purchase paid-up additions, effectively increasing both your death benefit and cash value. Guardian's whole life policies, for instance, offer this valuable feature. Whole life policies can also offer the ability to reduce paid-up coverage if needed, providing financial flexibility in challenging times. In emergencies, policy loans can offer access to funds. However, whole life insurance has some limitations in its flexibility. The premium payment schedule is less flexible than term life, and making changes to the base policy after it's issued is often restricted.

This factor deserves its place in this list because it addresses the long-term nature of life insurance planning. For budget-minded insurance shoppers, the initial affordability and conversion option of term life might be attractive. However, for conservative American families and individuals approaching retirement who prioritize long-term security and potential legacy planning, the enduring coverage and cash value accumulation features of whole life insurance, coupled with its dividend flexibility, may be more appealing. Health-conscious consumers will appreciate the ability to secure coverage through term conversion regardless of future health changes. Patriotic individuals seeking to support American insurers will find options within both term and whole life products.

Pros:

Term Conversion: Preserves insurability despite health changes

Term Life: Can adjust coverage through rider additions

Whole Life: Dividend options provide flexibility (cash, premium reduction, additional insurance)

Whole Life: Policy loans provide financial flexibility in emergencies

Cons:

Term Conversion: Usually limited to a specific age or timeframe

Term Life: Limited customization compared to permanent policies

Whole Life: Less flexible premium payment schedule

Whole Life: Changes to the base policy are often limited after issue

Tips for Making Informed Decisions:

Review conversion deadlines: Mark them on your calendar so you don’t miss the opportunity to convert.

Consider partial conversions: As your needs and budget change, consider converting a portion of your term life policy to whole life.

Compare riders: Explore the various riders available across different insurers before purchasing a policy.

Inquire about reduced paid-up options: Understand how your whole life policy can be adjusted in situations of financial hardship.

By carefully considering the flexibility and convertibility options offered by both term life and whole life insurance, you can choose a policy that best aligns with your current needs and future goals, providing financial security for you and your loved ones.

5. Tax Benefits and Treatment

When comparing term life vs whole life insurance, understanding the tax implications is crucial for making an informed decision. This factor significantly impacts the overall value and long-term benefits of each policy type, especially for conservative American families, individuals approaching retirement, and budget-minded insurance shoppers.

Both term and whole life insurance offer a significant tax advantage: tax-free death benefits. This means that when the insured passes away, the beneficiaries receive the death benefit without having to pay income tax on it. This can be a substantial benefit, preserving wealth for loved ones and helping families navigate difficult financial times.

However, whole life insurance offers additional tax advantages related to its cash value component, making it particularly attractive for those focused on long-term financial planning and wealth preservation:

Tax-deferred Cash Value Growth: The cash value within a whole life policy grows tax-deferred. This means you won’t pay taxes on the growth of your cash value each year, allowing it to compound more quickly than investments held in taxable accounts. This is a powerful tool for building wealth over time and can be especially appealing to individuals approaching retirement who are looking for tax-efficient growth.

Tax-Advantaged Access to Cash Value: You can access the cash value through policy loans, which are generally not subject to income tax. This provides a tax-advantaged way to access funds for various needs, such as supplementing retirement income, paying for education expenses, or covering unexpected costs. This feature can be particularly attractive for budget-minded insurance shoppers who value flexibility and access to funds.

Potential Estate Planning Benefits: Whole life insurance can be a valuable tool for estate planning. High-net-worth individuals often use permanent life insurance policies within irrevocable life insurance trusts (ILITs) to minimize estate taxes and ensure a smooth transfer of wealth to their heirs. This can be especially relevant for patriotic individuals who want to protect their legacy and ensure their hard-earned assets benefit their families.

Dividends Generally Not Taxable: Participating whole life policies may pay dividends, which are typically considered a return of premium and are generally not taxable. This further enhances the tax efficiency of whole life insurance.

Pros:

Both Policy Types: Death benefits are income tax-free for beneficiaries.

Whole Life: Cash value grows tax-deferred.

Whole Life: Policy loans are generally not subject to income tax.

Whole Life: Can be used in ILITs for estate tax planning.

Cons:

Both Policy Types: Premiums are paid with after-tax dollars (not tax-deductible).

Whole Life: Modified Endowment Contracts (MECs) lose some tax advantages if overfunded. This occurs when premiums paid within a certain timeframe exceed IRS limits.

Whole Life: Surrendering a policy may trigger tax liability on gains.

Whole Life: Estate taxes may apply if the insured owns the policy outside of an appropriate trust structure.

Examples:

A business owner uses the cash value of a whole life policy as a tax-advantaged form of executive compensation.

A high-net-worth family establishes an ILIT funded with a whole life policy to minimize estate taxes and pass wealth to the next generation.

Tips:

Consult with a qualified tax professional or financial advisor before implementing advanced life insurance strategies, especially those involving estate planning or business applications.

Understand MEC rules before making large additional payments to a whole life policy.

Consider the proper ownership structure for your policy to maximize estate tax benefits.

Monitor changing tax laws that might affect your insurance benefits.

This aspect of term life vs whole life insurance is crucial to consider. While term life offers the simplicity of tax-free death benefits, whole life provides additional tax advantages related to its cash value component that can be particularly appealing to long-term investors, those planning for retirement, and those seeking estate planning solutions. Careful consideration of these factors in light of individual financial goals and circumstances is essential for making the right choice.

6. Underwriting and Qualification Requirements

Underwriting is a critical process in obtaining life insurance, determining not just your eligibility for coverage but also the price you'll pay and the amount of coverage you can secure. Understanding the underwriting requirements for both term life and whole life insurance is crucial for making an informed decision that aligns with your individual needs and health status. This is a vital aspect of comparing term life vs whole life insurance, directly impacting accessibility and affordability.

How Underwriting Works:

Underwriting assesses your risk profile, essentially evaluating how likely you are to file a claim. Both term life and whole life insurance require underwriting, but the depth and rigor of the process can vary significantly. Underwriting typically involves two key components:

Medical Underwriting: This involves evaluating your health history, including current conditions, past illnesses, family history of disease, and lifestyle factors like smoking. This may include a medical exam, questionnaires, and accessing medical records.

Financial Underwriting: For larger coverage amounts, insurers may verify your income and assets to ensure the requested coverage is justified and affordable. This step helps prevent over-insurance.

Based on the underwriting results, applicants are assigned a “risk classification”:

Preferred Plus: The healthiest individuals qualify for the lowest premiums.

Preferred: Still healthy individuals with slightly higher premiums than Preferred Plus.

Standard: Average risk profiles with moderate premiums.

Rated: Applicants with health concerns or other risk factors; premiums are significantly higher, sometimes prohibitively so.

Simplified Issue and Guaranteed Issue Options:

For those who might struggle with traditional underwriting, both term and whole life offer alternative pathways:

Simplified Issue: These policies require answering some health questions but typically don't involve a medical exam. Coverage amounts may be lower and premiums higher than fully underwritten policies.

Guaranteed Issue (Whole Life Only): These policies offer acceptance regardless of health status, with no medical exam or health questions. However, death benefits are typically limited (e.g., $25,000) and often serve primarily to cover funeral expenses.

Pros and Cons of Underwriting for Term vs. Whole Life:

Feature | Term Life Pros | Term Life Cons | Whole Life Pros | Whole Life Cons |

|---|---|---|---|---|

Qualification | Easier to qualify for at younger ages | Difficult to qualify at older ages or with health issues | Coverage cannot be canceled due to health changes | Stricter underwriting due to permanent coverage |

Underwriting Process | Simplified options increasingly available | Renewal often requires new underwriting | Guaranteed future insurability options available | Rated policies are extremely expensive |

Examples:

Streamlined Underwriting: InsureTech companies like Haven Life and Ladder offer algorithmic underwriting for term life policies, providing instant decisions for some applicants. This appeals to tech-savvy consumers seeking a quick and efficient process.

Guaranteed Issue: Mutual of Omaha offers a guaranteed issue whole life policy requiring no medical exam but limits the death benefit to $25,000. This can be a valuable option for seniors or individuals with serious health conditions who want some level of coverage.

Tips for Navigating the Underwriting Process:

Health Optimization: Improving health metrics like BMI, blood pressure, and cholesterol before applying can lead to better rates. This demonstrates a proactive approach to health and financial well-being.

Apply Early: Applying for life insurance when younger and healthier generally secures the most favorable premiums.

Future Insurability: Consider policies with future insurability options, allowing you to increase coverage later without further medical underwriting.

Agent Assistance: Working with an independent insurance agent can be particularly helpful for those with health issues, as they can shop multiple carriers to find the best possible offer.

Tentative Quotes: Request tentative quotes before formally applying to get a sense of potential premiums without impacting your credit score.

Why This Matters:

Understanding underwriting is crucial for choosing the right life insurance policy. For healthy individuals, term life often provides affordable coverage with a simpler underwriting process, especially at younger ages. For those with health concerns or seeking lifelong coverage, whole life may be a better fit, despite stricter underwriting and higher premiums. By carefully weighing the pros and cons and understanding the process, you can secure the protection your family deserves.

Term vs Whole Life: Key Feature Comparison

Feature | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes ⭐📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Premium Structure and Cost | Moderate – simple level premiums for term; whole life higher and fixed | Term: Low monthly cost; Whole life: higher premiums, lifelong | Term: Affordable coverage early years; Whole life: builds cash value | Term: Young families, budget constraints; Whole life: long-term security, cash value growth | Term: Cost-effective; Whole life: stable premiums, cash value component |

Duration of Coverage | Low – Term fixed periods; whole life permanent | Minimal ongoing resource difference | Term: Coverage for set time; Whole life: lifetime protection | Term: Cover mortgage, education loans; Whole life: lifetime coverage needs | Term: Tailored, renewable; Whole life: guaranteed lifelong coverage |

Cash Value Accumulation | High – Whole life requires management; term none | Whole life: Investment component, policy loans | Whole life: Tax-deferred cash value growth; Term: no cash value | Whole life: Supplement retirement, living benefits; Term: pure protection | Whole life: Living benefits, policy loans; Term: straightforward coverage |

Flexibility and Convertibility | Moderate – Term offers conversion options; riders add customization | Moderate administration to track conversions/riders | Keeps coverage aligned with life changes | Term holders wanting to secure permanent coverage later; Whole life with customization needs | Term: Insurability preserved; Whole life: dividend flexibility, policy loans |

Tax Benefits and Treatment | Low – Standard tax rules apply; whole life tax aspects more complex | Mostly advisory resources needed | Tax-free death benefits; whole life offers tax-deferred growth, loans | Estate planning, executive compensation, tax-efficient wealth transfer | Both: Tax-free death benefits; Whole life: tax-advantaged cash value, estate planning |

Underwriting and Qualification | Moderate to high – Medical and financial checks; simplified and guaranteed issue options | More effort for whole life underwriting, simplified options save time | Term: Easier qualification when younger; Whole life: permanent coverage post-approval | Young healthy applicants, older/health-challenged applicants seeking guaranteed issue | Term: Easier access, simplified underwriting; Whole life: stable coverage, guaranteed insurability |

Making the Right Choice: Securing Your Future

Choosing between term life vs whole life insurance is a significant decision that impacts your family's financial well-being. We've explored key differences, including premium structure and cost, coverage duration, cash value accumulation, flexibility, tax implications, and qualification requirements. Understanding these distinctions empowers you to make an informed choice aligned with your specific needs. Term life insurance offers affordable, temporary coverage, ideal for protecting your family during crucial periods like a mortgage or children's education. Whole life insurance, on the other hand, provides lifelong protection and a cash value component that grows over time, offering a potential source of funds for future needs.

One of the most important takeaways is that there's no one-size-fits-all answer. The best choice depends on your individual circumstances, financial goals, and risk tolerance. Planning for your financial future involves considering various factors, including protecting your loved ones with life insurance. For veterans, exploring specific resources like the life insurance options for veterans from Homefront Group can provide valuable insights tailored to your unique needs and benefits. Mastering these concepts empowers you to secure your family's future, allowing you to focus on what truly matters.

Choosing the right life insurance policy provides peace of mind, knowing your loved ones are protected no matter what life throws your way. For values-driven financial solutions and guidance tailored to your specific needs when comparing term life vs whole life insurance, reach out to America First Financial. America First Financial can help you navigate the complexities of life insurance and find the perfect policy to safeguard your family's future while aligning with your beliefs.

_edited.png)

Comments