The 9 Best States to Retire In for 2025: A Financial Guide

- dustinjohnson5

- Aug 15, 2025

- 18 min read

Choosing where to spend your retirement is one of the most significant financial and lifestyle decisions you'll make. It’s a choice that extends far beyond scenic views and pleasant weather; it's about strategically protecting your nest egg, minimizing your tax burden, and ensuring access to quality, affordable healthcare for years to come. For many conservative, budget-minded Americans, finding a state that aligns with both your financial goals and personal values is the ultimate priority. This guide is designed to cut through the noise and provide a detailed, practical analysis of the best states to retire in from a fiscal and quality-of-life perspective.

We move beyond surface-level observations to deliver a comprehensive financial roadmap. Instead of just mentioning "low taxes," we will dissect the specific tax implications for retirees, including policies on Social Security, pensions, and 401(k) or IRA distributions. Our in-depth evaluations will cover:

Overall Cost of Living: A breakdown of housing, utilities, and daily expenses.

Tax Friendliness: A clear look at state income, sales, and property taxes affecting retirement income.

Healthcare Quality & Access: An assessment of medical facility rankings and costs.

Lifestyle & Amenities: Insight into the culture, community, and recreational opportunities that matter most to a comfortable and fulfilling retirement.

This article provides the actionable information needed to compare top-tier retirement destinations like Florida, Texas, and Tennessee. Our goal is to empower you to make an informed decision that secures your financial future and preserves the wealth you've worked a lifetime to build. We will explore how each state’s unique financial landscape can help you maximize your savings and enjoy a prosperous, well-deserved retirement.

1. Florida

Florida’s reputation as the quintessential retirement haven is well-earned, making it a perennial top choice for those seeking the best states to retire in. The state’s powerful draw for retirees, especially those with a conservative, budget-conscious mindset, stems from a potent combination of financial incentives, a robust senior-focused infrastructure, and an unbeatable climate. The most significant financial advantage is its tax-friendly environment; Florida has no state income tax, which means that Social Security benefits, pensions, and income from a 401(k) or IRA are not taxed at the state level. This allows retirement savings to stretch considerably further.

Cost of Living and Healthcare

While some coastal areas can be pricey, Florida’s overall cost of living is only slightly above the national average, with many inland communities offering significant savings. The state's healthcare system is extensive and caters specifically to an older population. With numerous top-tier hospitals and a high concentration of specialists, retirees can find quality care throughout the state.

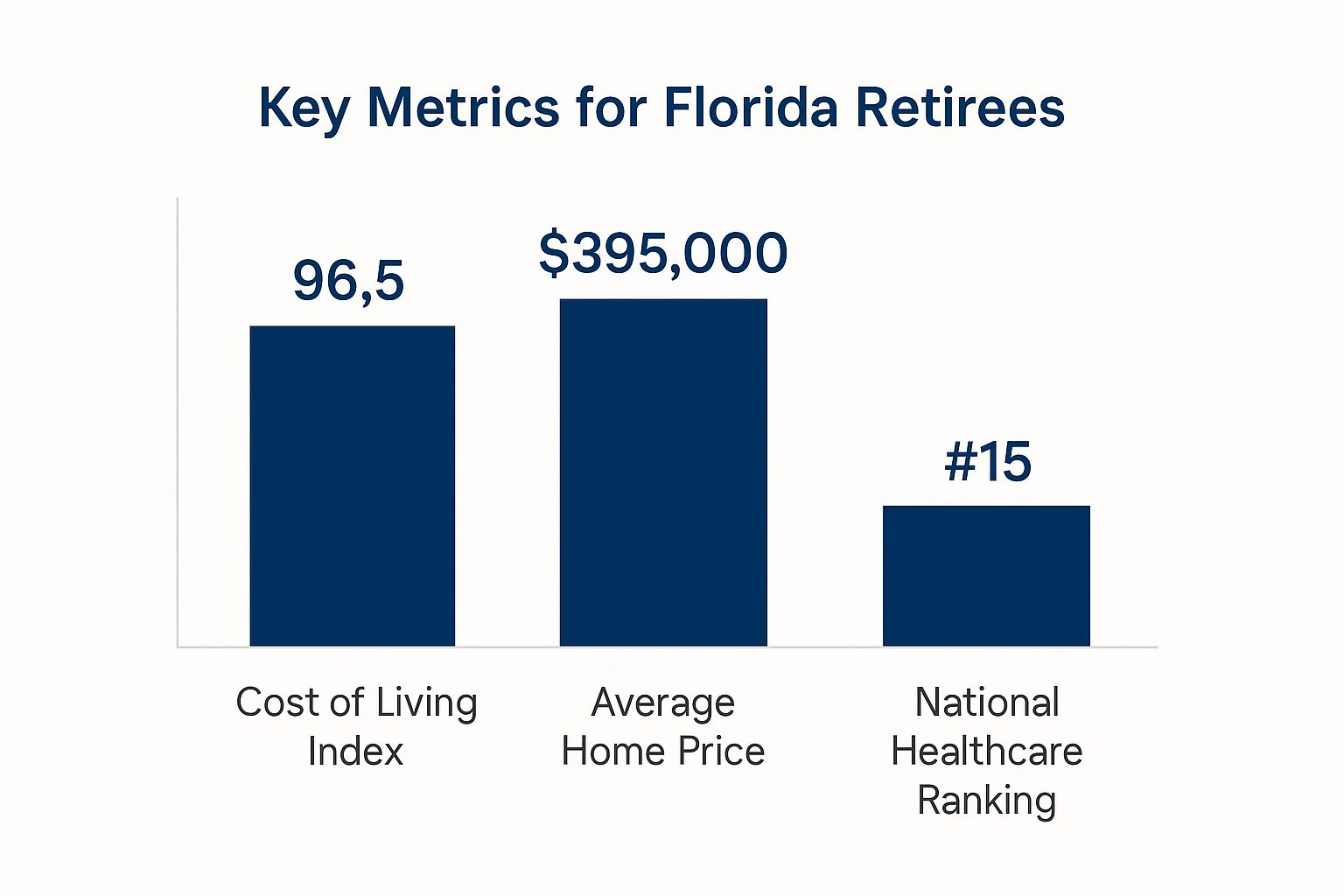

The following chart provides a snapshot of key metrics that make Florida an attractive retirement destination.

This data illustrates that Florida offers a competitive cost of living and high-quality healthcare, although its home prices reflect its popularity.

Lifestyle and Community

Beyond the financials, Florida offers a lifestyle designed for active seniors. It is home to world-renowned communities like The Villages, the largest retirement community in the U.S. with over 130,000 residents, offering endless amenities. For those seeking luxury, Naples provides upscale living and top-rated healthcare. Meanwhile, Sarasota is a cultural hub perfect for arts and theater lovers, and historic St. Augustine offers a unique, charming atmosphere with a lower cost of living.

Actionable Tips for Prospective Retirees

Research Hurricane Risk: Before purchasing property, thoroughly investigate hurricane zones and the associated insurance costs, which can be a significant annual expense.

Explore Inland Options: Consider communities away from the coast, such as Ocala or Lakeland. These areas often have a lower cost of living and reduced exposure to severe weather.

Take a Summer "Test Drive": Visit during July or August to experience the peak heat and humidity firsthand. This will help you determine if you are comfortable with the year-round warm climate.

2. Arizona

For retirees seeking dramatic landscapes and a dry, sunny climate, Arizona is a standout choice among the best states to retire in. Its appeal lies in a unique blend of affordability, favorable tax policies for seniors, and an outdoor-oriented lifestyle. Arizona’s tax structure is particularly attractive to retirees; the state does not tax Social Security benefits, and it provides a deduction for other forms of retirement income, such as pensions. This financial advantage, combined with stunning desert scenery, creates a compelling destination for a fulfilling retirement.

Cost of Living and Healthcare

Arizona's cost of living is generally close to the national average, making it an affordable alternative to more expensive Sun Belt states. While housing costs in popular areas have risen, many communities remain reasonably priced. The state's healthcare infrastructure is robust, with nationally recognized hospitals like the Mayo Clinic in Phoenix and Scottsdale. The dry air is also often cited as a benefit for individuals with certain respiratory conditions.

Lifestyle and Community

Arizona offers diverse retirement lifestyles set against breathtaking backdrops. Scottsdale is known for its upscale amenities, golf courses, and luxury living. For a more culturally rich experience, Tucson, a vibrant university town, offers a thriving arts scene and excellent dining. Those seeking milder temperatures and spiritual wellness are drawn to the scenic red rocks of Sedona. The state is also home to pioneering active adult communities like Sun City, which set the standard for a resort-style retirement with countless clubs and activities.

Actionable Tips for Prospective Retirees

Budget for Summer Utilities: Air conditioning is a necessity during the intense summer months. Research average electricity bills for your target area and factor them into your budget.

Explore Higher Elevations: For cooler summer temperatures, consider towns at higher elevations like Prescott or Flagstaff, which offer a distinct four-season climate.

Test the Summer Heat: Before committing, plan an extended visit during June or July. Experiencing the peak desert heat is crucial to ensure you are comfortable with the climate year-round.

3. North Carolina

North Carolina offers retirees a compelling middle ground, blending appealing financial benefits with a desirable four-season climate and diverse geography. For those seeking variety without the extremes, it stands out as one of the best states to retire in. The state provides a perfect mix of mountains, cities, and coastline, all while maintaining a tax structure that is favorable to retirees. While North Carolina does tax some retirement income, Social Security benefits are fully exempt from state income tax, providing significant relief for many seniors.

Cost of Living and Healthcare

North Carolina’s overall cost of living hovers right around the national average, making it an affordable option compared to many other popular retirement destinations. Housing costs are particularly reasonable, allowing retirees to find comfortable homes without depleting their savings. The state is also home to world-class healthcare systems, with renowned facilities like Duke University Hospital and UNC Hospitals in the Research Triangle area. Access to top-tier medical care is a significant draw for health-conscious retirees.

Lifestyle and Community

The state’s geographic diversity is its greatest lifestyle asset. For those who love the mountains and a vibrant arts scene, Asheville is a top choice, offering stunning scenery and a progressive culture. Retirees seeking an intellectual and active community often gravitate toward university towns like Chapel Hill. For a classic coastal retirement, the Outer Banks provides a serene, beach-centric lifestyle. Meanwhile, major urban centers like Charlotte offer all the amenities of a big city, including professional sports, extensive dining options, and a major international airport.

Actionable Tips for Prospective Retirees

Explore Different Regions: Spend time in the mountains, the Piedmont, and the coastal plain to see which region’s climate and lifestyle best suit your preferences.

Consider Proximity to Medical Centers: If specialized healthcare is a priority, map out communities that are within a reasonable drive of major hospital systems in areas like Raleigh-Durham or Charlotte.

Factor in Seasonal Allergies: The state's lush greenery and long pollen season can be challenging for allergy sufferers. Visit during the spring to see how you are affected.

Research Coastal Insurance: If you dream of living near the beach, investigate the costs and requirements for flood and wind insurance, as this can be a significant expense.

4. Texas

The Lone Star State has emerged as a powerhouse contender among the best states to retire in, appealing to retirees who value financial freedom, diverse lifestyle options, and a robust economy. Texas offers a compelling package for budget-conscious individuals, blending its lack of a state income tax with a cost of living that sits comfortably below the national average. This powerful financial combination means that retirement funds, including Social Security benefits and pension distributions, are not taxed at the state level, allowing for significant long-term savings.

Cost of Living and Healthcare

While Texas boasts a lower overall cost of living, it's crucial for retirees to consider property taxes, which can be higher than in other states. However, many find this is a manageable trade-off for the absence of an income tax. The state's massive size hosts a world-class healthcare infrastructure, most notably the Texas Medical Center in Houston, the largest medical complex in the world. Major metropolitan areas like Dallas-Fort Worth also feature top-tier hospitals and a high number of specialized physicians, ensuring retirees have access to excellent care.

The following chart provides a snapshot of key metrics that make Texas an attractive retirement destination.

This data highlights that Texas combines an affordable cost of living and reasonable home prices with high-quality healthcare, solidifying its appeal.

Lifestyle and Community

Texas’s sheer scale allows for an incredible variety of retirement lifestyles. For those seeking a vibrant cultural scene, Austin offers a legendary live music and food landscape. San Antonio provides a unique blend of historic charm and modern amenities with its famed River Walk and rich heritage. Retirees wanting access to major metropolitan perks can find them in the sprawling Dallas-Fort Worth metroplex, while those preferring coastal living can explore communities along the Gulf of Mexico.

Actionable Tips for Prospective Retirees

Factor in Property Taxes: When budgeting, carefully calculate potential property tax liabilities, as they can offset some savings from the lack of a state income tax. Look into Texas's homestead and over-65 exemptions.

Research Regional Climates: Texas has multiple climate zones. Spend time in your target region during its most extreme season, whether it's the summer heat in Dallas or the humidity of the Gulf Coast.

Assess Severe Weather Risks: Depending on the region, be mindful of potential risks like hurricanes along the coast, tornadoes in the north, and extreme heat statewide. Investigate insurance costs accordingly.

5. Tennessee

Tennessee is rapidly gaining favor as one of the best states to retire in, offering a compelling blend of financial advantages, scenic beauty, and rich cultural heritage. For retirees seeking a four-season climate without harsh winters and a low tax burden, the Volunteer State presents an attractive alternative to traditional coastal destinations. Its appeal lies in its combination of Southern hospitality, vibrant cities, and serene natural landscapes, from the Great Smoky Mountains to the Mississippi River.

A major draw for budget-conscious seniors is Tennessee's tax structure. The state has no state income tax, meaning that Social Security benefits, pensions, 401(k) distributions, and IRA withdrawals are not taxed at the state level. This financial benefit allows retirement income to go significantly further.

Cost of Living and Healthcare

Tennessee’s overall cost of living is well below the national average, particularly in housing, which makes it an affordable option for retirees on a fixed income. While the state's healthcare system is robust in urban centers like Nashville, it is important to note that access to specialized care can be more limited in rural areas. However, major cities boast top-rated medical facilities, ensuring quality care is within reach for most residents.

The following chart provides a snapshot of key metrics that make Tennessee an attractive retirement destination.

This data highlights Tennessee's exceptional affordability, especially in housing, making it a financially smart choice for retirement.

Lifestyle and Community

Tennessee offers a diverse range of lifestyles to suit any preference. For those who thrive on energy and culture, Nashville is the vibrant "Music City" with endless entertainment and urban amenities. Knoxville, a bustling university town, serves as a gateway to the Great Smoky Mountains National Park, perfect for outdoor enthusiasts.

For a mix of scenic beauty and adventure, Chattanooga is a celebrated river city renowned for its outdoor recreation. Meanwhile, historic Franklin offers upscale suburban living with a charming, well-preserved downtown just south of Nashville. This variety ensures retirees can find a community that perfectly matches their desired pace of life.

Actionable Tips for Prospective Retirees

Factor in Sales Tax: While there's no income tax, Tennessee has one of the highest combined state and local sales tax rates in the country. Be sure to factor this into your budget planning for everyday expenses.

Research Rural Healthcare: If you're considering a more rural setting, thoroughly investigate the proximity and quality of local hospitals and specialists to ensure your healthcare needs will be met.

Explore Different Elevations: The state's climate varies significantly from the cooler Appalachian highlands to the warmer western plains. Visit different regions to find the microclimate that suits you best.

6. Delaware

Delaware’s appeal as one of the best states to retire in lies in its powerful, under-the-radar financial benefits and its prime East Coast location. The "First State" offers a compelling package for retirees, especially those looking to maximize their savings without sacrificing access to major metropolitan areas. Its most significant draw is its tax structure; Delaware has no state or local sales tax, which provides immediate savings on all purchases, from daily essentials to big-ticket items like cars. Additionally, the state is tax-friendly toward retirees, with no tax on Social Security benefits and a generous exemption for other retirement income.

Cost of Living and Healthcare

Delaware’s overall cost of living is higher than the national average, primarily driven by housing costs, particularly in its popular coastal communities. However, property taxes are among the lowest in the nation, helping to offset higher home prices. The state boasts a robust healthcare system with highly-rated hospitals, especially in the northern region near Wilmington. Retirees have access to excellent care within the state and are also in close proximity to world-class medical facilities in nearby Philadelphia and Baltimore.

The following chart provides a snapshot of key metrics that make Delaware an attractive retirement destination.

This data highlights Delaware's very low property tax burden and tax-friendly policies, though its overall cost of living is influenced by its desirable East Coast location.

Lifestyle and Community

Delaware provides a diverse range of lifestyle options within its compact borders. For those seeking vibrant coastal living, Rehoboth Beach is a popular retirement community with a famous boardwalk, fine dining, and boutique shopping. Nearby, Lewes offers a quieter, more historic coastal charm with beautifully preserved architecture. For retirees desiring urban amenities, Wilmington provides a rich cultural scene with museums and theaters, while the state capital, Dover, offers a more suburban feel with a lower cost of living.

Actionable Tips for Prospective Retirees

Leverage No Sales Tax: Plan major purchases like vehicles, appliances, and furniture after you establish residency to take full advantage of the 0% sales tax.

Investigate Flood Insurance: If considering a home in sought-after coastal areas like Lewes or Rehoboth Beach, thoroughly research flood zone maps and the mandatory cost of flood insurance.

Assess Healthcare Proximity: While Delaware has quality healthcare, evaluate how far a potential home is from specialized medical centers in Wilmington or larger cities like Philadelphia to ensure your needs are met.

7. Nevada

Nevada offers a unique proposition for retirees, blending a highly favorable tax structure with world-class entertainment and stunning desert landscapes, making it one of the best states to retire in. The state’s primary appeal for budget-conscious seniors is its powerful financial profile. Like Florida, Nevada has no state income tax, which means retirees keep more of their Social Security benefits, pension payouts, and withdrawals from retirement accounts like a 401(k) or IRA. This tax advantage, combined with a relatively moderate cost of living, creates a compelling financial case for relocation.

Cost of Living and Healthcare

Outside of the bustling tourist centers, Nevada's cost of living is manageable, especially when compared to neighboring California. Housing costs can vary widely, but suburbs and smaller cities offer affordable options. The state's healthcare infrastructure is rapidly growing to meet the demands of its expanding population. Major metropolitan areas like Las Vegas and Reno boast high-quality hospitals and an increasing number of specialists, ensuring retirees have access to excellent medical services.

This data illustrates Nevada's competitive cost of living, though home prices in desirable areas can be elevated.

Lifestyle and Community

Nevada’s retirement lifestyle extends far beyond the Las Vegas Strip. The state is home to numerous master-planned communities designed for active adults, particularly in suburbs like Henderson, known for its safety and family-friendly atmosphere. For those who prefer a four-season climate and mountain scenery, Reno offers a completely different experience with easy access to Lake Tahoe. The state capital, Carson City, provides a quieter, small-town feel steeped in history. This diversity allows retirees to choose an environment that perfectly suits their preferences, from vibrant desert cities to tranquil mountain towns.

Actionable Tips for Prospective Retirees

Budget for High Utility Costs: The desert climate necessitates significant air conditioning use in the summer. Factor these higher electricity bills into your monthly budget.

Research Water Availability: In a desert state, water is a critical resource. Investigate local water rights and long-term availability in any community you consider.

Consider Elevation for Climate: Higher-elevation areas like Reno and Carson City offer cooler temperatures and distinct seasons compared to the hotter climate of Southern Nevada.

Factor in Tourism: If living near Las Vegas, be prepared for the impact of tourism on traffic, crowds, and the general pace of daily life, especially near major attractions.

8. South Carolina

South Carolina offers a classic Southern retirement experience, blending historic charm, coastal beauty, and a relaxed pace of life. Its appeal for retirees, particularly those looking for a mix of affordability and mild weather, comes from its favorable tax policies, diverse landscapes, and strong sense of community. The state provides significant tax breaks for seniors; Social Security benefits are completely exempt from state income tax, and retirees can deduct up to $15,000 of other retirement income. This financial advantage makes South Carolina a strong contender for those wanting to preserve their nest egg.

Cost of Living and Healthcare

The Palmetto State boasts a cost of living that is comfortably below the national average, allowing retirement funds to go further, especially in housing and daily expenses. While healthcare quality can vary by region, larger metropolitan areas offer excellent medical facilities and specialized care geared toward an older population. Retirees can access a network of reputable hospitals and healthcare providers, ensuring their medical needs are well-met without the premium costs found in other states.

This affordability, combined with the state's tax benefits, creates a compelling financial picture for retirees seeking one of the best states to retire in.

Lifestyle and Community

From the Appalachian foothills to the Atlantic coast, South Carolina provides a wide array of lifestyle options. For those drawn to history and coastal living, Charleston offers a unique blend of cobblestone streets, world-class dining, and seaside activities. Hilton Head is a premier resort-style community perfect for active seniors who enjoy golf and tennis. For a balance of urban amenities and mountain scenery, Greenville has a thriving downtown and cultural scene. Meanwhile, Myrtle Beach provides an affordable and lively coastal retirement option.

When considering South Carolina for retirement, the accessibility of leisure activities like golf is often a major draw; you can explore some of the top golf courses in the South to see the quality of courses available.

Actionable Tips for Prospective Retirees

Research Coastal Insurance: If you're considering a coastal property, investigate the costs of flood and hurricane insurance, as these can significantly impact your annual budget.

Explore Different Regions: Spend time in the Upstate (Greenville), Midlands (Columbia), and Lowcountry (Charleston, Hilton Head) to experience the distinct climates and cultures before deciding.

Factor in Seasonal Tourism: In popular coastal towns like Myrtle Beach and Hilton Head, be prepared for a significant increase in population and traffic during the peak tourist season.

9. Georgia

Georgia's unique blend of Southern charm, a four-season climate, and significant tax advantages for seniors cements its place as one of the best states to retire in. For retirees seeking a balance between affordability and a high quality of life, the Peach State offers a compelling package. Its diverse geography, from the Appalachian foothills to the Atlantic coast, provides a variety of lifestyle options, while its tax structure is particularly kind to those on a fixed income.

A key financial draw is Georgia's favorable tax policy for seniors. The state fully exempts Social Security income from state taxes and also offers a generous deduction on other types of retirement income. For individuals aged 65 and older, up to $65,000 per person ($130,000 per couple) of retirement income from sources like pensions, 401(k)s, and IRAs is deductible, which can drastically reduce a retiree’s tax burden.

Cost of Living and Healthcare

Georgia's overall cost of living is below the national average, making it an attractive option for budget-minded retirees. Housing, in particular, is more affordable than in many other popular retirement destinations. The state is home to a robust healthcare network, anchored by world-class facilities in the Atlanta metro area, including Emory University Hospital and Northside Hospital, ensuring access to top-tier medical care.

Lifestyle and Community

Georgia’s appeal lies in its diverse communities catering to different tastes. The historic city of Savannah offers cobblestone streets, a vibrant arts scene, and coastal charm. For those who prefer urban amenities with a suburban feel, the suburbs north of Atlanta provide access to big-city resources with a quieter lifestyle. The Blue Ridge Mountains in the north offer a cooler climate and stunning scenery for outdoor enthusiasts, while coastal communities like St. Simons Island provide a classic seaside retirement experience.

Actionable Tips for Prospective Retirees

Leverage Senior Tax Breaks: Consult with a financial advisor to understand how Georgia’s retirement income exclusion can maximize your savings.

Consider Elevation for Climate: If you prefer cooler summers, explore towns in the North Georgia mountains like Blue Ridge or Dahlonega, which offer relief from the state's typical humidity.

Plan for Coastal Risks: If considering coastal areas like Savannah or St. Simons Island, be sure to research and budget for the potential costs of hurricane and flood insurance.

Top 9 States to Retire: Comparison Overview

State | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Florida | Moderate - hurricane preparedness needed | Moderate - good healthcare and communities | High quality healthcare (#15), popular senior living | Warm climate retirees, tax savings seekers | No state income tax, strong healthcare, senior amenities |

Arizona | Moderate - manage extreme heat & water | Moderate - expanding healthcare, outdoor options | Good healthcare (#23), low living cost | Dry climate lovers, outdoor enthusiasts | No tax on retirement income, dry climate, active communities |

North Carolina | Moderate - diverse climate considerations | Moderate - healthcare and cultural hubs | Strong healthcare (#18), seasonal climate | Retirees wanting variety in climate & culture | Affordable living, no tax on Social Security, four seasons |

Texas | Higher - large size and varied climates | Moderate - urban healthcare centers | Solid healthcare (#30), diverse lifestyle options | Varied retirement preferences, urban retirees | No state income tax, strong economy, cultural diversity |

Tennessee | Low - mild climate, some tornado risk | Low - growing healthcare, cultural amenities | Moderate healthcare (#32), low living cost | Affordable living, music & culture lovers | No state income tax, low cost of living, rich culture |

Delaware | Moderate - coastal flood/hurricane risk | Moderate - proximity to East Coast healthcare | Strong healthcare (#12), higher living cost | Coastal retirees, those near East Coast cities | No sales tax, no tax on Social Security, coastal lifestyle |

Nevada | Moderate - extreme heat and water scarcity | Moderate - growing healthcare, entertainment | Lower healthcare ranking (#39), higher living cost | Entertainment and social activity seekers | No state income/estate tax, dry climate, nightlife |

South Carolina | Moderate - hurricane risk and humidity | Moderate - good healthcare in growing areas | Lower healthcare ranking (#40), affordable living | Coastal and golf retirees, mild climate fans | No tax on Social Security, affordable living, golf access |

Georgia | Moderate - coastal weather and traffic | Moderate - good metro healthcare | Moderate healthcare (#35), affordable with cultural options | Diverse retirees seeking urban and rural mix | Tax exemptions for seniors, diverse geography, culture |

Making Your Final Decision and Securing Your Future

Choosing where to spend your retirement years is one of the most significant and exciting decisions of your life. We've journeyed through a detailed analysis of some of the best states to retire in, from the sun-drenched coasts of Florida and South Carolina to the rugged independence of Texas and Arizona. Each state presents a unique tapestry of financial benefits, lifestyle opportunities, and community values tailored for the conservative, budget-minded retiree.

Our exploration highlighted critical factors that extend far beyond just sunny weather. We dissected the tax landscapes, revealing how states like Florida, Texas, and Tennessee offer a significant advantage with no state income tax, allowing you to keep more of your hard-earned retirement savings. We also examined the tangible benefits of a lower cost of living in places like Georgia and North Carolina, where your nest egg can stretch further without sacrificing quality of life.

Synthesizing the Data for Your Personal Blueprint

The "best" state is not a one-size-fits-all designation; it's the one that aligns perfectly with your personal priorities and financial reality. The true value of this guide lies in using it as a framework to build your own retirement blueprint. Don't just pick a state; pick the factors that matter most to you and find the state that checks those specific boxes.

Consider this a strategic checklist for your decision-making process:

Financial Health: Which state’s tax structure (income, property, sales, and inheritance) best protects your assets? How does the overall cost of living impact your projected retirement budget?

Healthcare Access: Does the state offer top-tier healthcare facilities that specialize in senior care? How do local healthcare costs and insurance options fit into your long-term plan?

Lifestyle and Values: Do you crave the vibrant energy of coastal communities, the tranquility of mountain life, or the cultural richness of a growing city? Does the local community reflect the patriotic and conservative values you hold dear?

Climate and Comfort: Are you seeking year-round warmth, or do you prefer the distinct beauty of four seasons? Be honest about what climate will contribute to your daily happiness and well-being.

Key Insight: The most successful retirement transitions happen when retirees move from a theoretical "best state" to a personally verified ideal location. The data gets you started, but on-the-ground experience finalizes the decision.

Actionable Next Steps: From Research to Reality

With your top contenders identified, it's time to move from passive research to active evaluation. This is the crucial phase where you validate your choice and ensure it’s the right fit for the long haul. A methodical approach will prevent costly mistakes and build confidence in your final decision.

Here are your practical next steps:

Plan “Test Drive” Visits: Schedule extended visits to your top two or three states. Crucially, visit during different seasons, not just the most pleasant one. An Arizona summer is vastly different from its mild winter, just as a Carolina winter differs from its humid summer.

Consult with Local Professionals: Before you make any moves, connect with a financial advisor and a real estate agent in your target state. A local financial expert can provide precise insights into the state and municipal tax codes that an out-of-state advisor might miss.

Engage with the Community: Don’t just be a tourist. Attend a local church service, visit a community center, shop at local grocery stores, and talk to other retirees. Ask them candidly about their experiences: the pros, the cons, and what they wish they’d known before moving.

Conduct a Healthcare Audit: Research the primary care physicians, specialists, and hospitals in the specific area you’re considering. Check their ratings, patient reviews, and whether they are in your potential insurance network. Your health is your wealth, and ensuring access to quality care is non-negotiable.

Choosing from the best states to retire in is about more than just finding a new address; it's about authoring the next great chapter of your life. It's about securing a future where your financial independence is protected, your values are respected, and your days are filled with purpose and peace. By combining diligent research with proactive, real-world vetting, you can confidently plant your flag in a place that feels, unequivocally, like home.

As you finalize your choice of state, securing your financial future becomes the top priority. America First Financial specializes in crafting retirement protection plans, including long-term care, annuities, and health insurance solutions designed to safeguard your assets and ensure your peace of mind, no matter where you choose to live. Visit America First Financial to learn how their expertise can help you build a secure and prosperous retirement.

_edited.png)

Comments