The Real Cost of Term Life Insurance

- dustinjohnson5

- Aug 17, 2025

- 12 min read

One of the biggest myths about life insurance is that it’s expensive. In reality, the cost of term life insurance is often surprisingly affordable—sometimes less than what you’d spend on streaming services each month.

While every quote is personalized, let's pull back the curtain on the numbers to show you just how accessible it can be to protect your family's financial future.

Understanding Sample Life Insurance Premiums

Think of a life insurance premium less like a fixed price tag and more like a custom quote built just for you. Insurers look at a handful of key details—mostly your age, health, and how much coverage you want—to figure out your rate.

To give you a realistic starting point, we've put together a table with some ballpark monthly premiums. This isn't a final quote, but it's a great baseline to see what someone who doesn't smoke and is in generally good health might pay.

The big takeaway? The younger and healthier you are when you buy a policy, the lower the risk you represent to the insurer. That lower risk translates directly into a more affordable premium for you, a rate you can often lock in for decades.

A Look at Sample Monthly Costs

The table below really highlights how age and coverage amount steer the cost of your premium. These are just estimates, of course. Your final rate will be determined after the insurance company has a complete picture of your health and lifestyle.

Sample Monthly Term Life Insurance Premiums

A quick look at estimated monthly premium ranges for a non-smoker in good health.

Age Group | Coverage Amount | Estimated Monthly Premium Range |

|---|---|---|

30-39 | $250,000 | $15 - $30 |

30-39 | $500,000 | $25 - $45 |

40-49 | $250,000 | $30 - $55 |

40-49 | $500,000 | $50 - $80 |

50-59 | $250,000 | $75 - $130 |

50-59 | $500,000 | $140 - $250 |

As you can see, there’s a clear financial advantage to getting coverage sooner rather than later. A 35-year-old can often secure a $500,000 policy for less than $45 a month, while someone in their 50s might pay three times that for the same benefit.

Across the United States, premiums can vary quite a bit based on your specific profile. Some providers even offer quotes starting as low as $1.99 per month for younger people who only need a small amount of coverage. To get a broader perspective, you can explore more data on Globe Life Insurance rates to see how these costs change with different factors.

What Goes Into Your Life Insurance Rate?

Ever wondered how an insurance company lands on your specific monthly premium? It's not just a number pulled out of thin air. The whole process, known as underwriting, is a deep dive into your individual risk profile.

Think of it this way: the insurer is essentially placing a bet. Your premium is the price they charge to take on the financial risk that they'll have to pay out your policy. The less risky you appear in their eyes, the lower your cost of term life insurance will be. Getting a handle on these factors is the first step to understanding your quote and finding ways to lower it.

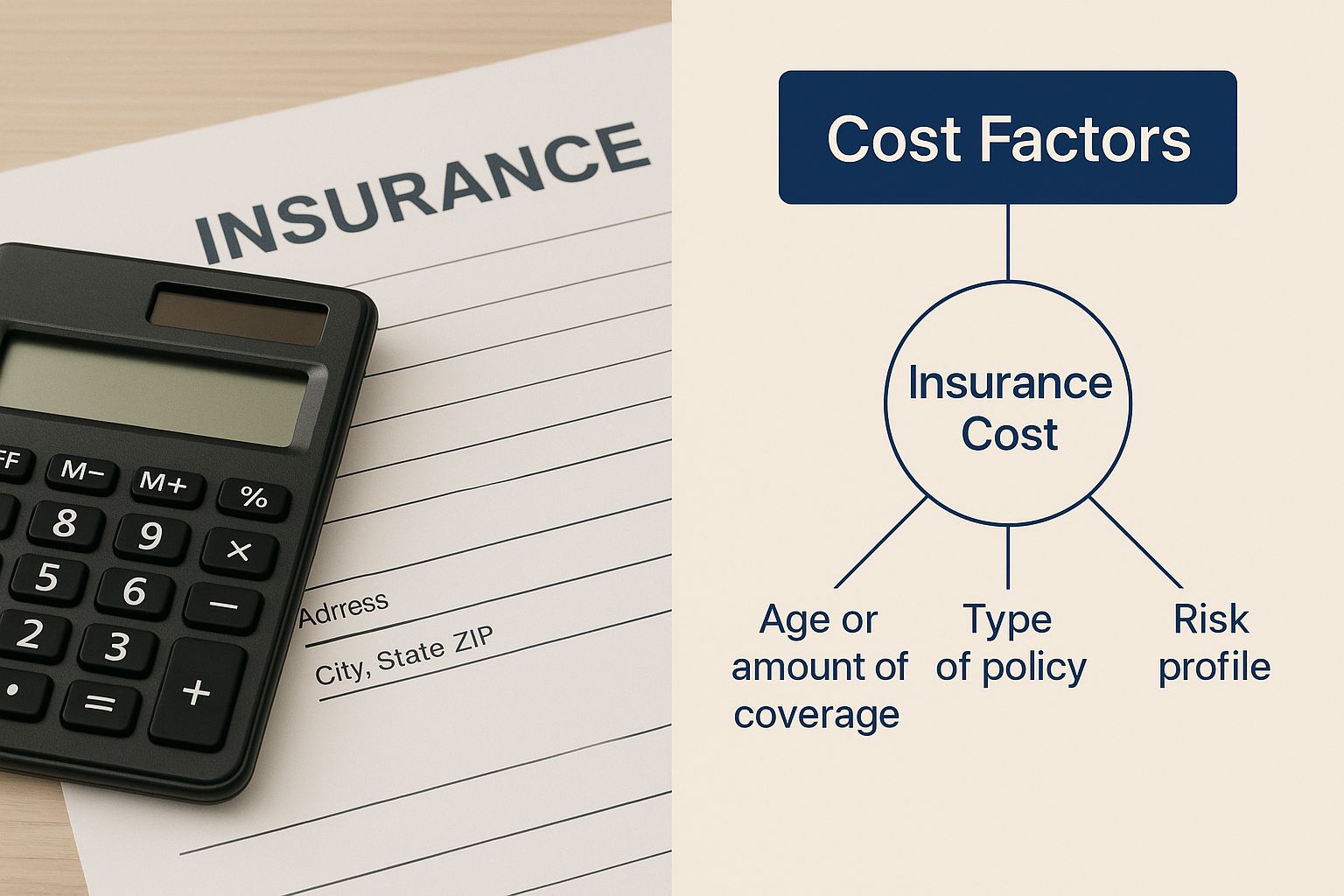

This visual gives you a great snapshot of the main elements that insurers look at when calculating what you'll pay.

As you can see, it really boils down to your age, health, lifestyle, and the specific policy you build.

Your Age and Gender

Age is easily one of the biggest drivers of your premium. It's a straightforward calculation for insurers: the younger you are, the longer your life expectancy. A younger applicant is statistically less likely to pass away during the policy's term, which means less risk for the company. This is why buying life insurance when you're young locks in the best possible rates.

Gender also factors in. On average, women live longer than men, which is a statistical reality that insurers can't ignore. Because of this, women often pay slightly less for the same amount of coverage.

Your Health and Medical History

Your overall health is put under a microscope during the underwriting process. Insurers want a complete picture of your health today and what it might look like in the future.

This review typically includes:

A Medical Exam: Don't worry, it's a simple check-up that can often be done right in your home. They’ll check your height, weight, and blood pressure and take blood and urine samples.

Your Medical Records: With your permission, the insurer will review your doctor's records to see your health history, including any past illnesses, surgeries, or chronic conditions like diabetes or heart disease.

Family Medical History: If serious hereditary conditions like cancer or heart disease run in your immediate family, it can sometimes influence your rates.

A clean bill of health is your best friend when applying for life insurance. Remember, well-managed health conditions often get much better rates than untreated ones. Being proactive about your health really does pay off here.

Your Lifestyle and Habits

What you do day-to-day matters just as much as what's in your medical records. Insurers look at your habits and hobbies to see if they add any extra risk.

Some of the key lifestyle factors they consider are:

Tobacco and Nicotine Use: This is a big one. Smokers or other nicotine users can expect to pay two to three times more than non-users because of the clear health risks involved.

Driving Record: A history of DUIs, reckless driving, or multiple accidents signals risk and can drive up your premium.

Dangerous Hobbies: Do you love scuba diving, rock climbing, or flying private planes? These adventurous activities may place you in a higher risk class.

Occupation: Some jobs are inherently more dangerous. A logger or a commercial pilot, for example, might see higher rates than an office worker.

Your Policy Selections

Finally, the details of the policy you choose have a direct and immediate impact on your cost. The good news is that these are the elements you have the most control over.

The two main levers you can pull are:

Coverage Amount (Death Benefit): This is the payout your beneficiaries receive. It's simple math: a $1,000,000 policy will cost more than a $250,000 policy because the insurer is on the hook for a much larger amount.

Term Length: This is how long your coverage lasts, typically for 10, 20, or 30 years. A 30-year policy costs more than a 10-year one because the odds of the insurer having to pay the death benefit increase over a longer time span.

By understanding how all these pieces fit together, you can make smarter decisions about your coverage. To see how these factors impact a real quote for your family's needs, you can get a quick, no-hassle estimate from providers like America First Financial.

Average Term Life Insurance Costs by Age and Gender

It’s one thing to talk about costs in the abstract, but seeing some real-world numbers is where it really clicks. To give you a solid baseline, let’s look at what someone might actually pay for a standard 20-year term policy.

The figures we’ll go over are for a non-smoker in excellent health—think of this as the "best-case scenario" price.

Having these averages in your back pocket is incredibly helpful. It sets a realistic expectation before you start shopping for quotes and gives you a benchmark to compare against.

Why Age and Gender Matter So Much

As you look at the numbers, two major trends will jump out at you. First, the older you are, the higher the premium. This is the core of how insurance pricing works; it's all about risk. Statistically, a younger person is far less likely to pass away during the policy term, so the risk for the insurer is lower.

Second, you’ll see that women typically pay a bit less than men for the same amount of coverage. This isn't just a random discount. It’s based on hard data—actuarial tables show that women, on average, live longer than men. Insurers build this statistical fact right into their pricing.

Securing a policy when you're younger and healthier offers a huge financial advantage. You get to lock in a low rate based on your lowest-risk profile and keep it for the entire term, potentially for decades.

Let's break down exactly what that looks like. The table below shows average monthly costs for common coverage amounts at different life stages.

Average Monthly Premiums for a 20-Year Term Policy

This table gives a clear picture of how age, gender, and the coverage amount you choose can shift the monthly cost. All estimates are for a non-smoker in excellent health.

Age | Gender | $250,000 Coverage | $500,000 Coverage | $1,000,000 Coverage |

|---|---|---|---|---|

30 | Female | $16 - $20 | $25 - $30 | $38 - $45 |

30 | Male | $18 - $24 | $28 - $35 | $45 - $55 |

40 | Female | $23 - $28 | $35 - $42 | $60 - $70 |

40 | Male | $27 - $33 | $40 - $48 | $70 - $85 |

50 | Female | $50 - $65 | $85 - $110 | $160 - $200 |

50 | Male | $65 - $80 | $120 - $145 | $225 - $270 |

The difference is pretty dramatic, isn't it? A 30-year-old woman could get a $500,000 policy for about the cost of a few lattes a month—around $25.

Contrast that with a 50-year-old man, who might be looking at nearly five times that cost for the very same coverage. This is the clearest argument for not putting off getting the protection you need.

How Global Trends Are Shaping Insurance Costs

Your insurance premium doesn't exist in a vacuum. It's tied to a massive, interconnected economic system, and big-picture forces can cause rates to shift for everyone across the entire industry.

When you understand these dynamics, you start to see that pricing isn't just about your personal health. It helps you become a much smarter shopper, because you'll know what market forces are at play when you're looking for a policy.

The Impact of Economic Shifts

The economy, especially interest rates, is one of the biggest outside influences on what you pay. Insurance companies are huge investors. They take the premiums we all pay and put that money to work, mostly in conservative, low-risk investments like government and corporate bonds.

When interest rates are high, insurers earn a lot more from these investments. That extra income helps them cover the cost of paying out death benefits, which in turn allows them to offer more competitive and affordable premiums to customers like you.

But when interest rates are low, the opposite happens. Their investment returns shrink, and to stay profitable and make sure they can cover future claims, they often have to charge higher premiums. So, believe it or not, the federal funds rate can have a real, indirect effect on the quote you get.

A stable economy with healthy interest rates generally leads to more stable and predictable life insurance costs. When insurers feel confident about their investment returns, they can price their policies much more accurately.

Public Health and Global Events

Major global events, particularly public health crises, can completely reshape the insurance world. These events force insurers to recalculate risk on a massive scale and can change how people think about insurance almost overnight. They're a real-time stress test for the entire industry.

Take the COVID-19 pandemic, for example. It had a huge impact on both term life insurance costs and public awareness. The crisis triggered a historic surge in the U.S. market as more people suddenly realized just how crucial financial protection is. In fact, life insurance sales spiked in 2021 to levels not seen in over 40 years. It's a powerful reminder of how global health events can redefine everything. You can find more about these U.S. market trends on LIMRA.com.

Other trends are also in the mix:

Advances in Medicine: As we get better at treating major conditions like heart disease and cancer, people live longer. Longer life expectancies can eventually help bring down long-term insurance costs.

Regulatory Changes: New laws and government rules can change how insurance companies have to do business, sometimes leading to adjustments in pricing or policy features.

Keeping these larger trends in mind gives you a much better picture of all the complex pieces that come together to determine your final premium.

Proven Strategies to Lower Your Insurance Costs

While you can't turn back the clock on your age, you have far more control over the cost of term life insurance than you might think. Getting a great rate isn't about finding some hidden secret; it's about being strategic and showing insurers that you're a low-risk applicant.

Think of it like getting ready for a big job interview. You want to highlight all your best qualities. In the world of life insurance, your "best self" is someone who is healthy and responsible. A little planning can make a massive difference in what you'll pay for years to come.

Act Early and Get Your Health in Order

The single biggest lever you can pull to get a lower rate is to apply when you're young and healthy. Honestly, it’s that simple. Each birthday you celebrate can nudge your potential premiums up. By locking in a rate in your 30s instead of waiting until your 40s or 50s, you could easily save thousands over the life of the policy.

Before you even start the application, focus on improving a few key health metrics. Small, consistent efforts can have a surprisingly big impact:

Tame Your Blood Pressure: In the weeks before your medical exam, cut back on salty foods and get some regular exercise.

Lower Your Cholesterol: A diet filled with fruits, veggies, and whole grains can work wonders.

Manage Your Weight: Insurers look closely at your height-to-weight ratio. Dropping even a few pounds can potentially bump you into a better (and cheaper) rate class.

Quit All Nicotine. Period. This is the big one. Insurers reserve their absolute best rates for non-smokers, and you usually need to be completely nicotine-free for at least a year to qualify for them.

Making these positive changes gives the insurance company the healthiest possible snapshot of you, which almost always translates directly into a lower premium.

Shop Around and Compare Your Options

Whatever you do, don't just take the first quote you get. The life insurance market is incredibly competitive, and the price for the exact same policy can vary wildly from one company to the next. Every insurer has its own way of calculating risk and has certain "sweet spots" for different types of people.

You wouldn't buy the first car you test drive, right? The same logic applies here. You should always get quotes from at least three to five different carriers to make sure you're not leaving money on the table.

Working with an independent agent or using an online comparison tool makes this process much easier. It lets you see several offers all at once, helping you quickly spot the company that views your specific health and lifestyle most favorably.

Fine-Tune Your Policy Details

Beyond your health, the way you structure the policy itself can unlock significant savings. It's all about being strategic so you aren't paying for more insurance than you actually need.

Think about making these adjustments:

Pick the Right Term Length: Try to match your policy's term to your longest financial responsibility. If your mortgage is paid off in 20 years and your kids are through college by then, a 20-year term makes a lot more sense—and is much cheaper—than a 30-year one.

Look into "Laddering" Policies: This is a more advanced move, but it's brilliant. It means buying several smaller policies with different term lengths. For instance, you could get a $500,000, 20-year policy for income replacement and a second, $250,000, 10-year policy just to cover a business loan. As your financial needs shrink, the smaller policies expire, and your total premium drops over time.

By carefully aligning your policy with your real-life timeline, you make sure your family is protected without pouring money down the drain. When you're ready to see how these strategies could work for you, you can get a quick, personalized quote from a provider like America First Financial to start comparing your options.

Common Questions About Term Life Insurance Costs

Even with all the factors laid out, there are always a few specific questions that pop up when you're thinking about the cost of term life insurance. It's totally normal. Let's walk through some of the most common ones so you can feel completely confident about your next steps.

These are the practical, "what if" questions that come to mind when you're getting serious about a policy. Getting straight answers now means no unwelcome surprises down the road.

Do I Need a Medical Exam to Get Term Life Insurance?

Not necessarily, but it's often a good idea. Many insurance companies now offer "no-exam" policies, which are super convenient. You can often get approved in as little as 24 hours because they rely on your application answers and public data instead of a physical exam.

So, what's the catch? This convenience usually costs you. The insurer is taking on a bigger risk without getting a detailed look at your health, so no-exam policies tend to have higher premiums. If you're in pretty good health, taking the time for an exam is almost always your best bet for a lower rate.

Think of it this way: a simple 30-minute medical exam could save a healthy person hundreds or even thousands of dollars over the life of their policy. It’s a small investment of your time for a potentially huge financial payoff.

What Happens if I Outlive My Term Life Insurance Policy?

This is a fantastic question and a scenario that many people hope for! When your policy term ends—whether it's after 10, 20, or 30 years—the coverage simply expires. You stop making payments, and the death benefit is no longer active.

By that point, many people find their biggest financial responsibilities are behind them. The mortgage might be paid off, and the kids are likely grown and independent. However, if you still need coverage, some policies give you a couple of options:

Renew the coverage: You can often renew your policy on a yearly basis. Just be prepared for a much higher premium, as the new rate will be based on your current, older age.

Convert to a permanent policy: Some carriers let you convert your term policy into a permanent one, like whole life, without needing another medical exam.

Can My Term Life Insurance Premium Increase During the Term?

For the overwhelming majority of term life policies, the answer is a solid no. One of the biggest selling points of a standard term policy is its "level premium."

This means your rate is locked in from day one and is guaranteed not to change for the entire length of the term. Whether you have a 10-year or 30-year policy, your payment will stay exactly the same, even if your health takes a turn later on. This predictability is what makes term life insurance such a reliable and budget-friendly way for families to protect themselves.

Ready to secure your family's future with coverage that aligns with your values? At America First Financial, we make it simple to find affordable, dependable term life insurance. Get your free, no-obligation quote in under three minutes and see how easy it can be to protect what matters most. Find your rate now at America First Financial.

_edited.png)

Comments