Top Conservative Insurance Companies for 2025

- dustinjohnson5

- May 17

- 17 min read

Finding the Right Conservative Insurance in 2025

Looking for insurance companies that align with your conservative values? This list features eight providers committed to financial strength and reliable coverage, helping you protect your family and assets without compromising your beliefs. Quickly compare companies like America First Financial, known for serving a conservative clientele, alongside established mutual companies like Northwestern Mutual and MassMutual, recognized for conservative investment strategies. Finding the right conservative insurance company can be challenging, but this list simplifies your search.

1. America First Financial

America First Financial positions itself as a trusted insurance provider catering specifically to conservative and patriotic Americans. They emphasize values-driven protection and financial stability, aiming to offer an alternative to traditional insurers they perceive as influenced by political agendas. This focus resonates with a specific demographic seeking alignment between their financial choices and their personal values. They offer a comprehensive suite of products designed to meet diverse needs, from family security to retirement planning, including term life insurance, disability coverage, annuities, long-term care, and health plans. This breadth of offerings allows customers to potentially consolidate their insurance needs under one provider that shares their values. America First Financial highlights its commitment to streamlined service and customer empowerment. Their online quote system promises a quick, less-than-three-minute process, without the pressure of aggressive follow-up calls, allowing potential clients to explore options at their own pace.

For conservative families and individuals approaching retirement, America First Financial offers a potentially attractive blend of financial planning and value alignment. For example, a family concerned about providing for their children's future could explore term life insurance options, while someone nearing retirement might be interested in their annuities or long-term care plans. Budget-minded insurance shoppers will appreciate the promise of affordable options, though specific pricing details are limited on the website, requiring the use of the quote tool or direct contact with an agent. This lack of transparent pricing could be a drawback for some consumers. The company's endorsement by figures like Donald Trump Jr. adds to its appeal within its target demographic, bolstering credibility and trust. Further enhancing its image within the conservative sphere is the commitment to donating a portion of every dollar earned to aligned philanthropic causes.

Pros:

Affordable insurance options tailored to conservative and patriotic Americans

Wide range of products, including term life, disability, annuities, long-term care, and health plans

Fast and user-friendly online quote system with no persistent follow-ups

Endorsed by prominent conservative voices, adding credibility and trust

Portion of every purchase supports meaningful philanthropic causes

Cons:

Primarily aimed at conservative and patriotic clientele, which may not resonate with all customers

Limited publicly available pricing details; customers need to use the quote tool or contact agents for specifics

America First Financial earns its place on this list of conservative insurance companies by explicitly targeting this demographic with products and messaging that align with their values. While the lack of transparent pricing may be a deterrent for some, the company's emphasis on customer-centric service, combined with its value-driven approach, makes it a potentially compelling option for conservative American families, individuals approaching retirement, and those seeking an insurance provider that reflects their worldview. For those seeking a company that aligns with their conservative values, America First Financial offers a potential solution, but further research and comparison shopping are recommended to ensure the best fit for individual needs and budgets.

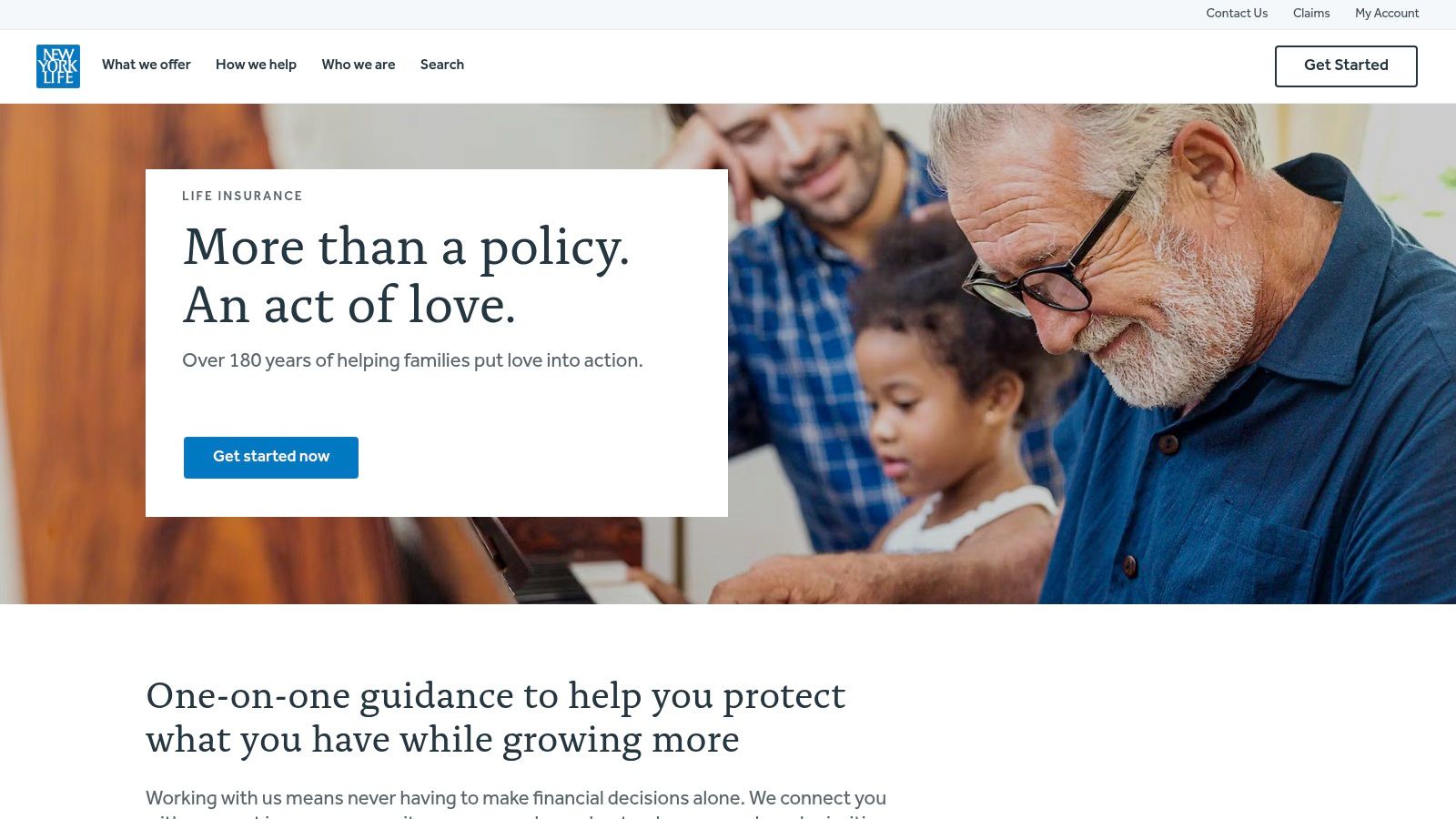

2. New York Life

For conservative American families, individuals approaching retirement, and those prioritizing financial stability, New York Life stands out as a reliable choice among conservative insurance companies. Founded in 1845, this mutual company prioritizes long-term value over short-term gains, a key differentiator in the insurance landscape. Its mutual structure means it's owned by its policyholders, not shareholders, allowing it to focus on the best interests of its customers rather than maximizing quarterly profits. This structure directly benefits policyholders through dividends, essentially sharing the company's profits. This commitment to financial prudence makes New York Life a particularly attractive option for budget-minded insurance shoppers and those seeking long-term security.

New York Life's conservative investment philosophy further reinforces its commitment to stability. The company maintains consistently high financial strength ratings (A++ from A.M. Best), indicating its ability to weather economic downturns and fulfill its obligations to policyholders. This proven track record of reliability provides peace of mind, especially for those concerned about market volatility and economic uncertainty. New York Life offers a comprehensive suite of products, catering to diverse needs. These include whole life, term life, universal life insurance, annuities, and long-term care options, offering solutions for various life stages and financial goals. For health-conscious consumers, the long-term care options provide a safety net for future healthcare expenses, aligning with a proactive approach to health and financial planning.

Features:

Mutual company structure (owned by policyholders): Profits are shared with policyholders through dividends.

Consistently high financial strength ratings (A++ from A.M. Best): Demonstrates exceptional financial stability.

Dividend-paying policies with a 165+ year track record: Provides a consistent return and participates in the company’s success.

Conservative investment philosophy: Focuses on long-term growth and security.

Extensive agent-based distribution network: Offers personalized service and support through local agents.

Pros:

Exceptional financial stability and conservative management: Provides a secure and reliable option for long-term financial planning.

Policyholders can participate in company profits through dividends: Offers a unique benefit not found with publicly traded insurance companies.

Long history of reliability during economic downturns: Reinforces its strength and commitment to policyholders.

Personal relationships with local agents: Provides personalized guidance and support throughout the insurance process.

Cons:

Products tend to be more expensive than some competitors: The focus on stability and dividends can result in higher premiums.

Limited online self-service capabilities compared to newer insurers: May not appeal to those who prefer managing their policies entirely online.

Agent-driven sales approach may feel pushy to some consumers: While personalized service is a benefit, some may find the agent-based approach less appealing.

Website: https://www.newyorklife.com/

New York Life earns its place on this list of conservative insurance companies due to its unwavering commitment to financial strength, its mutual structure prioritizing policyholders, and its long history of delivering on its promises. For those seeking a reliable and financially sound insurance partner, New York Life represents a solid choice.

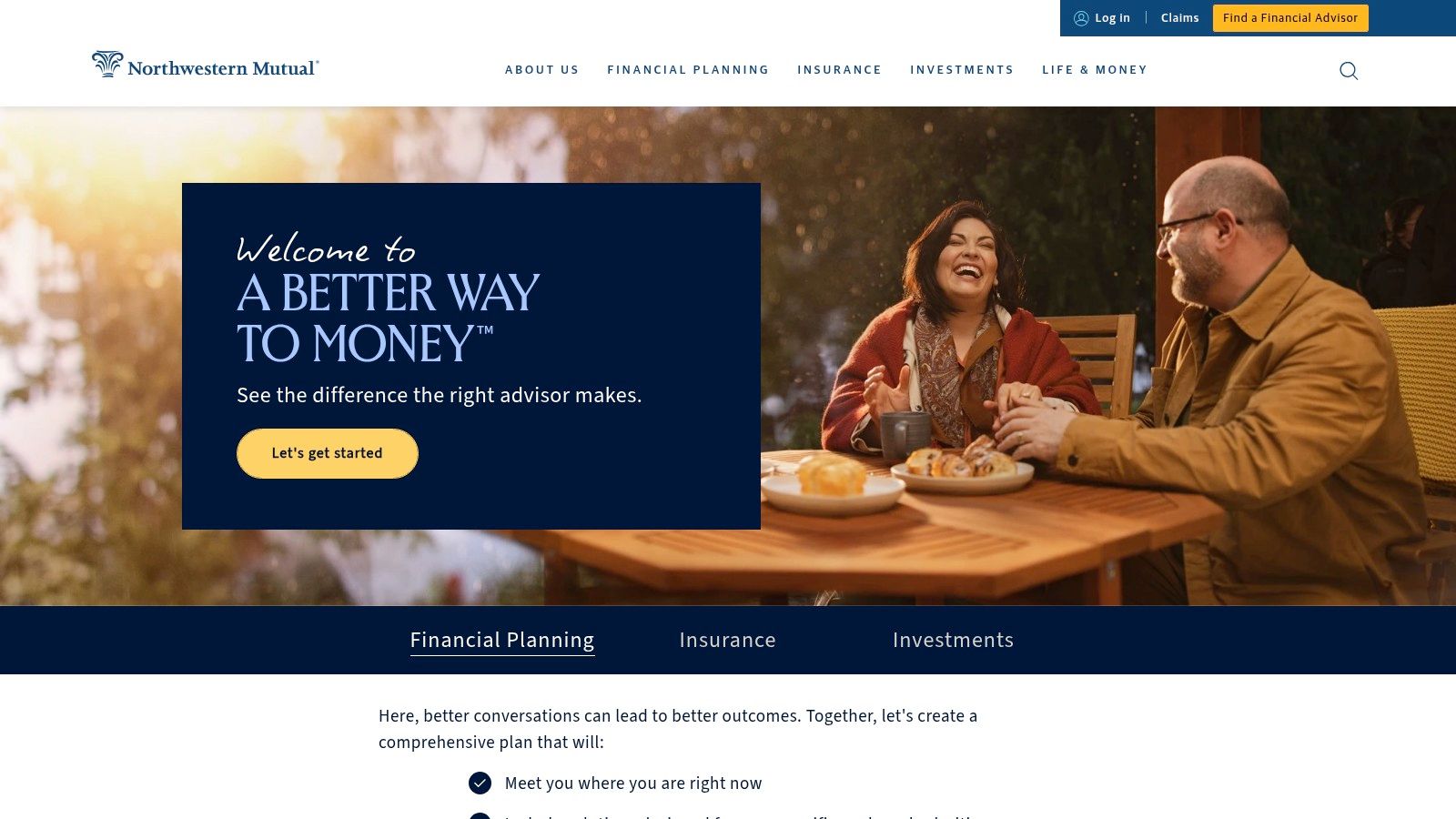

3. Northwestern Mutual

Northwestern Mutual stands out as a prominent choice among conservative insurance companies, particularly for those prioritizing long-term financial security and stability. Founded in 1857, this mutual company distinguishes itself through its conservative investment philosophy and unwavering commitment to its policyholders. This approach has enabled Northwestern Mutual to maintain top-tier financial strength ratings from all major rating agencies, even during periods of economic uncertainty. Their focus isn't on short-term market fluctuations, but on building lasting financial strength. This makes them a particularly attractive option for conservative American families, individuals approaching retirement, and anyone prioritizing financial stability.

Northwestern Mutual offers a comprehensive suite of financial planning and insurance solutions, including their flagship whole life insurance products. These policies are designed to build cash value over time, providing a source of funds that can be accessed for various needs, such as supplementing retirement income or covering unexpected expenses. The company's mutual structure, meaning it is owned by its policyholders, further aligns its interests with those it serves. This structure removes the pressure to maximize shareholder profits, allowing them to prioritize policyholder value. This resonates strongly with budget-minded insurance shoppers and those seeking a company with a proven track record of financial responsibility.

One of the most compelling features of Northwestern Mutual is its history of consistent dividend payments. Having paid dividends every year since 1872, the company demonstrates a commitment to sharing its financial success with policyholders. These dividends can be used to increase cash value, reduce premium payments, or taken as cash. This long-standing tradition provides an added layer of financial security, particularly appealing to conservative individuals and families.

While Northwestern Mutual offers significant advantages, it’s important to consider potential drawbacks. Premiums for their whole life policies are typically higher than term life insurance or policies offered by some competitors. This is due in part to the cash value component and the long-term guarantees associated with whole life insurance. Additionally, some potential clients have reported an aggressive sales approach from certain representatives, while others note a relative lack of emphasis on digital tools and self-service options compared to newer online insurance platforms. It is crucial to remember that financial representatives work on commission, so discussing your needs and expectations transparently is essential.

Features:

Mutual company (owned by policyholders)

Top-tier financial strength ratings

Comprehensive financial planning

Dividend-paying policies (nearly 150-year track record)

Strong cash value accumulation

Pros:

Industry-leading financial stability and conservative investment strategy

Integrated financial planning and insurance solutions

Consistent dividend payments

Highly trained financial representatives

Cons:

Higher premium costs than some competitors

Potential for aggressive sales tactics from some representatives

Less emphasis on digital tools and self-service

Commission-based compensation for representatives

Website: https://www.northwesternmutual.com/

For those seeking a conservative insurance company with a proven track record of financial strength and a focus on long-term value, Northwestern Mutual deserves serious consideration. Its mutual structure, comprehensive financial planning services, and consistent dividend payments offer a unique combination of stability and potential returns. However, potential clients should carefully weigh the higher premium costs and consider their comfort level with the company's traditional, representative-driven approach.

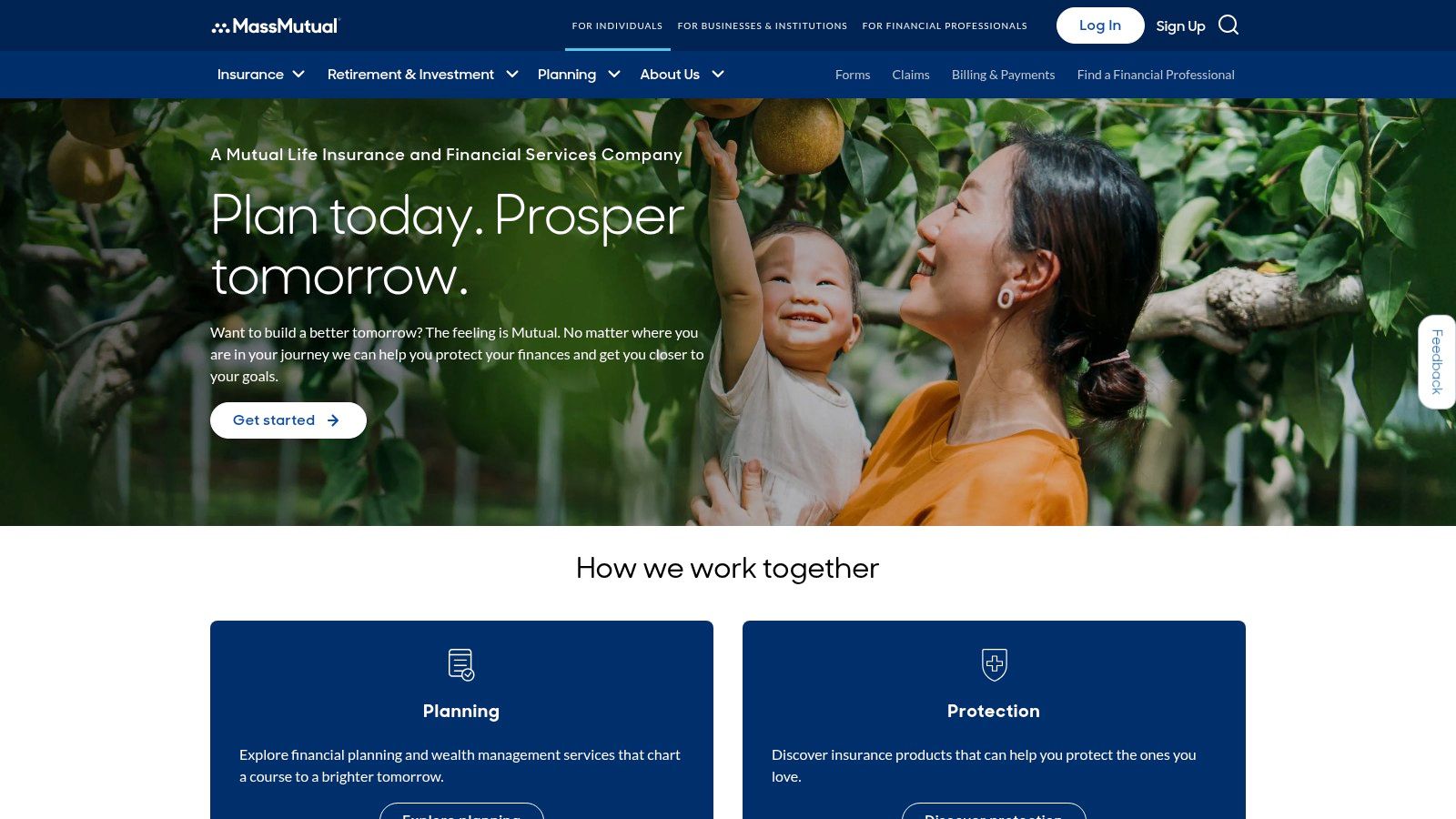

4. MassMutual

For conservative American families, individuals approaching retirement, and budget-minded insurance shoppers seeking a historically stable and reliable insurance company, MassMutual stands out as a strong contender among conservative insurance companies. Founded in 1851, Massachusetts Mutual Life Insurance Company (MassMutual) offers a range of financial products including whole life insurance, disability income insurance, long-term care insurance, retirement/401(k) plan services, and annuities. Its mutually owned structure, meaning it's owned by its policyholders, aligns the company's interests with those of its customers, emphasizing long-term financial strength and stability rather than short-term shareholder profits. This focus resonates particularly well with those prioritizing financial security and predictable growth.

MassMutual's conservative investment strategy further reinforces its appeal to risk-averse individuals. The company prioritizes preserving capital and generating steady returns, making it a suitable choice for those seeking to protect their assets and build a secure financial foundation. This conservative approach also contributes to the company's consistently high financial strength ratings (A++ from A.M. Best), providing additional reassurance to policyholders.

One of MassMutual's most distinctive features is its long and impressive history of paying dividends to eligible participating policyowners every year since the 1860s. This consistent dividend payout history underscores the company's financial strength and its commitment to sharing profits with its policyholders. This feature is particularly attractive for those seeking predictable income streams in retirement or looking to enhance the cash value growth of their permanent life insurance policies.

While MassMutual shines in its financial stability and long-term focus, there are some potential drawbacks to consider. Its products are generally more expensive than the industry average, reflecting the higher cost of its guarantees and the comprehensive nature of its offerings. Furthermore, its digital tools and online customer interface are not as advanced as some competitors, which might frustrate tech-savvy consumers. Finally, MassMutual often requires working with an agent, which might be a barrier for those preferring direct online purchases. The complexity of some of its products can also be challenging to navigate without professional guidance.

Features & Benefits:

Mutual Company Structure: Focuses on policyholder interests, not shareholder profits.

Dividend History: Consistent dividend payouts for over 150 years, adding value to participating policies.

Comprehensive Product Suite: Offers a wide range of insurance and financial planning solutions.

Conservative Investments: Prioritizes capital preservation and stable long-term growth.

High Financial Strength Ratings: Provides peace of mind regarding the company's financial stability.

Pros:

Consistent financial performance through various economic cycles

Long-term planning horizon due to the absence of shareholder pressure

Competitive cash value growth in permanent life insurance products

Strong commitment to policyholder interests

Cons:

Products tend to be more expensive than the industry average

Digital platform and customer interface less developed than some competitors

Typically requires working with an agent

Complex product structures can be difficult to understand

Website: https://www.massmutual.com/

MassMutual deserves its place on this list of conservative insurance companies due to its unwavering focus on long-term financial security, its demonstrated commitment to policyholders, and its impressive history of financial strength. For those prioritizing stability and predictable growth, MassMutual offers a compelling option, albeit at a premium price point.

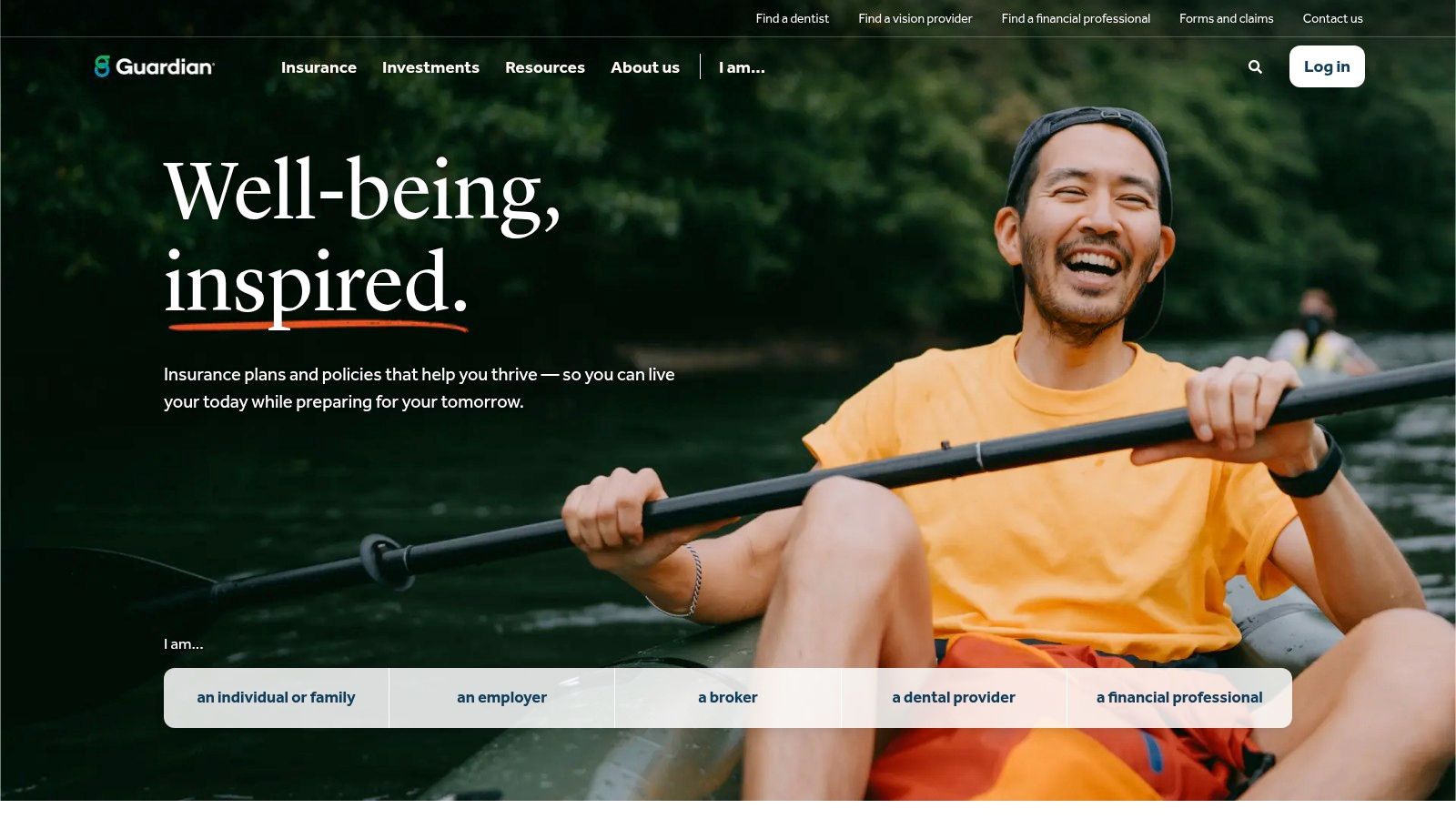

5. Guardian Life

If you're seeking a conservative insurance company with a proven track record of stability and financial strength, Guardian Life is worth considering. Founded in 1860, Guardian Life Insurance Company of America is one of the largest mutual life insurance companies in the United States. This mutual ownership structure means the company is owned by its policyholders, not shareholders, aligning its focus with long-term financial health rather than short-term profits. This structure resonates particularly well with conservative values, prioritizing stability and shared benefit among policyholders. This makes them a solid choice for conservative American families and individuals approaching retirement who value security and predictable growth.

Guardian Life's conservative investment philosophy and robust financial ratings (A++ from A.M. Best) further solidify its position as a reliable choice among conservative insurance companies. The company boasts a remarkable history of consistent dividend payments to participating policyholders every year since 1868, demonstrating its commitment to sharing profits and providing long-term value. This feature is particularly attractive to budget-minded insurance shoppers and those seeking to supplement their retirement income. Beyond its core life insurance offerings, Guardian Life provides a diverse product portfolio, encompassing disability income insurance, annuities, investments, dental, and vision insurance, catering to a holistic approach to financial well-being. This comprehensive suite of services makes them a convenient one-stop shop for health-conscious consumers who want to manage multiple insurance needs with a single, trusted provider.

For those seeking competitive cash value growth within whole life insurance products, Guardian Life offers compelling options. Their strong disability income insurance offerings are also worth noting, providing crucial financial protection in case of unforeseen circumstances. However, it's important to be aware that Guardian Life's premiums might be higher compared to some competitors, reflecting the company's emphasis on financial strength and conservative risk management. Additionally, their direct-to-consumer options are limited, and their digital tools might not be as advanced as some newer insurers. The quality of their agents can also vary depending on location. Therefore, it's crucial to do your research and compare quotes from multiple providers before making a decision. Consider working with an independent insurance broker who can help you navigate the options and find the best fit for your needs.

Pros:

Excellent financial stability and conservative risk management

Competitive cash value growth in whole life products

Strong disability income insurance offerings

Diverse product portfolio beyond just life insurance

Cons:

Higher premiums compared to many competitors

Limited direct-to-consumer options

Less advanced digital tools than some newer insurers

Agent quality can vary by location

Website: https://www.guardianlife.com/

6. State Farm

For those seeking a conservative insurance company, State Farm stands as a reliable choice, particularly for families, individuals approaching retirement, and budget-minded consumers prioritizing financial stability. Founded in 1922, State Farm has grown to become the largest property and casualty insurer in the United States, earning a reputation for its conservative approach to risk management. While not technically a mutual company, it operates with a mutual-like structure, prioritizing the interests of its policyholders over external shareholders. This focus aligns with the values of conservative consumers who appreciate stability and long-term financial security. State Farm offers a comprehensive suite of insurance products, including auto, home, life, and health, making it a potential one-stop shop for all your insurance needs.

State Farm's conservative underwriting policies and substantial financial reserves contribute to its exceptional financial strength, reflected in its A++ rating from A.M. Best. This financial stability is a crucial factor for conservative individuals seeking peace of mind knowing their insurer can reliably pay out claims. Their extensive network of local agents across the nation provides personalized service and readily available support. This personalized approach can be especially beneficial for those who prefer face-to-face interactions and appreciate local community connections.

Features and Benefits:

Mutual-like Structure: Prioritizes policyholder interests, offering potential benefits similar to a mutual company.

Comprehensive Offerings: Covers a wide range of insurance needs, from auto and home to life and health.

Extensive Agent Network: Provides personalized service and local support through a vast network of agents.

Conservative Underwriting: Focuses on minimizing risk, leading to strong financial stability.

Strong Financial Ratings: Boasts an A++ rating from A.M. Best, indicating excellent financial strength and claims-paying ability.

Bundling Discounts: Offers opportunities to save by bundling multiple insurance products.

Pros:

One-Stop Shop: Conveniently manage multiple insurance policies with a single company.

Local Agent Access: Benefit from personalized service and support from a local agent.

Financial Stability: Enjoy peace of mind knowing State Farm has a strong track record of financial stability and claims payment.

Bundling Discounts: Save money by combining auto, home, or other insurance policies.

Cons:

Potentially Higher Rates: Premiums, particularly for auto insurance, might be higher compared to some competitors.

Stricter Underwriting: Conservative underwriting practices might make obtaining coverage more challenging for some individuals.

Limited Specialty Coverage: May not be the most competitive option for specialized insurance needs.

Digital Tools: While improving, digital tools might not be as advanced as some direct-to-consumer insurers.

Website: https://www.statefarm.com/

State Farm's emphasis on financial stability, conservative risk management, and personalized service through local agents makes it a strong contender for conservative consumers. While potential drawbacks like higher rates and stricter underwriting exist, the company's long-standing reputation and comprehensive offerings position it as a solid option for those prioritizing long-term security and reliable service. For conservative American families, individuals approaching retirement, and those seeking a financially sound insurer, State Farm deserves serious consideration.

7. USAA

USAA (United Services Automobile Association) stands out among conservative insurance companies due to its unique member-owned structure and its focus on serving the military community. Founded in 1922, USAA initially catered to military officers but has broadened its eligibility to include enlisted personnel, veterans, and their families. This focus allows USAA to tailor its products and services to the specific needs of military families, often resulting in highly competitive pricing and specialized benefits. Its conservative financial management approach, evident in its strong financial strength ratings (A++ from A.M. Best), provides further assurance to its members. This approach translates to a prudent risk assessment strategy, ensuring the company remains financially stable and capable of meeting its obligations. For those seeking a financially sound and service-oriented insurer, USAA presents a compelling option, particularly for those connected to the military.

USAA's conservative approach manifests in several ways, including its rigorous underwriting process. While this may lead to stricter qualification requirements for certain products, it also contributes to the company's overall financial stability and allows it to offer competitive pricing for those who qualify. This stability is a key factor for conservative individuals seeking long-term financial security. Beyond insurance, USAA provides a comprehensive suite of financial products, including banking, investment, and retirement services, all integrated within a single platform. This integrated approach simplifies financial management and caters to the holistic needs of its members.

For conservative American families, particularly those with military ties approaching retirement, USAA's integrated platform offers a convenient way to manage finances and prepare for the future. Health-conscious consumers benefit from USAA's life insurance options and potential discounts for healthy lifestyles, while budget-minded insurance shoppers will appreciate the competitive pricing often available on auto and home insurance. The company's long history of serving the military aligns well with patriotic individuals seeking to support organizations that share their values.

Features:

Member-owned structure serving the military community

Consistently high customer satisfaction ratings

Integrated banking, insurance, and investment services

Conservative financial management approach

Strong financial strength ratings (A++ from A.M. Best)

Pros:

Exceptional customer service consistently rated among the best

Products specifically designed for military members and families

Competitive pricing on many insurance products

Innovative digital tools and mobile app capabilities

Cons:

Membership restricted to military members, veterans, and their families

Limited physical branch locations

Conservative underwriting may result in stricter qualification requirements

Some specialized insurance products may be limited compared to larger insurers

Website: https://www.usaa.com/

USAA earns its place on this list because of its demonstrably conservative financial management, its unique member-focused approach, and its strong commitment to the military community. While membership restrictions apply, those eligible will find a financially strong and service-oriented institution dedicated to its members' long-term financial well-being.

8. American National

For conservative American families, individuals approaching retirement, and budget-minded insurance shoppers seeking a financially stable and dependable insurer, American National offers a compelling option. Founded in 1905, this company prioritizes conservative financial management and a diverse product portfolio, making it a solid choice for those who value stability and comprehensive coverage. Their approach resonates with a focus on long-term security rather than aggressive market expansion, appealing to those seeking a reliable, steady insurance partner. This commitment to conservative principles makes them a strong contender among other conservative insurance companies.

American National distinguishes itself from many large insurers by remaining a publicly traded company while adhering to conservative underwriting and investment practices. This balanced approach contributes to their strong financial ratings (A from A.M. Best) and consistent performance through various economic cycles, providing peace of mind to policyholders. Their diverse product offerings span multiple insurance lines, including life insurance, annuities, health insurance, property and casualty insurance, and even pension products. This "one-stop shop" approach allows customers to consolidate their insurance needs with a single, trusted provider. This is particularly attractive to those seeking to simplify their financial planning and prefer working with one company for multiple insurance needs.

For health-conscious consumers and those approaching retirement, American National's emphasis on long-term financial health is especially relevant. Their life insurance and annuity products can play a key role in retirement planning and estate preservation, offering a sense of security in uncertain times. The company’s conservative approach to risk management translates into predictable premiums and reliable payouts, appealing to those who prioritize financial stability. While American National may not have the same widespread name recognition as some industry giants, their personalized service and strong local presence through career and independent agents provide a more individualized customer experience. This personalized approach can be a significant advantage, especially for those who value direct communication and tailored advice.

Pros:

Financial stability and conservative risk management: Provides peace of mind regarding the company's long-term viability.

Comprehensive product portfolio for one-stop insurance shopping: Streamlines insurance management by consolidating multiple needs with a single provider.

More personalized service than many larger insurers: Offers a more tailored experience through local agents.

Strong presence in multiple insurance markets: Provides access to a wide range of products and services.

Cons:

Less name recognition than industry giants: May not be as instantly recognizable as some competitors.

Digital tools and customer interface less developed than industry leaders: Online experience may not be as sophisticated as some tech-forward insurers.

Fewer specialized product options compared to some competitors: Might not offer the same breadth of niche products as larger companies.

Products may have higher premiums due to conservative approach: The emphasis on financial security can sometimes translate to slightly higher prices.

Website: https://www.americannational.com/

In summary, American National earns its place on this list of conservative insurance companies by consistently prioritizing financial stability and offering a diverse range of insurance products. For those who prioritize a conservative approach and personalized service over cutting-edge digital tools and rock-bottom prices, American National represents a solid and dependable choice.

Conservative Insurance Companies Comparison

Provider | Core Features & Coverage | User Experience / Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

🏆 America First Financial | Term life, disability, annuities, long-term care, health plans | ★★★★☆ Fast quotes, no pushy follow-ups | 💰 Affordable, tailored for conservatives | 👥 Conservative & patriotic Americans | ✨ Values-driven, philanthropic giving |

New York Life | Whole life, term life, universal life, annuities | ★★★★★ Strong financial ratings | 💰 Higher premiums, dividend-paying | 👥 Traditional policyholders | ✨ Mutual company, 165+ years dividends |

Northwestern Mutual | Whole life, financial planning, annuities | ★★★★★ Top financial strength | 💰 Premiums higher, cash value growth | 👥 Clients seeking integrated planning | ✨ Nearly 150 years of dividends |

MassMutual | Whole life, disability, long-term care, annuities | ★★★★☆ Strong financial history | 💰 Premiums above average | 👥 Long-term planners, policyholders | ✨ 150+ years dividend payments |

Guardian Life | Life, disability, annuities, dental, vision | ★★★★☆ Excellent stability | 💰 Generally higher premiums | 👥 Broad customer base | ✨ Diverse benefits beyond life insurance |

State Farm | Auto, home, life, health insurance | ★★★★ Wide agent network | 💰 Competitive but sometimes higher | 👥 General public seeking bundled coverage | ✨ Extensive local agents, bundling |

USAA | Insurance, banking, investment for military | ★★★★★ Top-rated customer service | 💰 Competitive for military families | 👥 Military members, veterans & families | ✨ Military focus, strong digital tools |

American National | Life, annuities, health, property, pension | ★★★★ Stable with diverse products | 💰 Moderate premiums | 👥 Customers wanting personalized service | ✨ Public company, conservative approach |

Securing Your Future with Conservative Values

Choosing the right insurance company is a crucial decision, especially for conservative American families, individuals approaching retirement, and budget-minded insurance shoppers. This listicle has highlighted several leading conservative insurance companies, including America First Financial, New York Life, Northwestern Mutual, MassMutual, Guardian Life, State Farm, USAA, and American National, each offering unique strengths and catering to different needs. From financial stability and long-term value to a commitment to traditional principles, these companies provide compelling alternatives for those seeking insurance aligned with their conservative values.

Key takeaways include the importance of researching each company's financial strength, understanding their investment philosophies, and comparing policy options and premiums. When implementing the tools and resources mentioned, consider factors like your family’s size, risk tolerance, and long-term financial goals. Whether you prioritize mutual ownership structures like those found in Northwestern Mutual and Guardian Life or seek the military focus of USAA, finding the right fit ensures your financial security is in line with your principles.

Protecting your future and building a legacy requires careful planning and partnering with institutions you trust. By actively engaging with these resources and evaluating your options, you are taking control of your financial destiny and securing a brighter future for yourself and your loved ones. For those seeking a company deeply rooted in conservative values, explore America First Financial, a leading provider of financial services dedicated to aligning with the principles of its members. Learn more about how America First Financial can help protect your future by visiting America First Financial.

_edited.png)

Comments