Top Retirement Tax Strategies to Save More Today

- dustinjohnson5

- May 23

- 18 min read

Unlocking Tax-Smart Retirement

Retirement planning requires smart tax strategies to protect your savings. This listicle presents seven powerful retirement tax strategies to minimize your tax burden and maximize your retirement income. Learn how Roth conversions, tax-loss harvesting, QCDs, asset location, backdoor Roth IRAs, QLACs, and systematic withdrawal sequencing can help you keep more of your money. Whether you're just beginning or nearing retirement, these techniques can significantly impact your financial future.

1. Roth Conversion Ladder

A Roth conversion ladder is a powerful retirement tax strategy that allows you to convert funds from traditional pre-tax retirement accounts, like IRAs and 401(k)s, into a Roth IRA. This strategy offers the significant advantage of tax-free withdrawals in retirement, but requires careful planning to minimize the immediate tax implications. By strategically spreading these conversions over several years, you can control your tax liability while gradually building a nest egg of tax-free retirement assets. This “ladder” approach offers a way to access retirement savings before the typical age of 59½ without incurring the usual 10% early withdrawal penalty.

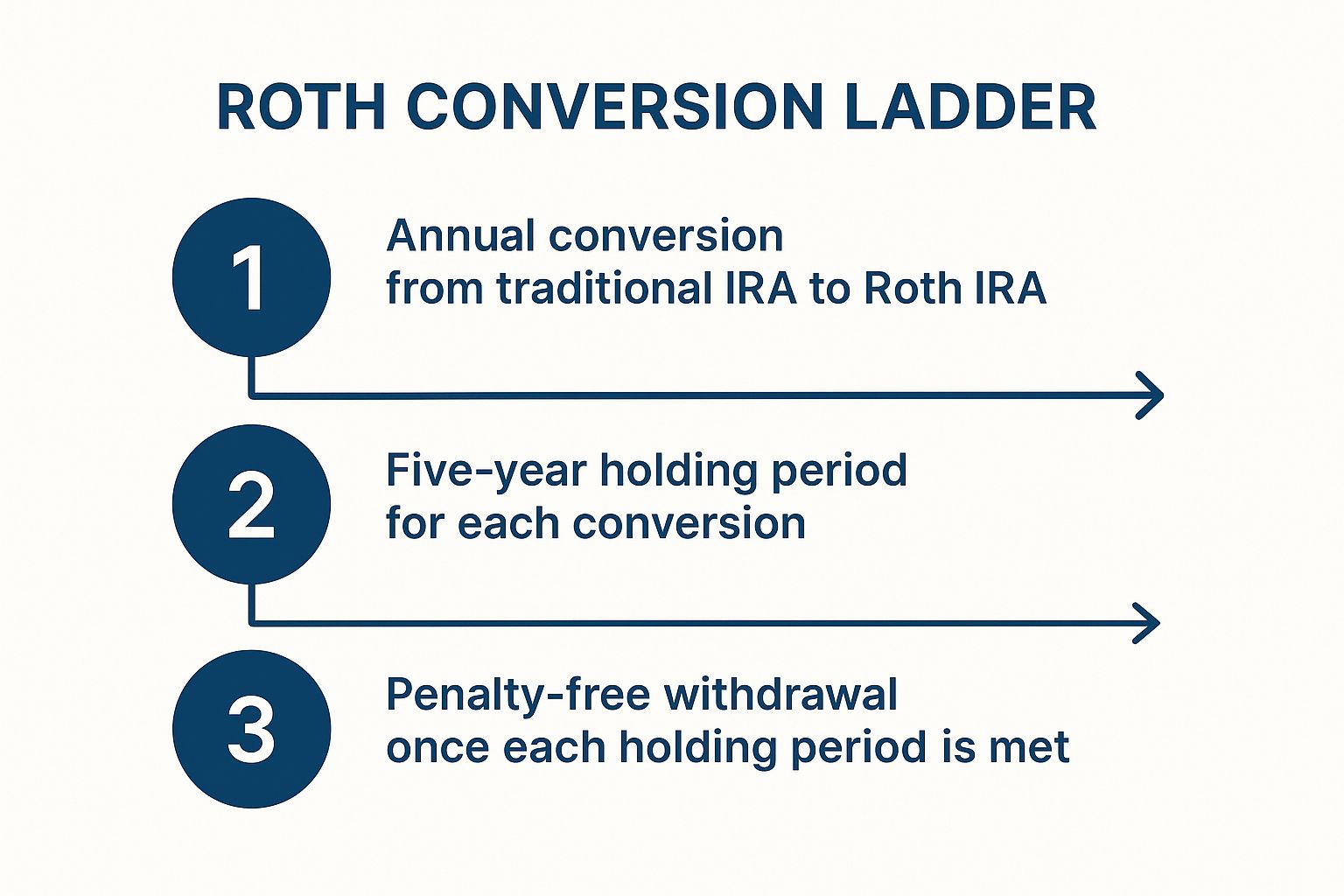

This infographic visualizes the process of a Roth Conversion Ladder, highlighting the five-year waiting period for each conversion before penalty-free withdrawals are allowed. Each rung on the ladder represents a conversion, clearly demonstrating how strategic annual conversions can create accessible funds over time.

The Roth conversion ladder deserves a place on this list of retirement tax strategies due to its potential for significant tax savings in retirement, particularly for those anticipating being in a higher tax bracket later in life. It's especially appealing to conservative American families and individuals approaching retirement who are looking for ways to protect their savings from future tax increases and maintain control over their finances.

How a Roth Conversion Ladder Works:

The process involves systematically converting a portion of your pre-tax retirement funds into a Roth IRA. Each conversion is treated as a separate event with its own five-year waiting period. Once that five-year period has elapsed for a given conversion, you can withdraw both the contributions and the earnings tax-free.

Key Features and Benefits:

Tax-Free Growth and Withdrawals: Enjoy tax-free growth and withdrawals in retirement.

Early Access to Funds: Access funds before 59½ without penalty after the five-year waiting period.

Reduced RMDs: Minimize required minimum distributions (RMDs) in retirement, allowing greater flexibility in managing your finances.

Mitigates Tax Rate Uncertainty: Offers protection against potential future tax increases.

Pros and Cons:

Pros:

Minimizes tax impact by spreading conversions over multiple years.

Creates tax-free growth and withdrawals in retirement.

Provides a strategy for early retirees to access funds.

Reduces required minimum distributions (RMDs) later in retirement.

Helps mitigate future tax rate uncertainty.

Cons:

Converted amounts are subject to income tax in the year of conversion.

Requires a five-year waiting period for each conversion.

Increases adjusted gross income in conversion years, potentially affecting other tax benefits.

Requires detailed record-keeping and tax planning.

May not be beneficial if your retirement tax bracket will be significantly lower.

Examples of Successful Implementation:

A 50-year-old planning to retire at 55 begins converting $40,000 annually from a traditional IRA to a Roth IRA. This creates a ladder of accessible funds starting at age 60 without penalties.

A couple in the 22% tax bracket strategically converts just enough each year to avoid pushing themselves into the 24% bracket, thereby minimizing their current tax liability while still benefiting from future tax-free growth.

Actionable Tips:

Strategic Timing: Consider conversions in years with unusually low income, such as during a career break or after retirement but before starting Social Security.

Optimal Conversion Amount: Calculate the optimal conversion amount that keeps you in your current tax bracket to minimize your immediate tax liability.

Detailed Record-Keeping: Maintain meticulous records of conversion dates and amounts for each “rung” of the ladder.

State Tax Implications: Consider state tax implications in addition to federal taxes. Some states don't recognize the tax benefits of Roth conversions.

Professional Guidance: Work with a qualified tax professional to model different scenarios and determine the best strategy for your specific situation.

This video further explains the intricacies of the Roth Conversion Ladder, offering valuable insights into its implementation and benefits.

The Roth Conversion Ladder, popularized by financial independence bloggers like the Mad Fientist and frequently recommended by financial advisors specializing in early retirement, is a valuable tool for anyone seeking to optimize their retirement tax strategy. With careful planning and execution, it can provide a secure pathway to a tax-advantaged retirement.

2. Tax-Loss Harvesting

Tax-loss harvesting is a powerful retirement tax strategy that allows you to strategically reduce your tax liability by offsetting capital gains with realized investment losses. It works by selling investments that have decreased in value, realizing a loss that can be used to counterbalance profits made on other investments. This can significantly lower your overall tax burden, leaving you with more money to enjoy during retirement. Not only does this strategy minimize taxes in the present, but unused losses can be carried forward indefinitely, offering potential tax benefits in future years as well. This makes tax-loss harvesting an important tool for maximizing your after-tax returns, a key element of any comprehensive retirement plan.

This strategy deserves a place on any list of retirement tax strategies due to its potential for significant tax savings and portfolio optimization. Specifically, tax-loss harvesting lets you:

Offset Capital Gains and Ordinary Income: Realized losses can offset capital gains from the sale of profitable investments. Furthermore, you can offset up to $3,000 of ordinary income annually, directly reducing your tax bill.

Carry Forward Unused Losses: If your losses exceed your gains and the $3,000 ordinary income offset, the excess can be carried forward to future tax years, providing ongoing tax benefits.

Maintain Portfolio Allocation: By reinvesting the proceeds from the sale of losing investments into similar (but not identical) assets, you maintain your desired asset allocation and overall investment strategy.

Examples of Successful Implementation:

Offsetting Gains: Imagine you sell a stock that has appreciated significantly, resulting in a $20,000 capital gain. By simultaneously selling an investment that has declined by $20,000, you can completely offset the gain and avoid paying taxes on it.

Reducing Ordinary Income: A retiree in the 22% tax bracket experiences a market downturn and strategically harvests $3,000 in losses. This offsets their ordinary income, resulting in a $660 reduction in their tax bill.

Actionable Tips for Tax-Loss Harvesting:

Focus on Taxable Accounts: Tax-loss harvesting is most effective in taxable brokerage accounts. It doesn't apply to tax-advantaged retirement accounts like 401(k)s or IRAs.

Market Downturns are Opportunities: Periods of market volatility and corrections present excellent opportunities for tax-loss harvesting.

Mind the Wash-Sale Rule: Avoid repurchasing substantially identical securities within 30 days of selling them at a loss. This includes purchases within IRAs or Roth IRAs. Violating this rule negates the tax benefit.

Keep Detailed Records: Maintain accurate records of your purchase prices, sale dates, and replacement investments to simplify tax reporting and demonstrate compliance with the wash-sale rule.

Consider Professional Help: Tax-loss harvesting software or the services of a financial advisor can automate the process and help you navigate the complexities of the wash-sale rule.

Pros and Cons of Tax-Loss Harvesting:

Pros:

Reduced current-year tax liability

Portfolio rebalancing with tax benefits

Unused losses carry forward indefinitely

Particularly valuable in market downturns

Most effective for high-income investors

Cons:

Complexity of avoiding wash-sale rules

Transaction costs may offset some benefits

May interfere with long-term investment strategy if not carefully managed

Limited benefit for investors in lower tax brackets

Potential for tracking error when replacing investments

While tax-loss harvesting can be highly beneficial, it's important to understand both the advantages and disadvantages. For conservative American families, individuals approaching retirement, and budget-minded individuals, the potential tax savings can be a valuable addition to a comprehensive retirement plan. However, the complexity of the wash-sale rule necessitates careful planning and record-keeping. Consult with a financial advisor to determine if tax-loss harvesting aligns with your individual financial goals and risk tolerance.

3. Qualified Charitable Distributions (QCDs)

Qualified Charitable Distributions (QCDs) offer a powerful retirement tax strategy, particularly for charitably-inclined individuals age 70½ and older. This method allows you to donate up to $100,000 annually directly from your Individual Retirement Account (IRA) to a qualified charity. Instead of taking a distribution and then donating separately, a QCD transfers the funds directly, satisfying your Required Minimum Distribution (RMD) requirements while excluding the donated amount from your taxable income. This makes QCDs a more tax-efficient way to support your favorite causes while managing your retirement income.

QCDs offer several key advantages for retirees. Unlike a standard charitable deduction, which lowers your taxable income, a QCD reduces your adjusted gross income (AGI). This is particularly impactful because a lower AGI can lead to lower Medicare premiums (specifically, the Income-Related Monthly Adjustment Amount, or IRMAA). Additionally, a lower AGI can help keep your income below the thresholds for Social Security taxation, preserving more of your benefits. For conservative American families and budget-minded individuals approaching retirement, these benefits can be significant. Even if you don't itemize deductions, QCDs provide a tax advantage, making them an effective strategy for a broad range of retirees.

Examples of QCDs in Action:

A 75-year-old retiree with a $30,000 RMD directs $15,000 directly to her church through a QCD. This reduces her taxable RMD amount to $15,000.

A married couple, both over 70½, each uses QCDs to donate $50,000 annually to their alma mater. This significantly reduces their taxable income while simultaneously fulfilling their RMD requirements.

Pros of Using QCDs:

Reduces AGI: This is more beneficial than a standard deduction as it impacts calculations for Medicare premiums and Social Security taxation.

Lowers Medicare Premium Surcharges (IRMAA): Helps control healthcare costs in retirement.

May Reduce Social Security Taxation: Preserves more of your hard-earned benefits.

Satisfies RMD Requirements: Meets IRS requirements without increasing taxable income.

Effective Even Without Itemizing: Benefits taxpayers regardless of their deduction strategy.

Cons of Using QCDs:

Not Available for 401(k)s: Funds must be rolled over to a traditional IRA first.

No Additional Tax Deduction: The benefit comes from the AGI reduction, not a separate deduction.

No Benefits in Return: The donor cannot receive any goods or services from the charity in exchange for the QCD.

Limited to Qualified Charities: Not all charitable organizations are eligible.

Requires Direct Transfer: The IRA custodian must transfer the funds directly to the charity.

Tips for Utilizing QCDs:

Request distributions early in the year: This ensures timely processing and allows you to meet RMD deadlines.

Obtain written acknowledgment from the charity: This documentation is essential for your tax records.

Coordinate with your IRA custodian: Each custodian has specific procedures for processing QCDs.

Consider "bunching" charitable giving: If you're close to the AGI thresholds for IRMAA or Social Security taxation, concentrating multiple years of giving into a single year might maximize the benefits.

Evaluate QCD vs. itemized deduction: Depending on your individual tax situation, one strategy may be more beneficial than the other. Consult with a financial advisor to determine the best approach for you.

QCDs deserve a place on this list of retirement tax strategies because they offer a unique and effective way to manage taxable income while supporting charitable causes. For patriotic individuals and those concerned with health and budget, QCDs can be a valuable tool for optimizing retirement finances. Popularized by organizations like AARP and financial experts like Ed Slott, QCDs represent a smart strategy for many retirees.

4. Asset Location Optimization

Asset location optimization is a powerful retirement tax strategy that can significantly enhance your after-tax returns without increasing your investment risk. It involves strategically placing your investments across different account types – taxable brokerage accounts, tax-deferred accounts like traditional IRAs and 401(k)s, and tax-free accounts like Roth IRAs – based on their tax efficiency. By thoughtfully coordinating where your assets are held, you can minimize the impact of taxes on your overall investment growth and keep more of your hard-earned money.

This strategy hinges on understanding how different investments are taxed. Some investments, like high-yield bonds and real estate investment trusts (REITs), generate significant taxable income. Others, like municipal bonds and broadly diversified index funds, are relatively tax-efficient. Asset location optimization aims to hold tax-inefficient investments within the sheltered environment of tax-deferred or tax-free accounts, while keeping tax-efficient investments in taxable accounts where their tax advantages can be fully realized. This allows you to maintain your desired overall asset allocation while minimizing your tax burden.

Examples of Successful Implementation:

Scenario 1: A conservative investor might hold high-yield bonds and REITs in a traditional IRA to defer taxes on the income they generate. Meanwhile, they might hold municipal bonds (which are often tax-free) and a low-cost S&P 500 index fund in a taxable brokerage account.

Scenario 2: An individual focused on long-term growth might hold growth stocks in a Roth IRA. This allows the growth to compound tax-free, and qualified withdrawals in retirement are also tax-free.

Scenario 3: A retiree with $2 million spread across various account types could potentially boost their returns by 0.5% annually through proper asset location. This translates to an additional $10,000 per year – a significant sum that can enhance their retirement lifestyle.

Actionable Tips for Asset Location Optimization:

Tax-Inefficient Assets in Tax-Advantaged Accounts: Generally, prioritize placing investments that generate high taxable income, such as high-yield bonds, REITs, and actively managed mutual funds with high turnover, in tax-deferred accounts like traditional IRAs and 401(k)s.

Growth in Roth Accounts: Consider holding growth stocks and other assets with high growth potential in Roth accounts to maximize tax-free compounding.

Tax-Efficient Assets in Taxable Accounts: Place tax-efficient investments, such as index funds, ETFs, municipal bonds, and dividend-paying stocks with qualified dividends, in your taxable accounts.

Rebalance Smartly: When rebalancing your portfolio, aim to do so through new contributions rather than selling existing holdings. This can minimize taxable events.

Stay Informed: Tax laws can change, so it's crucial to review your asset location strategy periodically and consult with a financial advisor to ensure it remains aligned with your goals and the current tax environment.

Pros and Cons of Asset Location Optimization:

Pros:

Significantly increased after-tax returns (estimated 0.20-0.75% annually).

No additional investment risk is required.

Works regardless of market direction.

Becomes more valuable as your portfolio grows.

Combines well with other tax strategies.

Cons:

Increases the complexity of portfolio management.

May make rebalancing slightly more difficult.

Benefits accrue gradually over long periods.

Can complicate withdrawal strategies in retirement.

Requires multiple account types to implement effectively.

Why Asset Location Matters for Retirement:

For conservative American families, individuals approaching retirement, and budget-minded individuals, asset location optimization offers a valuable way to improve long-term returns without taking on additional risk. It deserves a place on this list of retirement tax strategies because it provides a tangible benefit – more money in your pocket during retirement – through careful planning and coordination. By understanding the tax implications of your investments and strategically placing them across different account types, you can maximize your after-tax returns and secure a more comfortable retirement. As championed by Vanguard, Morningstar's Christine Benz, and Michael Kitces, asset location is a key component of a comprehensive retirement plan.

5. Backdoor Roth IRA Conversion

For those seeking to maximize tax-advantaged retirement savings, the Backdoor Roth IRA conversion stands out as a powerful strategy, especially for high-income earners. This approach allows individuals and families who exceed the Roth IRA income limits to indirectly contribute to a Roth IRA and reap its considerable tax benefits. This makes it a valuable addition to any comprehensive list of retirement tax strategies.

How it Works:

The Backdoor Roth IRA conversion is a two-step process:

Non-deductible Traditional IRA Contribution: You contribute to a traditional IRA, but because your income is above the Roth IRA limits, you don't get to deduct this contribution from your taxes. This is crucial – it sets the stage for tax-free growth later. The annual contribution limit is $7,000 for 2024 (or $8,000 if age 50 or older).

Roth IRA Conversion: Shortly after contributing to the traditional IRA, you convert the funds into a Roth IRA. Because you already paid taxes on the contributed amount (it was non-deductible), you’ll owe little to no taxes on the conversion if you don't have any other pre-tax IRA balances. This avoids the "pro-rata rule," which can trigger taxes on the conversion.

Examples:

A physician earning $300,000 annually contributes $7,000 to a non-deductible traditional IRA and converts it to a Roth IRA one month later. This allows them to bypass the Roth IRA income limits and build tax-free savings.

A married couple, both high earners, collectively contribute and convert $14,000 annually ($7,000 each) into Roth IRAs using the backdoor strategy.

When and Why to Use This Approach:

The Backdoor Roth IRA conversion is ideal for:

High-income earners: Those whose income exceeds the limits for direct Roth IRA contributions.

Individuals seeking tax-free retirement income: Roth IRA withdrawals in retirement are tax-free, offering significant advantages over traditional IRAs.

Long-term savers: The longer the money remains in the Roth IRA, the greater the tax benefits accumulate.

Features and Benefits:

Tax-Free Growth and Withdrawals: Earnings within the Roth IRA grow tax-free, and withdrawals in retirement are also tax-free.

No RMDs: Unlike traditional IRAs, Roth IRAs have no required minimum distributions (RMDs) during the owner's lifetime, providing more flexibility in retirement.

Estate Planning Advantages: Roth IRAs offer tax-free inheritance for beneficiaries.

Pros and Cons:

Pros:

Creates tax-free growth and withdrawals in retirement.

No income limitations when executed properly.

No RMDs during the owner's lifetime.

Provides estate planning advantages.

Can be repeated annually.

Cons:

Pro-rata rule: If you have existing pre-tax IRA balances, the conversion can become taxable. This is the biggest potential pitfall and requires careful planning.

Requires careful documentation and tax reporting: Form 8606 is required to report non-deductible contributions.

Step-transaction doctrine: A theoretical legal risk (though rarely enforced).

Potential future legislative changes: Roth IRA rules could change.

Actionable Tips:

Wait a reasonable period (at least a few days) between the contribution and conversion.

File Form 8606 to report non-deductible contributions.

Consider rolling existing traditional IRA balances into a 401(k) or other employer-sponsored plan before executing the backdoor Roth. This avoids the pro-rata rule.

Keep meticulous records of all transactions.

Consult with a qualified tax professional, especially the first time you implement this strategy.

The Backdoor Roth IRA conversion is a powerful tool for retirement tax planning, particularly for those with higher incomes. While it requires careful execution and attention to detail, the potential for tax-free retirement income makes it a strategy worth considering.

6. QLAC (Qualified Longevity Annuity Contract): Secure Your Future with Guaranteed Income

Managing taxes in retirement is crucial for preserving your hard-earned savings. A Qualified Longevity Annuity Contract (QLAC) offers a unique strategy within your broader retirement tax plan, providing guaranteed income later in life while potentially reducing your current tax burden. This makes it a valuable tool for conservative American families, individuals approaching retirement, and budget-minded insurance shoppers seeking to maximize their retirement resources.

A QLAC is a type of deferred income annuity purchased with funds from qualified retirement accounts, such as IRAs and 401(k)s. It allows you to postpone taking required minimum distributions (RMDs) on a portion of your retirement savings, effectively lowering your taxable income in your early retirement years. This deferred amount then grows tax-deferred until payments begin, typically between age 75 and 85, providing a predictable income stream during advanced age.

How it Works:

You allocate a portion of your retirement savings, up to $200,000 or 25% of your retirement account balance (whichever is less – as of 2024), to purchase a QLAC. This money is then used to purchase a contract with an insurance company. You select the age at which you want income payments to begin, and the insurance company calculates the guaranteed monthly or annual payments you'll receive for the rest of your life. Because the money used to purchase the QLAC is no longer subject to RMDs until payments begin, your taxable income is reduced during the deferral period.

Examples:

A 70-year-old retiree invests $200,000 from her IRA into a QLAC that will begin payments at age 85. This could reduce her annual RMDs by approximately $10,000, lessening her tax liability and potentially lowering Medicare premium surcharges.

A married couple, both 65, each purchases a $150,000 QLAC. By setting income to begin at age 80, they reduce their taxable income throughout their 70s and secure guaranteed income to cover potential future healthcare costs.

Pros:

Reduces taxable RMDs: Lowering your RMDs means less taxable income, which can help you manage your tax bracket in early retirement. This can be especially beneficial for those who anticipate being in a higher tax bracket during their early retirement years.

Provides insurance against longevity risk: A QLAC offers peace of mind, guaranteeing lifetime income even if you outlive your other savings.

Creates predictable income for advanced ages: Knowing you have a guaranteed income stream can alleviate financial anxieties about covering expenses later in life, particularly healthcare costs.

Potential for lower Medicare premiums: Reducing your taxable income through a QLAC may help lower your Medicare Part B and Part D premiums, which are based on income.

Cons:

Limited liquidity: QLACs typically offer no access to the principal once purchased.

Lower returns compared to market investments: The guaranteed nature of a QLAC comes at the cost of potentially lower returns compared to market investments.

Inflation risk: The purchasing power of your guaranteed income can be eroded by inflation unless you purchase an inflation rider, which will likely reduce your initial payout.

Insurance company credit risk: The ability of the insurance company to fulfill its obligations is dependent on its financial strength.

Tips for Utilizing QLACs as a Retirement Tax Strategy:

Compare quotes: Get quotes from multiple highly-rated insurance companies to ensure you're getting the best possible rates and terms.

Consider inflation protection: If concerned about inflation, explore inflation-adjusted QLACs to maintain purchasing power.

Check insurance company ratings: Review the financial strength ratings of the insurance provider before purchasing a contract.

Calculate RMD impact: Work with a financial advisor to determine the precise impact a QLAC will have on your RMDs and overall tax situation.

Maximize benefits for married couples: Spouses can each purchase their own QLAC, maximizing the total amount of retirement funds sheltered from immediate RMDs.

QLACs offer a valuable tool within a comprehensive retirement tax strategy, appealing to those prioritizing guaranteed income and tax management in later retirement. By understanding the features, benefits, and potential drawbacks, you can decide if incorporating a QLAC into your plan aligns with your individual financial goals and risk tolerance. Consult with a financial advisor to determine if a QLAC is the right fit for your unique retirement needs.

7. Systematic Withdrawal Sequencing: A Smart Retirement Tax Strategy

Systematic withdrawal sequencing is a crucial retirement tax strategy that can significantly impact the longevity of your retirement nest egg. It involves a structured approach to withdrawing funds from different retirement accounts in a specific order to minimize your tax burden and maximize the growth potential of your savings. This methodical approach is particularly beneficial for conservative American families and individuals approaching retirement who are focused on preserving their wealth and ensuring a comfortable retirement.

How it Works:

The core principle of systematic withdrawal sequencing revolves around strategically tapping your retirement accounts in a specific order:

Taxable Accounts: These accounts, such as brokerage accounts, are generally taxed at lower capital gains rates, especially if assets have been held for longer than a year. Depleting these first allows your tax-deferred and tax-free accounts to continue growing unburdened by taxes.

Tax-Deferred Accounts: Accounts like traditional 401(k)s and IRAs are next. Withdrawals from these accounts are taxed as ordinary income. By delaying withdrawals from these accounts, you maximize tax-deferred growth.

Tax-Free Accounts: Roth IRAs and Roth 401(k)s are the last to be tapped. Since qualified withdrawals from these accounts are tax-free, preserving them allows for the greatest long-term, tax-free growth.

Examples of Successful Implementation:

A retiree might spend down their taxable brokerage account first, allowing their traditional IRA to continue growing tax-deferred for another decade. This strategy maximizes tax-deferred growth and potentially reduces the overall tax burden.

A couple nearing retirement could strategically harvest capital gains at the 0% rate from their taxable accounts before starting withdrawals from their tax-deferred accounts, significantly minimizing their tax liability in the early years of retirement.

Benefits of Systematic Withdrawal Sequencing:

Extended Portfolio Longevity: Studies suggest that systematic withdrawal sequencing can extend the life of a portfolio by 2-3 years compared to random withdrawals.

Tax-Deferred Growth Maximization: Delaying withdrawals from tax-deferred accounts allows for continued tax-advantaged growth, compounding your returns over time.

Structured Framework: This strategy provides a methodical approach for managing complex withdrawal decisions.

Reduced Lifetime Tax Burden: By strategically managing withdrawals, you can potentially lower your overall tax liability throughout retirement.

Tax Bracket Management: Carefully timed withdrawals can help you stay within lower tax brackets, minimizing your annual tax payments.

Pros and Cons:

Pros:

Can extend portfolio longevity.

Maximizes tax-deferred growth.

Provides a methodical framework.

Can reduce lifetime tax burden.

Helps manage tax brackets.

Cons:

May not be optimal in all market conditions.

Requires ongoing monitoring and potential adjustments.

Standard sequence may conflict with estate planning goals.

Can be complex with multiple account types.

May need modification as tax laws change.

Actionable Tips:

Incorporate RMDs: Factor required minimum distributions (RMDs) from traditional IRAs and 401(k)s into your withdrawal strategy.

Tax-Gain Harvesting: Consider tax-gain harvesting in taxable accounts during low-income years to minimize capital gains taxes.

Cash Reserves: Maintain sufficient cash reserves to avoid forced selling during market downturns.

Annual Review: Revisit and potentially adjust your strategy annually based on portfolio performance and changes in tax laws.

Roth Conversions: Consider partial Roth conversions during the early retirement years, especially during periods of lower income, before RMDs begin. This converts taxable assets to tax-free assets for future withdrawals.

Why This Strategy Deserves Its Place:

For budget-minded individuals and families, especially those nearing retirement, systematic withdrawal sequencing offers a powerful framework for making informed decisions about retirement withdrawals. This strategy allows you to proactively manage your tax liability, potentially extending the life of your portfolio and ensuring a more secure financial future. By incorporating this essential retirement tax strategy, you can gain more control over your finances and enjoy a more comfortable and predictable retirement. This is particularly important for health-conscious consumers and patriotic individuals who value financial stability and self-reliance.

Retirement Tax Strategies Comparison

Strategy | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes ⭐📊 | Ideal Use Cases 💡 | Key Advantages ⚡⭐ |

|---|---|---|---|---|---|

Roth Conversion Ladder | High – multi-year tax planning & record-keeping | Moderate – tax professional recommended | Tax-free growth and penalty-free early access | Early retirees, those managing tax brackets over time | Minimize tax impact, early fund access, reduce RMDs |

Tax-Loss Harvesting | Moderate – requires careful trade timing and wash sale avoidance | Moderate – tracking software helpful | Reduced tax liability and portfolio rebalancing | Investors in taxable accounts, high-income earners in volatile markets | Offsets gains/income, portfolio tax efficiency |

Qualified Charitable Distributions (QCDs) | Low – involves direct IRA-to-charity transfers | Low – coordination with custodian and charity | Lower taxable income and satisfy RMDs | Retirees 70½+, charitably inclined | AGI reduction, satisfies RMDs without added taxable income |

Asset Location Optimization | Moderate – requires coordination across accounts and ongoing reviews | Low to moderate – portfolio management tools | Higher after-tax returns over time | Investors with multiple account types and large portfolios | Increases after-tax returns without added risk |

Backdoor Roth IRA Conversion | Moderate – two-step process with tax reporting complexity | Moderate – tax reporting and possible rollovers | Tax-free growth without income limits | High-income earners exceeding Roth IRA limits | Bypass income limits, estate planning benefits |

QLAC (Qualified Longevity Annuity Contract) | Moderate – requires insurer comparison and RMD calculation | Moderate – requires insurance purchase | Guaranteed income late in life, reduces early RMDs | Retirees seeking longevity income and RMD deferral | Longevity insurance, reduces taxable RMD burden |

Systematic Withdrawal Sequencing | High – ongoing monitoring and tax-aware decisions | Moderate – may need financial advisor | Extended portfolio longevity and tax efficiency | Retirees managing multi-account portfolios | Extends portfolio life, reduces lifetime taxes |

Securing Your Financial Future with Strategic Tax Planning

Smart retirement tax strategies are crucial for preserving your hard-earned savings and enjoying a comfortable retirement. This article explored several key strategies, including Roth conversions, tax-loss harvesting, Qualified Charitable Distributions (QCDs), optimizing asset location, Backdoor Roth IRA conversions, QLACs, and strategic withdrawal sequencing. Mastering these retirement tax strategies can significantly reduce your tax burden, allowing your savings to grow more effectively and providing you with greater financial security throughout your retirement years. These strategies empower you to keep more of what you've earned, ensuring you can maintain your lifestyle and enjoy the fruits of your labor. Remember, proactive planning is key to minimizing taxes and maximizing your retirement income, ultimately safeguarding your financial well-being and leaving a lasting legacy for your family.

For patriotic Americans seeking personalized guidance on implementing these strategies and securing their financial future, America First Financial offers a range of products and services designed to protect your assets and maximize your retirement income. Learn more about how America First Financial can help you develop a comprehensive retirement tax strategy by visiting America First Financial today.

_edited.png)

Comments