Top Tips for Handling Insurance Company Complaints Today

- dustinjohnson5

- May 29, 2025

- 18 min read

Decoding the Top Insurance Company Complaints

Understanding common insurance company complaints is crucial for protecting your finances and well-being. This listicle reveals the top six complaints against major insurers like State Farm, GEICO, Progressive, Allstate, Liberty Mutual, and Farmers Insurance. Learn about these common insurance company complaints to avoid potential issues and ensure you're getting the coverage you deserve. This knowledge empowers you to make informed decisions, whether you're a long-time policyholder or shopping for a new policy.

1. State Farm

State Farm, a name synonymous with insurance for many American families, holds the largest market share in the auto insurance industry. This widespread presence, coupled with an extensive network of local agents, makes State Farm a readily accessible option for individuals seeking various insurance products, including auto, home, life, and health. However, its considerable size also contributes to its position as one of the most complained-about insurers. This isn't necessarily an indicator of poor service quality, but rather a consequence of serving a massive customer base. Understanding the nuances of State Farm's strengths and weaknesses is crucial for making informed insurance decisions.

State Farm's appeal lies in its established reputation, competitive rates (for many customers), and comprehensive coverage options. Their strong financial stability ratings provide reassurance to policyholders, and their commitment to customer loyalty is often praised. The company boasts a robust digital presence, offering convenient online tools for claim filing and tracking, complemented by 24/7 customer service availability. The extensive network of local agents allows for personalized service and face-to-face interactions, a feature particularly valued by conservative American families and individuals approaching retirement who prefer traditional service models.

However, navigating the complexities of a large organization like State Farm can sometimes present challenges. The high volume of customers inevitably leads to a high volume of complaints, frequently concerning claim denials, delayed payments, and premium increases. While some of these issues are statistically inevitable due to sheer volume, others stem from specific company practices. For instance, their rigid underwriting guidelines can lead to coverage denials, which can be particularly frustrating for budget-minded insurance shoppers. Additionally, some customers report difficulty reaching agents during peak times, a potential inconvenience for those who value quick access to support. Common complaints include disputed liability determinations in auto accidents, homeowners struggling with water damage claim denials, and customers citing premium increases after filing claims. These experiences highlight the importance of carefully reviewing policy terms and maintaining thorough documentation throughout the claims process.

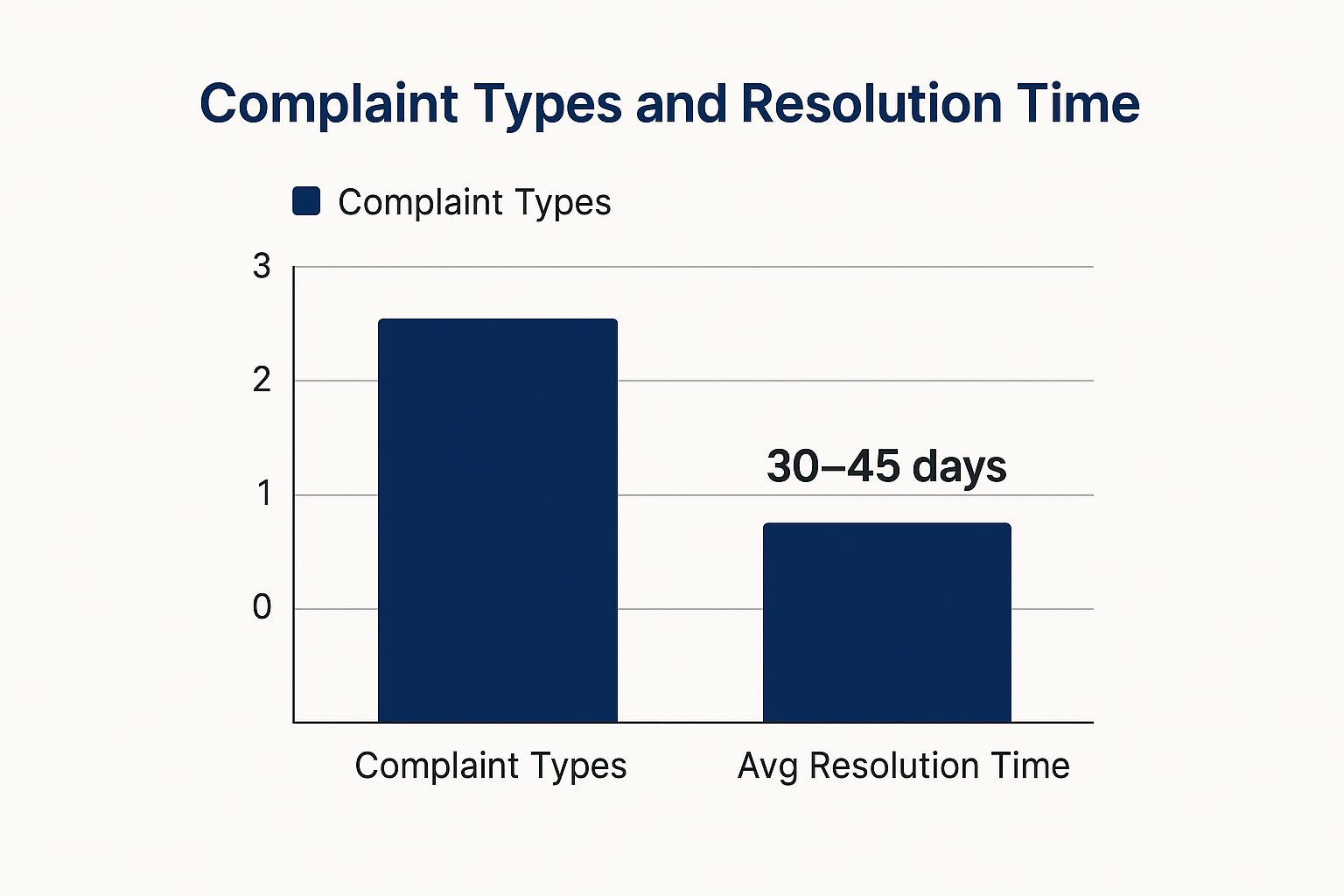

This infographic visualizes key data related to State Farm complaint types and average resolution times:

The simple bar chart highlights that while State Farm has a variety of complaint types (represented by a value of 3), the average resolution time falls between 30-45 days, indicating a potentially lengthy process for resolving issues. This reinforces the need for patience and diligent record-keeping.

So, when and why should you consider State Farm? If you prioritize widespread availability, agent accessibility, and a company with a long-standing history, State Farm might be a good fit. Bundling policies for potential discounts can be particularly attractive to budget-conscious consumers and families. However, be prepared to potentially navigate a complex claims process and be proactive in documenting all communications.

For health-conscious consumers seeking comprehensive health insurance options, exploring State Farm's offerings can be worthwhile. However, understanding the specifics of coverage and potential limitations is crucial. Similarly, patriotic individuals drawn to State Farm's prominent presence in American communities should weigh the benefits of local agent support against the potential drawbacks associated with a large corporation.

To navigate the State Farm experience effectively, consider these actionable tips:

Document everything: Maintain detailed records of all communications with agents and claims representatives.

Review your policy: Carefully examine the terms and conditions of your policy before purchasing.

Bundle for discounts: Explore bundling options to potentially lower your premiums.

File promptly: Submit claims promptly and follow up regularly.

Use the mobile app: Leverage State Farm's mobile app for faster claim reporting and tracking.

By understanding the complexities of State Farm’s strengths and weaknesses, and by actively engaging in the management of your policy and claims, you can make a well-informed decision about whether State Farm aligns with your insurance needs.

2. GEICO

GEICO, the second-largest auto insurer in the United States, is a name synonymous with aggressive marketing and competitive rates. Their ubiquitous presence, fueled by memorable ad campaigns featuring the gecko Martin, has made them a household name. However, this popularity doesn't shield them from a significant volume of insurance company complaints, particularly concerning claim disputes and customer service quality. While GEICO excels at attracting customers with its promise of affordable premiums and convenient digital tools, the company's direct-to-consumer model often leaves policyholders frustrated when navigating the complexities of the claims process.

GEICO operates on a direct-to-consumer model, meaning they bypass independent agents and sell policies directly to customers. This approach contributes to lower overhead costs, which are often reflected in competitive premium rates. Their digital-first strategy emphasizes online sales, self-service options through their mobile app, and a streamlined 15-minute claim reporting promise. These features are undoubtedly attractive to budget-minded insurance shoppers and those comfortable navigating digital platforms.

However, this streamlined approach comes at a cost. The absence of local agents, a cornerstone of traditional insurance, creates a gap in personalized support, especially when complex claims arise. Customers often find themselves grappling with automated systems and impersonal customer service representatives, struggling to get their concerns adequately addressed. This lack of personal touch can be particularly challenging for conservative American families and individuals approaching retirement who may prefer the reassurance of a dedicated local agent to guide them through difficult situations.

The pros of choosing GEICO are clear: competitive rates, a quick and easy online purchasing process, a user-friendly mobile app with a range of self-service functionalities, 24/7 claim reporting availability, and the backing of a financially stable company (Berkshire Hathaway). These advantages appeal to budget-conscious consumers and those prioritizing efficiency and digital convenience.

However, the cons are equally noteworthy and contribute to GEICO's inclusion on this list of insurance company complaints. The limited local agent support can be a significant drawback when dealing with intricate claim situations. Furthermore, complaints about lowball settlement offers are common, particularly for total loss vehicle valuations and property damage claims, where disputes over repair costs are frequent. Injury claims often start with low initial settlement offers, requiring persistent negotiation. These practices can be particularly frustrating for health-conscious consumers who might face unexpected medical expenses after an accident.

For example, a customer whose vehicle was totaled might find GEICO's valuation significantly lower than independent appraisals. Similarly, disputes over property damage repair costs are a recurring theme in customer complaints. These situations underscore the need for meticulous documentation and potentially the assistance of a public adjuster.

So, when and why should you consider GEICO? If you are comfortable with digital platforms, prioritize cost savings, and primarily need basic coverage with minimal anticipated claim complexities, GEICO’s direct-to-consumer model and competitive rates might be a good fit. However, if you value personalized service, prefer the guidance of a local agent, or anticipate needing extensive claim support, you may want to explore other options.

To navigate the potential pitfalls of GEICO's claims process, consider these actionable tips:

Get independent appraisals: For significant property damage or total loss vehicle claims, secure independent appraisals to counter potential lowball offers.

Document everything: Meticulously document all interactions, damages, and expenses with photos, videos, and written records.

Be persistent: Follow up on your claim status regularly and don't hesitate to escalate issues to supervisors if needed.

Consider a public adjuster: For large property claims, a public adjuster can be invaluable in navigating the complexities and advocating for your best interests.

Utilize digital tools, but escalate complex issues: Take advantage of GEICO’s digital tools for routine tasks, but don't hesitate to seek direct communication with a representative or supervisor for complex issues.

While GEICO offers attractive premiums and convenient digital tools, it's crucial to be aware of the potential challenges associated with their direct-to-consumer model and claims handling practices. By understanding these potential issues and taking proactive steps, you can make an informed decision about whether GEICO is the right insurance provider for your needs. For official information and to explore their offerings, you can visit the GEICO website.

3. Progressive

Progressive Insurance, a major player in the auto insurance landscape, has built its reputation on innovation, particularly with its usage-based insurance and comparison shopping tools. However, this focus on technology and data-driven pricing hasn't come without its share of insurance company complaints. While Progressive offers attractive features and benefits, potential customers should be aware of the potential downsides before committing to a policy. Understanding these nuances can empower you to make informed decisions about your insurance coverage, protecting your family and your finances.

Progressive pioneered the concept of usage-based insurance with its Snapshot program. This program uses a small device plugged into your car's diagnostic port or a mobile app to monitor your driving habits, such as speed, braking, and mileage. The idea is to reward safe drivers with lower premiums. They also popularized online comparison shopping for insurance, allowing consumers to compare rates from multiple companies, including their own, through their website. This transparency initially disrupted the industry and remains a core component of their marketing strategy.

While Progressive has a reputation for quick claim response and immediate inspection services following an accident, the company also faces frequent complaints regarding its aggressive claim investigation practices. This can be particularly problematic in complex liability situations, such as multi-vehicle accidents, where determining fault can be challenging. Many customers have reported experiencing lengthy delays in settlement due to these investigations. Disputes over coverage determinations, particularly concerning medical payment coverage limits and policy exclusions, are also common complaints. This can leave policyholders feeling frustrated and financially vulnerable, especially after an accident.

For conservative American families, the emphasis on personal responsibility and data-driven pricing might initially seem appealing. However, the potential for rate increases due to Snapshot data and the possibility of protracted claim disputes can create financial uncertainty. Individuals approaching retirement, often on fixed incomes, need predictable expenses. The potential for fluctuating rates based on driving behavior and the risk of drawn-out claim settlements can be particularly concerning for this demographic. Budget-minded insurance shoppers, attracted by Progressive's competitive rates and comparison tools, should carefully scrutinize policy details and customer reviews to understand the potential for increased costs and claim difficulties. Even patriotic individuals, drawn to Progressive’s American roots and CEO Tricia Griffith's leadership, should be aware of potential negative experiences reported by other customers. For health-conscious consumers, it’s important to understand how medical payment coverage limits might impact their financial responsibility after an accident, especially given the potential for disputes with Progressive over these limits.

Features of Progressive Insurance:

Snapshot Usage-Based Insurance Program: Tracks driving habits to potentially lower premiums.

Name Your Price Tool: Allows customization of coverage to fit specific budget requirements.

Immediate Claim Response and Inspection Services: Aims to quickly assess and process claims.

Progressive Advantage Agency Network: Provides access to a network of independent agents.

Extensive Online Comparison and Shopping Tools: Facilitates comparing rates from multiple insurers.

Pros:

Innovative technology and pricing tools like Snapshot and Name Your Price.

Transparent comparison with competitor rates.

Quick claim response and processing.

Flexible coverage options and payment plans.

Potentially good rates for high-risk drivers.

Cons:

Aggressive claim investigation can delay settlements.

Frequent disputes over fault determination and coverage.

Usage-based programs may increase rates for some drivers.

Customer service quality can be inconsistent.

Complex policy language can lead to coverage disputes.

Examples of Complaints:

Snapshot program complaints regarding privacy concerns and unexpected rate increases.

Disputes over liability in multi-vehicle accidents, often leading to delayed settlements.

Disagreements over medical payment coverage limits and policy exclusions.

Tips for Dealing with Progressive:

Carefully review Snapshot data and understand how it affects your rates.

Maintain detailed accident scene documentation, including photos and witness information.

Thoroughly understand your policy exclusions before filing a claim.

Utilize their comparison tools, but independently verify coverage details with other insurers.

If a claim decision is disputed, appeal it through the proper channels. Don't be afraid to stand your ground and document everything.

Progressive (www.progressive.com) offers a variety of tools and features that can be attractive to consumers. However, it's crucial to weigh the potential benefits against the reported downsides. By understanding the potential for aggressive claim investigation practices and disputes over coverage, you can make a more informed decision about whether Progressive is the right insurance provider for you and your family. A well-informed consumer is a protected consumer.

4. Allstate

Allstate, one of the largest insurance providers in the United States, holds a significant market share, offering a wide range of insurance products from auto and home to life and business coverage. While its extensive product portfolio and nationwide agent network are attractive to many, Allstate also finds itself the subject of a significant number of insurance company complaints, particularly regarding claim denials and settlement amounts. This raises important considerations for consumers seeking reliable and trustworthy insurance protection, especially for those prioritizing financial security and peace of mind in their golden years or those shopping on a budget.

Allstate’s business model emphasizes cost control, which, while beneficial for their bottom line, has led to accusations of aggressive claim management strategies. These strategies, critics argue, prioritize minimizing payouts over fairly compensating policyholders. This has resulted in numerous complaints from customers who feel they have been unfairly denied legitimate claims or offered settlements far below the actual value of their losses. This is a crucial point for budget-minded insurance shoppers and those approaching retirement who need to ensure their coverage truly protects them in times of need.

The company boasts a comprehensive suite of insurance products, including auto, home, renters, life, and business insurance. Features such as the Drivewise usage-based insurance program, which offers potential discounts for safe driving habits, and the Allstate Motor Club roadside assistance program are attractive benefits for many. Furthermore, their extensive local agent network offers personalized service, which can be especially valuable for conservative American families who appreciate traditional, face-to-face interactions. They also offer convenient digital claim filing and tracking systems for those who prefer online management.

Pros:

Strong Financial Stability and Market Presence: Allstate's size and established history provide a sense of security for those seeking a reliable insurer. This is a particularly important factor for individuals approaching retirement, who need confidence in their insurer's long-term viability.

Extensive Agent Network for Local Support: The accessibility of local agents appeals to those who value personalized service and prefer building relationships with a trusted advisor within their community.

Variety of Discount Programs Available: Allstate offers numerous discounts, making it potentially appealing to budget-conscious consumers.

Comprehensive Coverage Options: The range of products allows customers to bundle different insurance needs with a single provider, potentially simplifying insurance management.

Cons:

Frequent Complaints about Claim Denials: The high volume of complaints related to claim denials is a serious concern for consumers who worry about the effectiveness of their coverage when disaster strikes.

Aggressive Litigation Against Claimants: Allstate's reputation for aggressive litigation tactics against claimants can be intimidating and discouraging, particularly for those unfamiliar with the legal system.

Higher than Average Complaint Ratios: Compared to other major insurers, Allstate often has higher complaint ratios, raising red flags for those seeking a company with a strong customer service record.

Premium Increases Often Disputed: Unexpected premium increases are a common source of frustration for policyholders, especially those on fixed incomes.

Complex Policy Terms and Exclusions: Understanding insurance policy language can be challenging. Complex terms and exclusions can create confusion and potentially lead to denied claims, especially in complex situations like hurricane or natural disaster damage.

Examples of Common Complaints:

Disputes over hurricane and natural disaster claims, often involving disagreements about covered damages and policy exclusions.

Conflicts regarding liability determination in auto accidents, which can lead to protracted legal battles.

Homeowner claims denied due to policy exclusions, leaving homeowners financially vulnerable.

Tips for Dealing with Allstate (or any insurer):

Thoroughly document all damages with photos and videos. This is crucial for supporting your claim and providing evidence of the extent of your losses.

Review policy exclusions annually with your agent. Understanding what is and isn't covered is essential for avoiding surprises during the claims process.

Consider hiring professional help for large or complex claims. A public adjuster or attorney can help navigate the claims process and ensure you receive a fair settlement.

Keep detailed records of all claim communications. Documenting every interaction with the insurance company creates a valuable record of your claim's progress and any disputes.

Understand your state's insurance complaint process. If you encounter difficulties with your claim, knowing how to file a complaint with your state's insurance department can be a powerful tool.

Allstate's prominent marketing campaigns featuring Dennis Haysbert and the "Mayhem" character have contributed to the company's brand recognition and popularity. However, consumers should weigh the advertising appeal against the significant number of insurance company complaints lodged against Allstate. While Allstate offers a range of products and features that might appeal to specific demographics, the potential for difficulties during the claims process underscores the importance of thorough research and careful consideration before choosing an insurance provider. This is particularly crucial for conservative American families, those approaching retirement, and budget-minded consumers who prioritize financial stability and reliable protection.

5. Liberty Mutual: Navigating the Maze of a Large Insurer

Liberty Mutual, a prominent name in the insurance landscape, frequently appears in discussions surrounding insurance company complaints. As a large mutual insurance company that has expanded significantly through acquisitions, Liberty Mutual presents a complex picture for consumers. While boasting a wide range of coverage options and a generally strong financial standing, it also grapples with challenges related to customer service consistency, claims processing, and communication across its diverse portfolio of brands. This makes understanding the intricacies of this insurance giant particularly important for consumers seeking reliable and efficient insurance coverage. This section will delve into the common complaints leveled against Liberty Mutual, explore the reasons behind these issues, and offer actionable advice for navigating this complex insurance provider.

Liberty Mutual operates under a mutual company structure, meaning it is owned by its policyholders. Theoretically, this structure should prioritize the long-term interests of its customers. However, the sheer size of Liberty Mutual, combined with its multiple subsidiaries and brands (including Safeco and General), often leads to a disconnect between this ideal and the actual customer experience. This contributes significantly to its inclusion on lists of insurance company complaints.

One of the most prominent complaints revolves around inconsistent customer service. Experiences can vary dramatically depending on the specific subsidiary or brand a customer interacts with. This inconsistency can be incredibly frustrating for policyholders who expect a uniform level of service across a single company. Furthermore, communication breakdowns between different departments within Liberty Mutual frequently exacerbate customer service issues. Customers report being shuffled between representatives, often encountering individuals who lack the authority to resolve their problems. This can create a sense of helplessness and contribute to the perception that Liberty Mutual is unresponsive to customer needs.

Claim handling delays constitute another major source of complaints. While Liberty Mutual offers various appealing coverage options, such as accident forgiveness and new car replacement, the actual claims process can be drawn-out and cumbersome. Customers frequently report lengthy investigations for commercial property claims and delays in auto claims due to internal processing issues. This can be particularly distressing for individuals and businesses relying on timely claim settlements to recover from unforeseen events.

So, when and why should you consider Liberty Mutual despite these complaints? The company does offer some significant advantages. Their comprehensive coverage options and add-ons, along with generally competitive rates in many markets, make them an attractive option for those seeking a wide range of insurance products. Their strong financial backing and stability also provide a degree of reassurance, particularly for conservative American families and individuals approaching retirement seeking security. They offer good commercial and specialty insurance options, which might appeal to business owners. Furthermore, their RightTrack usage-based insurance program can offer potential savings for safe drivers.

However, it's crucial to be aware of the potential pitfalls and take proactive steps to mitigate them. Here are some practical tips:

Clarify which Liberty Mutual entity holds your policy: Understanding the specific subsidiary managing your policy can help streamline communication and avoid confusion.

Escalate issues quickly: If initial customer service representatives are unable to assist, don't hesitate to escalate the issue to a supervisor or manager.

Maintain meticulous records: Keep detailed records of all policy changes, payments, and communications with Liberty Mutual. This documentation can prove invaluable in case of disputes.

Use certified mail for important claim documentation: This ensures proof of delivery and helps prevent documents from getting lost in the system.

Consider working with independent agents: Independent insurance agents often have experience navigating the complexities of large insurers like Liberty Mutual and can advocate for their clients.

For more information, visit the Liberty Mutual website: https://www.libertymutual.com/

In conclusion, while Liberty Mutual offers a breadth of insurance products and generally competitive pricing, potential customers, especially budget-minded insurance shoppers, should carefully weigh the pros and cons before making a decision. Understanding the potential for inconsistent customer service, claims processing delays, and communication issues, and taking proactive steps to mitigate these risks, is crucial for a positive experience with this insurance giant. If you prioritize clear communication and efficient claims processing, it's vital to consider these factors and weigh them against the benefits Liberty Mutual offers.

6. Farmers Insurance: Navigating the Agent-Based System

Farmers Insurance, a well-established name in the American insurance landscape, often finds itself on lists of insurance company complaints. While it boasts a long history and a strong presence, particularly in the western United States, its unique structure contributes to both its strengths and weaknesses. Understanding these nuances is crucial for anyone considering Farmers Insurance, especially those prioritizing consistent service and clear communication. This detailed look at Farmers will help you navigate the potential pitfalls and leverage the advantages of their agent-based system.

Farmers Insurance operates through a network of independent agents. This decentralized model distinguishes it from companies with direct-to-consumer sales and can be a double-edged sword. While it fosters a sense of personalized local service, the quality of that service hinges heavily on the individual agent. This reliance on independent agents often leads to inconsistencies in claim handling, coverage disputes, and communication breakdowns between agents and the corporate claims department, ultimately contributing to its inclusion on insurance company complaints lists.

This agent-based approach appeals to many, particularly those who value local relationships and personalized service. Conservative American families, for example, often appreciate the face-to-face interaction and trust built with a local agent. Individuals approaching retirement may also find comfort in having a dedicated agent to guide them through complex insurance decisions.

However, this localized structure can also be a source of frustration. Communication gaps between the independent agent and Farmers' corporate claims department can lead to delays and confusion during the claims process. Budget-minded insurance shoppers might find themselves caught in protracted claim disputes stemming from miscommunication or differing interpretations of policy details between the agent and the company.

Farmers Insurance offers a range of insurance products, including auto, home, life, and business insurance, catering to a broad spectrum of customer needs. They also provide specialty coverage, including comprehensive agricultural and ranch insurance, aligning with their historical roots and appealing to rural communities and patriotic individuals invested in supporting American agriculture.

Among its features are the Signal usage-based insurance program, offering potential discounts based on driving habits, and Smart Claims technology aimed at expediting the claims process. These technological advancements showcase Farmers' efforts to modernize and improve efficiency. However, its digital self-service options remain limited compared to competitors, potentially deterring tech-savvy consumers.

Pros of choosing Farmers Insurance:

Local Agent Relationships: Personalized service and a familiar point of contact.

Strong Western US Presence: Extensive network and readily available service in the West.

Rural and Agricultural Expertise: Comprehensive coverage options for agricultural and specialty risks.

Competitive Rates: Offers competitive pricing in many markets.

Established Brand: Long-standing history and brand recognition.

Cons of choosing Farmers Insurance:

Agent-Dependent Service Quality: Service can vary significantly based on individual agent performance.

Agent-Claims Department Communication Gaps: Potential for miscommunication and delays during claims.

Inconsistent Claim Handling: Decentralized structure can lead to variations in claims practices.

Limited Digital Self-Service: Fewer online tools and resources compared to some competitors.

Agent Turnover: Changes in agents can disrupt established customer relationships.

Examples of common complaints:

Agricultural Claims: Disputes over coverage scope and interpretation of farm-specific policy details.

Auto Claims: Delays due to coordination issues between agents and adjusters.

Homeowner Claims: Inconsistent handling practices and varying coverage interpretations based on the agent.

Tips for navigating the Farmers Insurance system:

Cultivate a Strong Agent Relationship: Open communication and a clear understanding of your needs are paramount.

Verify Agent-Claims Communication: Ensure your agent has a strong working relationship with the claims department.

Meticulous Documentation: Keep detailed records of all conversations and correspondence with both your agent and claims representatives.

Understand Agent Authority vs. Company Policy: Clarify the agent's role and the ultimate authority of Farmers' corporate policies.

Research Agent Experience and Reputation: Choose an agent with a proven track record of excellent service and communication.

By carefully considering these factors and actively managing your relationship with your agent, you can potentially mitigate the risks associated with Farmers Insurance's decentralized structure and benefit from the personalized service a local agent can provide. If consistent service and streamlined communication are paramount to your insurance needs, however, carefully weigh these factors against Farmers’ potential drawbacks before making a decision. Understanding the intricacies of this agent-based system is crucial for informed decision-making and avoiding potential frustrations down the line.

Top 6 Insurer Complaint Types Comparison

Insurance Provider | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

State Farm | Medium - extensive agent network and digital systems | High - large agent base and 24/7 support | Moderate - resolution in 30-45 days, complaint volume due to size | Customers seeking local agents & comprehensive coverage | Strong financial stability, wide coverage options, agent accessibility |

GEICO | Low - direct-to-consumer digital model | Medium - relies on digital tools, limited local agents | Fast - average resolution 21-30 days, but impersonal service | Price-sensitive customers comfortable with online self-service | Competitive rates, fast quotes, strong digital tools |

Progressive | Medium - usage-based insurance and tech tools | Medium - tech-focused, requires data handling | Moderate - resolution 25-35 days, some dispute delays | Drivers interested in custom pricing and usage-based policies | Innovative technology, flexible plans, transparent comparison tools |

Allstate | Medium-High - local agents plus aggressive claim handling | High - agent network and extensive product portfolio | Moderate-Slow - resolution 35-50 days, high complaint ratios | Customers valuing local agent support and broad discounts | Strong presence, agent network, comprehensive discounts |

Liberty Mutual | High - multiple brands and complex corporate structure | High - mutual structure with several subsidiaries | Moderate - resolution 30-40 days, inconsistent service | Policyholders needing diverse insurance products | Mutual ownership, commercial offerings, financial stability |

Farmers Insurance | Medium-High - independent agents and decentralized structure | Medium-High - agent coordination required | Moderate - resolution 25-40 days, service varies by agent | Rural/agricultural clients needing personalized agent relations | Personalized local service, strong rural coverage, agent accessibility |

Protecting Your Peace of Mind: Choosing the Right Insurance

Navigating the complex landscape of insurance can be daunting, especially with the prevalence of insurance company complaints. This article has highlighted some common issues encountered with major providers like State Farm, GEICO, Progressive, Allstate, Liberty Mutual, and Farmers Insurance, empowering you to make more informed decisions. Remembering that not all insurance companies operate the same way is key. Prioritize your individual needs, thoroughly research different providers, and never hesitate to ask questions. When dealing with insurance company complaints, asking the right questions is crucial for a successful resolution. Framing your questions effectively can significantly impact the outcome. For guidance on constructing effective inquiries, refer to these examples of good research questions from Shy Editor. By understanding the potential challenges and asking insightful questions, you safeguard yourself against future frustrations and ensure your policy meets your specific requirements.

Mastering these concepts is invaluable for achieving true peace of mind regarding your insurance coverage. It empowers you to choose a provider that aligns with your values and provides reliable protection for your family and your future. For conservative American families, individuals approaching retirement, health-conscious consumers, and budget-minded insurance shoppers, securing the right coverage offers not just financial security, but also the confidence of knowing you're prepared for whatever life throws your way.

If you’re seeking an insurance provider committed to transparency and personalized service, and one that prioritizes policyholders' needs over profits, consider America First Financial. Specifically designed to address the concerns often raised in insurance company complaints, America First Financial offers a refreshing approach focused on traditional values and family protection. Secure your family's future with reliable and values-driven insurance – explore the options available at America First Financial today.

_edited.png)

Comments