Understanding Insurance Policy: Your Ultimate Coverage Guide

- dustinjohnson5

- May 7, 2025

- 11 min read

Breaking Down Insurance Policy Fundamentals

Understanding your insurance policy is crucial for anyone seeking financial protection. These policies, while sometimes complex, are essentially contracts detailing the agreement between you (the insured) and the insurance company (the insurer). This agreement outlines the risks covered, the amount of coverage you have, and the specific situations under which the insurer will pay out if you experience a covered loss. This section simplifies these important documents.

Key Components of an Insurance Policy

Every insurance policy, regardless of its type, includes a set of core components. Understanding these components is essential to understanding your coverage.

Declarations Page: This first page summarizes key information such as your name, address, policy number, coverage period, and premium. Think of it as a personalized coverage overview.

Insuring Agreement: This section describes the specific risks or perils covered. For instance, a homeowners policy might cover damage from fire, theft, or vandalism.

Exclusions: This section details what the policy doesn't cover. Common exclusions might include damage from floods, earthquakes, or acts of war. Understanding exclusions is vital to avoid unexpected gaps in coverage.

Conditions: This outlines the rules and obligations for both you and the insurer. For example, it may detail the claim filing process or your responsibilities for property maintenance.

Endorsements: These are modifications or additions to your policy that customize your coverage. You might add an endorsement to a homeowners policy to cover valuable jewelry, for example.

These elements work together to create a comprehensive framework for your protection.

The Importance of Understanding Your Policy

Making informed decisions about insurance is critical for protecting what matters most. For instance, certain groups may have unique needs, such as life insurance options for veterans. The insurance industry's overall financial health is also a relevant factor. The global insurance industry is projected to experience solid returns, with a return on equity (ROE) estimated at 10% in 2024 and 10.7% in 2025, reflecting the industry’s resilience. This growth is driven by factors such as rising demand in emerging markets and a steady increase in global premiums. More detailed statistics can be found here. Ultimately, understanding your own policy's details remains the most important step.

Failing to understand your policy can result in denied claims, unexpected costs, and inadequate protection. By reviewing each component carefully and asking your insurer questions, you can ensure you have the right coverage for your individual needs. This empowers you to make smart decisions about your financial security and avoid costly surprises down the road.

Decoding Insurance Policy Language That Actually Matters

When delving into the details of an insurance policy, understanding common insurance terminology is essential. A firm grasp of these terms helps ensure you have the right coverage for your needs. For additional insight into legal terminology found in contracts, consider reviewing this helpful resource: Legal Terms in a Letter of Intent (LOI).

Understanding the nuances of your insurance policy is crucial. This often involves deciphering confusing language. Essentially, you need to translate insurance jargon into plain English.

Key Terms Defined

Many key terms consistently appear in insurance policies. Understanding these is foundational to grasping how insurance works. Let’s explore some of the most important ones:

Premium: This is the regular payment you make to keep your insurance policy active. This payment ensures your coverage remains in effect.

Deductible: This is the amount you pay out of pocket before your insurance coverage begins. For instance, if your deductible is $500 and you have a $2,000 claim, you'll pay the first $500, and your insurance will cover the remaining $1,500.

Coverage Limit: This is the maximum amount your insurance company will pay for a covered loss. Knowing this limit helps you assess the adequacy of your coverage.

Actual Cash Value (ACV): ACV represents the current value of your property, taking into account depreciation. This value is often less than the cost of a new replacement.

Replacement Cost: This refers to the cost of replacing your property with a brand-new equivalent. This coverage helps avoid significant financial burdens after a loss.

To further clarify these essential insurance terms, let's look at the following table:

Essential Insurance Policy Terms Explained This table breaks down confusing insurance terminology into plain language with practical implications of each term.

Term | Definition | Why It Matters to You | Example |

|---|---|---|---|

Premium | The regular payment you make to maintain an active insurance policy. | Determines the ongoing cost of your insurance coverage. | Paying $100 per month for car insurance. |

Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. | Influences how much you pay in the event of a claim. A higher deductible typically means a lower premium, but higher out-of-pocket costs when you file a claim. | If your deductible is $500 and you have a $2,000 covered loss, you pay $500, and your insurance covers $1,500. |

Coverage Limit | The maximum amount your insurance will pay for a covered loss. | Sets the upper boundary of your insurance protection. Choosing adequate limits is vital for comprehensive financial protection. | A $100,000 liability limit on your auto policy means the insurer will pay up to that amount for damages you cause to others in an accident. |

Actual Cash Value (ACV) | The current value of your property, after depreciation. | Impacts how much you receive for damaged or lost items. ACV may not be enough to replace your belongings with new ones. | A five-year-old TV damaged in a fire might have an ACV of $300, even though a new comparable model costs $800. |

Replacement Cost | The cost to replace your property with a brand-new equivalent. | Ensures you receive enough to replace lost or damaged items without deducting for depreciation. | If your five-year-old TV, with a replacement cost of $800, is damaged, you receive the full $800 to buy a new one. |

This table summarizes key insurance terms and their implications, helping you understand your policy better.

Endorsements and Their Importance

Endorsements are modifications to your standard policy. They provide additional coverage or tailor it to your specific requirements. They’re crucial for customizing your policy to address your unique risks. This could involve adding coverage for valuable jewelry or increasing liability limits.

By understanding these core terms and the role of endorsements, you gain valuable insight. This allows you to make informed decisions about your insurance coverage and ensure proper protection. This knowledge empowers you to ask the right questions and avoid unexpected costs in the future.

Navigating The Insurance Policy Landscape

Not all insurance policies are created equal. Understanding the nuances of different coverage types, such as home, auto, life, and health insurance, is essential for building a secure financial foundation. The increasing availability of specialized products like cyber liability insurance adds another dimension to the insurance landscape. This section offers a guide to understanding these diverse options and their role in your overall financial plan.

Different Policies for Different Needs

Each insurance policy type serves a specific function. Home insurance safeguards your residence and possessions against hazards like fire or theft. Auto insurance addresses liabilities and damages associated with vehicle accidents. Life insurance provides a financial safety net for your beneficiaries after your passing. Health insurance helps manage medical costs. Each policy comes with its own set of coverage details, exclusions, and terms.

For example, standard home insurance policies often exclude flood damage. This highlights the need for supplemental flood insurance for homeowners in flood-prone regions. Furthermore, basic auto insurance may have insufficient liability coverage for serious accidents. Therefore, understanding the limitations of standard policies is vital.

Standard Coverage vs. Optional Add-ons

Many insurance policies offer optional add-ons, known as riders or endorsements. These additions expand your coverage but typically increase your premium. Carefully consider the value of these extras in relation to their cost.

Adding identity theft protection to your homeowners or renters insurance can be a valuable safeguard against information breaches. Similarly, roadside assistance added to your auto policy offers peace of mind during breakdowns. Assess your individual needs and risks to select appropriate optional coverage.

Bridging the Gaps: Complementary Coverage

An effective insurance strategy involves coordinating your policies to complement each other, minimizing overlap and maximizing coverage. This requires understanding how different policies interact.

Your health insurance might cover medical expenses after a car accident, but it won't cover vehicle damage. This is where your auto insurance becomes essential. Understanding this interplay is key to optimizing protection and minimizing out-of-pocket expenses. The global insurance market is constantly evolving, with premiums steadily increasing and specialized lines, such as cyber insurance, experiencing significant growth. Explore this topic further here.

Modern Insurance for Modern Risks

The insurance industry continually adapts to new risks. Cyber insurance has become increasingly critical for individuals and businesses alike due to the rise in data breaches and cyberattacks. This type of policy helps cover the costs of data recovery, legal representation, and notification requirements following a cyber incident.

Furthermore, insurers are developing new products to address emerging risks related to climate change and geopolitical instability. These innovations reflect the dynamic nature of the insurance industry and the importance of staying informed. Understanding your unique circumstances, including your life stage and specific needs, is crucial for selecting the right insurance. By strategically evaluating your risks and exploring available options, you can build a comprehensive insurance portfolio that protects what matters most.

Uncovering The Hidden Exclusions That Could Cost You

Understanding your insurance policy is vital. One often overlooked aspect? Exclusions. These define specific situations or events not covered by your policy. Ignoring them can lead to unwelcome surprises when you file a claim. This section explores common exclusions and how to manage them.

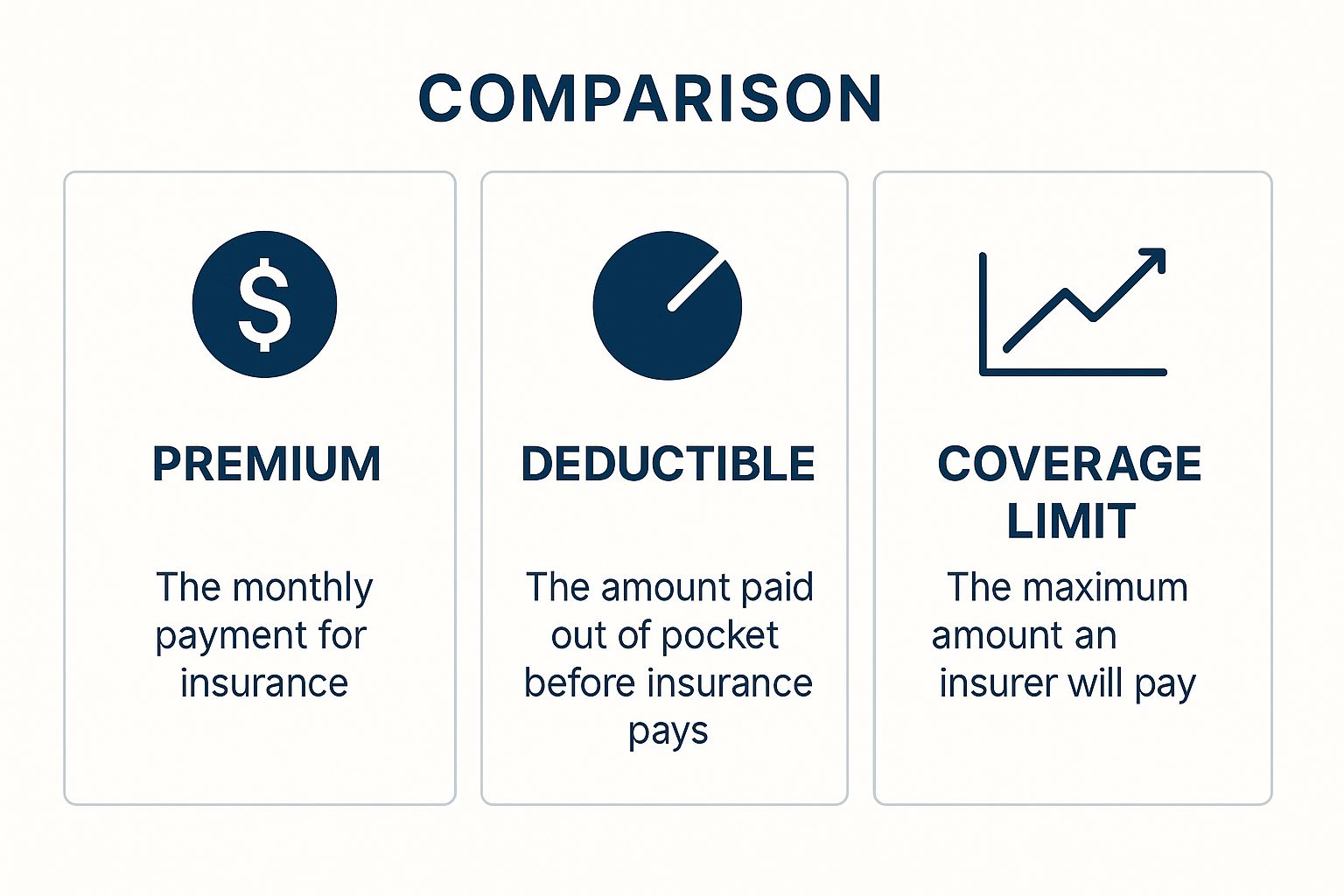

This infographic explains premium, deductible, and coverage limit. It visually defines each element, highlighting how these three concepts determine how much you pay, your out-of-pocket expenses before coverage begins, and the maximum payout from your insurer.

Common Exclusions Across Policy Types

Exclusions differ across insurance types. For instance, homeowners insurance often excludes flood damage, earthquake damage, and pest-related issues. Auto insurance commonly excludes damage from wear and tear, intentional damage, and commercial use of a personal vehicle. Health insurance may exclude pre-existing conditions, experimental treatments, or cosmetic procedures.

Understanding these common exclusions helps avoid coverage gaps. This knowledge allows you to assess your needs and explore supplemental coverage.

To help visualize potential coverage gaps, let's look at a comparison of common exclusions across different policy types:

Common Insurance Policy Exclusions By Policy Type This comparison table outlines typical exclusions across major insurance categories to help identify potential coverage gaps.

Policy Type | Standard Exclusions | Available Endorsements | Cost to Add Coverage |

|---|---|---|---|

Homeowners | Flood, Earthquake, Pest Damage, Normal Wear and Tear | Flood Insurance, Earthquake Insurance, Scheduled Personal Property | Varies based on location, risk, and coverage amount. |

Auto | Intentional Damage, Commercial Use, Wear and Tear, Racing | Ridesharing Coverage, Rental Reimbursement | Varies based on driving history, vehicle type and coverage amount. |

Health | Pre-existing Conditions (sometimes), Experimental Treatments, Cosmetic Procedures | Specific pre-existing condition coverage (sometimes available after a waiting period) | Varies greatly depending on the specific condition and plan. |

This table highlights how significantly exclusions can vary across different policy types. It emphasizes the importance of understanding your specific policy details and the need to consider additional coverage options to address potential gaps.

Identifying and Addressing Coverage Gaps

Carefully review your policy documents, paying close attention to the details. Discuss any questions about coverage gaps with your insurance agent. For example, consider supplemental flood insurance if you reside in a flood-prone area.

This proactive approach helps prevent financial hardship and empowers you to make informed decisions about your coverage.

Negotiating Broader Coverage and Supplemental Policies

You might be able to negotiate broader coverage with your insurer. If not, consider supplemental insurance policies to fill specific gaps in your standard policy. These policies can offer more specialized protection.

For instance, you could purchase a separate flood insurance policy or a valuable items policy for jewelry or art. This layered approach provides more comprehensive protection. The global commercial insurance market is constantly evolving, with rates fluctuating. For example, some regions and product lines saw a 3% decrease in rates during the first quarter of 2025. Staying informed about market trends in insurance can help you understand policy options and pricing.

By understanding exclusions and taking proactive steps, you can avoid costly surprises and ensure your insurance coverage meets your specific needs. This allows you to navigate the insurance landscape with confidence.

Mastering The Claims Process When You Need It Most

Filing an insurance claim can be stressful, especially during a difficult time. Understanding the process beforehand can lessen the burden and improve your chances of a successful outcome. This guide provides a step-by-step approach to navigating the claims process confidently.

Understanding Your Policy and Coverage

Before filing, review your insurance policy carefully. Understand your coverage limits, deductibles, and any specific requirements. Knowing your policy's details is the first step to a smooth claims process. This helps determine necessary documentation and sets realistic expectations for a settlement. For example, know if your policy covers replacement cost or actual cash value for damaged property.

Initiating the Claims Process: First Steps

Contact your insurance company immediately after an incident to start the claims process. Prompt notification is often a policy requirement. Provide accurate details, including the date, time, location, and involved parties. Be sure to obtain a claim number for future reference.

Gathering Necessary Documentation

Gather all supporting documentation for your claim. This may include photos or videos of the damage, police reports, medical records, repair estimates, and expense receipts. Comprehensive evidence strengthens your claim. Organized records make the claims process smoother and more efficient.

Working With the Claims Adjuster

A claims adjuster will be assigned to your case to investigate the claim and determine the payout amount. Be prepared to answer their questions thoroughly and provide any requested information. Maintaining clear communication with the adjuster throughout the process is essential.

Negotiating a Fair Settlement

The adjuster will offer a settlement after completing their investigation. Don’t feel obligated to accept the first offer if it seems insufficient. Negotiate with the adjuster, providing evidence to support your position. Knowing your policy’s coverage limits and the value of your losses strengthens your negotiating position.

Appealing a Denied or Undervalued Claim

If your claim is denied or undervalued, you can appeal. Understand the appeals process outlined in your policy, which typically involves a written appeal with supporting documentation.

Seeking External Assistance

If you struggle with the claims process or disagree with the insurer's decision, consider seeking help from a policyholder advocate or an attorney specializing in insurance claims. These professionals can offer guidance and represent your interests. State insurance departments can also provide information about your rights and help resolve disputes.

By understanding these steps and being proactive, you can approach the claims process with confidence. Remembering your policy details is key to maximizing your protection and securing your financial well-being during difficult times.

Making Insurance Decisions That Protect What Matters

Understanding insurance can feel overwhelming. It's more than just comparing prices. This section explores how to make smart insurance decisions that truly fit your needs and your budget. It's about getting the most protection without breaking the bank.

Evaluating the True Value of Insurance

Choosing insurance involves more than just looking at the price tag. Think about the insurance company's financial strength and how happy their customers are. A stable company is more likely to be there when you need them. Checking a company's A.M. Best rating can give you a good idea of their financial health.

Customer service matters too. High claims satisfaction ratings usually mean a smoother, less stressful claims process when you need it most. Focus on long-term value and peace of mind, not just the upfront cost.

Comparing Policies Beyond Premium Costs

Premiums are important, but they’re not the whole story. Look closely at the details like coverage limits, deductibles, and what the policy doesn't cover (exclusions). Sometimes, a higher premium means more comprehensive coverage or lower out-of-pocket expenses if you have a claim.

Paying a bit more upfront could save you a lot of money down the line. A higher premium with a lower deductible might be better if you think you'll need to file claims often.

Strategic Deductible Management

Your deductible has a big impact on your insurance costs. A higher deductible usually means lower premiums, but you'll pay more out of pocket if you have a claim. A lower deductible means higher premiums, but you'll pay less if something happens.

Finding the right balance depends on how much risk you're comfortable with and how much you can afford to pay if you need to make a claim.

The Power of Bundling and Regular Policy Reviews

Bundling different insurance policies, like home and auto, with the same company can often save you money. It’s a simple way to get more value and simplify managing your insurance.

It’s also important to review your policies regularly, especially after big life changes like getting married, buying a house, or having a child. These events can significantly change your insurance needs. Regular reviews ensure you have the right coverage. This helps you stay ahead of potential gaps in your protection as your life changes.

By taking a strategic approach to understanding insurance and using these practical tips, you can make confident decisions that protect what's important to you. This approach will help you manage risk effectively and secure your financial future.

Ready to secure your family's future with reliable and values-driven insurance? Get a free quote from America First Financial today and discover how affordable peace of mind can be.

_edited.png)

Comments