Understanding Life Insurance Policy Face Value

- dustinjohnson5

- Aug 31, 2025

- 10 min read

When you hear the term face value in life insurance, think of it as the headline number on your policy. It’s the specific, tax-free dollar amount that your loved ones are guaranteed to receive when you pass away. This is the core of the promise you’re making—the financial safety net you're setting up for their future.

What Exactly Is Your Policy's Face Value?

When you buy a life insurance policy, one of the first and most important decisions is choosing this face value. Whether it's $250,000, $500,000, or $1 million, this figure is the foundation of your entire contract. It's often called the face amount or, more commonly, the death benefit.

This number has a direct impact on how much you'll pay in premiums. A larger face value provides a bigger safety net, which naturally comes with a higher premium. It’s the starting line for building your family’s financial security plan.

Distinguishing Face Value From Other Terms

Life insurance comes with its own vocabulary, and it's easy to get a few key terms mixed up. But understanding the difference between them is crucial to knowing what your policy really offers.

The most common point of confusion is between face value and cash value. Remember, cash value is a separate feature that only exists in permanent life insurance policies, like whole life or universal life. It’s a savings-like account that grows within the policy.

The face value is the lump sum paid out after you're gone. The cash value is an account you can borrow against or withdraw from while you're still living.

Simply put, one is a legacy for your family, while the other can serve as a financial resource for you during your lifetime.

To make these distinctions crystal clear, let's break them down side-by-side.

Comparing Key Life Insurance Terms

Here’s a quick summary comparing the core concepts you'll encounter.

Term | What It Represents | Primary Purpose |

|---|---|---|

Face Value | The total amount paid to beneficiaries upon the insured's death. | To provide a financial safety net for loved ones. |

Cash Value | A savings component in permanent policies that accumulates over time. | To serve as a living benefit, accessible through loans or withdrawals. |

Death Benefit | The actual money paid out, which might be the face value minus loans. | The final, net payout received by the beneficiaries after any deductions. |

Think of the face value as the starting point. The final death benefit is what your beneficiaries actually receive, which could be less than the face value if you've taken out loans against the policy's cash value.

How Face Value Shapes Your Premiums

When you choose a life insurance policy, the face value you select is directly tied to how much you'll pay in premiums. It’s a simple trade-off, really. Think of it like a seesaw: as the face value goes up on one side, your premium payments go up on the other.

This makes perfect sense when you look at it from the insurer's perspective. A higher face value represents a bigger financial risk for them. If something happens to you, their payout on a $1 million policy is four times larger than on a $250,000 policy. To offset that greater risk, they have to charge a higher premium.

So, your premium isn't just an arbitrary number. It’s the cost of securing that specific level of protection for your loved ones.

The Risk and Reward Calculation

Insurance companies don’t just pull these numbers out of thin air. They use a detailed process called underwriting to figure out the exact premium for your policy. They’re essentially trying to predict their own risk.

While the face value is the biggest piece of the puzzle, it doesn’t stand alone. Insurers combine it with several personal factors to build a complete picture of their risk.

Age: The younger you are when you buy a policy, the lower your premiums will be. It's a simple matter of life expectancy.

Health: Your medical history, current health, and lifestyle choices (especially smoking) play a huge role in determining your rate.

Policy Type: The kind of insurance you buy matters. A term life policy with a $500,000 face value will always be more affordable than a whole life policy for the same amount because it doesn't build cash value.

Your premium is the price you pay for the insurer to carry the financial risk defined by your policy's face value. The higher the risk for them, the higher the premium for you.

This fundamental relationship is what drives the entire industry. The global life insurance market was valued at an incredible $3.1 trillion, a massive jump from $1.9 trillion back in 2017. With the United States making up nearly 27% of those premiums, it’s clear that people are taking their financial security seriously. You can dive deeper into these life insurance statistics and trends to get a sense of the scale.

How Much Life Insurance Do You Really Need?

Figuring out the right face value for your life insurance policy is one of the most important financial decisions you'll make. It’s not about pulling a number out of thin air; it’s about crafting a specific, reliable safety net that will be there for your family if you’re not.

Let’s get practical. You don't need to be a financial wizard to do this. You just need to take an honest look at your financial picture and what you want to protect. This means calculating the coverage that truly meets your family's future needs, so they aren't left struggling.

Mapping Out Your Financial Needs

To get to an accurate face value, you have to add up all the expenses your family would be on the hook for. Think of it like building a financial bridge that allows them to move forward without you.

A really straightforward way to do this is with the DIME formula. It's a simple acronym that covers the big-ticket items:

Debt: Start by adding up all your non-mortgage debts. This includes car loans, student debt, and any lingering credit card balances.

Income: How many years of your salary would your family need to maintain their lifestyle? Multiply your annual income by that number of years.

Mortgage: What's the outstanding balance on your home loan? You’ll want to include the full amount.

Education: If you have kids, estimate what it will cost to send them to college or trade school.

This little formula gives you a fantastic starting point. Another popular rule of thumb you might hear is the "10x income" rule, which simply suggests your face value should be at least ten times your yearly salary.

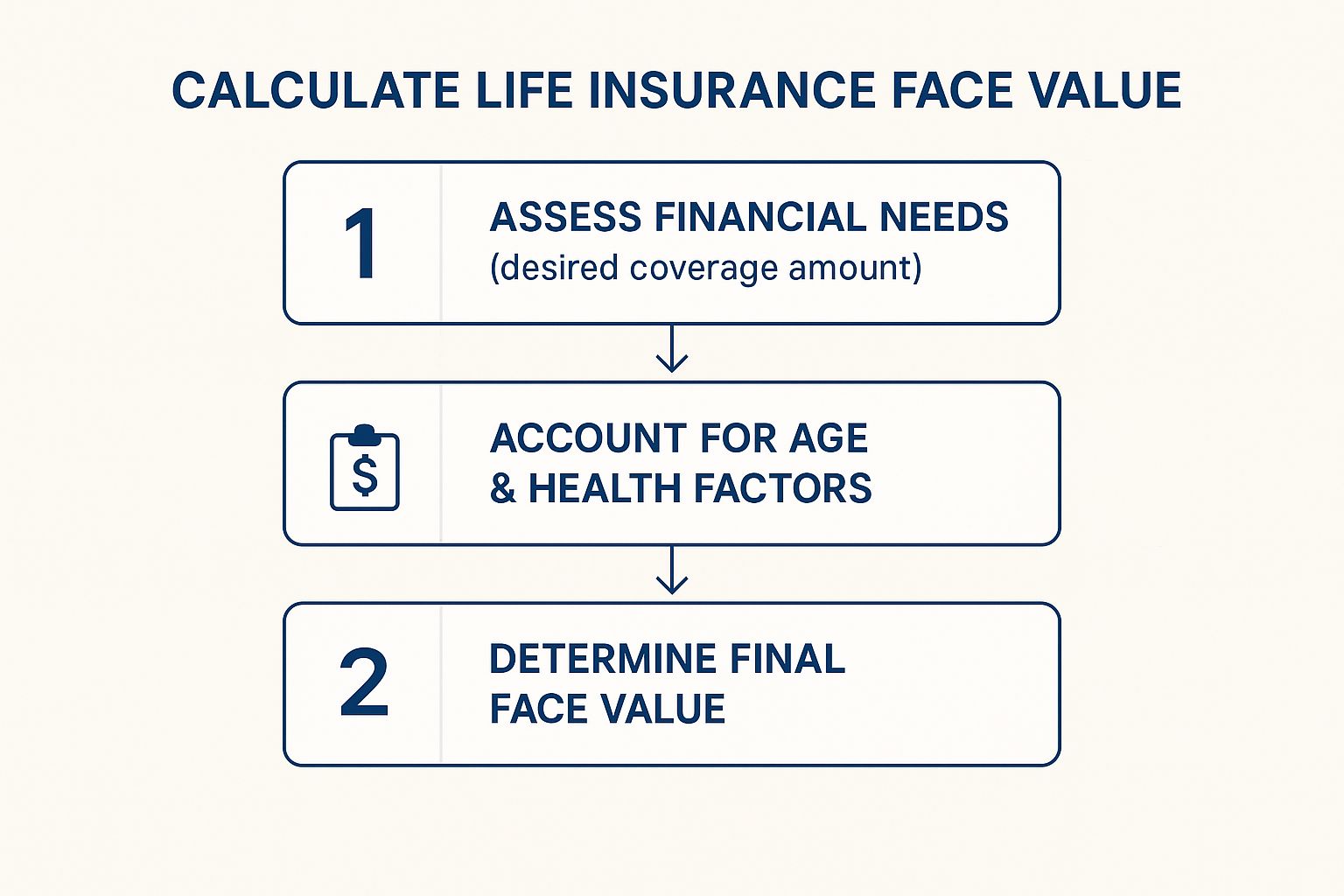

As you can see, getting to the right number is a process. It starts with your family's core financial needs and then gets refined by personal details like your age and health.

Finalizing Your Coverage Amount

Once you have a baseline number from the DIME method or the 10x rule, you're not quite done. Think about other costs. You'll want to add funds for final expenses, like funeral costs and medical bills, which can easily run $10,000 or more.

For people with more complex finances, choosing the right face value is a critical piece of their overall financial strategy. This is especially true when you start looking at a detailed guide to estate planning for wealthy individuals.

By adding up all these pieces, you can move from a ballpark guess to a well-researched number. That's how you get real peace of mind and create a legacy of security for the people you love most.

Why the Payout Might Differ From the Face Value

While the life insurance policy face value is the big number on the front page, it’s not always the exact amount your family will receive. The final check, known as the death benefit, can sometimes be higher or lower. This isn't some kind of trick; it’s simply a result of how the policy was used over the years.

Think of the face value as the starting point. Certain choices you make during your lifetime can lead to adjustments before the final payout is calculated. Knowing what these are helps you manage expectations and ensure your loved ones get the financial support you planned for.

The most common reason for a payout to be less than the face value is an outstanding policy loan. If you have a permanent life insurance policy, it builds cash value that you can borrow against. If you pass away with an unpaid loan balance, the insurance company will simply subtract that amount, plus any interest, from the face value before paying your beneficiaries.

How Policy Riders Affect the Payout

Optional add-ons, called riders, can also change the final payout. These riders add flexibility to your policy, letting you tap into its value for needs that arise while you're still living.

Accelerated Death Benefit Rider: If you're diagnosed with a terminal illness, this rider lets you access a portion of your death benefit early. It's a lifesaver for covering medical bills, but whatever you take out is subtracted from the final amount paid to your family.

Long-Term Care Rider: In the same way, this rider allows you to use your death benefit to pay for long-term care needs. Again, it provides crucial support but reduces the final inheritance.

These riders offer powerful "living benefits," but it's a direct trade-off between using the money for your needs today and preserving the full amount for your beneficiaries tomorrow.

It's essential to view your policy as a dynamic financial tool. The face value is the promised amount, but the final payout reflects how that promise was managed over time.

While the average face value for a life insurance policy is around $168,000, the final payout can be a different story. It’s also worth knowing that an estimated $200 billion in policies lapse or are surrendered each year, highlighting how important it is to manage your policy well. You can find more life insurance settlement statistics that show these market dynamics. Staying on top of your policy's features is the best way to avoid any surprises for your family down the road.

Can You Adjust Your Policy's Face Value Over Time?

Life changes, and your life insurance policy shouldn't be stuck in the past. Think of your initial policy as a snapshot in time—it captured your financial needs perfectly when you first bought it. But what happens when that picture changes?

Thankfully, a life insurance policy isn't a rigid, unchangeable contract. You often have the flexibility to adjust your life insurance policy face value to match where you are in life now. The process just depends on whether you need to dial it up or down.

How to Increase Your Face Value

Let's say you've had another child, bought a bigger house, or started a new business. Suddenly, that original safety net might feel a little small. Bumping up your face value is a common step, but it’s a bit like applying for a new loan.

Because the insurance company is taking on more risk, they’ll need to re-evaluate you. This usually means you'll have to go through a new underwriting process, which often includes a new medical exam and a review of your current finances.

Just remember, a higher face value means higher premiums. The new cost will be based on your current age and health, not the stats from when you first bought the policy.

When Decreasing Your Face Value Makes Sense

Just as life can add responsibilities, it can also take them away. There often comes a point where you simply don't need as much coverage as you once did, and that's a great time to think about reducing your face value.

You might want to lower your coverage for a few common reasons:

Your mortgage is finally paid off. For many people, this is their single largest debt, and once it's gone, their insurance needs can drop significantly.

The kids are grown and independent. With your children financially supporting themselves, your income replacement needs will likely decrease.

You've built a solid nest egg. If your personal savings and investments have grown enough to support your loved ones, you might not need as large of a policy.

Lowering your face value is a practical way to cut your monthly premiums and free up that money for other things, whether it's boosting your retirement fund or finally taking that trip you've been dreaming about. It's all about making sure your policy works for you right now.

Answering Your Questions About Face Value

Getting to grips with life insurance can feel like learning a new language, and it's totally normal to have questions. Once you start digging into the details of your policy, a few things about the face value might not seem crystal clear.

Let's walk through some of the most common questions people have. Think of this as your quick-reference guide to help you feel more confident about the protection you're putting in place for your family.

Is the Face Value the Same as the Death Benefit?

This is a big one, and it trips a lot of people up. The short answer is: they're very close, but not always the same thing.

The face value is the headline number—it’s the amount of coverage you signed up for when you bought the policy. The death benefit, however, is the actual check your beneficiaries will receive.

Most of the time, these two numbers will match. But, if you ever took out a loan against your policy and didn't pay it back, that amount would be subtracted from the death benefit. Similarly, any unpaid premiums could also reduce the final payout. It's also possible for the death benefit to be higher than the face value if you've added certain riders to your policy, but that’s less common.

How Does Inflation Affect My Policy's Face Value?

This is a critical point to understand. The face value on your policy is a fixed dollar amount. A $500,000 policy you purchased 10 years ago is still a $500,000 policy today. The problem is, $500,000 just doesn't buy what it used to.

Over time, inflation eats away at the purchasing power of your coverage. This is exactly why you need to think ahead when choosing your initial face value. You're not just covering your family's needs for today; you're planning for their expenses 10, 20, or even 30 years down the road.

Some policies offer a great tool to help with this: a cost-of-living adjustment (COLA) rider. It costs a little extra, but it automatically increases your face value over time to help your coverage keep up with inflation. It's a smart way to make sure the safety net you build today is just as strong tomorrow.

Does the Face Value on Term Life Insurance Decrease?

For the vast majority of term policies, the answer is a simple no. If you buy a standard 20-year term policy with a $500,000 face value, that $500,000 in coverage stays locked in for the entire 20-year period. It won't go down.

The only real exception is a niche product called decreasing term insurance. These policies are specifically designed for the face value to shrink over time, usually in sync with a large debt like a mortgage. Unless you deliberately choose one of these, you can count on your face value staying level.

Is the Face Value of a Life Insurance Policy Taxable?

Here’s one of the most powerful features of life insurance: in nearly all situations, the death benefit paid out to your beneficiaries is 100% tax-free.

They receive the full amount, and it’s not considered taxable income. This means your loved ones can use the money immediately for whatever they need most—covering funeral costs, paying off the mortgage, or just handling day-to-day bills—without worrying about a surprise tax bill later. It’s clean, direct financial support when it matters most.

At America First Financial, we believe in providing clear, straightforward insurance solutions that protect your family and honor your values. If you're ready to secure your family's future with a policy you can trust, get a free, no-obligation quote today. Visit us at https://www.americafirstfinancial.org to learn more.

_edited.png)

Comments