Unpacking the Policy Holder Meaning in Insurance

- dustinjohnson5

- Aug 8, 2025

- 13 min read

At its core, a policyholder is the person or entity who owns the insurance policy. Think of it this way: if an insurance policy were a car, the policyholder would be the person whose name is on the title. They are the one who enters into the contract with the insurer, pays for it, and holds all the rights and responsibilities that come with it.

What Does It Really Mean to Be a Policyholder?

While the definition seems straightforward, the role of a policyholder carries real weight. This person or organization is the central figure in the insurance agreement. They aren't just a customer; they're the insurer's contractual partner, the main point of contact, and the ultimate decision-maker.

This distinction is critical. The term policyholder always refers back to the owner who manages the policy and pays the premiums. This is true whether we're talking about auto, health, or life insurance. For example, with car insurance, the policyholder isn't necessarily the only person driving the car. They are, however, the one who bought the policy, pays for it, and has the exclusive right to make changes—like adding a new driver or adjusting coverage levels. You can dig deeper into these essential policyholder services to see how they function in the real world.

The Key Responsibilities and Rights of a Policyholder

To really grasp the concept, it helps to break down the role into three main pillars: ownership, financial duty, and control. These are the elements that set the policyholder apart from anyone else who might be covered by the policy.

Legal Ownership: The policyholder legally owns the insurance contract. This grants them the right to the policy documents and all official communication from the insurance company.

Financial Responsibility: The duty to pay premiums falls squarely on the policyholder's shoulders. If payments are missed, the policy could lapse or be canceled, which has consequences for everyone covered.

Administrative Control: Only the policyholder has the authority to change the policy. This could mean anything from increasing coverage limits and updating contact information to canceling the contract entirely.

Key Insight: Think of being a policyholder as being in the driver's seat. You have the power to steer the policy and the responsibility to keep it running smoothly.

To make this even clearer, here’s a quick breakdown of a policyholder's main attributes.

Key Attributes of a Policyholder at a Glance

Attribute | Description | Example |

|---|---|---|

Ownership | Holds the legal title to the insurance contract. | A small business is listed as the policyholder on its liability insurance policy. |

Payment Duty | Is responsible for paying all premiums to keep the policy active. | A father pays the monthly premiums for a family health insurance plan. |

Control | Has the sole authority to modify, update, or cancel the policy. | An individual calls her agent to increase the coverage on her homeowner's insurance. |

This table neatly summarizes the core functions that define who a policyholder is and what they do. It all comes down to ownership and the control that comes with it.

Your Core Rights and Responsibilities

Being a policyholder isn't just a title; it means you have both powerful rights and crucial duties. Getting a handle on this two-sided relationship is the key to making your insurance work for you when you actually need it. Essentially, you're the one in the driver's seat of the contract you bought.

Think of it as a partnership. Your policy grants you specific powers, but you have to hold up your end of the bargain to keep that contract strong and valid. These rights give you control, while your responsibilities make sure the whole arrangement works smoothly.

The Powers in Your Hands as a Policyholder

As the official owner of the policy, you hold all the cards. You have the exclusive authority to steer the ship, which is a fundamental part of what policy holder meaning is all about. This control is what allows you to make sure your coverage keeps up with your life.

Here are the key rights you have:

Modify Your Coverage: You can raise or lower your coverage limits, add or remove optional protections (often called riders), or tweak your deductibles to better fit your budget and how much risk you're comfortable with.

Change Beneficiaries: For a life insurance policy, you alone have the power to name, update, or remove the people who will receive the payout.

Access the Policy's Value: If you have certain types of permanent life insurance, you can borrow against the cash value it's built up or even surrender the policy for its cash sum.

Cancel the Policy: If you decide you don't need the coverage anymore, you are the only one who can call it quits and terminate the contract with your insurer.

These rights are what keep your insurance policy from becoming a dusty, outdated document. For example, if you get married or have a baby, using your right to update your life insurance beneficiary is a critical move to protect your family's future.

Key Takeaway: A policyholder's rights all boil down to one thing: control. You get the final say on who is covered, for how much, and who ultimately benefits from the policy.

The Responsibilities You Can't Ignore

With great power comes great responsibility. If you drop the ball on your obligations, you could face some serious consequences, like having a claim denied or seeing your policy canceled altogether. These duties are not optional.

Your main responsibilities include:

Paying Premiums on Time: This is non-negotiable. You must pay your insurance premiums when they are due and for the full amount. If you miss payments, your policy can lapse, leaving you completely unprotected.

Being Honest and Accurate: When you first apply for the policy and later if you have to file a claim, you have a duty to provide truthful and complete information. Hiding or fudging the facts—what the industry calls material misrepresentation—is one of the top reasons claims get denied.

Reporting Major Life Changes: You're required to let your insurer know about any significant changes that could impact your level of risk. This could mean adding a new teen driver to your car insurance or starting a business from home that changes your homeowner's insurance needs.

For homeowners, knowing how to act as a policyholder during a disaster is especially important. A good [guide to navigating property insurance claims](https://sparklerestoration.com/property-insurance-claims-for-homeowners-guide-to-navigating-the-process/) can be a lifesaver when you're under pressure. Ignoring these responsibilities creates unnecessary risk. Forgetting to tell your insurer about that new teenage driver, for instance, could lead to a flat-out refusal to cover an accident they cause.

Policyholder vs. Insured vs. Beneficiary

When you're dealing with insurance, a few key terms get thrown around that can be easy to confuse. Words like policyholder, insured, and beneficiary each describe a unique role in an insurance agreement. Getting these straight is crucial, because knowing who’s who determines who has control over the policy and who gets paid.

Let's think of it in terms of a simple story. Imagine a mother wants to make sure her son is financially protected if something happens to her. She goes out, finds the right life insurance plan, signs the contract, and starts paying the monthly premiums. In this scenario, she is the policyholder.

Because the policy is set up to pay out upon her death, her life is the one being covered. That also makes her the insured. Finally, she officially names her son as the person who will receive the money from the policy. Her son is the beneficiary.

Breaking Down the Key Roles

As you can see from the story, one person can fill more than one role at the same time. The mother was both the policyholder and the insured. But it’s important to remember that these roles are technically distinct, and in many situations, they are held by different people.

Getting them mixed up can cause real headaches down the line, especially when it's time to update the policy or, most importantly, file a claim.

The Policyholder (The Owner): This is the person or entity who owns the insurance contract. They have the authority to make changes, like increasing coverage or changing beneficiaries. They're also on the hook for paying the premiums.

The Insured (The Covered Individual): The insured is the person whose life, health, or property is covered by the policy. The entire risk assessment from the insurance company is based on this person or asset. An event happening to the insured is what triggers a potential claim.

The Beneficiary (The Recipient): This is the person, trust, or organization designated to receive the policy’s payout. While most common in life insurance, you'll see beneficiaries named in other types of policies, too.

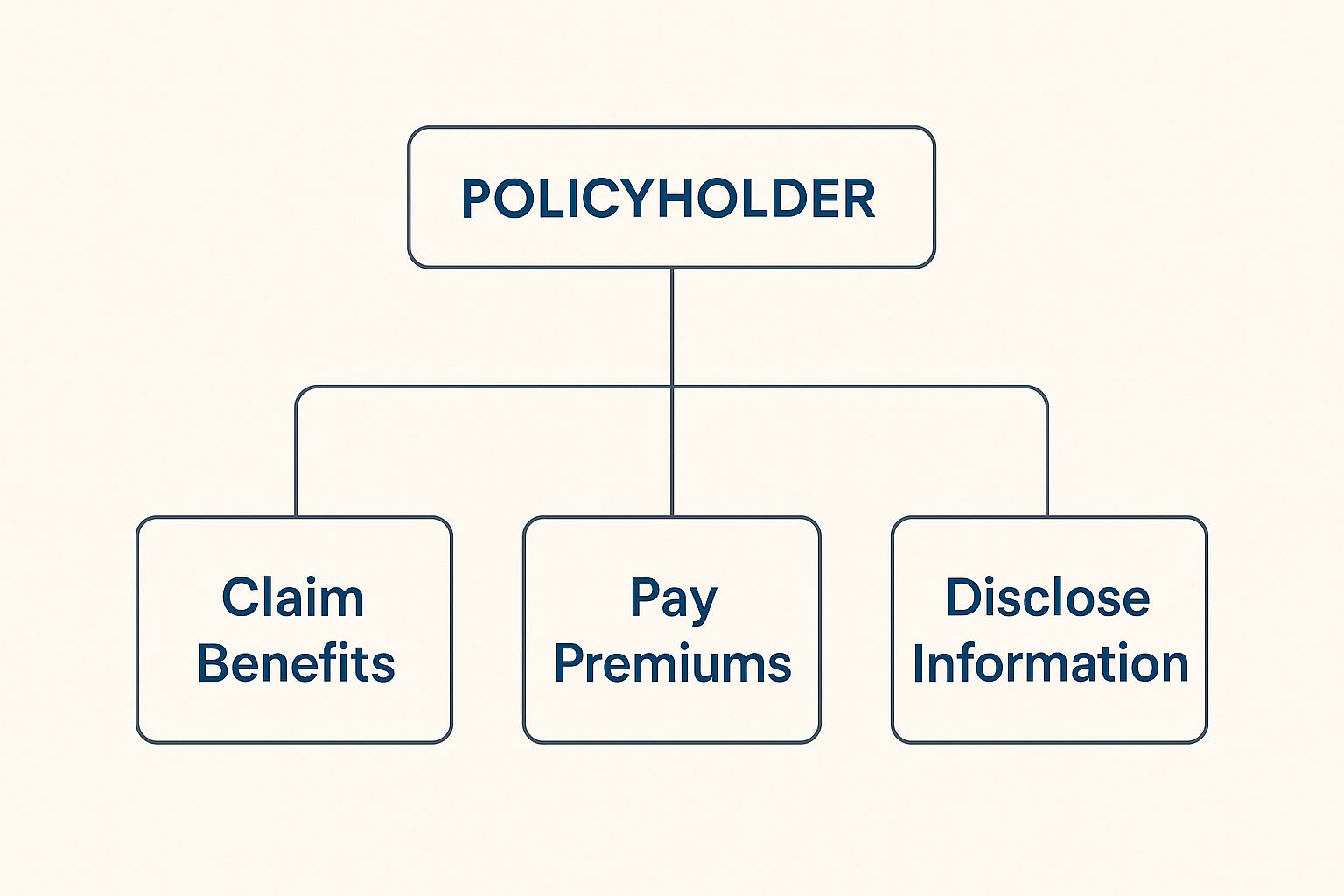

The following graphic really drives home the point that the policyholder is the one in the driver's seat, managing the core functions of the agreement.

As the image shows, paying premiums, disclosing necessary information, and initiating claims are all responsibilities that fall squarely on the policyholder's shoulders.

A Direct Comparison

To make these distinctions even clearer, it helps to see them side-by-side. While the differences can feel subtle, they are incredibly important in practice.

Here’s a quick-glance table to help you keep these roles straight.

Policyholder vs. Insured vs. Beneficiary

Role | Primary Function | Key Responsibilities | Who They Are (Example) |

|---|---|---|---|

Policyholder | Owns and controls the policy | Pays premiums; makes changes to coverage; names the beneficiary. | A parent who buys a life insurance policy for their family's protection. |

Insured | Is the person/property covered | Provides accurate personal or health information; their life or property is the basis of the risk. | The parent whose life is covered by that policy. |

Beneficiary | Receives the policy payout | Files the claim to receive the death benefit after the insured passes away. | A child named to receive the life insurance funds. |

Ultimately, understanding this structure is the key to grasping what being a policyholder truly means. Think of it this way: the policyholder is the architect of the financial safety net, the insured is the person it's built to protect, and the beneficiary is the one who receives that protection when it's needed most.

How Your Role Changes with Different Insurance

While the core meaning of a policyholder stays the same—you're the owner—your specific powers and day-to-day responsibilities look quite different depending on the type of insurance you have. Think of it less as a single job title and more as a role that adapts to protect what matters most, whether that’s your car, your health, or your family’s future.

It's a bit like being a captain. The title is always "captain," but steering a small sailboat is a world away from commanding a massive cargo ship. Each vessel demands unique skills and attention to navigate the waters safely. Insurance works much the same way.

In Auto Insurance: The Power to Permit

When you hold an auto insurance policy, you’re the gatekeeper. You have the ultimate authority over who is officially covered to drive your vehicle. This is a classic scenario in families everywhere. As the policyholder, a parent has the exclusive right to add their teenage son or daughter to the plan as a named insured driver.

This one action perfectly illustrates the policyholder's control. The newly licensed teen can now legally drive the car, but they can't just call up the insurance company to change the coverage or lower the deductible. Only the policyholder can make those kinds of decisions.

In Health Insurance: The Role of the Manager

With health insurance, the policyholder often acts as a family's healthcare administrator. You're the one choosing the plan, adding dependents like a spouse or children, and keeping an eye on crucial financial details like deductibles and out-of-pocket maximums. This administrative control is vital for ensuring everyone has the care they need without interruption.

In the United States and globally, the person who owns the health policy, pays the premiums, and has the authority to submit claims is the policyholder. Historically, something as simple as a missed premium payment could create a serious coverage gap, putting a family’s health security at risk. You can learn more about the policyholder's role in health insurance to get a better handle on these important duties.

Crucial Distinction: In a family health plan, the policyholder isn't just a member—they are the manager. They ensure everyone on the plan has access to benefits and that the policy itself remains active and in good standing.

In Life Insurance: The Authority to Designate

Perhaps nowhere is the policyholder's power more profound than with life insurance. Here, your role extends to one of the most significant financial decisions you can make: naming the beneficiary.

Only the policyholder has the power to decide who receives the policy's death benefit. This right is absolute and exclusive to you. For instance, after a major life event like a divorce or the birth of a new child, you—the policyholder—must be the one to formally update the beneficiary designation to reflect your current wishes. This is how you ensure your financial legacy is passed on exactly as you intended, providing a critical safety net for your loved ones.

Why Being a Policyholder Is a Big Deal

It’s easy to think of a policyholder as just the name on an insurance document, but the role is so much more than that. It's the very foundation of your financial security and, on a much grander scale, the engine that keeps the entire insurance industry running.

Think of it this way: being a responsible policyholder is a core part of smart financial planning. It’s the shield that protects your family, your home, or your business when the unexpected happens.

You're Part of a Much Bigger System

Your role as a policyholder makes you a key player in a global system of shared risk that props up our economy. It's a concept that has grown right alongside the insurance markets themselves, touching billions of lives.

Just in the United States, there are over 300 million active insurance policies, from individual life insurance to group health plans. Every single one has a designated policyholder who owns and manages the contract. You can learn more about how this role has evolved by checking out the historical development of the policyholder role.

The Cornerstone of Financial Stability

Policyholders are the lifeblood of the insurance world. The premiums you and millions of others pay create the massive pool of money that allows insurers to pay out claims when disaster strikes. Without this system, our economy would look very different.

Here’s why it’s so critical:

Economic Security: Insurance lets people transfer huge risks to an insurer. This gives them the confidence to take on big financial commitments, like starting a business or buying a home, which drives economic growth.

Personal Responsibility: Taking charge of your policy—making sure your coverage is right, your beneficiaries are up-to-date, and your premiums are paid—is a powerful way to take control of your financial future.

Peace of Mind: There's incredible value in simply knowing you have a plan. That peace of mind, knowing your loved ones are protected from a worst-case scenario, is priceless.

Key Insight: Being a policyholder isn't a passive role. It makes you an active partner in your own financial protection. The position carries real weight, both for your personal security and for the stability of the economy.

At the end of the day, understanding and embracing what it means to be a policyholder is the first real step toward building a secure financial foundation.

Common Questions About Being a Policyholder

Now that you have a solid grasp of what a policyholder is, let's dig into the questions that pop up in the real world. Think of this as your practical FAQ for navigating the ins and outs of your insurance contract with confidence.

These are the common points of confusion we see all the time. Getting these straight will help you manage your policies effectively, so there are no surprises right when you need your coverage the most.

Can The Policyholder and Insured Be Different People?

Yes, absolutely. This is an extremely common setup in the insurance world, especially for families and businesses. It all hinges on a legal concept called insurable interest.

In plain English, this means the policyholder has to have a legitimate financial stake in the person or property they're insuring. You have to stand to lose money if something goes wrong. This rule is what separates insurance from gambling; it prevents you from, say, taking out a life insurance policy on a random celebrity.

A classic example is a parent who is the policyholder for an auto insurance policy covering their college-aged child.

The Parent: Is the policyholder. They own the insurance contract and pay the bills.

The Child: Is the insured driver who is actually covered by the policy.

Here, the parent has a clear insurable interest. They likely own the car or are financially on the hook for their child's well-being and actions, giving them a valid reason to secure the policy.

What Happens if The Policyholder Passes Away?

This is a critical question, and the answer really depends on the policy and whether the policyholder was also the person being insured.

For a typical life insurance policy where the policyholder and the insured are the same person, it's pretty straightforward. When they pass away, the contract has done its job, and the death benefit is paid directly to the beneficiaries named in the policy.

The situation gets a bit more complex if the policyholder and the insured are different people. In that case, the policy itself is an asset, and its ownership has to be transferred.

Proactive Planning: The best way to handle this is to name a contingent owner or successor owner right in the policy documents. This person is pre-designated to take over ownership immediately, which helps avoid legal headaches and keeps the policy from getting stuck in probate court with the rest of the estate.

If no successor is named, the policy ownership usually goes to the policyholder's estate, where it will be distributed according to their will or state law.

Who Can Make Changes to An Insurance Policy?

This gets to the very core of what it means to be a policyholder. Only the policyholder has the authority to make changes to an insurance policy. This exclusive control is a fundamental right of ownership.

An insured person who isn't the policyholder simply can't call up the insurance company and start making adjustments. This is an important safeguard that centralizes control. For instance, if you're covered under your company's health plan, you can't alter the plan's coverage terms—only your employer (the policyholder) can do that.

The policyholder's exclusive rights include things like:

Changing coverage amounts or deductibles.

Adding or removing people or property from the policy.

Updating who the beneficiaries are on a life insurance policy.

Assigning the policy to someone else (if the contract allows it).

Canceling the policy entirely.

This authority really highlights the responsibility that comes with owning the insurance contract.

Is a Policyholder The Same as a Policy Owner?

Yes. For all practical purposes, these terms are interchangeable. "Policyholder" and "policy owner" mean the exact same thing.

Both terms describe the person or entity that legally owns the insurance contract, pays the premiums, and holds all the rights that come with it. You'll probably hear "policyholder" more often in everyday conversation and in materials from insurance companies. "Policy owner" might pop up more in formal legal documents or in financial planning discussions to emphasize that the policy is a financial asset.

As a consumer, you can treat them as one and the same.

At America First Financial, we believe in providing clear, straightforward protection for your family and assets, free from complex jargon and political agendas. Our goal is to empower you with the knowledge and coverage you need to feel secure. Get a simple, no-obligation quote in under three minutes and see how we can help you build a strong financial future.

_edited.png)

Comments