What Is Accelerated Death Benefit and How It Works

- dustinjohnson5

- Aug 20, 2025

- 13 min read

An accelerated death benefit (ADB) is a powerful feature baked into many life insurance policies that lets you tap into your death benefit while you're still alive. It's designed to provide a crucial financial lifeline if you're diagnosed with a terminal illness.

Think of it as an advance on your policy's payout, intended to ease the financial burdens that often come with a serious health crisis.

What Is an Accelerated Death Benefit in Simple Terms?

Let's use an analogy. Imagine your life insurance policy is a financial safety net, carefully woven to catch your loved ones when you're gone. An accelerated death benefit gives you the ability to access a piece of that net for yourself, right when you need it most.

This feature, which you'll often hear called a “living benefit,” turns a future promise into a present-day resource. The money you receive is yours to use however you see fit. You can put it toward medical bills, arrange for specialized hospice care, or simply handle everyday expenses to take financial pressure off your family. The goal is to let you focus on what truly matters: your quality of life.

To give you a quick overview, here’s a simple breakdown of what this benefit entails.

Accelerated Death Benefit At A Glance

Feature | Description |

|---|---|

Early Access | Allows you to receive a lump-sum payment from your death benefit after a qualifying diagnosis. |

Financial Flexibility | The funds have no restrictions. You can use them for medical costs, living expenses, or anything else. |

Benefit Reduction | The amount you take is subtracted from the final payout your beneficiaries receive. |

Triggering Events | Typically requires a physician to certify a terminal illness with a limited life expectancy. |

Ultimately, this rider provides immediate financial relief and greater control during an incredibly challenging time.

The Core Purpose of This Benefit

At its heart, the accelerated death benefit is about providing financial support and peace of mind. It was designed to tackle the overwhelming costs that can accompany a terminal diagnosis, giving policyholders a say in how their assets are used.

Here's what it boils down to:

Access When You Need It: You can get a large chunk of your policy's face value before you pass away.

Freedom of Use: The money isn't earmarked for anything specific. Medical treatments, in-home care, or even paying off a mortgage are all on the table.

Impact on Beneficiaries: It's important to remember that any funds you take out will reduce the final payout your loved ones get.

The core idea is simple: it gives you access to your own money to help manage the end-of-life journey with dignity and less financial strain.

This provision became more common as a direct response to the real-world financial struggles of terminally ill individuals. Payouts can range anywhere from 25% to 100% of the policy's value, though getting around 50% is quite common. You can explore the history of these benefits to see how they evolved to meet this critical need.

How You Actually Get Paid from an Accelerated Death Benefit

So, how does this all work in the real world? It's not like you just call up your insurance company and ask for cash. The process is straightforward, but it has a few key steps that start long before you'd ever need the money.

It all begins when you first set up your life insurance. The accelerated death benefit is typically added as a feature called a rider. Think of it as an optional upgrade to your policy—a built-in "break glass in case of emergency" switch that lets you tap into your death benefit while you're still living.

The real trigger, though, is a serious medical diagnosis. To activate the rider, a doctor usually has to certify that you have a terminal illness with a life expectancy of 12 to 24 months or less. This official medical confirmation is what gets the ball rolling.

With that documentation in hand, you'll file a claim with your life insurance company. It’s a formal process where you submit your request along with the doctor's certification. The insurer then reviews everything to make sure your situation matches the terms laid out in your policy's rider.

Crunching the Numbers and Getting Your Money

Once your claim gets the green light, the insurance company will figure out exactly how much you can receive. It's not as simple as just taking money out; it’s a calculated advance against your total death benefit. Most insurers will let you access a portion of your policy, often somewhere between 50% and 80% of its face value.

Let's walk through an example. Say you have a $500,000 life insurance policy and unfortunately receive a qualifying diagnosis. You decide it’s time to use the accelerated death benefit.

Your Policy's Face Value: $500,000

You Request and Get Approved for a 40% Advance: $200,000

What's Left for Your Beneficiaries: $300,000

The insurance company would send you that $200,000 as a single, tax-free payment. You can use it for anything—medical treatments, hiring a home health aide, or even just covering daily living costs. The most important thing to remember is that this advance permanently reduces what your loved ones receive later. In this case, they would get the remaining $300,000 when you pass away.

At its core, this rider lets you convert a piece of your future death benefit into a living benefit you can use right now, giving you critical financial support when you need it most.

What Happens to Your Policy Afterward?

Tapping into your accelerated death benefit changes your policy in two main ways. First, and most obviously, the death benefit paid out to your heirs will be smaller. It’s a direct trade-off: cash now in exchange for a lower payout later.

Second, your premium payments might actually go down. Because the total value of your policy has been reduced, the insurance company may adjust your premiums to reflect the new, lower face value. It’s a small but helpful bit of financial relief, making sure you aren't paying for coverage you no longer have.

The Specific Conditions for Qualifying

It’s one thing to understand what an accelerated death benefit is, but it's another entirely to know if you can actually access it. Insurance companies have strict, well-defined rules to make sure this benefit is used exactly as intended—to provide financial relief during a major health crisis.

The most common trigger is a terminal illness diagnosis. This isn't a loose term; insurers define it with precision. Typically, it means a physician has certified that your life expectancy is 24 months or less. Some policies might be even stricter, requiring a prognosis of 12 months or less.

This medical certification is the key. It's the official proof the insurance company needs to confirm your situation meets their criteria for paying out a portion of your death benefit early.

Beyond a Terminal Diagnosis

While a terminal illness is the primary reason for a claim, many life insurance policies have broadened their "living benefit" riders to cover other devastating health events. These additions create a financial safety net for situations that, while not immediately terminal, can shatter your quality of life and financial stability.

Other common qualifying events often include:

Critical Illness: This covers a diagnosis of a specific, life-threatening condition like a major heart attack, stroke, or invasive cancer.

Chronic Illness: This usually means you’re unable to perform at least two of the six Activities of Daily Living (ADLs)—things like bathing, dressing, eating, or getting out of a chair—without help.

Permanent Confinement: This applies when you require permanent care in a nursing home or another long-term care facility.

Just like with a terminal diagnosis, each of these scenarios requires official documentation from a licensed physician to validate the condition and its severity.

Ultimately, eligibility all comes down to one core principle: you must have a medically certified condition that fits the precise definitions laid out in your specific life insurance policy.

Your Eligibility Checklist

To file a successful claim, you have to be ready to provide some very specific documentation. Think of it as a checklist you need to complete before the insurance company will release the funds.

You will almost certainly need to provide:

A Physician's Certification: This is a formal, signed statement from your doctor confirming the diagnosis and, if applicable, your life expectancy.

Medical Records: You'll need to supply the records that back up your diagnosis and show your treatment history.

Policy Requirements: You must prove your policy is active and in good standing. Many insurers also require the policy to have a minimum face value, often around $25,000, to be eligible.

Knowing exactly what’s required from the start helps you set realistic expectations and gather the necessary paperwork. It makes an already difficult process just a little bit smoother.

Navigating The Financial And Tax Implications

Getting a large, lump-sum payment from an accelerated death benefit is a big deal, and it comes with some serious financial and tax considerations. You need to look beyond the immediate cash infusion and understand how it will ripple through your entire financial life.

One of the biggest perks is how the IRS treats this money. Under current U.S. law, money you receive from an accelerated death benefit because of a terminal illness is generally not considered taxable income. That’s huge. It means you get to use every dollar for your care without losing a chunk to taxes.

But that's not the whole story. The arrival of that cash can create other, less obvious, financial hurdles.

Impact On Government Assistance Programs

Even though the benefit is tax-free, it’s still counted as an asset. This is a critical detail because it can mess with your eligibility for government programs that are "means-tested," meaning they have strict limits on your income and the assets you own.

A significant payout could suddenly make you ineligible for programs like:

Medicaid: The health coverage program for millions of Americans with low incomes, including seniors and people with disabilities.

Supplemental Security Income (SSI): A program that provides monthly payments to adults and children with disabilities who have very limited financial resources.

Losing these benefits could mean losing your health coverage or a source of monthly income just when you need them most. It’s a major trade-off you have to think through carefully.

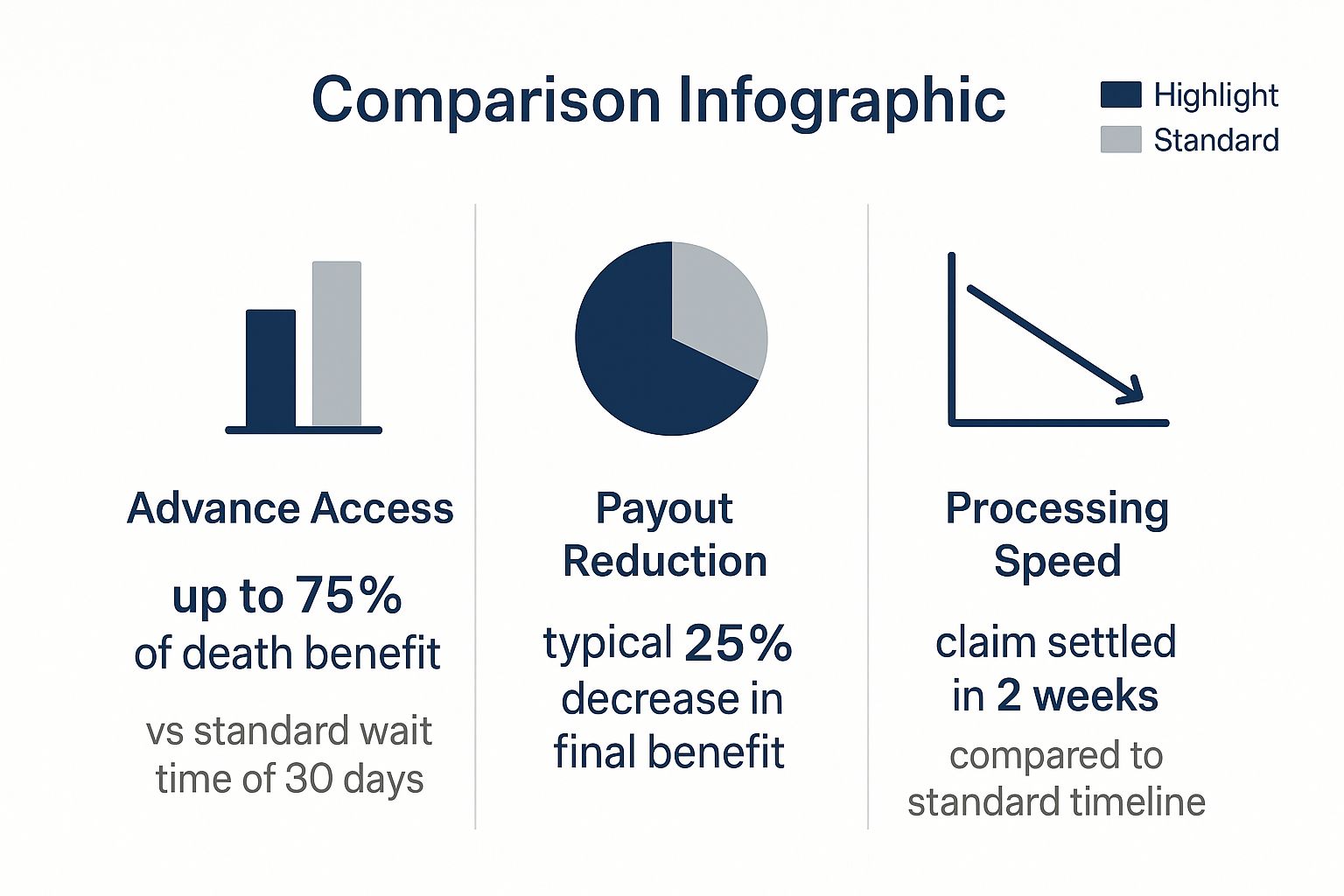

The image below breaks down some of the key figures you'll encounter, from the percentage of the benefit you can access to how it reduces the final payout for your beneficiaries.

As you can see, the trade-off is clear: you gain immediate access to a substantial part of your policy's value, but what's left for your heirs will be smaller.

It is essential to weigh the immediate financial relief against the potential long-term consequences, especially regarding ongoing government support and your estate plan.

The Importance Of Professional Guidance

This is not a decision to make in a vacuum. Given the complexities, I always recommend speaking with a financial advisor and an estate planning attorney before pulling the trigger on an accelerated death benefit.

These pros can help you see the complete picture. They’ll map out how this money fits into your overall financial strategy and help you anticipate any fallout, like losing other benefits. Gaining a solid understanding of how end-of-life care is typically paid for is also a smart move. For a deeper dive into those costs, check out this guide on how hospice care is funded.

Taking this step helps ensure the funds provide the relief you need without accidentally creating new financial headaches for you or your family.

When facing a serious illness, your life insurance policy can be a source of financial support, but the accelerated death benefit (ADB) isn't your only path to accessing funds. It’s crucial to understand the other avenues available, as each one works differently and has a distinct impact on your family's financial future.

Think of it this way: your policy holds value, and there are a few ways to unlock it. Besides an ADB, the two most common alternatives are viatical settlements and policy loans. One involves selling your policy outright, while the other treats it like collateral for a loan. Let's break down what that means for you.

Viatical Settlements Explained

A viatical settlement is when you sell your life insurance policy to a third-party company. They'll give you a lump-sum cash payment, which is more than the policy's surrender value but less than the full death benefit your family would eventually receive.

Once the sale is final, that company owns your policy. They become the new beneficiary, take over the premium payments, and collect the entire death benefit when you pass away. While this can sometimes offer a larger upfront payout than an ADB, it's a permanent decision. You're giving up all ownership, and your original beneficiaries will no longer receive anything from that policy.

Policy Loans Against Cash Value

If you have a permanent life insurance policy—like whole life or universal life—that has built up cash value over time, you can often take out a policy loan. This is exactly what it sounds like: borrowing money against the value your policy holds.

The great thing about a policy loan is its flexibility. You don't need a specific medical diagnosis to qualify and can use the funds for any reason. However, it's a true loan. Interest will accrue, and if you don't repay it, the outstanding amount (plus interest) gets deducted from the final death benefit paid to your beneficiaries.

The core difference is that an ADB is an advance on your death benefit due to a specific health crisis, while a policy loan is a debt against your cash value that must be repaid.

This is where the ADB often stands out. It provides immediate relief without creating a loan. If you accelerate $200,000 from a $1 million policy, your beneficiaries still get the remaining $800,000. It’s a straightforward reduction of the final payout. For a deeper dive, you can find more insights on the evolution of ADBs on soa.org.

To make sense of these choices, it helps to see them side-by-side. The table below lays out the key differences between an ADB, a viatical settlement, and a policy loan.

Cash Access Options For Life Insurance

Feature | Accelerated Death Benefit (ADB) | Viatical Settlement | Policy Loan |

|---|---|---|---|

Eligibility | Requires a qualifying medical diagnosis (e.g., terminal illness). | Requires a terminal or chronic illness; you sell the entire policy. | Requires sufficient accumulated cash value in a permanent policy. |

Payout Amount | A percentage of the death benefit, often up to 80%. | A lump sum greater than cash value but less than the death benefit. | Limited to the available cash value in your policy. |

Tax Impact | Generally tax-free for terminal illness. | Generally tax-free for terminal illness. | Not taxable, as it is considered a loan. |

Beneficiary Impact | The remaining death benefit is paid to beneficiaries. | Beneficiaries receive nothing, as the policy is sold. | The death benefit is reduced by any outstanding loan balance and interest. |

Ultimately, the right choice depends entirely on your personal circumstances—your health, your financial needs, and what you want to leave behind for your loved ones. Weighing these options carefully is a critical step in making a confident decision.

Consumer Protections and Regulatory Standards

When you're dealing with a serious health crisis, the last thing you need is to worry about being taken advantage of. Thankfully, the accelerated death benefit isn't some unregulated, wild-west feature. It's a structured financial tool overseen by specific rules designed to protect you.

These standards are in place to make sure the entire process is fair and transparent. They give you the confidence to use this important policy feature, knowing you understand exactly what you’re getting into.

Ensuring Transparency and Fair Practices

A primary goal of these regulations is to cut through the confusion and prevent exploitation. For starters, insurers are required to treat the accelerated death benefit as an "incidental" feature of your main life insurance policy.

This is a crucial distinction. It means the rider can’t overshadow the policy's primary job: leaving a death benefit for your beneficiaries. This rule keeps the focus squarely on providing you with financial relief, not on turning your life insurance into a complicated investment product.

At their core, these standards are designed to build trust. They ensure that when you access your accelerated death benefit, you are making a clear-eyed decision based on transparent information provided by your insurer.

These consumer protections aren't just polite suggestions; they're enforced. Over the years, actuarial standards have evolved to carefully manage how these benefits are structured and offered.

For example, organizations like the Interstate Insurance Product Regulation Commission have established clear guidelines in the U.S. Insurers must disclose the exact formulas they use to calculate your benefit. They even have to provide sample calculations showing your policy's value before and after you take the money, so you can see the real-world impact.

If you want to dig deeper, you can learn more about these insurance standards and see exactly how they work to protect policyholders like you.

Common Questions About Accelerated Death Benefits

When you start digging into accelerated death benefits, a lot of practical questions pop up. It's one thing to know the definition, but another to understand how this feature actually plays out in real life. Let's walk through some of the most common things people ask.

A big one is cost. Does this feature cost extra? Often, you'll find an accelerated death benefit rider is already built into a group life insurance policy with no added upfront cost. On other policies, it might be an optional add-on that bumps up your premium by a small amount.

People also want to know how they get the money. Once your claim is approved, the funds are typically paid out as a single, tax-free lump sum. This puts cash in your hands right away, giving you the freedom to use it for whatever you need most.

Will My Beneficiaries Get Anything?

Yes, absolutely—as long as you don't use the entire death benefit. The amount you take out early is simply subtracted from the total your beneficiaries would have received.

Think of it this way: if your policy is for $300,000 and you accelerate $150,000 for medical care, your loved ones will still get the remaining $150,000 when you pass away.

It's a straightforward trade-off. You get the financial support you need right now, and your family still gets a significant, though smaller, benefit later. The policy's core purpose of providing a safety net remains intact.

Can I Be Denied an Accelerated Death Benefit?

Yes, it's possible for a claim to be denied. This usually happens when your situation doesn't tick all the specific boxes laid out in your policy's fine print.

Here are a few common reasons for a denial:

Incomplete Medical Proof: Your doctor’s diagnosis might not explicitly state that your life expectancy is within the policy's required window (which is often 12-24 months).

Policy Exclusions: Some policies come with specific conditions or waiting periods that have to pass before the rider can be used.

Not Enough Coverage: The policy's face value might be too low. Insurers often have a minimum, like $25,000, for the accelerated death benefit to be an option.

It's so important to read through your policy documents before you ever need them. Knowing the exact rules and requirements ahead of time can save you from a lot of frustration and help you put together a claim that gets approved.

Getting clear on these points helps demystify how this benefit works. It’s a powerful tool designed for financial relief when you need it most, but you have to play by the rules to access it.

At America First Financial, we believe insurance should be clear, honest, and designed to protect your family's future. If you're looking for life insurance that reflects your values, we can help. Get a no-hassle quote from us today and see how we can help secure what matters most to you.

_edited.png)

Comments