What Is Convertible Term Life Insurance? Find Out Now

- dustinjohnson5

- Sep 9, 2025

- 13 min read

Convertible term life insurance gives you the affordable protection of a standard term policy but with a powerful, built-in feature: the option to switch to a permanent policy down the road, often without needing a new medical exam. This flexibility is a game-changer for families whose financial needs are bound to evolve over time.

Your Flexible Financial Safety Net Explained

Think of it like leasing a car with a guaranteed option to buy it when the lease is up. You enjoy the lower monthly payments of the lease right now, but you’ve locked in the right to own that car later, no matter what its market value is or what your personal situation looks like. Convertible term life insurance works in a very similar way.

It’s essentially a hybrid policy. It starts out as a normal term policy, giving you coverage for a set number of years—say, 10, 20, or 30 years. Most families lean toward term policies initially because the premiums are significantly lower, which makes getting the right amount of protection much more manageable while you're focused on raising kids or paying down a mortgage.

The magic is in what’s called the 'conversion privilege'. This is a contractual guarantee baked into your policy that lets you trade in your temporary term coverage for a permanent one, like whole life insurance.

The real power here is that this switch usually doesn't require you to go through another medical exam or prove you're still in good health. You effectively lock in the health rating you had on the day you first bought the policy.

To see why this is such a valuable feature, it helps to understand the fundamental difference between term and permanent life insurance. The conversion option beautifully bridges the gap between these two very different types of coverage.

To help you visualize where this policy fits, here's a simple breakdown.

Convertible Term Life at a Glance

Feature | Standard Term Life | Convertible Term Life | Permanent Life |

|---|---|---|---|

Coverage Duration | Fixed period (e.g., 20 years) | Starts as a fixed period | Lifelong, as long as paid |

Initial Premium Cost | Low | Low (slightly higher than standard) | High |

Cash Value Growth | No | No (until converted) | Yes |

Medical Exam | Yes, at the beginning | Yes, at the beginning | Yes, at the beginning |

Flexibility | Limited to the term | High (option to convert) | High (loans, withdrawals) |

Conversion Option | No | Yes (key feature) | Not applicable |

This table shows how a convertible policy gives you the best of both worlds to start—low cost like a term policy, with the future potential of a permanent one.

This built-in flexibility means that as your life changes—maybe you get a big promotion, or you simply decide you want coverage that will last your entire life—your insurance can adapt right along with you. It's a smart, strategic move for anyone who needs solid protection today but wants to keep their long-term options open, protecting their family without being forced into a higher-cost permanent policy from day one.

How the Conversion Process Actually Works

So, how does this actually work in the real world? It's much simpler than you might think. Think of it like a "get out of jail free" card for your health you've kept in your back pocket. The whole process is designed to be smooth, moving you from temporary protection to a permanent financial safety net for your family without a lot of headaches.

First things first, you need to know about your 'conversion period'. This is the specific timeframe your policy gives you to make the switch. It's not a forever deal. Some policies might give you the first ten years, while others let you convert anytime before you hit a certain age, like 65. It’s absolutely critical to know this date, because once it passes, the option is gone for good.

The Power of No New Medical Exam

Here’s the single most valuable part of the deal: no new medical exam is required. That’s huge. When you originally bought your policy, you locked in your health status. You were "insurable" then, and the company has to honor that.

This is a massive benefit. If you develop a health issue down the road—maybe high blood pressure, diabetes, or something more serious—it won't stop you from getting lifelong coverage. Your ability to get insurance is guaranteed based on the health you had years ago, not the health you have today.

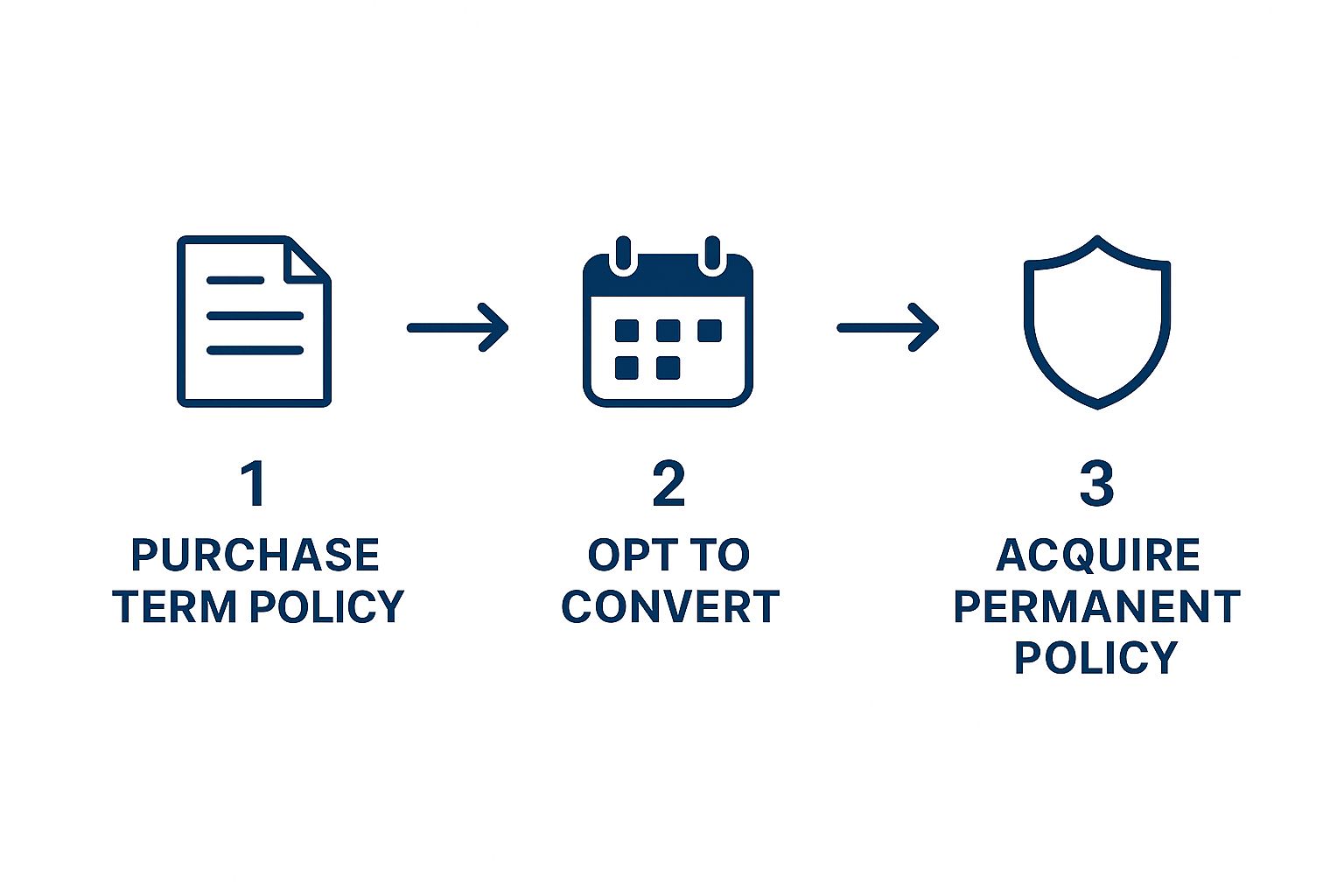

This visual breaks down the simple, three-step journey from buying your term policy to locking in permanent coverage for your family.

As you can see, the conversion option is built right in from the start, giving you a seamless path forward when your life and needs inevitably change.

Navigating the Practical Steps

When you decide the time is right, the actual steps are pretty straightforward. You're not starting over from scratch.

Here's what you'll do:

Notify Your Insurer: This is the most important step. You have to formally contact your insurance company and tell them you want to use your conversion privilege. Make sure you do this before your deadline.

Review Your Permanent Options: The insurer will then show you which permanent policies are available for conversion, usually a whole life or universal life plan. These are the policies that last your entire life and can build cash value.

Complete the Paperwork: You’ll need to sign new policy documents that make the switch official.

Begin New Premium Payments: Once the paperwork is done, you'll start paying the new, higher premiums for your permanent policy, and your lifelong coverage will be active.

The most critical financial detail to grasp is how your new premium is set. It will be based on your age at the time you convert, not the age you were when you first bought the policy. But—and this is key—it will not be based on your current health.

What does that mean? A 50-year-old who is now a diabetic will pay the standard rate for any other 50-year-old, even though they wouldn't qualify for that rate if they applied for a new policy today. You get the rate for your current age, but with the health rating of your younger, healthier self.

What Are the Real Benefits of a Convertible Policy?

So, why would a family pick a convertible policy instead of a standard term plan? The answer really comes down to its built-in flexibility. It's about getting the protection you need right now, at a price you can afford, while keeping your options open for the future.

This isn't just about a death benefit; it's a strategic move. A convertible policy understands that the insurance you need as a 30-year-old with a new mortgage might look very different from what you need as a 50-year-old planning for retirement.

Guaranteed Future Insurability

This is, without a doubt, the single biggest advantage. Life is full of surprises, and a sudden health diagnosis can completely change your ability to get life insurance coverage.

A convertible policy is your ace in the hole. You essentially lock in your health rating the day you sign the policy. If you were to develop a serious health condition like diabetes or heart disease years down the road, it doesn't matter. The insurance company can't turn you away. They are legally bound to let you convert to a permanent policy based on the clean bill of health you had when you first started.

It means you can switch your term policy to a permanent plan, like whole life or universal life, with no new medical exam. This conversion privilege is usually available for a specific window of time—sometimes it's the first few years, and with other policies, it can be the entire term. You can find more details on these convertible term policy provisions from Ethos.com.

Flexibility for Life’s Changes

Life doesn't stand still, and your financial plan shouldn't either. What makes sense for a young couple just starting out won't be the right fit once the kids are grown and you're thinking about the next chapter.

A convertible policy is designed to evolve right along with you.

Your Income Grows: As you advance in your career and your salary increases, a permanent policy that builds cash value might start looking like a smart piece of your overall financial puzzle.

Your Goals Shift: In the beginning, your main concern might be making sure the mortgage gets paid. Later, your focus could shift to using life insurance for estate planning or leaving a financial legacy for your kids and grandkids.

Business Needs Change: A small business owner might get a term policy to cover a business loan. Later, they could convert it to a permanent policy to fund a buy-sell agreement with a partner.

Affordability Today, Permanent Options for Tomorrow

For most families, especially those raising young children, every dollar counts. You need the most protection you can get for the lowest possible cost, which is the primary appeal of term life insurance.

A convertible policy gives you that critical affordability right now, but without closing the door on your future. You get a large amount of coverage during the years you need it most, while preserving the right to secure lifelong protection later on.

This approach lets you protect your family immediately without breaking the bank. It's a sensible, responsible strategy that balances your current budget with your long-term goals. That powerful combination of affordability and flexibility is truly the core strength of convertible term life insurance.

Potential Drawbacks and Important Considerations

While the flexibility of a convertible term policy is a huge advantage, it's not a magic bullet. To make the best choice for your family, you need to look at the whole picture—the good, the bad, and the fine print. The benefits are real, but they come with certain trade-offs you absolutely must understand.

The first thing you'll notice is the price tag. Convertible term policies usually cost a little more than their non-convertible counterparts. You're essentially paying a small premium for the option—the right, but not the obligation—to switch to a permanent policy down the road. It's a bit like paying for an insurance policy on your insurance policy, securing your future options.

The Inevitable Premium Increase After Conversion

The most significant financial shift happens when you actually decide to convert. Be prepared: your new permanent life insurance policy will cost more, and often, quite a bit more.

This isn't some kind of penalty. The new, higher premium is simply based on your age at the time you make the switch. So, if you convert at age 50, you'll be paying the rates for a 50-year-old, not the much lower rates you locked in at age 30. While you get to keep your original health rating—which is a massive benefit—you can’t lock in your original age.

To see how this plays out in the real world, let’s look at a typical example. The table below shows how premiums can change as a policyholder ages and decides to convert their coverage.

Policy Stage | Age of Insured | Health Status | Estimated Monthly Premium |

|---|---|---|---|

Initial Term Policy | 30 | Preferred Plus | $35 |

Term Policy Renewal | 50 | Preferred Plus | $250 (If not converted) |

Converted Permanent Policy | 50 | Preferred Plus (Original) | $450 |

As you can see, converting to a permanent policy at age 50 results in a significant premium increase, but it guarantees lifelong coverage without a new medical exam. This is the core trade-off you need to plan for.

Understanding the Conversion Window Deadline

This next point is critical: the option to convert isn't open forever. Every policy has a strict “conversion window,” which is the specific period during which you’re allowed to make the change. Once that window closes, the conversion privilege is gone for good.

This timeframe isn't standardized and can vary quite a bit from one insurer to another. Here are a few common structures:

A Specific Term: Some policies might state you can only convert within the first 5 or 10 years of your 20-year term.

An Age Limit: Others link the deadline to your age, allowing conversion anytime before you turn 65 or 70, for instance.

The Full Term: A few, more flexible policies might let you convert right up until your term policy is set to expire.

You absolutely must know your policy's deadline. Missing this window means you forfeit the single most valuable feature of your policy. When you buy the policy, find that date, circle it on your calendar, and set a reminder.

So, Who Is Convertible Term Life Insurance Really For?

Convertible term life insurance isn't the right choice for everyone, but for some people, it hits the sweet spot between what they can afford today and the security they want for tomorrow. Think of it less as a one-size-fits-all product and more as a strategic tool—a bridge between your immediate needs and your long-term financial goals.

It's all about getting that substantial coverage you need right now while leaving the door open to permanent, lifelong protection later on. You don't have to predict the future, you just have to plan for it.

Young Families on a Budget

When you're starting a family, it often feels like every dollar is spoken for. Between the mortgage, daycare, and just putting food on the table, finding room for life insurance can be tough. But this is also when you need the largest death benefit possible to protect your spouse and kids if something were to happen.

This is where convertible term life insurance shines. It gives you that high-coverage, low-premium protection you need today. Later, as your career progresses and your income grows, you have the guaranteed option to switch that affordable policy into a permanent one that can cover you for life and even build cash value.

People with a Family History of Health Issues

Maybe you're in perfect health right now, but you know that certain conditions like heart disease or diabetes run in your family. This creates a nagging worry: what if you can't qualify for life insurance down the road, right when you need it most?

Here's the real power of a convertible policy: it lets you lock in your insurability. By buying a policy while you're young and healthy, you secure the best possible health rating. If you develop a health condition later in life, it won't stop you from converting to a permanent policy. You're essentially getting ahead of any potential health hurdles. You can learn more about how convertible policies adapt to evolving financial needs on Ethos.com.

This isn't just a minor feature; it's a profound form of financial peace of mind. You're protecting your family's future from the uncertainties of both life and health.

Business Owners and Entrepreneurs

If you own a business, your financial needs can change dramatically over time. In the beginning, you might need a large term policy to secure a Small Business Administration (SBA) loan. It’s a common requirement that protects the lender and your business if you pass away before the debt is paid.

But what happens once that loan is paid off? Your focus might shift to planning for retirement or setting up a buy-sell agreement with a business partner. A convertible policy gives you the flexibility to pivot. You can convert that original term policy into a permanent one to fund a succession plan, ensuring your business can transition smoothly to your heirs or partners without a financial crisis. It's about protecting the legacy you've worked so hard to build.

Alright, let's get into the nitty-gritty of picking the right convertible term policy. It’s about more than just finding the lowest monthly payment; the real key is understanding the conversion feature itself. That’s where you’ll find the long-term value for your family.

First things first, you need to check the conversion period. This is the window of time you have to actually make the switch from term to permanent. It varies quite a bit between companies. Some might give you ten years from the day the policy starts, while others might let you convert anytime before you turn 65. The longer that window is, the more flexibility you have as your life and needs change.

What to Look for in the Fine Print

Once you know when you can convert, you need to know what you can convert to. This is a big one, because not all permanent policies are the same.

Here are the questions you should be asking any potential insurance company:

What are my permanent policy options? Can I choose from whole life, universal life, or other types? The more options, the better.

Are there any hidden fees for converting? There shouldn't be, but it's always best to ask and get it in writing.

Can I convert the full death benefit? You should be able to move the entire face value of your term policy over without needing another medical exam.

The policy documents are your best friend here. I know it’s not exciting, but you have to read the fine print. That’s where all the rules, deadlines, and potential limitations are hiding. Taking the time now means you won't get hit with any nasty surprises when you’re ready to convert down the road.

Choosing a life insurance policy is one of those big financial decisions that will echo for decades. Making sure it truly fits your long-term vision is what matters most.

If you feel like you're in over your head, think about talking to an independent financial advisor. They don't work for just one insurance company, so they can give you an unbiased look at what's out there. They'll help you sort through quotes from several top-rated insurers and find a policy that genuinely protects what you’re building.

Answering Your Top Questions

Even after getting the basics down, you probably have a few specific questions about how convertible term life insurance works in the real world. Let's walk through some of the most common ones we hear from families just like yours.

Can I Keep the Same Death Benefit When I Convert?

For the most part, yes. When you decide to convert, you can typically carry over the full death benefit amount from your original term policy. No new medical questions, no hassle.

Some insurance companies even give you the flexibility to choose a lower death benefit. This is a great option if your financial needs have changed—maybe the kids are grown or the mortgage is paid off—and it will help lower your new premium.

What you usually can't do without a new medical exam is increase the death benefit. If you want more coverage than you originally had, the insurance company will need to underwrite that extra amount from scratch.

Is There a Deadline to Convert My Policy?

Absolutely, and this is one detail you can't afford to forget. Every policy has a built-in “conversion period”, which is the window of time you have to make the switch. Miss it, and the option is gone for good.

This deadline isn't the same for every policy. It could be:

Within the first 5 or 10 years of your term.

Anytime before you hit a specific age, like 65 or 70.

All the way up until your original term expires.

Think of this deadline as a non-negotiable expiration date. We always tell our clients to find this date in their policy documents and put a reminder on their calendar right away. Losing this conversion privilege means losing one of the most valuable safety nets you have.

Does a Convertible Policy Cost a Lot More Upfront?

Not at all. You'll find that a convertible term policy is usually just a few dollars more a month than a standard, non-convertible one. That small extra cost is simply the price for keeping that powerful conversion option open for the future.

The real price change happens when you convert. Your new permanent life insurance premium will be calculated based on your age at the time you make the switch, so it will naturally be higher than what you were paying for your term policy.

But here’s the crucial part: you get to keep the health rating you had when you first bought the policy. This is a massive benefit. It means that even if your health has declined over the years, you can’t be denied permanent coverage or charged more because of it. You're locked in.

At America First Financial, we believe in providing clear, straightforward insurance options to protect what matters most. Get a free, no-hassle quote online in under three minutes and secure the protection your loved ones deserve.

_edited.png)

Comments