What Is Guaranteed Insurability Rider? Learn How It Protects You

- dustinjohnson5

- Sep 11, 2025

- 11 min read

Life insurance is rarely a "set it and forget it" kind of thing. As your life evolves—you get married, buy a house, have kids—your financial responsibilities grow right along with it. But what if your health takes a turn, making it difficult or expensive to get more coverage when you need it most?

That’s the exact problem a Guaranteed Insurability (GI) rider is designed to solve.

Think of it as a series of future "coverage coupons" you get when you first buy your policy. It gives you the right, but not the obligation, to purchase additional life insurance down the road, all without having to go through another medical exam or answer a single health question. You essentially lock in your current health status for the future.

How Does a Guaranteed Insurability Rider Actually Work?

Let's paint a picture. Say you buy a life insurance policy in your 20s. You're young, healthy, and the premiums are affordable. Fast forward ten years. Now you have a spouse, a mortgage, and a couple of kids who depend on you. Your original policy might not be enough anymore.

But what if you've developed a chronic condition like high blood pressure or diabetes in those ten years? Trying to qualify for a new, larger policy could be a nightmare. Your premiums would likely be sky-high, or you could even be denied coverage altogether.

This is where the GI rider shines. It acts as a powerful safety net against life's unpredictability.

The Core Function: A Future-Proof Plan

At its heart, the Guaranteed Insurability Rider lets you buy more protection at predetermined points in the future. You’re essentially pre-approved for more coverage, based on the good health you were in when you first took out the policy. You can find more details on how this rider secures future coverage for your family on Protective.com.

For a small increase in your current premium, you buy the option to increase your death benefit later. These opportunities, often called "option dates," are usually triggered by two things:

Specific Ages: Many insurers set regular option dates every few years, often on your birthday at ages like 25, 28, 31, 34, 37, and 40.

Major Life Events: Big milestones can also unlock an option. Think getting married, having or adopting a child, or even buying a new home.

The real value here is the absolute peace of mind it provides. You lock in your insurability from day one, so a health scare down the road won't stop you from protecting the people you love.

This makes the rider a fantastic tool for young adults and new families. You can start with a policy that fits your budget today, knowing you have a clear path to increase it as your financial world expands.

To help you get a quick overview, here’s a simple breakdown of what this rider offers.

Guaranteed Insurability Rider At a Glance

This table sums up the key features of the rider, so you can see its purpose and benefits in an instant.

Feature | Description |

|---|---|

Core Purpose | Allows you to buy more life insurance coverage in the future. |

No Medical Exam | You don't need to undergo a new medical exam or answer health questions to add coverage. |

Locked-In Health | Your eligibility for more coverage is based on your health when you first bought the policy. |

Option Dates | Opportunities to add coverage occur at specific ages or after major life events. |

Optional, Not Obligatory | You have the right to buy more coverage but are never forced to. |

Ideal Candidate | Young adults and new families who expect their financial needs to grow over time. |

Ultimately, this rider is about keeping your options open. It ensures that as your life grows, your life insurance protection can grow right along with it, no matter what your health looks like in the future.

How a GI Rider Works in Real Life

Theory is one thing, but let's walk through how a guaranteed insurability rider plays out in the real world. This is where you can really see its power.

Meet Alex, a 24-year-old professional just kicking off their career. Alex gets a whole life insurance policy and, for just a few extra dollars a month, wisely adds a guaranteed insurability (GI) rider. The initial death benefit is a good start, but Alex knows it won't be enough down the road, especially if a family is in the picture.

That little GI rider is Alex's ticket to buying more insurance later—without ever having to prove good health again.

Triggering an Option Date

Fast forward a few years. Life happens, and this is exactly what the GI rider was built for. The opportunities to buy more coverage are called "option dates," and they typically pop up in two ways:

Age-Based Options: The insurance company will automatically offer Alex the chance to buy more coverage on specific birthdays, like at ages 28, 31, 34, 37, and 40.

Life Event Options: Big milestones also unlock the rider. When Alex gets married at 27 or has a first child at 30, each of these events opens a window of time—usually 30 to 90 days—to add more insurance.

When an option date comes around, Alex gets a notification from the insurer explaining the opportunity. The process is refreshingly simple. No medical exams. No needles. No pages of health questions. Alex just has to accept the offer and complete the paperwork.

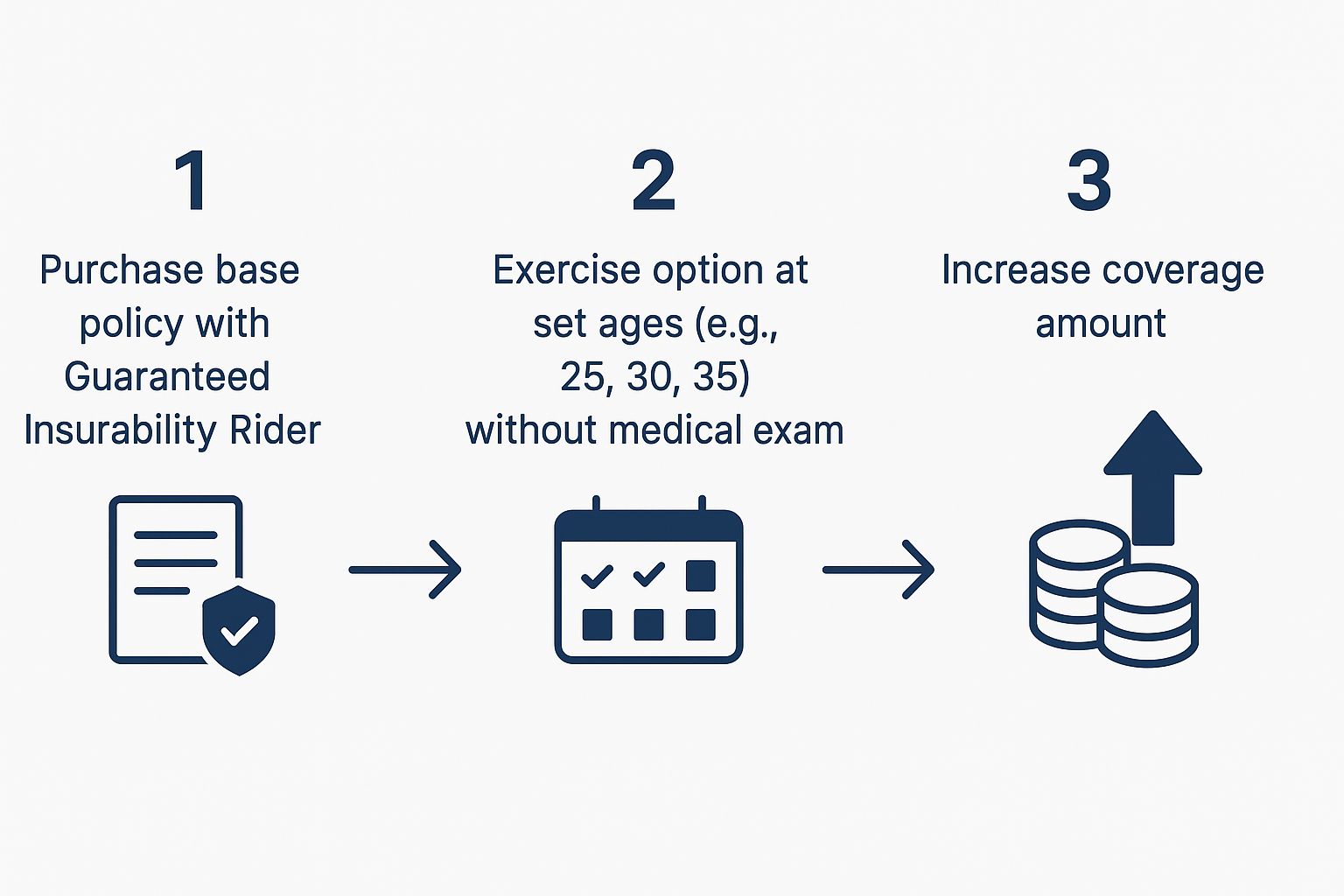

This chart breaks down how the rider works from the day you buy it to the day you use it.

The real magic here is getting to skip the entire underwriting process. You get to bypass the very step that could get you denied coverage later in life.

Understanding the New Premiums

Now, here’s a crucial detail. While Alex gets to skip the medical exam, the premium for the new slice of coverage isn't based on that original age of 24. The cost for the additional insurance is calculated based on Alex's current age.

For instance, when Alex adds coverage at age 30 after the baby is born, the premium for that new block of insurance is based on the rates for a healthy 30-year-old. This is still a massive win. Why? Because if Alex had developed a health issue like high blood pressure between ages 24 and 30, getting new insurance on the open market would either be incredibly expensive or flat-out impossible.

With the GI rider, Alex was able to lock in future coverage based on young, healthy self. It's a powerful tool that lets your life insurance grow with you, ensuring your family is protected no matter what health changes come your way.

Why This Rider Is a Smart Financial Move

Think of a guaranteed insurability rider as more than just a policy add-on. It's a strategic move that safeguards your financial future. It's about locking in your ability to get more coverage when life demands it, no matter what health challenges might come your way. This rider is a powerful shield against the unknown.

The biggest advantage is simple: it protects your future insurability.

Let’s say you’re diagnosed with a chronic health condition in your 30s. Without this rider, that diagnosis could make it incredibly difficult—or flat-out unaffordable—to qualify for more life insurance down the road.

A guaranteed insurability rider makes that entire problem vanish. It lets you buy more coverage based on the clean bill of health you had when you first took out the policy. You essentially freeze-frame your good health for future use.

Secure Coverage for Life's Biggest Moments

Life has a way of changing, and usually for the better. Your family grows, your income increases, and your financial responsibilities get bigger. As they do, your need for life insurance naturally grows right along with them. This rider gives you the power to adapt your financial plan without skipping a beat.

Here are a few classic moments where this rider proves its worth:

Getting Married: When you tie the knot, your financial lives become one. The rider lets you easily bump up your coverage to protect your new spouse.

Having a Child: A new baby brings a whole new level of responsibility. You can exercise an option to make sure your child is financially secure, no matter what.

Buying a Home: A mortgage is likely the biggest debt you'll ever have. Increasing your coverage ensures your family can stay in their home if the unthinkable happens.

Without the rider, you'd have to reapply for insurance and go through a full medical exam for each of these life events. With it? The process is simple, straightforward, and guaranteed.

This isn't just about buying more insurance; it's about buying peace of mind. It’s the confidence that comes from knowing you have a plan in place to protect your loved ones, even if your health takes an unexpected turn.

The Ultimate Financial Safety Net

When you get down to it, the guaranteed insurability rider is a forward-thinking tool for anyone serious about long-term financial planning. For a small extra cost, you're buying an incredibly valuable guarantee. You're securing the right to increase your family's protection at key moments, without ever letting future health issues stand in the way.

For example, a young professional might start with a modest policy that fits their budget today. A decade later, after a big promotion and starting a family, their financial picture looks completely different. The rider ensures their life insurance can grow alongside their life, offering a reliable safety net every step of the way. This kind of foresight turns a basic policy into a dynamic financial shield.

Who Should Consider Adding a GI Rider?

While a guaranteed insurability (GI) rider is a fantastic tool, it’s not for everyone. It's really designed for people who see their financial responsibilities growing down the road and want to lock in their ability to get more coverage, no matter what their health looks like in the future.

This rider is most valuable for those who are young and healthy right now but fully expect their need for protection to increase over time. Think of it as pre-qualifying for future life insurance while you're in peak condition.

The Best Candidates for a GI Rider

Certain life stages and situations make someone a perfect fit for this rider. If any of these sound like you, it’s definitely worth a closer look:

Young Professionals & New Grads: Just starting your career? Your income and responsibilities are probably on an upward trajectory. A GI rider lets you get a policy that fits your budget today, with a clear path to expand it as your life changes.

Newlyweds or Soon-to-Be-Married Couples: When you combine your lives and finances, your need to protect one another grows. This rider makes it easy to increase your coverage as you build a future together.

Expecting Parents or Those Planning a Family: A new baby is one of the single biggest reasons people need more life insurance. The GI rider ensures you can get that extra protection, hassle-free.

Anyone with a Family History of Health Problems: If you're concerned about developing hereditary conditions later in life, a GI rider is a powerful move. It lets you secure your insurability now, while you're still in great health.

Understanding the Eligibility Rules

Insurance companies have some ground rules for who can get a GI rider, which helps them manage their risk. The specifics can vary, but generally, this rider is available for permanent life insurance policies like whole or universal life.

Age is a big factor. Most insurers offer the rider to applicants from their late teens up to their early 40s. You also typically have to be in good health when you first buy the policy; significant pre-existing conditions might make you ineligible. You can learn more about guaranteed insurability rider requirements on westernsouthern.com.

At its core, the insurer is making a bet on your current health. By requiring you to be young and healthy at the start, they can confidently offer you the option to buy more coverage later without another medical exam.

This is exactly why it’s so important to consider this rider when you first apply for your policy. It's almost never an option you can add on later. Making this small investment upfront can pay huge dividends in securing your family’s financial future.

Weighing the Costs Against the Benefits

Whenever you're thinking about adding something to your life insurance policy, the first question is almost always, "What's it going to cost me?" With a guaranteed insurability rider, the answer is usually just a few extra dollars a month. It’s a small price, but what you’re buying is incredibly valuable.

Think of it this way: you aren't paying for more death benefit today. Instead, you're securing the right to buy more coverage down the road, no matter what your health looks like then. It’s an investment in your future self.

The Financial Trade-Off: How It Really Works

The rider itself is cheap because all you're paying for is the option. When you decide to actually use that option and buy more coverage, the premium for that new chunk of insurance will be calculated based on your age at that time. So, if you add coverage at 35, you'll pay the standard rate for a healthy 35-year-old.

This is a huge financial advantage. If you were to develop a health condition and tried to buy a new policy without the rider, that same coverage could be astronomically expensive—if you could even get it at all. The rider locks in your insurability, guaranteeing you always get the preferred rates for your age.

You're paying a little extra now to shield yourself from the risk of paying a lot more later. It’s a smart, calculated way to manage the financial uncertainty that comes with life.

Cost vs. Potential Savings: A Clear Comparison

To really see the numbers in action, let's look at a side-by-side comparison. Imagine someone wants to add $100,000 in coverage at age 35. One person has the GI rider, while the other doesn't and has unfortunately developed a health issue since they first got their policy.

Cost vs. Potential Savings with a GI Rider

This table illustrates the long-term financial value of a GI rider by comparing its modest cost to the potential increase in premiums without it if health changes.

Scenario | Cost of GI Rider (Example) | Cost of New Coverage (With GI Rider) | Potential Cost of New Coverage (Without GI Rider, Health Decline) |

|---|---|---|---|

Policyholder A (With Rider) | ~$40 per year | Based on standard rates for a healthy 35-year-old. | Not applicable. |

Policyholder B (Without Rider) | $0 | Not applicable. | Premiums could be 2-3x higher, or coverage could be denied completely. |

Looking at it this way, the value becomes crystal clear. That small annual cost for the rider is essentially an insurance policy on your insurance policy. It guarantees that life's unexpected health challenges won't lock you out of getting the affordable protection your family needs, making the guaranteed insurability rider one of the most powerful risk-management tools you can have.

Got Questions About Guaranteed Insurability? We Have Answers.

It's only natural to have a few questions when you're digging into the details of a life insurance rider. Let's walk through some of the most common ones people ask so you can get a crystal-clear picture of how this feature works.

Can I Add This Rider to a Policy I Already Own?

This is a big one, and the short answer is almost always no. You have to add a guaranteed insurability rider when you first buy your life insurance policy.

Think of it from the insurer's perspective. They’re making a bet on your long-term health based on a snapshot in time—the day you apply. Once that policy is locked in and issued, that window of opportunity to add the rider closes for good.

What Happens If I Skip an Option Date?

Life happens. You might forget an option date or simply decide you don't need more coverage at that moment. The great thing is, there's no penalty for skipping. The rider gives you the right to buy more insurance, not the obligation.

If you miss one of your scheduled dates, that specific chance is gone, but the rider itself remains active. You can still use it on any future option dates your policy offers until the rider expires, which is usually somewhere between age 40 and 50.

For instance, let's say you pass on the option at age 28. No problem. You can still jump on the opportunity when you turn 31. You've only missed one chance, not all of them.

Is the Guaranteed Insurability Rider Always Worth It?

For most people, especially younger folks just starting out, it’s an enthusiastic yes. The cost is usually very low—we're often talking just a few extra dollars a month—but the protection it buys you is massive. It's your defense against becoming uninsurable down the road.

Here’s how to think about it:

If your health takes a turn: The rider suddenly becomes priceless. It lets you lock in more coverage at standard prices for your age, something you likely couldn't do otherwise.

If you stay perfectly healthy: That small extra cost you paid over the years was for peace of mind. It was your financial safety net, ready and waiting just in case.

So, when you ask, "What is a guaranteed insurability rider?"—it’s really a smart, affordable way to future-proof your financial plan. It makes sure that as your life gets bigger and your responsibilities grow, your ability to protect the people you love can grow right along with you, no matter what health surprises come your way.

At America First Financial, we believe in providing clear, dependable insurance solutions that protect your family and align with your values. Secure your future with a provider that puts your financial security first. Get your free, no-hassle quote online in under 3 minutes.

_edited.png)

Comments