What Is Guaranteed Issue Life Insurance?

- dustinjohnson5

- Aug 19, 2025

- 10 min read

Guaranteed issue life insurance is exactly what it sounds like: a policy that guarantees your acceptance, no matter your health history. It's often called final expense insurance, and for good reason—it’s designed to provide a small cushion of cash for your loved ones after you're gone.

Think of it as the most straightforward life insurance option out there. If you've been turned down for other policies because of a pre-existing condition, this is your open door to getting coverage.

What Is Guaranteed Issue Life Insurance In Simple Terms?

Simply put, this type of insurance is built on a single, powerful promise: you will be approved. There are no health questions to answer, no medical exams to sit through, and no one asking for your prescription history. It strips away all the usual barriers to getting life insurance.

Its main job is to give your family a financial safety net to handle immediate costs when you pass away.

Covering Final Expenses

The death benefit from a guaranteed issue policy is typically modest, but it’s intended for very specific, immediate needs. Your loved ones can use the money for:

Funeral and burial costs: These can be surprisingly expensive, and a policy ensures the burden doesn't fall on your family.

Lingering medical bills: It can help clear up any final hospital or healthcare expenses.

Small personal debts: The funds can be used to settle outstanding credit card balances or other minor loans.

This approach ensures that your family has immediate funds to manage expenses during a difficult time, providing essential peace of mind.

This type of insurance became popular because it filled a critical gap, especially for seniors who found it hard to get traditional life insurance. The market for final expense coverage, which was valued at around USD 7.06 billion, continues to grow. This trend, which you can read more about on custommarketinsights.com, shows just how many people rely on this kind of accessible coverage.

For a quick overview, here are the core features of guaranteed issue life insurance.

Guaranteed Issue Life Insurance At a Glance

Feature | Description |

|---|---|

Acceptance | Approval is guaranteed within the specified age range. |

Medical Exam | None required. |

Health Questions | You won't be asked about your medical history. |

Coverage Amount | Typically smaller, usually between $5,000 and $25,000. |

Graded Death Benefit | The full benefit is only paid after a waiting period (usually 2 years). |

Premiums | Generally higher than traditional policies due to the increased risk. |

Best For | Individuals with serious health issues who can't qualify for other insurance. |

This table helps put the key trade-offs into perspective: you get guaranteed approval, but it comes with higher premiums and a waiting period.

How These Policies Actually Work Step-By-Step

Figuring out how a guaranteed issue policy works is a lot less complicated than wading through the details of a traditional insurance plan. The whole process is refreshingly simple, but there's one critical feature you absolutely need to understand: the graded death benefit.

The application itself is built for speed. Forget about medical exams or a long list of prying health questions. As long as you fall within the right age bracket and live in a state where the policy is available, you’re generally good to go. That’s a huge part of its appeal.

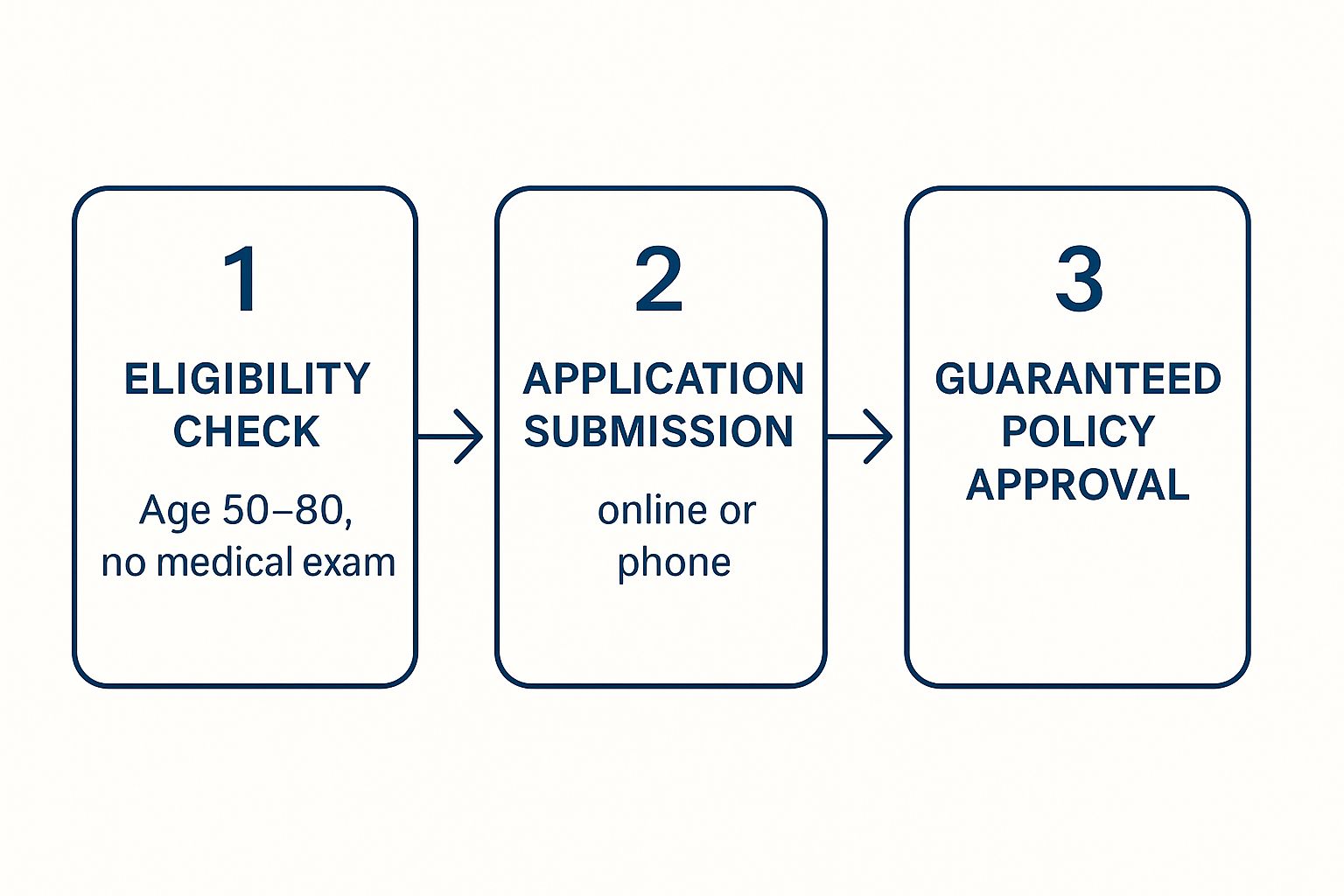

This visual breaks down the simple path from applying to getting approved.

As you can see, getting approved is a sure thing, provided you meet the basic age requirements.

The Graded Death Benefit Explained

This is the most important part to get your head around. A graded death benefit is essentially a waiting period, which is almost always two years long, right at the start of your policy. This is how the insurance company protects itself from immediate high-risk claims, and it's the reason they can offer coverage to anyone without a medical exam.

Here’s a practical look at how it works:

During the first two years: If you pass away from natural causes (like an ongoing illness), your family won’t get the full payout. Instead, the insurance company will refund all the premiums you've paid in, usually with a little extra interest—often around 10%.

After the two-year period: Once you cross that two-year mark, the policy is fully in force. Your beneficiaries will receive the entire death benefit amount, no matter the cause of death.

There is one major exception: accidental death. Most policies will pay out the full benefit from day one if the death is from a qualifying accident.

This structure is the fundamental trade-off of a guaranteed issue policy. You get the certainty of coverage without a health screening, but with a temporary limitation on the payout for non-accidental death.

Understanding this graded period is key to having the right expectations. These policies are designed to be a financial safety net for things like final expenses, and this waiting period is what makes it possible for insurers to offer that guarantee to everyone, regardless of their health.

Weighing The Pros And Cons Of Guaranteed Acceptance

Like any financial tool, guaranteed issue life insurance isn't a perfect fit for everyone. It comes with some very real benefits but also some significant trade-offs. It's crucial to look at both sides of the coin before deciding if it's the right move for your family.

The main draw is incredibly simple and powerful: peace of mind. For anyone who's been turned down for life insurance before due to health issues, knowing you absolutely cannot be denied can be a massive relief. The whole process is refreshingly straightforward.

Key Advantages Of Guaranteed Issue Policies

The upsides really boil down to easy access and predictability.

Guaranteed Approval: As long as you fall within the required age bracket, you’re in. No stress, no waiting by the phone, no uncertainty.

No Medical Exams or Health Questions: Forget the needles, doctor's appointments, and pages of invasive health questions. The application is typically short and sweet.

Locked-In Premiums: Your monthly payment is set in stone from day one. It will never go up, which makes it an easy, predictable line item in your budget.

Of course, these guarantees don't come for free. The convenience of skipping the medical exam means the insurance company is taking on a blind risk, and they account for that in the policy's cost and features.

Significant Drawbacks To Consider

Because the insurer can't screen for health risks, they have to assume the worst-case scenario for everyone. This reality is reflected in a few key ways. For a deeper dive into why people still choose these plans despite the costs, you can explore the latest final expense insurance market trends.

Here are the main disadvantages you need to be aware of:

Higher Costs: Dollar for dollar, you'll pay a lot more for this coverage than you would for a traditional policy that involves a medical exam.

Smaller Coverage Amounts: These policies aren't designed to replace a lifetime of income. The death benefits are modest, usually falling between $5,000 and $25,000, and are intended to cover final expenses like a funeral or medical bills.

The Graded Death Benefit: This is the single biggest trade-off. There's a mandatory waiting period, typically two years. If you die from natural causes (not an accident) during this time, your beneficiaries won't get the full death benefit. Instead, they’ll just get back the premiums you paid, plus a little interest.

Who Is This Type Of Insurance Really For?

Guaranteed issue life insurance isn't your everyday policy. Think of it less as a one-size-fits-all solution and more as a specialized tool for very specific situations. It’s built to be a crucial safety net for people who, for health reasons, find themselves locked out of the traditional insurance market.

For example, imagine a senior citizen managing chronic conditions like diabetes or heart disease. They’re often worried about leaving their family with final expenses, which can easily run between $7,000 and $10,000 for a funeral alone. For them, a guaranteed acceptance policy offers a straightforward way to secure peace of mind, knowing those costs are handled.

This is also the go-to option for anyone who has already been turned down for other life insurance. Getting denied coverage can be disheartening, but a guaranteed issue policy provides a final, welcome chance to lock in at least a small amount of coverage without any health questions asked.

Who Should Steer Clear?

It's just as important to know who this insurance is not for. If you're young and in good health, this policy is almost certainly the wrong choice.

You could easily qualify for a traditional term or whole life policy that offers a much larger death benefit for a fraction of the cost. Opting for a guaranteed issue plan in this case would simply mean you're overpaying for far less coverage.

Ultimately, deciding if this policy is right for you means looking at it as one piece of a bigger puzzle. It's about understanding overall financial risk management and choosing the right tool for your personal circumstances.

This policy is a last resort, not a first choice. Its real value is for those with very few options who want to ensure their final expenses are covered, no matter what.

To give you a clearer picture of how these policies stack up against each other, let's break down the key differences.

Guaranteed Issue vs. Simplified Issue vs. Fully Underwritten

Choosing the right life insurance comes down to your health, your budget, and how much coverage you need. The table below shows how guaranteed issue compares to other common types.

Feature | Guaranteed Issue | Simplified Issue | Fully Underwritten |

|---|---|---|---|

Medical Exam | Never required. Acceptance is guaranteed. | No exam, but you will answer health questions. | A full medical exam and health history review are required. |

Best For | Those with serious health issues or who've been denied coverage. | People with minor to moderate health concerns. | Healthy individuals looking for the best possible rates and high coverage. |

Cost | Highest premium for the amount of coverage you get. | A middle-ground, moderate premium cost. | The lowest premium per dollar of coverage. |

As you can see, each policy type serves a different purpose. While fully underwritten plans offer the best value for healthy applicants, guaranteed issue provides an essential, accessible option for those who need it most.

Understanding The Real Eligibility Rules And Limits

When you hear the word "guaranteed," it's easy to assume it’s a free-for-all, but that's not quite the case. While these policies famously skip the health questions, they have a few firm, non-negotiable rules. The main one isn’t about your health—it’s about your age.

Insurers created these policies for a very specific time in a person's life. By setting a strict age window for applicants, they can manage their financial risk without having to dive into your medical records.

The Strict Age Window

To qualify for guaranteed issue life insurance, you typically need to be between 50 and 85 years old. This isn't just a guideline; it's a hard rule.

If you’re 45, you’ll likely have to wait a few years to apply. And if you’re 86, you’ve probably aged out of eligibility for most plans. This age bracket ensures the product serves its intended purpose: helping older adults and seniors who might otherwise be uninsurable due to health issues they've developed over the years.

Modest Coverage With A Clear Purpose

The other key limitation to understand is the size of the death benefit. Guaranteed issue life insurance isn't designed to pay off a mortgage or replace a six-figure salary. The coverage amounts are intentionally small, aimed squarely at covering final expenses.

The whole point of this insurance is to create a small, dedicated fund for end-of-life costs, so that financial stress doesn't get passed on to your family.

Coverage amounts generally fall between $5,000 and $25,000. This range isn't accidental; it directly corresponds to the typical costs of a funeral, burial, and any lingering medical bills. These products became popular as a practical solution for seniors, a trend that reflects broader shifts in the need for accessible coverage, as detailed in this global insurance market report.

Knowing these built-in limits from the start helps you set the right expectations and decide if this type of policy truly fits your financial needs.

Common Questions About Guaranteed Issue Life Insurance

Even after getting the big picture, you've probably still got some specific questions rattling around in your head. That’s a good thing. It means you're thinking through the details, and getting straight answers is the best way to feel confident about your choice.

Let's tackle some of the most frequent questions people ask.

Can I Be Denied For Any Reason At All?

It’s a fair question. While these policies are famous for skipping the health questions, the word "guaranteed" has a few basic conditions attached. Think of it less as "guaranteed for everyone on the planet" and more as "guaranteed if you meet the simple, non-medical requirements."

So, what could get you turned down? It usually boils down to just a few things:

Age: You have to be in the right age bracket. Most companies offer these policies to folks between 50 and 85 years old.

Location: The insurance company has to be licensed to sell the policy in your state.

Cognitive Impairment: Some insurers may ask if you're currently in a nursing home or have been diagnosed with a terminal illness, which could be a reason for denial.

Your medical history won't be an issue, but you do have to fit these basic criteria.

What Happens During The Waiting Period?

This is probably one of the most important parts to understand. That two-year waiting period—sometimes called a "graded death benefit"—is for deaths from natural causes, like an illness. So what happens if the death is accidental?

Here's the good news: almost all guaranteed issue policies pay the full death benefit from the very first day if you pass away from a qualifying accident. If you get a policy and are in a fatal car accident six months later, your family gets the entire face value. It's a crucial feature that provides a safety net right away.

Is The Death Benefit Tax-Free?

Yes, absolutely. In nearly every situation, the money paid out from a life insurance policy comes to your beneficiaries completely tax-free. They don't have to worry about reporting it as income to the IRS.

This is a huge benefit of life insurance in general. It means the money you set aside for your family's final expenses actually goes to them, dollar for dollar, without the tax man taking a cut.

The tax-free nature of the death benefit maximizes the financial support provided to your loved ones, ensuring they have the resources they need during a challenging time.

It makes even a smaller policy a powerful and reliable financial tool.

Final Expense Versus Guaranteed Issue

You’ll often hear these two terms used together, and it can be a little confusing. They're related, but they aren’t the same thing. Here’s a simple way to think about it:

Final expense insurance describes the purpose of the policy. It’s a type of insurance designed specifically to cover things like funeral costs, medical bills, and other end-of-life debts.

Guaranteed issue describes how you qualify for the policy. It means there’s no medical exam and no health questionnaire. Many final expense policies are guaranteed issue, but not all of them. Some might ask a few health questions to see if you qualify for a better rate (those are called "simplified issue" policies).

So, when you see "guaranteed issue," you know for a fact that your health won't be a roadblock to getting coverage.

At America First Financial, we believe in providing clear, straightforward insurance solutions that protect what matters most—your family. If you're looking for a reliable way to cover final expenses without the hassle of medical exams, we're here to help. Get a no-obligation quote in under three minutes and secure the peace of mind your loved ones deserve. Find your plan with America First Financial today!

_edited.png)

Comments