What Is Joint Life Insurance Policy and How It Works

- dustinjohnson5

- Oct 8, 2025

- 11 min read

When you and your partner build a life together, you share everything—a home, finances, future plans. So, why not share a life insurance policy too? That’s the simple idea behind joint life insurance.

It's a single policy that covers two people (usually a couple) but only pays out the death benefit once. This makes it a unique tool for financial planning.

What Is Joint Life Insurance in Simple Terms

Think of it like a shared financial safety net. Instead of each partner having their own individual policy, you're both covered under one plan with one premium. It’s often a simpler and sometimes more affordable way to make sure the surviving partner is taken care of financially.

But here’s the crucial detail: the policy only pays out one time. When that payout happens depends entirely on which type of joint policy you get.

This brings us to the two fundamental versions of joint life insurance:

First-to-Die: This is the most common type. It pays out the full death benefit as soon as the first person on the policy passes away. The idea is to provide immediate cash for the surviving partner to cover things like mortgage payments, debts, or daily living expenses.

Second-to-Die: This one is a bit different. It doesn't pay out until both people on the policy have passed away. It’s not really for the surviving partner, but rather for leaving a financial legacy to children, covering estate taxes, or donating to a charity.

Deciding between these two is the first major step. It forces you to think about the real purpose of the insurance: is it to protect your partner, or to protect your heirs?

How the Two Main Types of Joint Life Insurance Work

When you hear "joint life insurance," it's easy to think of it as a single product. But it’s not a one-size-fits-all solution. There are two very distinct types—First-to-Die and Second-to-Die—and they’re built for completely different purposes. Knowing which one does what is the key to making sure your family is protected in the way you actually intend.

Life insurance is a massive global industry, with premium income hitting $3.1 trillion USD after a big 10.4% jump in growth. North America is a huge part of that market, seeing a 14.4% annual premium increase, often driven by the kinds of products that work alongside joint policies. You can dive deeper into these global insurance trends on Allianz.com.

First-to-Die: Immediate Financial Support

First-to-Die is the most common type of joint policy you'll run into. The name gives it away: the policy pays out the full death benefit as soon as the first of the two partners dies. After that payout, the policy ends. The surviving partner no longer has coverage under this plan.

You can think of it as an immediate financial safety net for the survivor. Its whole purpose is to give the person left behind the resources to handle shared debts and expenses without skipping a beat.

Real-World Example: Imagine Mark and Sarah, both 35, who just took on a 30-year mortgage for their first home. They get a First-to-Die policy. If something unexpected happens to one of them, the survivor can use the payout to clear the mortgage and manage the bills, avoiding a financial crisis during an already difficult time.

This type of policy is a great fit for:

Mortgage Protection: Making sure the surviving partner can pay off the house.

Income Replacement: Filling the gap left by the lost income.

Debt Repayment: Taking care of shared debts like car loans or credit cards.

Second-to-Die: A Legacy-Focused Strategy

Now, a Second-to-Die policy (sometimes called a survivorship policy) works in the exact opposite way. It doesn't pay out until both partners have passed away. Because of this, it’s not designed to provide financial help for the surviving spouse.

So what’s it for? It’s all about legacy and estate planning. The tax-free death benefit is paid to the couple’s beneficiaries, like their children or a specially created trust.

This makes it a really smart tool for couples with significant assets. It helps ensure their heirs have the cash to pay estate taxes without being forced to sell off a family business, property, or other inherited assets. It's a strategic way to preserve wealth and leave a lasting financial gift for the next generation.

Joint Life Insurance vs Two Individual Policies

When you're building a life with someone, figuring out life insurance is a major financial step. One of the biggest questions that comes up is whether to get a single joint policy or two separate, individual ones. It’s a classic tug-of-war between upfront cost savings and long-term flexibility.

Honestly, there's no single right answer. Your decision really hinges on your personal financial situation, your family's needs, and what gives you the most peace of mind.

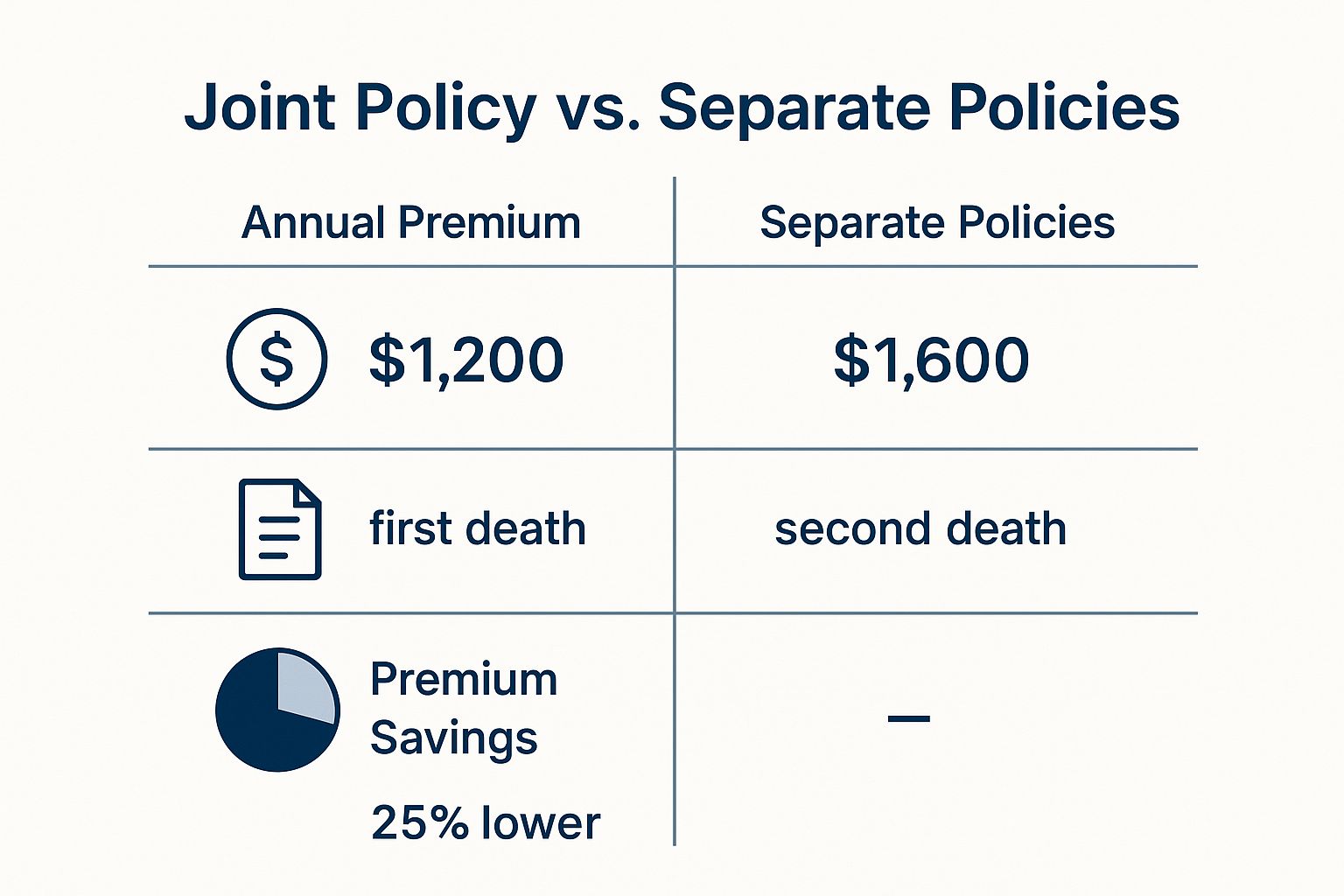

A joint policy often grabs people's attention because it's usually cheaper. Bundling two people under one plan means one set of administrative fees and a slightly lower risk profile for the insurer, which can translate into premium savings of up to 25%. That's a tempting offer. But—and it's a big but—it comes with a major catch: it typically only pays out once.

On the flip side, two individual policies mean two distinct death benefits. If one partner passes away, the surviving partner gets the payout, and their own policy continues without a hitch. This is a huge deal, as it ensures the survivor keeps their coverage, which could be much more expensive or even impossible to get as they get older.

Cost and Payout Comparison

The core difference really boils down to money in versus money out. A joint policy is one streamlined package, while two individual policies work independently, creating a much stronger financial safety net.

This infographic lays out the key numbers side-by-side.

As you can see, the joint policy is the clear winner for immediate savings. However, the separate policies provide double the potential payout, which is a powerful advantage.

To make this even clearer, let's break down the main points in a table.

Joint Policy vs Two Individual Policies: A Head-to-Head Comparison

This table offers a direct comparison to help you weigh the pros and cons of each approach based on what matters most to you and your partner.

Feature | Joint Life Insurance | Two Individual Policies |

|---|---|---|

Premiums | Generally lower; often 10-25% cheaper than two separate policies. | Higher combined cost, as each policy is underwritten and priced individually. |

Payout | A single death benefit is paid out, typically after the first partner dies. | Two separate death benefits. The survivor receives a payout and still has their own active policy. |

Coverage After Payout | The policy terminates after the death benefit is paid, leaving the survivor without coverage. | The survivor's policy remains in place, ensuring they continue to have life insurance. |

Flexibility in Divorce | Complicated. Splitting the policy is often difficult or impossible, sometimes forcing cancellation. | Simple. Each partner keeps their own policy with no changes needed. |

Best For... | Couples on a tight budget who need maximum coverage for the lowest immediate cost. | Couples who prioritize long-term security, flexibility, and ensuring the survivor remains insured. |

Ultimately, the choice between one policy or two comes down to a trade-off. Do you prioritize saving money now, or do you want the robust, flexible protection that two policies provide for whatever life throws your way?

Flexibility and Long-Term Planning

Life is unpredictable, and this is where individual policies truly shine. Because they aren't tied to the relationship, they move with you. If a couple decides to go their separate ways, each person simply takes their own policy with them. No fuss, no financial entanglements.

A joint policy, however, can become a real headache.

In the event of a divorce, trying to split a joint life insurance policy can be a nightmare. Some policies can't be divided at all, forcing a tough choice: who gets the coverage, or do you cancel it and both start over?

This lack of adaptability is a serious drawback. While saving a bit on premiums feels good today, the security and independence offered by two separate policies often provide far greater peace of mind for the long haul. It protects both of you, together or apart.

The Real Benefits of Choosing a Joint Policy

So, beyond how these policies work, why do people actually choose them? For most couples, the decision boils down to a few very practical advantages: saving money, keeping things simple, and finding a smart solution for shared financial goals.

The biggest and most obvious draw is that they are cost-effective. It's almost always cheaper to insure two people under a single contract than it is to buy two completely separate policies. Insurers have lower administrative costs for one policy versus two, and they often pass that savings on to you. For couples trying to make their budget stretch, this can be a huge win.

Then there’s the sheer simplicity of it all. Life is complicated enough without juggling two different life insurance policies. With a joint plan, you have one premium, one set of paperwork, and one company to deal with. It just cleans up your financial life and reduces a bit of that administrative headache we all try to avoid.

A Smart Tool for Specific Financial Goals

This is where joint life insurance really shines—it’s not just a generic safety net. It’s a tool you can use to protect very specific, shared responsibilities.

Protecting Your Mortgage: This is a classic use for a First-to-Die policy. If one partner passes away, the payout is designed to be large enough to completely pay off the mortgage. This ensures the surviving partner can stay in their home without the crushing weight of the full housing payment.

Planning Your Estate: On the other hand, a Second-to-Die policy is a powerful tool for legacy planning. The death benefit provides your heirs with immediate cash to handle estate taxes and other final expenses, so they don't have to sell off family assets like a home or business just to settle the estate.

When you match the right type of joint policy to a major financial goal, you're creating a highly efficient financial backstop. It's a practical strategy to safeguard your biggest investments and protect the legacy you're building together.

Potential Downsides and What to Watch Out For

While the idea of a single, cheaper policy sounds great on paper, joint life insurance comes with some significant trade-offs you really need to think about. The biggest issue is its inflexibility. If your relationship ends, things can get complicated—fast.

Unlike two separate policies that each person can take with them, a joint policy is tied to you as a couple. Trying to split it during a divorce can be a real headache. You might be faced with tough choices: one person keeps it, you cancel the policy altogether (losing everything you've paid in), or you keep paying for a policy with your ex. This is a major risk that shouldn't be overlooked.

The "One-and-Done" Payout Problem

Another key point to consider is how the payout works. With a first-to-die policy, it pays out once and then the coverage is done. The contract is fulfilled. This leaves the surviving partner without any life insurance coverage at all.

This is a big deal because they'll likely be older and could have new health issues, making it much harder and more expensive to get a new policy.

The money you save upfront on a joint policy can quickly disappear when the surviving partner has to find new, more expensive coverage later in life—a time when financial security is more important than ever.

The application process itself can also reveal some disadvantages. Here’s what you might run into:

Differences in Health or Age: The price you pay is based on a combined risk profile. If one of you is much older or has a pre-existing health condition, that person's higher risk will inflate the premium for both of you. You might end up paying more than you would with two separate plans.

A Smoker and a Non-Smoker: Insurance companies see smoking as a major risk. If a non-smoker shares a policy with a smoker, they'll be paying a much higher rate than they would on their own.

Getting a clear picture of these potential downsides is the only way to know if this kind of policy truly fits your long-term financial plan.

Is Joint Life Insurance the Right Move for You?

Choosing between a joint policy and two individual ones isn't just about crunching numbers. While the potential for a lower premium is a big draw, this decision is really about finding the right financial safety net for your unique life, both now and down the road.

So, who does a joint policy really make sense for? I've found it's often a great fit in a few key situations.

When a Joint Policy Shines

Couples with a Shared Mortgage: Think of a First-to-Die policy as a powerful mortgage protection tool. If something happens to one partner, the payout can ensure the surviving partner isn't forced to sell the home.

Business Partners: For entrepreneurs, a joint policy can be the linchpin of a buy-sell agreement. It provides the capital for the surviving partner to cleanly buy out the deceased partner's share of the business, preventing a lot of potential headaches.

Families focused on Estate Planning: This is where a Second-to-Die policy really comes into its own. It provides a tax-free lump sum to heirs, giving them the cash to cover estate taxes without having to liquidate family assets like a business or property.

When Individual Policies Are the Smarter Play

But a joint policy isn't a one-size-fits-all solution. In many cases, sticking with two separate policies is the much wiser choice.

Couples with a Big Age or Health Gap: Joint policy premiums are calculated based on a blended risk. If one of you is significantly older or has health issues, that higher risk can drive up the cost for both of you, often wiping out any potential savings.

Blended Families: If you have children from previous relationships, separate policies are the cleanest way to go. This allows each of you to leave a distinct, protected legacy for your own kids.

Anyone Prioritizing Flexibility: Life is unpredictable. If there's even a small chance of separation or divorce down the line, individual policies are the safer bet. They move with you, no matter what happens to the relationship, avoiding messy financial entanglements.

Thinking about this also brings up a bigger question: what is the best time to consider life insurance in general? Getting the timing right is just as important as picking the right policy.

It's no surprise that the global market for these policies is set to hit $494.1 billion by 2035. Insurers are getting better at offering more flexible, digital-first options that fit the reality of modern families and their needs.

Of course. Here is the rewritten section with a more natural, human-written tone.

Answering Your Top Questions About Joint Life Insurance

When you start digging into joint life insurance, a few key questions always seem to pop up. Let's walk through the answers to the most common ones we hear from couples.

What If We Get Divorced?

This is a big one, and for good reason. A joint policy is designed for a partnership, and when that partnership ends, things get complicated. Unlike individual policies that you'd each just keep, a joint policy presents a few tricky paths forward:

You could cancel the policy entirely, but that means you forfeit everything you've paid into it.

One person could try to take over the policy, though not all insurers allow this, and it can be a messy process.

You could agree to keep paying the premiums together, which means staying financially tied to your ex.

Frankly, none of these options are ideal, which is a major reason to think carefully before choosing a joint policy.

Can We Add Our Kids to the Policy?

The short answer is no, not directly. Joint life insurance is built specifically to cover two adults. It’s not a family plan.

If you want to get some coverage for your children, you’ll need to look at a child rider. This is an add-on to your policy that provides a small death benefit for your kids, and you’ll pay a little extra for it. The other route is to buy a completely separate child life insurance policy for them.

A common misconception is that a joint policy can cover an entire family. In reality, it's a specific tool designed for two individuals, and any additional coverage, like for children, requires separate add-ons.

Is It Harder to Get Approved For a Joint Policy?

It definitely can be. Since the insurance company has to cover two people under one plan, they're going to look at both of your health profiles.

If one partner has a serious health condition, is a smoker, or is significantly older, it could either drive the premium way up or even lead to a denial. For the policy to be issued, both applicants must meet the insurer's eligibility criteria. It’s a classic case of a chain only being as strong as its weakest link.

_edited.png)

Comments