What is Level Term Life Insurance? Your Complete Guide

- dustinjohnson5

- Oct 12, 2025

- 11 min read

When you hear people talk about life insurance, they're often thinking of level term life insurance. It's one of the most straightforward and popular ways to protect your family's financial future.

So, what is it exactly? In simple terms, it's a policy where both your monthly payments (premiums) and the final payout (death benefit) are locked in. They stay the same for the entire length of the policy, which is usually a set term of 10, 20, or 30 years.

The Foundation of Financial Predictability

Think of it like getting a fixed-rate mortgage. You know exactly what your payment will be every single month until the loan is paid off. Level term life insurance brings that same peace of mind to your financial safety net. No surprises, no sudden price hikes—just consistent, reliable coverage you can build a budget around.

This predictability is a game-changer for long-term planning. A young couple with a new baby might buy a 20-year policy to cover them until their child is through college. The premium they pay in year one is the exact same amount they'll pay in year nineteen, even as their health and age change.

Two Unchanging Pillars

The beauty of level term insurance lies in two simple guarantees that hold true for the entire policy term:

Fixed Premiums: The amount you pay every month or year is set in stone from day one. This makes it incredibly easy to factor into your long-term budget without any guesswork.

Fixed Death Benefit: The amount of money your loved ones would receive never changes. If you buy a $500,000 policy, it will pay out $500,000 whether a claim is made in the second year or the twenty-second year.

This simple, no-fuss structure is why so many financial experts consider it a cornerstone of smart financial planning. It takes the guesswork out of the equation and provides a solid safety net when your family needs it most.

To give you a better snapshot, let's break down the key features in a simple table.

Level Term Life Insurance At a Glance

This table quickly summarizes the core components of a typical level term life insurance policy.

Feature | Description |

|---|---|

Premiums | Payments are fixed and do not change during the term. |

Death Benefit | The payout amount is guaranteed to remain the same. |

Term Length | Typically available in 10, 15, 20, 25, or 30-year increments. |

Purpose | Designed to cover temporary needs like mortgage payments or raising children. |

Complexity | Simple to understand, with no investment or cash value components. |

This clear-cut approach makes it an incredibly effective tool for protecting specific financial responsibilities.

The numbers back this up. In 2023, nearly 40% of all new individual life insurance policies sold in the U.S. were term policies. Level term is by far the most common version because it's affordable and easy to understand. You can discover more insights about these insurance trends from Policygenius to see how it fits into the broader market.

How a Level Term Policy Actually Works

So, how does this play out in the real world? Let’s imagine a new parent who wants to make sure their child is taken care of financially until they’re grown. They run the numbers and decide a $500,000 policy would be enough to handle college costs, the mortgage, and other living expenses if something were to happen.

The first big decision is figuring out the policy's two main ingredients: the coverage amount (the $500,000 death benefit) and how long they need it for. Since the main goal is to protect their child through their dependent years, a 20-year term lines up perfectly.

Locking in Your Rate and Coverage

With the policy in place, they start making premium payments. Here's the key: that payment amount is now set in stone for the entire 20-year term. It won't go up.

This fixed rate was determined by their age and health when they first applied. The insurer takes a snapshot of your risk profile during the medical underwriting process, and that's what locks in your price. For the next two decades, that predictable premium keeps the $500,000 death benefit active, offering consistent peace of mind.

Most term policies come in common lengths like 10, 15, 20, 25, or 30 years. You pick the one that matches your financial timeline—like the years left on your mortgage or until your kids are through college. This flexibility helps keep insurance affordable, especially for younger people who can lock in fantastic rates for a long time.

What Happens When the Term Ends

Fast forward 20 years, and the level term period is over. Now what? By this point, the parent's financial picture has likely changed a lot. The kids are adults, and the mortgage might be a thing of the past.

The end of a term doesn't mean the end of your options. It's a natural point to reassess your financial needs and decide on the next best step for your family's security.

They usually have three main choices:

Renew the Policy: They can often keep the coverage going, but it usually renews annually. The catch? The premiums will be much higher because they're based on their current, older age.

Convert the Policy: Many term policies include a feature that lets you convert it into a permanent life insurance plan, often without needing another medical exam.

Let the Policy Expire: If the big financial obligations are covered, they can simply let the policy end. No fuss, no muss.

What Makes a Level Term Policy So Appealing?

When you dig into what makes level term life insurance so popular, it really boils down to three powerful, common-sense advantages. For millions of families, these benefits make it the bedrock of their financial safety net.

First up is the budget predictability. This is a huge one. Your premium is locked in from the day you sign the policy, meaning you never have to guess what you’ll be paying next year or ten years from now. If you sign up for a $50 monthly premium on a 30-year term, you’ll still be paying exactly $50 a month nearly three decades later. That kind of stability makes long-term financial planning so much easier.

Another major plus is its refreshing simplicity and transparency. Let's be honest, insurance can get complicated. But a level term policy is as straightforward as it gets. There are no confusing investment components or fluctuating cash values to track. It's a clean-cut deal: you pay a fixed amount for a fixed death benefit over a fixed period of time.

Getting the Most Protection for Your Money

Finally, level term life insurance is famous for its affordability. It's designed to do one job—provide a death benefit—and do it well, without the extra costs of building a cash value. This pure-protection approach means you can get a massive amount of coverage for a relatively small premium.

This is especially critical during those years when your financial responsibilities are at their peak, like when you’re raising kids, paying off a mortgage, or putting someone through college.

The real beauty of this structure is that you can secure a huge safety net—often hundreds of thousands of dollars—for a monthly payment that doesn't break the bank. It's all about making sure your family is protected without straining your current budget.

So, to wrap it all up, the key reasons so many people choose level term life insurance are:

Financial Stability: Your payments are set in stone, making budgeting a breeze.

Clear Terms: It's easy to understand, with no hidden clauses or complex features.

Cost-Effectiveness: You get the biggest possible death benefit for the lowest premium.

This trifecta delivers reliable peace of mind precisely when you and your family need it most.

Who Is Level Term Life Insurance Really For?

Level term life insurance isn’t the right call for everyone, but it’s a perfect match for people with financial responsibilities tied to a specific timeframe. Its predictable, locked-in nature is designed to protect your loved ones during the years they count on you the most.

Think of it as a financial safety net for a specific chapter of your life. If you have major debts with a clear end date or dependents who rely on your income, this is one of the most straightforward and affordable ways to make sure they’re covered if you’re gone.

Covering Your Biggest Responsibilities

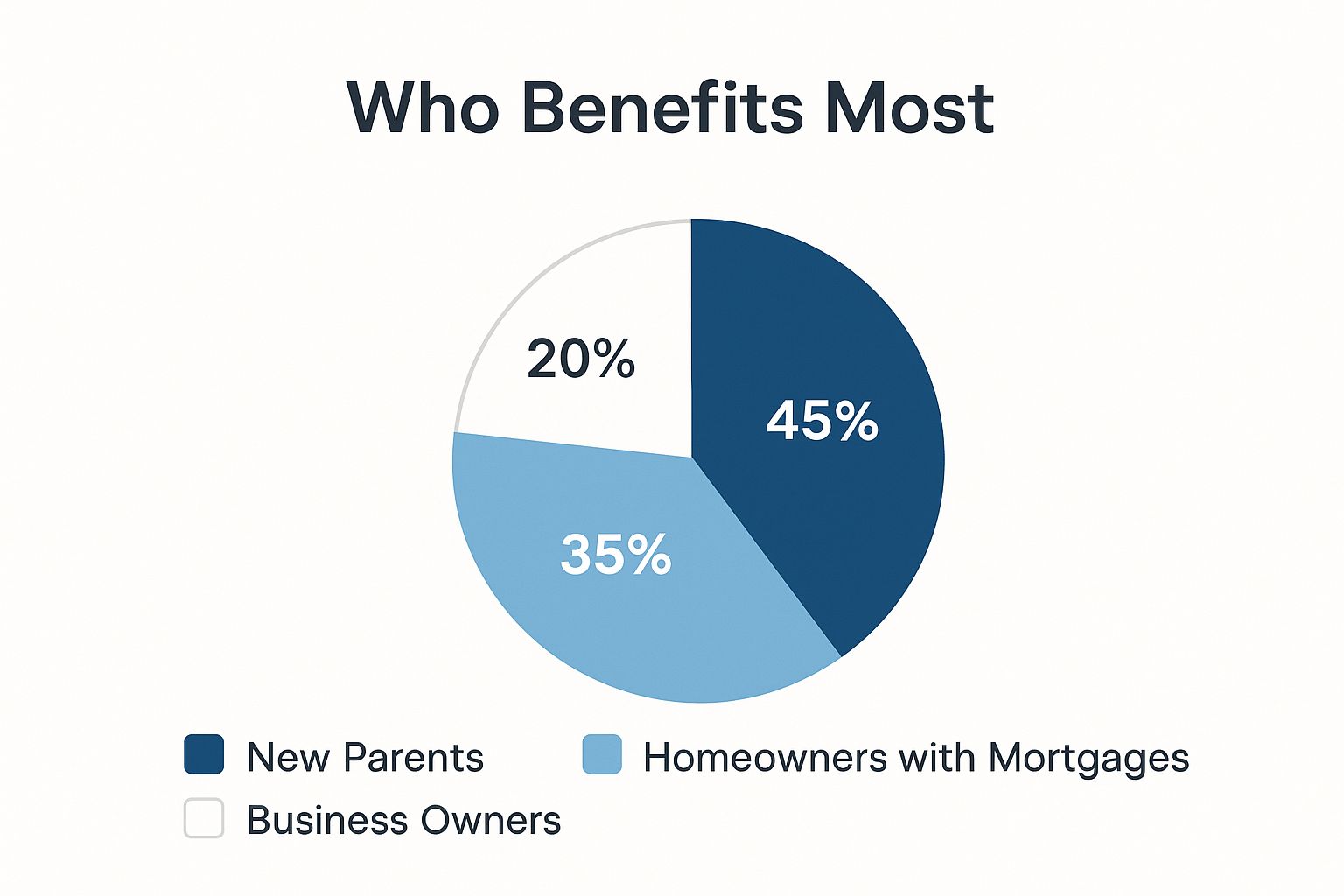

The number one reason people buy level term insurance is to protect their family’s financial future. If you’re a new parent, a 20 or 30-year term policy can ensure the money is there to raise your kids and pay for college, no matter what happens. It’s peace of mind in its purest form.

Homeowners also find it incredibly valuable. Matching a 30-year level term policy to a 30-year mortgage means your family won't have to face the stress of losing their home while grieving. The infographic below highlights the most common people who benefit from this strategy.

The takeaway is clear: if you have major, long-haul financial commitments like a mortgage or the costs of raising children, this policy type is built for you.

As our financial obligations have gotten bigger, so has the amount of coverage people are buying. Over the last decade, the average face value of a new individual life insurance policy in the U.S. jumped from $165,000 to $206,000. That tells you people are realizing they need a more robust financial cushion. You can dig into the numbers yourself and read the full life insurance fact book to see more of these trends.

Level term life insurance is a strategic tool for anyone who needs to guarantee a specific financial goal is met, whether that’s paying off a mortgage, funding a child’s education, or securing a business partnership.

A few other situations where level term really shines include:

Business Owners: Business partners often use level term policies to fund a buy-sell agreement. This provides the surviving partner with the cash needed to buy the deceased partner's share of the business, keeping operations stable and avoiding chaos.

Individuals with Large Debts: If you have hefty private student loans or other significant personal debts, a term policy ensures that liability doesn't get passed on to your family.

At the end of the day, if you can point to a major financial need with a clear finish line, level term life insurance is almost certainly a great fit.

Level Term Compared to Other Life Insurance Types

To get a real feel for what makes level term insurance so popular, it helps to see it in action next to the other players in the field. Its biggest strengths—simplicity and predictability—really stand out when you compare it to policies built for completely different financial jobs.

The most common alternatives you'll hear about are decreasing term and whole life insurance. Think of level term as your steady, reliable choice. Decreasing term is designed for debts that get smaller over time, while whole life is a lifelong product that also builds cash value. Understanding the key differences between term and permanent life insurance is the first big step, as it’s the most fundamental split in the insurance world.

A Head-to-Head Comparison

Let's break down exactly how these three policies stack up against one another. It's much easier to see their purpose when you compare their core features side-by-side.

Table: Level Term vs. Other Life Insurance Types

Feature | Level Term Life | Decreasing Term Life | Whole Life |

|---|---|---|---|

Premiums | Remain fixed for the entire term | Typically fixed, but often lower than level term | Significantly higher and fixed for life |

Death Benefit | Remains fixed for the entire term | Decreases over the term, often annually | Remains fixed for your entire life |

Cash Value | None | None | Yes, grows over time at a guaranteed rate |

Primary Use | Income replacement, raising children | Covering a specific loan, like a mortgage | Estate planning, lifelong dependents |

Each policy type is a specific tool for a specific job. Choosing the right one means matching its structure to your financial timeline and goals.

As you can see, there’s no single "best" option—just the right tool for your situation.

For instance, a decreasing term policy makes perfect sense for covering a mortgage. As you chip away at your home loan, the policy's death benefit shrinks right along with it. This specialization often means you pay a bit less in premiums.

On the other end of the spectrum, whole life insurance is built for permanence. It's a go-to for complex estate planning, funding a special needs trust for a lifelong dependent, or leaving a guaranteed inheritance, no matter when you pass away.

So, where does that leave level term life insurance? It’s the ideal solution for providing a stable, unchanging financial safety net during your family's most vulnerable years. It guarantees a specific amount of money will be there for them, offering straightforward, powerful protection that most people are looking for.

Common Questions About Level Term Insurance

We've covered the basics, but let's dig into a few common questions that pop up when people are considering a level term policy. Getting these details sorted out can help you feel much more confident about your decision.

What Happens When My Term Is Up?

So, you've reached the end of your 20 or 30-year term. What now? Your locked-in rate and death benefit are gone, but that doesn't mean you're out of options. You generally have three paths forward:

Renew the Policy: Most insurance companies will let you renew your coverage, often on a year-by-year basis. Be warned, though: the price will jump significantly. Your new premium will be based on your current age, not the younger, healthier you that first bought the policy.

Convert to a Permanent Policy: Many term policies include a "conversion" option. This is a great feature that lets you trade in your term policy for a whole life policy without having to go through another medical exam. It’s a way to keep coverage in place for the rest of your life.

Let It Expire: Maybe your situation has changed. The mortgage is paid off, the kids are financially independent, and you've built a solid nest egg. If you no longer need the large safety net, you can simply let the policy lapse.

Can I Have More Than One Life Insurance Policy?

Absolutely. In fact, holding multiple policies is a surprisingly common and savvy strategy called laddering.

Think about it this way: you could have one big, 30-year policy to make sure your mortgage is covered. At the same time, you might have a smaller, 20-year policy just to cover the kids' college expenses. Once the college years are over, you can let that smaller policy expire and stop paying the premium, while the mortgage protection continues. It’s a smart way to match your coverage to your life's timeline instead of paying for a single, massive policy for longer than you need it.

Does Level Term Insurance Build Cash Value?

This is a big one: no, level term insurance does not build any cash value. It’s pure and simple protection. Its only job is to pay out a death benefit if you pass away during the term.

That’s precisely why it’s so affordable compared to permanent options like whole life. With whole life, part of your premium goes into a savings component that grows over time.

Think of it like renting versus buying a house. Term life is like renting—you get the full protection you need for a set period at a low cost. Whole life is like buying—it's more expensive, but you're building equity (cash value) over time.

For most people, the goal is to get the most protection for the lowest cost during their peak earning years, and that's where level term shines.

How Much Coverage Do I Actually Need?

The old rule of thumb was to get 10 to 12 times your annual income. That’s a decent starting point, but your real number should be more personal.

To get a clearer picture, sit down and add it all up:

Your mortgage balance

Any other debts (car loans, student loans)

The estimated cost of your kids' college education

How much income your family would need to replace each year to maintain their lifestyle

Running these numbers gives you a coverage amount that’s truly tailored to your family's needs, ensuring they have a real financial safety net, not just a guess.

Ready to protect your family with a plan that aligns with your values? America First Financial offers straightforward and affordable level term life insurance options. Get your free, no-obligation quote in under three minutes and see how simple securing your family's future can be. Find your rate now at America First Financial.

_edited.png)

Comments