What Is Surrender Value of Life Insurance Policy? Learn More

- dustinjohnson5

- Aug 30, 2025

- 14 min read

When you hear the term surrender value, think of it as the cash-out option for your permanent life insurance policy. It’s the money you’d get back from the insurance company if you decide to terminate the policy before it matures or you pass away.

Essentially, it's the accessible cash savings built up inside the policy, minus any surrender fees the company charges for an early exit. This is a completely different figure from the death benefit, which is the money paid out to your beneficiaries.

Unlocking the Core Concept of Surrender Value

It helps to think of a permanent life insurance policy as a hybrid product: part long-term savings plan, part safety net. Every time you pay your premium, the money gets split. A portion covers the cost of the death benefit (the safety net), while the rest goes into a savings vehicle, building what's known as cash value.

The surrender value is simply the amount of that cash value you can walk away with if you end the policy. It's a fundamental feature of permanent life insurance, and it's no small amount. Globally, these values make up roughly 30% of total assets held by life insurance companies.

Which Policies Have Surrender Value?

This is a crucial point: not every life insurance policy has a surrender value. It's a feature exclusive to permanent life insurance, which is designed to last your entire life.

Here are the common types that build cash value:

Whole Life Insurance: This is the most straightforward type. It’s designed to last a lifetime and builds cash value at a guaranteed, fixed rate. Predictable and steady.

Universal Life Insurance: This option offers more wiggle room. You can often adjust your premiums and death benefits, and the cash value growth is tied to current interest rates.

Variable Universal Life Insurance: For those with a higher risk tolerance, the cash value in these policies is invested in sub-accounts, much like mutual funds. This means there's potential for greater growth, but it also comes with market risk.

In stark contrast, term life insurance has absolutely no surrender value. A term policy is pure insurance coverage, plain and simple. It provides a death benefit for a set period—say, 20 or 30 years—and that's it. There's no savings or investment component. If you cancel your term policy, you just stop paying, and your coverage ends. No money back.

Face Value vs Cash Value vs Surrender Value

It's easy to get these terms mixed up, but they represent very different things. Here’s a quick breakdown to keep them straight.

Component | What It Is | When It's Paid Out |

|---|---|---|

Face Value | The death benefit; the total amount promised to your beneficiaries. | Upon the policyholder's death. |

Cash Value | The policy's internal savings component that grows over time. | Can be borrowed against or used to pay premiums while the policy is active. |

Surrender Value | The cash value minus any surrender charges or outstanding loans. | When the policyholder voluntarily cancels or "surrenders" the policy. |

Understanding these distinctions is key to knowing what your policy is truly worth, both to your beneficiaries and to you.

Since your life insurance policy is a binding legal document, knowing how to effectively read and interpret contract clauses is a huge advantage. Getting comfortable with the fine print is the best way to understand exactly how your policy’s cash value grows and what fees might apply if you decide to access it.

How Your Policy's Surrender Value Is Calculated

So, how do insurance companies figure out your policy's surrender value? Thankfully, it’s not some mystical formula cooked up in a secret back room. It’s actually quite logical and follows a straightforward calculation.

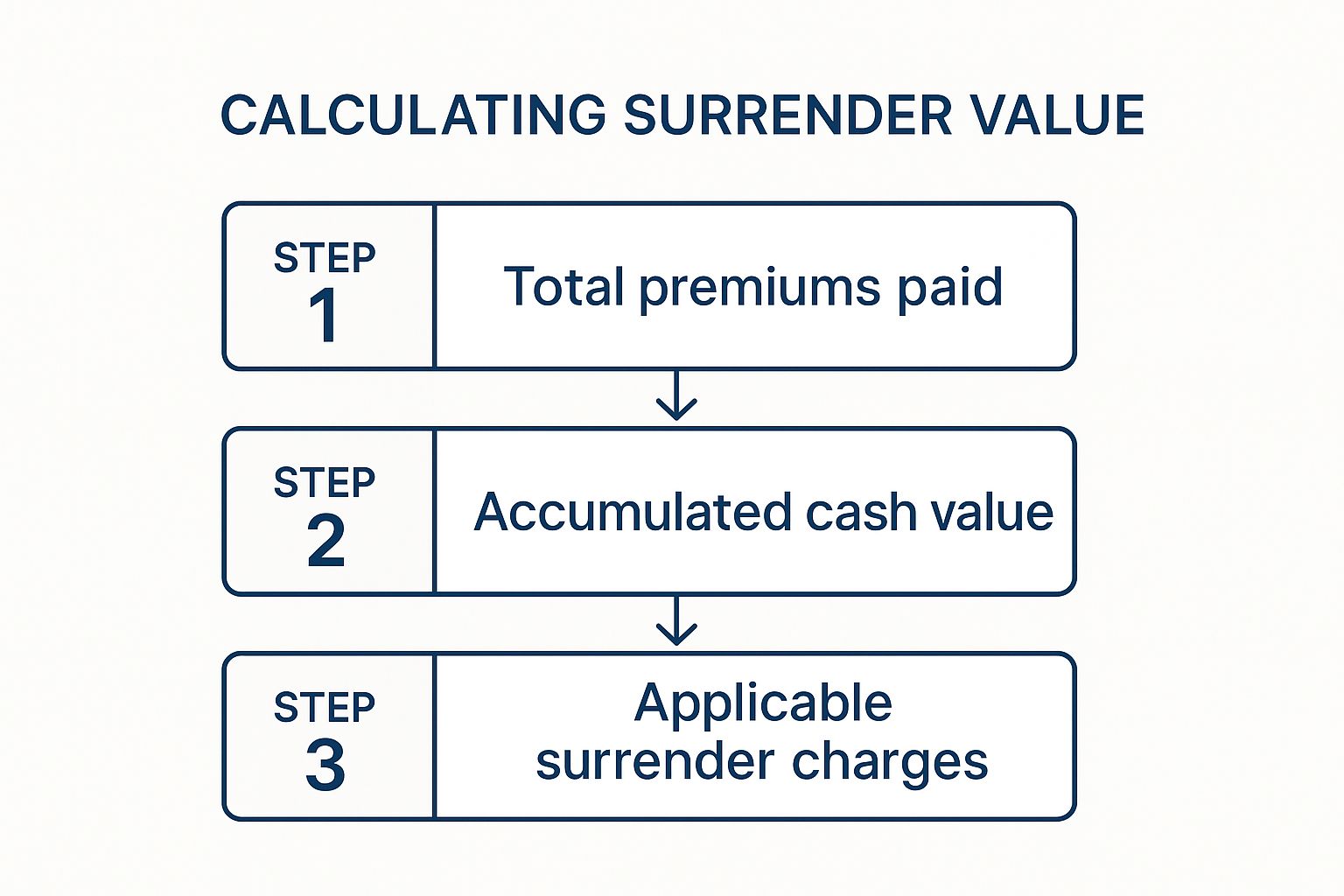

At its core, the process is simple. The insurer starts with the total cash value you’ve built up in your policy. Then, they subtract any surrender charges for ending the policy early. The amount left over is what you walk away with.

The Basic Formula:Accumulated Cash Value - Surrender Charges = Your Surrender Value

This simple equation is the key to understanding your payout. Let's peel back the layers on each part so you can see exactly how your money is working—and what it costs to get it out.

The infographic below breaks down this three-step process visually.

As you can see, it's all about what you've put in and grown, minus the fee for cashing out before the agreed-upon term.

The Growth Engine: Your Accumulated Cash Value

First up is your accumulated cash value. Think of this as the savings account tucked inside your life insurance policy. Every time you pay your premium, it gets split. A slice goes toward the actual death benefit and the insurer's administrative fees, but the bigger piece gets deposited into your cash value account.

This account doesn't just sit there, either. It grows in two ways:

Your Contributions: A chunk of every premium you pay goes directly into building this cash value.

Interest or Dividends: The insurance company invests this pool of money. Your cash value then earns interest—or sometimes dividends, depending on the company's financial performance—which gets added to your balance.

Over the years, this combination of steady contributions and compound growth can build up a pretty significant nest egg. This is the money you can later borrow against or, if you choose, surrender for cash.

The Early Exit Fee: Surrender Charges Explained

The second piece of the puzzle is the surrender charge. This is basically an early termination fee that the insurance company deducts if you decide to cancel your policy during a set period, known as the surrender period.

But why the fee? When an insurer issues a policy, they incur a lot of upfront costs—things like the agent’s commission, the medical exam, and all the administrative work to get you set up. These costs are meant to be paid off over the long life of the policy. If you bail early, the company hasn't had enough time to recoup its initial investment.

The surrender charge is their way of getting that money back. It’s almost always set up on a sliding scale. It starts high in the first few years and then gradually drops over time. For instance, a policy might have a 10% surrender charge in year one, which falls to 9% in year two, and continues to decrease until it eventually hits zero.

Watching the Numbers: A Year-by-Year Example

Let's put this into a real-world context. Imagine you have a whole life policy and, after five years, you've built up a cash value of $12,000. Your policy has a surrender charge schedule that started at 12% in the first year and drops by 1% annually.

Here’s how the math would work in year five:

Year 5 Cash Value: $12,000

Year 5 Surrender Charge: 8% (It was 12% in year 1, so it has dropped for four full years)

Charge Amount: $12,000 x 0.08 = $960

Your Surrender Value: $12,000 - $960 = $11,040

As this shows, the longer you hold the policy, the closer your surrender value gets to your full cash value. Once the surrender period is over—which is typically after 10 to 15 years—the charge disappears completely. At that point, your surrender value and your cash value are one and the same.

Key Factors That Influence Your Surrender Value

While the basic formula for figuring out your surrender value seems simple on the surface, the actual number you get is a mix of several moving parts. Think of it less like a fixed price tag and more like a recipe where the final taste depends on how long you've cooked it and what you’ve added along the way. Getting a handle on these variables is the key to understanding the real-world value of your life insurance policy at any given time.

The most straightforward influence is how long you've owned the policy. An older policy has simply had more time to build up its cash value from your premium payments and any interest it has earned. More importantly, it has also had more time to move past the initial surrender charge period, which means those early-exit penalties have likely shrunk or disappeared entirely. It's no surprise that a policy you've had for three years will have a much higher surrender charge than one you've held for thirteen.

Policy Type and Outstanding Loans

The kind of policy you have matters a great deal, too. A whole life policy is designed to grow at a guaranteed, steady rate, which makes its future cash value much easier to predict. On the other hand, a universal life policy often has its growth tied to market interest rates, introducing a lot more uncertainty. Your surrender value will be a direct reflection of how the cash value has performed based on your specific policy's rules.

Another huge factor? Any loans you’ve taken against the policy. One of the main perks of permanent life insurance is being able to borrow from your accumulated cash value. But that access comes with a string attached: any money you borrow has to be paid back.

If you decide to surrender your policy while you still have a loan, the insurance company will subtract the entire loan balance—plus any interest you owe—straight from your surrender value. This can take a major bite out of your final check.

For example, a $50,000 cash value with a $10,000 loan means your potential surrender value is already down to $40,000 before any surrender fees are even calculated. It’s critical to keep a close eye on any loans.

Broader Economic Conditions

Finally, what’s happening in the wider economy can play a role. The financial features of a life insurance policy, including its surrender value, are sensitive to what's happening with interest rates. When interest rates across the economy start to climb, the guaranteed return inside an older life insurance policy might not look as good compared to what you could get from newer investment options. This environment can prompt more policyholders to cash out, a trend you can be sure insurers are watching. You can learn more about how interest rates impact surrender payouts on suerf.org.

Here’s a quick rundown of what moves the needle on your surrender value:

Policy Age: The longer you've paid into it, the more cash value it’s likely to have and the lower the surrender fees will be.

Policy Type: Whole life provides predictable growth, while universal and variable life policies are tied to market performance.

Outstanding Loans: Anything you've borrowed, plus interest, will be deducted from your final payout.

Economic Climate: Major shifts in interest rates can make surrendering your policy a more or less attractive financial move.

The Pros and Cons of Cashing Out Your Policy

Deciding to surrender your life insurance policy is a major financial crossroad, one with consequences that will ripple for years. It’s not just about getting a check in the mail; it’s about fundamentally changing the financial safety net you've built. Before you make a move you can’t take back, you need to look at this from every angle.

The biggest pull, and the reason most people even consider it, is the promise of immediate cash. This lump sum can feel like a lifeline during a tough spot, whether you're facing unexpected medical bills or a critical home repair. It can also be a smart strategic move to tackle high-interest debt, like credit card balances, freeing up your monthly budget in a big way.

On top of that, surrendering your policy means no more premium payments. For anyone on a tight budget, this provides instant relief and lets you redirect that money to more pressing needs or other financial goals.

The Advantages of Surrendering

Let's start with the upside. The appeal of cashing out really comes down to having flexibility and immediate resources when you need them most.

Immediate Financial Relief: You get a single, lump-sum payment to use however you see fit—covering you during a job loss, helping with a down payment, or simply getting you through a rough patch.

Debt Elimination: Those funds can be a powerful tool to wipe out nagging, high-interest debts that are dragging down your financial progress.

Budgetary Freedom: By cutting a recurring premium payment from your monthly bills, you simplify your expenses and gain more control over your cash flow.

The Significant Downsides to Consider

Now for the other side of the coin. The drawbacks are serious and deserve your full attention, because the most significant loss isn't yours—it's your family's.

The moment you surrender your policy, your beneficiaries lose the death benefit. This is the core reason you likely bought the policy in the first place—to provide a financial safety net for your loved ones after you're gone.

Beyond that fundamental loss, you'll feel the financial sting in other ways. Expect to face steep surrender charges, especially if the policy is less than 10-15 years old. These fees can take a massive bite out of your final payout. What's more, if your surrender value is greater than the total premiums you've paid in, that difference is considered a gain and you'll owe income tax on it.

Finally, think about the future. If you try to get a new life insurance policy later on, it will be far more expensive and possibly much harder to qualify for, particularly if your health has changed. Your age alone will drive up the premiums, and you might not be able to get the same level of coverage. Before making this kind of choice, it helps to follow a structured investment decision-making process to fully weigh the long-term implications.

Should You Surrender Your Policy? A Side-by-Side Look

Making this decision often feels like a balancing act. To help clarify things, here's a straightforward comparison of what you stand to gain versus what you could lose.

Potential Advantages (Pros) | Potential Disadvantages (Cons) |

|---|---|

Immediate access to a lump sum of cash. | Your beneficiaries lose the death benefit. |

Elimination of future premium payments. | You may pay significant surrender charges. |

Funds can be used to pay off high-interest debt. | You could face income tax on any gains. |

Provides financial flexibility in an emergency. | Replacing the policy later will be much more expensive. |

Ultimately, there's no single right answer. It comes down to your personal financial situation, your long-term goals, and the needs of your family.

Exploring Smart Alternatives to Surrendering

When you're in a cash crunch, eyeing the surrender value of your life insurance policy can seem like the only way out. But before you make a decision you can't undo, it's worth knowing that surrendering is rarely your only—or best—option. There are several smarter strategies that can get you the funds you need without forcing you to dismantle the protection you’ve built for your family.

The urge to surrender often spikes when the economy gets rocky. It’s a predictable pattern: when household incomes drop, more people look to their policies for emergency cash. If you’re interested in the data, you can read the full research on life insurance surrender patterns and see this trend for yourself. The good news is, tapping into your policy's value doesn't have to mean giving up your coverage.

Access Cash While Keeping Your Policy

One of the most common and effective alternatives is taking a policy loan. Instead of tearing up your contract, you’re simply borrowing against the cash value you’ve already built. This gets you tax-free cash, and unlike a traditional loan, there’s no rigid repayment schedule. The loan does accrue interest and will be subtracted from the final death benefit if it's not paid back, but the crucial part is your policy and its protection stay in force.

Another powerful move to consider is a life settlement. This is where you sell your policy to a third-party investor. For many people, the payout from a life settlement can be significantly higher than the surrender value offered by the insurance company. You get more cash in hand, and the responsibility for the policy shifts to a new owner.

This strategy is particularly popular with seniors who may no longer need the death benefit but want to unlock the maximum value from their policy. It essentially turns an otherwise illiquid asset into a more immediate financial resource.

Restructure Your Coverage to Fit Your Budget

What if the problem isn't a one-time cash need, but simply that the premiums have become too high? You don't have to walk away completely. Your policy is more flexible than you might think, and a few adjustments can ease the financial strain while keeping some protection in place for your loved ones.

Think about making one of these strategic changes:

Reduce Your Death Benefit: Ask your insurer to lower the policy's face value. A smaller death benefit means a smaller premium, which might be all you need to make the payments affordable again.

Convert to a Paid-Up Policy: This is a fantastic option where you use the cash value you've already accumulated to "buy" a smaller, fully paid-up policy. You'll stop paying premiums altogether, and while the death benefit is reduced, you'll have permanent coverage for life.

Use Cash Value for Premiums: If you have a healthy cash value balance, you can often instruct the insurer to use those funds to cover your premiums for a while. This gives your budget some much-needed breathing room without disrupting your coverage.

Your Top Questions About Surrender Value Answered

Even with a solid grasp of how surrender value works, it's natural to have questions when it comes to your own policy. This isn't just a financial transaction; it's a big decision with real-world consequences. Let's walk through some of the most common questions people ask to clear up any lingering confusion.

Think of this as the practical side of the conversation—the details that truly matter before you make a move.

Will I Owe Taxes if I Surrender My Policy?

You might, and it all comes down to whether your policy has "gains." If the cash you get back—the surrender value—is more than what you've paid in premiums over the life of the policy (this is called your "cost basis"), then that extra money is considered taxable income.

Let's say you paid a total of $20,000 in premiums. If your surrender value is $25,000, you’ve got a $5,000 gain that you'll need to report and pay income tax on. On the flip side, if your surrender value is less than what you paid in, the money you receive is typically tax-free.

How Quickly Will I Get My Money?

While every company's process is a little different, most insurers can get this sorted out within a few weeks. You'll need to fill out some specific surrender forms and verify your identity, which is standard procedure.

Once all your paperwork is in and gets the green light, you can generally expect a check or a direct deposit to hit your account within 7 to 10 business days. It never hurts to call your insurance provider and ask for their specific timeline upfront.

Can I Undo It if I Change My Mind?

This is a big one: no, once a policy is surrendered, it's gone for good. The moment you cash that check, the contract is officially terminated. The death benefit disappears, and all other features of the policy are gone forever.

This finality is precisely why you should think long and hard about all your other options first. If you surrender the policy, your only path back to life insurance coverage is to apply for a brand-new policy. That means new medical questions, a potential exam, and premiums based on your current age and health—which will almost certainly be higher.

Are All Surrender Charge Schedules the Same?

Definitely not. The length of the surrender period and the percentage they charge is unique to your specific policy and the insurance company that issued it. Most policies have a declining charge schedule that phases out over 10 to 20 years, but you'll find the exact details spelled out in your policy documents.

For example, a common schedule might look something like this:

Year 1: 15% charge

Year 5: 10% charge

Year 10: 5% charge

Year 15: 0% charge

Always pull out your actual policy contract to see what schedule applies to you. Don't rely on general examples.

What if I Just Stop Paying My Premiums?

If you simply stop making payments, what happens next depends entirely on whether you've built up any cash value. First, your policy will enter a grace period, which is usually 30 days. If you still haven't paid by the end of that window, a couple of things could happen.

If you have enough cash value, some policies have an "Automatic Premium Loan" feature that will kick in and use that money to cover the premiums for you. But if there’s little or no cash value, the policy will lapse. A lapsed policy means your coverage is terminated, and the death benefit is lost. You might get a small payout in some scenarios, but it's usually much less than what you'd get from an official surrender.

Navigating your financial future requires partners who align with your values. America First Financial offers life insurance and other financial products designed to protect your family's future without compromising your principles. Get a straightforward quote in under three minutes and secure the protection your loved ones deserve. Learn more and get your free quote today at America First Financial.

_edited.png)

Comments