What Is Underwriting in Insurance? Your Guide to Risk Assessment

- dustinjohnson5

- Aug 28, 2025

- 11 min read

Ever wondered how an insurance company decides whether to cover you—and how much to charge? That’s where underwriting comes in. Think of an underwriter as the insurance world’s risk assessor, the person responsible for figuring out if you're a good bet.

Their job is to weigh the odds and set a fair price for your policy based on the level of risk you bring to the table.

What an Underwriter Really Does

It’s a common misconception that underwriters are just looking for reasons to say no. In reality, their main goal is to keep the entire insurance system fair and financially sound for everyone involved. By carefully vetting each applicant, they make sure the money collected in premiums is enough to cover the claims that will eventually be paid out. This prevents a few high-risk individuals from draining the pool, which would cause premiums to skyrocket for everyone else.

This whole concept isn’t new. It actually goes all the way back to the 17th century at Lloyd's of London, where wealthy merchants would literally write their names under the details of a ship's voyage, pledging their personal assets to cover potential losses. Today's process is a bit more sophisticated, but it still serves the same vital purpose: protecting the insurer from going broke and keeping coverage accessible.

To understand their modern role, it helps to break down their work into a few key responsibilities.

The Underwriter's Core Responsibilities

An underwriter’s day-to-day work boils down to three main functions that directly shape your insurance policy. Let's take a look at what they do.

The table below breaks down the key functions of an insurance underwriter, showing how they move from initial analysis to a final policy decision.

Key Functions of an Insurance Underwriter

Function | Description | Example |

|---|---|---|

Risk Assessment | Sifting through an applicant's information to gauge the likelihood and potential cost of a future claim. | A life insurance underwriter reviews medical records, family history, and lifestyle choices like smoking. |

Pricing Premiums | Calculating the exact cost of the policy based on the level of risk identified during the assessment. | A property underwriter sets a higher premium for a home located in a region prone to wildfires. |

Setting Policy Terms | Defining the specific rules of the policy, including what’s covered, what’s not, and any special conditions. | A health underwriter might add a clause excluding coverage for a specific pre-existing condition for a set period. |

Ultimately, these three steps ensure that the policy you're offered is a fair exchange—you get the protection you need, and the insurer takes on a calculated risk it can afford to manage.

The Underwriting Journey from Application to Decision

So, you’ve filled out an insurance application. What happens next? It’s not just sitting in a digital pile; it’s kicking off a detailed journey that takes your information from the page to a final policy decision. Think of it as a methodical investigation, where an underwriter acts as a detective to build a clear picture of the risk involved.

It all begins with your application. The underwriter’s first move is to dive deep into the details you provided. If you’re applying for car insurance, for instance, they're looking at your driving record, the make and model of your vehicle, and how many miles you typically drive each year. This is the starting point for sketching out your initial risk profile.

But they don't just take your word for it. The next step involves a bit of fact-checking. The underwriter will verify your information against external, official sources. This means pulling your motor vehicle report to confirm your driving history is accurate or checking industry databases for any past claims. This verification isn't about distrust; it's about ensuring the final assessment is built on a solid foundation of accurate data.

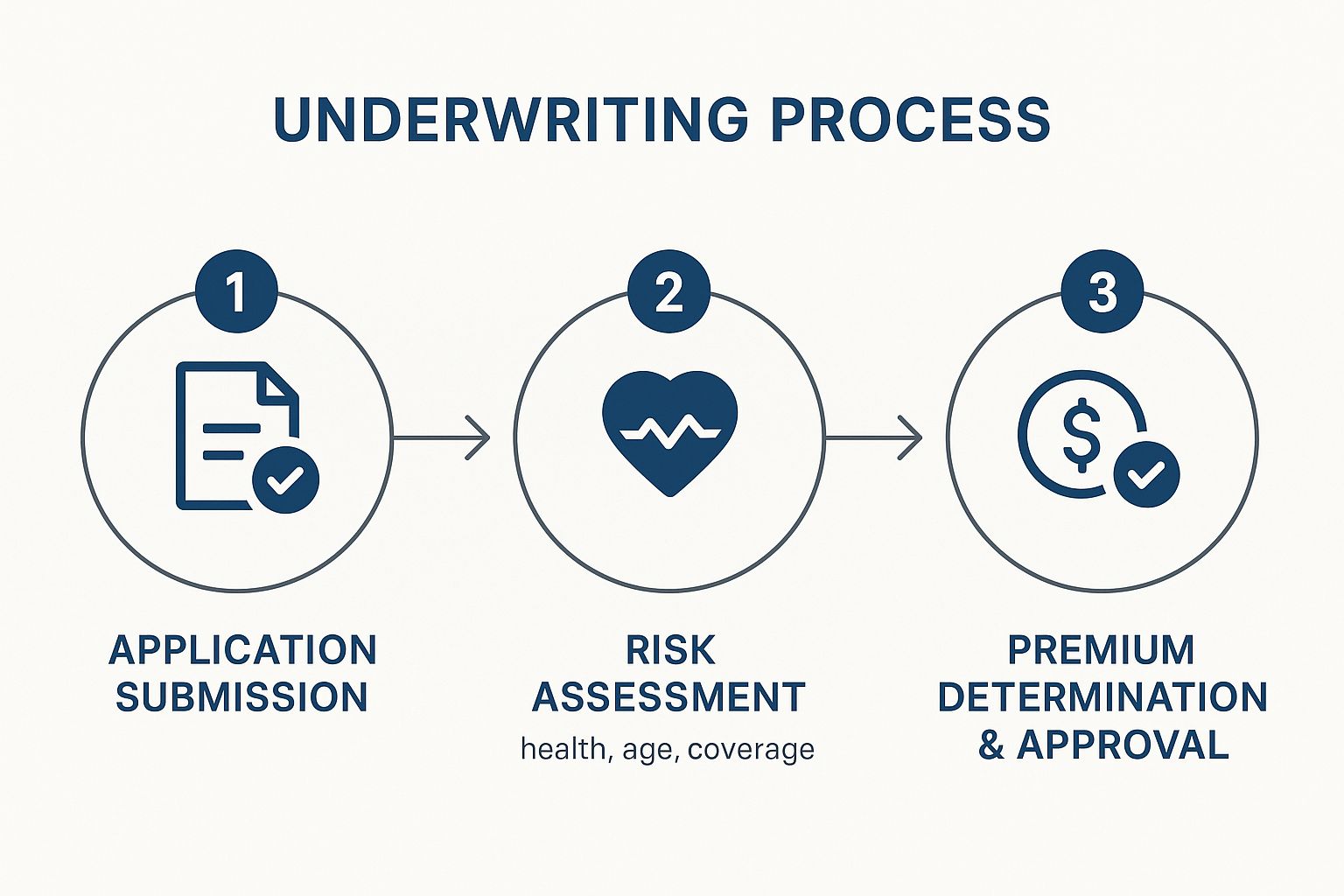

This infographic provides a great visual overview of how these stages flow together.

As you can see, it's a logical progression: gather the facts, analyze the risk, and then make a calculated decision about coverage and cost.

Analyzing the Data and Making a Decision

With all the puzzle pieces in place, the real analysis begins. The underwriter uses sophisticated models and a healthy dose of professional judgment to weigh all the risk factors. Their goal? To predict the probability that you’ll need to file a claim. It’s pretty intuitive—a driver with a spotless record in a reliable sedan is a fundamentally different risk than someone with a history of accidents.

Ultimately, this deep-dive analysis leads to one of three outcomes:

Approved: Great news! Your application is accepted, and the insurer will offer you a policy.

Approved with Conditions: You're in, but with some adjustments. This might mean a higher premium to offset a specific risk, a larger deductible, or even certain exclusions added to your policy.

Denied: If the underwriter determines the risk is just too high to be predictable or profitable for the company, your application may be turned down.

The underwriter's work doesn't just stop at a "yes" or "no." Their evaluation directly sets the terms of your coverage. Getting a handle on [understanding insurance policy limits](https://nwclaimsmanagement.com/insurance-policy-limits-explained-3/) can give you a much clearer picture of how these underwriting decisions translate into the real-world protections you receive. This final step is where the abstract risk assessment becomes a concrete insurance policy tailored to your specific situation.

How Underwriting Varies Across Different Insurance Types

While the core mission of underwriting—figuring out risk—is universal, the actual work changes dramatically depending on what's being insured. The questions an underwriter asks are anything but one-size-fits-all. It's a specialized field where the investigation shifts to match the unique risk of each policy.

Here's an easy way to think about it: a doctor diagnosing a sore throat asks very different questions than one treating a broken leg. In the same way, the lens an underwriter uses for a life insurance application is completely different from the one they use for home insurance. Each policy protects against a different kind of loss, so the evaluation has to be tailored accordingly.

Life and Health Insurance Underwriting

When you're applying for life or health insurance, the spotlight is squarely on you—your health, your history, and your habits. The big questions revolve around your longevity and how likely you are to need expensive medical care down the road. Underwriters in this space are essentially experts in human health risk.

They'll dig into things like:

Medical History: Chronic conditions like diabetes or heart disease, past surgeries, and prescription records are all key pieces of the puzzle.

Family Health History: A pattern of hereditary conditions in your family tree can certainly influence the underwriter’s assessment.

Lifestyle Choices: Do you smoke? Do you have risky hobbies like skydiving? These habits are major factors in building your risk profile.

Current Health Status: A medical exam gives a real-time snapshot, providing concrete data on blood pressure, cholesterol, and body mass index (BMI).

Property and Casualty Insurance Underwriting

Now, flip the script. For property and casualty (P&C) insurance—think your home or your car—the underwriter’s focus shifts from your personal health to your physical assets and potential liabilities. The concern here is the probability of damage, theft, or a lawsuit.

For a homeowner's policy, an underwriter is looking at factors like:

Property Location: Is the home in a flood zone or an area known for wildfires or high crime? Geography matters. A lot.

Construction and Age: The type of materials used to build the home, how old the roof is, and the condition of the wiring are all under scrutiny.

Protective Measures: Things like smoke detectors, a modern security system, or storm shutters can actively reduce risk and work in your favor.

The specific data points and risk factors underwriters analyze are fundamentally different from one insurance line to another. The following table breaks down what they're looking for in each major category.

Underwriting Factors Across Different Insurance Types

Insurance Type | Key Underwriting Factors | Example Data Source |

|---|---|---|

Life Insurance | Age, health history, lifestyle (e.g., smoking), occupation, and family medical history. | Medical records, motor vehicle reports, prescription history databases. |

Health Insurance | Pre-existing conditions, age, location, and tobacco use. | Application health questionnaire, prior insurance claims history. |

Property & Casualty | Property location, construction materials, age of home, claims history, and credit score. | Property inspection reports, public records, and CLUE reports. |

Ultimately, knowing these differences helps explain why you're asked such different questions for different policies. Every application kicks off a unique investigation, perfectly aligned with the specific risks involved.

Why Underwriting Is the Backbone of the Insurance Industry

Think of underwriting as the bedrock of the entire insurance world. It’s not just about approving or denying applications; it's the critical process that ensures an insurance company can actually pay out claims when they're needed. This protects the insurer, of course, but it also protects every single person who holds a policy.

This whole protective function really comes down to managing a couple of key financial ideas. First up is preventing something called adverse selection. This is what happens when only high-risk people—the ones most likely to file a claim—are the ones buying insurance. Without a good underwriter filtering applications, the risk pool would get skewed, funds would drain fast, and the whole system could collapse.

The other big job is maintaining solvency. That’s just a fancy way of saying the insurer has enough money to pay its bills. By carefully picking which risks to take on and pricing them correctly, underwriters build a balanced portfolio where the premiums collected from everyone can reliably cover the claims filed by a few.

Underwriting isn't a barrier designed to keep you out; it's a structural support system designed to ensure the insurer is still standing strong when you need it most.

Balancing Profitability and Protection

This careful balancing act has a direct line to an insurer's financial health. The quality of the underwriting team's decisions shows up in key metrics like loss ratios, which measure how much is paid out in claims versus how much is collected in premiums.

For example, when underwriting standards get a little too relaxed, insurers almost always see a jump in both how often claims are filed and how expensive they are. This is why the discipline has to be so nimble, constantly adjusting to what's happening in the market to keep things stable. If you're interested in the data behind this, you can dig into key research on the insurance market to see how trends affect the industry.

At the end of the day, good underwriting is what makes the whole insurance model work. It builds a diverse and financially solid risk pool that can handle everything from a minor fender-bender to a major natural disaster. It's how a company makes sure its promise to protect you is one it can always keep.

How Technology is Reshaping Modern Underwriting

The days of underwriters drowning in paper files and painstakingly crunching numbers are quickly fading. Technology has swept through the insurance world, making the entire underwriting process faster, smarter, and far more accurate than what was possible even a decade ago. It’s a complete overhaul, powered by tools that can digest and interpret information on a scale that’s simply beyond human capability.

Leading this charge are Artificial Intelligence (AI) and machine learning. Think of them as super-powered analysts. These systems can sift through mountains of data—far more than any person could—to identify subtle risk patterns that would otherwise fly under the radar. An AI model might, for instance, connect seemingly unrelated data points about an applicant's lifestyle, location, and career to build a remarkably precise risk profile.

The New Standard: Automated Underwriting

One of the biggest game-changers has been the rise of automated underwriting. These systems are designed to make near-instant decisions on straightforward applications. When you apply for a standard car insurance policy online, it's often an automated system that checks your driving record, assesses your vehicle's risk factors, and approves your coverage in a matter of minutes.

This isn't putting underwriters out of a job. Quite the opposite. By handling the routine applications, automation frees up human experts to dig into the really tricky cases—think multi-million dollar life insurance policies or unique commercial risks that require a seasoned professional's judgment. It makes the whole system run more smoothly.

Technology isn't here to replace underwriters. It’s giving them a powerful new toolkit. They can stop being data collectors and start being true strategic risk analysts.

This reliance on data-driven decision-making is only growing. The global market for the insurance analytics that fuel modern underwriting was expected to hit $43.95 billion by 2025. You can dig into the growth of insurance analytics at Fortune Business Insights to see just how massive this trend is.

Toward Hyper-Personalized Risk Profiles

Technology is also making risk assessment much more personal and fair. We’re moving beyond static data points like age and zip code and into a world of dynamic, real-time information. Data from vehicle telematics (those little devices that track driving habits) and wearable health trackers gives underwriters a live look at an applicant's actual behavior.

What does this look like in practice?

A driver who consistently avoids speeding and hard braking could see their good habits rewarded with a lower premium.

Someone who uses a fitness tracker to maintain an active lifestyle might secure better rates on their life insurance.

This shift creates a more equitable system where premiums are tied directly to an individual's actions, not just broad statistical categories. It’s a win for responsible consumers and a win for insurers, who get a much clearer, more accurate picture of the risks they’re taking on.

Got Questions About Insurance Underwriting? Let's Clear Them Up.

Even when you understand the basics of underwriting, it’s the practical, real-world questions that often pop up. What actually happens behind the scenes? How long will I be waiting? Let's walk through some of the most common questions people have.

How Long Does This Whole Underwriting Thing Take?

Honestly, it really depends. The timeline for underwriting can be anything from a few minutes to a couple of months. For something straightforward like a standard auto insurance policy, automated systems can crunch the numbers and give you a thumbs-up (or down) almost instantly.

But for more complex policies, a real person has to get involved. Life insurance is the classic example here. Because it involves digging into medical histories and sometimes even scheduling a medical exam, the process can easily take four to eight weeks. It's just a more involved, hands-on evaluation.

Think of it this way: the more unique or complicated the risk, the longer it takes. A simple car policy is quick; insuring a multi-million dollar commercial property with unique liabilities requires a much deeper dive.

What If My Application Is Denied?

Getting a denial letter is never fun, but it’s not always a dead end. When an insurer denies your application, they are required by law to tell you exactly why. This is your chance to see what specific red flags they found.

The first thing you should do is review the reasons they gave you. Did they get a piece of information wrong? It happens. You have the right to see the information they used and correct any mistakes. It's also a good idea to ask what you could change to be a better candidate down the line. And remember, every company has its own rulebook—one insurer's "no" could easily be another's "yes," so don't be afraid to shop around.

Is There Anything I Can Do to Get a Better Outcome?

Absolutely. The best thing you can do is be completely upfront and honest on your application. Hiding information is a huge red flag that can lead to an instant denial or, worse, get your policy canceled right when you file a claim.

Beyond that, you can definitely take steps to make yourself a more attractive applicant:

Life & Health Insurance: Living a healthy lifestyle is key. If you quit smoking or get a chronic condition under control, it can make a massive difference in your rates.

Property Insurance: Simple upgrades like installing a new security system, adding smoke detectors, or even replacing an old roof show the underwriter you’re serious about minimizing risk.

Across the Board: A solid credit history often signals responsibility to an underwriter, which can work in your favor no matter what type of policy you're seeking.

Ultimately, the goal is to show that you're a responsible, predictable risk. The more you can do that, the better your chances are of getting approved with the best possible terms.

At America First Financial, we believe in providing clear, straightforward insurance solutions that protect what matters most. Our process is designed to be quick and transparent, helping you secure your family's future without the hassle. Get a free, no-obligation quote in under three minutes and see how we can help you build a strong financial foundation. Learn more at https://www.americafirstfinancial.org.

_edited.png)

Comments