What to Do When Insurance Denies Claim: Expert Tips

- dustinjohnson5

- Jun 26, 2025

- 14 min read

It’s a gut-punch, no question about it. You’ve been paying your premiums, you filed a legitimate claim, and now you’re holding a denial letter. It feels final, but I can tell you from experience, it’s often just the start of a new chapter.

Don’t let frustration take over. Instead, channel that energy into action. The insurance company has made its move; now it's time to make yours.

Your Insurance Claim Was Denied. Now What?

When that denial letter arrives, it's easy to feel like you've hit a brick wall. But here's the secret: that letter isn't the end of the conversation. It's the opening line. The most powerful thing you can do right now is shift from feeling defeated to becoming strategic.

The first step is surprisingly simple, yet it's something people often skip in the heat of the moment. You need to become a meticulous record-keeper. Whether you grab a three-ring binder or create a dedicated folder on your laptop, this file is now your single source of truth.

Start Building Your Case File

Your immediate objective is to gather every single piece of paper and every email related to your claim. Don't rely on your memory, and absolutely do not assume the insurance company has your back. You need your own complete, independent record.

Start pulling these documents together:

The Denial Letter: This is exhibit A. It’s supposed to spell out exactly why they denied the claim, citing specific policy language.

Your Complete Policy: You need more than just the declarations page. Request a certified copy of your entire policy, including every single endorsement and rider attached to it. This is your contract.

Your Original Application: Denials are sometimes based on what the insurer claims were misrepresentations on your application. Get a copy so you know exactly what you submitted.

All Correspondence: Every email, every letter, and every note you've jotted down from phone calls needs to go into your file.

My Go-To Tip: After any phone call with the insurance company, immediately send a follow-up email. Keep it simple: "Hi [Rep's Name], just to confirm our conversation today, [Date] at [Time], we discussed..." This creates a paper trail and holds them accountable for what was said.

Taking Back Control

By systematically collecting all this information, you're doing more than just getting organized. You're taking the first tangible step toward challenging the denial. You’re no longer just reacting to their decision; you're building the foundation for your appeal. This methodical approach is precisely what you need to do when an insurance company says no.

The table below breaks down your immediate first moves into a simple action plan. It turns that feeling of "what do I do now?" into a clear, manageable checklist.

Your Immediate Action Plan After a Claim Denial

This plan is your road map for the first 24-48 hours. Taking these steps right away sets the stage for a much stronger appeal.

Action Item | Why It's Important | Your First Move |

|---|---|---|

Request Your Claim File | This gives you the insurer's internal notes, adjuster reports, and all the evidence they used to deny you. It’s a look behind the curtain. | Send a formal written request via email and certified mail. Address it to the claims adjuster who signed your denial letter. |

Set Up a Log | It creates a bulletproof timeline of every conversation and submission, which is invaluable for eliminating "he said, she said" arguments. | Use a simple notebook or a spreadsheet. Log the date, time, who you spoke with, and a quick summary of the conversation. |

Review Your Policy | This is where you compare their reason for denial against the actual words in your contract. You're looking for contradictions or misinterpretations. | Go straight to the "Exclusions" and "Definitions" sections. Does their reasoning really line up with the policy language? |

Don't Make Threats | Staying professional is far more effective. Yelling or threatening legal action at this stage often just makes them dig in their heels. | Keep all your communication polite, factual, and focused on gathering the information you need to move forward. |

Once you have this groundwork laid, you're in a position of strength. You have the same information they do, and you're ready to start dissecting their argument and building yours.

How to Decode Your Denial Letter and Policy

That denial letter in your hands isn't just bad news; it's a critical piece of evidence. Insurance companies are legally required to explain why they're saying no. Think of it as a roadmap to your appeal, because hidden in their justification are the exact points you'll need to challenge.

The language is almost always dense and packed with jargon. That's intentional. Your first job is to cut through the noise and find the real reason they're denying your claim.

Pinpointing the Insurer's Justification

In my experience, insurers tend to lean on a few common reasons to deny claims. Once you understand what they're really saying, you can start building a counter-argument.

Here are some of the usual suspects you'll see:

Not Medically Necessary: This is a classic, especially in health insurance. Essentially, the insurer is saying their internal guidelines don't deem the treatment necessary, even if your own doctor strongly disagrees.

Experimental or Investigational: They're flagging the treatment as too new or unproven to be covered by the policy.

Pre-Existing Condition: The argument here is that the health issue you're seeking treatment for was present before your coverage started.

Filing Errors: Sometimes it's as simple as a clerical mistake. Missing information or an incorrect billing code can be enough to trigger an automatic denial.

Lack of Coverage: The most straightforward denial—the company claims your policy just doesn't cover that specific service or event.

Your denial letter should point to a specific denial code or reference a particular clause in your policy. Hunt for that detail, because it’s the anchor of their entire argument. If the letter is frustratingly vague, that's actually your first opening. A vague denial is a weak denial.

Cross-Referencing with Your Policy Documents

Okay, you've found their reason. Now it's time to put on your detective hat. You're going to compare what the denial letter says directly against the language in your insurance policy. This is where you'll find the loopholes and contradictions that make for a powerful appeal.

Get your hands on the full policy document. It might be called the "Evidence of Coverage" or "Summary Plan Description." Don't just skim the highlights page; you need the fine print where the real rules are written.

I remember a client whose denial letter for a procedure just said 'not covered.' That's it. When we dug into the actual policy, we found the 'Exclusions' section was incredibly detailed, and their specific procedure wasn't listed anywhere. The insurer was using a broad, convenient interpretation that we successfully challenged.

As you read, focus on these key areas:

Definitions: How does the policy define a term like "Medical Necessity" or "Experimental"? Their definition might be very different from the common-sense one.

Exclusions and Limitations: This is the list of everything the policy specifically does not cover. If your denied service isn't explicitly named here, you have a solid point to argue.

Schedule of Benefits: This part outlines what is covered. See how it lines up with the service that was denied.

If the denial letter says something like "per policy exclusion on page 42, section B," you need to go right to that page and that section. Read it, then read it again. Does it genuinely apply to your situation, or is the insurer stretching the truth? They often misapply their own rules. Your job is to catch them in the act. This careful comparison is the bedrock of a successful appeal when an insurance company denies your claim.

Building Your Appeal with Strong Evidence

Let's be blunt: an appeal without solid proof is just you voicing an opinion. And in the world of insurance, opinions are incredibly easy to ignore. If you want to force an insurer to reconsider and overturn a denial, you need to build a case file so airtight that they have no choice but to take you seriously. This isn't about just resending the same old paperwork.

Your job is to systematically tear down their rationale for the denial with undeniable facts. For example, if they rejected a procedure because it wasn't "medically necessary," your doctor's initial chart notes probably won't cut it. You have to get proactive.

Go Beyond Standard Medical Records

For a health insurance appeal, the single most powerful tool in your arsenal is a Letter of Medical Necessity. This isn't something that just appears in your file; you have to explicitly ask your doctor to write one for you.

This letter needs to speak directly to the insurance company's specific reason for denial. It should clearly explain why the treatment is critical for your health, detail why other options aren't appropriate, and show how it fits squarely within accepted medical standards.

A well-crafted Letter of Medical Necessity completely reframes the argument. It's no longer your word against theirs; it's a medical expert's professional judgment against a corporate policy. That kind of letter carries significant weight, both in the company's internal review and any external appeal that follows.

Don't stop there. Getting a second opinion from another specialist can be a game-changer. When an independent expert backs up your doctor's recommendation, it powerfully reinforces the fact that the treatment is necessary and not just a single physician's preference.

Assembling a Persuasive Evidence File

Think of yourself as building a narrative. You want to gather a complete package of evidence where every document adds another layer to your story, making your case more and more compelling.

Your file should be comprehensive. Here's what to include:

Clinical Practice Guidelines: Search for and print out guidelines from respected medical associations that endorse the treatment you were denied. This demonstrates that the procedure is part of the established standard of care, not some fringe idea.

Relevant Medical Studies: A few minutes on a site like PubMed can uncover peer-reviewed research showing your treatment's effectiveness. Including these studies is the perfect way to counter a claim that a procedure is "experimental."

Testimonials and Personal Records: If you're dealing with a disability or life insurance denial based on lifestyle or daily activities, sworn statements (affidavits) from friends, family, or colleagues can be invaluable. A detailed journal documenting your symptoms and limitations over time also adds crucial, personal context that a medical chart can't capture.

Putting in this work has never been more critical. Insurance claim denials have been climbing steadily, with one analysis pointing to a 16% increase between 2018 and 2024. This trend puts immense financial and emotional pressure on families who are already struggling. When you're in this fight, a meticulously built evidence file is your best weapon. Learn more about the impact of rising claim denials.

It can also be helpful to think like the other side. Understanding the tactics used in a professional insurance fraud investigation offers a unique perspective. When you know how insurers scrutinize claims, you can better anticipate their arguments and make sure your own documentation is buttoned up and free of potential red flags.

Navigating the Formal Insurance Appeal Process

When your insurance company denies a claim, filing a formal appeal is your official, structured way to fight back. This isn't just about sending a quick email or making another phone call. It’s a formal process with strict rules and deadlines, and missing them can cost you everything.

You have to understand the difference between simply asking for a do-over and escalating the issue. Your first move is typically an internal appeal. This is where you formally demand the insurance company conduct a full and fair review of its own decision. If they still say no, your next option is often an external review, where an independent, unbiased third party steps in to examine your case and issue a final, binding decision.

Crafting a Compelling Appeal Letter

Your appeal letter is the heart of your challenge. It needs to be professional, packed with facts, and persuasive—this is not the place for an emotional rant. Think of yourself as building a legal case, with your evidence systematically dismantling the insurer's reasons for denial.

A powerful appeal letter should always include:

A Clear Introduction: Right at the top, list your name, policy number, and the specific claim number. State plainly that you are appealing the denial issued on [Date of Denial Letter].

A Point-by-Point Rebuttal: Go through their denial letter and address every single reason they gave. For instance, if they claimed a procedure wasn't medically necessary, you’ll counter that with your doctor's Letter of Medical Necessity and cite the clinical guidelines you found.

An Evidence Inventory: Create a numbered list of every document you're including. This creates an undeniable record and helps the reviewer see exactly how your evidence supports your claim.

A Specific Request: End with a firm, clear statement of what you expect. A good example is, "I am requesting that you overturn your denial and approve full payment for this claim."

For a deeper dive into effective tactics, you can explore some proven strategies to fight insurance claim denials and win your appeal.

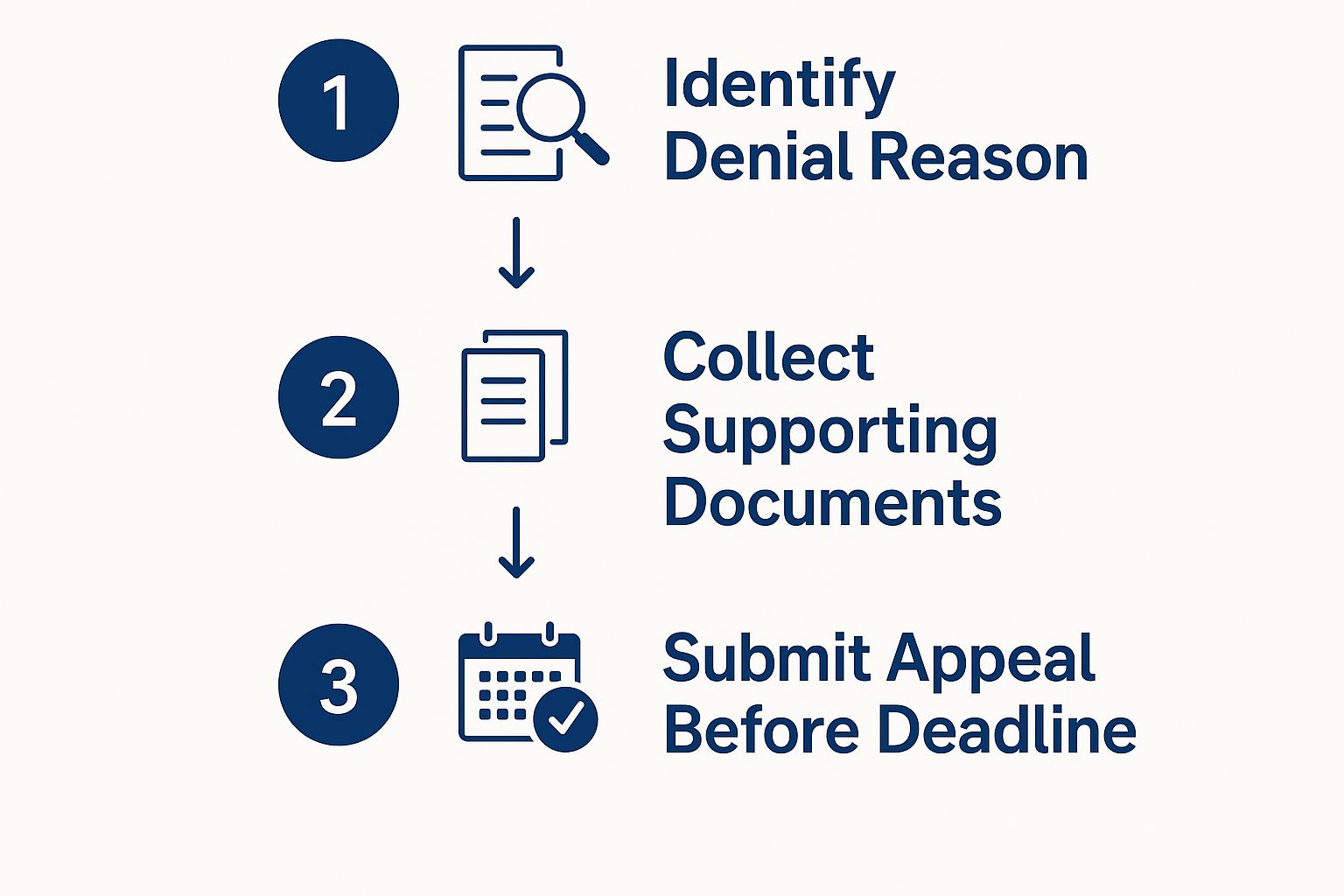

The chart below breaks down the essential steps to take when you're ready to submit.

This visual is a great reminder of the core sequence: pinpoint the real reason for the denial, gather all your critical documents, and get your appeal submitted before that deadline hits.

Crucial Insight: From my experience, the single biggest mistake people make is missing the appeal deadline. Most plans give you 180 days for an internal appeal, but you must check your denial letter to confirm the exact date. If you miss that window, you’ve likely lost your right to challenge the decision for good.

It's also worth knowing who you're up against. A 2023 analysis of Marketplace health plans revealed some shocking differences in how often insurers deny claims. For example, UnitedHealthcare and AvMed denied roughly 33% of in-network claims, a stark contrast to Kaiser Permanente, which denied only about 6%. Knowing these stats helps you mentally prepare for the potential fight ahead. Find out more about how health payer denial rates compare.

What to Do When Your Appeal Is Also Denied

If your internal appeal comes back with another "no," it’s easy to feel defeated. I've seen many people throw in the towel at this stage, but this is precisely when your most powerful options finally open up. An insurer upholding its own denial is incredibly common; now it's time to take the decision out of their hands.

Your very next move should be requesting an independent external review. This is a formal process that hands your case over to an unbiased medical professional or an impartial third-party panel. Crucially, they have zero connection to your insurance company. Their decision is based purely on the evidence and is legally binding.

Taking Your Fight to a Higher Authority

When that internal appeal fails, you have to escalate. Just sending the same information back to the insurer is a dead end. Instead, you need to engage the systems specifically designed to hold insurance companies accountable.

One of the most effective tools in your arsenal is filing a formal complaint with your state’s Department of Insurance. This government agency is the official regulatory body overseeing every insurer's conduct in your state. They have the power to investigate consumer complaints and can apply serious pressure on companies to comply with state laws and the terms of their own policies.

Filing a complaint is usually a straightforward process you can kick off right on their website. It accomplishes two things: it creates an official record of your dispute and sends a clear signal to the insurer that you aren't backing down. They are legally required to respond to the state regulator, forcing them to justify their denial to a higher power.

Pro Tip: An external review and a state-level complaint are not mutually exclusive. I often advise people to pursue both paths at the same time. This strategy can significantly increase the pressure on the insurance company and maximize your chances of getting that denial overturned.

Knowing When to Bring in Legal Help

For some situations, especially those with substantial financial stakes, getting professional legal help is non-negotiable. This is particularly true for high-value life insurance claims, which can be wrongfully denied, leaving families in a truly devastating financial position.

This problem is more common than you might think. Life insurance claims can be denied or delayed in an estimated 10% to 20% of cases, often due to flimsy reasons like alleged misrepresentations, policy lapses, or obscure exclusions. While insurers don't rush to publish this data, these figures—compiled from consumer complaints and court filings—show why beneficiaries must be ready to fight back.

If your claim is delayed beyond 60 days or denied for a reason that feels weak, it could be a sign of bad faith. This is when you should seriously consider legal help. You can get more details on how these life insurance statistics affect families from leading legal experts who see these cases every day.

Consulting an attorney who specializes in insurance law is a critical step when your claim is complex or involves a lot of money. A great tip is to look for a lawyer who works on a contingency fee basis. That means you won’t owe them a penny unless they win your case. An experienced attorney knows exactly what to do when an insurance company denies a claim and can take the fight to a level you simply can't reach on your own.

Navigating a Claim Denial: Your Questions Answered

When an insurance company denies your claim, it's natural for a million questions to start racing through your mind. The process can feel like a maze, full of unfamiliar terms and deadlines. Let's walk through some of the most common—and critical—questions people have when they decide to fight back.

How Long Do I Have to File an Appeal?

This is, without a doubt, one of the most important questions you can ask. The clock starts ticking the moment you receive that denial letter, and the answer can make or break your entire case.

For most health insurance plans, you'll generally have 180 days to submit your internal appeal. But you absolutely cannot treat that as a universal rule. Your denial letter and policy documents are your source of truth here—find the specific deadline and circle it on your calendar. Insurance companies are notoriously rigid with these timeframes. If you miss that date, even by a single day, you could lose your right to challenge their decision for good.

What’s the Difference Between an Internal and External Appeal?

Thinking about this as a two-step process is the easiest way to understand your options. You can't just jump to the final stage; you have to follow the prescribed path.

The Internal Appeal: This is your first shot. You're officially asking your own insurance company to take another look at its decision. This is where you submit all your new evidence—like a powerful Letter of Medical Necessity from your doctor—and make your case directly to them.

The External Appeal: If the insurance company doubles down and denies your internal appeal, you get to escalate. Your case is handed over to an independent, third-party reviewer who has zero connection to your insurer. This person looks at the facts objectively, and their decision is legally binding.

You must go through the internal appeal process first. It’s a mandatory step before you can unlock the external review.

Why This Matters: An external review gets your case in front of a neutral party. While insurance companies often uphold their own denials internally, your odds can improve significantly when an independent expert, free from bias, examines the facts.

Can I Handle the Appeal Myself, or Do I Need to Hire a Lawyer?

For many people, the answer is yes—you can absolutely handle the internal appeal on your own. Plenty of people build a compelling case and win by staying organized, collecting solid evidence, and writing a clear, persuasive appeal letter.

However, there are times when bringing in a legal expert is a very smart move. You should seriously think about consulting an attorney who specializes in insurance law if you find yourself in one of these situations:

The stakes are incredibly high. We're talking about a large life insurance policy, a long-term disability claim, or any benefit that represents a significant financial amount.

The case is a tangled mess. If the denial hinges on complicated medical facts or obscure policy language, a lawyer can cut through the jargon.

You've already been denied internally. As you prepare for an external review or other legal action, having an expert in your corner is a huge advantage.

You suspect bad faith. If you feel the insurer is intentionally dragging its feet or denying your claim without a legitimate reason, that’s a major red flag.

An experienced lawyer knows the pressure points and can take the fight to a level that’s tough to achieve on your own.

At America First Financial, we believe your family’s future deserves protection from clear, reliable insurance that aligns with your values. If you're tired of politically charged agendas and just want coverage you can count on, we're here to help. You can get a straightforward, no-hassle quote online in under three minutes. Secure your family's financial well-being today.

_edited.png)