When Can I Collect Social Security? Find Out Now

- dustinjohnson5

- Jul 12, 2025

- 15 min read

So, when can you actually start collecting Social Security? The short answer is you can begin as early as age 62. But—and this is a big but—making that choice means your monthly checks will be permanently smaller.

Your First Look at Social Security Claiming Ages

Deciding when to start your Social Security benefits is easily one of the most important financial decisions you'll make in retirement. While you can technically get your first check at 62, the full story really revolves around three key age milestones. Each one has a lifelong impact on your income.

I like to think of it like picking apples from a tree you've tended your whole working life. You have a few choices on when to harvest:

Pick Early (Age 62): You can grab the apples as soon as they appear. This gets you money in your pocket right away, but the apples are smaller, and they'll stay that way forever.

Pick When Ripe (Full Retirement Age): You can wait until the apples are perfectly mature. This gives you the full, standard-sized harvest you've earned—no penalties, no bonuses.

Pick Late (Age 70): You can let the apples keep growing even after they're ripe. It takes patience, but your final harvest will be much larger, giving you a bigger bounty for the rest of your life.

What Is Your Full Retirement Age?

Your Full Retirement Age (FRA) is that "perfectly ripe" moment for your benefits. It’s the age when the Social Security Administration says you're entitled to 100% of the benefits you’ve earned. This age isn't a one-size-fits-all number; it's based on the year you were born.

If you were born in 1960 or later, your FRA is 67. For people born earlier, it's somewhere between 66 and 67. Knowing your specific FRA is the absolute starting point for making a smart claiming decision.

The choice of when to file is becoming more important than ever. The U.S. population is aging, and between 2015 and 2025, the number of people collecting Social Security benefits jumped by roughly 19%, from 59 million to about 70 million.

This trend really shines a spotlight on why getting the most out of your personal benefits matters. Even with the clear financial upside of waiting, a lot of people still choose to claim at 62. This locks them into a benefit that’s reduced by about 30% compared to what they’d get if they waited for an FRA of 67. You can dig deeper into the rise in early Social Security claims and what it means for retirees.

How Your Claiming Age Changes Your Benefit

The financial gap between claiming early, at your FRA, or late is significant, and it’s a permanent one. Claim before your FRA, and you get a permanently smaller check. Wait past your FRA, and you earn what are called "delayed retirement credits," which boost your monthly payment all the way up until you hit age 70.

To see what this means for you, have a look at the table below. It shows your Full Retirement Age based on your birth year and how your monthly benefit changes if you claim at the earliest possible time (62) or delay for the maximum payout (70).

Your Full Retirement Age (FRA) and Benefit Adjustments

Year of Birth | Full Retirement Age (FRA) | Benefit at Age 62 (% of FRA amount) | Benefit at Age 70 (% of FRA amount) |

|---|---|---|---|

1943-1954 | 66 | 75% | 132% |

1955 | 66 and 2 months | 74.2% | 130.7% |

1956 | 66 and 4 months | 73.3% | 129.3% |

1957 | 66 and 6 months | 72.5% | 128% |

1958 | 66 and 8 months | 71.7% | 126.7% |

1959 | 66 and 10 months | 70.8% | 125.3% |

1960 and later | 67 | 70% | 124% |

Getting comfortable with these numbers is the first step. From here, you can start building a retirement income strategy that truly fits your financial situation and your vision for the future.

How Your Social Security Benefit Is Calculated

Knowing when you can start getting Social Security checks is just one part of the equation. The other, arguably more important, piece is figuring out how much you’ll actually receive each month. The Social Security Administration (SSA) uses a specific formula, and once you get the hang of it, you can see exactly how your career choices impact your future retirement income.

It all starts with something called Social Security credits. I like to think of them as building blocks. You need to stack up enough of them throughout your working life to build a foundation for your benefits.

You collect these credits by working and paying your Social Security taxes. In 2024, you earn one credit for every $1,730 you make, up to a maximum of four credits per year. To qualify for retirement benefits, you generally need 40 credits, which for most people translates to about 10 years of work.

Your 35 Highest-Earning Years Matter Most

Once you've got your 40 credits in the bag, the SSA gets down to calculating your actual payment amount. This is where your entire earnings history gets put under the microscope. Specifically, the SSA zeroes in on your 35 highest-earning years.

Now, they don't just take the raw dollar amounts you earned back in the day. That wouldn't be fair, right? A dollar in 1995 bought a lot more than a dollar does today. So, they use a process called "indexing" to adjust your past earnings, bringing them up to today's wage levels. This ensures that your hard work from early in your career is valued fairly.

After your earnings are indexed, the SSA adds up the totals from those 35 best years and divides the sum by 420 (that's just the number of months in 35 years). This gives you your Average Indexed Monthly Earnings (AIME), which is the key number used to figure out your benefit.

Why Every Year of Work Can Make a Difference

This 35-year rule is exactly why working even a year or two longer can make such a big difference. Think about it: many of us have our peak earning years later in our careers. Each additional year you work at a higher salary can replace a lower-earning year from your past, bumping up your overall average.

Here’s how that plays out:

Replacing a Low-Income Year: Remember that part-time job you had in college? A new year of higher earnings can knock that old, low number right out of the calculation.

Replacing a Zero-Income Year: If you ever took time off to raise kids, care for a parent, or were between jobs, those years go into the calculation as a "$0." Working another year at almost any salary is a huge improvement over a zero and can give your average a significant boost.

Your final benefit isn't just a simple average, though. The SSA applies a progressive formula to your AIME to calculate your Primary Insurance Amount (PIA). This is the amount you'll get if you claim at your Full Retirement Age, and the formula is designed to give lower-income earners a proportionally larger benefit.

For most people, figuring out when to claim Social Security is just the first step. To get a real sense of what your retirement will look like, you need the actual numbers. The best way to get them is to create a personal account on the official Social Security website. I highly recommend visiting www.ssa.gov to do this. Your personalized statement will show your entire work history and give you concrete benefit estimates for claiming at age 62, at your full retirement age, and at age 70—giving you the hard data you need to plan with confidence.

Choosing Your Moment: Claiming at 62 vs. FRA vs. 70

Deciding when to start taking your Social Security benefits is one of the most significant financial choices you'll make for your retirement. It's not a simple math problem; it's a deeply personal decision that will shape your financial reality for decades. The three main milestones—age 62, your Full Retirement Age (FRA), and age 70—each represent a different path with its own set of trade-offs.

There's no one-size-fits-all answer here. What works beautifully for your neighbor might be a poor fit for you. Let's break down what each of these claiming ages really means for your financial well-being.

The Trade-Off: Claiming Early at 62

You can start drawing on your Social Security benefits as early as age 62. For many, this provides a crucial financial lifeline. If you've been laid off, are dealing with health issues, or simply need the income to make ends meet, getting those monthly payments can be a game-changer.

But this early access comes at a steep price. By starting your benefits before your Full Retirement Age, you lock in a permanently smaller monthly check for the rest of your life. For instance, if your FRA is 67, claiming at 62 will slash your benefit by a full 30%.

Think of someone who has to leave their job to care for an ailing spouse. The immediate income from Social Security, even if reduced, could be what keeps the lights on. In that scenario, the instant relief might outweigh the long-term benefit of waiting for a larger check.

The Baseline: Getting Your Full Share at FRA

Your Full Retirement Age (FRA) is the magic number when you become eligible for 100% of the benefit you've earned over your working life. There’s no penalty for claiming at your FRA, but you don't get any bonus either. It’s the standard, baseline amount calculated from your lifetime earnings.

This is a solid, straightforward choice for many people. If you have enough savings to carry you to your FRA or perhaps a pension that kicks in then, claiming your full, unreduced benefit offers a great sense of security. You get the entire amount you're entitled to without having to wait any longer.

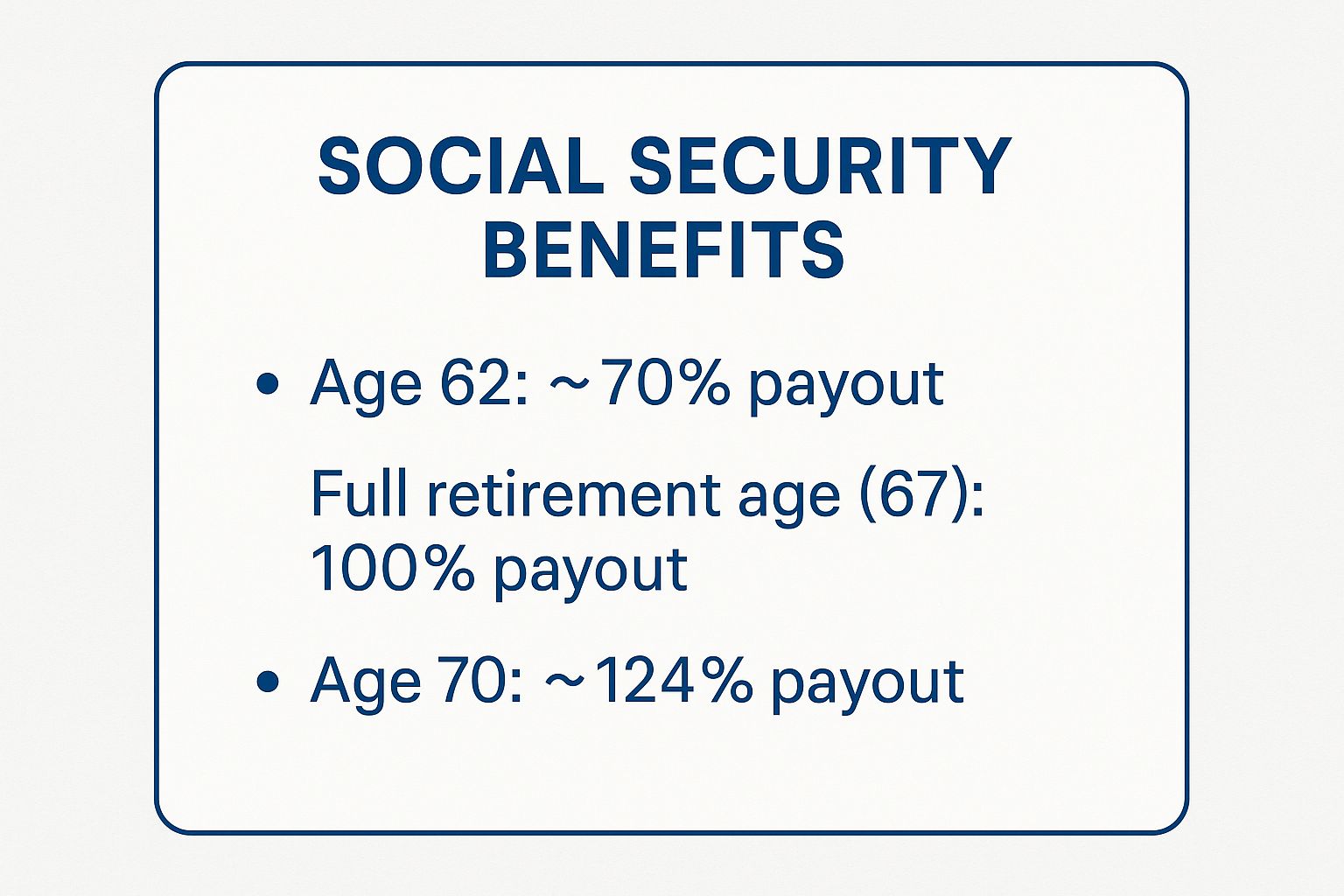

The infographic below really puts the numbers into perspective, showing how your benefit amount changes depending on when you start.

As you can see, the difference is stark. Claiming at 62 gets you about 70% of your full benefit, while waiting until 70 can supercharge your payment to roughly 124% of your FRA amount.

The Power of Patience: Delaying Until 70

Waiting to claim your benefits past your FRA requires patience, but the financial reward is substantial. For every single year you hold off, your future monthly benefit grows by about 8%. These are called delayed retirement credits, and they continue to pile up until you hit age 70. After that, there's no more incentive to wait.

This strategy is all about maximizing your monthly income, which is a powerful way to secure your financial future. A bigger check provides a higher, inflation-protected stream of income that will last for as long as you live.

Imagine a healthy retiree with a decent 401(k). They could use their personal savings to cover expenses for a few years, allowing their Social Security benefit to grow. By age 70, they'll have locked in a much larger monthly payment, which can be a huge help in protecting against the risk of outliving their other assets and covering higher healthcare costs in their 80s and 90s.

Interestingly, this idea is catching on. Since the mid-1990s, the average retirement age has climbed by about three years, and far fewer people are claiming at the earliest possible age of 62. This shift shows a growing awareness of just how valuable waiting can be. If you're curious, you can read more about how Social Security claiming ages have increased over time.

Ultimately, choosing your moment is a balancing act between your immediate needs and your long-term security. The right decision depends entirely on your health, your finances, and your vision for the retirement you want to live.

How Life and Work Can Change Your Benefits

Deciding when to take Social Security is never a simple, isolated choice. It’s a decision deeply woven into the fabric of your life—your job, your health, and your family. While your claiming age lays the groundwork for your benefit amount, it’s these real-world factors that often fine-tune, and sometimes significantly change, what you actually receive each month.

Think of your initial benefit calculation as a starting point. From there, things like continuing to work, your marital status, and even federal taxes can come into play. Understanding these moving parts is what separates a basic retirement plan from a truly solid one.

The Earnings Test If You Work and Collect

One of the first questions people ask is, "Can I work and still get my Social Security checks?" The answer is a definite yes, but there's a catch. If you decide to claim your benefits before your Full Retirement Age (FRA) and keep working, your earnings could temporarily reduce your payments.

This is because of a rule called the earnings test. Don't think of it as a penalty; it’s more like the government temporarily holding back some of your benefits because you’re still earning a solid income.

Here's how it shakes out for 2024:

If you're under your FRA for the whole year, the Social Security Administration will hold back $1 from your benefits for every $2 you earn over the annual limit of $22,320.

In the year you actually reach your FRA, the rule gets a bit more generous. The government will deduct $1 for every $3 you earn above a much higher limit of $59,520. This only applies to the money you earn in the months before your birthday month.

The moment you hit your Full Retirement Age, the earnings test vanishes. Poof. You can earn any amount of money you want, and your Social Security check won't be touched.

It's crucial to understand that the money withheld isn't gone for good. Once you reach your FRA, Social Security recalculates your benefit. They give you credit for those withheld payments, which results in a slightly higher monthly check for the rest of your life.

How Spousal and Survivor Benefits Work

Your Social Security decision doesn't just affect you; it has a ripple effect on your spouse. Spousal and survivor benefits are a cornerstone of the system, designed to provide a financial backstop for partners who might have earned less over their careers or spent time out of the workforce raising a family.

Spousal Benefits If you're married, your spouse might be able to claim a benefit based on your work record. This can be a game-changer, especially if your spouse has a limited earnings history.

A spouse can get up to 50% of your full retirement benefit. But there’s a timing element here, too. If they claim this spousal benefit before their own FRA, the amount is permanently reduced. To even be eligible, your spouse has to be at least 62.

Survivor Benefits Losing a spouse is one of life's most difficult experiences, both emotionally and financially. Survivor benefits are there to help ease the financial burden. A widow or widower can typically begin receiving benefits as early as age 60.

The amount a surviving spouse gets is based on their age and what the deceased spouse would have received. For instance, a widow or widower who has reached their own Full Retirement Age can generally receive 100% of the deceased worker’s benefit. This is a critical piece of the puzzle when planning for your family's future, and something a trusted partner like America First Financial can help you navigate.

Are Social Security Benefits Taxable?

Finally, there’s one last surprise many retirees aren't prepared for: taxes. Yes, depending on your total income, your Social Security benefits might be subject to federal income tax.

It all comes down to what the IRS calls your "combined income." To figure this out, you take your adjusted gross income, add any nontaxable interest you have, and then add half of your Social Security benefits for the year.

If that total number crosses certain thresholds, a portion of your benefits becomes taxable. Forgetting to account for this can throw a wrench in your retirement budget. By planning for potential taxes ahead of time, you can create a far more realistic picture of the income you'll actually have to live on.

Navigating Your Personal Social Security Decision

After sifting through all the rules and numbers, it all comes down to one question: when should you start taking your Social Security benefits? There's no secret formula or magic age that applies to everyone. The right answer is deeply personal, rooted entirely in your own unique circumstances.

Think of it like being the captain of a ship heading into retirement. You have to take stock of your provisions, check the long-range forecast for your health, and chart a course that actually gets you where you want to go. This section will give you the practical checklist to help you do just that.

Your Personal Claiming Checklist

The best time to file for your benefits really boils down to a few key areas of your life. By answering these questions honestly, you'll get much closer to a decision you can feel good about.

Health and Family History: Are you in great health? Do you come from a long line of relatives who lived well into their 90s? If the answer is yes, then delaying your benefits to lock in that bigger monthly check could lead to a significantly higher lifetime payout.

Your Complete Financial Picture: What other money do you have coming in? We're talking about your 401(k), an IRA, maybe a pension. If those accounts can comfortably cover your expenses for a few years, waiting until your Full Retirement Age or even age 70 becomes a much more realistic strategy.

Your Desire to Work: Do you enjoy your job and plan to keep working into your 60s? Just remember that the earnings test can temporarily lower your benefit check if you claim before your Full Retirement Age, which might make it less appealing to draw a salary and benefits at the same time.

Your Marital Status: Are you married, divorced, or widowed? This is a big one, because your decision directly affects the spousal or survivor benefits your partner could receive. For couples, a coordinated strategy is almost always the smartest path forward.

There Is No Single Best Age

If there's one thing to take away from all this, it's that the "best age" to claim is a myth. For one person, taking benefits at 62 is a financial lifesaver that lets them escape a physically demanding job. For their neighbor, having the discipline to wait until 70 might be the key to a more secure and worry-free lifestyle in their later years.

The goal isn't to find a perfect answer, but the right answer for you. It's about weighing the immediate need for income against the long-term benefit of a larger monthly payment for the rest of your life.

Thinking through these factors turns this from a math problem into a personal planning exercise. It’s about building a strategy that reflects your health, your finances, and what truly matters to you.

Using Official Tools for a Clearer Picture

There's absolutely no room for guesswork in a decision this important. The Social Security Administration (SSA) offers fantastic tools that show you the concrete numbers based on your actual earnings record. The single most powerful step you can take is to create a my Social Security account.

You can get started on the official SSA website at www.ssa.gov. Once your account is set up, you can see your personalized statement. It will show your estimated benefits at age 62, at your Full Retirement Age, and at age 70. Seeing these real numbers makes the trade-offs of your decision crystal clear.

With this personalized data and your checklist in hand, you'll have everything you need to make a confident choice for your future.

Answering Your Top Social Security Questions

Once you’ve got a handle on the basics of when to claim Social Security, the real-world "what ifs" start to surface. It’s one thing to know the rules, but another thing entirely to see how they apply to your specific situation. Let's tackle some of the most common questions people ask as they get closer to retirement.

Can I Change My Mind After I Start Taking Benefits?

Believe it or not, yes—but you get a very short window for a do-over. If you start your benefits and then have second thoughts, maybe because you landed a great job or just realized waiting longer would pay off, you have one shot to reverse course.

The Social Security Administration (SSA) gives you a 12-month grace period from your initial entitlement date to withdraw your application. Think of it as hitting the reset button. You'll need to file Form SSA-521, and here’s the critical part: you must pay back every cent you and your family received. If you do that, the slate is wiped clean, and your future benefit amount will continue to grow as if you never claimed it at all.

What's the Actual Process for Applying?

Gone are the days of spending hours in a government office. By far, the simplest and quickest way to get the ball rolling is to use the SSA's official online application. It's secure, straightforward, and most people can get it done in less than an hour right from their kitchen table.

To make things even smoother, have a few key documents handy before you log on:

Your Social Security number, of course.

Your birth certificate (an original or certified copy).

Your most recent W-2 or your self-employment tax return.

Your bank's routing and account numbers for direct deposit.

The online portal walks you through everything, step-by-step. A good tip is to apply early—you can start the process up to four months before you want your payments to begin. This helps ensure there are no delays and your first check arrives right on schedule.

How Does a Divorce Impact Spousal Benefits?

This is a big one, and the answer often comes as a pleasant surprise. A divorce doesn’t necessarily mean you forfeit the ability to claim benefits based on your ex-spouse's work record. The rules are in place to help protect people who may have spent significant time out of the paid workforce during their marriage.

The key is what’s known as the 10-year rule. If your marriage lasted for at least 10 consecutive years, you might be eligible to claim as a divorced spouse. You also need to be at least 62 and currently unmarried. What's really interesting is that your ex-spouse doesn't even have to be collecting their own benefits for you to claim yours, as long as they are eligible. Your decision to file is completely independent of theirs.

Trying to figure all this out can feel overwhelming, but you don't have to go it alone. For clear, dependable guidance that aligns with your values, America First Financial offers solutions designed to protect your family's financial future. Explore your options and get the peace of mind you deserve.

_edited.png)

Comments