When to Start Collecting Social Security A Guide

- dustinjohnson5

- Oct 5, 2025

- 16 min read

Deciding when to start taking your Social Security benefits is one of the most significant financial choices you'll make for your retirement.When to start taking your Social Security benefits is one of the biggest financial decisions you'll make for your retirement. There's no single magic number that's right for everyone; it really boils down to your personal situation.

You can start as early as age 62, but your payments will be permanently reduced. You could wait until your Full Retirement Age (FRA) to get 100% of your earned benefit, or you can hold off until age 70 to receive the absolute maximum monthly amount.

At its core, the decision is a classic trade-off: do you want smaller checks for a longer period of time, or larger checks for a shorter one?

Understanding the Social Security Claiming Milestones

Figuring out when to claim Social Security can feel like trying to hit a moving target. The right answer is deeply personal and depends heavily on your health, your other financial resources, and what you want your retirement to look like. To make a smart choice, you first need to get a handle on the three key ages that anchor your decision.

Think of these ages less as strict deadlines and more as strategic options on your retirement timeline. Each one comes with its own set of pros and cons that will permanently affect your monthly income for the rest of your life.

The Three Core Claiming Ages

The amount you receive from Social Security is directly tied to the age you start the clock. Here are the three milestone ages that frame your options:

Age 62 (The Earliest Start): You can get your hands on your benefits as soon as you turn 62. While this gives you income right away, it comes at a cost—your monthly checks will be permanently slashed by up to 30% compared to what you'd get at your Full Retirement Age.

Full Retirement Age or FRA (The Baseline): This is the age when you become eligible for 100% of the benefit you've earned over your working years. Depending on when you were born, your FRA will be somewhere between 66 and 67 for most people getting ready to retire now.

Age 70 (The Maximum Benefit): For every single year you wait past your FRA, your benefit grows by about 8%. If you can hold out until age 70, you'll lock in the largest possible monthly payment—a benefit that will last for the rest of your life.

To help you visualize these trade-offs, here’s a quick summary of how your claiming age impacts your monthly benefit.

Social Security Claiming Ages at a Glance

Claiming Age | Impact on Monthly Benefit | Best For Individuals Who... |

|---|---|---|

Age 62 | Permanently reduced by up to 30% | Need the income immediately, are in poor health, or want to retire early. |

Full Retirement Age (FRA) | Receive 100% of your earned benefit | Want their full benefit without waiting longer and have sufficient savings to bridge the gap. |

Age 70 | Increased by roughly 8% per year of delay past FRA | Are in good health, have other income sources, and want to maximize their lifetime payout. |

As you can see, the structure creates a clear choice. Claiming early gives you cash flow sooner, which might be critical if you need the money or simply can't wait to leave the workforce. On the flip side, waiting gives you a much higher, inflation-protected income stream that serves as fantastic insurance against outliving your savings.

The decision of when to start collecting Social Security is less about finding a secret formula and more about aligning the system’s rules with your personal life plan. Your health, other savings, and family needs are the most important variables in the equation.

Ultimately, the best strategy is the one that fits the retirement you've envisioned. Are you planning to travel the world and need the income now? Or is your top priority building the most secure financial backstop for your later years? By weighing these personal goals against the financial reality of each claiming age, you can confidently choose the path that best secures your future.

Understanding Your Full Retirement Age

When you start thinking about Social Security, one term comes up more than any other: Full Retirement Age, or FRA. This isn't just jargon; it's the single most important number for your entire claiming strategy.

Think of your FRA as the official finish line set by Social Security. It’s the age when they consider you eligible to receive 100% of the retirement benefit you’ve earned over your working career. Everything—claiming early, waiting longer—is measured against this specific age.

Knowing your FRA is crucial because every decision you make revolves around it. If you decide to take your benefits before this age, you’ll get a smaller check for the rest of your life. But if you have the patience to wait past it, your monthly payment will grow substantially, all the way up to age 70.

This magic number isn’t the same for everyone, though. It’s determined by law and is tied directly to the year you were born.

How Your Birth Year Determines Your FRA

The Social Security Administration has a simple chart that nails down your exact FRA based on your birth year. For a long time, 65 was the standard age, but that started to change as people began living longer. Congress gradually pushed the age back to keep the system financially sound.

For anyone born in 1960 or later, the Full Retirement Age is now 67. This slow increase is a big reason why you can't rely on what your parents or older relatives did. You have to know your own number. You can dig deeper into the history of these legislative changes to see how we got here.

Here’s a quick-glance table to find your FRA.

Year of Birth | Full Retirement Age |

|---|---|

1943-1954 | 66 years |

1955 | 66 years and 2 months |

1956 | 66 years and 4 months |

1957 | 66 years and 6 months |

1958 | 66 years and 8 months |

1959 | 66 years and 10 months |

1960 and later | 67 years |

Once you've found your age on the chart, you can start to see how it acts as the pivot point for your whole retirement plan.

Why FRA is the Foundation of Your Strategy

Let’s use an analogy. Imagine your total Social Security benefit is a pie. Your FRA is the age at which you get the whole pie.

Claiming Early (age 62): You get a slice of the pie sooner, but the slice itself is permanently smaller. Depending on your FRA, it could be a reduction of up to 30%.

Claiming at FRA: You get exactly what you were promised—100% of your benefit. The whole pie.

Claiming Late (up to age 70): This is like getting bonus servings. For every single year you delay past your FRA, your benefit grows by a guaranteed 8%. That’s a powerful return.

Your Full Retirement Age is not a retirement deadline. It’s just the age when you can claim your full benefit. You can work as long as you want, well past your FRA.

Understanding this benchmark is empowering. It changes the conversation from a simple "When do I retire?" to a much smarter one: "When is the optimal time for me to turn on my Social Security income stream?"

Knowing your FRA lets you accurately weigh the real-world financial trade-offs of claiming early versus waiting, putting you in complete control of a decision that will shape your financial security for decades to come.

The Reality of Claiming Benefits at Age 62

The moment you hit 62, a big door swings open: Social Security. It’s the very first opportunity you get to start collecting your retirement benefits, and frankly, the temptation can be overwhelming. Starting that income stream can feel like a massive weight off your shoulders, especially if you’re eager to leave the 9-to-5 behind or are facing a financial curveball.

But here’s the thing—deciding when to start taking Social Security isn’t just about getting money sooner rather than later. When you claim at 62, you're making a permanent trade-off. In exchange for getting your benefits early, you lock in a smaller monthly check for the rest of your life. It’s a decision with long-lasting ripple effects that you really need to sit with.

And we're not talking about a minor haircut. Depending on your Full Retirement Age (FRA), your monthly benefit gets slashed by as much as 30%. Thinking about it in percentages can feel a bit abstract, so let’s dig into what that actually looks like in the real world.

Why Is Claiming Early So Popular?

Even with that permanent reduction, age 62 is still one of the most common ages for people to start their benefits. There are some very real, very powerful reasons why this strategy just makes sense for some folks. Figuring out if you're one of them starts with understanding the motivations.

Immediate Financial Need: Let’s be honest, sometimes life makes the decision for you. A sudden layoff, an unexpected health crisis, or the need to care for a loved one can turn that early benefit from a "nice-to-have" into a "need-to-have."

Funding an Early Exit: For those who have been saving diligently and are just plain ready to retire, taking Social Security at 62 can be the final piece of the income puzzle that makes it all possible.

Personal Health Concerns: If you’re dealing with health issues that might point to a shorter-than-average life expectancy, claiming early is often a pragmatic way to maximize the total amount of money you receive over your lifetime.

At its heart, the appeal of claiming at 62 is about one thing: control. It gives you access to your money on your terms, letting you react to life's surprises or just start enjoying your retirement while you can.

Of course, that control comes with a hefty price tag. The biggest drawback is that permanent cut to your monthly check, which can put a squeeze on your budget for decades to come.

Seeing the Financial Impact in Black and White

To really wrap your head around the long-term consequences of claiming at 62, it helps to move past percentages and look at a real-life example. This makes it crystal clear how the decision hits your actual monthly budget.

Let's imagine a retiree named Alex whose Full Retirement Age (FRA) is 67. If Alex were to wait until then, their monthly Social Security check would be $2,000.

Now, let's see how taking it at 62 changes the math:

Claiming at FRA (Age 67): Alex gets the full $2,000 per month.

Claiming Early (Age 62): Alex's benefit is cut by 30%, so the new monthly payment is just $1,400.

That’s a $600 difference every single month. Over a full year, that's $7,200 less income. Stretch that out over a 20- or 30-year retirement, and the total difference can easily climb past $150,000.

It doesn't stop there, either. This reduction also impacts any future Cost-of-Living Adjustments (COLAs). Since those annual inflation adjustments are calculated based on your benefit amount, starting with a smaller check means your COLA raises will also be smaller in dollar terms. Over time, this can cause your purchasing power to slowly but surely erode.

The decision to claim early isn't just about your income today; it's about shoring up your financial foundation for the rest of your life.

The Long Game: Why Waiting Until Age 70 Can Maximize Your Income

If claiming Social Security at 62 is about getting your money as soon as possible, then waiting until age 70 is all about playing the long game. This is a strategy built on patience and the goal of securing the largest possible monthly check for the rest of your life. For those who have the means to pull it off, the reward is significant.

The Magic of Delayed Retirement Credits

So, how does this work? The Social Security Administration actually rewards you for holding off. For every year you wait past your Full Retirement Age (FRA), you earn something called Delayed Retirement Credits (DRCs).

Think of it as a guaranteed bonus. For each year you delay, your future monthly benefit gets a permanent 8% bump.

This isn't just a one-time thing. If your full retirement age is 67, waiting until 68 means your benefit will be 108% of your base amount. If you can hold out until age 70, you'll lock in a monthly payment that's a massive 124% of what you would have gotten at 67.

Why This Growth Is So Powerful

That 8% annual, government-guaranteed increase is one of the best deals in finance. You simply can't find that kind of secure return anywhere else. It’s a surefire way to turbocharge your retirement income.

Let's put it in perspective. Someone who waits from the earliest possible age of 62 all the way to 70 can end up with a monthly check that is over 75% higher. That’s not a rounding error—it’s a life-changing difference that can redefine your financial security for decades.

Waiting until age 70 to claim Social Security is one of the most effective ways to create a larger, inflation-protected annuity for yourself and potentially for a surviving spouse. It acts as powerful longevity insurance, reducing the risk of outliving your savings.

Don't forget about inflation adjustments, either. Every future Cost-of-Living Adjustment (COLA) is calculated off your base benefit. A 3% COLA on a $2,500 monthly check adds more dollars to your pocket than a 3% COLA on an $1,800 check, widening the financial gap even further over time.

Who Should Seriously Consider Waiting?

Delaying until age 70 isn't for everybody, but it can be a brilliant move for certain people. Figuring out when to start collecting Social Security often comes down to whether you fit one of these profiles:

You're in good health and expect a long life. If you and your family have a track record of longevity, waiting gives you a much better shot at collecting more total money over your lifetime.

You have other ways to pay the bills. If you can comfortably live off your 401(k), IRA, pension, or even a part-time job through your 60s, you can let that Social Security benefit grow untouched.

You're the higher earner in a couple. This is a huge one. By delaying the bigger benefit, you maximize the survivor benefit for your spouse. If you pass away first, your spouse gets to switch to your larger payment for the rest of their life.

The "Break-Even" Question

Naturally, everyone wants to know: "When will I make back the money I gave up by not claiming earlier?" This is what’s known as the break-even age. It's the point where the total cash you’ve received from your bigger, delayed checks finally overtakes what you would have gotten from the smaller, earlier ones.

Your exact break-even point depends on your specific benefit numbers, but it generally lands somewhere in your late 70s or early 80s. For instance, if you passed on five years of payments to get that bigger check at 70, it might take around 12 years to make up the difference.

But focusing only on the break-even math can be shortsighted. It's a simple calculation that ignores things like peace of mind, market downturns, or your personal health. The real power of waiting isn't just about "breaking even"—it's about building a rock-solid financial floor for your later years, when other savings might be dwindling.

How Your Health And Finances Shape Your Decision

Deciding when to start taking Social Security isn’t just a math problem—it’s a deeply personal choice that sits right at the intersection of your health, your finances, and your family's needs. The numbers on a spreadsheet are a great starting point, but they don't tell the whole story. Your real-life circumstances are what truly matter when building a claiming strategy that works for you.

Think of it like planning a cross-country road trip. You wouldn't just glance at a map; you'd check the weather forecast, the condition of your car, and how much gas is in the tank. In the same way, you need to look beyond the basic age milestones and take stock of your personal landscape before you hit the road to retirement.

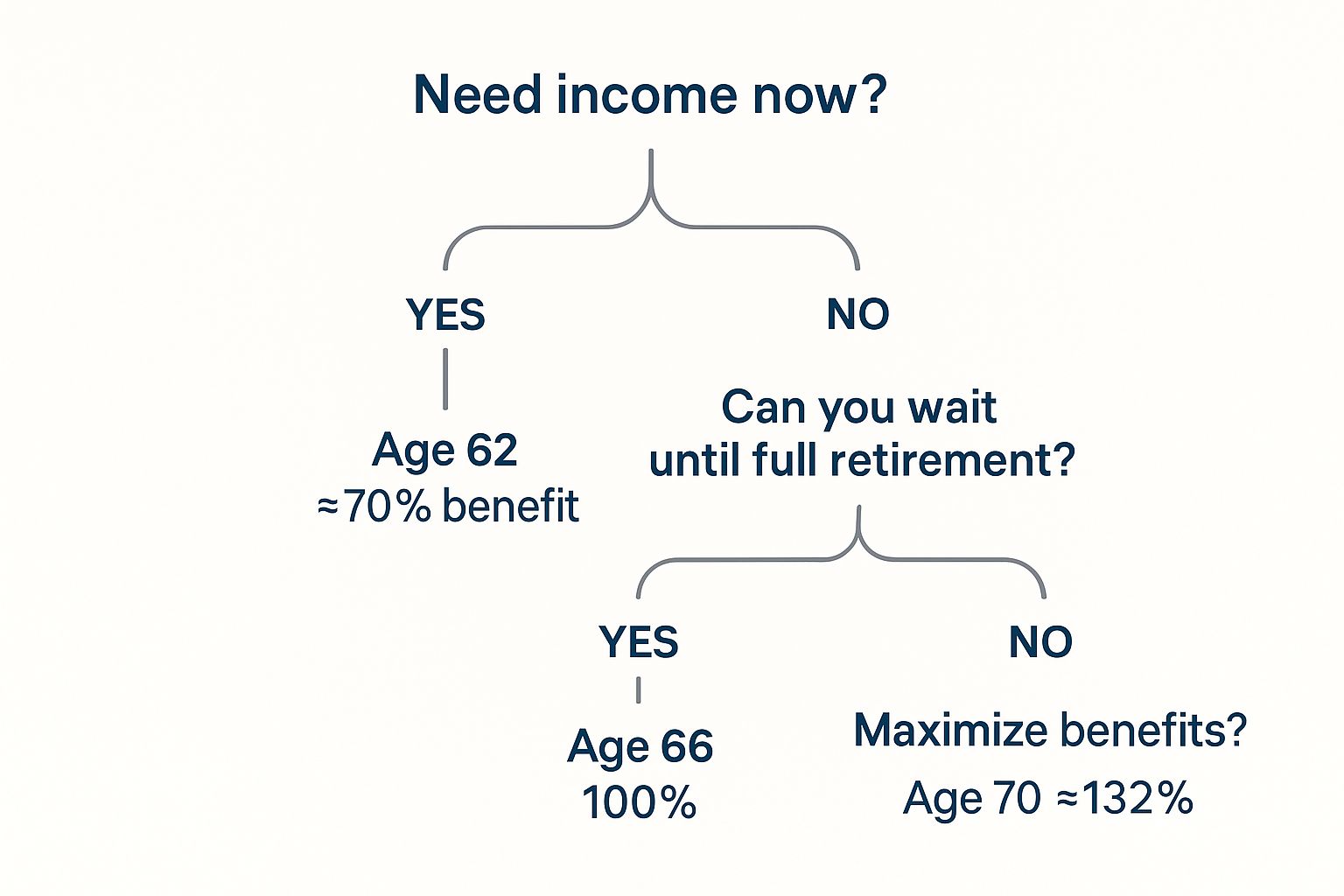

This handy decision tree can help you visualize the core questions that will guide your timing.

As you can see, the path forks based on everything from immediate income needs to long-term benefit growth, showing the key trade-offs you'll need to weigh.

Your Health and Longevity Outlook

Let's talk about one of the most sensitive but necessary parts of this decision: being honest about your health. Your life expectancy has a massive impact on which claiming age turns out to be the "best" one on paper.

If you're managing a serious health condition or have a family history of shorter lifespans, claiming benefits earlier, even at age 62, can be a perfectly logical move. It simply means you get to receive more of your benefits over your lifetime.

On the flip side, if you're in great health and long life runs in your family, waiting becomes an incredibly powerful strategy. Delaying your claim until age 70 essentially acts as longevity insurance. It guarantees a larger, inflation-adjusted income stream that dramatically lowers the risk of outliving your other savings. Understanding your own health trajectory—perhaps with insights from resources like at-home health testing for longevity—can give you more confidence in your plan.

Building a Financial Bridge to a Bigger Benefit

Your ability to delay Social Security often boils down to one simple question: Can you afford to wait? If you have other sources of income to live on during your 60s, you can create a "financial bridge" that lets your future Social Security benefits grow untouched.

This bridge can be built from several different materials:

Retirement Accounts: You could draw from your 401(k) or IRA to cover living expenses while your Social Security benefit compounds by that guaranteed 8% each year you wait past your full retirement age.

Pension Income: If you're fortunate enough to have a pension, it can provide the steady cash flow needed to postpone your claim without feeling the pinch.

Continued Work: Staying on the job, even part-time, can bring in enough money to let your benefits mature to their maximum potential.

Key Factors Influencing Your Claiming Decision

This decision is a balancing act. The table below outlines some of the most common personal factors and how they might pull you toward claiming sooner versus later.

Consideration Factor | Favors Claiming Early (Age 62) | Favors Waiting (Post-FRA to 70) |

|---|---|---|

Personal Health | You have known health issues or a family history of shorter lifespans. | You're in excellent health and longevity runs in your family. |

Immediate Financial Need | You need the income now to cover essential living expenses. | You have sufficient savings (401k, IRA, etc.) to live on. |

Spouse's Security | You are the lower-earning spouse and can switch to a higher spousal benefit later. | You are the higher-earning spouse and want to maximize the survivor benefit for your partner. |

Employment Status | You've been forced into an early retirement or can no longer work. | You plan to continue working and don't need the extra income yet. |

Risk Tolerance | You'd rather take a guaranteed, smaller benefit now than risk unforeseen life changes. | You're comfortable forgoing payments now for a much larger, guaranteed payout later. |

Use this as a checklist to think through your own situation. Often, your final choice will be a trade-off between several of these competing factors.

The Crucial Impact on Your Spouse

If you're married, this isn't a solo decision—it’s a team sport. This is especially true if you are the higher earner in the household, because your choice has a direct and permanent impact on your partner's financial future.

When you pass away, your surviving spouse is generally entitled to a survivor benefit equal to 100% of the benefit you were receiving. Your decision directly determines their financial security for the rest of their life.

By delaying your own benefit to make it as large as possible, you are simultaneously maximizing the potential survivor benefit for your spouse. If you claim early and lock in a permanently reduced payment, you are also locking them into a smaller survivor benefit for good. For many couples, protecting the surviving spouse is the single most compelling reason for the higher earner to wait until age 70. It's a strategic choice that can provide lasting peace of mind for the person you love.

Got Questions? Let's Clear Up the Common Social Security Sticking Points

It's one thing to understand the rules of Social Security in theory, but it's another thing entirely to apply them to your own life. Once you start picturing your retirement, the "what ifs" and "how does this affect me" questions naturally start piling up.

Let's walk through some of the most common questions people wrestle with when deciding on the right time to file. We'll give you straight answers so you can make your choice with real confidence.

Can I Still Work and Collect Social Security?

Yes, you can, but there’s a catch if you haven't hit your Full Retirement Age (FRA) yet. The Social Security Administration has an annual earnings limit, and you need to be aware of it.

If you’re collecting benefits before your FRA and you earn more than that limit from a job, the government will temporarily hold back some of your benefits. The rule is simple: for every $2 you earn over the limit, they’ll deduct $1 from your Social Security check.

The good news? The moment you reach your Full Retirement Age, that earnings test vanishes completely. You can earn as much as you want without a single dollar being taken from your benefit. And don't worry—that money they withheld isn't gone forever. It gets credited back to you later in the form of a slightly higher monthly benefit.

How Do I Calculate My "Break-Even" Age?

The "break-even age" is a popular concept for a reason—it feels like a concrete way to see if waiting to claim "pays off." It’s the age when the extra money you get from delaying finally adds up to more than the total amount you would have gotten by starting your benefits early.

While it sounds technical, the basic math is pretty straightforward. Here’s how to get a rough idea:

Find your monthly gain: Subtract your smaller, early benefit amount from your larger, delayed benefit amount.

Tally up the "missed" payments: Multiply the number of months you waited by the lower benefit amount. This is the total you passed up by delaying.

Calculate the break-even point: Divide the total "missed" payments (Step 2) by your monthly gain (Step 1). The result is the number of months it will take for your bigger checks to make up the difference.

Let's put some numbers to it. Say you'd get $400 more per month by waiting until your FRA instead of claiming at 62. If you had claimed at 62, you would have received $1,500 a month for 60 months (5 years), which is a total of $90,000. To find your break-even point, you'd divide that $90,000 by your $400 monthly gain. The answer is 225 months, or about 18.75 years. That means you'd break even around age 85.

A word of caution: the break-even calculation is a useful tool, but it should never be the only factor in your decision. It's just math. It doesn't account for your health, your peace of mind, or what you might do with that money in the meantime.

What Happens to My Spouse if I Die?

This is easily one of the most important questions for any married couple, especially if one person was the primary earner. Your claiming decision doesn't just affect you; it directly impacts the financial security of your surviving spouse.

Here’s the critical rule: when you pass away, your spouse can receive a survivor benefit equal to 100% of what you were getting at the time of your death. This makes your choice a huge part of their long-term financial plan.

Think about the two paths:

Claim early, get a reduced benefit: You lock in that smaller payment for yourself, and in doing so, you also lock in that same smaller income for your surviving partner for the rest of their life.

Delay until age 70, get the maximum benefit: By waiting for the largest possible check, you're also ensuring your spouse will receive the largest possible survivor benefit after you're gone.

For many couples, making sure the surviving partner is taken care of is the single most compelling reason for the higher earner to delay Social Security. It’s an act of patience that can provide decades of stability and peace of mind for the person you love. It’s not just a personal financial move—it’s a legacy.

Planning for your future involves more than just Social Security; it requires a solid foundation of protection for every aspect of your life. At America First Financial, we provide insurance solutions that secure your family's well-being and safeguard your hard-earned assets, all while honoring the values you hold dear. Explore our term life, disability, and health care plans to build a retirement free from worry. Get a no-hassle quote today.

_edited.png)

Comments