When to Start Medicare A Clear Guide

- dustinjohnson5

- Oct 4, 2025

- 13 min read

Navigating the world of Medicare for the first time can feel a little overwhelming, especially when it comes to timing. For most people, the magic number is 65, and the key window to act is your Initial Enrollment Period (IEP). This is a one-time, 7-month opportunity that is absolutely crucial to get right.

Getting this timing wrong isn't just an inconvenience—it can lead to gaps in your health coverage and even permanent financial penalties.

Your Medicare Enrollment Timing Explained

Think of your Initial Enrollment Period like your personal boarding pass for Medicare. When your window opens, it's time to get on the plane. If you sign up during this period, your transition to new health coverage will be seamless. But if you miss it, you might find yourself stuck at the gate, facing delays and paying extra fees for the rest of your life.

This is especially true if you're still working past 65 or have health insurance through a spouse's job. Your situation might have its own set of rules, and knowing them is the best way to avoid some common—and costly—mistakes.

Why Planning Your Start Date Matters

Your enrollment timing is about more than just checking a box; it's a decision that directly affects your finances and your peace of mind. Enrolling on time means you lock in the standard premium rates and avoid late penalties that can inflate your monthly costs permanently. More importantly, it ensures you have continuous health coverage, protecting you from potentially massive medical bills.

To help you find your path, let's break down the three main enrollment periods. Each one is designed for a different situation:

Initial Enrollment Period (IEP): This is the main 7-month window for nearly everyone turning 65. It's your first and best chance to enroll.

Special Enrollment Period (SEP): This is a flexible option for people who have other qualifying health coverage (like from an employer) and choose to delay Medicare.

General Enrollment Period (GEP): Think of this as the last resort. It's for those who missed their IEP and don't qualify for an SEP, but it usually comes with penalties and a later coverage start date.

Understanding which of these periods applies to you is the first step toward a successful enrollment. Our goal here is to give you the confidence to make the right choice at the right time, securing the healthcare benefits you've earned without any of the headaches.

Understanding Your Initial Enrollment Period

If there's one Medicare deadline you absolutely need to know, it's your Initial Enrollment Period, or IEP. Think of this as your personal, one-time-only window to sign up for Medicare when you first become eligible. Getting this right is the key to a smooth start and avoiding pesky, lifelong penalties.

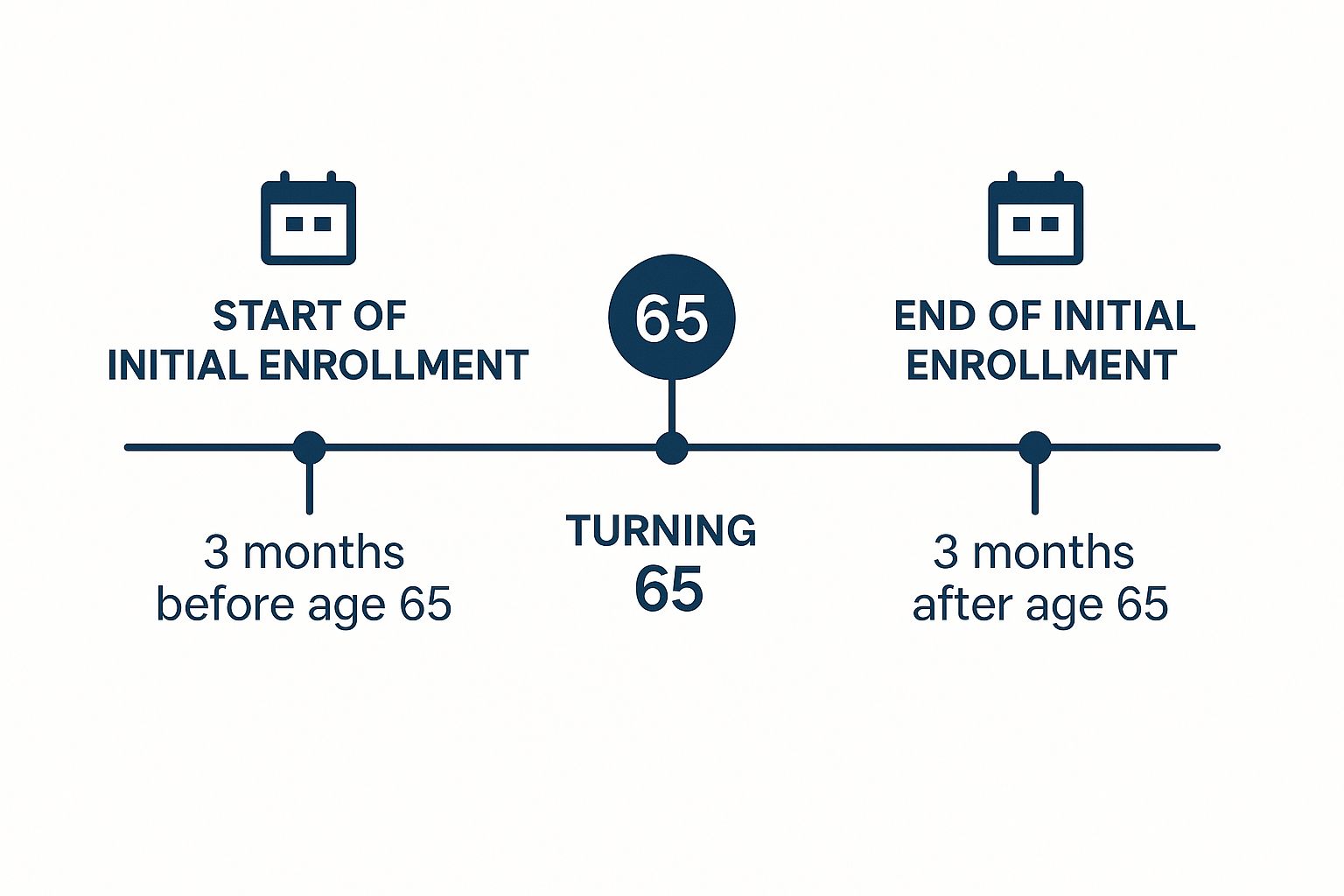

This crucial window lasts for a full seven months. It kicks off three months before the month you turn 65, includes your birthday month, and then runs for three months after. It’s a pretty generous timeline designed to give you plenty of space to figure things out.

The 7-Month Window in Action

Let's make this real. Say your 65th birthday is in June. Your personal enrollment window would open on March 1st and officially close on September 30th. This gives you a clear runway to review your options and get your application in without feeling rushed.

But here’s the important part: when you sign up during this seven-month stretch directly affects when your coverage actually begins. My advice? Don't wait. Acting early is the best way to make sure you don't have a gap in health coverage.

Key Takeaway: Timing is everything. If you enroll in the three months before you turn 65, your Medicare coverage will kick in on the very first day of your birthday month. It's the simplest way to guarantee a seamless transition.

This timeline gives you a great visual for how the seven-month period is laid out around your big day.

As you can see, the window is clearly defined, showing you the ideal time to sign up to get your coverage right on schedule.

Why Your Sign-Up Date Matters

So, what happens if you wait? Procrastinating, even within your IEP, can lead to frustrating delays in when your benefits start. Let’s break down exactly how your sign-up date impacts your start date with a simple table.

Your 7-Month Initial Enrollment Period (IEP) Window

If You Sign Up... | Your Medicare Part A & Part B Coverage Starts... |

|---|---|

In the 3 months before your 65th birthday month | The 1st day of your birthday month |

During your birthday month | The 1st day of the month after your birthday |

In the 1st month after your birthday month | The 1st day of the month after you sign up |

In the 2nd or 3rd month after your birthday month | The 1st day of the month after you sign up |

As the table shows, the only way to guarantee coverage starts on your birthday month is to enroll beforehand. Any delay on your part results in a delay of your benefits.

This is precisely why you'll hear experts stress the importance of being proactive. The numbers don't lie—most of the 67.3 million Americans on Medicare sign up the moment they're eligible. It's a smart move, especially as more people gravitate toward comprehensive plans. In fact, nearly 50.4% of beneficiaries are now enrolled in Medicare Advantage plans, which bundle medical, hospital, and often prescription drug coverage.

If you're interested in the data, you can explore more Medicare statistics and facts to see how the landscape is shifting.

How Special Enrollment Periods Work

Let's face it, the traditional retirement age of 65 doesn't fit everyone's timeline anymore. Many of us are working longer, and if you or your spouse are still covered by a health plan at work, you probably don't need to sign up for Medicare Part B just yet. This is exactly what a Special Enrollment Period (SEP) is for.

Think of it as your personal, penalty-free "on-ramp" to Medicare. An SEP opens up because of a specific life event—most often, when you stop working. It gives you the flexibility to delay enrolling in Part B, so you can avoid paying for coverage you don't need and prevent any gaps when you do finally retire.

Of course, there are some rules. The key is that your current health plan must be what Medicare calls "creditable coverage."

Qualifying for a Work-Based SEP

To be eligible for an SEP and safely put off enrolling in Part B, the health insurance you have must come from an employer where you or your spouse are still actively working. Here's the most important detail: that employer must have 20 or more employees.

This isn't a suggestion; it's a firm rule. If your company has fewer than 20 employees, their plan is generally not considered creditable coverage, and you'll need to sign up for Medicare during your Initial Enrollment Period to avoid penalties.

As long as your coverage meets that size requirement, you're in the clear. When you eventually stop working or lose that employer coverage (whichever comes first), your SEP window swings open.

Your Special Enrollment Period is an 8-month window that begins the month after your employment or your group health plan coverage ends. This gives you plenty of time to get your Part B enrollment sorted out without a penalty.

It's just as crucial to know what doesn't count. Making a mistake here can be costly, as these common types of coverage will not protect you from late enrollment penalties for Part B:

COBRA: While it lets you keep your old work insurance, COBRA doesn't count as active employment coverage. You can't use it to delay Medicare.

Retiree Health Plans: Any health plan from a former employer after you’ve already retired won't qualify you for an SEP.

VA Coverage: VA health benefits are great, but they aren't a substitute for Medicare Part B and don't allow you to postpone enrollment.

If you miss your 8-month SEP window, you're stuck waiting for the next General Enrollment Period. That could mean months without medical insurance and a late penalty that sticks with you for life. Understanding how this works is the key to a seamless and stress-free transition from your job's health plan to Medicare, right when you need it.

The Cost of Missing Your Enrollment Window

Thinking about putting off your Medicare enrollment? It might seem like a minor decision now, but it can have a major—and permanent—impact on your healthcare costs for the rest of your life. Missing your sign-up window isn't just a simple inconvenience. It can lock you into lifelong penalties and, even worse, leave you completely uninsured for months at a time.

If you miss your Initial Enrollment Period, your next chance to get covered is the General Enrollment Period, which runs from January 1st to March 31st every year. But enrolling this way comes with a couple of serious catches: your coverage won’t start right away, and you’ll likely face some expensive financial penalties.

The Dangers of a Coverage Gap

One of the biggest risks of signing up late is the gap it creates in your health coverage. If you enroll during the General Enrollment Period, your Part B benefits don't kick in until the month after you sign up. That could leave you uninsured for several months, totally exposed to the full cost of any unexpected medical bills.

It's a precarious spot to be in. Imagine you have an accident in April and need surgery, but your coverage doesn't start until May. You'd be on the hook for 100% of the cost, a bill that could be financially devastating for most families.

Lifelong Late Enrollment Penalties

Even more punishing is the late enrollment penalty for Medicare Part B. This isn’t a one-time fee you pay and forget about. It's a permanent increase tacked onto your monthly premium for as long as you have Part B.

Here’s how it works: for every full 12-month period you were eligible for Part B but didn't sign up, your premium goes up by 10%.

Let's look at a real-world example. Say you turned 65 but decided to wait two full years before enrolling in Part B. Because of that delay, your monthly premium will now be permanently 20% higher than what everyone else pays. If the standard premium is $174.70, you’d pay an extra $34.94 every single month, forever.

This penalty follows you for the rest of your life. The cost compounds over time, which is why timing your Medicare start date is so critical for your long-term financial health. The longer you wait, the more you’ll pay.

And it doesn't stop with Part B. There’s a similar late penalty for Part D prescription drug coverage. This one is calculated as 1% of the "national base beneficiary premium" (which was $34.70 in 2024) for every month you went without credible drug coverage. That amount gets added to your monthly Part D premium—again, permanently.

It's no surprise that the vast majority of people sign up for Medicare as soon as they're eligible to avoid these exact problems. While overall Medicare enrollment has steadied at about 2% growth per year since 2020, new beneficiaries are overwhelmingly choosing to enroll on time. You can discover more about recent Medicare enrollment trends and see how others are handling it. When it comes to Medicare, procrastination just isn't worth the risk.

Figuring out when to sign up for Medicare is just the first step. The next big question is deciding how you want to receive your benefits. When you first become eligible, you're at a crossroads with two primary paths to choose from. Each one takes a different approach to your healthcare, and the best fit really boils down to your personal health needs, budget, and priorities.

The Traditional Path: Original Medicare

Your first option is what's known as Original Medicare. This is the traditional, government-administered health plan that includes Part A (for hospital stays) and Part B (for doctor visits and other medical services).

The biggest draw here is freedom. With Original Medicare, you can go to any doctor or hospital in the entire country that accepts Medicare. There are no restrictive networks to worry about, which is a huge plus if you travel often or want complete control over who you see for your care.

But that flexibility comes with some financial exposure. Original Medicare wasn't designed to cover 100% of your costs; you'll still be on the hook for deductibles and a 20% coinsurance on most services with no annual cap. That's why many people who go this route also buy a separate Medicare Supplement (or Medigap) policy to fill in those cost-sharing gaps, plus a standalone Part D plan for prescription drug coverage.

The All-In-One Alternative: Medicare Advantage

Your second option is a Medicare Advantage (MA) plan, which you might also hear called Part C. These are plans offered by private, Medicare-approved insurance companies that package all your benefits together. By law, they have to cover everything that Original Medicare does, but they often sweeten the deal with extra perks.

These bundled extras are a major reason for their popularity and often include:

Prescription drug coverage (most plans bundle this in)

Routine dental, vision, and hearing care

Fitness programs like gym memberships

Allowances for over-the-counter health products

So, what’s the trade-off? Most Medicare Advantage plans are built around a local network of doctors and hospitals, similar to an HMO or PPO you might have had through an employer. To keep your costs down, you'll generally need to stick with providers in that network, and sometimes you'll need a referral to see a specialist.

Making a thoughtful decision at the start is incredibly important. While you can switch between these paths later on, your initial choice can impact your future options, especially when it comes to qualifying for a Medigap policy down the road.

The rise of these all-in-one plans has been nothing short of remarkable, changing how people approach their initial enrollment. As of February 2025, an incredible 34.4 million Americans—that's about 55% of everyone eligible—have chosen a Medicare Advantage plan. The overwhelming majority (over 99%) are in local HMOs and PPOs, which highlights why signing up during your IEP is so critical for getting immediate, seamless access to their network of doctors and benefits. You can see these trends for yourself in the full data breakdown on Medicare enrollment from MedPAC.

To help you visualize the difference, here's a direct comparison of the two main Medicare paths you'll choose from when you first enroll.

Original Medicare vs. Medicare Advantage at a Glance

Feature | Original Medicare (Parts A & B) | Medicare Advantage (Part C) |

|---|---|---|

Provider Choice | See any doctor or hospital nationwide that accepts Medicare. No referrals needed for specialists. | Must use doctors and hospitals in the plan's network (HMO, PPO). May need referrals for specialists. |

Out-of-Pocket Costs | You pay a 20% coinsurance for most services with no annual limit on what you might spend. | Costs are predictable with copayments and an annual out-of-pocket maximum to protect you. |

Prescription Drugs | Not included. You must buy a separate Part D plan. | Usually included in the plan (known as an MA-PD). |

Extra Benefits | Does not cover routine dental, vision, or hearing. | Often includes benefits like dental, vision, hearing, and fitness programs. |

Premiums | Most pay the standard Part B premium. You'll also pay separate premiums for a Part D and/or Medigap plan. | Many plans have a $0 monthly premium (you still must pay your Part B premium). |

Travel Coverage | Coverage is good anywhere in the U.S. and its territories. Limited coverage for foreign travel. | Coverage is typically limited to the plan’s local service area, except for emergencies. |

Ultimately, there's no single "best" choice—only what's best for you. Thinking through your priorities for cost, convenience, and provider choice will guide you to the right starting point for your Medicare journey.

Your Simple Medicare Enrollment Checklist

Getting started with Medicare really boils down to a few key moments and decisions. If there's one thing to remember, it's this: act on time. Signing up during your designated enrollment window is the single best way to get coverage when you need it and dodge late penalties that can stick with you for life.

Think of this checklist as your roadmap. It's designed to take you from feeling overwhelmed to feeling confident that you've got all your bases covered for your health and your wallet.

Your Path to Enrollment

Here are the essential steps to make sure you're on the right track:

Pinpoint Your IEP: First things first, figure out your personal 7-month Initial Enrollment Period. Get a calendar and physically mark the start and end dates. Don't let these dates sneak up on you.

Assess Your Current Coverage: Are you planning to work past 65? If so, you need to talk to your HR department. Ask them one critical question: is your employer's health plan considered "creditable coverage" by Medicare? The answer will determine if you can safely delay Part B without penalty.

Choose Your Medicare Path: Now it's time to decide on your route. Will you go with Original Medicare (often paired with a Medigap policy and a Part D drug plan) or an all-in-one Medicare Advantage plan? Each path has its own pros and cons, so think about what fits your lifestyle, health needs, and budget.

A bit of expert advice: The best time to sign up is almost always within the first three months of your IEP. Why? Because this ensures your coverage kicks in on the very first day of the month you turn 65, leaving you with no gaps in your health insurance.

By walking through these steps, you take what seems like a complicated system and turn it into a straightforward, manageable plan. You'll be setting yourself up for a smooth and successful transition into Medicare.

Your Top Questions About Starting Medicare, Answered

Figuring out exactly when to sign up for Medicare can feel tricky, especially when life doesn't follow a simple script. Let's tackle some of the most common questions people have when they’re trying to get the timing right.

I'm Still Working. Should I Sign Up for Medicare?

This one is a classic, and the answer comes down to one thing: the size of your company.

If you work for a larger company with 20 or more employees, their group health plan is your primary coverage. This means you can usually hold off on enrolling in Medicare Part B without getting hit with a late penalty. You can just stick with your work insurance for now.

That said, it's almost always a good idea to sign up for Part A when you turn 65. It’s premium-free for most people and can act as secondary coverage for hospital stays. It costs you nothing, so why not?

Now, if your company has fewer than 20 employees, the rules flip. Medicare becomes your primary insurer the moment you turn 65. In this scenario, you must sign up for both Part A and Part B during your Initial Enrollment Period. Skipping this can lead to major gaps in your health coverage and lock you into lifelong late enrollment penalties.

I'm Already Getting Social Security. Do I Need to Do Anything?

Good news—for most people in this situation, the work is already done. If you've been collecting Social Security or Railroad Retirement Board benefits for at least four months before you turn 65, you'll be enrolled in Medicare Part A and Part B automatically.

You don't have to lift a finger. Your red, white, and blue Medicare card will just show up in your mailbox about three months before your 65th birthday. You'll still have the choice to drop Part B if you have other primary insurance (like from a current job), but the initial enrollment is handled for you.

A Quick Word of Caution: While automatic enrollment is great, don't just assume everything is set. It's always smart to double-check that your coverage is active. A simple mix-up could leave you with a surprise gap in coverage.

Does COBRA or My Retiree Plan Count as Creditable Coverage?

This is a huge one, and getting it wrong can be a costly mistake. The answer is a firm no. From Medicare's perspective, neither COBRA nor a retiree health plan is considered "creditable coverage" for delaying Part B.

Even if you have COBRA or a retiree plan lined up, you still need to enroll in Medicare Part B during your Initial Enrollment Period to avoid a permanent late penalty. These plans can certainly supplement Medicare, but they are not a valid substitute that lets you postpone your enrollment. Don't let this detail slip by—it can impact your premiums for the rest of your life.

Navigating these decisions is easier with a trusted partner. America First Financial offers clear, straightforward health care plans designed to protect you and your family without the political noise. Get a no-hassle quote in under three minutes and find the security you deserve. Learn more about your options at America First Financial.

_edited.png)

Comments