Your 2025 Life Insurance Review Checklist: 8 Key Steps

- dustinjohnson5

- Jul 17, 2025

- 16 min read

Your life insurance policy isn't a 'set it and forget it' product. Life evolves - families grow, finances change, and goals shift. An outdated policy can leave your loved ones dangerously under-protected or cause you to overpay for coverage you no longer need. A regular, thorough review is one of the most critical financial health check-ups you can perform. It ensures the financial safety net you've built remains strong and reliable, protecting the American dream you've worked so hard to achieve.

This definitive life insurance review checklist provides a step-by-step framework to analyze every facet of your policy, from coverage amounts to beneficiary designations. We will guide you through each essential check-point with actionable insights, ensuring your policy aligns perfectly with your life today and your goals for tomorrow. Think of it as an annual physical for your financial security plan.

By following this guide, you can confidently assess whether your current coverage is still the right fit. For those seeking coverage that aligns with their values, providers like America First Financial offer straightforward solutions to secure your family’s future without the noise of modern political agendas. Let's begin the process of making sure your policy works as hard for your family as you do.

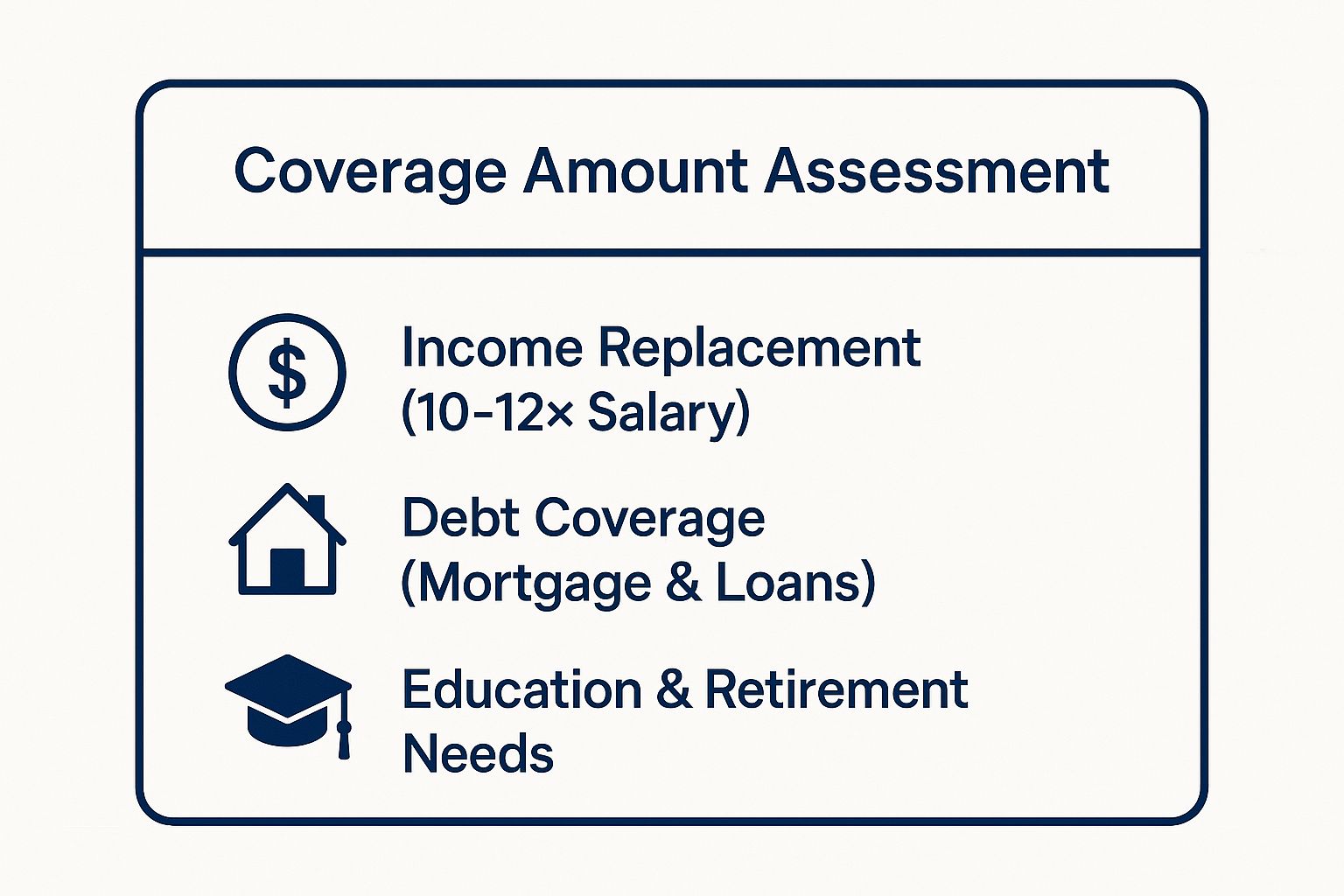

1. Coverage Amount Assessment

The first and most critical item on any life insurance review checklist is evaluating your coverage amount. Your life insurance needs are not static; they evolve with major life changes. The policy that was perfect five years ago might be inadequate or excessive today. This assessment ensures the death benefit is sufficient to protect your beneficiaries without causing you to overpay for unnecessary coverage.

Why It's Crucial

The primary purpose of life insurance is to replace your economic contribution to your family. A proper assessment prevents your loved ones from facing financial hardship, ensuring they can cover immediate expenses, pay off debts, and maintain their standard of living. It also protects you from paying for more insurance than you need, freeing up funds for other financial goals.

How to Calculate Your Needs

A reliable starting point is the DIME method, which helps you calculate a baseline coverage amount by tallying your major financial obligations:

Debt: Add up all non-mortgage debts, including car loans, student loans, and credit card balances.

Income: Multiply your annual income by the number of years your family would need support. A common rule of thumb is 10-12 years.

Mortgage: Include the full remaining balance of your mortgage.

Education: Estimate the future cost of your children's college or private school education.

Consider this scenario: a young family buys a new, larger home. Their mortgage and overall debt increase significantly. Reviewing their policy and increasing coverage from $250,000 to $500,000 ensures the mortgage could be paid off and their children provided for. Conversely, a retiree who has paid off their home and whose children are financially independent might reduce their coverage, lowering their premium payments in retirement.

The following infographic highlights the core components to consider when assessing your coverage needs.

As visualized, a comprehensive review must account for replacing your salary, clearing major debts, and funding long-term goals like education. Don't forget to factor in inflation and potential Social Security survivor benefits to fine-tune this number. While online calculators are useful, consulting a financial professional is recommended for complex situations, such as business ownership or special needs dependents. This step ensures your policy truly matches your life's financial picture.

2. Beneficiary Information Update

The second crucial step in any life insurance review checklist is to confirm your beneficiary designations are current. Your beneficiary is the person, trust, or entity designated to receive the policy's death benefit. Outdated information can lead to devastating consequences, sending the proceeds to an unintended recipient, such as an ex-spouse, or causing significant delays in payment during a time of need.

Why It's Crucial

Keeping your beneficiary information up-to-date ensures your wishes are honored without complication. A life insurance policy is a legal contract, and the death benefit is paid to the beneficiary named on the form, regardless of what your will might say. Regular reviews prevent disputes and ensure the financial support reaches the right people quickly and efficiently, safeguarding your family's future.

How to Review Your Beneficiaries

A thorough beneficiary review involves more than just checking a name. It requires careful consideration of life events and proper legal designations. This process should be completed annually or immediately following any significant life change.

Review Primary and Contingent Beneficiaries: Always name a primary beneficiary and at least one contingent (or secondary) beneficiary. The contingent receives the benefit if the primary beneficiary is deceased or cannot accept it.

Update After Life Events: Major events like marriage, divorce, birth of a child, or death of a family member should trigger an immediate review. For instance, after a divorce, you must proactively change the beneficiary from an ex-spouse to your children or new spouse.

Use Specific and Legal Information: Provide the full legal names, Social Security numbers, and current contact information for all beneficiaries. This helps the insurance company locate them quickly.

Consider a Trust for Minors: Naming a minor child directly can create legal complications, as they cannot legally control the funds. Establishing a trust with a designated trustee is a common strategy to manage the inheritance until the child reaches adulthood.

For example, a business owner might name a trust as the beneficiary to fund a buy-sell agreement, ensuring a smooth transition of ownership without financial strain. Likewise, a newly remarried individual may designate their new spouse as the primary beneficiary while naming their children from a previous marriage as contingent beneficiaries, protecting everyone involved. Making this review a priority is a fundamental part of responsible financial planning.

3. Premium Payment Review

A crucial part of any life insurance review checklist involves a detailed look at your premium payments. How you pay, how often you pay, and whether the cost remains affordable are key factors in maintaining your policy long-term. An effective premium review ensures your payment structure is efficient, sustainable, and aligned with your current financial situation, preventing accidental lapses in coverage and uncovering potential savings.

Why It's Crucial

Your life insurance policy is only active as long as you pay the premiums. A payment structure that doesn't fit your budget or cash flow is a significant risk. Reviewing your premiums helps you confirm the policy remains affordable and allows you to make adjustments that can save you money or make payments more manageable. This proactive step is vital for ensuring your family's protection remains secure without causing unnecessary financial strain.

How to Optimize Your Payments

Start by examining your payment method and frequency. Many insurers offer discounts for certain payment schedules, and aligning payments with your income can prevent missed deadlines.

Payment Frequency: Check if your insurer offers a discount for paying annually instead of monthly. While a larger one-time payment, it often eliminates processing fees. For instance, a policyholder switching from a $100 monthly payment to a $1,150 annual payment could save $50 per year.

Payment Method: Set up automatic payments from a checking account or credit card to avoid missing a due date. This is especially helpful for business owners or those with fluctuating schedules.

Budget Alignment: If you’re on a fixed income, like many retirees, switching from a large annual premium to a more manageable monthly payment might be better for your cash flow, even if it costs slightly more over the year.

Consider a scenario where a young professional gets a new job with bi-weekly paychecks. They review their policy and shift their monthly premium due date to align with the day after they get paid, ensuring funds are always available. This simple change provides peace of mind and guarantees uninterrupted coverage. A thorough review of your payment strategy is a simple but powerful way to maintain your policy's health and affordability.

4. Policy Type and Features Evaluation

Beyond the death benefit, the very structure of your life insurance policy deserves regular scrutiny. A policy type that was a perfect fit a decade ago, like a simple term policy, may no longer align with your evolving financial strategy, risk tolerance, or long-term goals. This part of your life insurance review checklist involves a deep dive into whether your policy's mechanics, features, and limitations still serve your best interests.

Why It's Crucial

Different policy types (term, whole, universal) serve vastly different purposes. Term life is pure protection for a set period, while whole and universal life policies build cash value and offer lifelong coverage. Choosing the wrong type or failing to adjust can mean missing out on growth opportunities, paying for features you don't need, or facing unexpected policy lapses. A thorough evaluation ensures your policy is a tool working for you, not just a static expense.

How to Evaluate Your Policy Type

Start by understanding your current policy's core function and comparing it to your present needs. Examine its features, such as cash value growth, premium flexibility, and available riders.

Term vs. Permanent: Did you buy term insurance when you were younger? As you build wealth, you might want to convert a portion to a permanent policy to cover final expenses or create a legacy.

Policy Performance: If you have a universal life policy, compare its current cash value performance against the original illustration. Underperformance, common in low-interest-rate environments, may require higher premiums to prevent a lapse.

Rider Re-evaluation: Are you still paying for riders you no longer need? A child rider, for instance, becomes obsolete once your children are financially independent adults.

Consider a business owner who initially bought a whole life policy for its stability. As their business cash flow became more variable, they switched to a flexible-premium universal life policy, allowing them to adjust payments as needed. Conversely, a young professional with a new family might convert their term policy to a permanent one, locking in their good health and starting to build tax-advantaged cash value for the future. As recommended by independent analysts and the Society of Financial Service Professionals, this evaluation is key to maximizing your policy's value.

5. Cash Value and Investment Performance Analysis

For those with permanent life insurance like whole, universal, or variable life, a crucial part of your life insurance review checklist involves analyzing the policy's cash value and investment performance. Unlike term insurance, these policies include a savings or investment component designed to grow over time. Regularly reviewing this element ensures your policy is performing as projected and meeting your long-term financial goals.

Why It's Crucial

The cash value in a permanent policy is a living benefit, one you can use for loans, premium payments, or retirement income. Poor performance can jeopardize these goals and, in some cases, cause the policy to lapse if the cash value can no longer cover the internal costs. A thorough analysis helps you identify underperformance early and take corrective action to protect your investment and the policy's death benefit.

How to Evaluate Performance

Start by requesting an in-force illustration from your insurance carrier. This document projects your policy's future performance based on current interest rates, dividend scales, or sub-account returns, contrasting it with the original illustration you received when purchasing the policy.

Key areas to scrutinize include:

Cash Value Growth: Is the accumulated value tracking with, exceeding, or falling short of the original projections?

Credited Interest/Dividends: For whole and universal life, check the current dividend or interest crediting rate. Have these rates decreased, impacting your growth?

Investment Sub-accounts (Variable Life): Compare the annual returns of your chosen sub-accounts against relevant market benchmarks, like the S&P 500. Are your funds underperforming?

Policy Loans: If you have an outstanding loan, review its impact. The loan balance accrues interest and directly reduces the death benefit paid to your beneficiaries.

For instance, a policyholder might find their universal life policy’s cash value is eroding because current low interest rates are insufficient to cover the rising cost of insurance. To fix this, they may need to increase their premium payments. Conversely, an individual with a whole life policy from a carrier with a strong dividend history may find their cash value growth is stable and on track to supplement their retirement as planned, confirming their strategy is working. Regular monitoring, as advocated by insurance analysis services and fee-only planners, is vital for ensuring your policy remains a valuable asset.

6. Life Changes and Needs Assessment

Life is a series of milestones and transitions, each with financial implications. A crucial part of any life insurance review checklist is assessing how major life events impact your coverage needs. The policy you established as a single professional will rarely be adequate after marriage, the birth of a child, or buying a home. Regularly aligning your policy with your current life situation ensures your financial safety net remains strong and relevant.

This review process is vital because life insurance is not a "set it and forget it" product. Failing to adjust your coverage after a significant change can leave your family underinsured and vulnerable. Conversely, you might be overpaying for protection you no longer need, such as after your children become financially independent or your mortgage is paid off. A proactive assessment keeps your policy optimized for your family's protection and your budget.

Why It's Crucial

Your financial responsibilities shift dramatically with life's biggest moments. Marriage often means combining finances and taking on a mortgage, while the birth of a child adds decades of future expenses. Divorce can restructure beneficiary designations and financial obligations. A significant career change or promotion may increase your family’s reliance on your income. Each of these events directly alters the amount of capital your loved ones would need if you were no longer there to provide for them.

How to Handle Major Life Events

Proactively reviewing your policy during these times is key. Your approach should be tailored to the specific event:

Marriage or New Partnership: Combine your financial pictures. You may need to increase coverage to protect your new joint mortgage and ensure your spouse can maintain their lifestyle.

Birth or Adoption of a Child: This is one of the most significant reasons to increase coverage. You must now account for childcare, daily living expenses, and future education costs.

Divorce: Review and update your beneficiary designations immediately. You may still need to maintain a policy naming your ex-spouse as a beneficiary to secure alimony or child support obligations per a divorce decree.

Career Change or Promotion: A substantial salary increase means your economic value to your family has grown. Your coverage should be adjusted upward to match this new income level.

Retirement or Paid-Off Mortgage: As your financial obligations decrease, you may be able to reduce your coverage, lowering your premiums and freeing up cash flow.

For instance, a newly married couple with a $400,000 mortgage should review their individual policies. They might decide to purchase a new joint policy or increase their existing ones to ensure the surviving spouse is not burdened with debt. Similarly, a business owner nearing retirement might reduce a large policy meant for business succession while retaining a smaller one to cover estate taxes. It's wise to review your policy within 60 days of any major life event to ensure your protection aligns with your new reality.

7. Health Status and Insurability Review

Another vital component of a comprehensive life insurance review checklist is an honest assessment of your current health and future insurability. Your health status is the single most significant factor determining your eligibility for coverage and the premiums you will pay. Reviewing it periodically allows you to secure coverage proactively before potential health issues arise, or to seek better rates if your health has improved.

Why It's Crucial

Life insurance is almost always cheaper and easier to obtain when you are young and healthy. As you age, the risk of developing a chronic illness increases, which can make new coverage prohibitively expensive or even unattainable. A regular review ensures you have locked in adequate protection while you are still insurable, safeguarding your family against the risk that you won't qualify for coverage later when you might need it most.

How to Evaluate Your Insurability

Evaluating your insurability involves looking at your current health profile and considering any potential future changes. This proactive approach helps you make strategic decisions about your coverage.

Anticipate Future Needs: Consider your family's medical history. If there is a history of conditions like heart disease or cancer, it may be wise to secure additional coverage now. For example, a 45-year-old with a family history of heart disease might purchase a new term policy before showing any symptoms themselves.

Leverage Health Improvements: If your health has improved, you may qualify for lower premiums. A former smoker who has been tobacco-free for over three years can request a premium re-evaluation from their insurer to be reclassified as a non-smoker, potentially saving thousands.

Understand Your Limits: Recognize that certain diagnoses can limit your ability to get more coverage. A business owner with a recent diabetes diagnosis might find they cannot qualify for a new policy, making their existing coverage all the more valuable to maintain.

Securing coverage with a guaranteed insurability rider can be a powerful strategy. This rider allows you to purchase additional coverage at specified future dates without needing to prove your insurability again. This protects your ability to increase your death benefit even if your health declines. Always be transparent about health issues on applications to ensure your policy remains valid and your beneficiaries are protected.

8. Estate Planning and Tax Implications

A frequently overlooked part of a life insurance review checklist is how your policy integrates with your broader estate plan. Life insurance is a powerful tool for wealth transfer, but without proper planning, its benefits can be unintentionally diminished by taxes and legal complications. Reviewing your policy's role in your estate ensures the death benefit is distributed efficiently, maximizing its value for your heirs while minimizing their tax burden.

Why It's Crucial

While life insurance death benefits are generally received income-tax-free by beneficiaries, the proceeds can be included in your taxable estate if you own the policy. For larger estates, this could trigger substantial federal or state estate taxes, reducing the net amount your loved ones receive. Proper structuring ensures your policy fulfills its intended purpose, whether that's providing liquidity, funding a trust, or transferring wealth across generations tax-efficiently.

How to Integrate Your Policy

Coordinating your life insurance with your estate plan involves strategic ownership and beneficiary designations. The goal is to align the policy with your will, trusts, and overall financial objectives.

Irrevocable Life Insurance Trust (ILIT): Transferring ownership of your policy to an ILIT can remove the death benefit from your taxable estate. This is a common strategy for high-net-worth individuals aiming to provide liquidity for estate taxes without forcing the sale of other assets, like a family business or real estate.

Business Succession Planning: Business owners can use life insurance to fund a buy-sell agreement. This ensures a smooth transition of ownership and provides the necessary cash for the remaining partners to buy out the deceased owner's share from their heirs.

Generation-Skipping Transfers: Life insurance can be structured to benefit grandchildren, creating a tax-efficient legacy that bypasses the children's estates.

For example, a person with a significant estate might establish an ILIT and transfer their policy into it. Upon their death, the trust receives the proceeds tax-free and can use the funds to pay estate taxes, preventing the forced liquidation of cherished family assets. For comprehensive estate planning and managing tax implications, an AI-powered financial tax document analyzer can be a valuable tool to help you and your advisors sort through complex documents. Consulting with an estate planning attorney is essential to navigate rules like the three-year look-back period for policy transfers and to ensure all components of your plan work in harmony.

Life Insurance Review Checklist Comparison

Aspect | Coverage Amount Assessment | Beneficiary Information Update | Premium Payment Review | Policy Type and Features Evaluation | Cash Value and Investment Performance Analysis | Life Changes and Needs Assessment | Health Status and Insurability Review | Estate Planning and Tax Implications |

|---|---|---|---|---|---|---|---|---|

Implementation Complexity 🔄 | Moderate - requires financial calculations and periodic review | Low - involves paperwork updates and verification | Low to Moderate - depends on payment setups | High - complex policy details, requires expertise | High - involves investment and policy loan analysis | Moderate - requires life event monitoring | Moderate - health data analysis, medical review | High - complex legal and tax coordination |

Resource Requirements ⚡ | Moderate - financial tools and possibly advisor help | Low - mostly administrative with occasional legal aid | Low - banking/payment system and monitoring | High - expert advice and policy comparison needed | High - requires policy statements and financial insight | Moderate - timely updates and professional advice | Moderate - medical exams and underwriting | High - legal and tax professional involvement |

Expected Outcomes 📊 | ⭐⭐⭐⭐ - Adequate coverage, cost control, peace of mind | ⭐⭐⭐ - Accurate benefit delivery, reduces disputes | ⭐⭐ - Payment consistency and cost efficiency | ⭐⭐⭐⭐ - Policy alignment with goals, cost optimization | ⭐⭐⭐⭐ - Wealth growth, liquidity, retirement support | ⭐⭐⭐ - Coverage relevance, premium optimization | ⭐⭐⭐ - Better insurability timing and coverage | ⭐⭐⭐⭐ - Tax benefits and estate liquidity |

Ideal Use Cases 💡 | Adjusting coverage to current/future financial needs | Ensuring current and contingent beneficiaries are correct | Optimizing payment method/frequency for budget | Evaluating policy type against financial goals | Monitoring permanent policy investments | Life event-driven coverage and policy adjustments | Securing coverage before health declines | Integrating life insurance into estate plans |

Key Advantages ⭐ | Prevents over/under-insurance, adapts to life changes | Prevents legal issues, ensures intended payout | Cost savings via optimal payment structure | Enables feature upgrades, cost-effectiveness | Tax-deferred growth, policy loans, retirement aid | Keeps coverage aligned with life changes | Proactive coverage planning, better rates | Tax-free benefits, multi-generational wealth transfer |

Taking Control of Your Financial Legacy

Navigating the intricacies of life insurance can feel like a complex journey, but as we've detailed, it doesn't have to be. By methodically working through this life insurance review checklist, you transform what might seem like a passive expense into a dynamic and powerful instrument for securing your family's future. This isn't just about ticking boxes; it's an act of profound responsibility and foresight, ensuring the promises you made to your loved ones are backed by a solid financial plan.

Key Takeaways from Your Review

Your journey through this checklist has equipped you with the tools to take decisive action. Remember these critical points:

Your Policy Must Evolve With You: Life is not static, and neither is your financial situation. A policy that was perfect five years ago may now have significant gaps. Regular reviews based on life changes, such as marriage, a new home, or children, are not optional, they are essential.

Details Matter Immensely: A simple oversight, like an outdated beneficiary designation or an incorrect address, can cause significant delays and heartache for your family during an already difficult time. Scrutinizing these details ensures your wishes are carried out exactly as you intend.

Coverage is About More Than Just a Number: Your review should go beyond the death benefit. Understanding the performance of your cash value, the nuances of your policy's riders, and its tax implications are all part of maximizing its value and ensuring it works efficiently for you.

Turning Your Insights into Action

Completing this review is the first step. The next is to act on what you've discovered. Did you find your coverage amount is no longer sufficient to protect your family's lifestyle? Is your current policy type misaligned with your long-term financial goals, such as retirement or estate planning? These are not findings to be filed away, they are signals that it is time to optimize your strategy.

Proactively managing your life insurance is a cornerstone of a well-built financial house. It provides the ultimate peace of mind, freeing you to live your life to the fullest, knowing that a robust safety net is in place. This process also ensures your life insurance integrates seamlessly with your broader financial legacy. To ensure your financial legacy is managed efficiently, considering a comprehensive estate settlement checklist can be invaluable, especially as life insurance often plays a critical role in this process.

By embracing this life insurance review checklist, you are not just managing a policy; you are taking deliberate, meaningful control of your financial legacy. You are affirming your commitment to protecting those who depend on you, no matter what the future holds. This diligent effort is a true testament to your values and your dedication to family, providing a legacy of security that will last for generations.

If your review has uncovered a need for a new policy that better reflects your values and financial needs, explore your options with America First Financial. They offer a straightforward path to obtaining affordable, reliable protection aligned with your principles. Get a free, no-obligation quote online today and secure your family's future.

_edited.png)

Comments