Your Guide to a 401k Rollover to Annuity

- dustinjohnson5

- Aug 10, 2025

- 14 min read

Thinking about moving your 401(k) funds into an annuity? You're not alone. In simple terms, a 401(k) rollover to an annuity means you're taking the money you've saved in your employer's retirement plan and using it to buy an insurance contract. The goal here is a big one: turning your nest egg into a guaranteed stream of income you can count on during retirement.

This isn't a move for everyone. It's a strategic choice for people who value predictability more than they chase the potential for big market gains.

What a 401(k) to Annuity Rollover Really Means

When you roll your 401(k) into an annuity, you're making a fundamental trade. You're swapping a lump sum of money that goes up and down with the market for a solid, contractual promise of future payments from an insurance company.

Think of it as creating your own private pension. With traditional pensions all but disappearing from the American workplace, many people are looking for a way to replicate that steady, reliable paycheck in retirement. An annuity is one of the primary tools for the job.

The real appeal is locking in a predictable income. You'll know how much money is coming in and for how long, which can be a huge relief. It helps shield a portion of your retirement savings from the anxiety of stock market swings, which is why it’s so popular with retirees and those getting close to that finish line.

Why Are So Many People Talking About This?

This financial strategy is popping up in more and more retirement conversations. Why? Because millions of Americans are leaving their jobs every year, either by retiring or simply switching careers. This "Great Resignation" and the wave of Baby Boomer retirements are setting a massive amount of money in motion.

In fact, the amount of money rolling over from retirement plans each year is projected to blow past $1 trillion by 2030. You can dig into the full projections on retirement fund movements to see just how significant this trend has become. It signals a major shift in how we're all approaching our post-work financial lives.

The Bottom Line: People roll over a 401(k) to an annuity for one main reason: to secure a predictable, lifelong income. It’s a way to insure your retirement against the ups and downs of the market.

This isn't about hitting a home run with your investments. It’s about managing risk. After spending decades building your savings, the peace of mind that comes from protecting that principal while still getting a steady paycheck is hard to overstate.

401(k) vs. Annuity At a Glance

To really grasp what a rollover entails, it helps to see how these two financial vehicles stack up against each other. At their core, a 401(k) is a tool for saving and growing money, while an annuity is an insurance product designed to distribute it as income.

Here's a quick look at their fundamental differences.

Feature | Typical 401(k) Plan | Retirement Annuity |

|---|---|---|

Primary Goal | Accumulating wealth through market investments | Generating a guaranteed income stream |

Risk Profile | Exposed to market volatility and potential loss | Principal is often protected from market loss |

Income Stream | No guaranteed income; withdrawals deplete balance | Provides a predictable, often lifelong, paycheck |

Control | You manage investments or choose from a set menu | Insurance company manages funds to meet guarantees |

Ultimately, there’s no single right answer. Deciding to roll your 401(k) into an annuity is a deeply personal choice. It all comes down to your unique financial situation, how comfortable you are with risk, and whether you need the security of a guaranteed income stream in retirement.

Is an Annuity Rollover Right for You?

Figuring out if you should roll your 401(k) into an annuity isn't a simple yes-or-no question. It’s a major financial decision, and the right answer is deeply personal—it really boils down to your specific situation, how you feel about risk, and what you picture for your retirement years.

This isn’t about chasing a trend. It's about making sure your hard-earned money aligns with the life you want to live.

For many people, an annuity is the perfect fit. Think about the retiree who spent decades on the rollercoaster of the stock market. Their goal isn't about hitting home runs anymore; it's about getting on base, every single time. They just want the certainty of knowing that a specific amount of money will show up in their bank account each month to cover the bills. For that person, turning a piece of their savings into a guaranteed income stream delivers incredible peace of mind.

Another common scenario I see is someone who worked for companies that never offered a traditional pension. They essentially have to build their own. A 401(k) rollover into an annuity is one of the most direct ways to do just that, creating a private pension that can last a lifetime.

When an Annuity Might Not Be the Best Fit

But let's be clear: this strategy isn't for everyone.

If you’re an investor who is perfectly comfortable with market fluctuations and you're confident in your own ability to manage your portfolio for growth, locking up funds in an annuity might feel incredibly restrictive. Before deciding, it's always wise to explore all your options, including looking into the 7 Best Stocks for Retirement.

Likewise, if you think you might need a big chunk of your savings for a major purchase, a sudden medical need, or you just want maximum flexibility, an annuity is probably the wrong move. Most come with surrender periods where pulling your money out early triggers steep penalties. That lack of liquidity is the fundamental trade-off you make for the security they offer.

Key Takeaway: An annuity trades liquidity and high-growth potential for stability and predictable income. Your personal comfort with this trade-off is the most important factor in your decision.

The market environment matters, too. Heading into 2025, we're seeing a huge turnover in the U.S. retirement market, with over $63 billion in multi-year guaranteed annuities (MYGAs) coming to the end of their terms. This wave is largely from contracts sold back in the high-interest-rate environment of 2020-2022, meaning a lot of people are now free to roll those funds into new products without paying surrender charges.

A Practical Checklist for Your Decision

To make a truly informed choice, you have to get honest about your personal situation. So grab a pen and paper and really think through these questions:

What are my core monthly expenses? Add up the absolute must-pays: housing, food, healthcare, and utilities. Does your Social Security and any other pension income cover this amount? An annuity can be a fantastic tool to fill that gap.

How do I *really* feel about market swings? If watching your account balance drop keeps you up at night, securing a portion of your income can be a powerful stress reliever.

What's my health and life expectancy? If you're in good health and have longevity in your family, a lifetime annuity can be a great defense against the risk of outliving your money.

Is leaving a legacy a top priority? Some annuities can have death benefits that pass any remaining value to your heirs, but many don't. You need to be crystal clear about your goals for generational wealth.

Answering these questions won't give you a magic, one-size-fits-all answer. But it will arm you with the clarity you need to decide if a 401(k) to annuity rollover is a move that genuinely supports your vision for retirement.

So, How Does This Rollover Process Actually Work?

Starting a 401(k) rollover to an annuity can sound like a mountain of paperwork and red tape, but I've walked hundreds of clients through it, and it's far more manageable than you’d expect. The most important thing to understand right out of the gate is that there are two ways to move the money: a direct rollover and an indirect rollover.

Making the right choice here is critical, as it has major tax consequences.

The Two Paths: Direct vs. Indirect Rollovers

Think of a direct rollover as the express lane. Your 401(k) plan administrator sends your money straight to the insurance company that will issue your annuity. The check is made out to them, not you. Because the money never lands in your personal bank account, there are no automatic tax withholdings and zero chance of accidentally messing up and facing a penalty. It’s clean, simple, and frankly, the best route for almost everyone.

Then there's the indirect rollover. This path puts you squarely in the middle of the transaction. Your 401(k) provider will cut you a check for your balance, but here’s the catch: they’re legally required to withhold 20% for federal taxes. You then have a strict 60-day window to deposit the full original amount into your new annuity. If you miss that deadline, the IRS treats the whole thing as a taxable withdrawal, and you could be looking at a hefty tax bill.

Getting the Ball Rolling

Your first move is a simple one: get in touch with your 401(k) plan administrator. This could be the HR department at your old job or a big financial firm like Vanguard or Fidelity that manages the plan for them. Just let them know you want to do a direct rollover into an annuity.

They’ll send you their required paperwork. At the same time, the annuity provider you’ve chosen will have its own set of forms for you to complete to open the new account. My advice? Be meticulous. A single typo in an account number or your Social Security number can bring the whole process to a screeching halt. Double-check everything before you sign and send.

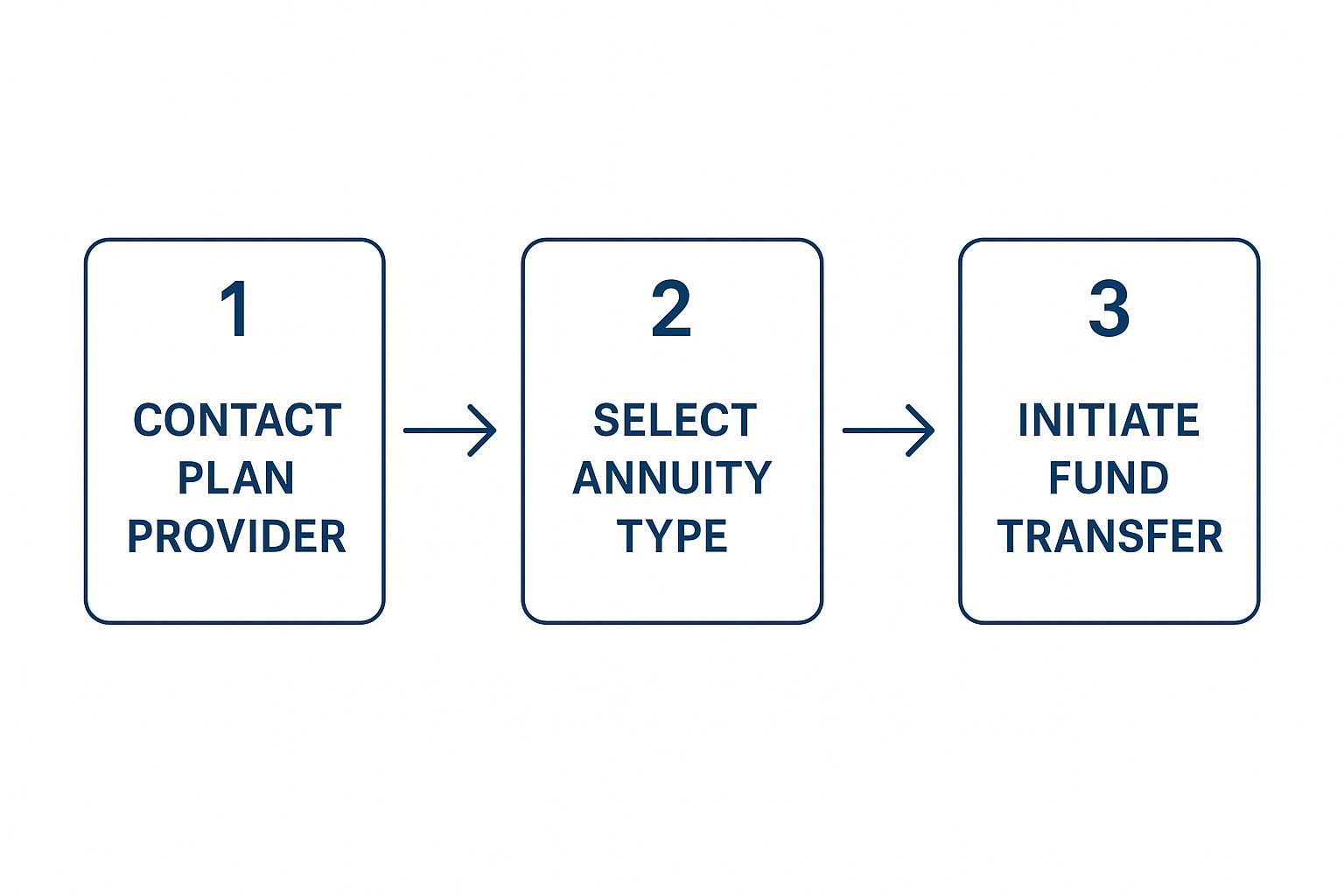

The entire process really boils down to three core stages.

As you can see, once you've done your research and picked your product, it's a matter of coordinating the transfer between the old and new accounts.

The Big Risk: The 60-Day Indirect Rollover Rule

Let's circle back to the indirect rollover, because the risk here is very real. It’s all centered on what’s known as the 60-day rule.

Here’s a real-world example:

You have a $100,000 401(k) balance.

You choose an indirect rollover. Your plan administrator sends you a check for $80,000. The other $20,000 was sent to the IRS as a mandatory tax withholding.

The clock is now ticking. You have 60 days to deposit the full $100,000 into your new annuity.

Where does that missing $20,000 come from? Your own pocket. You have to find that money somewhere else to complete the rollover. You might get that withheld money back when you file your taxes, but in the meantime, you're on the hook for it.

My Personal Takeaway: Unless there's a compelling, unusual reason to do otherwise, always opt for a direct rollover. It completely sidesteps the 20% withholding, eliminates the pressure of the 60-day deadline, and protects you from making a very expensive tax mistake.

Once all the paperwork for your direct rollover is submitted, don't just forget about it. Stay on top of the process. A typical transfer can take a few weeks to complete. When it's done, make sure you get written confirmation from both your old 401(k) provider and your new annuity company. That paperwork is your proof that everything was handled correctly—and it’s your key to sleeping well at night.

Making Sense of the Tax Rules for Your Rollover

Let's get right to the big question everyone has: "What about taxes?" It's the first thing I'm asked when we discuss moving a 401(k) to an annuity. The good news is, if you do it the right way, the initial rollover itself is usually a non-event for the IRS.

When you execute a direct rollover—meaning the money moves straight from your 401(k) provider to the annuity company—you're just shifting pre-tax funds from one tax-sheltered home to another. No taxes are due. Your nest egg keeps its tax-deferred status, allowing it to grow without you having to write a check to Uncle Sam. It’s a clean handoff that protects your principal.

How You'll Be Taxed on Future Annuity Payments

Of course, the tax man eventually comes calling. The real tax considerations pop up down the road when you actually start taking income payments from your annuity.

For any money rolled from a traditional 401(k) into a qualified annuity, those future payments are taxed as ordinary income. The IRS treats this money just like your old salary or withdrawals from a traditional IRA. The income you receive from the annuity gets added to your other income for the year, like Social Security, and is taxed at whatever your income tax bracket happens to be at that time.

Think of it this way: you got a tax break when the money went into your 401(k), so you pay taxes when it comes out.

The core principle here is to prevent "double-dipping." The tax system is set up so you either get a tax break on the way in (with a traditional 401(k)) or on the way out (with a Roth), but never both.

What About Special Cases, Like a Roth 401(k)?

Have a Roth 401(k)? The rules are even better. Moving a Roth 401(k) into a Roth annuity is also a non-taxable event. And since you already paid your taxes on those Roth contributions years ago, every qualified withdrawal you take from your Roth annuity during retirement is 100% tax-free.

This can be a fantastic strategy. Having a source of tax-free income can be a game-changer, especially when you need to supplement other taxable income streams. For a holistic view, it's wise to incorporate this into your overall investment planning with optimal tax implications to make sure every piece of your financial puzzle fits together efficiently.

The best part is that these rollovers are not limited by annual contribution caps. While the IRS periodically raises those limits—for example, the 2025 401(k) contribution limit is set at $23,500—a rollover involves moving your existing balance, which can be much larger. You can always check the latest IRS contribution limits and rollover rules directly from the source to stay up-to-date.

Choosing the Right Annuity and Provider

Okay, so you’ve decided that a 401(k) rollover to an annuity might be the right move for you. Now comes the hard part: figuring out which one. The market is crowded, and frankly, it can be overwhelming.

The trick is to remember that you're hiring a product to do a specific job for your retirement. Don't let a salesperson fit you to their product; you need to find the product that fits your goals. Your decision really boils down to how you feel about risk and whether you’re prioritizing guaranteed income stability or the potential for your money to keep growing.

Matching Annuity Types to Your Goals

There are a few main flavors of annuities, and each one is built for a different kind of person with a different vision for their retirement. Getting this part right is probably the single most important step in the entire process.

Fixed Annuities: This is your straightforward, no-surprises option. Think of it like a high-powered Certificate of Deposit (CD). You hand over your rollover funds, and the insurance company guarantees you a specific, fixed interest rate for a set number of years. It’s predictable, simple, and your principal is safe. If the thought of market swings makes your stomach turn, this is likely your best bet.

Variable Annuities: For those who aren't quite ready to give up on market growth, there are variable annuities. This is essentially an investment portfolio wrapped in an insurance contract. You get to choose from a menu of sub-accounts (which look and feel a lot like mutual funds). Your annuity's value—and the income you eventually get—is tied directly to how well those investments perform. You have the highest potential for growth here, but you also carry all the market risk.

Indexed Annuities: This is the hybrid, the attempt to get the best of both worlds. The interest credited to an indexed annuity is linked to the performance of a market index, like the S&P 500. When the market goes up, you participate in some of the gains, usually up to a cap. The real magic, though, is what happens when the market goes down: you typically don't lose a dime of your principal. It’s a trade-off—less upside potential than a variable annuity, but with a built-in floor to protect you from losses.

To put it simply: A fixed annuity is about safety. A variable annuity is about growth. An indexed annuity tries to give you a taste of both.

Vetting the Insurance Company

An annuity contract is a long-term promise. It's only as solid as the company making that promise. You're counting on this insurer to be financially sound enough to send you checks for potentially decades to come. This isn't a decision to take lightly.

So, how do you know if a company is rock-solid? You check their report card from independent rating agencies. These firms do the heavy lifting, analyzing an insurer's financial health and their ability to actually pay their claims.

Key Rating Agencies to Check:

A.M. Best: This is the big one in the insurance world. I personally don't look at anything with less than an "A" rating.

Standard & Poor's (S&P): A household name for a reason; their ratings are a critical data point.

Moody's: Another top-tier agency that provides deep financial analysis.

Never, ever sign on the dotted line without checking these ratings. Seeing a strong grade from multiple agencies is a powerful sign that a provider is built to last.

When you're ready to talk specifics with a company or an advisor, like the folks at America First Financial, you need to come prepared with some tough questions. A trustworthy professional will have no problem giving you clear, written answers.

Here are a few questions I insist my clients ask:

Can you give me a breakdown of all the fees? I want to see administrative charges, mortality and expense risk charges, and the cost for any add-on riders.

What does the surrender charge schedule look like? Show me how many years it lasts and exactly what percentage I'd pay to get out early.

When it's time to turn on the income stream, what are my exact payout options?

If I pass away prematurely, what happens to the money left in the contract?

Getting straight answers to these questions is non-negotiable. It’s how you protect yourself from nasty surprises down the road and make sure the annuity you pick is truly working for you.

Answering Your Lingering Rollover Questions

Even with a solid grasp of the process, it’s the "what if" scenarios that often keep people up at night. When you're talking about a move as significant as a 401(k) rollover to an annuity, a few nagging questions are perfectly normal. Let's walk through some of the most common ones I hear from clients to get you the clarity you need.

Do I Have to Roll Over My Entire 401(k)?

This is a big one. Many people assume it's an all-or-nothing deal, which can feel intimidating.

The short answer is no, absolutely not. In fact, for many retirees, a partial rollover makes a lot more sense. You have complete control over how much of your 401(k) you want to move.

Think of it this way: you could roll over just enough to create an annuity that generates a guaranteed income stream to cover your essential bills—mortgage, utilities, food, and healthcare. The rest of your money can stay right where it is in your 401(k) or move to an IRA, where it remains invested for growth. It’s a classic strategy for balancing security with upside potential.

What If the Insurance Company Goes Under?

A completely fair and critical question. After all, an annuity's promise is only as strong as the company making it. This is why digging into the insurer's financial stability isn't just a good idea; it's a non-negotiable part of the process.

Your Built-In Safety Net: Your primary protection is choosing a highly-rated, financially sound insurance company from the start. But there's another layer of security. State guaranty associations step in to protect policyholders if an insurer fails, covering your annuity up to specific state-mandated limits. It's a system very similar to how the FDIC protects your bank accounts.

Always look for top-tier ratings from independent agencies like A.M. Best. A strong financial health rating is the clearest indicator that a company has the capital and prudent management to fulfill its promises to you for decades to come.

What About Hidden Fees? Am I Going to Get Nickeled and Dimed?

Annuity fees can be complex, and you're right to be wary. Transparency isn't a bonus; it's a requirement. You should never have to guess what you're paying for.

Before you commit to any contract, insist on a complete, written breakdown of all potential charges. Be on the lookout for:

Administrative Fees: Basic costs for account maintenance.

Mortality and Expense (M&E) Charges: Found in variable annuities, these cover the insurance guarantees.

Rider Costs: Extra fees for optional features, like a guaranteed lifetime withdrawal benefit or an enhanced death benefit.

Surrender Charges: These are steep penalties if you pull your money out early, so you need to know the exact timeline.

Any reputable advisor or company will lay these out for you without hesitation. If you get vague answers or feel like they're dodging the question, that’s a massive red flag. Trust your gut and find someone else to work with. The right 401(k) rollover to an annuity is one where you go in with your eyes wide open, feeling confident and fully informed.

At America First Financial, we believe in providing clear, straightforward answers to protect your retirement. If you're looking for an annuity provider that aligns with your values and prioritizes your financial security, get a no-hassle quote today. Learn more at https://www.americafirstfinancial.org.

_edited.png)

Comments