Your Guide to a Period Certain Annuity

- dustinjohnson5

- Sep 6, 2025

- 14 min read

A period certain annuity is an insurance contract that promises to pay you a steady stream of income for a specific, predetermined number of years. If you happen to pass away before that term is up, your beneficiary steps in to receive the rest of the payments. Simple as that. It's a guarantee that every penny of the contracted payments goes to either you or your loved ones.

Your Guaranteed Retirement Paycheck

Think of it like setting up your own personal payroll for retirement. You tell an insurance company, "I want a steady paycheck for the next 15 years," and they agree to send you a fixed amount of money every month for that exact period. No surprises, no market fluctuations—just a reliable check you can count on.

This is what makes a period certain annuity so straightforward. While some retirement products can get tangled in complex rules, this one works on a clear and predictable timeline. You're essentially building an income bridge to cover a specific chapter of your life, taking the guesswork out of at least one piece of your financial puzzle.

The Core Components of Your Annuity

The real power of a period certain annuity comes from a few key elements working together to give you peace of mind. When you buy one, you're essentially locking in a contractual promise from an insurance company built on these three pillars:

A Fixed Term: You get to pick the exact length of the payment period. Common choices range from five to 20 years, giving you the control to match the income stream to your specific needs or financial goals.

Guaranteed Payments: Your payment amount is calculated right at the start and stays the same. That consistency is a huge help when it comes to budgeting and feeling financially secure in retirement.

Beneficiary Protection: This is the feature that really sets it apart. The contract guarantees that all payments will be made, one way or another. If you die before the term ends, the income doesn't just stop; it seamlessly transfers to the person you named as your beneficiary until the original term is complete.

The big draw here is the contractual guarantee. A period certain annuity promises that the money you put in will be fully paid out over the agreed-upon timeframe, whether it’s to you or to the people you care about most.

Why This Structure Matters

This setup offers a unique kind of security. A common fear among retirees is putting a large sum of money into an annuity, only to pass away a year or two later and lose the rest of their investment. The period certain annuity was designed to solve that exact problem. It acts as a backstop for your principal while giving you the income you need today.

Let's say you choose a 20-year term and pass away in year five. Your beneficiary will then start receiving the same monthly payments for the remaining 15 years. This makes it a surprisingly effective tool for leaving a legacy, ensuring a spouse, child, or other loved one has financial support for a predictable amount of time.

This combination of personal income and protection for your heirs is what really distinguishes it from many other annuity options on the market.

To help you see it all in one place, here's a quick summary of the key features.

Period Certain Annuity Features at a Glance

This table quickly summarizes the essential components of a period certain annuity, helping you grasp its core guarantees and structure.

Feature | Description |

|---|---|

Payment Duration | A fixed, predetermined number of years (e.g., 10, 15, or 20 years) that you choose at the beginning. |

Income Stream | Provides a consistent, predictable payment amount that does not change due to market performance. |

Beneficiary Guarantee | If you pass away before the term ends, your designated beneficiary receives the remaining payments until the term is complete. |

Longevity Risk | Payments stop after the term ends, regardless of how long you live. It does not protect against the risk of outliving your money. |

Simplicity | Generally one of the more straightforward annuity products, with clear terms and a predictable outcome. |

At its heart, this annuity is all about guarantees over a defined period. It’s a tool built for certainty, not for lifelong income.

How Your Annuity Payments Are Calculated

Ever wonder how an insurance company comes up with that specific, guaranteed payment number? It's not pulled out of thin air. There's a clear-cut formula at work, and understanding the moving parts can help you see exactly how your income stream is built.

Think of it like a three-legged stool. If you change the length of any one leg, the whole thing changes. For a period certain annuity, those three legs are your initial investment, the payment term you choose, and the interest rate the insurer assumes.

The Three Pillars of Your Payment

It all starts with the money you put in. A bigger premium will naturally lead to a bigger monthly check—that part’s pretty straightforward. This is the foundation for the entire calculation.

Next, the "certain period" you select has a huge impact. Let's say you have a $200,000 premium. If you ask the insurance company to pay it back to you over just 10 years, your payments will be much larger than if you stretch them out over a 20-year term. You're simply slicing the same pie into fewer, bigger pieces.

The main ingredients are:

Your Initial Investment: The lump sum you hand over to the insurance company. More in means more out.

The Payment Term: The guaranteed number of years you'll receive payments (e.g., 10, 15, or 20 years). A shorter term equals a higher payment.

The Assumed Interest Rate (AIR): This is the conservative growth rate the insurer bakes into the calculation, representing how your money is expected to earn while it's being paid out to you.

It's a classic trade-off. A longer guarantee gives you peace of mind for more years, but each individual payment will be smaller. A shorter guarantee boosts your monthly cash flow, but only for that limited time.

A Practical Calculation Example

Let's put this into perspective with a real-world scenario. Meet John, a recent retiree who wants to turn a portion of his savings into a reliable income stream. He decides to use $200,000 to buy a period certain annuity. His goal is to guarantee an income for the next 15 years to cover his essential bills.

The insurance company runs the numbers using its current assumed interest rate. They determine they can pay John $1,380 per month, guaranteed, for that entire 15-year term. That number is now locked in. John knows he will receive exactly $1,380 every single month for 180 months (15 years x 12 months).

And if John were to pass away in year 10, the guarantee doesn't stop. His daughter, whom he named as his beneficiary, would step in and continue receiving that same $1,380 per month for the remaining five years.

How Lifetime Guarantees Change the Math

Now, what happens if you add a lifetime income component to this? This hybrid product is often called a "Life with Period Certain" annuity, and it brings a whole new variable into the equation: your life expectancy.

When an insurer has to guarantee payments for the rest of your life, they are taking on a much bigger risk. You might live to be 105! To account for that possibility, they have to lower the monthly payment compared to a standalone period certain annuity.

Insurers use complex actuarial tables to make these predictions, a science that's always getting more refined. Decades ago, for instance, it was common for actuaries to factor in annual mortality improvement rates of around 0.75% for men and 1% for women to keep their pricing on track. You can explore more about how these projections influence annuity valuations to see just how deep this analysis goes. Adding that lifetime promise fundamentally changes the risk for the insurer, and in turn, the payment you'll receive.

Weighing The Pros and Cons

When it comes to financial products, there's no such thing as a free lunch. Every tool has its trade-offs, and a period certain annuity is no different. While it delivers some powerful guarantees, it’s crucial to stack those benefits against its limitations to figure out if it truly fits your retirement picture.

The big question really comes down to what you're trying to achieve. Are you prioritizing a predictable income stream and leaving a legacy? Or is your main goal lifetime income, no matter how long you live? Let's break down both sides of the coin.

The Upside: What Period Certain Annuities Do Well

The biggest draw of a period certain annuity is its rock-solid predictability. You know, down to the penny, how much you’ll get and for exactly how long. That kind of certainty makes budgeting in retirement a whole lot easier. It’s an income stream that won't give you any surprises, no matter what the stock market is doing.

The other major win here is the beneficiary protection. This is huge. With a period certain annuity, there's no risk of the insurance company just keeping your money if you pass away a year or two into the payment term. The contract guarantees that all the payments will be made, whether to you or to the person you name as your beneficiary.

This makes it a fantastic tool for making sure a loved one is taken care of for a specific amount of time. Think about it—you could use it to ensure mortgage payments are covered or that there's money set aside for a grandchild's college tuition.

To put it simply, here are the main highlights:

Guaranteed Income Stream: You get a fixed, steady paycheck for a term you choose. No guesswork involved.

Legacy Protection: Your beneficiary is guaranteed to receive any payments left on the table if you die before the term is up. Your investment is never forfeited.

Simplicity and Clarity: These are generally more straightforward than other, more complex annuities. The terms are clear and easy to grasp.

The Downside: Potential Risks and Drawbacks

Now for the flip side. The most glaring risk of a standalone period certain annuity is outliving your payments. It’s right there in the name—the payments last for a certain period. If you set up a 15-year term but live for another 30 years, you’ll face 15 years with no income from this annuity. You absolutely need other sources of income to carry you through the rest of your retirement.

Then there's the silent wealth killer: inflation. A fixed payment that feels comfortable today might barely cover the essentials 10 or 15 years down the road. Without an inflation-protection rider (which would lower your initial payments), the real value of your income will slowly but surely shrink over time.

A period certain annuity offers a powerful guarantee within its timeframe, but it provides no protection against outliving your assets. Its certainty is confined to the specific period you select.

Finally, your money isn't exactly easy to get to. Like most annuities, your funds are considered illiquid. If you suddenly need a large chunk of cash for an emergency, you'll likely face hefty surrender charges to get it. That lack of flexibility can be a major hurdle if you don't have other liquid savings to fall back on.

Comparing the Advantages and Disadvantages

Every financial decision involves weighing the good against the bad. Here’s a straightforward look at how the pros and cons of a period certain annuity stack up against each other.

Pros (Advantages) | Cons (Disadvantages) |

|---|---|

Provides a highly predictable and stable income stream. | Income stops when the term ends, creating longevity risk. |

Guarantees payments to a beneficiary if you die early. | Fixed payments can lose purchasing power due to inflation. |

Simple to understand with clear, defined terms. | Funds are illiquid and subject to surrender charges. |

Can be used strategically to bridge an income gap. | Offers no upside potential from market growth. |

Ultimately, this table highlights the central trade-off: you get absolute certainty for a defined period in exchange for giving up lifelong income protection and flexibility.

When Does a Period Certain Annuity Make Financial Sense?

A period certain annuity isn't the right answer for everyone, but in the right situation, it can be a remarkably powerful financial tool. Its real advantage is its predictability and fixed term. This makes it a perfect fit when you need a guaranteed income stream for a specific number of years, rather than for your entire life.

It’s best to think of it less as a total retirement plan and more as a specific solution for a specific problem. It really excels at bridging a particular financial gap in your personal timeline.

Bridging an Income Gap

One of the most popular and effective ways to use a period certain annuity is to create an income bridge. Let's say you're ready to retire at age 62, but you've decided to wait until age 70 to claim Social Security to get the biggest possible monthly check. What do you live on for those eight years?

This is where an eight-year period certain annuity fits perfectly. You could use a portion of your savings to buy one, and it would deliver a steady, guaranteed income stream to cover your expenses. This allows your other retirement funds to stay invested and grow, and it lets your Social Security benefit mature to its maximum value.

This same idea works for bridging the gap until a pension starts paying out. It gives you the financial stability you need without forcing you to sell off investments, especially if the market happens to be down.

Making Sure Your Dependents Are Cared For

Another excellent use is to provide dedicated financial support for a loved one. Because of the beneficiary guarantee, this annuity is a great way to ensure specific financial responsibilities are handled, even if you pass away unexpectedly.

Just think about these common scenarios:

Paying for College: You could purchase a four-year period certain annuity timed to cover your grandchild’s tuition payments, guaranteeing the money is there when the bills arrive.

Covering a Mortgage: If your spouse has a few years of mortgage payments left, a period certain annuity can be set up to make sure that debt is paid off.

Supporting a Loved One: It can also be structured to provide a reliable income stream for a set number of years to help care for a child with special needs or an elderly parent.

When figuring out where a period certain annuity fits in your overall strategy, it's helpful to see it as one part of optimizing your investments and keeping your financial plan on track.

Maximizing a Legacy for Beneficiaries

For retirees who have known health issues, a period certain annuity can be a very practical choice. If there's a real concern about life expectancy, a standard lifetime annuity might not provide the best return on your money.

By choosing a 10 or 15-year period certain annuity instead, you ensure that even if you pass away early, your beneficiary will continue to receive payments for the rest of the term. This approach guarantees that a significant portion—if not all—of your premium is paid out, securing a financial legacy for your loved ones.

This concept is also being used by larger institutions, like pension plans, to manage their financial risk. We saw a big move in this direction back in 2011, when the market for single premium group annuity settlements grew to $900 million in premiums, which was the first major jump since 2007. For a deeper dive into these market shifts, you can discover more insights about institutional annuity markets from Aon.

Comparing Annuity Payout Options

Picking the right annuity is about more than just the product itself; you have to decide how you want to get paid. That's where the payout structure comes in, and it needs to line up perfectly with what you want your retirement to look like. A period certain annuity is a fantastic tool, but it's not the only one in the shed. Let's walk through how it stacks up against the other big players.

Your main alternatives are typically a life-only annuity or a joint-and-survivor annuity. Each one is built to solve a different problem, which means you have to get clear on your top priority. Are you trying to get the absolute biggest check for yourself? Guarantee money is left behind for a loved one? Or make sure your spouse is covered for the rest of their life, no matter what?

The Payout Trade-Off

Let's start with the life-only annuity. This one almost always gives you the highest monthly payment for the money you put in. The reason is simple: the insurance company is only on the hook for as long as you are alive. If you live to be 105, you've made a great bet. But if you pass away a year after payments start, the insurance company keeps the rest. The payments stop, period.

On the other end of the spectrum is the joint-and-survivor annuity, which is built for couples. The income stream keeps flowing as long as either you or your spouse is still living. It’s an incredible source of security for the surviving partner, but that lifelong guarantee for two people comes at a cost—your monthly payments will be lower than what you'd get from a life-only or a period certain option.

This is where the period certain annuity finds its sweet spot. It offers a compromise. It guarantees payments for a specific number of years, so if you pass away early, your beneficiary gets the rest. It protects your initial investment. The trade-off? There's no protection if you outlive the payment term.

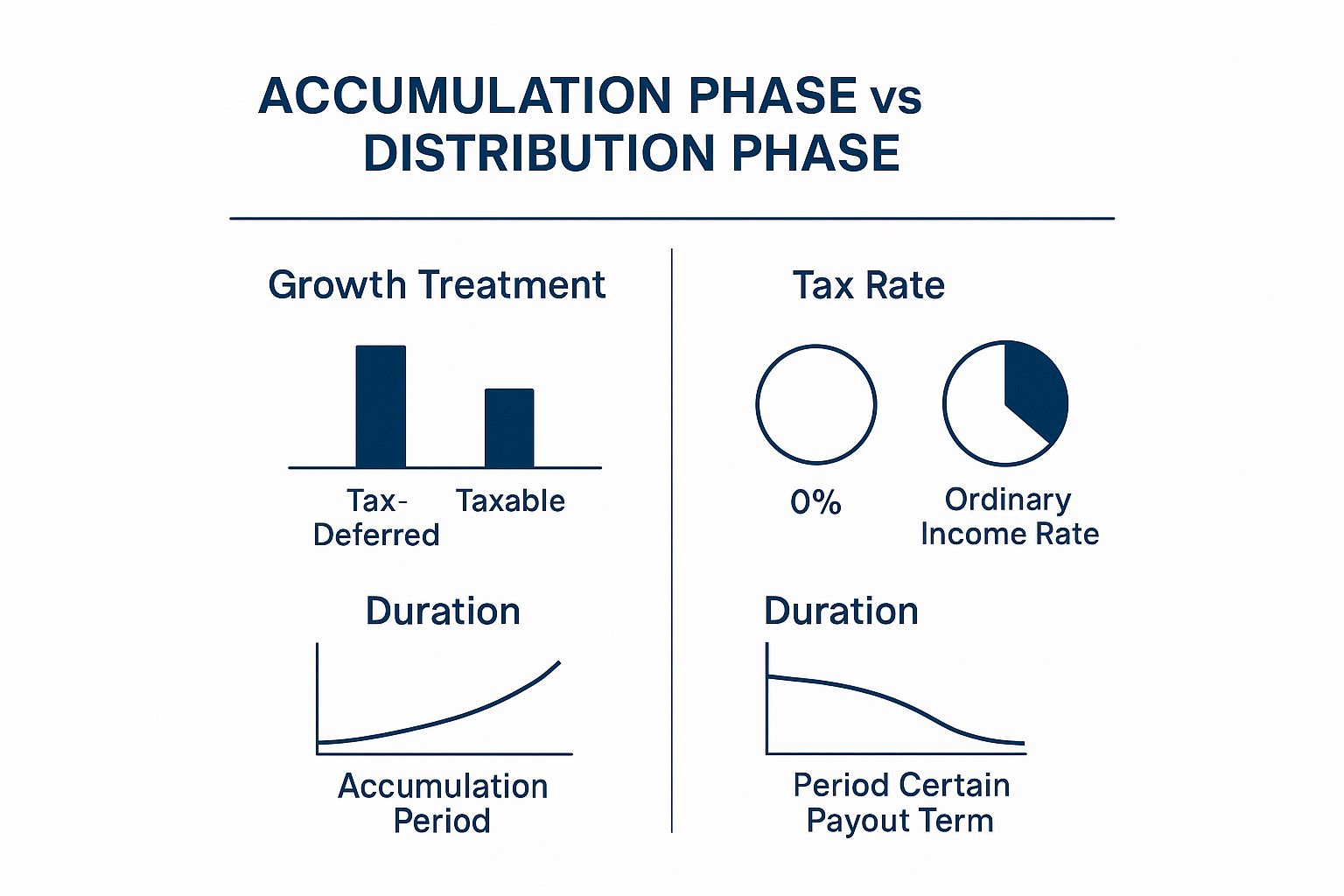

The image below breaks down the two key phases of an annuity: when it's growing and when you're taking money out.

Understanding this shift from tax-deferred growth to taxable income is a huge piece of the retirement puzzle.

Why This Decision Is So Important Right Now

Choosing wisely has never been more critical. As more and more people head into retirement, the search for guaranteed income has exploded. Between 2022 and 2024, Americans poured over $1.1 trillion into annuities. In 2023 alone, sales jumped 23% from the year before. This isn't just a small trend; it shows a fundamental shift as retirees scramble to lock in reliable paychecks. You can read more about the growing annuity market on Bankrate.com.

When you compare payout options, you're doing more than just crunching numbers. You're deciding what your retirement legacy will be. Is it about maximizing your own cash flow, making sure a beneficiary is taken care of, or providing a financial safety net for your partner for life?

At the end of the day, there's no single "best" answer. It all comes down to your personal situation, your health, and your family's financial needs. A period certain annuity is an excellent choice for predictable income and leaving a legacy over a set timeline, but you owe it to yourself to see how it measures up against the lifetime options before making a final call.

Answering Your Key Questions

Even after covering the basics, it's completely normal to have a few "what-if" questions running through your mind. A period certain annuity is a serious financial commitment, and feeling confident means understanding how it works in the real world. Let's tackle some of the most common questions people ask.

Think of this as the final check-in, where we clear up any lingering uncertainties so you can see the full picture.

What Happens If I Outlive the Certain Period?

This is probably the most important question of all, and the answer depends on the exact type of annuity you have. If you own a standalone “period certain only” annuity, the payments will stop the moment the term ends. For a 15-year term, that means the income stream cuts off after the 180th payment. That's the biggest risk associated with this specific product.

However, a more popular option is a hybrid known as a “life with period certain” annuity. This structure gives you the best of both worlds: your payments are guaranteed to last for your entire lifetime. The "certain period" simply acts as a safety net, ensuring a minimum number of payments are made, either to you or to your beneficiary if you pass away early.

Can I Change My Beneficiary?

Generally, yes. Most annuity contracts allow you to change your beneficiary at any time before payments begin (this is called the annuitization phase). This flexibility is crucial because life happens—you might get married, have a grandchild, or simply change your mind.

But once those payments start flowing, the rules can get a lot stricter. It's vital to read your contract carefully or call the insurance company to know their exact process. Some may allow changes after annuitization, while others may not.

Your annuity contract is a legally binding document. Always double-check the specific rules for beneficiary changes with your provider. Don't assume the rules are the same across all companies.

Are My Annuity Payments Taxable?

Yes, you can count on annuity payments being taxed. How much tax you'll owe, though, depends entirely on the type of money you used to buy the annuity.

Funded with Pre-Tax Money: If you bought the annuity using funds from a traditional IRA or 401(k), every dollar you receive is taxed as ordinary income.

Funded with After-Tax Money: If you used non-qualified funds (money you've already paid taxes on), you only pay taxes on the earnings portion of each payment. A part of each payment is considered a tax-free return of your original principal.

Each year, the insurance company will send you a Form 1099-R. This form breaks everything down, showing you the total amount you received and how much of it is considered taxable income.

How Does Inflation Affect My Payments?

This is a big one. A standard period certain annuity provides a fixed, unchanging payment. While that predictability is great, it also means its buying power will shrink over time. A monthly payment of $1,500 will buy you a lot less in 15 years than it does today, thanks to inflation.

To combat this, some insurance companies offer a rider called a Cost-of-Living Adjustment (COLA). If you add a COLA rider to your contract, your payments will increase each year (usually by a fixed percentage) to help you keep up with rising costs. The trade-off? Your initial starting payments will be lower than they would be without the rider.

At America First Financial, we believe in providing clear, straightforward financial tools that protect your family and secure your future without the political noise. Our annuity products are designed to offer you peace of mind and financial stability.

_edited.png)

Comments