Your Guide to a Rollover 401k to IRA

- dustinjohnson5

- Jul 11, 2025

- 13 min read

So, you’ve left your job and now you’re staring at a 401k account from your old employer. What should you do with it? This is a common crossroads for many people, and one of the smartest options on the table is a rollover to an IRA.

A rollover is just the technical term for moving your retirement savings from that old 401k plan into an Individual Retirement Account (IRA) that you own and control directly. Think of it as moving your money from a home you were renting from your employer to one you own outright. It's a strategic move that can open up a world of new possibilities for your retirement funds.

Why a Rollover 401k to an IRA Can Be a Smart Move

When you part ways with an employer, you generally have a few choices for your 401k. You can cash it out (usually a bad idea due to taxes and penalties), leave it where it is, or roll it over. For most people I’ve worked with, the rollover offers some serious advantages for growing their nest egg over the long haul.

At its core, it’s about taking your hard-earned retirement money out of a restricted, employer-managed plan and putting yourself in the driver's seat.

Gain Control and a Universe of Options

For me, the biggest win in a rollover 401k to an IRA is the explosion in investment choices you suddenly have. Most 401k plans are pretty limited. Your old employer probably offered a small menu of maybe 15-20 mutual funds they picked out. That’s it.

An IRA, on the other hand, is like walking into an investment supermarket. You can pick and choose from a much wider world of assets, depending on the brokerage you open the account with. Your options expand to include:

Individual stocks and bonds from thousands of companies

A massive selection of Exchange-Traded Funds (ETFs)

Countless mutual funds from all the major fund families

Even alternative assets like real estate or precious metals, if you go with a Self-Directed IRA

This kind of flexibility means you can build a portfolio that’s truly tailored to your personal goals and comfort level with risk, not just pick from a list someone else made.

Simplify Your Financial Life

If you’re like most people and have had a few jobs over the years, you might be juggling several old 401k accounts. It gets messy trying to keep track of everything. A rollover is the perfect opportunity to clean house.

Consolidating those scattered accounts into a single IRA just makes sense. Suddenly, everything is in one place. You can see your overall performance, manage your beneficiaries easily, and build one cohesive investment strategy. It’s a huge step toward taking full command of your financial future.

This isn't just about reducing paperwork headaches. It gives you a crystal-clear, bird's-eye view of all your retirement savings at once.

401k vs IRA Rollover At a Glance

To help you see the differences side-by-side, I’ve put together this quick comparison. It breaks down what you're looking at if you leave your money in your old 401k versus what you get with an IRA rollover.

Feature | Staying in Your 401k | Rolling Over to an IRA |

|---|---|---|

Investment Choices | Limited to a small menu of pre-selected funds. | Vast selection of stocks, bonds, ETFs, and mutual funds. |

Account Control | Managed by your former employer's plan administrator. | You have direct control over account and investment decisions. |

Fee Transparency | Fees can sometimes be hidden within fund expenses. | Fees are typically more transparent and can be lower. |

Withdrawal Flexibility | Often has restrictive rules on withdrawal timing and frequency. | More flexible withdrawal options and payout structures. |

Financial Consolidation | Keeps accounts separate, complicating oversight. | Allows for easy consolidation of multiple old retirement accounts. |

Looking at the table, you can see how an IRA gives you significantly more freedom and control. While leaving money in an old 401k might seem like the easiest path, taking the time to execute a rollover can pay dividends in the long run.

When a Rollover Makes Financial Sense

Deciding whether to rollover your 401k to an IRA is a lot more than just financial housekeeping. It’s a strategic move, and certain life events—like changing jobs or heading into retirement—are the perfect triggers to take a hard look at where your money is and whether it’s truly working for you.

Think of it as a fork in the road. You can leave your money with your old employer, or you can take the wheel yourself. Was their plan great, or were you stuck with high fees and so-so investment choices? This is your moment to decide.

Seizing Control for Better Growth and Lower Fees

Let's imagine you're a marketing director who just left a company with a pretty basic 401k. The plan was okay, but the fees were a little steep and the fund choices were limited to a handful of expensive mutual funds. Moving that money into a self-directed IRA opens up a whole new world. Suddenly you have access to thousands of low-cost ETFs, individual stocks, and a much broader investment universe.

That one move can have a staggering impact over the long haul. The seemingly small percentages you save on fees compound year after year, potentially adding tens or even hundreds of thousands of dollars to your retirement nest egg.

Key Takeaway: A rollover isn't just about shuffling money from one account to another. It's about optimizing for lower costs and more investment choices—two of the most powerful levers you have for building wealth.

It's no surprise that changing jobs is the number one reason people initiate rollovers, driving 68% of these transactions. Retiring from a job is the next biggest catalyst, accounting for another 43%. While there have been some policy discussions about making 401k plans more portable, the desire for more control and better options keeps the rollover trend going strong. You can dig into the data and see exactly how Americans are managing their retirement assets in detailed industry reports.

When Sticking With Your Old 401k Is the Smarter Play

But hold on—a rollover from a 401k to an IRA isn't always the right answer. Sometimes, keeping your money right where it is makes more sense. You really have to weigh what your old plan offers against the freedom of an IRA.

For instance, some large company 401k plans have unique investment options you simply can't find in a retail IRA, like stable value funds. These can be fantastic, low-risk holdings that provide steady returns, especially when the stock market gets choppy.

Another major consideration is legal protection. 401k plans generally have stronger safeguards against creditors and lawsuits than IRAs do, thanks to federal law. If you're in a profession with high liability risk, that enhanced protection might be more valuable than a wider array of investment choices. It’s crucial to read your old plan’s documents carefully before making a move.

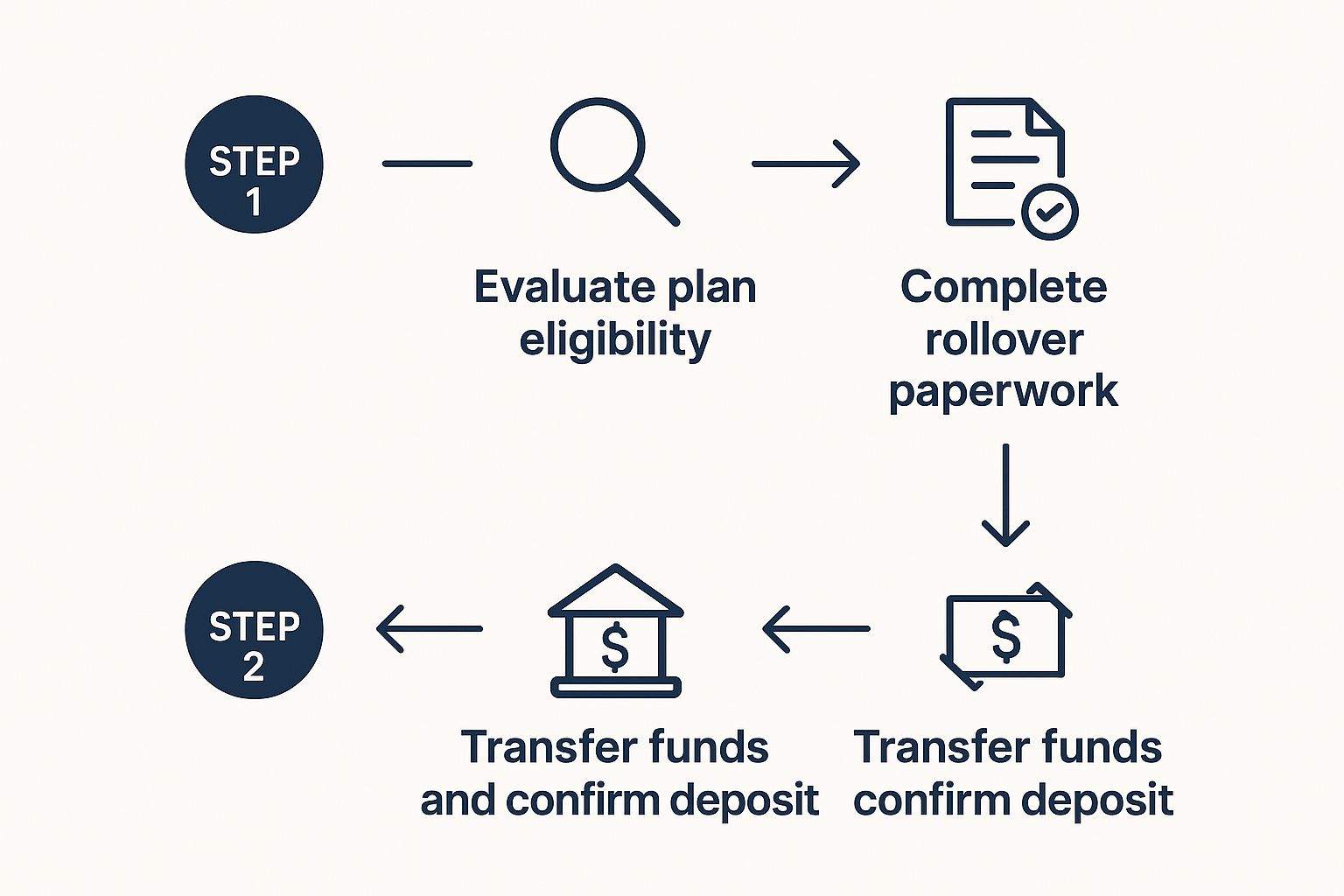

How to Start Your 401k Rollover

So, you've made the call. It's time to roll over that old 401k. Moving from thinking about it to actually doing it can feel like a big leap, but the process is more manageable than most people realize. The key is being meticulous to keep the transfer smooth and—most importantly—tax-free.

Your first real move is to decide where your money is going to live next. You'll need to open an IRA with a brokerage or financial institution, and this choice really sets the tone for your future investing.

Choose Your New IRA Provider

Think about how involved you want to be. Are you a hands-on investor who loves digging into research and hand-picking stocks? Or do you prefer a "set it and forget it" approach?

Full-Service Brokerages: These give you the keys to the kingdom. You can invest in a huge universe of stocks, bonds, ETFs, and more. If you enjoy having complete control and making every call yourself, this is your path.

Robo-Advisors: If you'd rather not get into the weeds, a robo-advisor is a fantastic option. They use smart algorithms to build and manage a diversified portfolio for you based on your goals and risk tolerance. It's a low-cost, low-effort way to keep your money working for you.

My two cents: Don't get hung up solely on fees. Look at the whole picture—customer service, the quality of their research tools, and how easy their platform is to use. You're picking a long-term partner, so make sure it's a good fit.

Once you’ve picked a provider, opening the new IRA is usually a quick online affair. You’ll enter your personal info and choose the account type. To receive pre-tax 401k funds, you’ll typically open a Traditional IRA.

Initiate the Rollover Paperwork

With your new IRA ready and waiting, it’s time to get in touch with your old 401k plan administrator—the company that managed your previous employer's plan. Simply tell them you want to initiate a rollover 401k to an IRA.

They’ll send over the required distribution paperwork. I'll be honest, these forms can be dense with legalese. It often helps to have a resource for [understanding legal documents in plain-English](https://legaldocumentsimplifier.com/blog/understanding-legal-documents) to make sure you're clear on every detail.

When you fill out the forms, there's one option you absolutely want to select: a direct rollover.

This is the cleanest, safest way to move your money. Your old 401k provider sends the funds straight to your new IRA provider. The money never touches your personal bank account, which is exactly what you want. It sidesteps tax withholding and other headaches.

The alternative is an indirect rollover, where they cut you a check. This path is full of traps. Your old plan is legally required to withhold 20% for federal taxes, and you only have 60 days to deposit the entire original amount into your new IRA. That means you'd have to come up with that missing 20% out of your own pocket to complete the full rollover. If you miss the deadline, the whole distribution could be considered taxable income.

Just stick with the direct rollover. It's the standard for a reason.

This very process is a huge driver of the retirement industry. In 2020 alone, an estimated $595 billion was transferred from employer-sponsored plans into IRAs. It’s a clear sign of just how many people are taking control of their retirement funds this way.

Understanding Rollover Tax Rules

When you're thinking about a rollover 401k to IRA, the tax rules are probably the most intimidating part. Getting it wrong can mean a surprise tax bill you weren't expecting, but once you understand the basic principles, you can move forward with confidence. The key is knowing how the IRS treats different kinds of rollovers.

The most straightforward move is a direct rollover from a Traditional 401(k) to a Traditional IRA. Think of it as moving your money from one tax-deferred bucket to another. Because both accounts are funded with pre-tax dollars, the transfer is a non-taxable event. No taxes, no penalties. Simple.

The Roth Conversion: A Taxable Event

Now, let's talk about moving money from a pre-tax 401(k) into a post-tax Roth IRA. This isn't just a simple transfer; it's what's known as a Roth conversion, and this is a taxable event. The full amount you convert gets added to your ordinary income for the year, and you'll pay taxes on it at your current rate.

So, why on earth would you willingly pay taxes sooner rather than later? The big payoff comes down the road. Once that money is inside a Roth IRA, it grows completely tax-free. And when you take qualified withdrawals in retirement, they are 100% tax-free. This is an incredibly powerful move if you expect to be in a higher tax bracket in the future. To get the most from your IRA, it's also smart to look into different strategies for minimizing investment taxes.

Demystifying the Pro-Rata Rule

What happens if your 401(k) is a mix of both pre-tax and after-tax (Roth) money? This is where a tricky little regulation called the pro-rata rule can trip people up. If you try to roll over only a part of these mixed funds, the IRS won't let you pick and choose. They'll treat the money you move as a proportional blend of pre-tax and after-tax dollars.

Here's a real-world example: Let's say your 401(k) has a balance of $100,000. Of that, $80,000 is pre-tax and $20,000 is after-tax. If you decide to roll over $50,000, you can't just tell the IRS it was all pre-tax money. They'll see that withdrawal as 80% pre-tax ($40,000) and 20% after-tax ($10,000), which can make your tax filing a bit more complicated.

A Rollover Is Not a Contribution

This is a point of confusion I see all the time, so let’s clear it up: a rollover does not count toward your annual IRA contribution limit. It’s a clean no. A rollover is simply a transfer of money you've already saved for retirement. A contribution is new money you're adding for the current year.

This is a critical distinction for your financial planning. For 2025, you can contribute up to $7,000 to an IRA (plus a $1,000 catch-up if you're 50 or older). A rollover lets you move a much larger sum from an old 401(k) without using up that separate $7,000 contribution space. This is precisely what allows you to consolidate your retirement nest egg into an account you control, while still actively saving for the future.

Investing and Managing Your New IRA

So, the rollover is complete and the funds have landed in your new IRA. It’s tempting to breathe a sigh of relief and check this off your to-do list, but the real work—and the real opportunity—is just getting started.

Your rolled-over funds almost always arrive as uninvested cash. Leaving it sitting there is one of the biggest mistakes you can make, as it completely misses the point of investing for retirement: growth. Now’s your chance to build a portfolio that’s truly yours, tailored to your retirement timeline and risk tolerance, not one dictated by a former employer's limited plan options.

Building Your New Investment Portfolio

This is where the freedom of an IRA really shines. You've just traded a handful of mutual fund choices for a vast investment universe. While your old 401(k) probably offered 15-20 funds at most, an IRA opens the door to a much wider world of assets. It’s worth taking the time to explore different IRA options to see what aligns best with your long-term vision.

You can now build a portfolio with a diverse mix of investments, such as:

Exchange-Traded Funds (ETFs): These are my go-to for instant, low-cost diversification. You can buy an ETF that tracks the entire S&P 500, a specific sector like technology, or even commodities.

Individual Stocks: For those who enjoy research and want to own a piece of specific companies you believe in, an IRA gives you the freedom to buy individual shares.

Bonds: To introduce a layer of stability and predictable income, you can now purchase individual government or corporate bonds—something rarely available in a typical 401(k).

The key is to create an asset mix that matches your strategy, whether you're aiming for aggressive growth, a steady stream of income, or simply preserving your capital.

I see this all the time: investors get hit with "analysis paralysis." Faced with so many new choices, they get overwhelmed and do nothing. The best advice I can give is to start simple. Define your goals, build a basic, diversified portfolio, and get your money invested. You can always fine-tune it later, but time in the market is critical.

Essential Ongoing IRA Management

Your new IRA isn't something you can just set and forget. To keep it on track and working for you, a little bit of regular maintenance is required. Think of it like a car—it needs occasional check-ups to run smoothly.

First, and this is non-negotiable, designate your beneficiaries. It's one of the most crucial steps you'll take. By clearly naming who inherits the account, you ensure your hard-earned assets pass to your loved ones without getting tied up in probate court or creating unnecessary legal headaches.

Next, get into the habit of rebalancing your portfolio. Over time, your best-performing assets will naturally grow to become a larger slice of your portfolio pie. This can unintentionally increase your risk exposure. Rebalancing, usually done once a year, is just the simple process of selling a bit of what's done well and buying more of what's lagged to get back to your target asset allocation.

Finally, make it a point to review your entire strategy at least once a year. Life happens—you might get a new job, get married, or simply decide you want to retire earlier. Your investment plan needs to be flexible enough to adapt right along with you.

Answering Your Top Rollover Questions

Even with a solid plan, you’re bound to have questions pop up once you start the actual rollover 401k to IRA process. That’s perfectly normal. I've walked countless clients through this, so let's clear up some of the most common questions I hear to make sure your rollover goes off without a hitch.

How Long Does a Rollover Actually Take?

This is usually the first thing people ask. The speed of the process really depends on which method you choose.

If you go with a direct rollover—where your old 401(k) administrator sends the money straight to your new IRA provider—you're looking at a timeline of about 7-10 business days. It's clean, simple, and the money never touches your hands.

An indirect rollover can feel faster at first because you get a check in hand quickly. But then the clock starts ticking on that nerve-wracking 60-day deadline to get the money into your new IRA.

Can I Roll Over My 401(k) If I Still Work There?

This is a big one. Generally, the answer is no. Most 401(k) plans don't allow "in-service" rollovers while you're still an active employee.

There are some exceptions, though. Some plans will let you do it once you hit age 59 ½. The only way to know for sure is to check your plan’s specific rules or talk directly to your HR department or plan administrator. They have the final say.

What Happens If I Miss the 60-Day Rollover Deadline?

Going the indirect route and missing that 60-day window can be a costly mistake. This isn't a soft deadline; the consequences are serious.

If you don't deposit the full amount within 60 days, the IRS treats the entire distribution as a taxable event. It gets added to your ordinary income for the year, and if you’re under age 59 ½, you’ll get hit with an additional 10% early withdrawal penalty.

The IRS is very strict about this rule and rarely grants waivers. This is precisely why most financial experts, myself included, strongly recommend a direct rollover. It completely eliminates the risk of missing the deadline.

Do I Have to Report My Rollover on My Taxes?

Yes, even though a direct rollover isn't a taxable event, you still have to report it to the IRS. Think of it as telling the IRS, "Hey, I moved my retirement money, but I did it the right way, so no tax is due."

It's a straightforward process based on a couple of forms you'll receive in the mail:

Form 1099-R: Your old 401(k) provider sends this to show the money that was distributed from your account.

Form 5498: Your new IRA provider sends this to confirm they received the rollover contribution.

When you file your taxes, you'll use the information from these forms to show the IRS it was a legitimate rollover. This is a simple but critical step to keep your financial records clean and avoid any potential tax headaches down the road.

At America First Financial, we believe in providing clear, straightforward protection for your family's future, free from outside agendas. Our commitment is to your financial security and peace of mind. To see how our insurance and annuity products can fit into your long-term retirement strategy, get a personalized quote in under three minutes today at https://www.americafirstfinancial.org.

_edited.png)

Comments