Your Guide to Essential Financial Planning Steps

- dustinjohnson5

- Jul 9, 2025

- 16 min read

Before you can even think about where you’re going, you have to know exactly where you’re standing. That’s the core of any good financial plan. It’s not about wishful thinking; it’s about starting with a brutally honest look at your money today. This first step sets the stage for everything else.

Where Are You Now? Building Your Financial Foundation

Think of it like getting a "You Are Here" marker on a map. Without that starting point, any financial goals or budgets you dream up are just shots in the dark. A strong financial future is built on a solid grasp of some basic personal finance principles, and that begins with understanding your own numbers.

This initial self-assessment gives you the context for every decision you’ll make down the road. It’s about more than just crunching numbers—it’s about gaining real clarity on your relationship with money.

H3: The Great Financial Document Hunt

Your first move is to gather all the important paperwork. It’s time to play detective and round up the evidence of your financial life. Don't judge what you find just yet; simply collect it.

You'll want to track down:

Income records: Grab recent pay stubs, W-2s, and any proof of income from side gigs or other sources.

Debt statements: Find the latest statements for your mortgage, car loans, student loans, and credit cards.

Asset information: Pull up the balances for your checking, savings, retirement (like a 401(k) or IRA), and any investment accounts. You'll also need a rough estimate of what major assets like your home or car are worth.

Monthly bills: Round up your utility bills, insurance premiums, streaming subscriptions, and other regular expenses.

Having all this in one place makes the next steps infinitely easier and more accurate. It stops you from guessing and ensures your plan is built on facts, not fiction.

H3: Your Personal Financial Snapshot

With your documents in hand, you’re ready to create a personal balance sheet. This is a simple but incredibly powerful tool that gives you a clear snapshot of your net worth.

Calculating it is straightforward: subtract your liabilities (everything you owe) from your assets (everything you own).

This exercise can be a real eye-opener. For many people I've worked with, it's the very first time they've seen their entire financial picture in one place. It immediately shows you what's working—like a healthy retirement fund—and what needs work, like that high-interest credit card debt.

A financial plan is a road map that shows us where we are and where we want to go. The process of creating this map forces us to be honest about our current situation and intentional about our future.

Gaining this kind of clarity is empowering. It turns that vague, nagging feeling of financial stress into a concrete list of things you can actually tackle and improve.

Your Financial Snapshot Worksheet

Use this simple worksheet to get a clear, honest picture of where you stand financially. List your assets (what you own) and liabilities (what you owe) to calculate your net worth.

Category | Item (Example) | Estimated Value / Balance |

|---|---|---|

Assets | ||

Cash | Checking Account | $2,500 |

Savings Account | $10,000 | |

Investments | 401(k) Account | $50,000 |

IRA Account | $15,000 | |

Property | Home (Market Value) | $300,000 |

Car (Blue Book Value) | $12,000 | |

Liabilities | ||

Debt | Mortgage Balance | $220,000 |

Student Loan Balance | $25,000 | |

Car Loan Balance | $5,000 | |

Credit Card Balance | $4,000 |

Once you've filled this out, simply subtract your total liabilities from your total assets. The result is your current net worth, your starting line for the journey ahead.

H3: Following the Money: Your Cash Flow

The final piece of the puzzle is figuring out where your money is actually going each month. This isn’t about building a restrictive budget—not yet, anyway. Right now, it's purely about understanding your cash flow.

Just add up all your monthly income and subtract all your monthly expenses. Simple as that.

Is the result positive or negative? A positive number means you have money left over to save and invest. A negative number shows you’re spending more than you earn—a situation you’ll need to fix. This basic calculation reveals your financial momentum and perfectly sets the stage for creating a budget that truly works for you.

Setting Meaningful Goals and Crafting a Budget That Works

Now that you have a clear snapshot of where you stand financially, it's time to give your money a mission. Honestly, without a destination, you’re just wandering. Goals are the "why" behind every dollar you save or invest—they turn abstract numbers into something you can actually get excited about.

But these goals can't be vague wishes like "be rich" or "retire someday." To have any real power, they need to be specific, measurable, and deeply motivating. Think of them as building blocks. Nailing your short-term goals gives you the momentum and the foundation to tackle your bigger, long-term ambitions.

Defining Your Financial Ambitions

The first thing to do is just brainstorm. Seriously, grab a notebook or open a doc and write down everything you want your money to do for you. Don't filter yourself. Maybe you want to obliterate your credit card debt in the next year, save for a down payment on a house in five years, or make sure you can travel the world in retirement. Just get it all out.

Once you have a list, it's time to bring some order to the chaos by sorting your goals into a few key buckets. This simple exercise brings immediate clarity.

Short-Term Goals (1-3 Years): These are your quick wins. Things like building a $1,000 emergency fund, finally paying off that high-interest personal loan, or saving up for a much-needed vacation.

Mid-Term Goals (3-10 Years): These require more sustained effort and planning. This is where you’ll find goals like saving for a down payment on a home, funding a child's education, or launching that side hustle you've been dreaming about.

Long-Term Goals (10+ Years): Here’s where the big picture comes into focus. The most common one is a comfortable retirement, but it could also include buying a vacation property or leaving a meaningful legacy for your family.

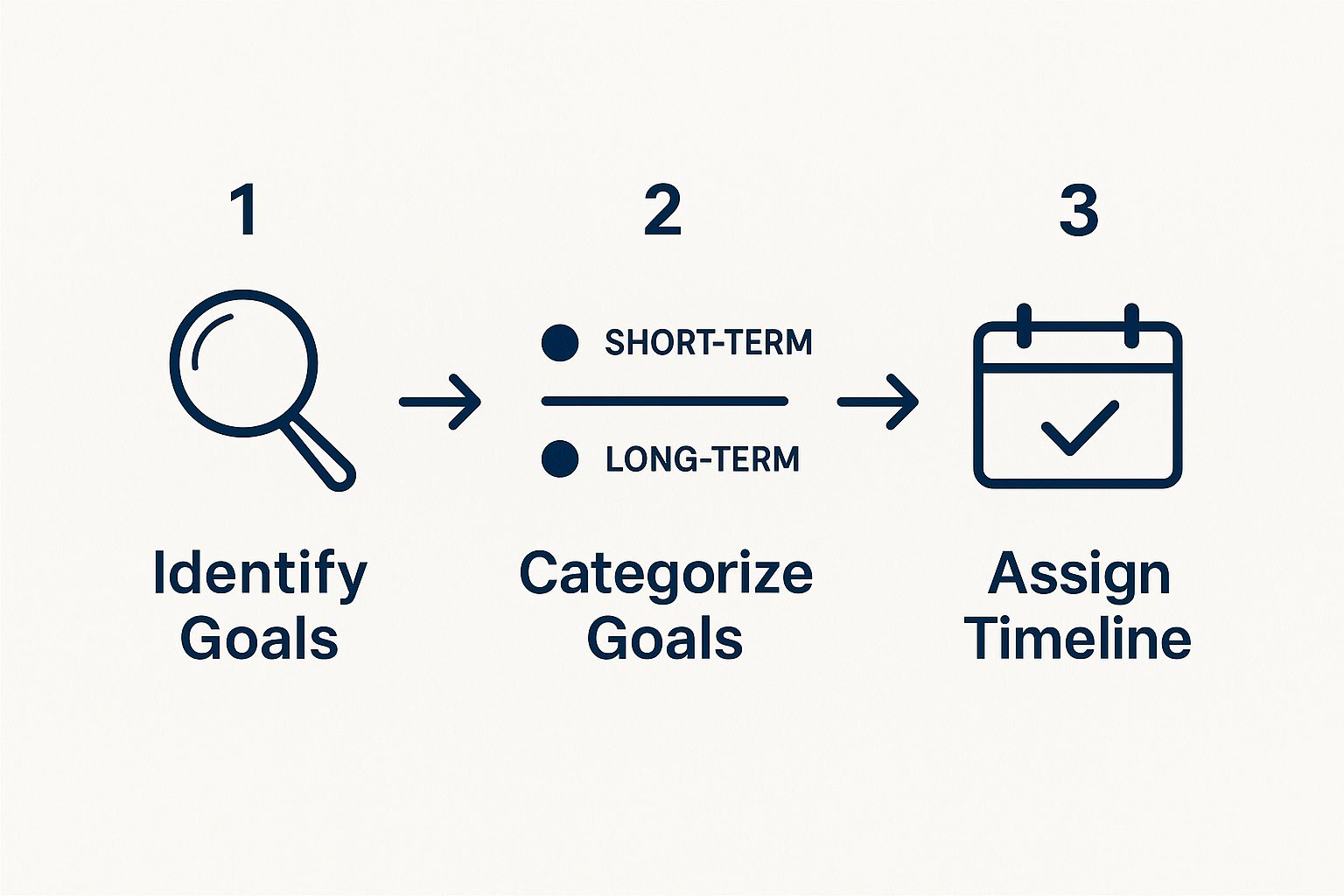

This process—identifying, categorizing, and slapping a timeline on your goals—is the bedrock of any solid financial plan. This infographic really shows how all these pieces fit together to create a roadmap you can actually follow.

Seeing it laid out like this makes it clear that your goals aren't just a random list; they're a structured plan of attack. Every single goal needs a deadline to keep you accountable and moving forward. Now, let's connect these aspirations to your day-to-day financial habits.

Connecting Goals to a Budget That Breathes

A budget is the tool that turns your goals from "someday" into "scheduled." But if the word "budget" makes you cringe, thinking of restrictive spreadsheets that suck all the fun out of life, it's time for a reframe. A good budget isn’t about what you can't have; it's about making sure your money is working toward what you truly want.

The trick is finding a system that actually clicks with your personality. A budget you can’t stick with is worse than having no budget at all.

A budget is telling your money where to go instead of wondering where it went. It’s the single most powerful tool for achieving your financial goals, turning your ambitions from dreams into a concrete plan.

Let's look at two popular and refreshingly flexible methods that have helped millions get a handle on their cash flow without losing their minds.

Flexible Budgeting Methods for Real Life

Forget tracking every single penny if that sounds like a nightmare. The best budget is the one you'll actually use. Here are a couple of my favorite approaches:

1. The 50/30/20 Rule: This is a fantastic starting point because it’s so simple. You just split your after-tax income into three main pots:

50% for Needs: This covers your absolute essentials—housing, utilities, groceries, and getting to work.

30% for Wants: This is your lifestyle fund. Think dining out, hobbies, streaming services, and vacations. It’s the fun stuff.

20% for Savings & Debt Repayment: This is the powerhouse category. This chunk goes directly toward hitting your financial goals, whether that's building your emergency fund, attacking debt, or investing for the future.

2. Zero-Based Budgeting: This one is more hands-on, but it gives you an incredible amount of control. The idea is simple: Income - Expenses = Zero. You give every single dollar you earn a specific job, whether that's paying a bill, going into savings, or being set aside for spending.

For instance, if your take-home pay is $4,000, you'll map out where every one of those dollars is going until you're back at zero. It forces you to be incredibly intentional and is amazing for finding those little money leaks you never knew you had.

Whichever method you lean toward, the objective is the same: create a system that aligns your daily spending with your long-term vision. Forging this connection is one of the most powerful steps in financial planning, creating a direct link between what you do today and the security you'll have tomorrow.

Make Your Money Work: Crafting a Smart Investment Strategy

You’ve set your goals and have a budget telling your money where to go. You've built the launchpad. Now it’s time for liftoff—putting your money to work so it can start growing for you. This is where investing comes in, the step that truly shifts you from being a saver to a wealth-builder.

Let's be honest, investing can feel intimidating. It’s a world filled with confusing jargon and charts that look like heart monitors. But at its core, investing is simply buying assets that have the potential to earn more money. It’s the engine that will power you toward long-term goals like retirement far faster than any savings account ever could.

First, Know Your Investor DNA

Before you even think about putting a dollar into the market, you need to understand your personal risk tolerance. This is your gut-level ability to handle the market's inevitable ups and downs without hitting the panic button. Would a 10% drop in your portfolio have you losing sleep, or would you see it as a chance to buy more at a discount?

Your risk tolerance isn't just a random feeling; it's shaped by a few key things:

Your Time Horizon: If you’re investing for retirement that's 30 years away, you have plenty of time to ride out market volatility. But if you need that cash for a house down payment in three years, you can't afford to take the same chances. Time is your best friend here.

Your Financial Foundation: A stable job and a fully funded emergency fund give you the security to weather market storms. If your income is less predictable, you’ll naturally want to be more cautious.

Your Comfort Zone: This part is purely psychological. You need a strategy that lets you sleep at night. Being honest with yourself about this is absolutely critical for staying the course long-term.

Knowing your investor DNA helps you pick investments that feel right for you, which is the key to avoiding emotional, knee-jerk decisions when things get rocky.

The Two Pillars: Compounding and Diversification

Two incredibly powerful concepts will do most of the heavy lifting on your investment journey: compound growth and diversification. Getting your head around these is one of the most empowering things you can do for your financial future.

Compound growth is what Albert Einstein supposedly called the "eighth wonder of the world." It’s your investment returns generating their own returns. Picture a small snowball rolling downhill—it starts small but gradually picks up more snow, growing bigger and faster. A modest but consistent investment today can snowball into a massive sum over the decades. That's compounding in action.

Diversification is the age-old wisdom of not putting all your eggs in one basket. By spreading your money across different types of investments (like stocks and bonds) and various industries, you lower your overall risk. If one part of your portfolio has a bad year, the others can help pick up the slack.

A well-diversified portfolio is your best defense against market volatility. It’s designed to ensure that the poor performance of any single investment doesn’t wreck your entire financial plan, providing stability and peace of mind.

These two principles work hand-in-hand to grow your wealth steadily while keeping risk in check. They are the bedrock of any successful long-term investment plan.

Picking the Right Tools for the Job

With those core principles in mind, it's time to look at the actual investment vehicles you'll use to build your portfolio. While the options are vast, most people build their wealth using a mix of these common tools:

Stocks: Owning a stock means you own a tiny piece of a company. They offer the highest potential for long-term growth but also come with the most volatility.

Bonds: When you buy a bond, you're lending money to a government or corporation. In return, they pay you interest. Bonds are generally safer than stocks and provide a more stable, predictable income stream.

ETFs and Mutual Funds: Think of these as pre-packaged baskets of investments. For instance, buying one share of an S&P 500 ETF instantly gives you a stake in 500 of the largest U.S. companies. They are a fantastic, low-cost way to achieve instant diversification, especially for new investors.

As you build your strategy, learning to interpret what the pros are saying can be a huge advantage. Taking the time for understanding stock analyst ratings can give you a much better feel for how individual assets are valued in the market.

A huge external factor you can't ignore is inflation—the silent thief that erodes your money's buying power. Your investments must grow faster than inflation just to break even. This is a top concern for many right now, with 51% of U.S. adults expecting inflation to climb higher. In fact, 52% feel their income is falling behind the cost of living, making it a major roadblock to their financial goals.

The right mix of these assets, your asset allocation, all comes back to your risk tolerance and timeline. A younger investor might have a portfolio that’s 80% stocks and 20% bonds. Someone closer to retirement might flip that ratio completely. Getting this allocation right is probably the single biggest factor in how your portfolio performs over time.

Protecting Your Wealth and Managing Financial Risks

It’s easy to focus on the exciting parts of finance—watching your investments grow and hitting savings goals. But building wealth is only half the battle. The other, arguably more critical half, is protecting what you’ve built.

A solid financial plan needs a strong defense. Without it, a single unexpected event, like a medical emergency or a sudden job loss, can unravel years of careful planning. This is where risk management comes in, and frankly, it's what lets you sleep at night.

Building Your Financial Safety Net

Your first line of defense is always a well-stocked emergency fund. Think of it as your personal financial shock absorber, ready to cushion the blow from life's unwelcome surprises.

This isn't your investment money or vacation fund. This is the cash that keeps you from raiding your 401(k) or racking up credit card debt when the car breaks down or you're hit with an unexpected medical bill. The classic rule of thumb is to save three to six months' worth of essential living expenses. That means covering the absolute necessities: rent or mortgage, utilities, groceries, transportation, and insurance premiums.

So, where do you keep it? The answer is simple: somewhere safe and accessible. A high-yield savings account is perfect for this. It keeps your money liquid while earning you a bit more interest than a standard checking account, ensuring your cash is ready the moment you need it.

The Role of Insurance in Your Plan

Once your cash buffer is in place, insurance becomes the next layer of your financial fortress. It’s a straightforward trade: you pay a predictable premium to an insurance company, and they agree to shoulder the financial fallout from an unpredictable and potentially devastating event.

The world of insurance can feel like a maze of policies and fine print, but a few key types of coverage are non-negotiable for most people. They are the core pillars of your defensive strategy. Understanding them is a critical part of making your financial plan resilient enough to handle real-world challenges.

Essential Coverage to Protect Your Assets

Everyone's situation is different, but four types of insurance form the bedrock of a secure financial life. Lacking any one of them can leave a massive gap in your defenses.

Health Insurance: In the U.S., medical bills are a notorious cause of bankruptcy. This makes health insurance an absolute must. It shields you from the crippling costs of healthcare, whether it's for a routine check-up or a major surgery.

Life Insurance: If anyone relies on your income—a partner, children, or even aging parents—you need life insurance. It's not for you; it's for them. It provides a financial lifeline to cover the mortgage, daily bills, and future goals like college if you're no longer around. For most families, term life insurance is a refreshingly affordable and straightforward choice.

Disability Insurance: Your ability to earn an income is your most valuable asset, hands down. Disability insurance protects it. If an illness or injury prevents you from working, this policy replaces a portion of your paycheck, making sure you can still pay your bills and live your life.

Property & Casualty Insurance: This is a broad category that covers your physical stuff, primarily through auto insurance and homeowners or renters insurance. A major car wreck or a fire in your apartment can create enormous financial liability and personal loss. Proper coverage turns a potential disaster into a manageable problem.

Thinking about risk shouldn't stop at just insurance. Managing Investment Risk: Your Guide to Smarter Protection is just as vital for safeguarding your portfolio from market volatility and other threats to your long-term growth.

Reviewing your policies annually is a smart habit. Life changes—a new job, a growing family, a home purchase—and your coverage should change with it. Taking the time to manage these risks is what separates a fragile plan from one that can truly stand the test of time.

Planning for Retirement and Your Lasting Legacy

It’s easy to get caught up in saving for a new car or a down payment—goals you can see and touch. But the real game-changer, the ultimate step in your financial plan, is securing your future decades from now. This is where retirement and estate planning come in. They might feel a long way off, but the choices you make today will define the life you lead later on.

This isn't just about stashing cash away. It's about building genuine, lasting financial freedom. That means creating a forward-thinking strategy to grow your wealth in a smart, structured way and making sure your wishes are respected, no matter what happens down the road.

Supercharge Your Retirement Savings

The path to a comfortable retirement is paved with special investment accounts that offer a massive advantage: taxes. These accounts are designed to help your money grow far faster than it ever could in a regular savings or brokerage account.

You've probably heard of the most common ones:

401(k) Plans: If your employer offers one, this is your starting line. The magic here is the employer match. Think about it—if your company matches your contributions, you're getting an immediate 100% return on that money. It's free money. Don't ever leave it on the table.

Individual Retirement Accounts (IRAs): Whether you have a 401(k) or not, an IRA (like a Traditional or Roth) is a fantastic tool. You open it yourself, which gives you a much wider world of investment options to choose from. They're the perfect supplement to a workplace plan or a great primary vehicle if you're self-employed.

Making the most of these accounts is one of the smartest financial moves you can make. At the absolute minimum, contribute enough to get your full employer match. From there, try to nudge your contribution up by a percentage point or two every year. You'll be surprised how quickly it adds up.

How Much Is Enough for Retirement?

Trying to nail down your "retirement number" can feel daunting, but a simple guideline can get you in the ballpark. A great rule of thumb that I often share with clients is the 4% Rule. It suggests you can safely withdraw 4% of your total nest egg in your first year of retirement and then adjust that amount for inflation in the years that follow.

Want to work backward? Just decide on your ideal annual income in retirement and divide it by 0.04. For instance, if you picture yourself needing $80,000 a year to live comfortably, your target nest egg would be $2,000,000 ($80,000 / 0.04). Suddenly, you have a concrete goal to aim for.

A retirement plan isn’t just about having enough money to stop working. It’s about having the financial freedom to live life on your own terms, with security and peace of mind.

Of course, this is a starting point, not a hard-and-fast rule. Your personal number will shift based on the lifestyle you want, your health, and other income you might have, like Social Security. But having a tangible target makes saving feel real and keeps you motivated.

Creating Your Lasting Legacy

Estate planning isn't something reserved for the ultra-wealthy. It's a core responsibility for every single adult. It’s simply the process of deciding how your assets should be handled and distributed if you pass away or become unable to make your own decisions. Without a plan, you're leaving those intensely personal choices in the hands of courts and state laws.

At a minimum, every adult should have these key documents in place:

A Will: This is where you state who gets what and, crucially, name a guardian for any minor children.

Power of Attorney: This document gives someone you trust the authority to make financial decisions for you if you become incapacitated.

Healthcare Directive: Also known as a living will, this outlines your wishes for medical care if you can't communicate them yourself.

Getting these documents sorted out is a gift to your loved ones. It gives them clarity and a roadmap during what will already be an incredibly difficult time.

As you look to the long term, you also have to keep an eye on the wider economic environment. For example, tax policy is always in flux and can have a huge impact on your wealth. The 2025 financial outlook suggests some major tax policy shifts could be coming, which means building flexibility into your strategy is more important than ever to protect what you’ve built.

Don't Just Set It and Forget It: Why Your Financial Plan Needs Regular Tune-Ups

You wouldn't drive your car for years without a single oil change or tune-up, right? Your financial plan deserves the same attention. It’s not a dusty document you create once and then shove in a drawer. Think of it as a living, breathing guide for your financial life—one that needs to adapt right along with you.

Life has a way of throwing curveballs and opportunities at us. A promotion, a new baby, a wedding, or even a move to a new city can completely change your financial picture. Each of these moments is a signal—a flashing light on your dashboard—telling you it's time to pull out your plan and make sure it still fits your new reality.

The Annual Financial Checkup: Your Roadmap to Success

Even if your year was relatively quiet, blocking off time for an annual financial review is one of the smartest money habits you can build. This is your dedicated time to see how you’re doing, catch small issues before they become big headaches, and make sure your strategy is still pointing you toward your goals.

So, what should you actually look at during this check-in? It doesn't have to be an overwhelming audit. A simple, focused review will do the trick.

Here’s a practical checklist to get you started:

Your Budget vs. Your Bank Statements: How did your spending actually stack up against your budget? Be honest. If you consistently blew past your dining-out budget, maybe it's time to adjust that number to something more realistic. The goal isn't to feel guilty; it's to create a plan that works in the real world.

Your Investment Health: Take a look at your portfolio's performance. More importantly, ask yourself if your risk tolerance has changed. Are your investments still properly diversified, or has market movement thrown your asset allocation out of whack? This is the perfect time to rebalance and get things back in line with your long-term strategy.

Your Safety Net (Insurance): Did your insurance needs change this year? If you welcomed a new child, you almost certainly need more life insurance. If you paid off your mortgage, you might be able to adjust your coverage. Don't pay for protection you no longer need, and don't leave your family exposed.

Your Progress on Goals: Are you still on track to hit that down payment goal or retire on time? Take a moment to celebrate the milestones you've achieved! If you've fallen a bit behind, now is the time to figure out why and adjust your savings or investment contributions to get back on course.

Your financial plan should be a trusted guide, not a rigid set of rules. Regular reviews transform it from a document into a dynamic tool that reliably steers you toward your aspirations, no matter what twists and turns life throws your way.

Treating your plan as an active part of your financial life is what makes it powerful. This is how you build a reliable roadmap you can truly count on for the journey ahead.

At America First Financial, we believe in protecting your family's future with financial solutions that align with your values. Secure your legacy with insurance options free from political agendas. Get your fast, no-hassle quote today.

_edited.png)

Comments