Your Guide to Off Exchange Health Insurance

- dustinjohnson5

- Jul 5, 2025

- 16 min read

When you're shopping for health insurance on your own, you'll hear two terms pop up constantly: "on-exchange" and "off-exchange." It sounds complicated, but the concept is actually pretty simple.

Off-exchange health insurance just means you're buying a health plan directly from an insurance company or a licensed broker, instead of going through a government marketplace like HealthCare.gov.

Think of it like buying a plane ticket. You can go to a travel aggregator site (the marketplace) that shows you flights from multiple airlines, often with special deals. Or, you can go directly to a specific airline's website (off-exchange) to see everything they offer, including flights that might not be on the aggregator site.

Understanding Off Exchange Health Insurance

A common myth is that off-exchange plans are somehow inferior or less regulated. That's just not true. In reality, off-exchange plans must follow the same core rules laid out by the Affordable Care Act (ACA). They're legitimate, comprehensive health plans.

This means they have to provide the same level of fundamental coverage and consumer protections as any plan you'd find on the official marketplace.

Both on-exchange and off-exchange plans must cover the 10 Essential Health Benefits. This is non-negotiable and includes things like emergency care, hospitalization, prescription drugs, and preventive services.

These plans are a crucial piece of the health coverage puzzle. The global insurance market has seen significant growth, expanding by 8.6%, and choices like off-exchange plans play a big part in giving consumers more control. You can dig into the full report on the global insurance market's growth here. They’re particularly important for people who don't qualify for government subsidies or who care more about specific benefits than getting a discount.

Why Do Off Exchange Plans Even Exist?

If the plans have to follow the same basic rules, why have a separate way to buy them? It all comes down to flexibility and choice—for both you and the insurance companies.

Insurers don't always list every single one of their plans on the government marketplaces. They often create specific plans designed for the off-exchange market to appeal to shoppers who aren't looking for subsidies. These are typically individuals and families whose income is too high to qualify for financial help.

For them, the main question isn't "How much can I save?" but rather, "Which plan has the best network of doctors and overall value for my family?"

This gives you two distinct paths for buying health insurance:

On-Exchange: Using a government marketplace (HealthCare.gov or a state-run site) to access financial help.

Off-Exchange: Shopping directly with an insurer or broker, which can sometimes open up a wider selection of plans, but without any financial aid.

Off Exchange vs On Exchange At a Glance

Here’s a quick table to make the core differences crystal clear.

Feature | Off Exchange Plans | On Exchange (Marketplace) Plans |

|---|---|---|

How You Buy | Directly from an insurer or through a licensed broker. | Through government websites like HealthCare.gov or state-run marketplaces. |

Financial Assistance | No subsidies or tax credits are available. You pay the full price. | Yes, premium tax credits and cost-sharing reductions are available if you qualify. |

Plan Selection | Can include a wider variety of plans, some not listed on the marketplace. | A curated selection of plans that meet specific marketplace requirements. |

Who It's For | People who know they do not qualify for income-based subsidies. | People who do qualify for subsidies and want to lower their monthly costs. |

Ultimately, choosing an off-exchange plan is a strategic move. It really only makes sense for people who are certain their income is too high for government assistance and want to see every possible plan available to them.

Marketplace vs. Off-Exchange Plan Comparison

Choosing between a marketplace health plan and an off-exchange one can feel a lot like buying a car. Think of the government marketplace as a giant, centralized dealership. Every car on the lot has to meet certain government standards, and you might qualify for a big factory rebate (a subsidy) that makes your purchase much more affordable.

On the other hand, buying an off-exchange health insurance plan is like going straight to a specific car brand's private showroom. You might discover premium models or special packages you couldn't find at the main dealership, but you'll be paying the full sticker price. There are no rebates here.

The whole decision really boils down to one simple question: do you qualify for financial assistance? If your income makes you eligible for subsidies, the marketplace is almost always going to be your best bet financially. But if you have a higher income, shopping off-exchange can open up a whole new set of possibilities.

The Deciding Factor: Cost and Subsidies

The single biggest difference between buying on-exchange versus off-exchange is access to financial help. Government subsidies, specifically Premium Tax Credits (PTCs) and Cost-Sharing Reductions (CSRs), are only available for plans you buy through the official ACA marketplace.

These subsidies aren't just a few dollars, either. A PTC directly slashes your monthly premium, while CSRs lower your out-of-pocket costs like deductibles and copays when you actually use your insurance. If you qualify for this help, picking an off-exchange plan means you’re knowingly walking away from hundreds, or even thousands, of dollars in savings each year.

But what if your income is too high? If your household earns more than the subsidy threshold (typically 400% of the Federal Poverty Level), the price you see on the marketplace is the full, unsubsidized cost. That’s the exact same price you’d pay for the very same plan if you bought it directly from the insurer. This is where the playing field levels out, and your focus can shift from pure cost to the actual features of the plan.

For individuals and families who earn too much for financial aid, the real reason to look at the off-exchange market isn't to find a cheaper plan. It’s to find a plan that offers better value through a wider choice of doctors or more robust benefits.

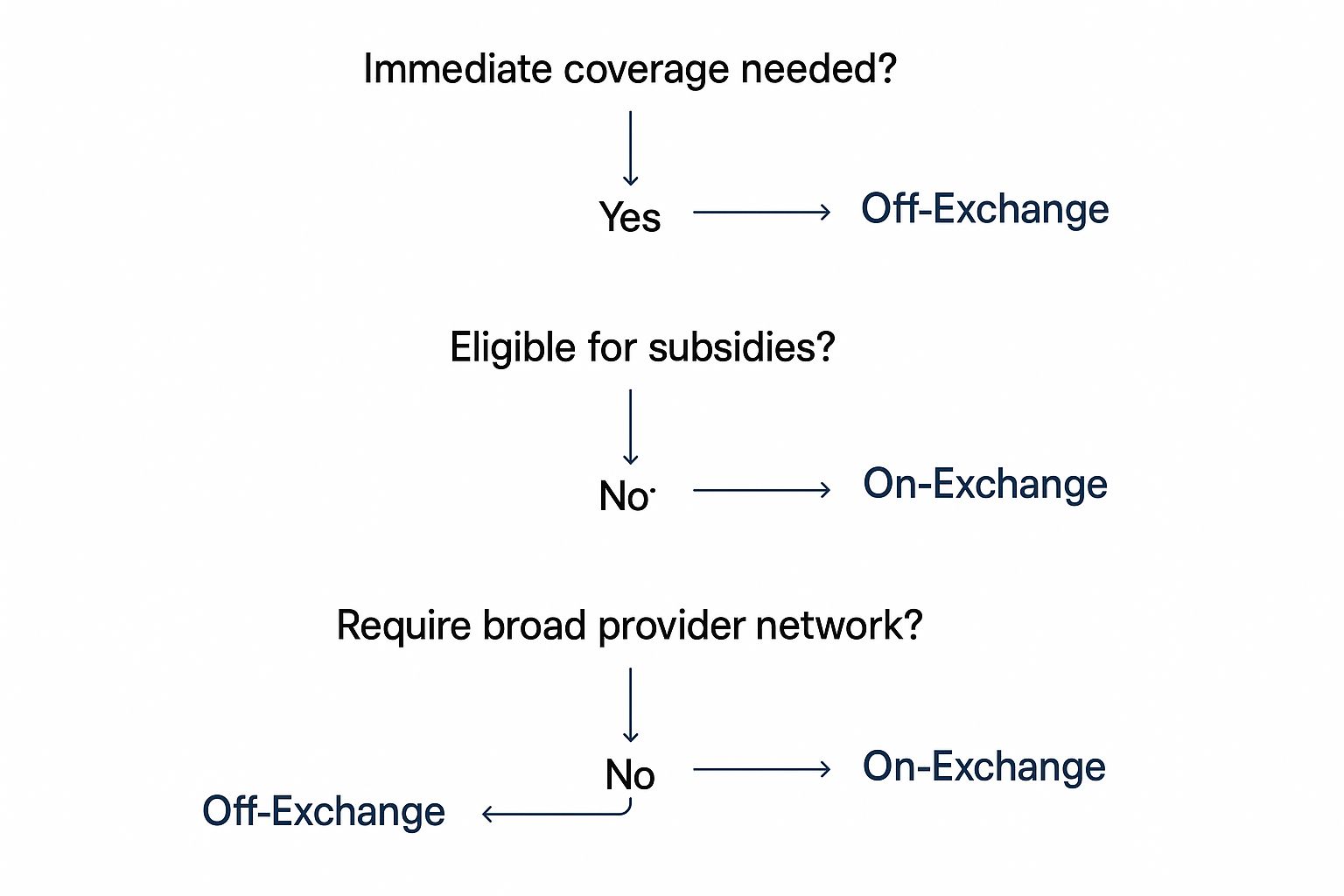

This decision tree gives you a quick visual on how to think through your options.

As the chart makes clear, that first question about subsidies is the critical fork in the road that directs you toward the best path for your situation.

Plan Variety and Provider Networks

While the marketplace wins on subsidies, the off-exchange world often wins on variety. Insurance companies don't always put their full lineup of plans on the government exchange. They frequently keep certain plans, often with more attractive features, exclusively for the direct-to-consumer, off-exchange market.

So, what does that mean for you in practical terms?

More Plan Designs: You can find plans with different benefit structures or cost-sharing setups that simply aren't an option on the marketplace.

Wider Provider Networks: This is a huge deal for many people. Insurers often sell off-exchange plans with broad PPO (Preferred Provider Organization) networks. These give you the freedom to see more doctors and specialists without needing a referral. In contrast, to keep premiums low, many marketplace plans use more restrictive HMO (Health Maintenance Organization) or EPO (Exclusive Provider Organization) networks.

Let’s say you have a trusted specialist you’ve been seeing for years. If that doctor isn’t part of any network on your local marketplace, your top priority might be finding an off-exchange plan that includes them. In that case, shopping direct is the obvious move.

Comparing the Shopping Experience

Finally, let's talk about the actual process of buying a plan. The on-exchange experience is built to be a one-stop shop. You visit one website, like HealthCare.gov, fill out one application, and see all your plan options and subsidy information neatly laid out in one place.

Shopping for an off-exchange health insurance plan is a bit more fragmented. You generally have two ways to go about it:

Go Directly to Insurers: This means visiting the websites of individual insurance companies like Blue Cross Blue Shield, UnitedHealthcare, or Cigna one by one to see what they offer and compare them yourself.

Work with a Broker: A licensed health insurance broker is an expert who can show you plans from multiple insurance carriers, both on and off the exchange. They provide personalized advice and can help you navigate the fine print, all at no extra cost to you.

If you enjoy doing your own deep-dive research, going directly to insurers can work just fine. For most people, though, a good broker makes the process much simpler. They act as your personal guide, helping you cut through the confusion and find a plan that genuinely fits your life and health needs.

The Pros and Cons of Buying Off-Exchange

Deciding between an on-exchange and an off-exchange health insurance plan really comes down to weighing what you gain against what you give up. It’s not just about the monthly premium; it's about the bigger picture—what makes the most sense for your health, your doctor preferences, and your wallet.

To make the right call, you need a clear, balanced look at the trade-offs. Let's break down the real-world advantages and disadvantages of going directly to an insurer or broker.

The Advantages of Off-Exchange Health Insurance

The biggest draw for shopping off-exchange is simple: more choice. Insurance companies often have a whole portfolio of plans they don't list on the government marketplace. This means you might find options that are a much better fit for you and your family.

This expanded menu of plans can be a game-changer. You could find coverage with benefits that perfectly match your needs, instead of being limited to the standardized plans on the exchange.

Another huge benefit is the potential for better provider networks. Off-exchange plans are more likely to offer PPO networks, which give you the freedom to see specialists without a referral and choose from a wider list of doctors. If keeping your trusted doctor is non-negotiable and they aren't in any marketplace networks, shopping off-exchange might be your only viable path.

Here’s a quick rundown of the main upsides:

Wider Plan Selection: You see an insurer's entire catalog, not just the curated list they put on the public exchange.

More Network Flexibility: You'll find more plans with broad PPO networks, giving you more freedom to choose your doctors and hospitals.

A Direct Relationship: You work directly with the insurance company or a dedicated broker, which can sometimes make getting answers or resolving issues a bit more straightforward.

For anyone who prioritizes having the most options and flexibility, the off-exchange market is definitely worth exploring.

The real reason to shop off-exchange isn't to find a "cheaper" plan, but to find a "better" one. If you know you don't qualify for subsidies, the goal isn't about chasing discounts—it's about getting the absolute best coverage and network access for your money.

The Disadvantages of Off-Exchange Health Insurance

Now for the other side of the coin. The single biggest drawback of buying off-exchange is a financial one: you get no access to government subsidies. Period.

If your income makes you eligible for Premium Tax Credits or Cost-Sharing Reductions, you’re walking away from that financial help by buying off-exchange. For many families, this assistance is substantial, often amounting to thousands of dollars in savings over the course of a year.

On top of that, the shopping process itself can feel a bit more disjointed. Instead of one website that lays everything out for you, you have to do the legwork yourself by visiting multiple insurer websites or working with a broker. While a good broker can make this much easier, it’s not the one-stop-shop experience you get with the federal or state marketplace.

The primary downsides include:

No Financial Assistance: You pay 100% of the premium yourself, with no help from income-based tax credits or other subsidies.

A More Fragmented Shopping Experience: Comparing plans takes more effort because you’re pulling information from different sources instead of a single, centralized website.

Potential for Confusion: Without the standardized "metal level" framework of the marketplace, making a true apples-to-apples comparison between plans from different companies can sometimes be tricky.

Weighing Your Options: The Trade-Offs of Off-Exchange Plans

Choosing an off-exchange plan involves a clear trade-off between choice and cost. Here’s a side-by-side look at what you’re weighing.

Potential Advantages | Potential Disadvantages |

|---|---|

Greater Plan Variety: Access to plans not sold on the marketplace. | No Subsidies: You forfeit all eligibility for Premium Tax Credits. |

Broader Doctor Networks: More likely to find PPO plans with more choice. | No Cost-Sharing Reductions: You miss out on lower deductibles and copays. |

Direct Insurer/Broker Relationship: A single point of contact for service. | More Complex Shopping: Requires comparing plans across multiple websites. |

Potentially Better "Fit": Can find unique benefits for specific needs. | Full Price Premiums: You are responsible for the entire monthly cost. |

Ultimately, it comes down to your personal bottom line. If you know for certain that you won't qualify for financial aid, the expanded options off-exchange are a powerful advantage. For almost everyone else, the subsidies available on the marketplace are simply too valuable to pass up.

Ready to find an off-exchange health plan? While it might sound a little intimidating, the process is actually pretty straightforward once you know the steps. This path is really for people who are confident they won't qualify for financial help from the government.

Before you even think about shopping, do this one crucial thing first: confirm you are not eligible for subsidies. Seriously, there’s no sense in going down the off-exchange road if you’re leaving money on the table. You can pop over to the official HealthCare.gov subsidy calculator for a quick check. If your income is above the threshold for a subsidy, then you're good to go.

Once you’re sure, you have a couple of main ways to find an off-exchange plan.

Step 1: Choose How You Want to Shop

Your first big decision is how you'll search for your options. Think about how much you like doing your own research versus getting some expert help.

Go Directly to the Insurance Carriers: You can hop onto the websites of individual insurance companies—think Blue Cross, UnitedHealthcare, Cigna, and others. This gives you a direct look at their full menu of plans, but it’s on you to gather all the details and line them up for comparison.

Work With a Licensed Insurance Broker: This is often the most efficient route. A broker is an independent pro who can lay out plans from several different carriers all at once. The best part? Their help is at no extra cost to you, because they’re paid by the insurance companies.

Think of a good broker as your personal guide to the health insurance maze. They can help you cut through the noise and find a plan that actually fits your health needs and your wallet.

Step 2: Compare Your Top Plan Choices

Okay, you’ve got a few plans in your sights. Now it's time to dig deeper than just the monthly premium. A cheap premium can sometimes hide steep out-of-pocket costs, so you need to compare apples to apples to find the real value.

Zero in on these three things:

Your Total Potential Costs: Look at the deductible, copays, coinsurance, and that all-important out-of-pocket maximum. This gives you the full picture of your financial exposure if you get sick or injured.

The Doctor Network: This is a big one. Check if your must-have doctors, specialists, and hospitals are in the plan’s network. For many people, keeping their trusted providers is the main reason to shop off-exchange.

Prescription Drug Coverage: If you take medications regularly, make sure they’re on the plan’s list of covered drugs (the formulary) and find out what your copay will be.

Remember, the "best" plan isn't always the one with the lowest price tag. It's the one that gives you the right coverage for your unique health situation, at a price you can manage, all while letting you see the doctors you know and trust.

Step 3: Fill Out the Application and Enroll

Found your plan? Great! The last step is filling out the application. If you’re using a broker, they’ll walk you through everything. If you’re buying directly from an insurer, you’ll complete the application right on their website.

You'll need to provide some basic personal information for everyone who will be on the policy, so have names, birthdates, and other key details handy. After you submit, the insurance company will review your application. Once you're approved, they'll send over your official policy documents and tell you how to make that first premium payment.

The entire Health Insurance Exchange market, which includes both the official marketplace and private off-exchange options, is growing fast. It’s projected to jump from USD 2,505.8 million in 2025 to USD 4,985.8 million by 2033. This growth shows that more and more people are looking for better, simpler ways to buy and manage their health insurance. You can discover further market research on health insurance exchanges to see the data behind this trend.

Finally, timing is everything. Off-exchange plans follow the same calendar as the marketplace. You have to sign up during the annual Open Enrollment Period, which usually runs from November 1st to January 15th. The only exception is if you have a Qualifying Life Event—like losing your job-based coverage, getting married, or having a baby—which opens up a Special Enrollment Period just for you.

Navigating the Costs of Off-Exchange Insurance

When you start looking at off-exchange health insurance, the first thing everyone mentions is the lack of subsidies. But if you stop your financial homework there, you're missing the bigger picture. Insurers set the monthly premium, but that's just the sticker price. The real value of a plan—and its true cost—is only revealed when you look at the total potential cost of your care.

To do this, you have to look past the premium and dig into the four core components of health insurance costs: your deductible, copayments, coinsurance, and the all-important out-of-pocket maximum. These numbers tell you exactly what your financial responsibility is when you actually need to use your insurance.

Think of it this way: the monthly premium is just your entry ticket. Your out-of-pocket maximum, on the other hand, is the absolute most you could be on the hook for in a given year for covered services. Understanding this number is the key to creating a realistic health budget.

It’s also worth noting how the broader economy can play a role. Projections for a 2.8% global economic expansion in 2025, for instance, might mean more disposable income for many households. This kind of growth often encourages people to look for more comprehensive off-exchange plans where having a wide choice of doctors is more important than getting a subsidy.

Creating a Personal Health Insurance Budget

Let's walk through how this works in the real world by creating a sample budget for a family of four. This family doesn't qualify for subsidies and they're trying to decide between a lower-premium Bronze plan and a more expensive Gold plan, both purchased off-exchange.

They expect some routine healthcare needs this year: a few doctor check-ups for the kids, a couple of specialist visits for one of the parents, and some ongoing prescriptions. Just to be safe, they also want to plan for a minor, unexpected trip to the emergency room.

By mapping this out, we can see which plan is actually the most cost-effective for their situation, not just which one has the lowest monthly bill.

Comparing Bronze vs. Gold Plan Costs

Here’s a breakdown of how their annual expenses might look under each of the two off-exchange plans.

Cost Component | Bronze Plan Example | Gold Plan Example |

|---|---|---|

Annual Premium | $14,400 ($1,200/month) | $20,400 ($1,700/month) |

Deductible | $9,000 (family) | $3,000 (family) |

Specialist Copay | $120 (after deductible) | $60 (before deductible) |

ER Visit Coinsurance | 40% (after deductible) | 20% (after deductible) |

Out-of-Pocket Max | $18,000 | $10,000 |

With the Bronze plan, the family would have to pay the full cost for almost every medical service until they hit their massive $9,000 deductible. The lower premium looks good on paper, but their out-of-pocket costs for even routine care would be high. One ER visit could easily result in a bill for thousands of dollars.

Now, let's look at the Gold plan. The $20,400 annual premium is a much bigger upfront investment. However, their specialist visits only require a small, predictable copay from day one, and their family deductible is significantly lower. This offers far more financial stability and predictability throughout the year.

As you compare plans, it's also smart to check how specific doctors and hospitals work with different insurance. You can often find a list on a healthcare provider's insurance policies page, which helps confirm if your preferred doctors are in-network.

By forecasting their likely medical needs against each plan's cost structure, the family can make an informed decision. The Bronze plan might seem cheaper initially, but the Gold plan could actually save them money—and a lot of financial stress—if they end up needing care more than a couple of times. It’s a practical approach that helps you choose a plan based on its total value, not just its monthly premium.

Your Top Questions About Off-Exchange Plans, Answered

When you start looking into off-exchange health insurance, you’re bound to have some questions. It’s not the path you hear about on the news, so a little bit of confusion is completely normal. Let's clear things up and tackle the most common concerns people have when they consider stepping off the government marketplace.

Think of this as your personal FAQ. We’ll get you the straightforward answers you need to feel confident about your decision.

Are Off-Exchange Plans a Safe Bet? Do They Follow ACA Rules?

This is a big one, and for good reason. The short answer is yes—most plans you find off-exchange are fully ACA-compliant. Any major medical plan, whether you buy it on the marketplace or directly from an insurer, has to play by the same rules.

That means they must cover the 10 essential health benefits (like maternity care, prescriptions, and hospitalization), can't turn you away for pre-existing conditions, and have no annual or lifetime caps on what they'll pay for your care.

But here’s a crucial tip: the off-exchange world can also include plans that aren't ACA-compliant, like short-term insurance. The easiest way to know you're getting a real, comprehensive plan is to look for the "metal" tiers: Bronze, Silver, Gold, or Platinum. If you see those names, you know you're looking at a plan that meets all the ACA’s consumer protection standards.

Can I Just Switch from an On-Exchange to an Off-Exchange Plan Whenever I Want?

Nope. The timing rules are exactly the same whether you're shopping on or off the exchange. You can’t just hop between plans mid-year because you feel like it. Health insurance enrollment is locked down to two specific windows:

The Annual Open Enrollment Period: This is your main shot to sign up for a new plan, typically running from November 1st to January 15th in most states.

A Special Enrollment Period (SEP): Life happens. If you experience a Qualifying Life Event—like losing your job, getting married, moving, or having a baby—a 60-day window opens up for you to get new coverage.

Without one of these events, you’ll have to wait for the next Open Enrollment, regardless of where you buy your plan.

How Can I Tell if an Off-Exchange Plan Is Actually a Good Deal?

Since you won't have subsidies to lower the cost, figuring out what makes a "good deal" is all about total value, not just the monthly price tag. A cheap plan isn't a good deal if it doesn't cover your doctor or leaves you with a massive bill after a minor emergency.

The real measure of a good off-exchange plan is its ability to provide predictable costs and access to the care you need. It's about financial security, not just a low sticker price.

Here’s a quick mental checklist to gauge a plan’s true value:

Check the Network: Does the plan include the doctors, specialists, and hospitals you trust? For many people, wider network access is the number one reason to shop off-exchange.

Look Beyond the Premium: A low monthly payment can be deceiving. Compare the deductible, copays, and the out-of-pocket maximum to see what your real financial exposure is. Sometimes, a slightly higher premium for a much lower deductible is the smarter move.

Should I Use a Broker or Go Straight to the Insurance Company?

This really comes down to what you're comfortable with, but a lot of people find that working with a licensed health insurance broker is a game-changer. There's no right or wrong choice, but here’s how the two approaches stack up.

Shopping Method | Pros | Cons |

|---|---|---|

Directly from Insurer | You get a direct line to the company and can manage it all yourself. | You have to jump between multiple websites to compare plans. |

Using a Broker | You get expert advice, a single place to see all your options, and their help is free. | You’re trusting the broker’s expertise and recommendations. |

A good broker essentially acts as your personal shopper and advocate. They save you the headache of navigating the confusing parts and can help you sidestep common mistakes. If you’re feeling a bit lost, their guidance can be a massive help.

At America First Financial, we understand that protecting your family's health is about more than just numbers—it's about security and peace of mind. We offer comprehensive health care plans designed to provide reliable coverage free from political agendas. Explore your options and get a no-hassle quote in minutes.

_edited.png)

Comments