Your Retirement Budget Worksheet Made Simple

- dustinjohnson5

- Aug 16, 2025

- 17 min read

A retirement budget worksheet isn't just another spreadsheet; it's the tool that turns your retirement dreams into an actual, workable financial plan. It lets you systematically map out your expected income against all your potential expenses, giving you a crystal-clear picture of your financial future before you clock out for the last time.

Why You Absolutely Need a Retirement Budget Worksheet

Let's be honest, planning for a future that feels a decade or more away is easy to put on the back burner. But a detailed retirement budget worksheet makes it real. It forces you to move from vague "what-ifs" to concrete numbers, giving you a clear roadmap for the years ahead. Think of it as your first line of defense against the very real risk of outliving your money.

The whole point of this exercise is to find clarity. When you sit down and list every possible source of income and every potential expense, you're uncovering your financial truth. You might be pleasantly surprised to find you're right on track. Or, you might spot a shortfall that needs to be addressed now, while you still have time to do something about it.

To give you a head start, a truly effective worksheet needs to cover several key areas. Think of these as the non-negotiable building blocks of your retirement plan.

Core Components of an Effective Retirement Budget Worksheet

A quick summary of the essential categories your retirement budget worksheet must include to be comprehensive and effective.

Component | What It Tracks | Why It's Critical |

|---|---|---|

Income Streams | Social Security, pensions, 401(k)/IRA withdrawals, rental income, part-time work, etc. | Gives you the "top line" number—the total amount of money you have to work with each month or year. |

Essential Expenses | Housing, utilities, food, transportation, taxes, and—most importantly—healthcare and insurance. | These are your have-to-pays. Getting this number right is the foundation of your entire budget. |

Discretionary Spending | Travel, hobbies, dining out, entertainment, gifts, and everything else that makes life enjoyable. | This is where you plan for the fun part of retirement. It ensures your budget supports your lifestyle goals. |

Contingency/Emergency Fund | Savings for unexpected costs like major home repairs, unplanned medical bills, or family emergencies. | Life happens. This buffer protects your core retirement savings from being derailed by the unexpected. |

Without these pieces, you’re flying blind. A solid worksheet brings them all together, giving you a complete view of your financial landscape.

From Uncertainty to Financial Confidence

So many of us approach retirement with a mix of excitement and deep-seated anxiety, haunted by the question, "Will my savings be enough?" That uncertainty usually comes from not having the real numbers in front of you. A retirement budget worksheet gets rid of that guesswork by creating a tangible forecast of your financial life after you stop working.

Going through this process pays off almost immediately:

It reveals your true spending habits. You’re forced to be honest about where the money will go, moving past overly optimistic assumptions.

You can project future needs more accurately. This is where you account for changing costs, especially for big-ticket items like healthcare and travel.

It flags savings gaps early. Finding a potential shortfall five or ten years before you retire is a gift. It gives you precious time to course-correct.

A well-structured budget is the bridge between your retirement goals and your financial reality. It transforms the question "Will I have enough?" into a confident statement "Here is my plan to have enough."

Grounding Your Plan in Reality

Recent data really highlights this widespread fear. A study from Northwestern Mutual found that the average American believes they'll need $1.26 million to retire comfortably. Despite that, over half are worried they'll outlive their savings. A retirement budget worksheet is the single best tool to tackle this fear head-on, helping you realistically assess your needs and build a resilient plan.

Ultimately, this is an exercise in taking control. You're empowered to manage your financial destiny and make smart decisions that align with the life you want to live. Instead of just hoping for the best, you're actively building the secure and fulfilling retirement you've earned.

Gathering Your Financial Puzzle Pieces

Before you can build a useful retirement budget, you first have to pull together all the raw materials. I like to think of this as a financial scavenger hunt—you're collecting all the individual puzzle pieces that will eventually reveal the complete picture of your financial life. It can feel like a bit of a chore, I know, but getting precise numbers is the only way to build a plan you can actually count on.

This initial data-gathering phase is everything. Without it, you’re just making educated guesses, and something as important as your retirement is no time for guesswork. Let's walk through exactly what you need to find and where to look for it.

Locating Your Retirement Account Statements

Most of your retirement nest egg is probably sitting in dedicated investment accounts. So, your first job is to get the most recent statements for every single one of them. Don't just ballpark the balances from memory; you need to log into each account and get the exact figures.

You’ll want to hunt down the details for any of the following you have:

Employer-Sponsored Plans: This is your 401(k), 403(b), or 457 plan. Head over to the provider's website (like Fidelity, Vanguard, or Schwab) and download the latest quarterly statement.

Individual Retirement Accounts (IRAs): Find the statements for your Traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA. These might be with the same company that holds your 401(k), or they could be at a completely different brokerage.

Other Investment Accounts: Remember to include any taxable brokerage accounts, mutual funds, or individual stocks you've set aside for your retirement goals.

Once you have these documents in hand, the number you're looking for is the total vested balance. That’s the amount of money you could walk away with if you left your job tomorrow.

Uncovering Future Income Sources

Retirement income isn't just what you've saved; it's also about any predictable payments you'll be getting down the road. These are absolutely critical pieces for your budget worksheet because they form a stable foundation for your monthly income.

Your Social Security statement isn't just a piece of paper—it's an official projection of a significant part of your future income stream. Getting this estimate is one of the most important first steps you can take.

Next, you need to track down the official estimates for these income sources:

Social Security Benefit Estimate: This is a big one. You can get a personalized estimate by creating an account on the Social Security Administration's website. The statement they provide is incredibly helpful, showing your projected monthly benefit at different claiming ages like 62, 67 (your full retirement age), and 70.

Pension Plan Details: If you're lucky enough to have a pension, get in touch with the HR department from your current or former employer. Ask for a statement that details your estimated monthly or lump-sum payout and when you'll be eligible to start receiving it.

Annuity Contracts: For any annuities you own, dig up the original contract documents. They will spell out the payment amounts, start dates, and any benefits for a surviving spouse.

Getting all these puzzle pieces together now means you won't be scrambling for information later. By organizing your account balances and income estimates, you'll have everything you need in one place, ready to fill out your retirement worksheet with real confidence. This clarity is the first major win on your path to a secure retirement.

Projecting Your Future Income Streams

Alright, you've got your financial statements in hand. The next move is to figure out how much money will actually be flowing in each month once you retire. It's easy to think of retirement income as a single number, but in reality, it's usually a patchwork of different streams you’ve spent a lifetime building. Getting these projections as accurate as possible is the key to creating a budget that actually works.

We have to look beyond just Social Security and old-school pensions. For most people today, the real heavy lifting is done by personal savings. As of the first quarter of 2024, total U.S. retirement assets hit a staggering $43.4 trillion. A huge chunk of that is in Individual Retirement Accounts (IRAs) at $16.8 trillion and defined contribution plans like 401(k)s, which hold $12.2 trillion.

How Much Can You Safely Pull from Your Nest Egg?

This is the million-dollar question—literally, for some. The bulk of your retirement income will likely come from withdrawals from your 401(k), IRA, or similar accounts. But how much can you take out without the well running dry? This is where a smart withdrawal strategy is absolutely essential.

A classic rule of thumb you’ll hear about is the "4% Rule." It’s a simple starting point: the idea is you can withdraw 4% of your total retirement savings in your first year of retirement. From there, you just adjust that dollar amount for inflation each year.

So, if you retire with a $1 million portfolio, the 4% rule suggests taking out $40,000 in year one. If inflation runs at 3% that year, your next annual withdrawal would be $41,200 ($40,000 x 1.03). It's a straightforward way to get a baseline number.

But let's be clear: the 4% rule is a guideline, not gospel. You'll want to adjust your own rate based on your retirement age, how comfortable you are with market swings, and how your investments are actually performing. If you're cautious, you might feel better with a 3% or 3.5% withdrawal rate.

Don't Forget Your Other Income Sources

Now, let's look beyond your main investment accounts. Every potential source of income needs a spot on your worksheet because each one contributes to your financial security. You’d be surprised what people forget to include.

Make sure you've got these covered:

Social Security: Pull that estimate you got from the Social Security Administration's website. Remember, this figure changes based on when you decide to start taking benefits.

Pensions: If you're lucky enough to have a pension, jot down the guaranteed monthly amount.

Annuities: Add any income you're set to receive from annuity contracts.

Rental Property Income: If you're a landlord, calculate your net income—that’s the rent you collect minus the mortgage, taxes, insurance, and upkeep.

Part-Time Work: Planning to work a bit in retirement? Many people do. Try to estimate a realistic monthly income.

Dividends and Interest: Don't forget any income your taxable brokerage accounts might be generating.

When you're trying to forecast growth and model different withdrawal scenarios, a good an investment calculator can be a huge help in seeing how the numbers might play out over time.

Putting It All Together on Your Worksheet

Time to get organized. On your retirement budget worksheet, create a dedicated "Income" section and list every single source as its own line item. This will give you a crystal-clear picture of what to expect.

Here’s a simple way you could lay it out:

Income Source | Estimated Monthly Amount | Notes |

|---|---|---|

401(k)/IRA Withdrawal | $3,333 | Based on 4% of $1M portfolio |

Social Security (Age 67) | $2,200 | From SSA estimate |

Pension | $850 | Fixed monthly payment |

Part-Time Consulting | $500 | Average of 10 hours/week |

Total Monthly Income | $6,883 | Your top-line budget number |

By doing this, you've just turned a bunch of abstract account balances into a tangible, monthly income figure. Now that you know what's coming in, you're ready to tackle the other side of the equation: your expenses.

Getting Real About Your Retirement Expenses

Once you have a good sense of the money coming in, it's time to tackle the other side of the equation: your expenses. This is where a lot of retirement plans go sideways. People often cling to generic advice, like the old 70% to 80% rule, which suggests you'll only need a fraction of your pre-retirement income. Frankly, that can be a dangerous assumption when you're building a reliable retirement budget worksheet.

The reality is your spending patterns are about to go through a major shake-up. Some costs, like your daily commute, will disappear. Others, like healthcare and travel, could easily balloon. The only way to build a plan that won't leave you short is to get brutally honest about what your life will actually cost.

Nailing Down Your Essential Living Costs

First things first, let's look at the non-negotiables—the bills that will show up every month like clockwork. These are the foundation of your budget, so getting them right is crucial.

Housing is almost always the biggest line item. If your mortgage is paid off, you've already won a huge battle. But don't get too comfortable; the costs of owning a home never truly vanish. You've still got to account for:

Property Taxes: They have a stubborn habit of only going in one direction: up.

Homeowners Insurance: Premiums can shift, especially depending on where you live and what climate risks are emerging.

Maintenance and Repairs: A smart rule of thumb is to earmark 1% of your home's value each year for upkeep. On a $400,000 house, that’s about $333 a month you need to have ready.

Utilities: Your bills might not drop as much as you think. Being home more often can sometimes mean more electricity and water usage, even if you're trying to be mindful.

After housing, think through your other core needs—groceries, transportation, and personal care. Your gas bill might shrink without a daily commute, but it could just as easily rise if you plan on more road trips to see the grandkids.

The Healthcare Wildcard

Let's be blunt: for most people heading into retirement, healthcare is the single biggest financial question mark. This is one category that deserves its own dedicated section in your worksheet because its costs tend to outpace inflation by a long shot.

Fidelity recently estimated that a 65-year-old couple retiring today might need over $315,000 in after-tax savings just to cover their medical bills in retirement. That number can feel paralyzing, but breaking it down makes it something you can actually plan for.

Don't make the mistake of only budgeting for your monthly Medicare premiums. A realistic healthcare estimate must also factor in co-pays, deductibles, prescription drugs, and the potential need for long-term care down the road.

Here's a closer look at what you should be planning for:

Medicare Part B Premiums: This is what most people think of, and it's usually taken right out of your Social Security benefits.

Supplemental Insurance (Medigap): A Medigap policy is what saves you from the big out-of-pocket costs that Original Medicare doesn't cover.

Prescription Drug Plan (Part D): Your costs here will depend entirely on the medications you need.

Dental, Vision, and Hearing: These are the big three that Medicare generally doesn't touch. You'll need to cover these costs yourself or buy a separate plan.

Underestimating healthcare is one of the quickest ways to sink an otherwise solid retirement plan. My advice is always to aim a little high here. It’s far better to have a cushion you don’t need than to face a bill you can’t pay.

Planning for the Fun Stuff: Lifestyle and Discretionary Spending

Retirement isn't just about paying the bills. It's about finally having the time to do all the things you worked so hard for. This is where your budget meets your dreams, whether that means exploring Europe, taking up woodworking, or just spoiling your grandkids rotten.

You have to get specific here. "Travel" is not a budget item. This is:

One big international trip each year: $5,000

Four shorter domestic trips to see family: $2,000

Monthly dinners out with friends: $200

Golf club membership: $150/month

Putting real dollar amounts next to your goals is a critical step that many people skip. Without it, you're just guessing. You either end up overspending and burning through your savings too fast, or you underspend and look back with regret, wondering why you didn't enjoy your freedom more. This part of your retirement budget worksheet is where you truly connect your money to your happiness.

To help you think through these changes, it's useful to see how your spending categories will likely shift.

Common Pre-Retirement vs. Post-Retirement Expense Shifts

Expense Category | Likely Change in Retirement | Budgeting Consideration |

|---|---|---|

Housing | Decreases (if mortgage is paid) | Increase your budget for maintenance, property taxes, and insurance. |

Transportation | Decreases (no daily commute) | Factor in higher fuel and maintenance costs for leisure travel. |

Healthcare | Increases Significantly | Budget comprehensively for premiums, deductibles, and out-of-pocket costs. |

Travel & Hobbies | Increases Significantly | Be specific about your goals and assign them real dollar amounts. |

Taxes | Changes (income source shifts) | It's wise to consult a professional to estimate taxes on your retirement withdrawals. |

By taking the time to break down your spending into these three core areas—essentials, healthcare, and lifestyle—you move from vague rules of thumb to a detailed, personal financial roadmap. This is how you build a plan that prepares you for both the necessities and the joys of the years ahead.

Analyzing Gaps And Adjusting Your Plan

You’ve done the hard work of projecting your income and mapping out your expenses. Now comes the moment of truth. This is where you bring both sides of the equation together on your retirement budget worksheet to see exactly where you stand. It's the step that turns all those numbers and estimates into a single, powerful verdict: do you have a surplus or a shortfall?

Seeing the bottom line is refreshingly simple. If your projected annual income is $70,000 and your total estimated expenses are $65,000, you can breathe a little easier—you’ve got a $5,000 annual surplus. That cushion is fantastic for handling life's curveballs or splurging on a few extras.

But what if the numbers are flipped? What if you're looking at $65,000 in income against $70,000 in expenses? That's a $5,000 annual gap. Staring at a shortfall can feel like a punch to the gut, but it is absolutely not a sign of failure. In fact, uncovering this gap years before you retire is a huge advantage. It gives you the one thing you need most: time to make smart adjustments.

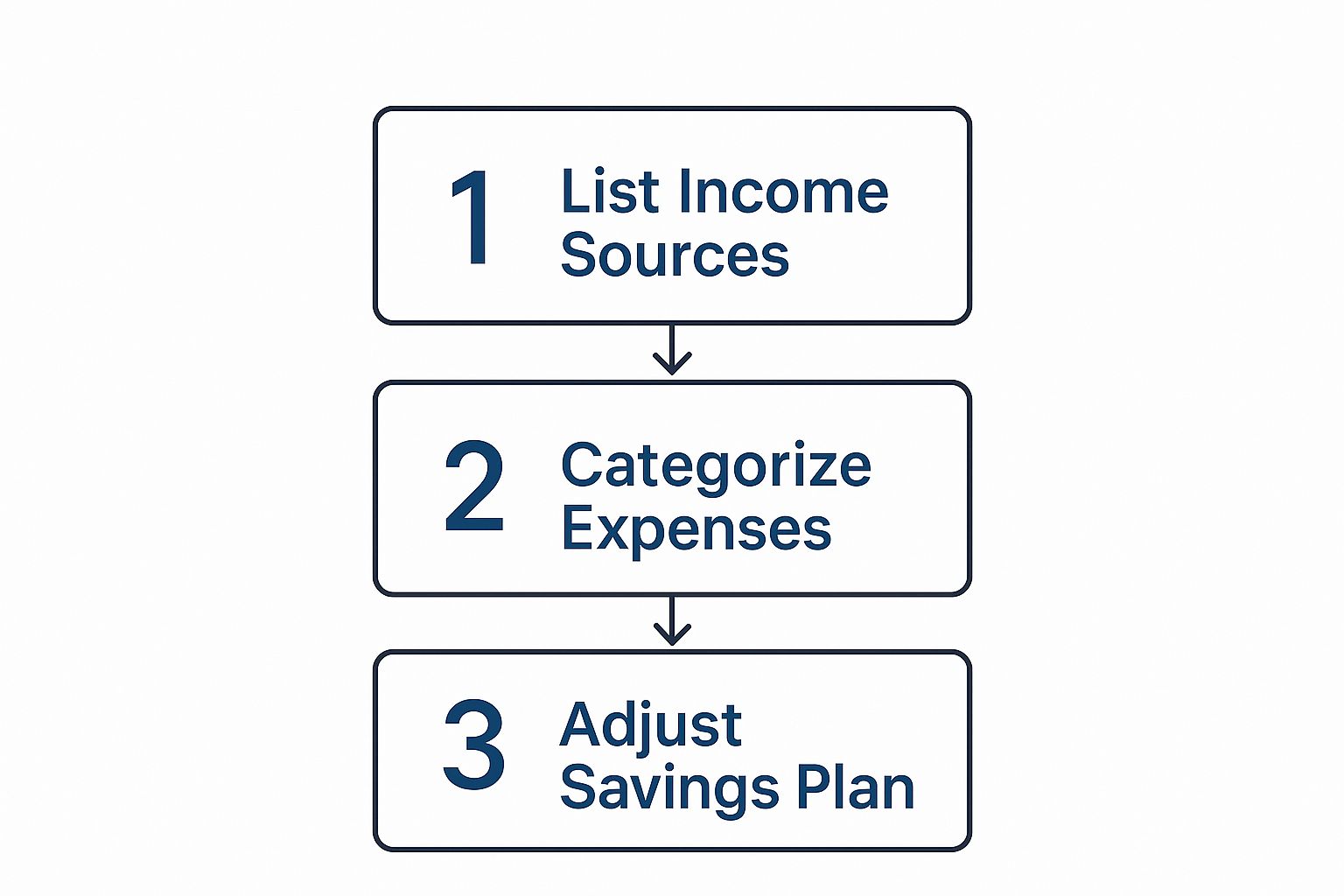

This simple graphic breaks down how you move from just gathering data to creating a real, actionable plan.

As you can see, the goal of a retirement budget worksheet isn't just to list numbers. It's a tool for making proactive decisions that shape your future.

Actionable Strategies To Close A Retirement Gap

If your worksheet reveals a funding gap, don't get discouraged. Think of it as a puzzle to solve. Your goal is to find the right combination of adjustments that bring your budget back into balance. Even small, consistent changes today can have a massive impact down the road.

Here are four practical levers you can pull to close that gap:

Bump Up Your Savings Rate: This is the most direct route. It might seem small, but increasing your 401(k) contribution by just 2% can add tens of thousands of dollars to your nest egg over a decade, thanks to the magic of compounding.

Delay Your Retirement Date: I know, it's not what anyone wants to hear, but working longer is incredibly powerful. It gives your investments more time to grow, and just as importantly, it reduces the total number of retirement years you need to fund. Pushing retirement back by just two or three years can dramatically shrink a projected shortfall.

Rethink Your Investment Mix: As retirement gets closer, the conventional wisdom is to shift toward more conservative investments. But if you're facing a gap and your stomach can handle it, you might consider keeping a slightly higher allocation in growth-oriented assets to help your portfolio work harder for you.

Fine-Tune Your Lifestyle Goals: This doesn't mean giving up on your dreams—it just means recalibrating them. Could that $10,000 annual European vacation become a fantastic $5,000 trip every other year? Small tweaks to discretionary spending can free up a surprising amount of cash.

A retirement budget shortfall isn't a dead end; it's a redirection. It's a signal to make thoughtful, proactive choices now to secure the future you've been working toward.

A Real-World Scenario

Let's look at Sarah, who is 55 and planning to retire at 65. After filling out her worksheet, she discovers a projected annual gap of $8,000. Instead of panicking, she sits down and explores her options.

Option A (Savings Focus): She decides to get aggressive with savings. She increases her 401(k) contributions by $300 a month and adds another $150 per month to her IRA. Right there, she's closed nearly $5,400 of the gap annually from new savings alone, not even counting the investment growth.

Option B (Hybrid Approach): Sarah decides to work until she's 67. This gives her two more years of income, savings, and investment growth, plus it boosts her future Social Security benefit. To seal the deal, she trims her projected travel budget by $2,000 a year.

By combining a couple of strategies, Sarah completely erases her $8,000 gap and even builds a small surplus. It’s a perfect example of using the worksheet not just as a diagnostic tool, but as a dynamic instrument for planning.

For many, pensions are a cornerstone of this financial security. Globally, pension funds manage an astonishing $52 trillion in assets, with North America holding about $25 trillion of that total. With an average annual return of 6.2% last year, these funds are vital for generating stable retirement income. You can learn more about the scale of global pension funds and their performance. This just goes to show how crucial it is to accurately account for every single income source, especially something as significant as a pension, in your analysis.

Answering Your Top Retirement Budgeting Questions

Even with the perfect retirement budget worksheet, you're bound to have questions. That’s perfectly normal. Financial planning isn't something you do once and then shove in a drawer; it's a living, breathing process that has to bend and flex as your life unfolds.

Let's dive into some of the most common questions I hear from people. Getting these tricky spots sorted out is what transforms a good plan into a great one, preparing you for both the predictable bills and the unexpected curveballs retirement might throw your way.

How Often Should I Really Be Looking at This Budget?

The simple answer? Plan on sitting down with your retirement budget at least once a year. Think of it as an annual financial check-up. This is your chance to make sure your spending still makes sense, see how your portfolio did last year, and adjust your withdrawal strategy accordingly.

But some life events don't wait for your annual review. When something big happens, you need to pull out the budget right away. These moments can completely change your financial picture, and your plan needs to catch up to your new reality.

You'll want to schedule an immediate budget review after things like:

A major health diagnosis for you or your spouse

An expensive and unexpected home repair (like a new roof or HVAC system)

A significant swing in your investment portfolio's value

The decision to move, downsize, or even buy a second home

Your annual review is like a routine physical for your finances. It’s the perfect time to catch small issues before they snowball and to make sure your financial health is on track for the long haul.

That yearly check-in is what keeps your plan from getting stale. It stops you from running on outdated assumptions about your spending or income, which is one of the fastest ways to derail a perfectly good retirement plan.

How Do We Plan for Huge, One-Time Costs?

Your monthly budget is a champ at handling the regular stuff—groceries, utilities, gas. But what about those massive expenses that pop up every five or ten years? I'm talking about replacing a car, that dream anniversary cruise, or a major kitchen remodel. These can absolutely demolish a budget if you're not ready.

The best tool for the job here is a "sinking fund." It sounds technical, but it’s just a fancy name for a dedicated savings account where you set money aside specifically for these future big-ticket items.

Let's walk through an example. You know your car is getting old, and in about five years, you’ll probably need a new one. You estimate it’ll cost around $30,000. Instead of stressing about where that money will come from, you can get ahead of it.

Your Goal: $30,000

Your Timeline: 5 years (which is 60 months)

Monthly Savings Needed: $30,000 / 60 months = $500 per month

By socking away $500 every month into your "new car fund," you’ve turned a giant, scary expense into a predictable, manageable part of your plan. You can use this exact strategy for any major cost you see on the horizon. It’s a proactive move that prevents you from having to raid your primary investment accounts when you least expect it.

How Do I Keep Inflation from Wrecking My Fixed Income?

Inflation is the silent thief of retirement. It’s one of the biggest risks out there because it quietly eats away at your purchasing power. When the cost of everything goes up but your income stays the same, your money just doesn’t stretch as far. A realistic retirement budget has to face this head-on.

The good news is that you likely have some built-in protection. Social Security, for instance, has an annual Cost-of-Living Adjustment (COLA) that helps your benefits keep pace with rising prices. Some pensions and annuities have similar features.

The real trick is protecting the income you pull from your investment portfolio. A classic strategy is to give yourself a small "raise" each year. If you withdrew $40,000 last year and inflation was 3%, you'd plan to withdraw $41,200 this year just to buy the same amount of stuff.

Beyond that, here are a few practical things you can do to fight back against inflation:

Stay Invested. While you'll naturally want to lower your risk in retirement, keeping a healthy allocation to growth-focused assets like stocks is your best long-term defense for helping your nest egg outpace inflation.

Get Smart with Your "Wants." This is where having a flexible budget is so valuable. In years when inflation is running hot, you might decide to put off a big trip or eat out a little less. This protects the money you need for your essential expenses.

Hunt for Discounts. Don't ever feel shy about asking for a senior discount! You can find them on everything from groceries and movie tickets to travel and car insurance. Every little bit you save helps offset rising costs elsewhere.

By weaving these strategies into your plan, you build a retirement budget that’s tough, realistic, and ready for whatever the economy throws at you.

At America First Financial, we believe that securing your family's future shouldn't be complicated by political agendas. We provide clear, affordable insurance solutions—from life and disability to long-term care and health plans—designed to protect what matters most. Get a no-hassle quote in under three minutes and discover the peace of mind that comes with a provider who shares your values.

Secure your future with a partner you can trust at https://www.americafirstfinancial.org.

_edited.png)

Comments