A Clear Guide to Fixed Index Annuity Benefits

- dustinjohnson5

- Oct 19, 2025

- 15 min read

Ever wished you could capture some of the stock market's upside without risking your hard-earned savings when it tumbles? That's the basic idea behind a fixed index annuity (FIA). It's a bit like having a "heads I win, tails I don't lose" approach to your retirement money.

Your Retirement Nest Egg's Safety Net

At its core, a fixed index annuity is a contract you make with an insurance company—like us here at America First Financial—built for long-term savings. It's a unique blend, borrowing the best features from different types of annuities to strike a balance between safety and the potential for growth.

The key thing to understand is that you're not directly investing in the stock market. Your principal is always protected from downturns. Instead, any interest you earn is tied to the performance of an external market index, like the S&P 500. This setup gives your money a chance to grow when the market is doing well, but shields it when things go south. It’s this one-two punch of protection and potential that draws so many people to them for retirement planning.

The Building Blocks of a Fixed Index Annuity

So, how does it actually work? It all comes down to a few key ingredients that define how an FIA operates. Getting a handle on these will help you see if this kind of tool makes sense for your own financial goals.

Principal Protection: This is the big one. The money you put in, plus any interest you've already earned, is protected from market losses. The insurance company guarantees that your account value won't drop because the index had a bad year.

Index-Linked Growth: Your earnings potential is linked to a portion of the gains from a market index. This gives you a better shot at growth than you'd typically find in traditional fixed-rate products like CDs.

Tax-Deferred Growth: Just like with other retirement accounts, your money grows without being taxed along the way. You only pay taxes when you start taking money out, which allows your earnings to compound more powerfully over the years.

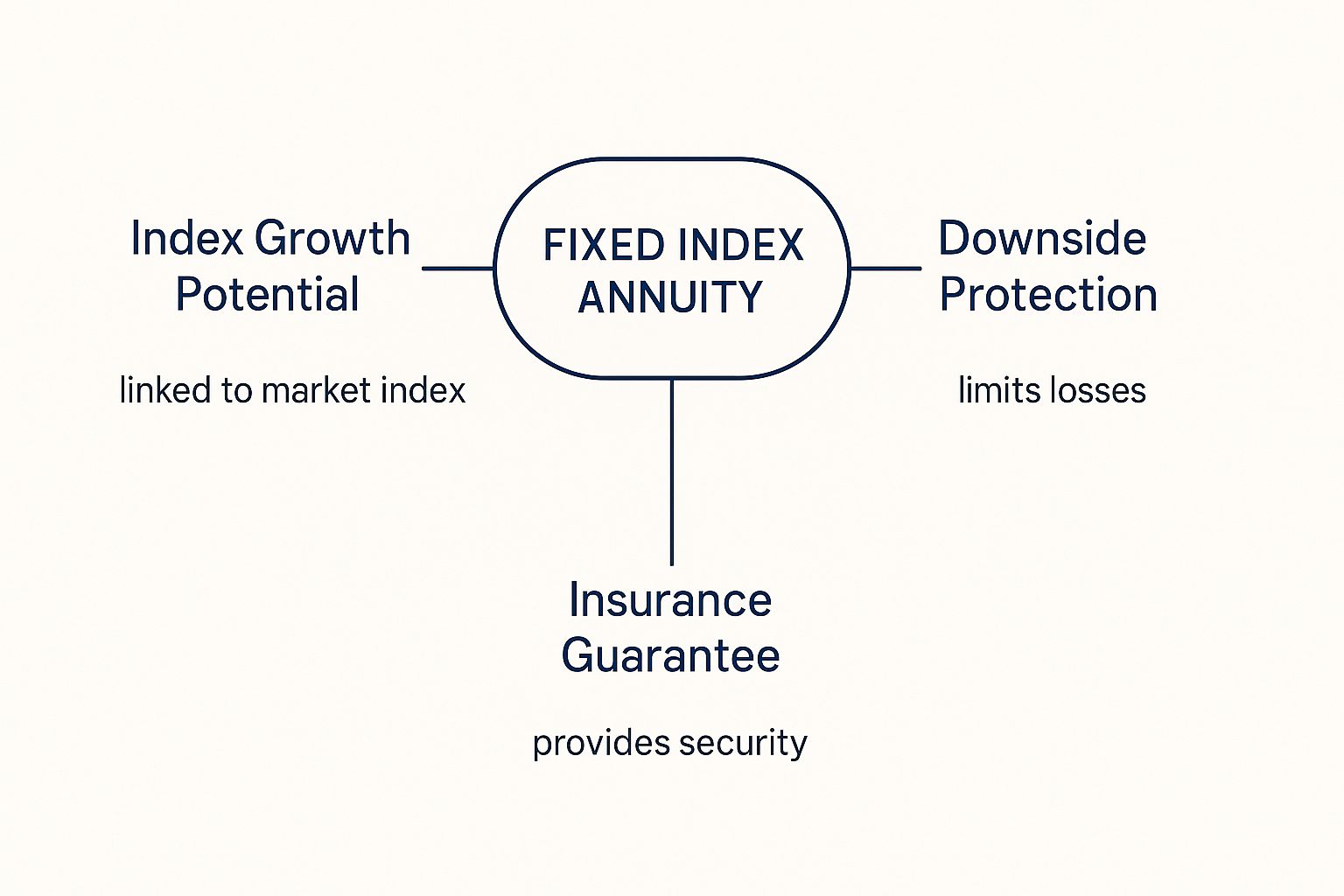

This visual helps tie these three core ideas together into a single, powerful retirement tool.

As the infographic shows, the whole concept is built on using insurance guarantees to offer both a floor to protect you from losses and a ceiling that still allows for market-linked growth.

To give you a quick snapshot, here’s a high-level summary of what makes an FIA tick.

Fixed Index Annuity At a Glance

Feature | Description |

|---|---|

Asset Type | An insurance contract, not a direct market investment. |

Principal Protection | 100% protection from market downturns is guaranteed. |

Growth Potential | Interest is linked to an external stock market index (e.g., S&P 500). |

Growth Limitation | Gains are typically limited by caps, participation rates, or spreads. |

Tax Treatment | Earnings grow on a tax-deferred basis. |

Primary Goal | To provide a balance of safety, growth potential, and long-term income. |

This table neatly lays out the fundamental characteristics that define this unique retirement planning vehicle.

A Growing Choice for Today's Savers

It's no surprise that this balanced approach is catching on. More and more people are looking for ways to shield their retirement savings from market volatility without giving up on growth entirely. This has turned the fixed index annuity into a real standout in the retirement world.

The numbers tell the story. In just one year, insurers launched 96 new FIA products—a 35% increase from the year before. That surge helped drive industry sales to over $125.5 billion. This isn't just a fleeting trend; it reflects a genuine demand from consumers for financial products that offer both security and opportunity. You can explore more about the rise of the FIA in retirement planning and see what's driving this shift.

How Your Money Grows Inside an FIA

So, what’s the secret sauce behind a fixed index annuity? How does it offer a shot at growth without putting your hard-earned savings on the line in the stock market? It’s a pretty clever system, really.

Instead of buying stocks and bonds directly, the insurance company takes your premium and uses it to back the annuity's guarantees. Then, they use a portion of their investment earnings to buy options on a market index, like the S&P 500. This is the engine that actually drives your potential earnings.

Think of it like this: You're not actually in the race car, so you can't crash. You're a spectator with a special ticket that pays you a bonus based on how well the winning car performs. With an FIA, your money is safely on the sidelines, but the interest you earn is linked to how the index performs.

This unique structure is governed by a few key mechanics. Getting a handle on these terms is the key to understanding how an FIA strikes a balance between growth potential and the principal protection that families partnering with America First Financial find so valuable.

The Power of the Floor

The single most important feature of any fixed index annuity is the floor. This is your absolute safety net. It guarantees that your account will not lose a single penny due to a downturn in the market index it’s linked to.

For the vast majority of FIAs, this floor is set firmly at 0%. What does that mean in the real world? If the index has a bad year and drops 5%, 15%, or even 50%... your credited interest for that period is simply zero. You don't gain, but crucially, you don't lose. Your principal and all the interest you've earned in previous years are locked in, safe and sound.

The 0% floor is the bedrock of an FIA's appeal. It’s what gives you the peace of mind that your core retirement savings are shielded from the kind of volatility that can wreak havoc on a traditional portfolio.

This protection from market losses is what lets conservative savers sleep at night. Of course, there's a trade-off. This protection is paid for by putting a ceiling on some of your potential gains.

Calculating Your Growth Potential

When the market index has a good year, your FIA has the chance to earn interest. But you don't typically get 100% of the index's gain. The amount of interest that actually gets credited to your account is determined by one or more of these limiting factors:

Participation Rate: This determines the percentage of the index's gain your annuity "participates" in. For instance, if the index is up 10% and your FIA has an 80% participation rate, your account would be credited with an 8% gain (10% x 80%).

Cap Rate: This sets the maximum interest rate you can earn for the period, no matter how high the index shoots up. If the index gains a whopping 15% but your annuity has a 7% cap, the interest credited to your account is capped at 7%.

Spread (or Margin): This is a percentage that gets subtracted from the index's return before interest is credited. If the index returns 9% and your FIA has a 2% spread, you would earn 7% (9% - 2%). If the index gain is less than the spread, your interest for that period is simply 0%.

These mechanisms are how the insurance company can afford to give you that 0% floor. By limiting a portion of the upside, they can finance the options that guarantee your principal is protected from market losses. It's the fundamental compromise at the heart of every single fixed index annuity contract.

What Can an FIA Do For Your Retirement?

It's one thing to understand the nuts and bolts of a fixed index annuity, but it’s another to see how it can solve the real-world problems that keep retirees up at night. For many people, an FIA isn't just another financial product; it's a strategic tool built to tackle the biggest fears of retirement planning head-on.

Think of it as a multi-tool for your retirement savings. It offers a unique combination of features designed to protect what you've built while still giving it a chance to grow, all while planning for a predictable future. Let's dig into the powerful benefits that make FIAs a cornerstone of so many retirement plans.

Unwavering Principal Protection

The biggest draw for most people is the profound peace of mind that comes from principal protection. After decades of hard work, the last thing you want is to watch your nest egg get wiped out by a market crash right when you need it most.

An FIA directly addresses this fear. Your contract with the insurance company guarantees that your principal is shielded from market losses. Because of the 0% floor, even if the stock market index it's linked to takes a nosedive, your account value won't drop because of it.

This protection is like having a safety net for your retirement funds. It lets you participate in some of the market's potential without ever putting your hard-earned savings on the line.

This feature is absolutely critical for anyone nearing or already in retirement, as they simply don't have the time to wait for a market recovery.

A Unique Path for Growth Potential

While safety is a top priority, your money still needs to grow to keep up with inflation and fund your lifestyle. This is where an FIA offers a compelling alternative to traditional "safe money" products like bank CDs or standard fixed annuities.

By linking your potential interest credits to a market index, an FIA gives you a real opportunity to earn more when the market is doing well. No, you won't capture the entire upside of a massive bull market, but you get a shot at higher returns than most other guaranteed products can offer. It's this blend of safety and opportunity that has made FIAs so popular.

The numbers back it up. The U.S. annuity market has been booming, with total sales hitting a staggering $225.8 billion in just the first half of a recent record-breaking year. FIAs have been a huge part of that surge, with their sales doubling over a five-year period as more savers look for this exact balance of protection and growth.

The Power of Tax-Deferred Growth

One of the most effective ways to build wealth is to let it grow without the yearly drag of taxes. A fixed index annuity grows on a tax-deferred basis, which simply means you don't owe any taxes on the interest you earn until you actually start taking money out.

This tax deferral gives your money a powerful compounding advantage. Every dollar that would have gone to the IRS each year stays in your account, working for you and earning even more interest. It's a simple concept that can make a huge difference over time.

Having a solid plan for minimizing taxes in retirement is crucial, and an FIA’s tax-deferred status can be a key piece of that puzzle.

Creating a Guaranteed Income Stream

Maybe the single biggest fear for today's retirees is the thought of outliving their savings. An FIA can solve this problem directly by giving you the option to create a guaranteed income stream for life.

This is done through a process called annuitization, or more commonly, by adding an income rider to your contract (which may have an additional fee). Either way, you can turn your account's value into a series of regular, predictable payments. You’re essentially creating your own private pension—one that you can’t outlive, ensuring you always have money coming in to cover your essential expenses.

Understanding the Trade-Offs and Risks

Let's be clear: no financial product is a silver bullet, and FIAs are no exception. A smart decision means looking at the whole picture—the good, the bad, and the fine print. While a fixed index annuity offers a powerful combination of safety and growth potential, those benefits come with some very specific trade-offs.

Think of it like a high-performance car engine. It has a governor built in to keep it from redlining and blowing up. An FIA works similarly. The features that limit your returns are the very same ones that make the 0% floor and principal protection possible. They aren't hidden gotchas; they're part of the core design. Let’s take an honest look at what you’re giving up to get that peace of mind.

Limited Upside Potential

The biggest trade-off is straightforward: you won't get all the gains when the market has a fantastic year. The caps, participation rates, and spreads that protect your principal from losses also put a ceiling on how much you can earn.

So, if the S&P 500 skyrockets by 25%, your annuity won't see a 25% credit. That's the fundamental deal you're making with an FIA. You trade away unlimited, sky-high growth potential in exchange for the complete elimination of market loss. For many people focused on preserving their nest egg, that’s a trade they’re happy to make.

Another thing to keep in mind is that index performance usually doesn't include dividends. When you hear about the S&P 500's performance, it's typically just the price movement of the stocks. The dividends those companies pay out aren't factored into an FIA's interest calculation, and over the long haul, that can make a real difference in total returns.

Complexity and Potential Fees

Fixed index annuities are definitely more complex than your average CD or savings account. Getting your head around the different crediting methods, how caps can be renewed each year, and the various index options can feel a bit overwhelming at first. It really pays to sit down and read your contract carefully.

On top of that, while the base annuity itself might not have direct fees, adding extra features usually does. These optional add-ons, called riders, can provide valuable benefits like a guaranteed lifetime income stream. But they come at a cost, typically an annual fee of around 1% of your account value that gets deducted from your assets.

The Critical Role of Surrender Charges

This is probably the most important thing to understand: an FIA is a long-term commitment. It is not a liquid savings account you can raid whenever you need cash. If you pull out more than the penalty-free amount (usually 10% a year) during the surrender charge period, you'll face a steep penalty.

This period can last anywhere from five to ten years, sometimes even longer. The charges are highest in the early years and gradually decrease until they disappear.

A surrender charge isn't a hidden fee. It’s the mechanism that allows the insurance company to make the long-term investments needed to back your annuity's guarantees. It reinforces the fact that FIAs are built for retirement accumulation, not for short-term savings.

Because of this, it's absolutely crucial that you only use money you're confident you won't need for emergencies before that surrender period is over.

To help you weigh everything we've discussed, here’s a simple side-by-side look at the pros and cons of a fixed index annuity.

Pros vs Cons of a Fixed Index Annuity

This table breaks down the key advantages you gain with an FIA against the potential disadvantages and limitations you should consider.

Advantages (Pros) | Disadvantages (Cons) |

|---|---|

Principal is 100% protected from market downturns. | Upside growth is limited by caps or participation rates. |

Potential to earn higher interest than CDs or fixed annuities. | Returns do not include stock dividends, which can lower total gains. |

All earnings grow on a tax-deferred basis. | Surrender charges apply for early withdrawals, making it illiquid. |

Can provide a guaranteed income stream for life via riders. | Optional riders for enhanced benefits come with additional annual fees. |

Ultimately, deciding if an FIA is right for you comes down to what you value most: the security of knowing your principal is safe or the potential for unlimited market gains, with all the risks that come with it.

Is a Fixed Index Annuity the Right Fit for You?

Figuring out if a financial product is right for you goes way beyond the numbers on a page. It's about your personal goals, your stage in life, and frankly, what helps you sleep at night. A fixed index annuity is a very specific tool designed for a very specific job. So, let's get practical and look at who this tool is really built for.

Think of it this way: an FIA isn't just another stock or bond to toss into the mix. When you're thinking about an FIA, it's also a good time to consider how to diversify your overall investment portfolio. This type of annuity plays a unique role, one that’s squarely focused on protecting what you’ve built while aiming for a little bit of growth.

The Cautious Pre-Retiree

Imagine someone who is five to ten years away from punching the clock for the last time. They've worked hard to build a solid nest egg, and their priority has shifted. They're no longer trying to hit home runs; they just want to protect their lead. The nightmare scenario for them is a massive market crash that erases 30% of their life savings right before they need it.

This is where a fixed index annuity can be a game-changer. It gives them a way to lock in their savings and shield that principal from stock market chaos. At the same time, it still offers a shot at growth that can beat inflation or what they'd get from a simple savings account. The name of the game has changed from wealth accumulation to wealth preservation, and the safety net of an FIA is exactly what they're looking for.

The Risk-Averse Saver

Now, let's think about the person who just can't stomach market risk. Maybe they got burned in a previous downturn, or maybe they’re just wired to avoid volatility. Their money is probably sitting in "safe" places like CDs or savings accounts, but they're watching its buying power get slowly chipped away by inflation.

This individual feels stuck. They’re frustrated with earning practically nothing but are terrified of losing money in the market. A fixed index annuity can be the perfect bridge for this gap. It provides the 100% principal protection they desperately want, but it also hooks them into the potential for market-linked gains—something a bank just can't offer. It’s a step up in growth without forcing them to abandon their need for security.

A fixed index annuity balances safety with growth opportunity by linking interest to a market index while guaranteeing a minimum return floor, often between 0% to 3%. This ensures your principal is safe from market downturns.

Who Should Probably Look Elsewhere?

It's just as important to know who an FIA is not for. If you're a young investor in your 20s or 30s with decades before retirement, an FIA is likely not your best move. You have a long time horizon and can afford to take on more risk for potentially higher returns through direct market investments.

For you, the growth-limiting features of an FIA—like caps and participation rates—would probably feel like driving with the emergency brake on. Your primary goal is to maximize growth over the long haul, and you have time to recover from any market bumps along the way.

A Quick Gut-Check

Not sure where you fall? Run through this quick checklist.

Your Risk Tolerance: On a scale of 1 to 10 (where 1 is "I can't lose a penny" and 10 is "high risk, high reward"), where do you land? An FIA is typically best for those with lower scores.

Your Time Horizon: Will you need to touch this money in the next 7-10 years? FIAs are long-term commitments, and pulling money out early can trigger surrender charges.

Your Main Goal: Are you trying to aggressively grow your money, or are you focused on protecting what you have while still earning a modest return? FIAs are built for the second one.

Answering these questions honestly will give you a much clearer idea of where you stand. It's the first step toward having a meaningful conversation with a financial professional at America First Financial to build a retirement plan that truly fits you and your family.

Got Questions About Fixed Index Annuities? Let's Clear Them Up.

Even after laying out the basics, it's totally normal to have some lingering questions. FIAs are a unique blend of an insurance product and an investment-like tool, so it's easy to get stuck on a few of the details. Let's tackle some of the most common questions head-on.

Think of this as the Q&A after a big presentation. We've covered the main points, but now it's time to dig into those "what-if" scenarios that are probably running through your mind. These answers should help connect the dots.

What Happens to My Annuity When I Die?

This is a big one, and rightly so. When you're planning your financial future, you're also thinking about your legacy. The good news is the money in your fixed index annuity doesn't just vanish or go back to the insurance company when you pass away. It goes directly to the people you name as your beneficiaries.

Typically, your beneficiaries will receive the full remaining value of the contract, which is called the death benefit. One of the best parts about this process is that it generally avoids probate. That's the often slow, public, and expensive court process for settling an estate. This means your loved ones can get the funds much faster and with more privacy.

The ability to name a beneficiary and bypass probate is a powerful estate planning feature of a fixed index annuity, ensuring a smoother transfer of wealth to your loved ones.

It’s a simple, effective way to make sure the money you've worked hard to save gets passed on exactly as you intended.

Can I Roll My IRA or 401(k) into an FIA?

Yes, you can, and it's actually one of the most common ways people fund a fixed index annuity. You can use a rollover from an existing retirement account—like a traditional IRA, Roth IRA, or an old 401(k) from a previous job. This is usually handled with a direct rollover, where the money moves from one institution to the other without you touching it.

The best part? When you do it the right way, this is not a taxable event. You're just moving your retirement savings from one qualified plan to another. The main reason people do this is to take a portion of their nest egg out of the stock market's direct line of fire and into the principal-protected world of an FIA.

It's a popular move for people getting closer to retirement who want to lock in the gains they’ve made over the years and put a shield around that money.

Are Fixed Index Annuities Really Safe?

When we talk about safety with an FIA, we're really looking at two things. First, as we've covered, your principal is protected from market losses. That 0% floor is your contractual guarantee that your account won't go down just because the index had a bad year.

The second, and equally important, pillar of safety is the financial strength of the insurance company itself. All the guarantees in your contract are backed by the insurer's ability to pay its claims. This is why you should only consider annuities from companies with high financial strength ratings from agencies like A.M. Best, S&P, and Moody's. These ratings are an independent report card on the company's long-term financial health.

At America First Financial, we make it a point to only partner with highly-rated carriers, ensuring the promises made to our clients are built on a rock-solid foundation.

Ready to see if a fixed index annuity could bring more security to your retirement plan? The team at America First Financial is here to give you a clear, no-pressure quote that fits your values and goals. Get your free, personalized quote today and take the first step toward a more protected future.

_edited.png)

Comments