Unlocking Social Security Spousal Benefits

- dustinjohnson5

- Oct 17, 2025

- 16 min read

When you think about your Social Security benefits, you probably focus on your own work history. But what if you could also claim benefits based on your spouse's earnings? That's exactly what Social Security spousal benefits are designed for.

This provision is a financial lifeline that allows you to receive monthly payments based on your spouse's record, potentially providing you with up to 50% of their full benefit amount. It’s especially helpful if your own earnings history is lower, offering a way to secure a more comfortable retirement.

Unlocking Your Retirement Partnership

Think of spousal benefits as a built-in feature of your financial partnership. The system acknowledges that in many marriages, one partner steps back from the workforce to raise children or support the other's career, leading to lower lifetime earnings.

These benefits aren't some kind of bonus. They are an earned right, designed to ensure that both partners in a marriage have a foundation of financial security in retirement. It's Social Security's way of recognizing the joint contributions—both in and out of the formal workplace—that a couple makes over a lifetime.

The Core Idea Behind Spousal Benefits

At its heart, the spousal benefit exists to prevent a lower-earning spouse from facing financial hardship later in life. It's a powerful acknowledgment of the non-monetary contributions that don't show up on a pay stub but are crucial to a family's well-being.

The Social Security Administration (SSA) gives you a choice. You can take the retirement benefit you've earned from your own work record, or you can claim a spousal benefit based on your partner's record. You don't get both, but the SSA will automatically give you whichever amount is higher.

This structure serves as a critical safety net, ensuring that a spouse who may have had intermittent employment or lower wages isn't left vulnerable. It reinforces the idea of retirement as a shared journey.

Who Are These Benefits For?

While the rules apply to anyone who is eligible, spousal benefits are a game-changer for people who:

Spent years out of the workforce as a primary caregiver.

Had lower lifetime earnings due to part-time work or lower-paying jobs.

Played a key supporting role that helped their higher-earning spouse advance their career.

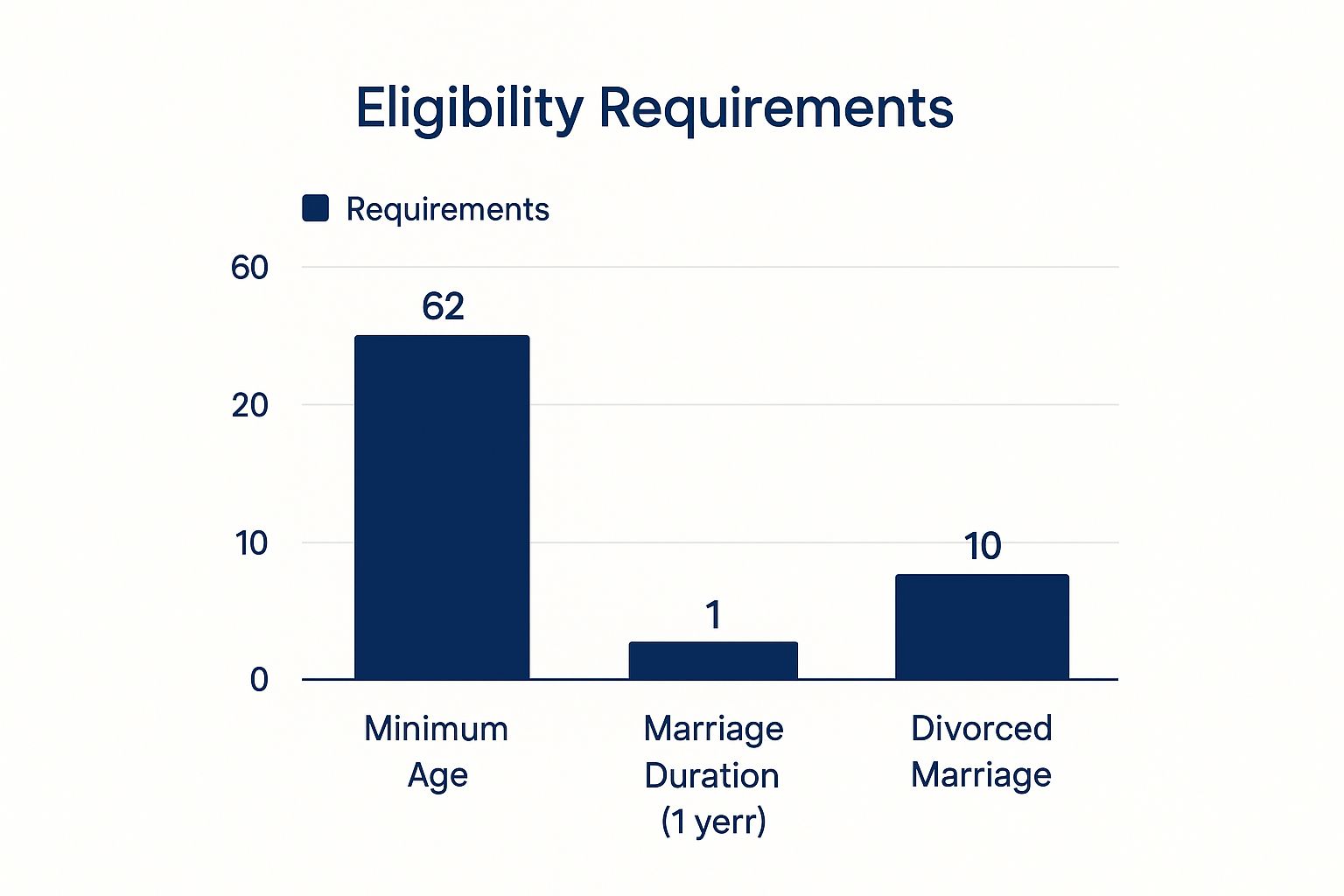

To get a clearer picture of the basics, here’s a quick rundown of the main eligibility points.

Quick Guide to Spousal Benefit Eligibility

Here is a simple table breaking down the fundamental requirements you need to meet to qualify for spousal benefits.

Requirement | Details |

|---|---|

Minimum Age | You must be at least 62 years old. |

Marital Status | You must be currently married to the person whose record you're claiming on. |

Marriage Duration | The marriage must have lasted for at least nine consecutive months. |

Primary Worker's Status | Your spouse must already be receiving their own Social Security retirement or disability benefits. |

These are the foundational rules, but timing your claim is just as important.

The maximum spousal benefit is up to 50% of your partner's full retirement benefit, but you only get that full amount if you wait until your own full retirement age (which is 67 for most people now) to start collecting. As you can see, understanding these basics is the first step toward building a solid retirement strategy together. You can find more helpful insights on these requirements from resources like Britannica.com.

Do You Qualify for Spousal Benefits?

So, you know what spousal benefits are, but the big question remains: can you get them? The Social Security Administration (SSA) has a set of rules, and while they can seem a little intimidating at first, they're really just a straightforward checklist.

These rules exist to make sure the benefits support people in long-term, committed partnerships as originally intended. Let’s break down exactly what you need to qualify, step by step.

The Core Requirements for Current Spouses

If you're currently married, the path to qualifying is pretty clear. The SSA is going to look at three main things: your age, how long you've been married, and whether your spouse has started collecting their own Social Security benefits.

You'll need to meet all of the following conditions:

You must be at least 62 years old. This is the earliest you can claim, but keep in mind that claiming this early means your monthly payment will be permanently reduced.

Your spouse is already receiving their own retirement or disability benefits. This is a critical point. You can't claim a spousal benefit until the higher-earning spouse has officially filed for their own Social Security. Their filing essentially "unlocks" your ability to claim on their record.

Your marriage has lasted for at least one continuous year. This rule is simply there to prevent people from getting married just to claim benefits.

If you can tick all three of those boxes, you're very likely eligible to apply for spousal benefits. For most married couples, it's that simple.

Key Takeaway: The most important thing to remember is that your spouse has to file for their benefits first. Even if you meet every other requirement, you can't access spousal benefits until they've started their own Social Security payments.

Special Rules for Divorced Spouses

What happens if you're no longer married? This is where things can get confusing, but the rules for divorced spouses provide a crucial financial safety net for many people. The SSA acknowledges that even if a marriage ends, both people contributed to the household's financial picture for years.

This visual helps illustrate the key difference in how long you needed to be married.

As you can see, the 10-year marriage requirement for divorced spouses is much longer, highlighting the SSA's focus on supporting those from long-term unions.

If you're divorced, you may still be able to claim a benefit based on your ex-spouse's work record. The qualifications are similar to those for a current spouse, but with a few very important distinctions.

Your Checklist for Divorced Spousal Benefits

To qualify for benefits on an ex-spouse’s record, you have to meet a different, specific set of conditions.

Here’s what the SSA is looking for:

Your marriage lasted 10 years or longer. This is the non-negotiable rule. The marriage must have spanned a full decade before the divorce was finalized.

You are currently unmarried. If you remarry, you generally lose the ability to claim benefits on a former spouse's record. Instead, you would look into spousal benefits through your current partner.

You are age 62 or older. Just like for current spouses, this is the earliest you can file.

Your ex-spouse is entitled to Social Security retirement or disability benefits. Here’s an interesting twist: your ex-spouse doesn't actually have to be collecting their benefits yet. As long as they are eligible (at least 62) and you’ve been divorced for at least two years, you can file independently of their decision.

The benefit you would receive on your own work record is less than the spousal benefit. Social Security will always pay your own benefit first. If the spousal amount from your ex is higher, they'll simply top up your payment to match that higher amount. You don't get to collect both full benefits.

How Your Spousal Benefit Is Calculated

Figuring out the numbers behind your Social Security spousal benefits isn't as complicated as it might seem. The entire calculation really boils down to just one key number: your spouse's retirement benefit at their full retirement age.

This foundational amount is officially called the Primary Insurance Amount (PIA). Just think of the PIA as the 100% benchmark—it's the full, unreduced payment your spouse is entitled to if they wait until their own Full Retirement Age (FRA) to file.

Your potential spousal benefit is tied directly to that PIA. At most, you can receive 50% of your spouse's PIA. But hitting that 50% ceiling all comes down to when you decide to start taking your benefits.

The Deciding Factor: Your Claiming Age

The age you file for benefits is the single most powerful factor in determining your monthly payment for the rest of your life. While you have the option to start claiming as early as age 62, doing so triggers a permanent reduction in your benefit.

To get the full 50% spousal benefit, you must wait until you reach your own Full Retirement Age (FRA). For anyone born in 1960 or later, that age is 67. If you claim any earlier, the Social Security Administration reduces your payment for each month you jump the gun.

It's crucial to understand that this reduction is permanent. It’s not a temporary hit that disappears once you reach your FRA; that lower amount is what you'll receive for life, adjusted only for future cost-of-living increases.

Let's walk through an example to see how this works in the real world.

Example Scenario:

John's Full Retirement Benefit (PIA): $2,800 per month

Maximum Spousal Benefit for Mary (50% of PIA): $1,400 per month

Mary's Full Retirement Age (FRA): 67

If Mary waits until she turns 67 to claim, she’ll get the full $1,400 a month. But what if she files right at age 62? Her benefit will be permanently cut to about 32.5% of John's PIA, which works out to just $910 a month. That's a nearly $500 difference every single month, for the rest of her life.

Impact of Claiming Age on Spousal Benefit Amount

The financial penalty for claiming early can be substantial. The following table clearly illustrates how your benefit percentage shrinks the earlier you file, assuming your Full Retirement Age is 67.

Spouse's Claiming Age | Full Retirement Age (FRA) | Percentage of Worker's Full Benefit Received |

|---|---|---|

Age 62 | 67 | Approximately 32.5% |

Age 63 | 67 | Approximately 35% |

Age 64 | 67 | Approximately 37.5% |

Age 65 | 67 | Approximately 41.7% |

Age 66 | 67 | Approximately 45.8% |

Age 67 (FRA) | 67 | 50% (Full Spousal Benefit) |

As you can see, patience really does pay off with a significantly higher monthly income. While this guide explains the mechanics, using a comprehensive retirement income calculator can help you model all of your potential income streams to get the full picture.

The Deemed Filing Rule You Need to Know

Once upon a time, retirees could use a clever strategy to claim only spousal benefits at their FRA while letting their own retirement benefit grow until age 70. For most people today, that door has closed thanks to a rule called "deemed filing."

This rule impacts anyone born on or after January 2, 1954. It essentially says that when you apply for one Social Security benefit, you are automatically "deemed" to be applying for all benefits you're eligible for at that moment.

Here's what that means in practice:

You can't pick and choose. You can't tell the SSA you only want the spousal benefit now and will take your own later.

You will receive the higher of the two. The SSA calculates both your own retirement benefit and your potential spousal benefit, then pays you whichever amount is larger.

You don't get both. If your own benefit is $1,200 and your spousal benefit is $1,400, you’ll receive a total of $1,400, not $2,600. Your own $1,200 is paid first, and the spousal portion "tops it up" by $200 to reach the higher amount.

This rule definitely simplifies things, but it also eliminates some of the advanced claiming strategies that were once popular. It really highlights how important it is to know which benefit will be higher for you before you make the decision to file.

Smart Strategies for Claiming Benefits

Knowing the rules of Social Security is one thing, but turning that knowledge into a real-world plan is where the magic happens. A smart claiming strategy isn’t about finding some secret loophole; it's about working with your spouse to make coordinated decisions that can maximize your total household income for the rest of your lives.

There's no one-size-fits-all answer here. The right approach for you will depend entirely on your family’s unique situation—your ages, health, and what you’ve each earned over the years.

When One Spouse Was the Primary Earner

This is a classic scenario, and it's where spousal benefits can be incredibly powerful. Let’s look at a common example: David was the higher earner his whole career, while his wife, Sarah, worked part-time and focused on raising their children. As a result, her own Social Security benefit is much smaller than his.

For them, the best strategy usually involves a coordinated delay.

David Delays His Benefit: If David waits until age 70 to claim, he significantly boosts his own monthly payment. For every year he waits past his Full Retirement Age (FRA) of 67, his benefit grows by a guaranteed 8%. That’s a total increase of 24%.

Sarah's Claiming Decision: Sarah has options. She could claim her own smaller benefit early to get some cash flowing. The key thing to remember is she can't claim her spousal benefit until David actually files for his.

The Payoff: Once David files at age 70, Sarah can switch to her spousal benefit. This will be 50% of David's benefit amount at his full retirement age—not his inflated age-70 amount. This simple move locks in a much higher base income for them as a couple.

This isn't just about boosting their monthly checks now; it has a huge impact on what happens down the road.

The Critical Link to Survivor Benefits

The claiming decisions you make today directly shape the financial security of whoever lives longer. It's a sobering but crucial point. When one spouse passes away, the survivor gets to keep the higher of the two benefits—they don't get both.

By delaying, David isn't just getting a bigger check for himself; he's creating a much stronger safety net for Sarah. If he passes away first, her benefit will "step up" to 100% of the amount David was receiving. A bigger benefit for the higher earner automatically becomes a bigger survivor benefit for their partner.

This might be the single most important part of coordinating your claims. The decision to delay is an act of long-term financial protection for your spouse, ensuring they have the largest possible income to live on for the rest of their life.

When Both Spouses Have Similar Work Histories

What if you and your spouse both have solid, comparable work records? In this case, the spousal benefit itself might not even come into play, since you always get your own benefit if it's higher. But that doesn't mean you can ignore strategy.

The focus simply shifts from claiming a spousal benefit to individually maximizing each of your own retirement benefits.

The core strategy, funny enough, often stays the same: delay.

Analyze Both Benefits: First, figure out which spouse has the higher potential benefit, even if the numbers are pretty close.

Prioritize Delaying the Larger Benefit: The partner with the higher earnings record should make it a priority to wait until age 70 if at all possible. This ensures the largest possible payment becomes the foundation for the couple's income and, just as importantly, the future survivor benefit.

Evaluate the Second Benefit: The lower-earning spouse has a bit more flexibility. They might decide to claim earlier to bridge an income gap while the higher benefit grows, or they might also choose to delay to maximize their own check.

Of course, Social Security is just one piece of your retirement puzzle. It’s always smart to see how these decisions fit in with your general pension planning strategies. A holistic view makes sure all your assets are working together. The key is to run the numbers and see which combination of claiming ages gives your household the most income over your lifetimes.

Of course. Here is the rewritten section with a more natural, human-expert tone.

Navigating Special Circumstances and Exceptions

Life is complicated, and the Social Security rulebook has its own set of twists and turns. While the standard rules for spousal benefits apply to most people, there are several key exceptions that can completely change the game for you. These special situations usually pop up because of unique work histories or family dynamics.

Getting a handle on these exceptions isn't just about knowing the fine print; it's about making sure you get every dollar you're entitled to. For many families, these rules can mean a significant difference in their monthly retirement income. Let's walk through some of the most common scenarios you might run into.

The Government Pension Offset

Did you spend your career in public service—maybe as a teacher, firefighter, or state employee—and earn a pension from a job that didn't pay into Social Security? If so, you need to know about the Government Pension Offset (GPO). This rule was put in place to create a more level playing field between government workers who paid Social Security taxes and those who didn't.

Here’s how it works: the GPO reduces your Social Security spousal or survivor benefit by two-thirds of your government pension amount.

Let's make that real. Say you get a $900 monthly pension from your non-covered government job. The GPO reduction would be $600 (that's $900 x 2/3). If you were otherwise eligible for a $1,000 spousal benefit, you'd only end up receiving $400 per month.

Be warned: this offset can be a shock. In some cases, it can completely eliminate your spousal benefit. If you have a public service pension, factoring in the GPO is an absolutely critical step in your retirement planning.

Spouses Caring for a Qualifying Child

Here’s an important exception that provides a crucial financial bridge for spouses raising children. Normally, you have to be at least 62 to even think about claiming a spousal benefit. But that age limit gets waived if you are caring for the primary worker's child who is either under 16 or has a disability.

Under this "child-in-care" provision, you can claim spousal benefits at any age. Better yet, the benefit isn't reduced for claiming early—you still get the full 50% of your spouse's primary benefit amount. This support continues until the youngest child in your care turns 16 (unless they are disabled, in which case the benefits can continue).

This rule is a recognition that raising kids puts a strain on family finances, and it ensures the caregiving spouse has access to support when it's often needed most.

When the Primary Worker Receives Disability Benefits

Your path to spousal benefits doesn't just open up when your spouse retires. If your spouse becomes disabled and starts receiving Social Security Disability Insurance (SSDI), that also makes you eligible. The core rules are the same: you still need to be at least 62 and married for the required duration.

Your benefit is calculated based on their Primary Insurance Amount (PIA), which in the case of disability is their full, unreduced retirement benefit. This ensures that a spouse's disability doesn't financially penalize you from receiving the support you're entitled to.

This is one area where you can really see how spousal benefits act as a financial backstop, particularly for women who have historically been lower earners or have taken time out of the workforce. For example, data shows the average monthly benefit for a wife of a retired worker was $949, while the average for a husband was much lower at $645. You can explore more of these trends and figures on the SSA's official statistics page.

The Social Security Administration's data, shown below, highlights this disparity quite clearly.

This data isn't just numbers on a page; it shows that spousal and survivor benefits are essential for helping to close income gaps and provide financial stability in retirement, especially for women.

Your Step-by-Step Guide to Applying

Applying for Social Security spousal benefits can feel a little daunting, but it's really just a matter of getting your ducks in a row. A bit of preparation goes a long way.

Think of it like getting ready for a trip—the more you plan and pack ahead of time, the smoother the journey. Let’s walk through exactly what you need.

What You Need to Apply

The Social Security Administration (SSA) just needs to verify the basics: who you are, when you were born, and your marital status. Having these documents ready from the start will make the whole process a breeze, whether you decide to apply online or talk to someone directly.

Here’s a simple checklist of what to gather:

Proof of Birth: Your original birth certificate or a certified copy from the issuing agency.

Proof of U.S. Citizenship or Lawful Alien Status: This is only necessary if you were born outside the United States.

Marriage Certificate: The original or a certified copy is needed to confirm your marriage.

Your Social Security Number: You'll also need your spouse's Social Security number.

Your Spouse's Birth Information: Be sure you have their date and place of birth handy.

Final Divorce Decree: If you're applying based on a previous marriage, you’ll need this document.

Pro Tip: Try to avoid mailing your original documents. The SSA recommends sending certified copies to keep your originals safe and sound. You definitely don't want those getting lost!

Choosing How to File Your Application

Once you have your paperwork organized, you get to choose how you want to file for your social security spousal benefits. There are three main ways to do it, so you can pick whatever works best for you.

Apply Online: For most people, this is the quickest and easiest route. You can fill out the application from your own home, at your own pace, and even save your progress if you need to take a break.

Apply by Phone: If you’d rather talk it through with someone, just call the SSA at 1-800-772-1213. A representative will ask you the questions and fill out the application for you right over the phone.

Apply in Person: Prefer a face-to-face conversation? You can always schedule an appointment at a local Social Security office. An agent there will sit down with you and guide you through everything.

No matter which path you take, the questions and requirements are the same. With your documents ready to go, you can confidently move forward and secure the benefits you're entitled to.

Common Questions About Spousal Benefits

Even when you've got the basics down, a few "what if" scenarios always pop up when talking about Social Security spousal benefits. These are the real-world questions that can make or break your retirement plan, and getting straight answers is the first step toward making confident decisions.

Let's walk through some of the most common questions people ask as they get ready to claim.

What Happens if My Spouse Passes Away?

This is probably the most serious and common question people have. If your spouse passes away, your spousal benefit doesn't just continue as is. It automatically converts into a survivor benefit.

The good news? A survivor benefit is almost always a higher amount. It can be as much as 100% of the benefit your spouse was receiving when they died. The Social Security Administration handles this transition, so you'll start receiving the larger payment, which can provide a critical financial lifeline during an incredibly tough time. Keep in mind, you will only receive one benefit—either your own or the survivor benefit, whichever is higher.

How Does My Own Work Record Affect My Spousal Benefit?

This trips a lot of people up, but the rule is pretty straightforward: you can't double-dip. Social Security will always look at your own retirement benefit first.

If the spousal benefit you're entitled to is more than your own, Social Security will pay your benefit and then add an extra amount to bring you up to the higher spousal benefit total. It all comes in one payment. So, you always get the larger of the two amounts, but you never get both stacked on top of each other.

Key Takeaway: Think of it as a "top-up." Your own benefit is the foundation. If the spousal benefit is higher, it tops up your payment to that higher level. It’s not a second check in the mail.

Can I Work While Receiving Spousal Benefits?

Yes, you can, but there’s a catch if you haven't reached your Full Retirement Age (FRA) yet. You need to pay close attention to the annual earnings limit. For 2024, that limit is $22,320.

If you're under your FRA for the entire year and earn more than that, the SSA will temporarily hold back $1 in benefits for every $2 you earn over the limit. The key word here is temporarily. This isn't lost money. Once you hit your FRA, the earnings limit goes away entirely, and the SSA actually recalculates your benefit to credit you for any months your payments were withheld.

Figuring out these rules is a huge part of building a secure financial future. At America First Financial, we focus on giving you clear, straightforward guidance and insurance solutions that protect your family and reflect your values. You can explore options for life insurance, long-term care, and retirement without any political noise. Get a free, no-hassle quote today and see how we can help safeguard what matters most to you.

_edited.png)

Comments