Estate Planning for Families: Secure Their Future Now

- dustinjohnson5

- May 15, 2025

- 15 min read

The Uncomfortable Truth About Family Protection

Discussing death or incapacity is often avoided. This reluctance, however, can leave families vulnerable. Many mistakenly believe estate planning is only for the wealthy. This is simply not true. Estate planning, regardless of income, offers vital protection for families. It ensures loved ones are cared for and your wishes are honored, no matter what the future holds.

Why Family Protection Matters

Family protection goes beyond finances; it's about mitigating emotional hardship during difficult times. Imagine the stress your family might face navigating legal and financial matters while grieving. Proper estate planning eases this burden. It provides a clear plan outlining your wishes for healthcare, asset distribution, and guardianship of minor children. This clarity reduces potential conflict and provides peace of mind.

A startling statistic reveals that only 33% of American adults have vital estate planning documents such as wills, trusts, or powers of attorney. This means two-thirds of families are unprepared. Even more concerning, 60% have not started estate planning, leaving assets unprotected and families vulnerable to probate costs, which can consume up to 10% of an estate's value. This lack of planning often stems from procrastination or the misconception that estate planning is solely for the affluent. Find more detailed statistics here

Common Misconceptions and Their Consequences

A common misconception is that estate planning is only for the elderly. However, unforeseen events can occur at any age. An accident or illness could leave your family struggling to manage your finances and make critical medical decisions. This is where a Durable Power of Attorney and a Healthcare Directive are essential, enabling designated individuals to act on your behalf.

Another false assumption is that estate planning is unnecessary without significant assets. This is untrue. Even modest estates benefit from a plan, especially with minor children. Without a will, the court decides guardianship, potentially disregarding your preferences.

Taking Control: The First Steps

Starting the estate planning process may seem daunting, but it doesn't have to be. Begin by openly communicating your wishes with your family. This ensures everyone understands and respects your decisions. Next, consult with an experienced estate planning attorney. They can help create a personalized plan tailored to your family's specific needs and circumstances. Protecting your family's future isn't about predicting what will happen; it's about being prepared.

Building Your Family Protection Framework

Estate planning is more than just paperwork; it's about building a comprehensive safety net for your family's future. It involves strategically combining legal tools to ensure your wishes are respected and your loved ones are cared for, no matter what challenges life may bring.

Key Components of a Robust Estate Plan

A truly effective estate plan addresses multiple aspects of family protection. Here's a breakdown of the essential elements:

Will: This fundamental document outlines how you want your assets distributed after you pass away. It designates guardians for minor children and names an executor to manage your estate. However, wills are subject to probate, a potentially lengthy and public legal process.

Trusts: These offer greater control and flexibility than wills, allowing assets to be managed for your beneficiaries' benefit. Trusts can avoid probate, minimize estate taxes, and provide for dependents with special needs.

Durable Power of Attorney: This authorizes someone to manage your financial affairs if you become incapacitated. This important document prevents financial gridlock and ensures bills are paid even if you can't manage them yourself.

Healthcare Directive: This specifies your medical wishes should you become unable to communicate them, sparing your family from difficult decisions during already stressful times.

Guardianship Designations: This explicitly names guardians for your children in the event of your death or incapacity, preventing court battles and ensuring your children are cared for by the people you trust most.

Beneficiary Designations: These ensure your assets, like life insurance and retirement accounts, pass directly to your intended beneficiaries, bypassing probate. Regularly review these designations to ensure they are current.

Wills vs. Trusts: Understanding the Differences

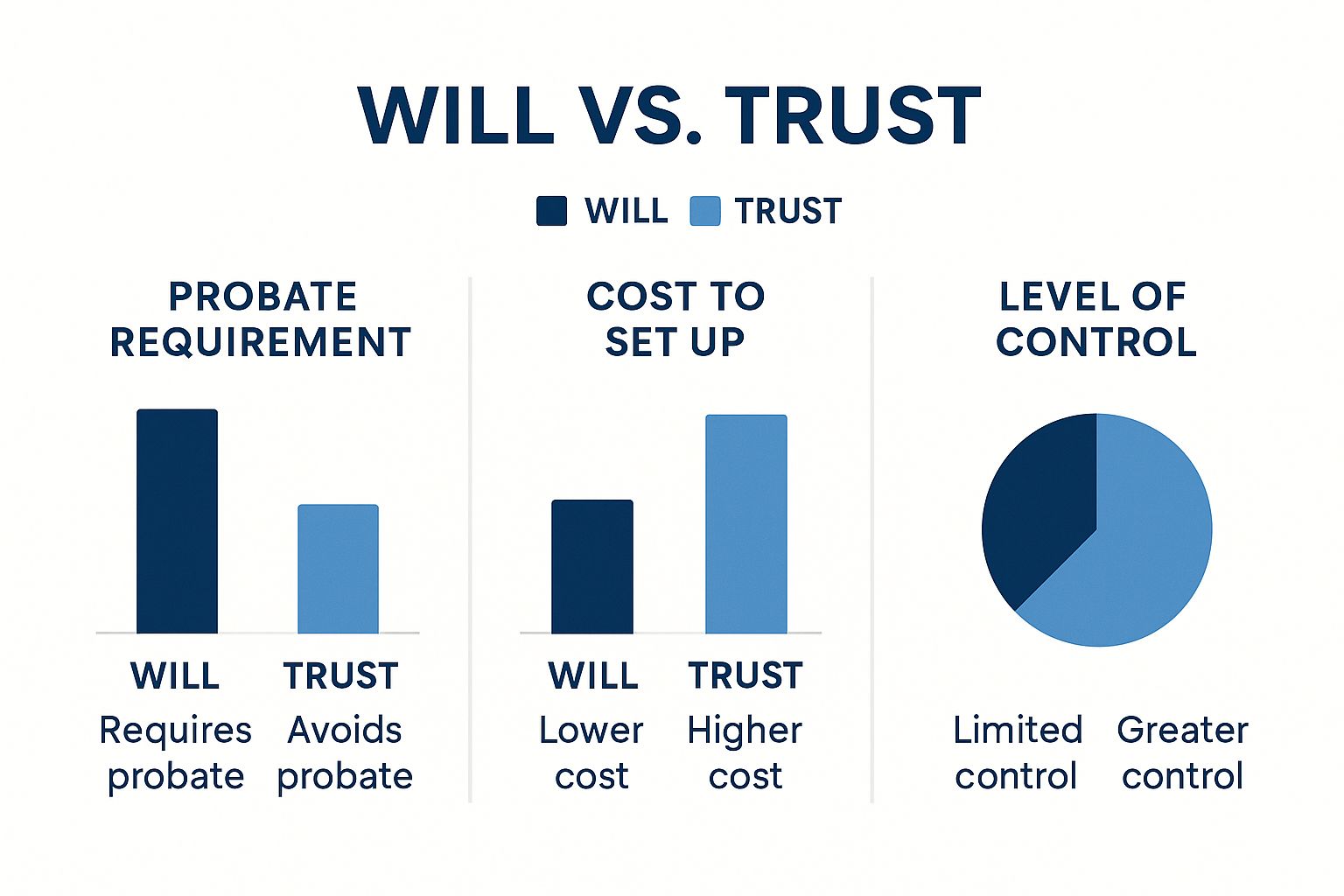

The infographic below highlights three key differences between wills and trusts: probate requirement, cost, and the level of control you retain.

As the infographic illustrates, wills are generally less expensive to create, but trusts offer significant advantages by avoiding probate and providing more control over asset distribution. Developing a healthy relationship with finances can be just as important as the legal strategies themselves. Consider cultivating a wealth mindset.

Real-World Applications of Estate Planning Tools

These tools are more than just abstract legal documents; they provide solutions to real-world problems for families. For example, a special needs trust can ensure a child with disabilities receives continuous care without impacting government benefits. A power of attorney can allow a spouse to manage finances seamlessly if their partner becomes ill. Avoiding probate through careful planning helps families preserve assets and reduces emotional stress during difficult times.

To further illustrate the importance of each document, let's examine the following table:

Estate Planning Documents That Actually Work This table compares key estate planning documents, their primary purposes, and when each is most important for family protection.

Document Type | Primary Purpose | Who Needs It | Key Benefits | Typical Cost Range |

|---|---|---|---|---|

Will | Distribute assets after death | Everyone | Basic instructions, guardianship designations | $300 - $1,000 |

Trust | Manage assets for beneficiaries | Those with complex estates, special needs dependents | Avoids probate, tax advantages, asset protection | $1,000 - $5,000+ |

Durable Power of Attorney | Authorize financial decisions if incapacitated | Everyone | Prevents financial disruption | $100 - $500 |

Healthcare Directive | Specify medical wishes if incapacitated | Everyone | Ensures wishes are honored | $50 - $200 |

Guardianship Designations | Name guardians for minor children | Parents | Prevents custody disputes | Often included in a will |

Beneficiary Designations | Direct transfer of assets | Everyone with life insurance, retirement accounts | Avoids probate | Typically no cost |

As shown in the table above, while a Will is a foundational document, other tools like Trusts and Powers of Attorney offer critical additional layers of protection and control depending on individual circumstances.

Building Your Personalized Framework

The right combination of estate planning tools for your family depends on your unique situation. Factors to consider include the size and complexity of your assets, the needs of your dependents, and your long-term financial goals. Consulting with an experienced estate planning attorney is essential to create a plan tailored to your specific needs. They can guide you through the process, explain complex legal concepts, and empower you to make informed decisions that secure your family’s future. This proactive approach provides not just financial security but also peace of mind knowing your loved ones are protected.

Estate Planning That Evolves With Your Family

Families grow and change over time, and so should their estate plans. What works for a young couple buying their first home won't necessarily work for parents with young children, blended families, or those caring for aging parents. This section explores the unique estate planning considerations for each stage of family life, offering practical advice and actionable steps.

Young Families: Building a Foundation

When you're a young couple starting a family, estate planning is about creating a basic safety net. This includes writing wills, designating guardians for future children, and establishing powers of attorney. These initial steps can often be accomplished for under $1,000, making them accessible even when you're working with a limited budget. This foundational plan protects your assets, ensures your wishes are honored, and protects your children if something unexpected happens.

Growing Families: Expanding Protections

As your family grows, your estate planning priorities change. It becomes critical to update the beneficiary designations on your life insurance and retirement accounts. This ensures these assets go directly to your chosen beneficiaries, bypassing probate and avoiding potential delays. Also, consider opening 529 plans. These plans offer a tax-advantaged way to save for future college expenses, helping to secure your children's education. It's also a good time to review and update guardianship designations to ensure they still align with your wishes.

Blended Families: Navigating Complexity

Blended families often face unique estate planning challenges. Without careful planning, stepchildren could be unintentionally excluded from inheritance. Clear communication is crucial, as are updated legal documents like wills and trusts. Trusts can offer more control over how your assets are distributed, allowing you to provide for children from previous marriages while also protecting your current spouse's financial security.

Sandwich Generation Families: Balancing Multiple Priorities

Many people find themselves part of the "sandwich generation," caring for both children and aging parents. This often involves juggling many financial and emotional responsibilities. Estate planning at this stage involves ensuring care in both directions – for your children’s future and your parents’ long-term care needs. This requires open communication and comprehensive financial planning. Establishing powers of attorney for your aging parents can help simplify financial matters, allowing you to manage their affairs if needed. A 2025 report revealed that 55% of Americans have no estate planning documents at all, highlighting the importance of taking action. Explore this topic further

Planning for the Unexpected: Life Events that Demand Updates

Life is full of unexpected events. Marriage, divorce, birth, death, and significant financial changes all warrant a review and update of your estate plan. For example, a new marriage might require updating beneficiary designations and creating or revising a will. A divorce, conversely, necessitates removing the former spouse from these documents. Regularly reviewing and updating your estate plan, perhaps annually or bi-annually, ensures it aligns with your current needs and prevents unintended consequences. This proactive approach provides ongoing protection and security for your loved ones.

Preserving Family Wealth Without Complex Schemes

Estate planning is more than just drafting a simple will. It's about strategically protecting your assets and optimizing your tax situation, regardless of your family's financial standing. This section explores practical tools that safeguard your wealth without resorting to complicated strategies, ensuring your legacy for future generations.

Trusts: Shielding Assets and Preserving Control

Trusts are valuable instruments for protecting family assets from creditors, lawsuits, and high taxes. They function by placing assets under the management of a trustee, who administers them according to your wishes for the benefit of your beneficiaries.

A revocable living trust, for instance, lets you maintain control over your assets during your lifetime while ensuring a smooth distribution after you're gone, bypassing probate. An irrevocable life insurance trust (ILIT) can hold life insurance policies outside your taxable estate, minimizing estate taxes. Trusts offer a secure and adaptable way to preserve family wealth across generations.

Gifting Strategies: Passing Wealth with Foresight

Gifting assets during your lifetime can be a wise move for reducing estate taxes and transferring wealth to loved ones. This approach allows you to minimize the potential tax burden on your estate.

The annual gift tax exclusion, for example, lets you gift a specific amount each year to each recipient tax-free. Charitable gifting can also align your family values with tax benefits. However, consulting a financial advisor is crucial to structure gifts correctly and avoid unintended tax issues, ensuring your generosity benefits everyone involved.

Insurance: An Estate Planning Superpower

Life insurance plays a vital role in securing your family's financial future. It provides a death benefit to replace lost income, cover debts, and fund future expenses.

If a primary earner passes away unexpectedly, life insurance offers vital financial support for the family. This is especially important for families with young children or significant financial responsibilities. Permanent life insurance policies can also build cash value over time, providing a source of funds accessible during your lifetime for retirement income or education expenses.

Basis Planning and Tax Minimization

Basis planning is a crucial part of estate planning that aims to reduce capital gains taxes on inherited assets. An asset's cost basis is its original purchase price. When sold, the difference between the sale price and the cost basis is the capital gain, which is taxable.

Inheriting a stock portfolio with a low cost basis could result in significant capital gains taxes if sold. Effective basis planning, however, can lessen this burden. This might involve strategic lifetime gifting or using specific trust structures that allow for a "step-up in basis" when assets are inherited. The estate planning services market is growing significantly, valued at roughly USD 15 billion in 2023 and projected to reach USD 25 billion by 2032. Read the full research here

These strategies emphasize the importance of a proactive and well-informed approach to estate planning. By understanding these tools and working with experienced professionals, families can effectively preserve their wealth, minimize taxes, and build a secure financial future.

Securing Your Digital Legacy Before It's Too Late

Increasingly, our lives are intertwined with the online world. From social media profiles and treasured photos to online banking and cryptocurrency investments, our digital assets form a significant part of our legacy. However, traditional estate planning often overlooks these vital elements. This can leave families struggling to access accounts, retrieve important information, or navigate financial complexities after a loved one passes away.

Cataloging Your Digital Assets

The first step in securing your digital legacy is creating a detailed inventory. This goes beyond simply listing usernames and passwords. Consider including the following:

Financial Accounts: Online banking, investment platforms, cryptocurrency wallets

Online Businesses: E-commerce stores, blogs, domain names

Digital Photos and Videos: Cloud storage, personal devices

Email Accounts: Personal, business, and archived emails

Subscription Services: Streaming platforms, software licenses

A comprehensive list of these assets, including account details and login information, is the foundation of a sound digital estate plan. Understanding the tax implications of inherited assets is also crucial. For example, you can learn more about inheritance tax on Spanish property.

Navigating Platform-Specific Rules

Different online platforms have specific rules regarding account access after death. Some platforms allow designated individuals to manage or close accounts, while others permanently lock them. Understanding these platform-specific policies is essential.

Google's Inactive Account Manager, for instance, lets you specify what happens to your account after a period of inactivity. Facebook offers the option to memorialize an account, preserving content while restricting access. Familiarizing yourself with these options will ensure your wishes are respected.

Secure Password Management and Digital Executors

Storing passwords securely while ensuring authorized access is a significant challenge. Using a password manager is recommended. This allows you to store login credentials securely and share them with designated individuals as needed.

Appointing a digital executor is another vital step. This person will be responsible for managing your digital assets according to your instructions. Granting them legal authority through your estate plan empowers them to act on your behalf. This proactive approach prevents access problems and ensures your digital legacy is handled responsibly.

Emerging Digital Legacy Services

Several services now specialize in managing digital legacies. These services offer secure storage for digital assets, automated account access after death, and streamlined communication with online platforms. While some services charge fees, they can simplify the process for your family. Exploring these options can provide varying levels of support based on your individual needs and technical comfort level.

Having The Conversation Your Family Is Avoiding

Even the most carefully prepared estate plans can fail if families avoid open communication. This section explores practical ways to begin and navigate these important conversations, ensuring your wishes are understood and your family relationships remain strong.

Why These Conversations Matter

Talking about estate planning isn't just about the legal paperwork. It's about preparing your family for the future. Open communication builds understanding, reduces potential disagreements, and provides peace of mind for everyone. This transparency is especially important in blended families or when assets are divided unequally. These conversations, though sometimes difficult, are essential for preserving family harmony during challenging times.

Starting the Conversation: Practical Tips

Beginning these discussions requires sensitivity and planning. Choosing the right time, place, and approach can greatly influence how your intentions are received.

Timing: Avoid discussing estate planning during holidays or stressful events. Choose a calm, neutral time when everyone can concentrate.

Setting: A comfortable and private environment encourages open communication. This could be at home, a quiet restaurant, or even a family walk.

Framing: Present estate planning not as a depressing topic but as a way to protect and provide for your loved ones. Focus on the positive aspects.

For example, instead of focusing on death or incapacity, you could begin by saying, "I want to make sure you all are taken care of, so I've been working on our family's estate plan."

Addressing Sensitive Issues

Discussions about inheritance can be emotionally charged. Explain your reasoning, particularly if distributions are unequal, to prevent misunderstandings and resentment. This builds trust and minimizes potential conflict. However, remember that full disclosure isn't always necessary. Partial disclosure might be better in some cases, especially with complex family dynamics.

Managing Emotional Reactions and Challenging Questions

Be prepared for various emotional responses, from relief and gratitude to confusion and anger. Listen carefully, acknowledge feelings, and answer questions honestly. This empathetic approach maintains trust and encourages open dialogue. If family dynamics are particularly complicated, consider involving a neutral professional, such as a therapist or mediator, to facilitate the conversation. This extra support can help manage difficult emotions and promote healthy communication.

Adapting to Different Communication Styles

Families communicate in different ways. Some are open and expressive, while others are more reserved. Adjust your approach to fit your family's communication style. With reserved families, start with less sensitive topics and gradually discuss more complex issues. For more expressive families, create a safe space for open sharing and discussion.

To help guide these conversations, consider using the following discussion guide:

Family Estate Planning Discussion Guide

This table outlines approaches for discussing estate plans with different family members and what information to share at each stage.

Family Member Role | Timing of Discussion | Topics to Cover | Potential Challenges | Helpful Approaches |

|---|---|---|---|---|

Spouse | Regularly, as plans evolve | All aspects of the plan, including finances, healthcare wishes, and guardianship of minor children. | Disagreements on asset distribution or end-of-life care. | Open and honest communication, compromise, and professional advice if needed. |

Adult Children | When the plan is established and after significant life events. | Overall plan objectives, inheritance plans, and roles/responsibilities. | Concerns about fairness, lack of understanding of the planning process. | Transparency in decision-making, clear explanations, and opportunities for questions. |

Elderly Parents | As needed, with sensitivity to their health and cognitive abilities. | Healthcare directives, power of attorney, and long-term care plans. | Resistance to discussing these topics, fear of losing independence. | Focus on ensuring their wishes are honored and their comfort is prioritized. |

Other Beneficiaries | As appropriate, depending on their relationship and the details of the plan. | Specific bequests or provisions that directly affect them. | Questions about the rationale behind decisions, potential for disappointment. | Clear and respectful communication, explaining the reasoning behind choices. |

This table provides a starting point for tailoring discussions to individual family members. Remember, flexibility and empathy are crucial.

Building a Foundation of Trust

Ultimately, these conversations are about strengthening family bonds. By communicating openly and honestly, you build a foundation of trust that will support your family through life’s transitions. This ongoing dialogue ensures your estate plan serves its purpose: protecting not only your family's financial well-being but also the relationships that matter most. America First Financial understands the importance of family security. We offer various insurance options to help families prepare for the future.

From Planning to Peace of Mind: Your Action Path

Turning your intentions into a solid estate plan requires action. This section offers a practical roadmap to guide you through implementing your family's estate plan, from assembling a qualified team to navigating potential challenges.

Building Your Estate Planning Team

The first step towards securing your family's future is assembling the right team of professionals. This team should include:

Estate Planning Attorney: An attorney specializing in estate planning is crucial. They draft your will, trusts, and other necessary legal documents, ensuring they align with your wishes and comply with state laws.

Financial Advisor: A financial advisor helps align your estate plan with your overall financial goals. They can optimize your investments and insurance coverage to provide for your family's future, and project future expenses and potential growth.

Tax Advisor: A tax professional helps minimize estate taxes and ensure efficient asset transfer. They can provide valuable insights into gifting strategies and trust structures to lessen the tax burden on your estate.

Executor: The executor is responsible for carrying out the instructions outlined in your will. Choosing someone trustworthy and capable is paramount. This could be a family member, a close friend, or a professional executor.

Overcoming Roadblocks and Setting a Realistic Budget

Many families postpone estate planning due to perceived obstacles. Let's address some common concerns:

Cost: Estate planning costs vary depending on the complexity of your situation. A simple will might cost a few hundred dollars, while a more complex plan involving trusts can range from $1,000 to $5,000 or more. However, consider these costs as an investment compared to the potential expenses of not having a plan, such as court battles, probate fees, and administrative costs which can quickly deplete an estate.

Time: While estate planning does require time, breaking the process down into manageable steps makes it less daunting. Start by gathering essential information and discussing your goals with your family. Then, schedule consultations with professionals and set realistic deadlines for each step.

Emotional Difficulty: Discussing death and incapacity can be uncomfortable. However, open communication with your family is essential. Frame these discussions positively, emphasizing the peace of mind and protection the plan provides for everyone involved.

Choosing the Right Professionals

Finding qualified professionals is essential to a successful estate plan. When interviewing estate planning attorneys, inquire about their experience with families similar to yours, their fee structure, and their communication style. Be wary of attorneys offering quick, generic solutions. Your estate plan should be personalized to your unique circumstances and goals. Warning signs include pressure to make hasty decisions, a lack of transparency regarding fees, and an unwillingness to thoroughly answer your questions.

Organizing Your Information

Before meeting with professionals, organize your key financial documents. This preparation will save time and facilitate productive discussions. Gather the following:

Asset List: This includes real estate, bank accounts, investments, and personal property.

Debt List: Include mortgages, loans, and credit card balances.

Insurance Policies: Compile a list of your life insurance, health insurance, and disability insurance policies.

Beneficiary Designations: Review and update the beneficiary designations on all applicable accounts.

Implementation Timeline and Ongoing Review

Estate planning isn't a one-time event. It requires ongoing review and updates as your life changes. Create a timeline with specific milestones, such as completing your will, establishing trusts, and reviewing beneficiary designations.

Store your essential documents securely and inform your family of their location. Review your estate plan at least every three to five years or after significant life events like marriage, divorce, birth, or death. Regular review ensures your plan continues to protect your family as your circumstances evolve. Families who plan proactively gain invaluable peace of mind knowing their loved ones are protected. America First Financial offers insurance solutions to help families prepare for the future, providing a safety net that complements a robust estate plan. Contact us today to learn how we can help secure your family’s financial well-being.

_edited.png)

Comments