Is Life Insurance Premiums Tax Deductible? Find Out Now

- dustinjohnson5

- Oct 15, 2025

- 10 min read

For most people, the question of whether they can write off their life insurance premiums comes up every tax season. The answer is usually a straightforward no—life insurance premiums are not tax deductible for individuals.

The Simple Answer to Your Tax Deduction Question

Think of it this way: the IRS views your life insurance premiums as a personal expense, putting them in the same category as your car payment or your rent. It’s part of your personal financial management, not a cost of doing business.

There's a solid principle behind this rule. Since the death benefit your beneficiaries receive is almost always completely income-tax-free, the government doesn't let you get a tax break on the premiums you paid to secure that benefit. You can't have it both ways—it's a trade-off. No tax on the payout means no deduction on the payments.

This isn't just a U.S. concept. Global financial bodies follow similar logic. The OECD, for instance, points out that for individuals, premium payments are a mix of consumption and savings, not an expense tied to earning income. You can read more about these international tax perspectives on oecd.org.

But here’s where things get interesting. While that's the rule for personal policies, the game changes completely when a business is involved.

Individual vs Business Premium Deductibility at a Glance

This table breaks down the fundamental difference in how the IRS treats life insurance premiums depending on who is paying for the policy.

Policyholder Type | General IRS Rule | Common Reason |

|---|---|---|

Individual | Not Deductible | Treated as a personal expense. |

Business | Potentially Deductible | Can be considered a legitimate cost of doing business. |

Understanding this distinction is the first and most important step. While your personal policy won't lower your tax bill, the rules for businesses open up a whole new world of financial strategy.

Why the IRS Considers Personal Premiums a Non-Deductible Expense

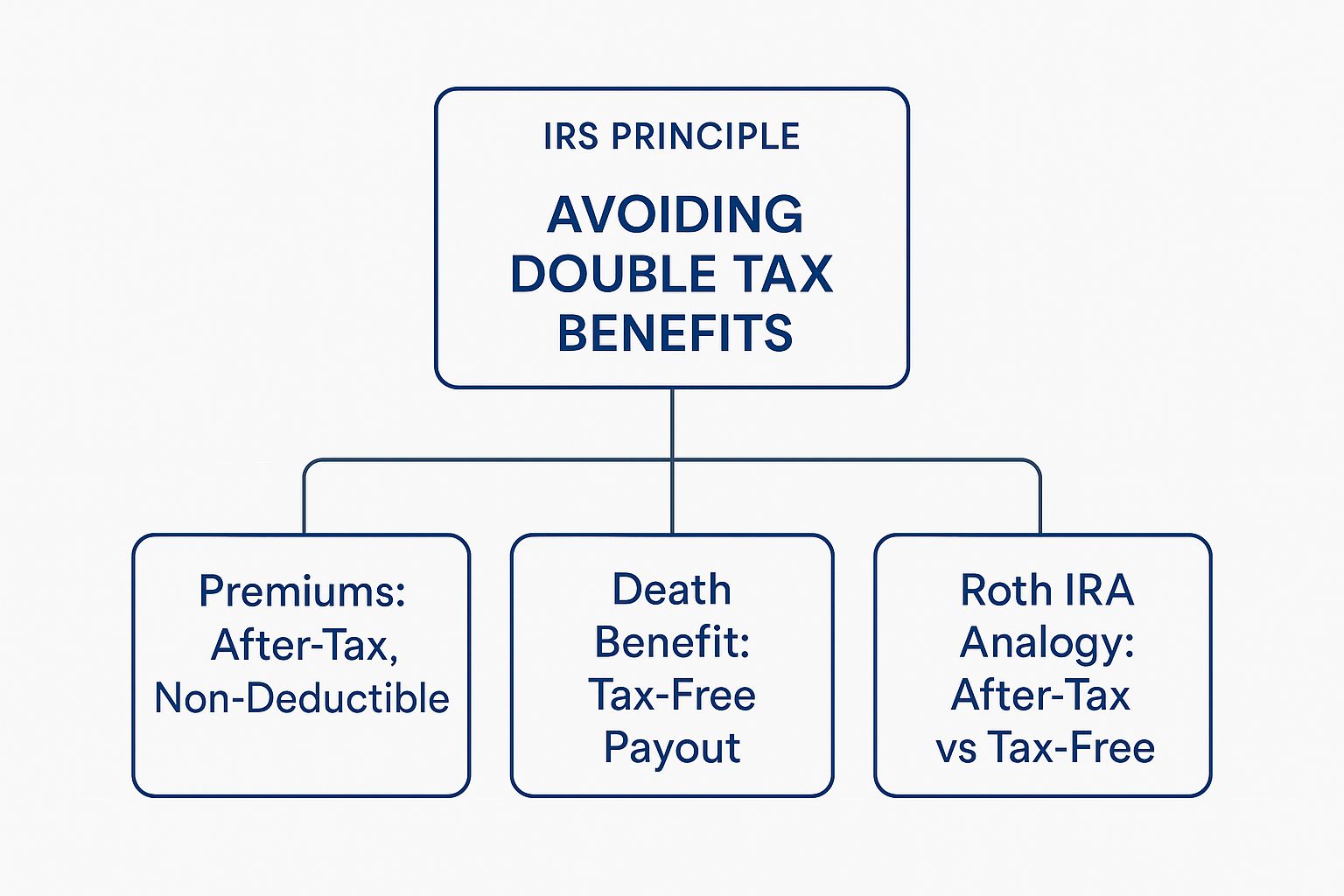

The IRS's stance on personal life insurance premiums is pretty clear, and it all comes down to one core idea: preventing a "double-dip" on tax benefits. The government offers a straightforward trade-off.

You pay your premiums with money you've already paid taxes on—what we call after-tax dollars. In exchange for that, the massive death benefit your beneficiaries eventually receive is completely income-tax-free. It’s a pretty good deal when you think about it.

If the IRS let you deduct the premiums, you'd get a tax break on the front end and your family would get a tax-free payout on the back end. That's the double-dipping they want to avoid. So, it doesn't matter if you have a term, whole, or universal life policy; those premium payments are considered a personal expense, not a deductible one.

The logic is simple: Because the final payout—the death benefit—is a tax-free windfall for your loved ones, the money you spent to secure it (your premiums) can't be used to lower your taxable income along the way.

A Familiar Financial Parallel

Think about how a Roth IRA works. You put after-tax money into your Roth account, which means you don't get a tax deduction for your contributions today. The big payoff comes down the road, when you can withdraw that money in retirement, totally tax-free.

Personal life insurance is built on that same foundation: pay the tax now to get a tax-free benefit later.

This clear separation of personal and business finances is a cornerstone of tax law. Understanding why personal premiums aren't deductible becomes easier when you're clear on distinguishing between business and personal financial purposes.

The infographic below helps visualize this fundamental IRS principle.

As you can see, it’s a direct trade. Non-deductible premiums on one side of the scale balance out the tax-free death benefit on the other, ensuring nobody gets an unfair double tax advantage.

When Businesses Can Deduct Life Insurance Premiums

While you can’t write off your personal life insurance premiums, the game changes entirely when a business foots the bill. For companies, some life insurance premiums can be treated as a legitimate, deductible cost of doing business—right alongside rent and payroll. This is where the answer to whether life insurance is tax-deductible pivots from a hard "no" to a qualified "yes."

The most common situation where this comes into play is with employee benefits. If your company provides a group-term life insurance plan for your team, the premiums you pay are generally deductible. Why? Because the IRS sees it as a form of employee compensation. It’s a classic win-win: your employees get valuable coverage, and your business gets to lower its taxable income.

Think of a construction company that pays for a group plan for its entire crew. Those premium payments are a deductible business expense, which directly chips away at the company's final tax bill.

The Critical Beneficiary Rule

So, what's the catch? It all boils down to one crucial question: who gets the money when the insured person passes away?

For a business to deduct life insurance premiums, it cannot be the direct or indirect beneficiary of the policy. If your company is set to receive the tax-free death benefit, the IRS won’t let you deduct the premiums you paid to maintain that policy.

The logic here is simple and consistent: The IRS doesn't let you get a tax deduction for an expense that produces tax-free income. If the business benefits from the payout, it can't deduct the cost.

This single rule is the reason why premiums for things like key person insurance (where the business is the beneficiary) are almost never deductible.

Deductible Premiums in Action

With that rule in mind, let’s look at the specific scenarios where a business can confidently write off these costs.

Group-Term Life Insurance: This is the big one. Premiums paid for employee group plans are a standard business deduction. It's an especially sweet deal because the premium cost for the first $50,000 of coverage is also a tax-free benefit for the employee.

Executive Bonus Plans (Section 162): This is a smart strategy where the business gives an executive a bonus with the understanding they will use it to buy a personal life insurance policy. The company doesn't deduct the premium itself, but it can deduct the entire bonus as employee compensation.

Life Insurance as Loan Collateral: Sometimes, a lender will require a business to take out a policy on a founder or key executive as collateral for a loan. As long as the business isn't the policy's beneficiary, the premiums can often be deducted as a cost of financing.

This two-sided system gives businesses a clear advantage. In the United States, individuals get very few tax breaks on life insurance, but companies can often deduct the cost for employer-sponsored plans. You can discover more about how tax policies treat insurance on oecd.org.

Looking Beyond Premiums: Other Tax Rules and Opportunities

If you only focus on whether you can deduct the premiums, you're missing the real story behind life insurance's tax-saving muscle. While the direct answer to "are life insurance premiums tax-deductible?" is usually a "no" for individuals, that’s just the tip of the iceberg. The real financial power lies in the other tax benefits baked right into the policy itself.

One of the biggest perks is the tax-deferred growth of the cash value. With permanent policies like whole or universal life, part of what you pay builds up a cash reserve. This money grows year after year, and you don’t owe a dime in taxes on the gains along the way.

It’s like having a high-powered savings account where your earnings can compound freely, without the yearly tax bill that slows down growth in a standard brokerage account.

The Power of Tax-Free Payouts and Loans

It’s not just about how the money grows; it’s about how you and your family can get it out. Life insurance is one of the few financial tools out there that hands you tax breaks at multiple points in its lifecycle.

Two features, in particular, are game-changers:

A Tax-Free Death Benefit: This is the heart and soul of life insurance. When you pass away, the money paid out to your beneficiaries is almost always completely free from federal income tax. They get the full amount you intended for them, right when they need it most.

Tax-Advantaged Policy Loans: Need cash? You can often borrow against the cash value you’ve built up. These loans are typically income tax-free, don’t require a credit check, and won't create a taxable event, making them an incredibly flexible source of funds.

Getting a handle on these features is crucial. It shows you the true financial horsepower of a life insurance policy. Even if you can't write off the premiums, the combination of tax-deferred growth and tax-free distributions can create massive long-term value.

This kind of strategic thinking is all about understanding how different financial moves are taxed. For instance, a small business owner can't deduct personal life insurance, but they can lower their tax bill by properly tracking business mileage for tax deductions. These are separate rules for separate tools, which is exactly why a smart financial plan looks at the whole picture, not just one type of deduction.

Uncommon Scenarios for Premium Deductions

While the IRS is pretty clear that personal life insurance premiums aren't deductible, there are a few corners of the tax code where exceptions exist. These situations are definitely not the norm and have some very specific hoops to jump through, but they’re worth knowing about.

One of the classic examples you'll hear about is tied to alimony. In the past, if a divorce decree ordered an ex-spouse to maintain a life insurance policy for the other's benefit, those premium payments could sometimes be deducted as alimony. It's a tricky area, though, especially since the tax laws around alimony have changed quite a bit over the years.

Turning Premiums Into Charitable Giving

Another interesting angle is using a life insurance policy for charitable giving. This strategy involves donating your policy to a qualified charity and making them the new owner.

Here’s how it works: you must completely and irrevocably transfer ownership of the policy to the non-profit. Once they own it, any premiums you continue to pay on their behalf are generally treated as tax-deductible donations. It's a creative way to support a cause you're passionate about while also getting a potential tax break.

These are highly specialized situations with strict IRS rules. It's absolutely essential to talk with a tax professional before trying to deduct your premiums under these circumstances.

It’s also interesting to see how the U.S. compares globally. A 2018 study that looked at 132 countries found that nearly half—47%, to be exact—let individuals deduct their premiums. You can discover more about these global fiscal incentives on worldbank.org to see the bigger picture.

Do Tax Deductions Actually Drive Insurance Purchases?

You’d think offering a tax break would be a surefire way to get more people to buy life insurance. It just seems like common sense, right? Everyone loves a good deduction.

But when you zoom out and look at the real-world data, the story isn't quite so simple. The assumption that making premiums deductible would cause the market to explode doesn’t really hold up. In reality, that tax perk isn't the main thing on people's minds when they're shopping for coverage.

It turns out, much bigger factors are at play. Things like the overall health of a country's economy, how financially savvy the general public is, and the level of trust people have in banks and insurance companies—these are the things that truly move the needle.

Challenging What We Think We Know

This isn't just a hunch; there's solid research to back it up. Economists have crunched the numbers from different countries to see if there's a direct link. Even after accounting for vast differences in national income, their studies found no significant connection between premium deductibility and a booming life insurance market. If you're interested in the nitty-gritty, you can read the full research about these economic findings from the World Bank.

So, what does this mean for the average person? It tells us that the decision to buy life insurance usually comes from a much deeper place than just trying to lower a tax bill. It’s about fundamental human needs.

At the end of the day, the real motivations are far more personal and powerful. People buy life insurance to:

Protect their family from financial chaos if the worst should happen.

Replace lost income so the mortgage still gets paid and the kids can still go to college.

Build a financial legacy or create long-term savings through a permanent policy.

While understanding the tax rules is definitely smart, it's just one small piece of the puzzle. The real driver has always been the profound peace of mind that comes from knowing you have a safety net in place for the people you care about most.

Frequently Asked Questions

When you get down to the nitty-gritty of life insurance and taxes, a lot of specific questions pop up. Let's walk through some of the most common scenarios people ask about so you can see how these IRS rules play out in the real world.

Can I Deduct Premiums If I Am Self-Employed?

This is a big one for entrepreneurs, and the short answer is usually no. If you're self-employed, the premiums you pay for your own personal life insurance policy are considered a personal expense, not a business one. The IRS sees it the same way they would for a W-2 employee.

But here's where it gets interesting: the game changes if you have a team. If you set up a group-term life insurance plan for your employees, the premiums you pay for their coverage are absolutely a deductible business expense. Think of it as part of their compensation package—a cost of doing business.

What If My Business Is the Beneficiary?

This is a classic "key person" insurance scenario and a point of frequent confusion. If your company pays the premiums on a policy where the company itself is the beneficiary, those premiums are not tax-deductible.

The IRS has a straightforward line of thinking here: You can't double-dip. Since the business would receive the death benefit completely tax-free, the government doesn't also allow you to get a tax break on the premiums that keep the policy in force.

For a premium to even have a chance at being deductible, the business can't be the one getting the payout.

Are Disability Insurance Premiums Tax Deductible?

Disability insurance is a different animal, and its tax treatment hinges on one simple question: who paid the premium, and was it with pre-tax or post-tax money?

You pay with after-tax money: If you buy your own disability policy and pay for it with money you've already paid taxes on, the premiums are not deductible. The huge advantage, though, is that if you ever become disabled, the benefits you receive are 100% income-tax-free.

Your employer pays with pre-tax money: If your employer provides disability coverage as a benefit and deducts the premiums, any benefits you receive will be treated as taxable income.

It all comes down to whether the tax break is taken on the front end (the premium) or the back end (the benefit).

At America First Financial, we're here to give you clear, honest answers to protect your family's future. Our life insurance plans are built to provide security and real peace of mind, without the political noise. You can get a straightforward quote in less than three minutes and take the first step toward building a solid financial foundation. Find your plan today.

_edited.png)

Comments