Long Term Care Insurance for Seniors: Secure Your Future

- dustinjohnson5

- Jun 5

- 12 min read

Understanding Long-Term Care Insurance For Seniors

Planning for retirement often includes considering the potential need for long-term care. Understanding long-term care insurance (LTCI) can be challenging, but it's an important aspect of securing your financial future. This section explains what LTCI is, what it covers, and why it differs from standard health insurance and Medicare.

What Does Long-Term Care Insurance Cover?

LTCI is designed to cover the costs of assistance with activities of daily living (ADLs). These are the essential tasks we perform daily, such as bathing, dressing, eating, and using the restroom. If a senior needs help with two or more ADLs due to a chronic illness or disability, LTCI can help cover those costs.

LTCI can cover care in a variety of settings, including:

In-Home Care: This provides assistance with ADLs and other household tasks in the comfort of your own home.

Assisted Living Facilities: These facilities offer supportive living arrangements with help for ADLs and other services.

Nursing Homes: These facilities offer skilled nursing care and medical supervision for those needing more intensive care.

Memory Care Units: These units provide specialized care for individuals with Alzheimer's disease or other dementias.

Why Traditional Insurance Isn't Enough

Traditional health insurance and Medicare may cover some short-term rehabilitation or skilled nursing care, but they typically do not cover extended long-term care services. This gap in coverage can leave seniors facing significant out-of-pocket expenses. These expenses can quickly deplete retirement savings and place a heavy financial burden on families.

The average annual cost of a private nursing home room can be over $100,000. This considerable financial strain highlights the importance of considering LTCI within a comprehensive retirement plan.

The Growing Importance of LTCI

As the senior population grows and lifespans increase, so does the need for long-term care. This makes LTCI increasingly vital in major markets like the United States. Despite this growing need, it remains a somewhat specialized product globally.

In early 2025, the largest LTCI providers were paying out over $18 million in benefits daily, a substantial rise from previous years. This illustrates the increasing demand for LTCI and its crucial role in protecting seniors' financial well-being. More detailed statistics can be found here: https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2025.php

Understanding the fundamentals of long-term care insurance allows you to assess your needs and explore available coverage options. This knowledge empowers you to make informed decisions about your future care and financial security.

Real Costs And Value Of Senior LTC Coverage

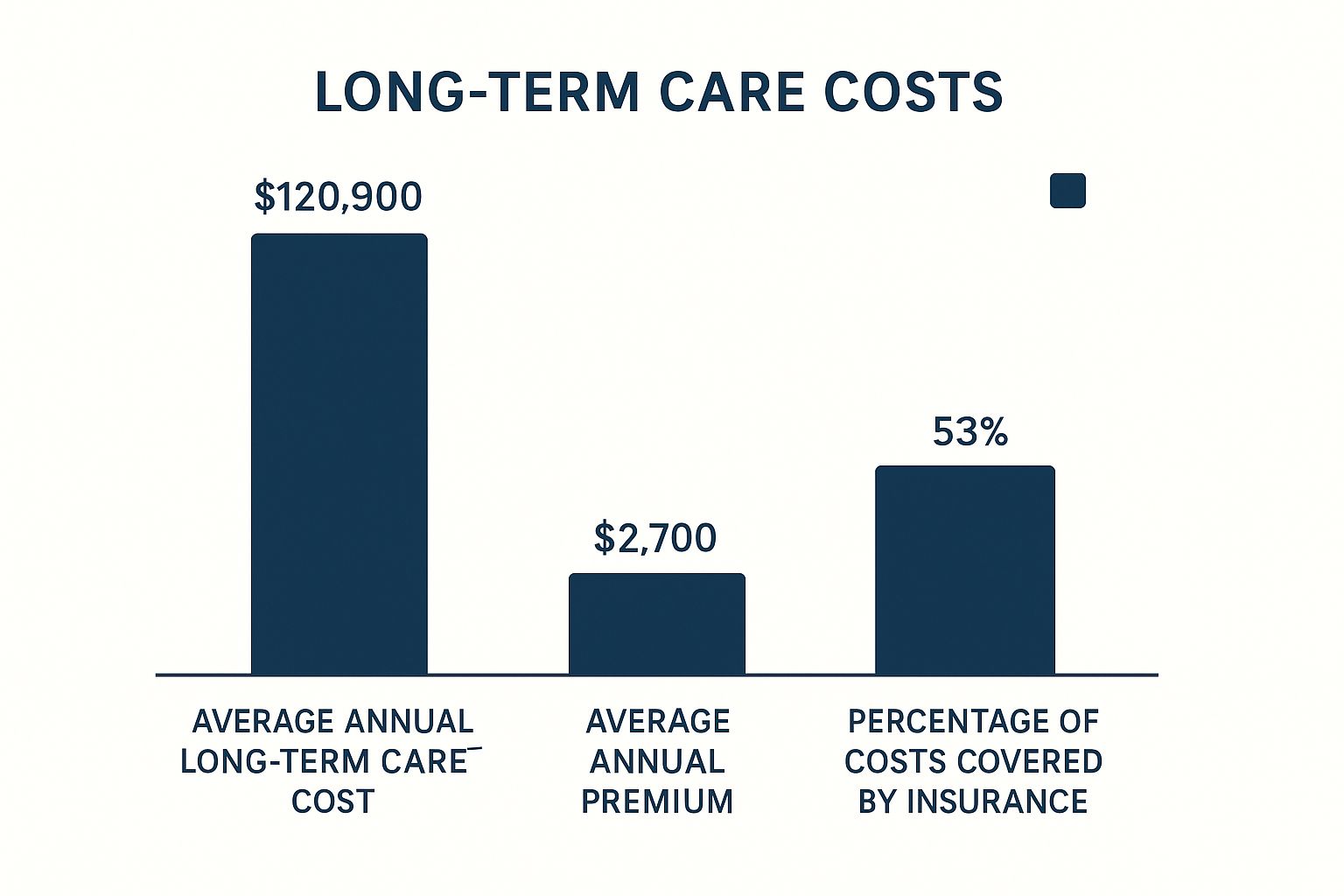

The infographic above illustrates a key comparison: the average annual cost of long-term care, the average annual premium for long-term care insurance (LTCI), and the percentage of costs covered by insurance. The visual clearly shows that while premiums require a significant financial commitment, they are considerably less than the potential costs of long-term care. This underscores the value of securing coverage.

Having LTCI can significantly lessen the financial strain on seniors and their families.

Understanding LTCI Premium Ranges

A common question among seniors considering LTCI is, “How much will it cost?” The premiums for LTCI are influenced by several key factors.

These factors include your age at the time of purchase, the level of coverage you select, and any optional riders, such as inflation protection. A more comprehensive policy with a longer benefit period will naturally have a higher premium than a more basic policy.

Premiums have also been increasing. For a healthy 60-year-old couple looking for a comprehensive policy, average annual premiums now fall within the $5,000–$6,000 range. This amount varies depending on benefit levels and whether inflation protection is included. The number of insurers offering LTCI has decreased significantly, from over 100 in the late 1990s to fewer than a dozen major providers today. This reduced competition contributes to the difficulty in obtaining coverage and its increased cost. Learn more about these trends from the American Association for Long-Term Care Insurance. Many seniors also need specialized care at home, an expense that can often be covered by LTCI. For example, at-home wound care can become a considerable expense.

To help illustrate how premiums can change based on age and coverage options, take a look at the table below:

Long Term Care Insurance Premium Comparison by Age and Coverage Compare average annual premiums for different ages and benefit levels to help determine the most cost-effective coverage options

Age at Purchase | Basic Coverage | Comprehensive Coverage | Premium with Inflation Protection |

|---|---|---|---|

50 | $2,000 | $3,500 | $4,200 |

60 | $3,000 | $5,000 | $6,000 |

70 | $5,000 | $8,500 | $10,200 |

This table presents estimated average annual premiums and demonstrates how costs increase with age and broader coverage. Inflation protection, while adding to the initial cost, provides crucial long-term value by ensuring benefits keep pace with rising healthcare expenses.

Evaluating the True Value

While the initial cost of premiums may appear high, it's crucial to weigh them against the potential cost of care without insurance. Long-term care services can be quite expensive, potentially accumulating costs of hundreds of thousands of dollars over time.

Such expenses can rapidly deplete retirement savings and create a financial burden for families.

Managing Premium Increases

It's important to recognize that LTCI premiums can rise over time. However, strategies exist to mitigate these increases.

One option is choosing a policy with a level premium feature. This guarantees your premiums will remain constant. Another strategy is to carefully consider the inflation protection rider. This rider helps ensure your benefits keep up with the increasing cost of care.

While initial premiums might be higher with this rider, the coverage will be more comprehensive in the future.

Maximizing Value and Protection

When selecting an LTCI policy, concentrate on features that deliver substantial value, not just attractive marketing tactics. Look for a policy that covers a wide range of care settings, such as home care, assisted living facilities, and nursing homes.

Consider the elimination period, which is the duration you're responsible for paying for care out-of-pocket before your benefits start. A shorter elimination period generally corresponds to a higher premium but provides quicker access to benefits. Carefully evaluating these factors ensures you maximize your coverage. Understanding the nuances of policies allows for effective planning and cost management while offering maximum protection when you need it most.

Choosing Coverage That Actually Fits Your Needs

Finding the right long-term care insurance can feel daunting. This section simplifies the process, helping you pinpoint coverage that truly aligns with your needs and budget. We'll explore key policy features, assess your personal risk factors, and compare different options available for seniors.

Key Policy Features to Consider

Several policy features significantly impact the effectiveness of your long-term care insurance. Understanding these features empowers you to make well-informed decisions.

Benefit Amount: This is the daily or monthly amount your policy pays towards your care. Consider future care costs and how much you'll need to cover expenses like in-home care or a nursing home stay. For instance, if the average daily cost of care in your area is $200, your benefit amount should cover a substantial portion of this.

Benefit Period: This is how long your policy will pay benefits. Options can range from a few years to lifetime coverage. Factor in your family health history and current health status. A longer benefit period provides more comprehensive coverage, but typically comes with a higher premium.

Elimination Period: This is the waiting period between when you qualify for benefits and when the policy starts paying. It acts like a deductible. A longer elimination period means more out-of-pocket expenses initially, but usually results in lower premiums. Choose a waiting period you can comfortably manage.

Assessing Your Personal Needs

Choosing the appropriate long-term care insurance requires careful evaluation of your individual circumstances. This includes considering your personal risk, family caregiving options, and financial resources.

Personal Risk Profile: Factors like your age, current health, and family history of illness can influence your likelihood of needing long-term care. This information will help you determine the appropriate level of coverage.

Family Caregiving Capacity: If family members can provide some care, consider a policy with a lower benefit amount or a longer elimination period. This can lower premium costs while still providing crucial financial protection.

Financial Resources: Your financial situation plays a vital role in selecting the right coverage. Balance affordability with the level of protection you need. A financial advisor can help determine a sustainable premium.

Comparing Policy Types

Various long-term care insurance options are available for seniors. Understanding these options will help you choose the one that best suits your situation.

Traditional Standalone Policies: These policies exclusively cover long-term care expenses. They offer comprehensive coverage but may come with higher premiums.

Hybrid Policies: These combine long-term care insurance with life insurance or an annuity. While offering more flexibility, the long-term care benefits might be less comprehensive than standalone policies. These policies may not be suitable for those with immediate or short-term long-term care needs.

By carefully evaluating these factors, you can select long-term care insurance that aligns with your individual needs and budget. This allows you to safeguard your financial future and access quality care when needed.

Mastering The Application And Approval Process

Obtaining long-term care insurance for seniors can be more complicated than it initially appears. This section provides a roadmap for navigating the application and approval process, giving you the tools for a successful outcome.

Understanding Underwriting

Underwriting is the process insurance companies use to evaluate risk. For long-term care insurance, this involves a comprehensive review of your health, medical history, and cognitive function.

This review includes:

Medical Exams: These exams assess your current physical well-being.

Cognitive Assessments: These evaluations measure your mental sharpness.

Review of Medical Records: Insurers carefully examine your medical history, looking for pre-existing conditions.

The underwriting process determines not only your eligibility for coverage, but also the cost of your premiums.

Common Approval Obstacles

Several factors can complicate the approval process for long-term care insurance. Being aware of these potential roadblocks can help you prepare.

Pre-existing Conditions: Conditions such as Alzheimer's, Parkinson's disease, or a history of strokes can make securing coverage more challenging.

Age: Applying at an older age often presents obstacles, as the risk of needing care statistically increases.

Incomplete Medical Records: Fragmented or missing medical documentation can delay or even derail the application process.

While these factors can be significant hurdles, understanding them in advance can greatly improve your chances of a positive outcome.

Tips for a Smoother Process

A successful application requires preparation and attention to detail. The following strategies can help simplify the process and increase your likelihood of approval:

Work With a Knowledgeable Agent: An experienced insurance agent specializing in long-term care insurance can provide invaluable guidance. They can anticipate potential problems and advocate for you throughout the process.

Gather Comprehensive Documentation: Organize all relevant medical records, including doctor’s notes, test results, and medication lists. This comprehensive approach provides a clear and complete picture of your health history.

Be Transparent: Accurate and complete disclosure of all health information is essential. Withholding information can jeopardize your coverage.

Optimal Timing: Applying for coverage earlier, before health issues arise, is generally beneficial. For a healthy 60-year-old couple, average annual premiums are typically in the $5,000-$6,000 range, but these costs rise with age.

Even with pre-existing conditions, securing long-term care insurance is often achievable with careful planning. By being proactive and working closely with an experienced agent, you can navigate potential obstacles and secure the coverage you need to protect your financial future and long-term care needs.

Market Evolution And What It Means For Your Coverage

The long-term care insurance (LTCI) market is in constant flux, directly impacting the coverage choices available to seniors. A clear understanding of these market shifts is essential for making well-informed decisions about future care needs. This section explores how evolving demographics and increasing healthcare costs are reshaping the LTCI industry and its implications for your coverage.

Demographic Pressures and Rising Costs

Demographic trends, especially the growing aging population, are driving increased demand for long-term care services. Combined with rising healthcare expenses, this surge in demand is significantly affecting the LTCI market. New care delivery models, such as home-based care and telehealth services, are emerging and reshaping the LTCI landscape.

These changes offer potential advantages. They create opportunities for more flexible and personalized care. However, they also present challenges, particularly in managing costs and maintaining high-quality care.

This means long-term care insurance for seniors is now more critical than ever. As the need for care grows, so does the importance of securing financial protection. We are also seeing a rise in hybrid insurance products. These products often combine long-term care coverage with other benefits, such as life insurance.

Hybrid products offer a different approach compared to traditional LTCI. While offering greater flexibility, they require careful review of their specific terms and conditions.

The global long-term care insurance market is responding to these evolving demands with consistent growth. In 2024, the global LTC market reached an estimated $1,138.5 billion. Projections indicate it will reach $1,827.8 billion by 2033. This represents a compound annual growth rate (CAGR) of 5.13%. Find more detailed statistics here.

Regulatory Developments and Innovations

Regulatory changes also play a key role in shaping the LTCI market. New laws and regulations influence coverage options, associated costs, and consumer protections. Staying informed about these regulatory developments is crucial to understanding their potential impact on your current or future coverage.

Technological advancements are transforming how LTCI benefits are accessed and managed. Digital platforms are streamlining claims processing and improving communication between insurers and policyholders. Navigating the application and approval process for long-term care insurance requires careful consideration of data privacy. For a comprehensive guide to understanding the requirements of data security compliance strategies, click the link.

Understanding these ongoing developments helps you choose coverage that offers the necessary flexibility and support. This proactive approach ensures you are well-prepared for the evolving landscape of long-term care.

Evaluating Top LTC Insurance Providers For Seniors

Choosing the right long-term care insurance can feel overwhelming. It's not just about the policy itself, but also about the insurance provider you choose. Finding a reliable company that will be there when you need them most requires careful evaluation of factors like financial strength, claims history, and customer satisfaction.

Financial Strength and Stability

A provider's financial stability is paramount. You need assurance that they can pay out your benefits when the time comes. A.M. Best ratings offer valuable insights into an insurer's financial health. A high rating, such as "A" or higher, indicates a strong ability to meet financial obligations, providing peace of mind.

Claims Paying Track Record and Customer Service

Beyond financial stability, examine the company's claims history. Complaint ratios, available from state insurance departments, offer a glimpse into customer satisfaction. A lower ratio generally suggests better customer service and claims handling. A solid track record and positive reviews build trust and confidence.

National vs. Specialized LTCI Companies

You'll find both large national insurers and smaller companies specializing in long-term care insurance.

National Insurers: These often have substantial financial resources and a wider selection of products.

Specialized LTCI Companies: These may offer greater expertise and more personalized service.

Market consolidation has reduced the number of LTCI providers, making thorough research even more crucial.

Researching and Asking the Right Questions

Active research is key. Review independent ratings from agencies like A.M. Best, read customer reviews, and compare policy options. Asking key questions about the claims process, required documentation, and typical processing times can clarify important details and prepare you for the future.

To help you in your research, we've compiled a comparison of some major long-term care insurance providers:

Major Long Term Care Insurance Providers Comparison

Compare key features, financial ratings, and policy options from leading LTCI providers to help you choose the best insurer

Insurance Company | AM Best Rating | Years in LTC Market | Key Policy Features | Average Premium Range |

|---|---|---|---|---|

Sample Company A | A+ | 40+ | Inflation protection, shared care | $2,000 - $4,000 annually |

Sample Company B | A | 30+ | Lifetime benefits, optional riders | $2,500 - $5,000 annually |

Sample Company C | A- | 25+ | Cash benefit option, flexible care | $1,800 - $3,500 annually |

This table is for illustrative purposes only. Premium ranges are estimates and can vary significantly based on age, health, and coverage options. Contact insurers directly for personalized quotes.

As you can see, different insurers offer various features and premium ranges. Comparing these factors will help you find a policy that aligns with your needs and budget. By carefully considering these factors, you can select an insurer with both financial stability and excellent customer support, ensuring your needs are met when you require care. The ideal provider depends on your individual priorities.

Making Your Final Decision With Confidence

After exploring the intricacies of long-term care insurance for seniors, it's time to confidently decide on a plan. This involves carefully evaluating your personal circumstances, financial resources, and care preferences against the available options. This section offers a framework for making an informed choice, addressing typical decision-making mistakes and exploring alternative solutions to traditional Long-Term Care Insurance (LTCI).

Evaluating Your Personal Situation

Consider these factors when assessing your need for long-term care insurance:

Health Status: Your present health and family medical history significantly influence the likelihood of needing long-term care.

Family Support System: Do family members have the capacity to provide care if needed? This can impact the extent of coverage you require.

Financial Resources: Evaluate your finances to decide how much you can comfortably allocate to premiums.

Care Preferences: Think about where you'd prefer to receive care—at home, in an assisted living facility, or a nursing home.

Alternatives to Traditional LTCI

Explore these alternatives to traditional long-term care insurance:

Self-Insurance: This involves setting aside funds specifically for future care expenses. This requires diligent financial planning.

Hybrid Products: These combine LTCI with life insurance or annuities, providing a combined benefit. Understand the inherent compromises compared to standalone LTCI.

Government Programs: Investigate eligibility for programs like Medicaid, which can offer financial aid for long-term care. Medicaid has specific eligibility requirements.

Avoiding Common Mistakes

Many seniors make long-term care insurance decisions they later regret. Avoid these common pitfalls:

Delaying the Decision: Postponing coverage can restrict your options and increase costs, as premiums typically rise with age.

Focusing Solely on Price: The least expensive policy may not provide adequate coverage. Prioritize value and comprehensive protection.

Not Understanding Policy Details: Carefully examine policy terms, including benefit periods, elimination periods, and inflation protection.

Ignoring the Claims Process: Select an insurer with a reliable claims-paying history and strong customer service.

Taking Action

Whether you choose long-term care insurance or an alternative, develop a clear action plan:

If Choosing Coverage: Collaborate with a knowledgeable insurance agent specializing in LTCI to compare policies and find the best fit.

If Choosing Alternatives: Create a comprehensive financial plan addressing potential care costs. This might entail consulting a financial advisor.

Making a confident decision about long-term care necessitates understanding your needs and assessing available options. By considering your circumstances and weighing the pros and cons of each approach, you can make a choice that supports your long-term well-being and financial security. For a provider focused on affordable protection and traditional values, consider America First Financial, offering a range of plans, including long-term care insurance, designed for American families.

_edited.png)

Comments